Equity Metals’s (EQTY.V) exploration program on the Silver Queen project is in full swing and the assay results of the drill holes that have been released so far have yielded spectacular grades. Hole 10 – which contained the bonanza grade mineralization- was drilled 50 meters away from hole number 3 which we reported on before. Hole number 3 contained high-grade but narrow intervals of silver mineralization and hole 10 isn’t any different: the average silver grade is sky-high, but the width remains relatively narrow.

The headline 56-kilo result was obtained in a 0.3 meter interval but the broader 1.65-meter interval still contained an excellent silver grade of 12,448 g/t. This means the 1.35 meters of the interval that was not included in the 0.3-meter intercept was still running at 2,850 g/t silver.

Those grades are definitely catching the attention of the market, and we wanted to follow up with VP Exploration Robert MacDonald to pick his brain on grades, widths and the next steps to unlock value at Silver Queen.

A chat with Robert MacDonald, VP Exploration

Camp Vein

Your recent drill results were from holes drilled on the Camp Vein and your first few holes have successfully intersected (very) high-grade mineralization, albeit over relatively limited widths. Do the results meet your expectations?

The results did surprise us somewhat. We knew there were very high-grade silver intercepts in historic holes, but we were questioning our identification of “ruby silver” when looking at the core from hole -10 as there was just so much of it. Obviously, we didn’t want to bring attention to the intercept until we were sure, based on assays and repeats of assays.

