Life isn’t always fair, and many of the exploration stage companies have a hard time capturing the interest of the (few?) investors left in the exploration space. Just two months ago, Equity Metals (EQTY.V) raised C$1.6M in a flow-through financing but is currently trading at less than half the flow-through placement price.

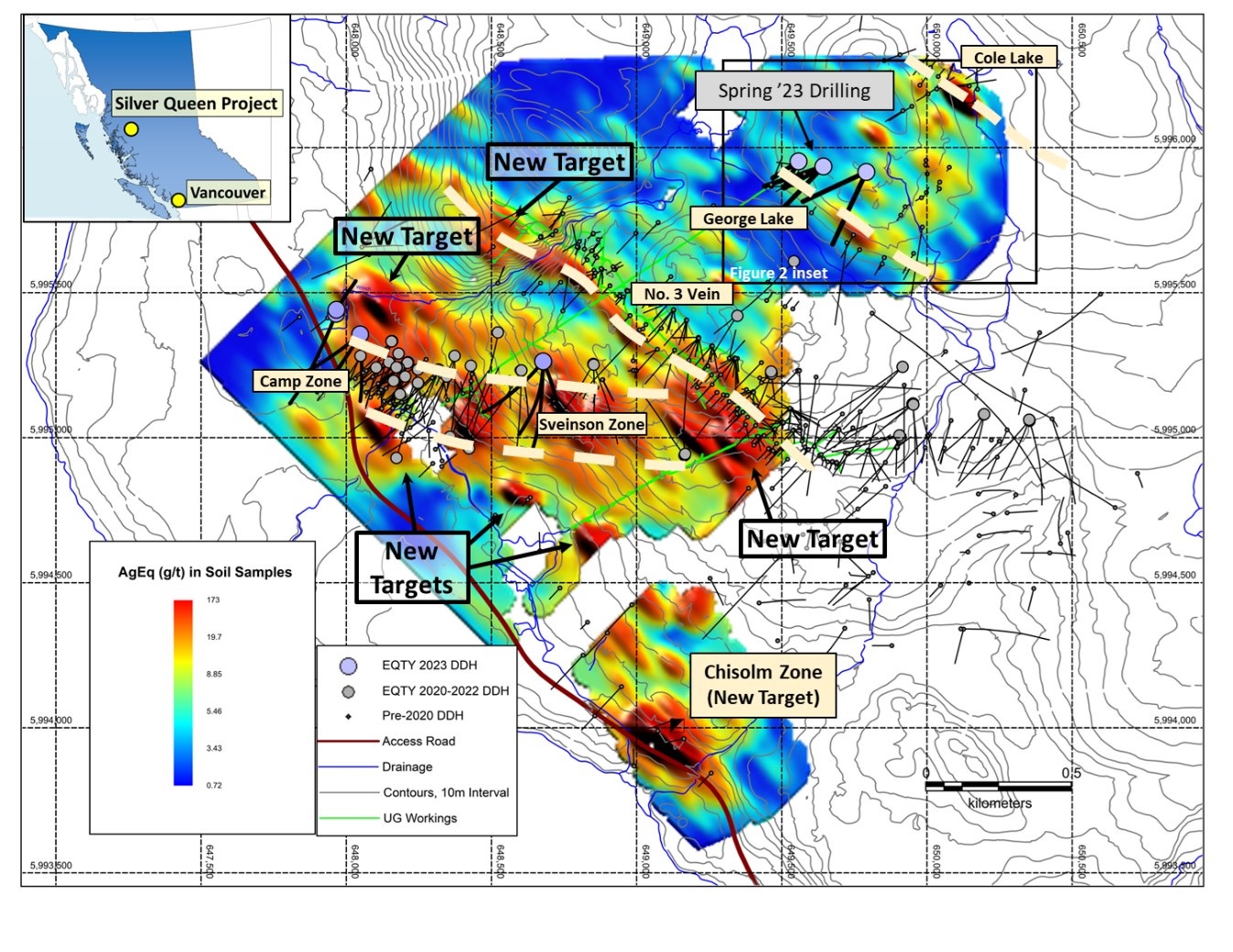

The company has been focusing on the Camp Vein, No3 Vein and the Sveinsson extension in the past, but it decided to drill-test some of the regional targets in the summer of 2023. All assay results from the holes that have been drilled on the Cole Lake and George Lake targets have now been received, and the initial results actually are encouraging. In this update we will have a look at the George & Cole Lake drill results and we will discuss the implications with VP Exploration Robert MacDonald.

