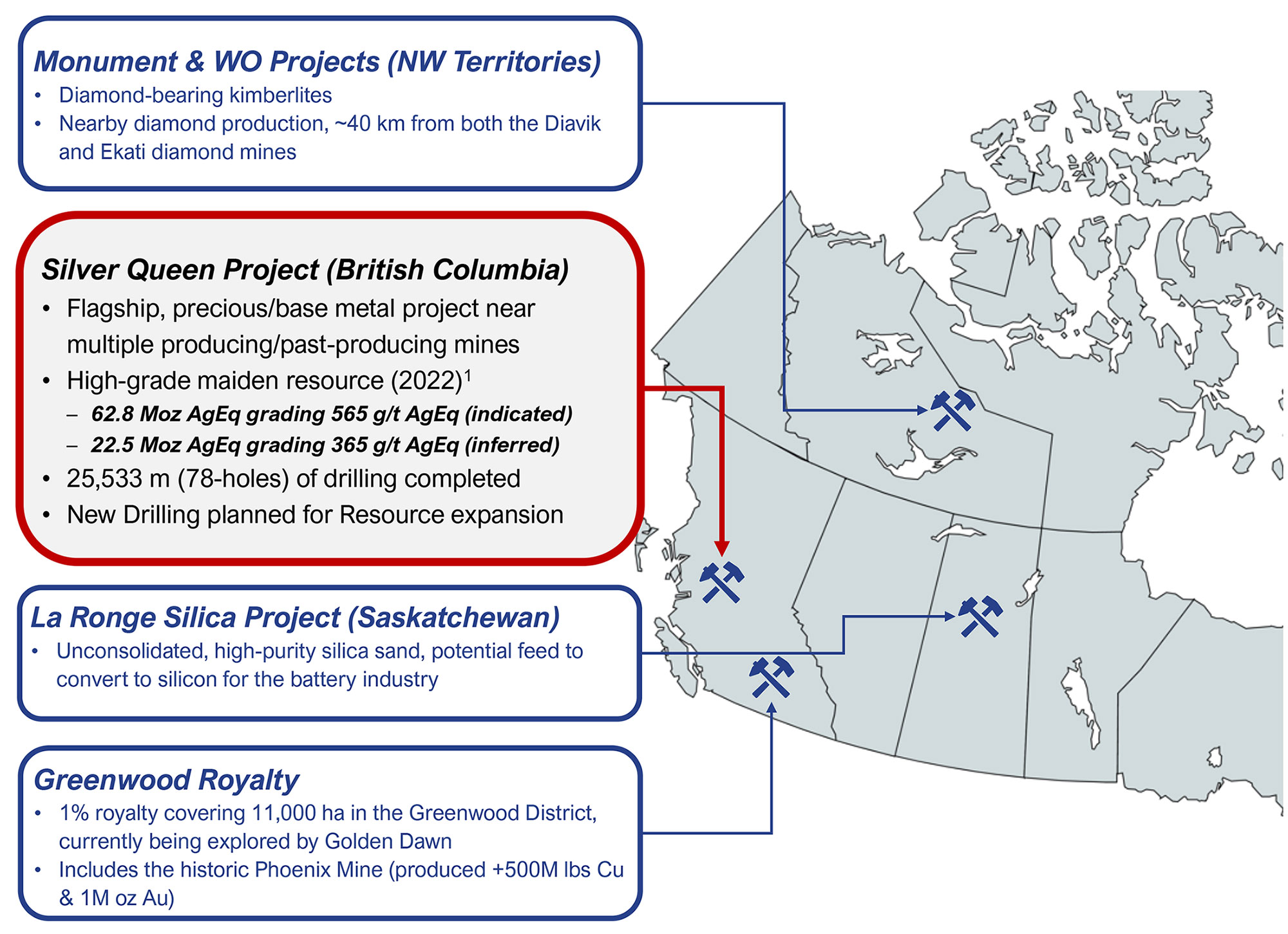

The share price of Equity Metals (EQTY.V) has been suffering this year although the company was making good progress towards a resource update on its flagship Silver Queen project. That would be the very first resource calculated by Equity Metals since the project was managed by the Manex Group.

