We visited Fremont Gold’s (FRE.V) Gold Bar projectin Nevada last February. The company had just initiated a three-hole drill program at the Gold Bar project, located to the south of McEwen Mining’s (MUX, MUX.TO) newest gold mine, the Gold Bar mine. Unfortunately, the three holes didn’t yield the desired results so Fremont dropped the Gold Bar project, which was returned to the optionor, Ely Gold & Royalties (ELY.V), and subsequently sold their rights and interest in the Gold Canyon project (also in close proximity to Gold Bar and McEwen’s mine) to McEwen. Having exited the Gold Bar camp, Fremont turned its attention towards acquiring new projects.

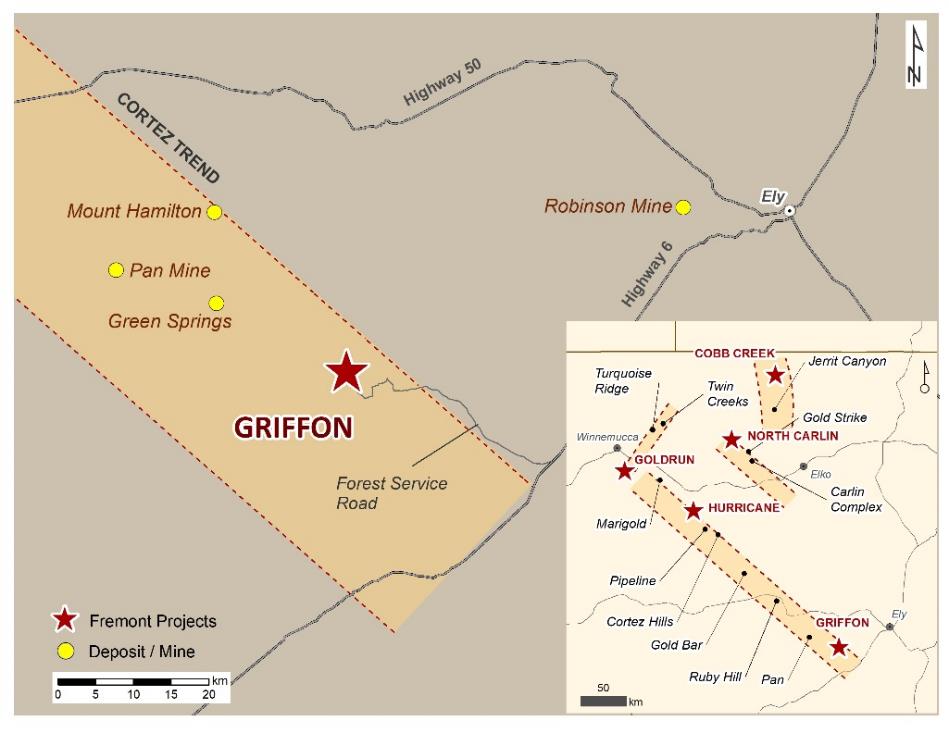

Since selling Gold Canyon, Fremont Gold entered into a purchase option agreement for the Cobb Creek gold project in September and the Griffon gold project in December. We sat down with CEO Blaine Monaghan to discuss these recent developments.

The sale of Gold Canyon and relinquishing Gold Bar

You sold the Gold Canyon project to McEwen Mining for 300,000 shares. Have you monetized those shares now that the mandatory hold period has expired?

The four-month Canadian hold period just expired, December 27, and we will look to monetize the shares shortly. At present the 300,000 shares are worth CAD$510,000.

As the three holes you drilled at Gold Bar project in Q1 2019 didn’t yield the desired results, you decided to give the Gold Bar project back to Ely Gold, who subsequently sold it to McEwen for a token amount of shares and a 2% NSR. What does McEwen see at the Gold Bar project that Fremont didn’t see? Or do you think McEwen just wanted to consolidate the entire area around the Gold Bar mine when the opportunity arose?

I can’t speak for McEwen but, as you mentioned, they were able to acquire the Gold Bar project relatively cheaply. I believe they acquired it for approximately 53,000 shares. The total consideration paid by McEwen for the Gold Bar project and the Gold Canyon project absolutely justifies our decision to exit the Gold Bar camp and focus our activities on acquiring other projects that have the potential to deliver far superior returns for shareholders. Again, I can’t speak for McEwen but it does make sense for them to consolidate the area around their Gold Bar mine.