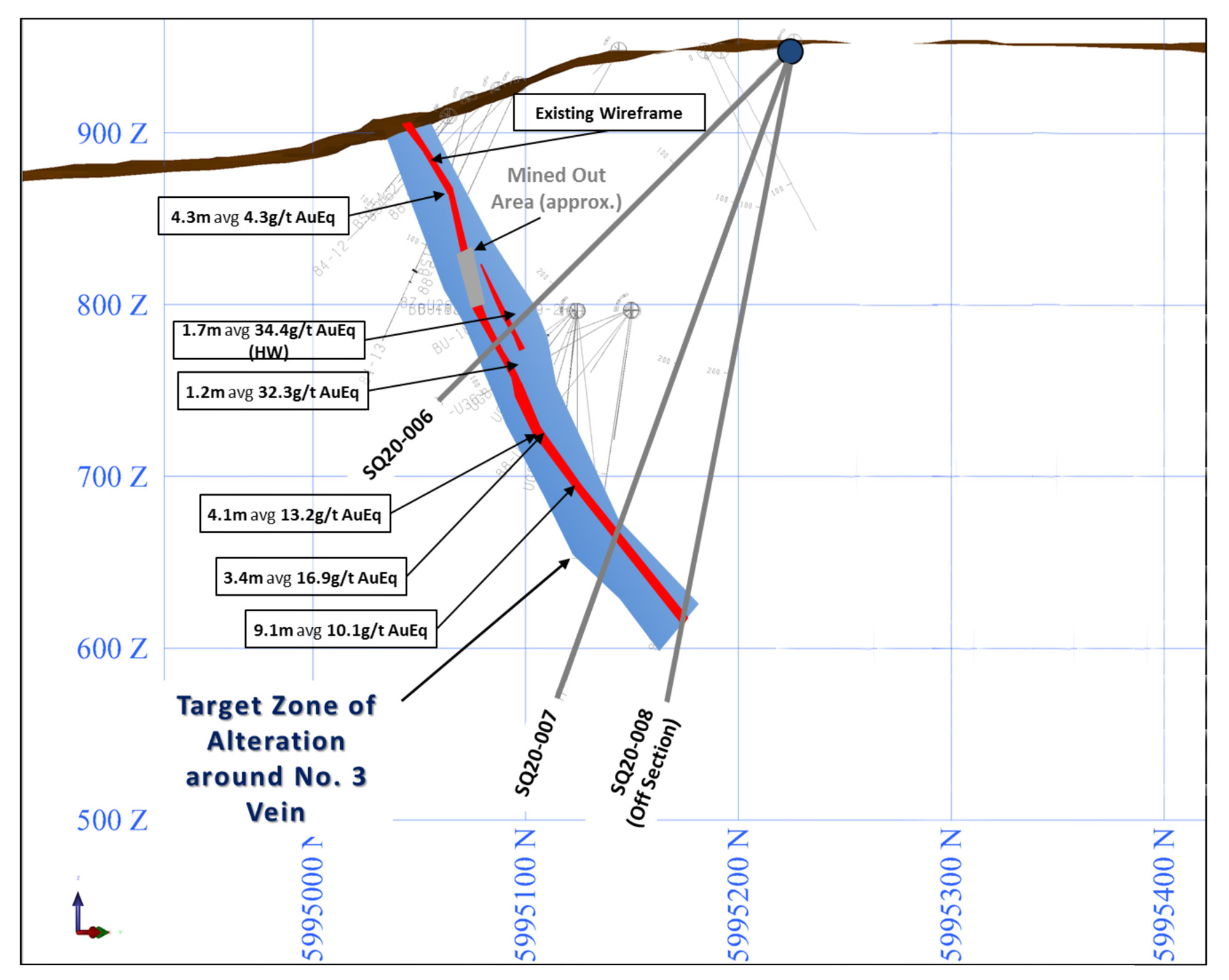

The assays were confirmed, and there are nice shoulder assays of +4,000g/t Ag as well as the narrow bonanza interval to form a vein zone of 1.7m wide within a wider zone of 4.5m when including lower Ag values. After drilling holes -04 through -08 at the No. 3 Vein, we wanted to drill offsets of the thicker intervals of mineralization which were identified in our hole -03. We were looking at our 3D model and wondered if there was an elevational control to the 14,000+ g/t Ag assay in a nearby historic hole and hole 10 suggests there may be.

The Camp Vein may be complicated, based on historic drilling, and we wanted to drill holes that would help us unravel the vein geometry in order to calculate an accurate resource. One possibility that we are continuing to test is based on potential metal zoning in the epithermal veins identified at the Camp Vein system, which are very rich in silver relative to gold.

This feature, and the presence of other minerals in the veins suggest the Camp Vein is less eroded than some of the other veins on the property and if so, we wonder if these veins will transition with depth into a more gold-rich vein system. That is what we found during our exploration of the Homestake deposit in the Golden Triangle.