The update didn’t disappoint. In a report published in September we were already scratching our heads seeing how the share price had dropped to just five cents for a market capitalization of C$5M and we were aiming for a resource increase to 60-80 million ounces silver-equivalent. Equity released the update earlier this year and it was a positive surprise to see in excess of 85 million ounces of silver-equivalent across the indicated and inferred resource category. And even more important was seeing that in excess of 70% of the ounces in the global resource actually fell into the indicated resource category.

The long-awaited resource update is good – better than we had originally anticipated

Equity Metals (EQTY.V) has released its long-awaited resource update on its flagship Silver Queen project in British Columbia. The updated resource estimate includes data from in excess of 25,000 additional meters of drilling completed since the previous resource estimate was completed a few years ago.

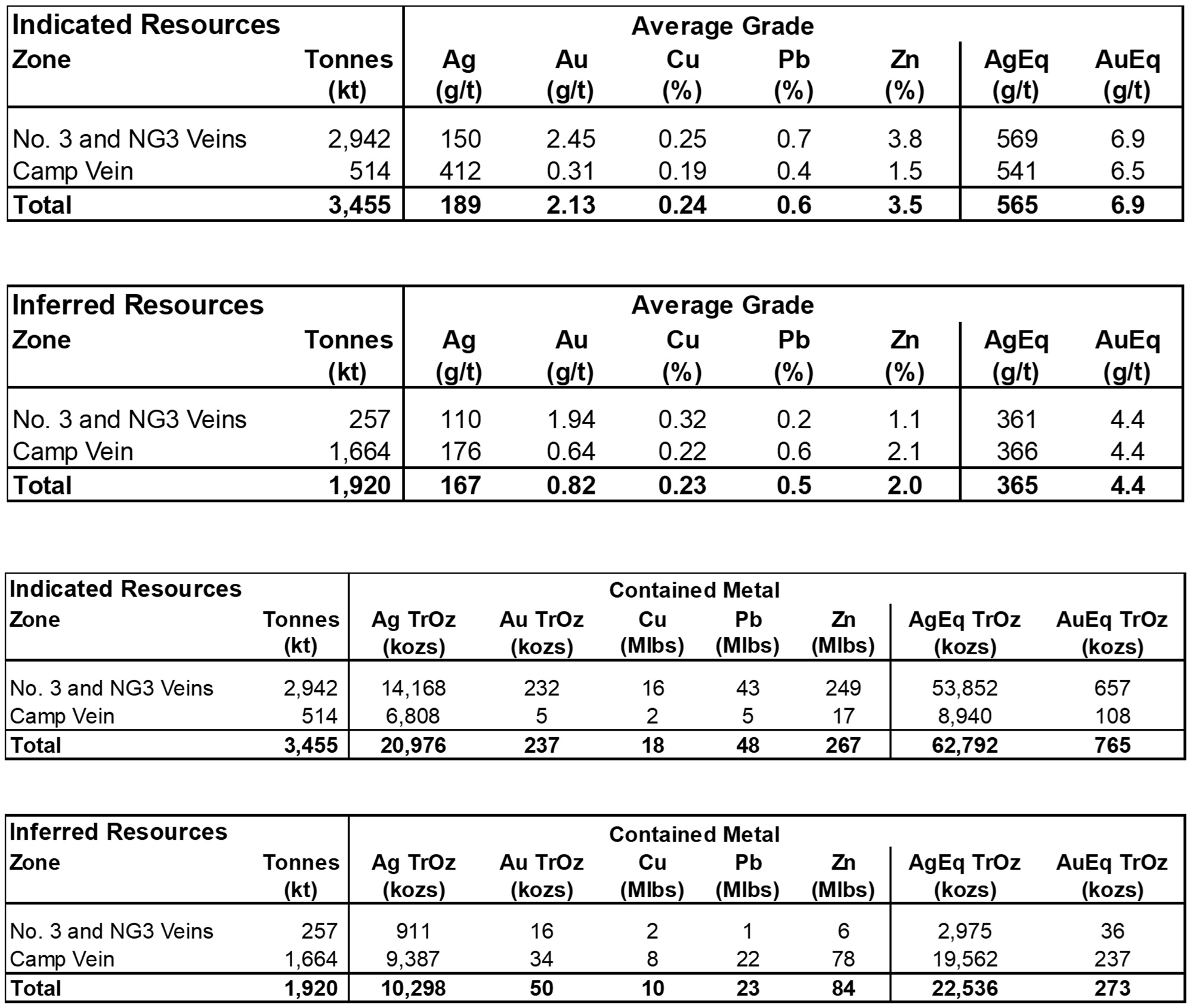

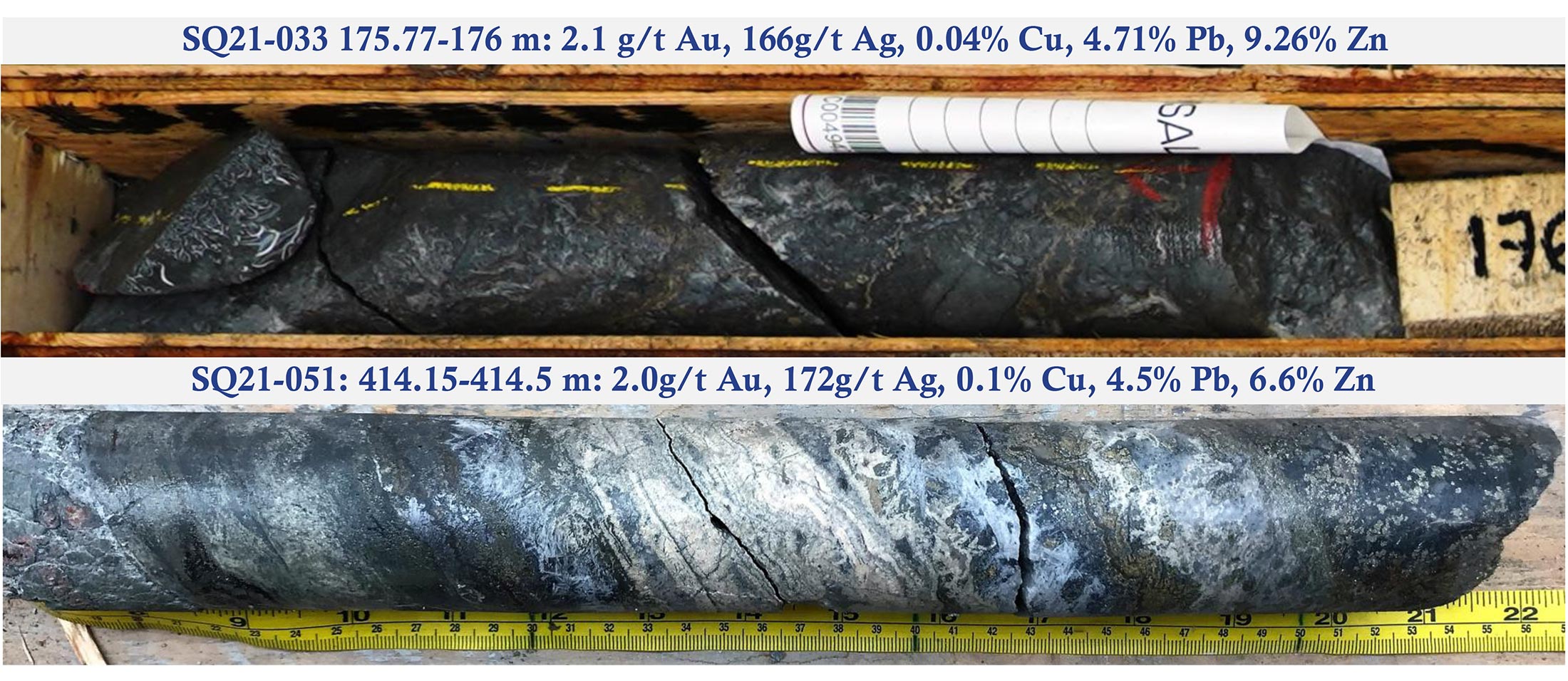

Not only was Equity Metals able to increase the total resource, it also more than quadrupled the total amount of tonnes in the indicated resource category. In the updated estimate, the indicated resources now contain just under 3.5 million tonnes of rock at an average grade of 189 g/t silver, 2.13 g/t gold, 0.24% copper and 4.1% ZnPb for a total of 21 million ounces of silver, 237,000 ounces of gold, 18 million pounds of copper, 48 million pounds of lead and 267 million pounds of zinc. This represents a silver-equivalent content of 62.8 million ounces or about 767,000 ounces gold-equivalent.