The acquisition of Cobb Creek

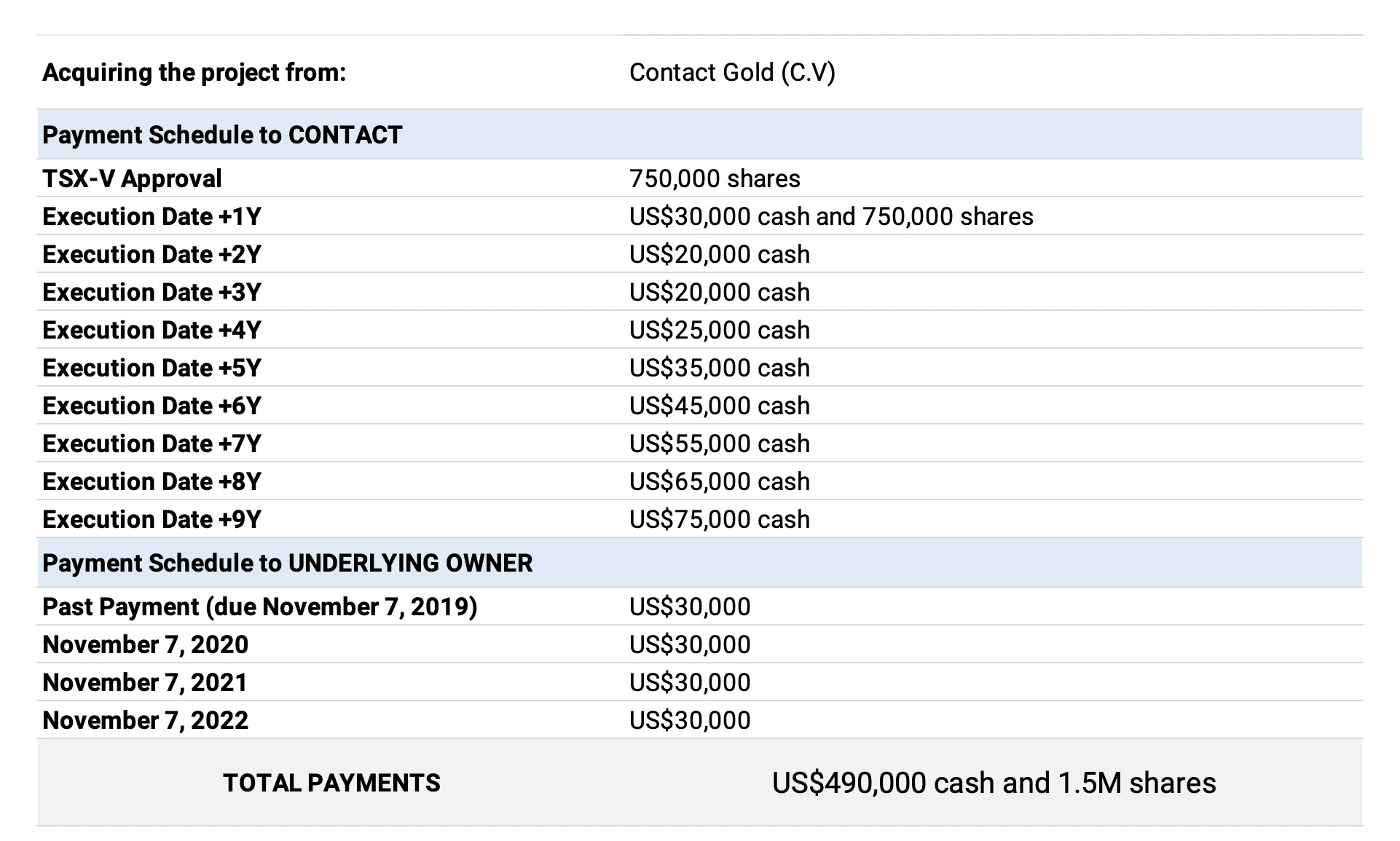

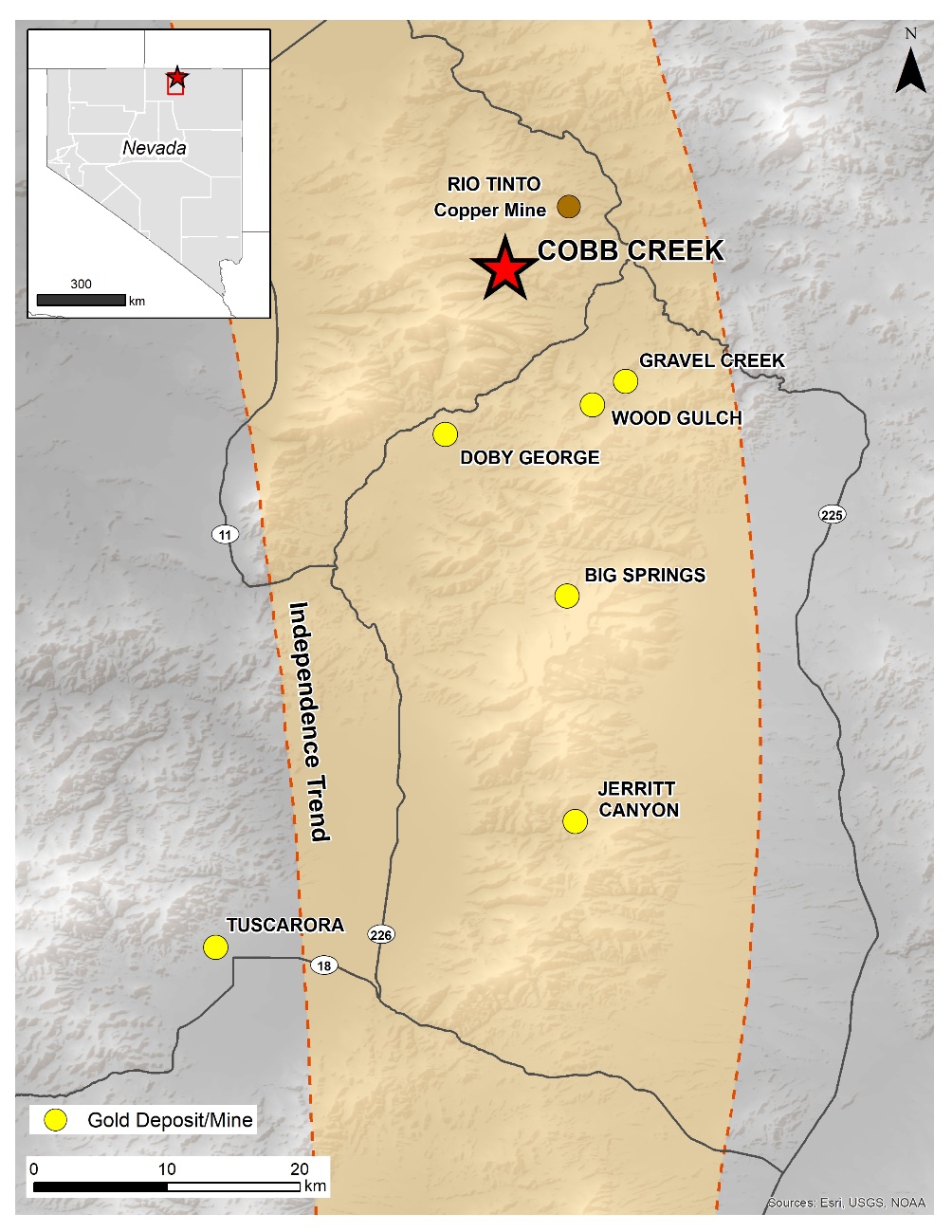

In September you did a deal with Contact Gold (C.V) to acquire a 100% interest in their Cobb Creek gold project, which has a historical resource estimate of approximately 170,000 ounces gold in excess of one gram per tonne. Was grade one of the reasons why you acquired the project?

We do like the grade, and the historic resource. However, what we were most attracted to is the potential for a relatively shallow Carlin-type deposit.

72 holes have already been drilled on the property. Do you have any data on how the holes were drilled and how easy it would be to expand and update the historical resource to ensure it meets the critical mass needed for the potential development further down the road?