Reviewing the recent Cole Lake and George Lake drill results

George Lake

When the company broadened its focus to have a look at the regional targets around the main veins, it also expanded its exploration focus to George Lake. The 2023 exploration program included a budget to drill-test some of the regional targets, including the George Lake target.

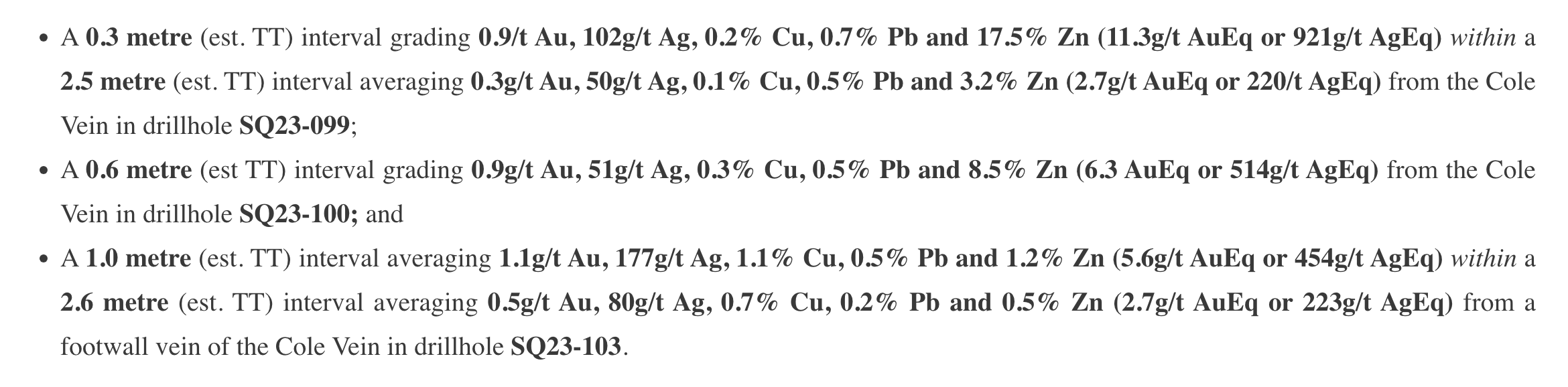

George Lake is not a new discovery but this target hasn’t been drilled in over 30 years and Equity Metals was keen on having another look at the mineralized occurrence. The company completed almost 2,500 meters of drilling in 7 holes at George Lake and the assay results of the first three holes were promising. The company highlighted two high-grade but very narrow intercepts in its bullet points:

Equity Metals’ technical team appears to be quite pleased with these results as the drill bit ‘confirmed the overall tenor of mineralization’ around the Bulkley Crosscut to a depth of up to 200 meters below surface. The company also intersected additional narrower veins and the preliminary interpretation by Equity is that this suggests the potential for the development of hanging wall and footwall zones.

While those initial three holes were encouraging, we were waiting to see the assay results of the other four holes that were drilled on George Lake and those were released in December.

All four holes encountered mineralization (which means all seven holes of the 2023 George Lake drill program successfully intersected mineralization) in the same style as the Camp Vein and No3 Vein at Silver Queen but as you can imagine, the grades definitely do vary.

