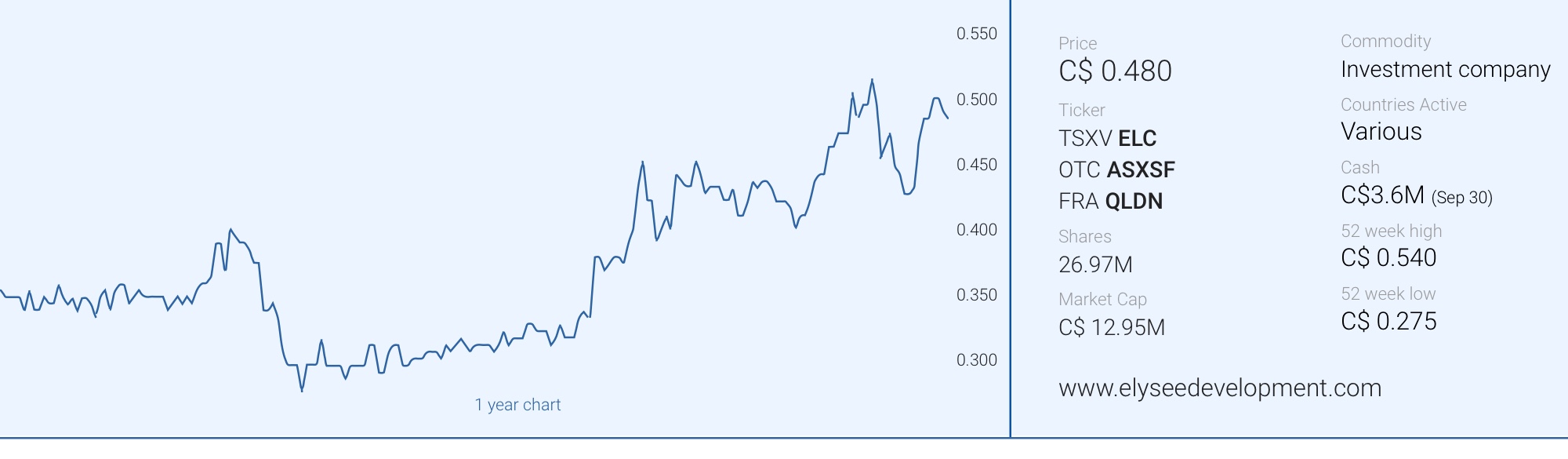

In the third quarter, Elysee Development Corp. (ELC.V) recorded another impressive NAV increase thanks to a C$0.09 EPS in Q3. Trading at a discount of roughly 25% to its NAV/Share (C$0.64 as of the end of September) and roughly 30% of its market capitalization held in cash, Elysee remains an attractive choice for an investor looking for exposure to a variety of commodities in an actively managed portfolio.

A strong third quarter thanks to the precious metal prices

Elysee’s third quarter performance was exceptional. The company recorded a realized gain of C$2.03M on the sale of securities in its investment portfolio, while the unrealized gain came in at C$423,000. As Elysee’s operating expenses remain very low (less than C$160,000 in the third quarter and less than C$375,000 in the first nine months of the year) the strong performance of the portfolio resulted in a net income of C$2.33M or C$0.09 for the quarter.

Plenty of reasons to be happy. The NAV increase to C$0.64 means the current share price of C$0.48 represents a 25% discount to the fair value as of the end of September. Additionally, Elysee declared a one-cent interim dividend, payable at the end of the month.