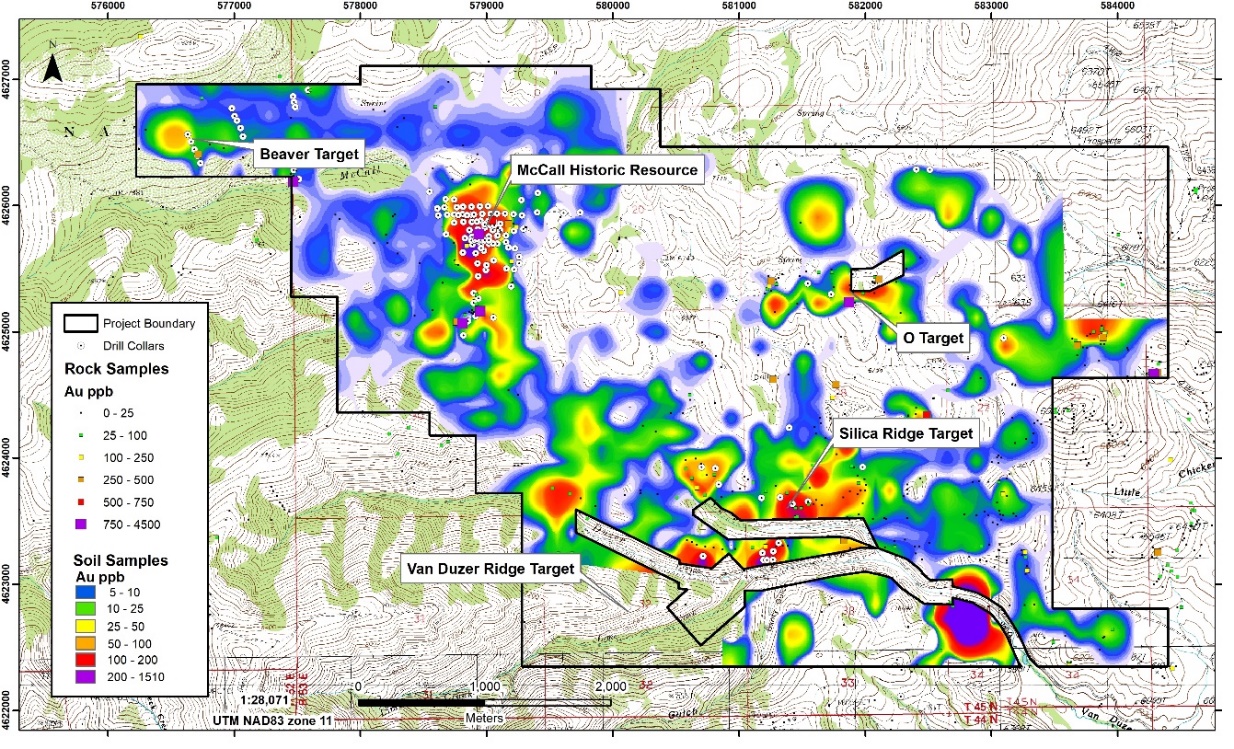

We do have all of the data and all of the drill holes that comprise the historical resource at the McCall target have been inputted into Leapfrog, a software program that can be used to model resources, so we have a very good understanding of the drilling to date. I believe there is excellent potential to expand the historical resource at McCall but, again, I’m most excited about the potential for a new, relatively shallow discovery at Cobb, whether at McCall or at a number of other previously identified targets.

Of the in excess of 140 drill holes completed on the property, the majority were ‘shallow’. How shallow were they and do you anticipate the oxidized mineralization to continue at (moderate) depth underneath those historical drill holes?

Most of the holes were very shallow, between 90 – 125 metres. The four deepest holes were only 161 – 366 metres deep and failed to penetrate the lower plate carbonate sequence. I don’t want to get too technical but the historical resource at McCall has been called an orogenic vein deposit. However, there is evidence to suggest that the mineralization is actually Tertiary and represents the upper part of a Carlin-type system. If that is indeed the case, then there could be Carlin-type target(s) in underlying lower plate carbonate rocks.