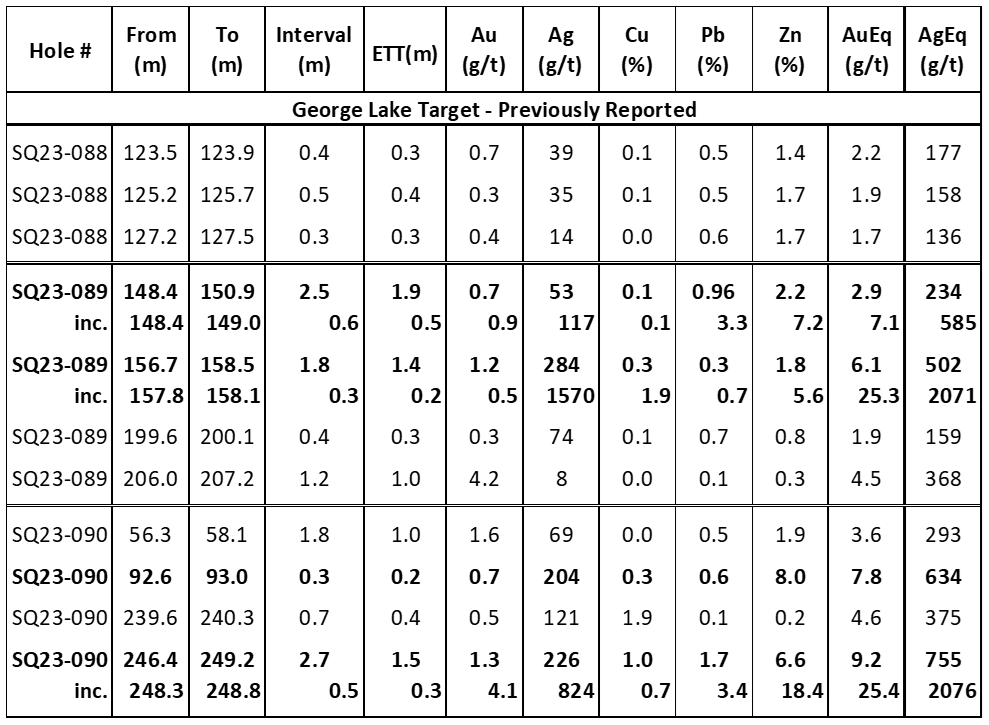

In hole SQ23-091 for instance, the company intersected 1.2 meters (true width) containing 460 g/t silver-equivalent but only 78 g/t of that equivalent-calculation are effectively silver. The lead and zinc grades are pretty strong and even the gold grade of 1.4 g/t adds more to the silver-equivalent calculation than silver does.

In hole SQ23-092, the drill bit intersected several narrow intervals of which 0.7 meters (0.5 meters true width) with 752 g/t silver-equivalent was the best interval. In this particular area, the silver did make up almost half of the silver-equivalent grade. Holes 93 and 94 did encounter higher grade mineralization over a wider interval. Hole SQ23-093 for instance encountered 2.7 meters (true width) of 405 g/t silver-equivalent within an interval of 5 meters (again true width) containing 256 g/t silver-equivalent. The narrower 2.7 meter interval definitely seems to ‘carry’ the entire interval as the average grade in the residual 2.3 meters of the hole is just over 80 g/t silver-equivalent.

In the four hole update that Equity Metals disclosed, the fresh batch contains both the thickest intercept of mineralization at George Lake as well as some of the highest gold grades, including some interesting near-surface gold grades in holes 093 and 094 with respectively 0.3 and 0.5 meters containing 5.5 g/t and 10.4 g/t gold starting at a down-hole depth of respectively 9.2 meters and 12.3 meters.

The initial drill results from George Lake are very encouraging as Equity Metals has booked early successes while following up on the historical exploration activities on the asset. The company has now confirmed the lateral projection of the vein for approximately 400 meters and has successfully chased the mineralization to a depth of 250 meters. According to Equity, the mineralization remains open laterally to the southeast and at depth, and Equity Metals is making George Lake a primary target for its 2024 drill program.