There is an additional inferred resource containing 1.92 million tonnes at an average grade of 162 g/t silver, 0.80 g/t gold, 0.23% copper and 2.5% ZnPb or a total of 10.3 million ounces of silver, 50,000 ounces of gold, 10 million pounds of copper, 23 million pounds of lead and 84 million pounds of zinc for a total of 22.5 million ounces silver-equivalent or 273,000 ounces gold-equivalent.

Combining both resource categories (which is not allowed as per the NI43-101 rules), the global resource contains just over 85 million ounces of silver-equivalent or just over 1 million ounces of gold-equivalent. That’s an important increase from the less than 440,000 ounces gold-equivalent or 39 million ounces silver-equivalent in the 2019 resource estimate, indicating Equity Metals has done a good job in creating value for its shareholders. According to the company, the discovery cost since 2019 was just C$0.15 per silver-equivalent ounce and C$11 per gold-equivalent ounce.

At the current metal prices, silver is most definitely the dominant metal on a gross rock value basis, but it will be interesting to see how the ratio changes on a post-recovery and post-payability basis as some of the silver will report to the zinc concentrate which would result in a lower amount of silver payable. In any case, it clearly is a silver-gold project with a substantial by-product component thanks to the base metals.

Just two months ago, we were surprised to see Equity Metals was trading at just five cents despite the looming resource update. Back in September we mentioned we would be happy to see 60-80 million ounces of silver-equivalent at a good grade, and with 85 million ounces across all categories with in excess of 70% of those ounces in the higher-rated indicated resource category, the resource update exceeds our expectations.

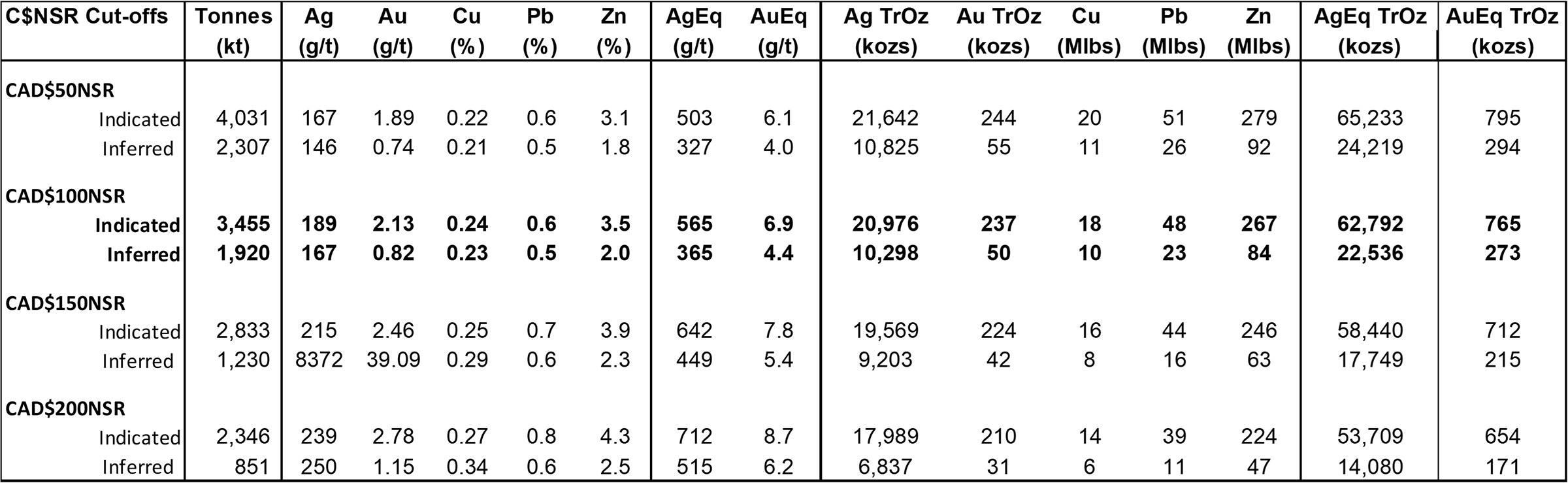

The 2022 resource is based on a cut-off grade using C$100/t as base case scenario. According to the footnotes to the resource update, this was based on an anticipated mining cost of C$70/t, a processing cost of C$20/t and a G&A cost of C$10/t. We think the processing cost and G&A cost per tonne is quite conservative (as especially the G&A cost should come down), but it would be good to get more details about the C$70/t mining cost as the project advances. Considering this is a narrow-vein project with average vein widths of 1-4, we should be mentally prepared for a mining operation that’s perhaps not as efficient as wider vein systems. This doesn’t mean these veins will pose a major problem as epithermal veins are successfully being mined all over the world with Silvercrest Metals (SILV, SIL.TO) as best-known example. We’ll just have to be mindful of mining dilution, but it’s impossible to guesstimate the dilution at this point and that will only become clear once the company puts a mine plan together.