The interim dividend is later than usual, but will be paid before month’s end

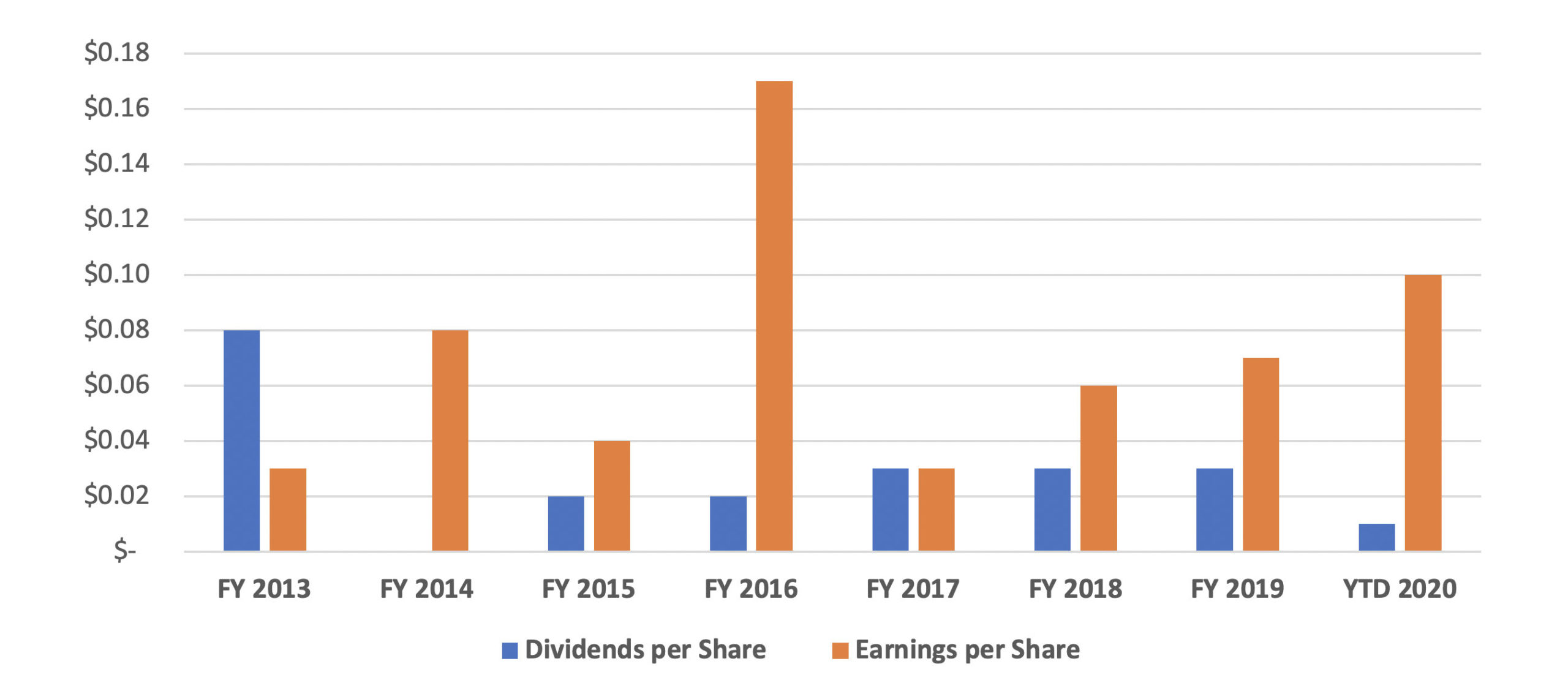

Investors were perhaps a bit surprised when Elysee didn’t declare a dividend when it announced its Q2 results, just like it used to do in the past few years. However, it turns out there was just a delayed announcement and upon announcing the Q3 results, Elysee also confirmed an interim dividend of 1 cent per share will be paid out.

Management’s interest is very aligned with that of the other shareholders. The Chairman/CEO is the largest shareholder of the company. He owns 5.03M shares, or almost 19% of the shares outstanding, and thus has a vested interest in the share price moving up and collecting dividends. Unlike other executives in the mining sector, his base salary is very reasonable; C$90,000/year is very much on the lower end of the spectrum.