Cole Lake

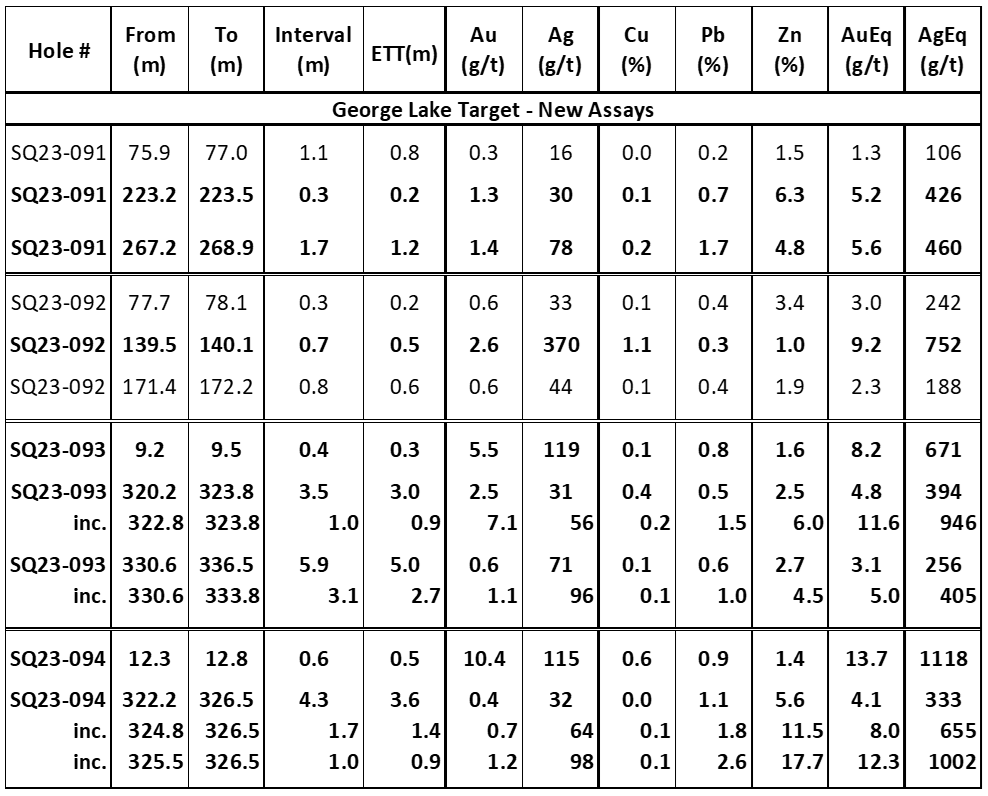

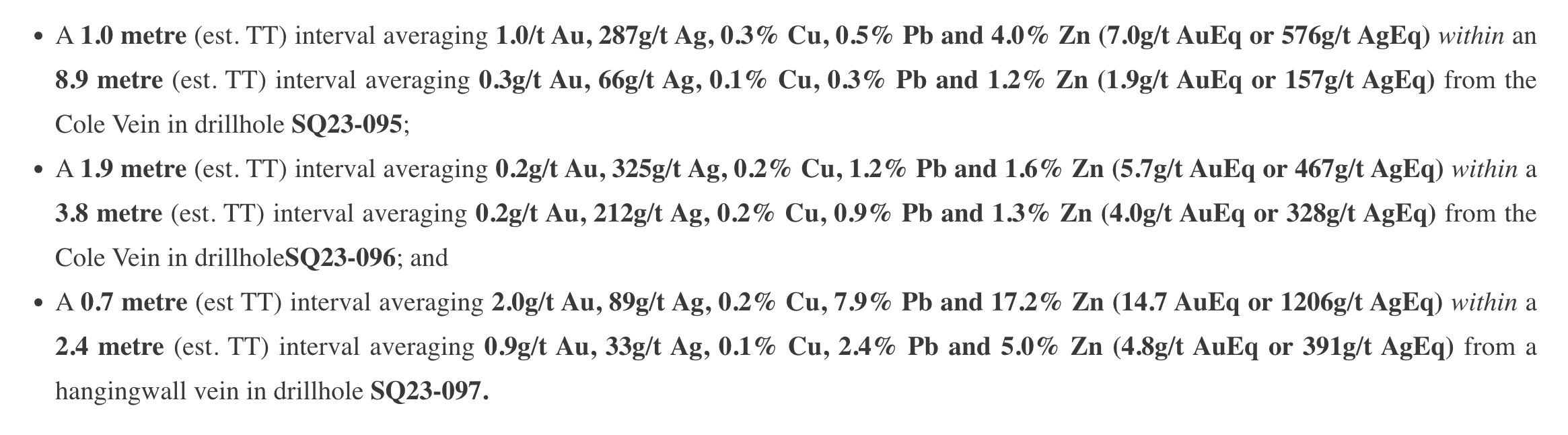

In December, the company released assay results from the Cole Lake target which is just a little bit to the north-northeast of George Lake. Equity Metals drilled nine holes at Cole Lake and has now released the assay results from the first three holes. The highlights of those holes can be seen below.