That being said, Equity Metals also provided a sensitivity analysis using three different cut-off values for the Silver Queen rock as the company provided resource estimates based on a C$50, C$150 and C$200 NSR per tonne. We can easily disregard the C$50 NSR scenario as the odds of the mining + processing costs coming in at or below C$50/t are pretty close to zero.

If anything, we should strongly consider the C$150/t NSR scenario as well and it is encouraging to see the company would lose ‘just’ 20% of the tonnage in the indicated resource category, but in return it would see a 15% grade bump which means that even if the cut-off grade increases by 50%, Equity Metals would lose just over 4 million silver-equivalent ounces in the indicated resources. That’s solid.

The ‘damage’ would be greater in the inferred resource as about 35% of the total tonnage would disappear, although the 23% grade bump makes up for that. As you can see in the table above, the total amount of silver-equivalent ounces would decrease by less than 5 million if the NSR value would be increased from C$100/t to C$150/t and the total resources would still contain in excess of 76 million ounces silver-equivalent across both categories.

Bottom line: although the mine plan would become more complicated, the sensitivity analysis of the resource based on cut-off grades indicates that the total silver and silver-equivalent content wouldn’t be too severely impacted. Even in the very conservative C$200/t NSR scenario, the total resource would still come in at 53.7 million ounces silver-equivalent in the indicated resource category and 14.1 million ounces in the inferred resource category. That’s a decrease of respectively 14.5% and 37% despite a 100% increase in the cut-off value.