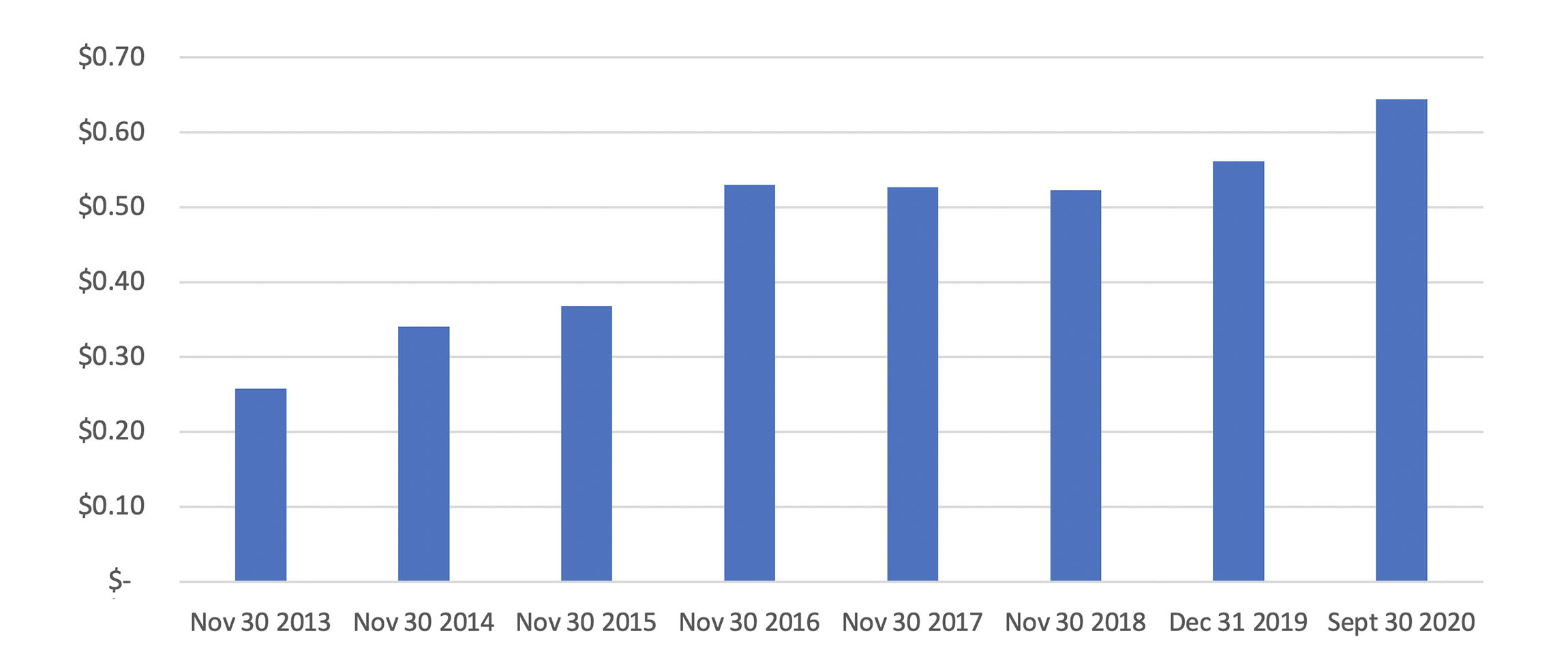

One way to determine if an investment issuer is doing a good job is by looking at value creation. And especially this year it has been clear why the bonus system has its merit. As of January 1st, the NAV/share of Elysee was C$0.56/share. This has now increased to C$0.64 while the company has already paid out a $0.02 dividend bringing the total created net value increase to C$0.10 or almost C$3M.

Despite the vested interest in declaring dividends (as part of creating value), it’s encouraging to see the company isn’t declaring dividends for the sake of keeping up with historical dividend payments.

Dividends are and will be declared when deemed opportune and reasonable and although the timing may sometimes be erratic, just know the interests of the main shareholder to create shareholder value through a combination of NAV growth and dividend payments is completely aligned with the interests of the smaller shareholders.

As you can see below, the company has kept the dividend unchanged at C$0.03 in the 2017-2019 period. The lower bar for 2020 simply represents the interim-dividend and we are expecting an additional final dividend to be declared when Elysee reports its full-year results.

Looking at the balance sheet, the decision to pay a dividend makes sense. Elysee’s cash position currently exceeds C$4M (up from C$3.6M as of the end of September) which, divided by the current share count of 26.97 shares represents a net cash position of just over C$0.15 per share. Although we fully agree with the company’s level of caution by keeping a substantial amount of cash on the balance sheet for rapid deployment when the opportunity arises, it’s good to see the shareholder remuneration. The dividend will be payable on November 27th, and the record date is November 19th (with the ex-dividend date 2 days before the record date). Keep in mind this is just an interim-dividend and if Elysee can end the year on a strong note, we think it’s very likely to see the investment issuer pay a final dividend as well. Assuming the final dividend is maintained at 2 cents per share, that would imply an annual dividend yield of 6.25% based on a price of 48 cents per share.

Elysee has plenty of cash to take advantage of opportunities in Q4

As of the end of September, Elysee had C$3.6M in cash on the balance sheet but the accompanying press release confirmed the cash position has increased to C$4.1M as of the end of October. This means that approximately 30% of the current share price is backed by cash, providing both a cushion as well as a nice wallet to go shopping when opportunities come knocking.