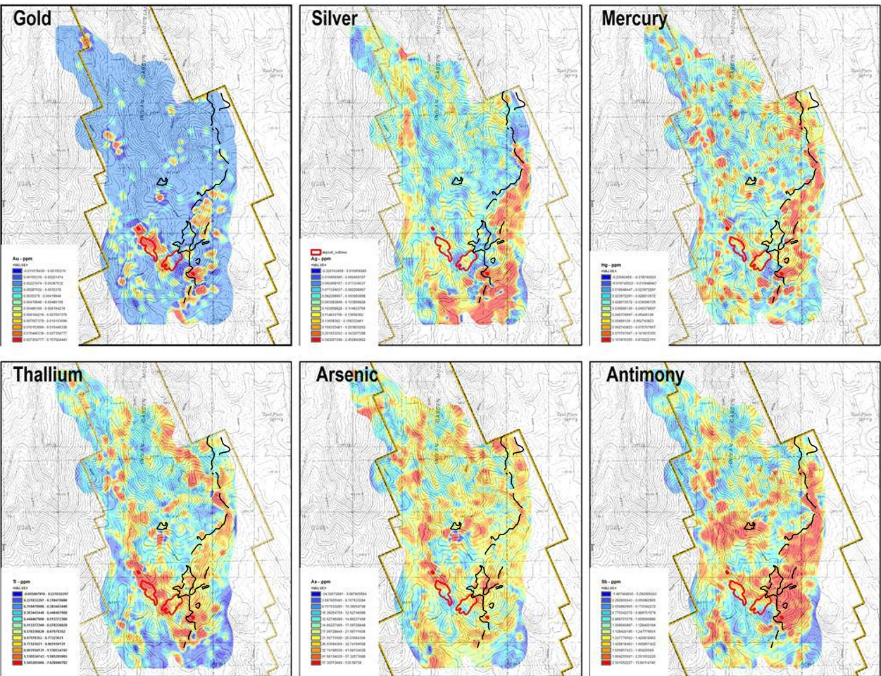

You published the heat map with the results of the soil sampling program at Cobb Creek, which revealed several interesting targets. Can you unveil your exploration strategy? I imagine that you and your team have done enough homework since signing the agreement 3.5 months ago?

Although Cobb has seen over 140 drill holes and does have a historic resource, it is still relatively underexplored – it hasn’t been drilled since 1992. Some targets have seen limited shallow drilling in the past, and others have never been tested. It’s a large project area, with numerous targets so we would like to do the required exploration work this year to refine the drill targets.

The acquisition of Griffon

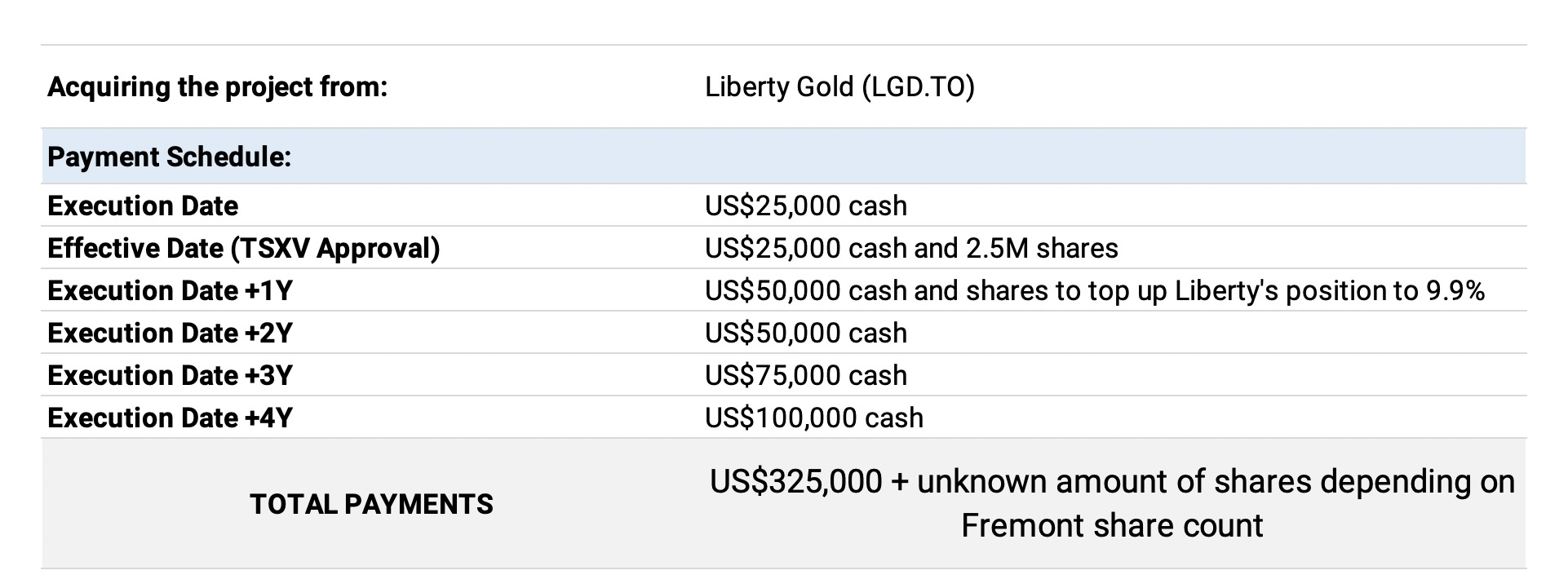

You entered into an agreement to acquire a 100% interest in the Griffon gold project, a past-producing gold mine in Nevada, from Liberty Gold (LGD.TO). Can you elaborate on how this transaction came together?