There’s a clear path towards 100 million silver-equivalent ounces

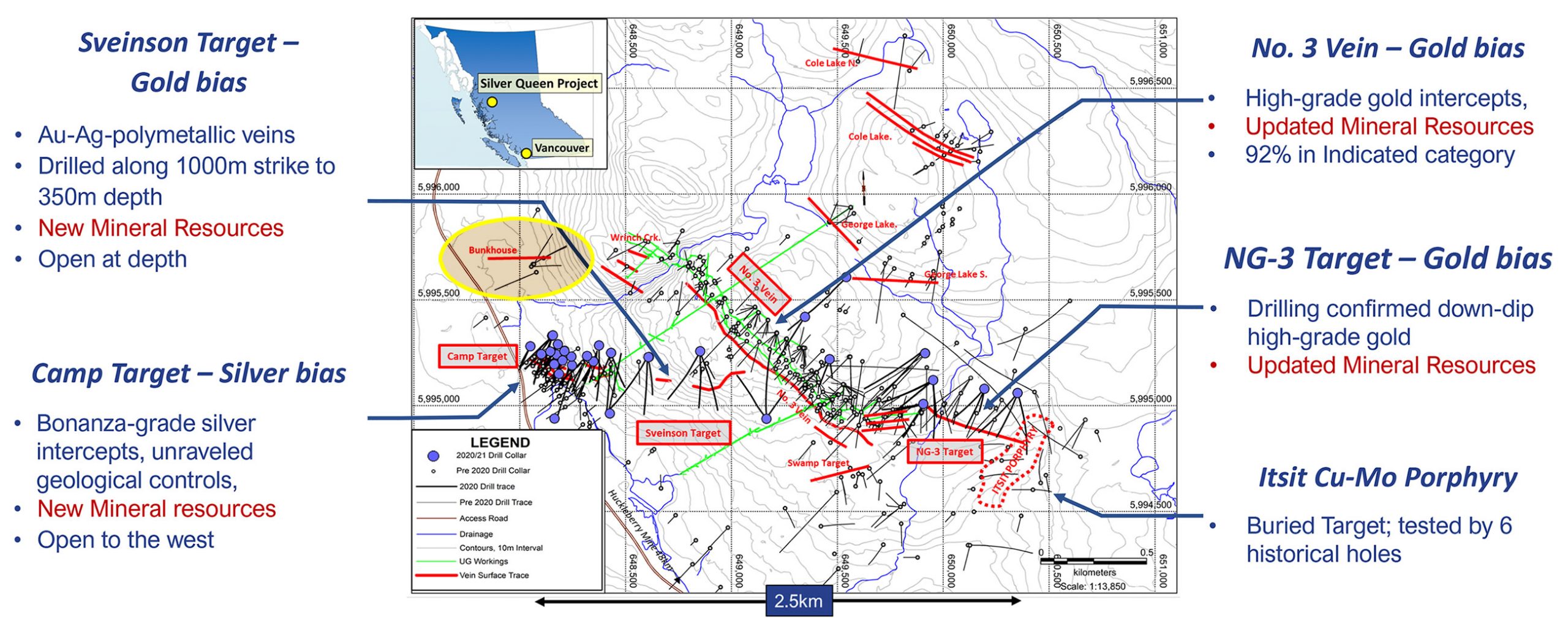

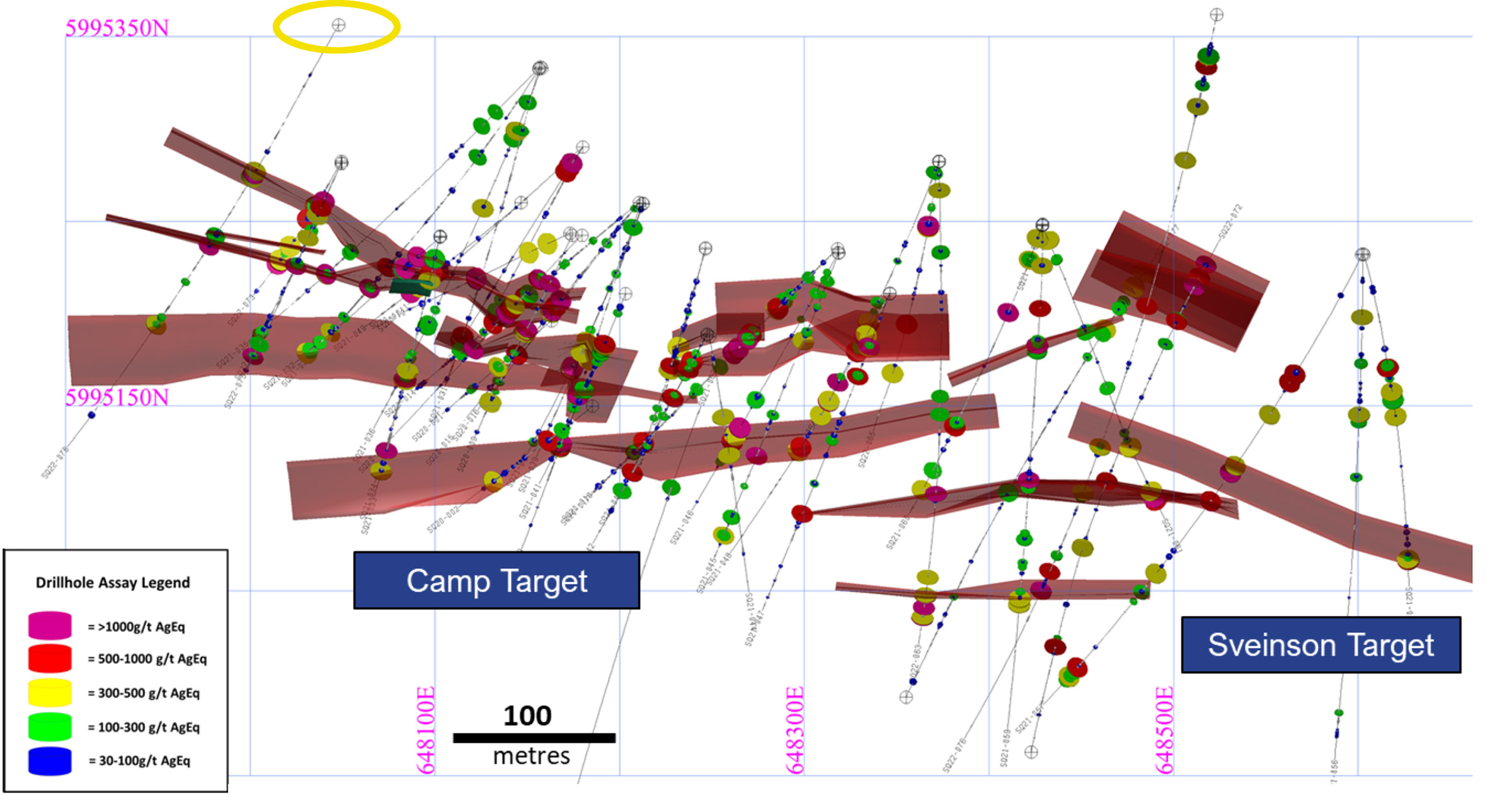

The resource update already surpassed our expectations, but there still is plenty of exploration potential at Silver Queen. The image below shows some of the low-hanging fruit that’s still present on the project.

At the Sveinson target, the company expects to be able to further extend the average depth of the mineralization although the deepest holes already confirmed the presence of (gold-heavy) mineralization up to a vertical depth of 350 meters. These epithermal veins can run pretty deep and further adding tonnage below 350 meters will help the global resource at Silver Queen. As a reminder, expanding the mineralization by 50 meters vertically over a 300-meter length and applying an average width of 2 meters would add almost 100,000 tonnes of mineralized material for what would likely be 5-10 million ounces of silver-equivalent.

At the Camp Target, the mineralization remains open towards the west. Additionally, Equity Metals plans to complete a surface exploration program at the Bunkhouse target (highlighted in yellow). This surface program will likely consist of a basic soil sampling program although it is also possible there will be an auger sampling component.

As the mineralization at the Camp Vein remained open towards the west, it only makes sense to have a look in the west-northwestern direction as it is possible there is a wider mineralized corridor running through the Silver Queen project. Of course, this is just a theory, but that theory will get tested in the near future with the sampling program and perhaps a drill program should the surface exploration results warrant a follow-up program.

The potential at the Camp Vein target was further highlighted by hole 78, highlighted in yellow below. That hole pierced through three distinct mineralized zones and confirms the mineralization remains open towards the west.

We expect to see Equity announce a 2023 exploration program after closing its financing.