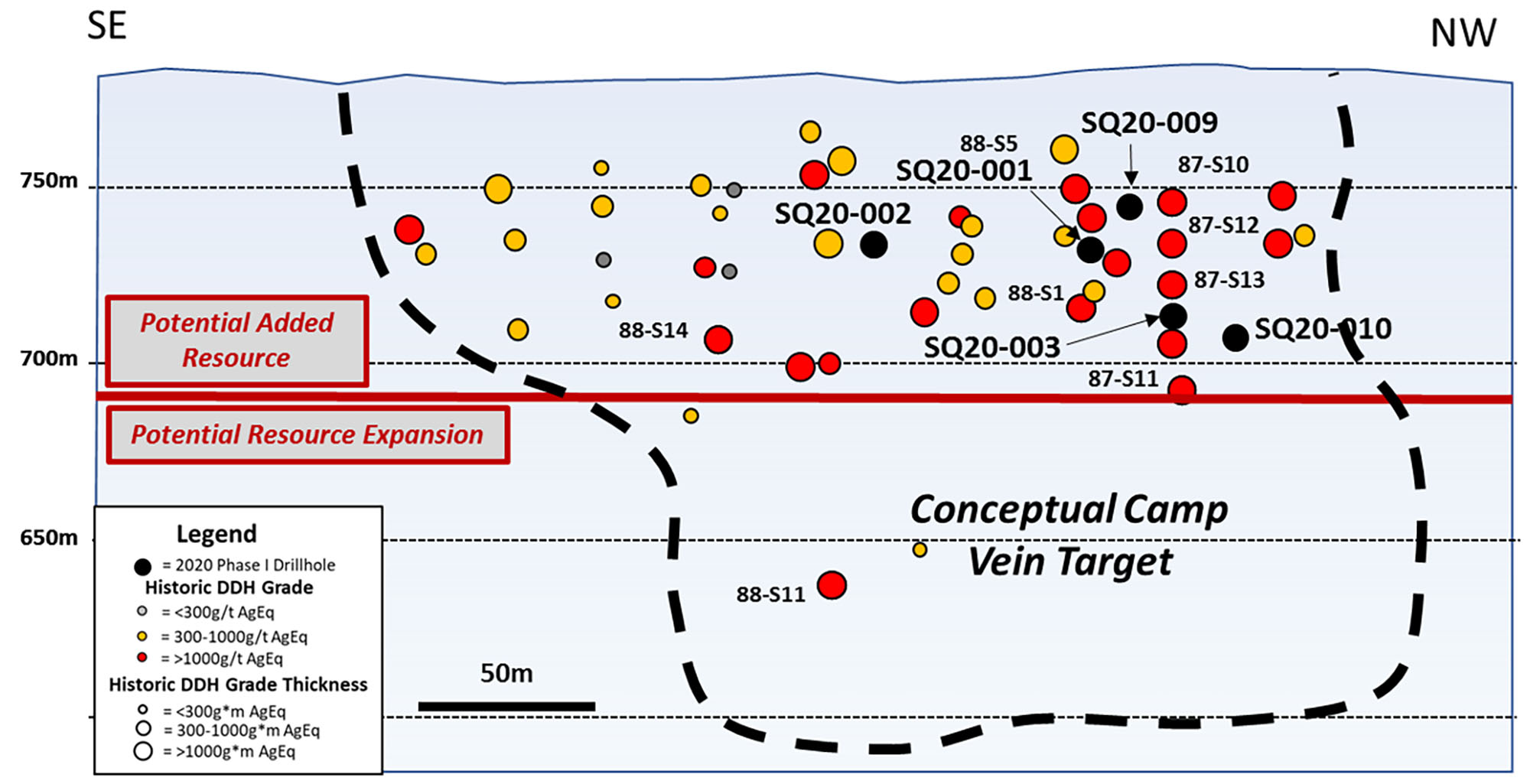

It’s perhaps still early days, but it’s also important to mention the Camp Vein is currently NOT included in the NI43-101 compliant resource estimate on the project, so any additional tonnage you will be able to define at the Camp Vein is pure bonus. There is a historical resource of 205,000 tonnes at an average grade of 1 g/t gold, just over 800 g/t silver and 4% zinc. After your first few holes at the Camp Vein, has your confidence in the historical resource estimate increased?

It is too early to determine a resource for the Camp Vein because we are still working out the geometry. It will likely need further drilling in the previously drilled parts of the deposit in order to fully confirm the “historic reserve”. Fortunately, this will be relatively shallow drilling.

We like the thickness of the vein structures identified in holes -003 and -010 and feel that these zones form the basis for further extensions of the mineralization both along strike and particularly at depth. Again, the veins may be less eroded than the No. 3 Vein and if so, testing deeper on the Camp Vein system, the veins may become more discrete, wider, and potentially gold-rich.

Your own exploration target is 500,000 tonnes at an average grade of in excess of 1000 g/t silver-equivalent. Your target is based on a 500 by 300 meter area, and using a density of 2.85 this implies an average vein width of around a meter. You obviously completed just five holes at Camp, but do you still see your conceptual target area as valid, or is it starting to look like you are erring on the cautious side?

We always try to be realistic based on the data available to us, but we specifically test ideas that could result in exceeding our target parameters. The identification of 56,115g/t Ag over 0.3m at the Camp Vein represents a milestone intercept as it clearly demonstrates the exceptional high-grade potential of the Camp Vein system and helps confirm high-grade results from earlier historic drilling.