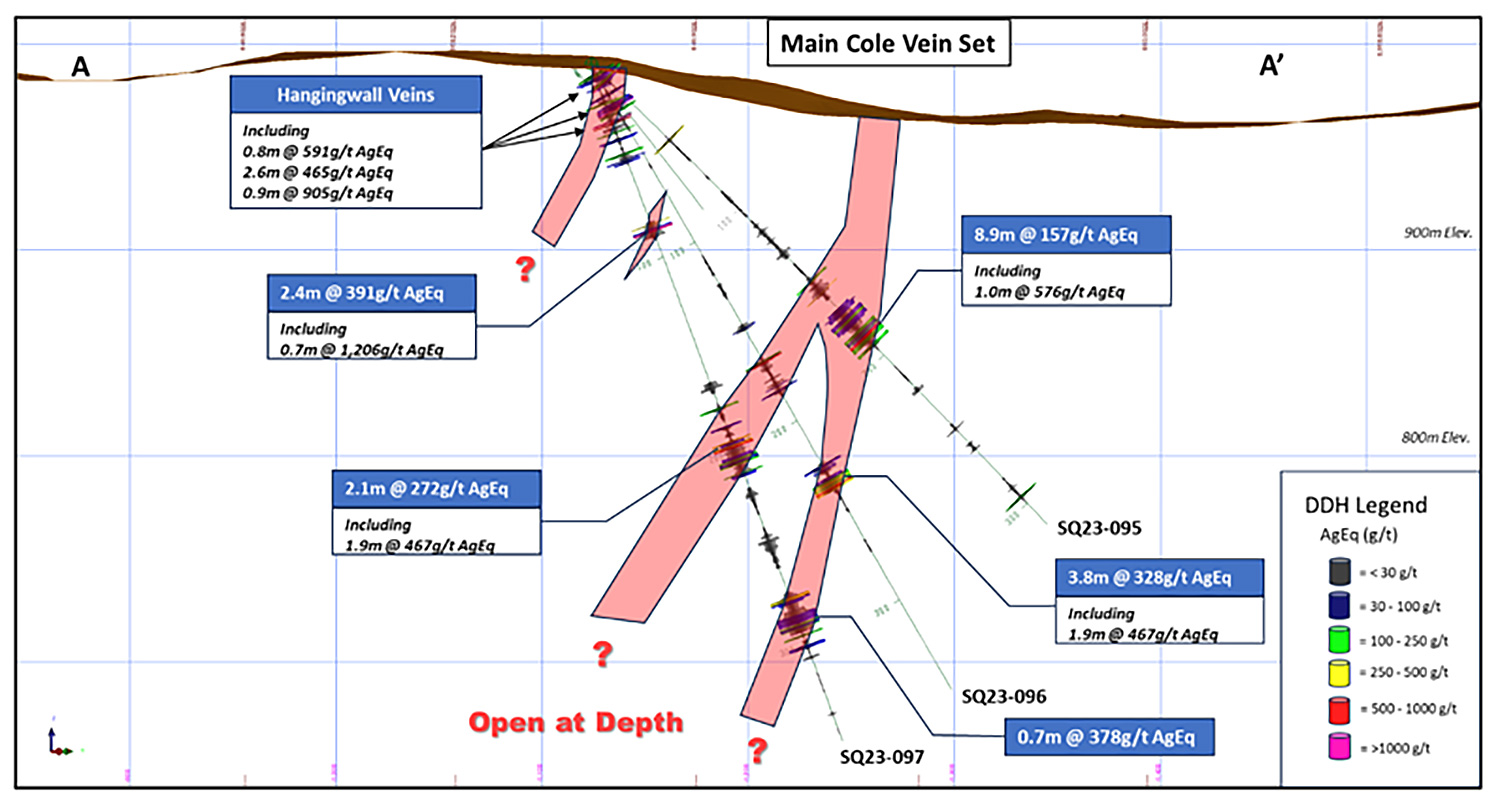

These first three holes form a vertical fan and according to Equity’s technical team, they confirm the tenor and thickness of the mineralization at the main Cole Vein up to a depth of in excess of 250 meters below surface.

A few weeks after the first exploration update, Equity Metals released the remaining holes that were completed on the Cole Lake target.

The Cole Lake target is really shaping up to be quite interesting as all six additional holes were also mineralized. While some assay results were nothing to get too excited about (like the 1.3 meters containing 225 g/t AgEq in the Cole vein in hole 98 and the narrow intervals in hole 102 with 0.4 meters and 0.3 meters containing respectively 261 g/t silver-equivalent and 199 g/t silver-equivalent), there certainly are some holes that made heads turn. Hole SQ23-100 for instance encountered some nice grades (but over relatively short intervals) with for instance 0.6 meters (true width) containing 514 g/t silver-equivalent.

There also were some intervals that were thicker with for instance 2.6 meters true width containing 223 g/t silver-equivalent and 1.2 meters containing 378 g/t silver-equivalent.

The main takeaway from the Cole Lake drill program is the fact that all four holes that were targeting the Cole Vein actually intersected the vein while the drill bit also intersected multiple hanging wall veins and clusters of footwall veins. The drill program has now successfully traced the Cole vein over a distance of over 400 meters laterally and up to a depth of 400 meters below surface. The technical team also noticed the thickness and grades increased towards the northwest, especially at depth and this will for sure help the company to figure out drill targets for a follow-up drill program this year.