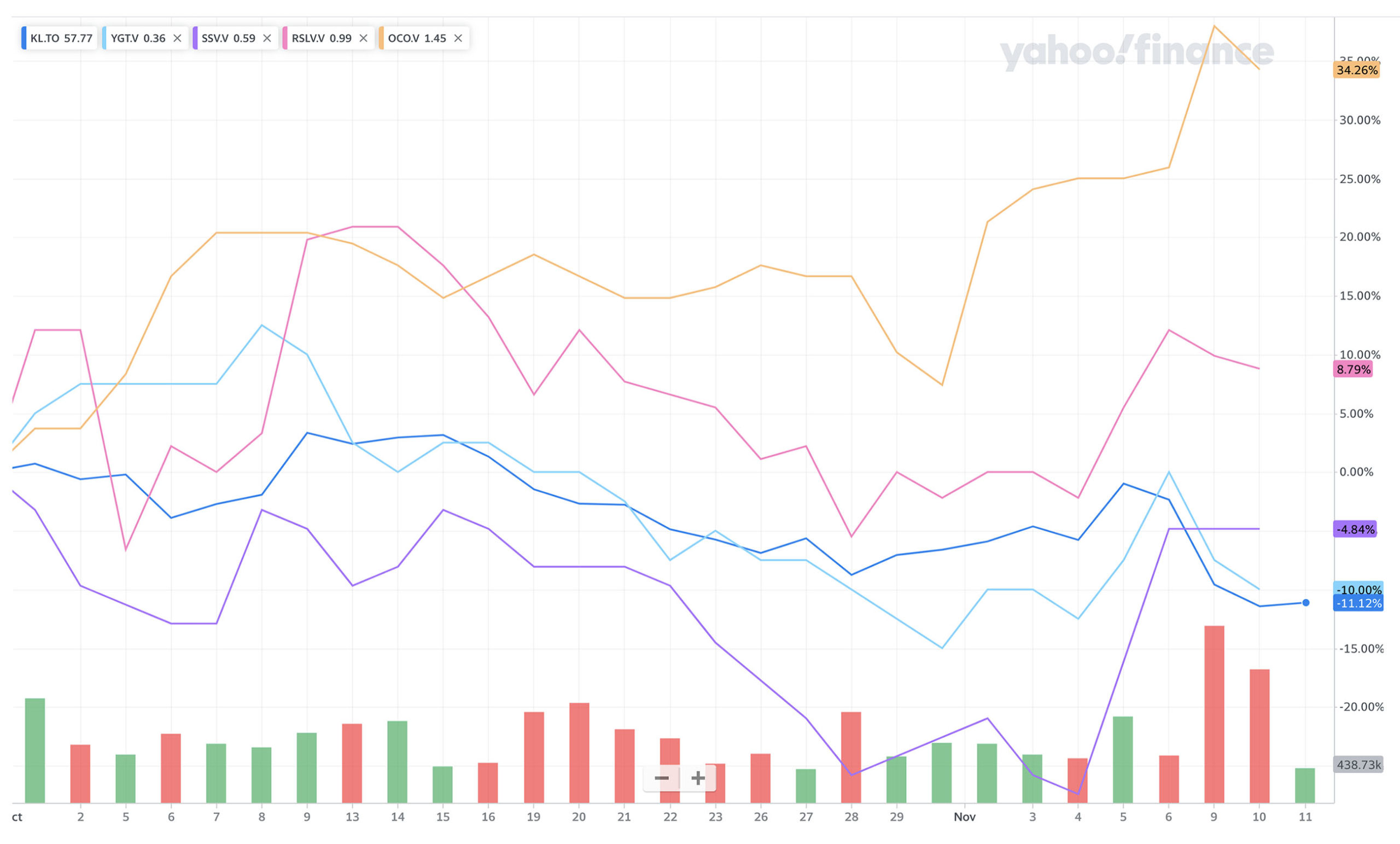

The one-cent dividend will reduce the cash position by approximately C$0.3M, but we can also reasonably expect Elysee to take some profit on some of its positions. In its press release, Elysee mentions its five largest positions are Kirkland Lake Gold, Gold Terra Resource Corp, Oroco Resource Corp (OCO.V), Southern Silver Exploration (SSV.V) and Reyna Silver (RSLV.V). The image below shows the performance of these five companies since October 1st.

The average performance of the five largest holdings between October 1st and November 11th was positive, so if Elysee can keep the momentum going, we wouldn’t be surprised to see the NAV/share showing another increase in December, even after paying the 1 cent dividend.

Note, we obviously cannot provide a weighted average performance as we don’t know the exact position sizes. Elysee provided the names of the five largest positions in its press release and provides a top-10 on its website but does not provide information on the relative sizes of these positions.

Conclusion

Investors looking for exposure to a basket of commodity companies may have to give Elysee Development a closer look. Rather than investing in an ETF (which passively tracks a certain index), Elysee’s advantage is the active management of the portfolio. The company doesn’t have to mimic an index and when certain opportunities arise, the company can act immediately. An active investment strategy is a clear advantage over an ETF which just passively tracks an index.

Another interesting feature of Elysee is the cost structure. In the first nine months of the year, Elysee had a cash operating cost of less than C$270,000 and will likely end the year with a total cash overhead cost of around C$0.5M (allowing for performance bonuses).

As such, the interest of the CEO, Chairman and 19% shareholder Guido Cloetens, are fully aligned with the shareholders. Cloetens won’t be making his money with his compensation but with future share price appreciation and dividends. Trading at a discount of approximately 25% to the NAV per share as of the end of September and with Q4 shaping up to be a robust quarter, Elysee offers perhaps the easiest exposure to an actively managed portfolio of commodity investments.

Disclosure: The author has a long position in Elysee Development Corp and Oroco Resource Corp, Southern Silver Exploration and Reyna Silver. All companies mentioned previously are or have been a sponsor of the website.