Mineralization is open on strike and at depth and as is typical in these types of epithermal vein systems, widths of the vein intercepts can vary greatly. In that regard, we don’t anticipate that the full 300m x 500m target area will be of uniform thickness and that it is likely that we will identify one or more thicker “shoots” of mineralization within the target area which will “carry” much of the potential resource. We have identified mineralized structures with good thickness ranging from 4m to 7m that can form the basis of a potential shoot and will now start the process of extending and delineating this zone and searching for others.

And perhaps a very preliminary question. In a purely hypothetical mining scenario, what would be the appropriate technique to mine the Camp Vein, in your experience, given the narrow but very high-grade mineralized intervals? We obviously know there’s no guarantee the Camp Vein will ever be developed (let’s start with a resource first!), but it would be great to get some color on how similar vein types are being mined around the world and how the efficiency can be boosted?

Current Camp Vein intercepts start nearly at surface and extend to about 80 metres depth. That gives us some flexibility to go after relatively small, but very high-grade zones of mineralization. We obviously need a better understanding of the geometry and width of mineralization before planning a mine, but fortunately we can drill quite a few relatively shallow holes to gather that data.

No3 Vein

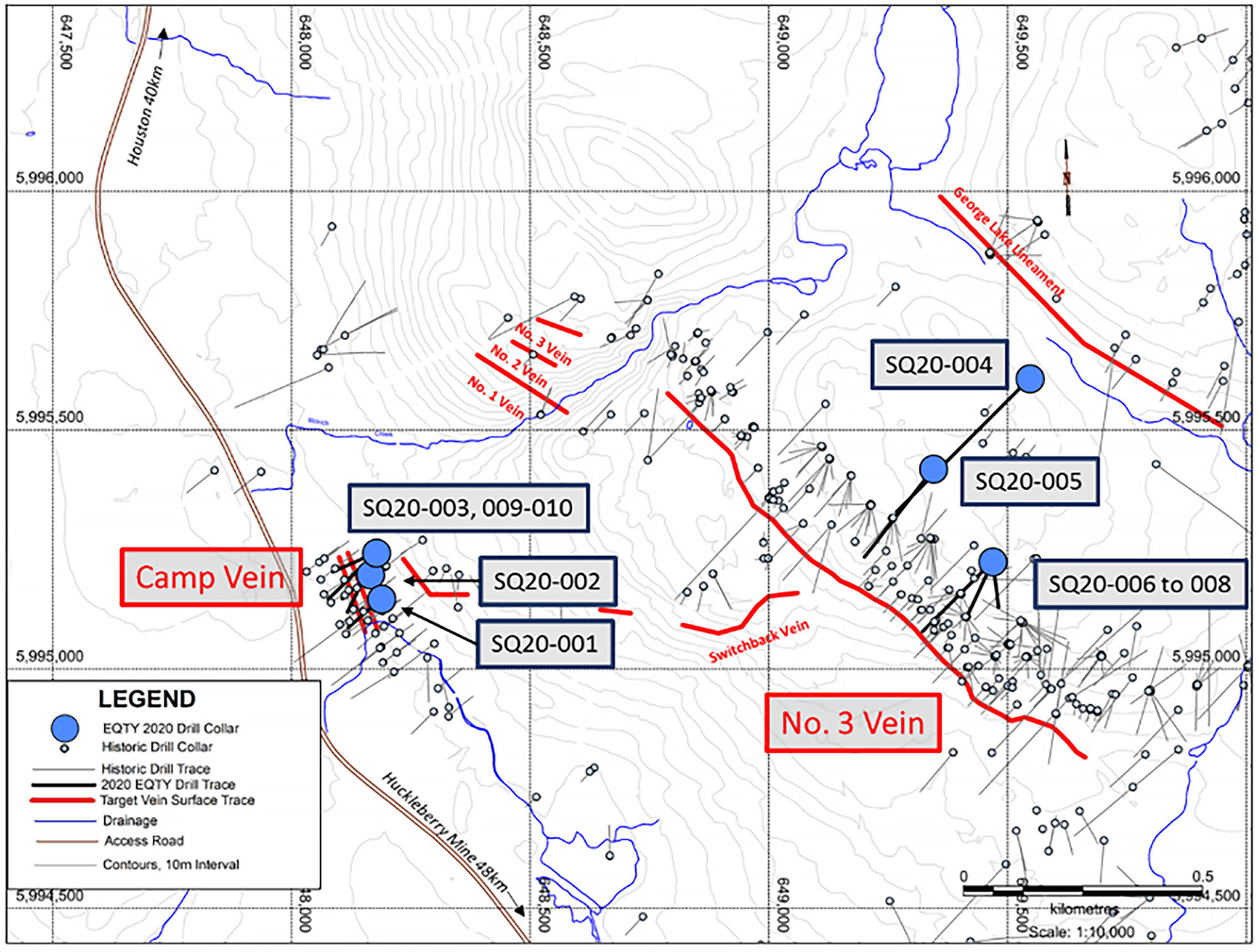

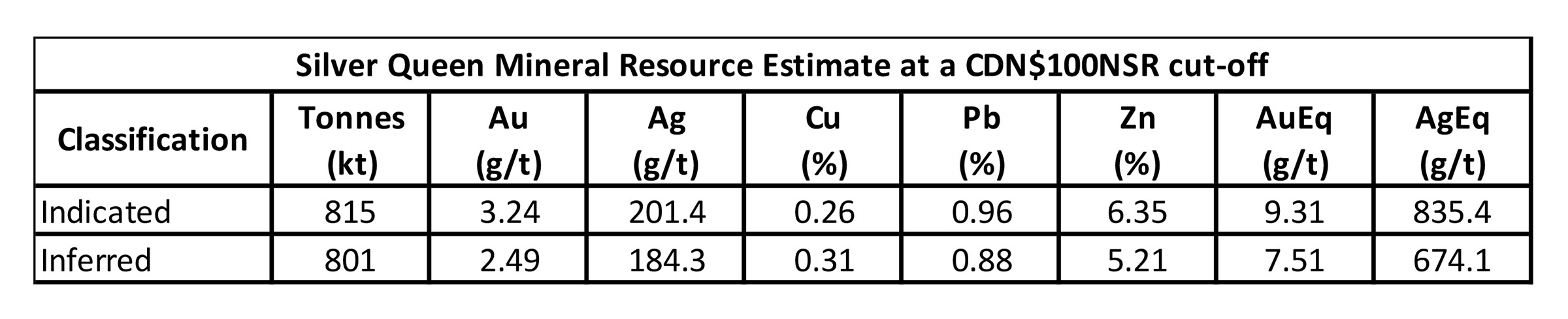

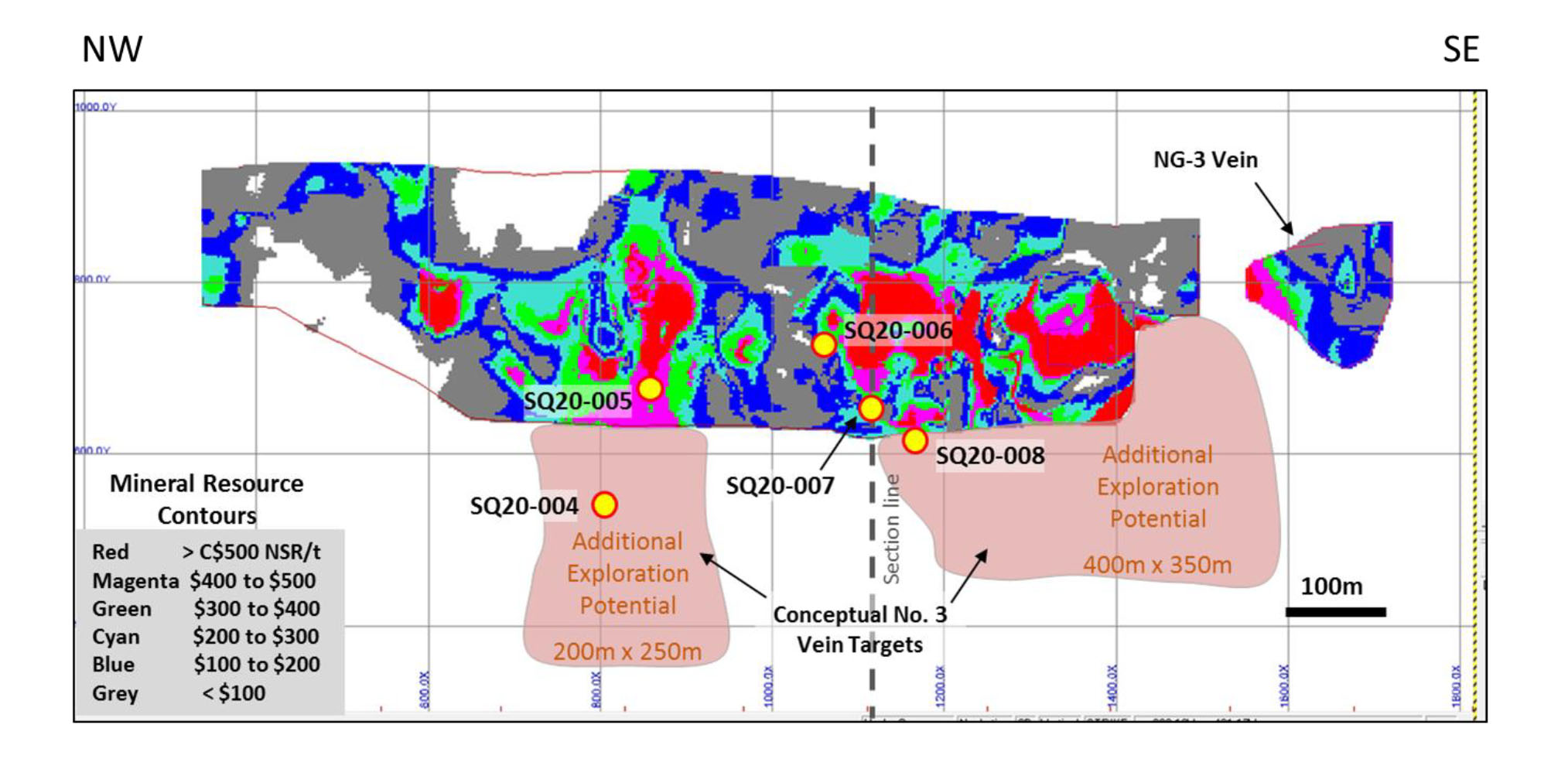

Your next batch of drill results will focus on the No3 Vein, which hosts the current resource estimate (see image above). Can you elaborate on what the 2020 drill program aims to achieve? Will you predominantly focus on increasing the credibility of the already high-grade resource, or will you be targeting resource expansion as well?

The initial holes, which we completed, were designed to verify some of the historic intercepts, and to particularly test for mineralization in alteration zones around the veins and for mineralized splays and parallel veins. The next set of holes will test down dip of the high-grade zones already identified.

Your exploration target at the No3 Vein is 2.5-3.5 million tonnes at an average grade of 10 g/t AuEq, but this should be seen as an ADDITIONAL exploration target, on top of the existing 437,000 ounce gold-equivalent resource estimate, correct?

Not quite, the current exploration target is to initially grow the existing resource from 1.6 million tonnes to over 3.5 million tonnes or 1Mozs to 1.5Mozs AuEq. So this would include the existing resource. Our sense is that the project would at that point become more attractive for M&A activity by mid-tier and major mining companies which would create better value for the company.