This year’s exploration activities will be financed with the proceeds of a flow-through financing closed by the company in December. The company was able to raise C$1.6M by issuing 8.5 million premium flow-through units priced at C$0.19. Each unit consisted of one flow-through share and a full warrant allowing the warrant holder to purchase an additional (non flow-through) share at C$0.18 for a period of five years after closing. The shares will be free tradeable from April 21st on.

That is a very generous warrant, but Equity Metals will be happy to have the cash in the bank so it can plan its 2024 drill campaign.

Sitting down with Robert MacDonald

Since the last time we spoke, the attention has shifted somewhat from the Camp Vein and No 3 Vein to Cole Lake and George Lake as you started to focus on some of the regional targets. What was the main reason behind focusing on those two targets first?

Much of our exploration and resource growth to date in the Camp, Sveinson, No. 3 and NG-3 deposits was the result of analysis and re-assessment of historical drilling and data generated by previous workers. There is a terrific pre-existing database on the property that we were able to take full advantage of in or own drill targeting and were successful in effectively doubling the Mineral Resources on the property at cash discovery costs of only C$0.15/oz AgEq.

Our focus on the George and Cole Lake target areas follows that same formula. Historical drilling on both targets identified multiple intercepts of high-grade polymetallic mineralization. Our drilling confirmed the overall tenor of mineralization and extended the lateral project of mineralization of both target structures.

Some other targets on the property are less well defined and we will be conducting additional surface work this summer to upgrade some of those targets as well.