Equity is raising cash to hit the ground running in 2023

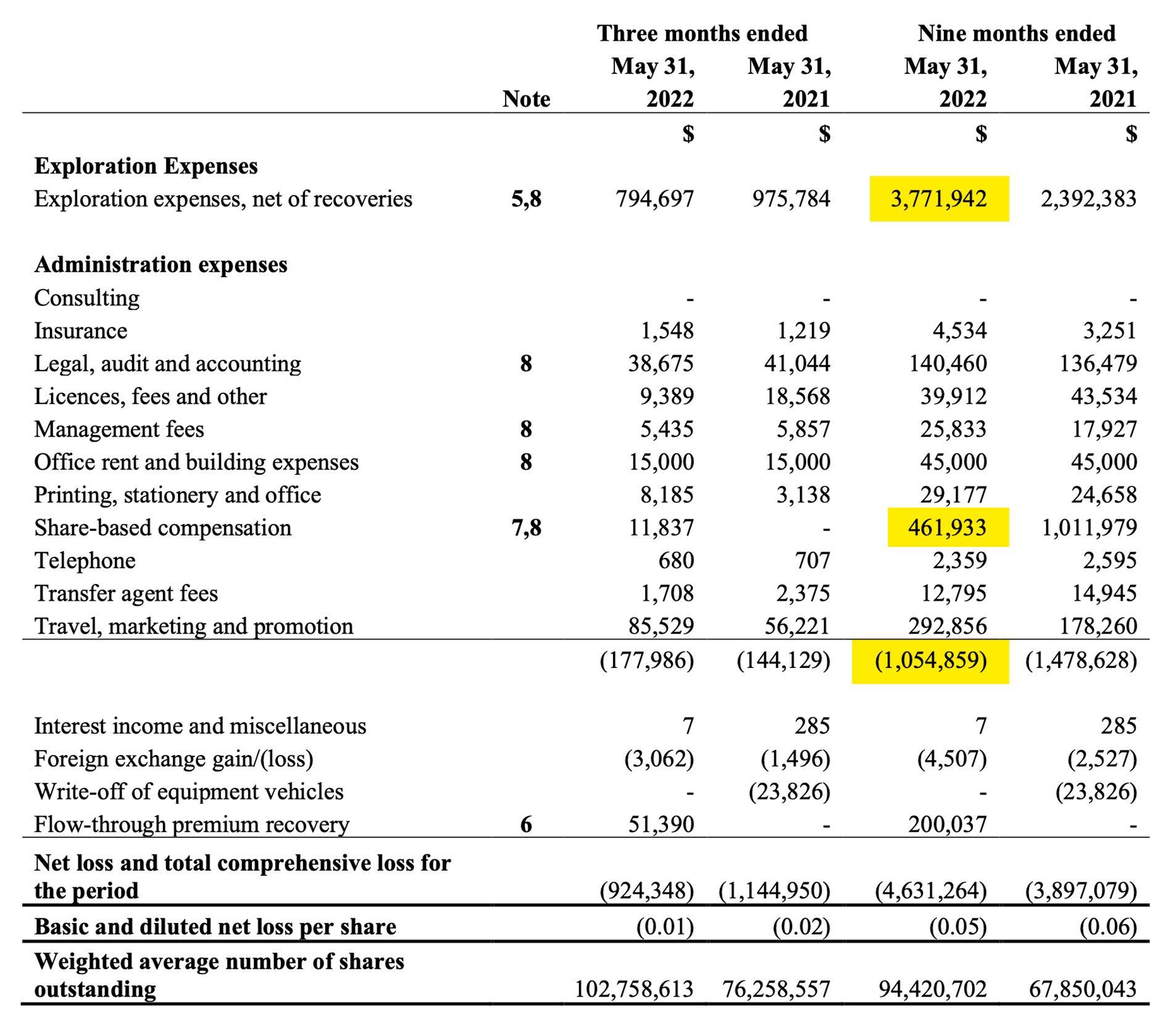

Exploration ain’t cheap, and Equity Metals has been running on shoestring budgets ever since it took control of the project. It’s remarkable to see the total silver-equivalent content in the resource more than doubled despite spending less than C$7M on exploration. And just to show how careful the company is when it needs to spend money: in the first nine months of the financial year (which ended in August, so we should see the full-year financial results pretty soon), Equity spent C$3.77M on exploration while the overhead expenses were just C$1.05M. And of that C$1.05M, almost C$0.5M was related to (non-cash) share-based compensation which means the cash overhead expenses were just C$0.6M in the first nine months of its financial year.

Needless to say this team is spending the cash on drilling and exploring Silver Queen.

As the cash and net working capital position has decreased to just a few hundred thousand dollar (the updated corporate presentation mentions a cash position of C$0.4M), Equity Metals was clearly waiting for the resource update to raise cash. In hindsight, this was the right decision as the share price reacted quite favorable to the resource update and Equity Metals is taking advantage of the situation to initially raise C$1.7M and due to strong demand this was almost immediately upsized to C$2M.

The proposed financing will consist of three different tranches. A hard-dollar unit was priced at C$0.10 and should allow the company to raise C$800,000 (including the recent upsize). The flow-through units are priced at C$0.12 for a total of C$500,000 as well, and finally, the charitable flow-through units were priced at C$0.147 and Equity Metals is hoping to issue C$700,000 worth of these charitable FT shares. This brings the total size of the financing to C$2M.

Each unit will include a full warrant which will allow the warrant holder to acquire an additional share for C$0.15 during a three year period.

Conclusion

It is pretty remarkable to see what Equity Metals has been able to do with just C$6.75M in exploration expenditures. The discovery cost since taking the reigns of the exploration program in 2019 was just C$0.15 per added silver-equivalent ounce or C$11 per ounce of gold-equivalent.

Cash has never been easy to come by for Equity Metals and even today, at C$0.11 per share, the company’s market capitalization is less than C$11M despite the recent 100% share price increase. It does create a Catch 22 situation for Equity: while the company’s valuation is pretty attractive based on the updated resource, the low market cap also makes it more difficult for Equity to raise funds without incurring too much dilution.

Based on the recent resource update, there’s a clear path for the Silver Queen resource to increase to 100 million silver-equivalent ounces across all categories. And hopefully that will give Equity Metals enough confidence to start working on a Preliminary Economic Assessment to figure out the economic value of those ounces.

Disclosure: The author has a long position in Equity Metals. Equity Metals is a sponsor of the website. Please read the disclaimer.