However, it should be noted that there are 20 different veins currently identified on the property and only two veins have had significant drill testing. There remains a tremendous amount of exploration potential on the property and lots of room for continued resource growth beyond that initial target in the mid- to longer-term scenarios.

You are reporting the grades of your exploration target at Camp in AgEq, but your No 3 exploration target contains an AuEq grade. Is there a specific reason for preferring different equivalent-metals for both veins? Would it make sense to make everything ‘uniform’ and report it in silver- or gold-equivalent grades?

We report both Au-eq and Ag-eq for comparison purposes as the Camp Vein zone (at least at the level drilled) is mostly Ag and the No. 3 Vein is a combination of Ag and significant Au. Both have base metal credits.

Looking at the ‘regional’ exploration potential, you have highlighted the NG3 Vein before, which appears to bear resemblance to the Camp Vein with higher gold-silver values. Do you have any plans to work on the NG3 Vein this campaign? What about the other regional targets and additional vein systems which haven’t been drilled nor added to a resource estimate yet?

We would hope to get a few holes into the NG-3 Vein system over the next year. However, given the initial results on the Camp Vein and what we hope to see in the No. 3 Vein, the bulk of our near-term exploration will be focused on those targets. Also, there is definitely porphyry potential on the property as evidenced by some of the work completed by previous management in the 1990s and the early 2000s. This may become a longer term priority, but at this time we feel that more value can be added to the project through the identification, exploration and development of the high-grade, high-margin epithermal vein systems.

Corporate

How backed up are the labs in British Columbia these days? Are the longer-than-usual turnaround times due to a massive surge in exploration or due to understaffing at the labs due to COVID-19? Or a combination of both?

Yes, like everywhere, the labs in BC are backed-up. We are currently looking at 8 to maybe 12 week turn-arounds at this point. I think that the reasons are two-fold: 1) there has been a massive surge in exploration resulting in significantly more demand for analytical services and 2) Covid has reduced the lab capacity due to distancing protocols and staffing issues due to some people not being comfortable coming into work.

We are having the same issues with lab delays in Nevada. I think it is partly because of Covid restrictions on distancing in the labs, partly because drilling programs planned for earlier in the year were postponed, and partly because Juniors were able to raise funds to drill projects with targets ready for drilling.

Back in August, you closed a C$1.7M financing with units priced at C$0.07. Those units also contained a full warrant with a strike price of C$0.10 and are thus in the money at this point. If all 27.2M warrants would be exercised, you’ll see about C$2.7M in cash hitting your treasury. Before this raise, there were also 14.3M warrants outstanding with a strike price of C$0.12 (which would bring in an additional C$1.7M) Are you hoping warrant exercises will be your main source of funding going into 2021? Do both warrants (27.2M expiring in 2023, 14.3M expiring in 2022) have acceleration clauses?

Other than the $0.12 warrants, which we are receiving some exercise orders for right now because of the acceleration clause, there are no other warrants with an acceleration clause. This means that one cannot necessarily rely on warrant exercises to fund exploration.

What’s your view on accepting flow-through funding?

Flow-through funding can be a great option to raise capital for Canadian exploration projects at a premium to market. As with all financings, the goal is to add more value to the company using that capital than the dilution would reduce. We feel there is great opportunity to dramatically increase our low market capitalization by developing significant, high-margin resources at the Silver Queen property.

Conclusion

Equity Metals intercepted exciting mineralization in the first few holes it drilled at the Camp Vein. All eyes will now be on the No3 Vein, which hosts the current Silver Queen resource. The labs in BC are still backed up, but we should see the assay results later this month. At the current share price of C$0.155 and given the share count of 55.6M shares, the current market capitalization of C$8.6M still offers an interesting risk/reward ratio.

Disclosure: The author has a long position in Equity Metals. Equity Metals is a sponsor of the website.