We already discussed the Cole Lake and George Lake assay results in previous updates on the website and both targets seem to have their merit. Do you have a preferred target? Where would it be the ‘easiest’ to build tonnage for a resource calculation?

At this juncture the George Lake target is the priority. Drilling in 2023 confirmed historical results and a potential strike-length of 400 metres which remains open both along strike and at depth. Further drilling is required to bring this zone into a resource category. This will likely be the inferred category first before we get to a tighter drill spacing.

Furthermore, the structure is connected to the historical workings of the No. 3 deposit via the Bulkley Cross-cut. The No. 3 deposit is the largest single deposit in the current mineral resource. This could significantly impact any proposed mining scenario as it would reduce pre-development costs associated with accessing the mineralization and could ultimately increase mining rates in the earliest stages of a production schedule.

The company recently raised C$1.6M in a flow-through financing priced at C$0.19 per share. In hindsight, that was an excellent move as the stock is currently trading at just half the price the new shares were issued at. Where will the funds be deployed?

We are currently funded to drill approximately 6,500 metres. Most of that will target the George Lake vein set. Drilling will confirm the 400 metre projected strike-length of the structure to depths of up to 350 metres below surface. We may also drill test a couple of more conceptual targets as we continue to generate and evaluate new areas of mineralization on the property.

Silver Queen currently has a resource of almost 63 million silver-equivalent ounces in the indicated category and an additional 22.5 million ounces silver-equivalent in the inferred category. What would be your next resource target and when do you expect to achieve that? When do you think you will reach the ‘critical mass’ to move ahead with a preliminary economic assessment to figure out the commercial viability of the project?

We would like to add an additional 40Mozs AgEq the resource base which would bring the total Mineral Resources on the property to about 125Mozs AgEq. At that point we will evaluate whether we should conduct an economic assessment on the property.

How is the investor appetite for silver exploration companies like Equity Metals? The C$1.6M flow-through financing was very encouraging but it feels like the sentiment has soured a bit again over the past two months.

From what I can tell, investor interest in silver remains high. Many of our investors are ‘silver-bugs’ and have taken the opportunity to invest in silver companies at what they perceive as extraordinarily low company valuations. For example, I saw a recent Rick Rule interview where he suggests that silver today is where uranium was two years ago and I definitely hope that he is correct.

The recent stall in precious metal prices appears to be the result of a more hawkish outlook toward inflation and interest rates by the Central Banks. However, it is expected that as the threat of inflation recedes, interest rates will fall and in turn stimulate a rise in precious metal prices.

Traditionally, the silver price tends to initially lag upswings in the gold price, but compensates for that by trading at higher multiples later in the cycle. As an industrial mineral, silver consumption has out paced silver production for several years now and the fundamentals remains strong in that regard. Many investors I speak to are very bullish on the price of silver looking forward through 2024 and beyond, and feel that we are only at the beginning of the next bull market in silver.

Conclusion

Equity Metals’ decision to drill some of the regional targets appeared to be the right on as it has confirmed mineralization at Cole Lake and George Lake in all holes. As VP Ex Robert MacDonald explained, the George Lake target is more interesting to the company than the Cole Lake target as it sounds like it will be easier to build tonnage, potentially mineable tonnage, at George Lake.

The company would like to get to 125M silver-equivalent ounces before pulling the trigger to get started on an economic assessment, and we hope the 2024 drill campaign will get the company close to the critical mass at the Silver Queen project. The company currently has a market capitalization of C$11.7M which represents C$0.14 per ounce of silver-equivalent in the ground. Of course, not all ounces were created equal and we shy away from a valuation that’s purely based on ‘ounces in the ground’ but we hope the company will be in a position to release an economic study on the project in the near future to get a better understanding of the NPV and IRR of a potential mining scenario at Silver Queen, further down the road.

We will likely see more details on the anticipated 2024 drill program soon, and fortunately the company has access to flow-through funds to kick off the exploration program.

Disclosure: The author has a long position in Equity Metals. Equity Metals is a sponsor of the website. Please read the disclaimer.