Going back to one of your earlier questions, after receiving the drill results from the Gold Bar project, we knew we had to pivot. We made the strategic decision> to exit the Gold Bar camp and monetize any related assets, which we did. However, it also meant that we had to rebuild our property portfolio with projects that were financeable. For Fremont that meant advanced-stage gold projects. Projects with historic or current resources or were past producers. Ultimately, we were looking for projects that had the potential to host an economic deposit with a minimum of 1 million ounces of gold.

We looked at dozens of gold projects in the Western U.S. and conducted numerous site visits. Cobb was the first acquisition meeting that criteria and Griffon was the second. I’m very exited about Griffon’s potential and look forward to testing that potential later this year.

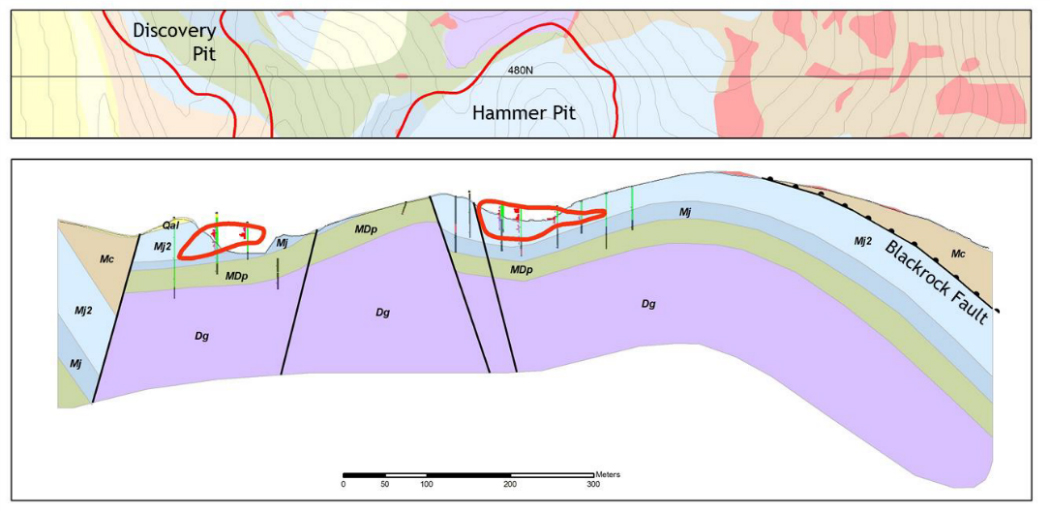

The total historical production is quite low at 90,000 ounces, is there still a historic resource on site, or at least a path to quickly develop an initial leachable resource?

I think its important to point out that Griffon was a relatively new discovery, it was first drilled in 1988, and was put into production less than a decade later. And, yes, there is an opportunity to develop leachable resources in and around the pits. In fact, Alta Gold had proposed expanding operations to the southwest of the Hammer Ridge pit, one of two open pits, before operations ceased. However, Griffon also hosts numerous gravity, soil, and stratigraphic targets. The Pilot Shale horizon – the primary gold host at Fiore Gold’s (F.V) nearby Pan Mine – has not been adequately tested, and the Joana/Chainman transitional horizon, which hosts gold at Griffon, may be concealed underneath and within the Blackrock fault.

Very little work has been done on the targets surrounding the old pits, will those targets be your exploration priorities?

There is so much to like about Griffon. In addition to being a Carlin-type deposit with numerous targets, it is also permitted for drilling. We will most certainly look to target mineralization in and around the pits but I’m most excited about testing the stratigraphic targets and the Blackrock fault, which can be traced for ~ 3km and has never been drilled.

What was the main reason to acquire Griffon? Are you after the low-hanging fruit in the oxide zones or do you care more about the sulphide potential (if there is any)?

Again, there is so much to like about Griffon: Carlin-type deposit, past producer, numerous targets, relatively underexplored, and permitted. But the main reason we acquired it is because we truly believe that Griffon has the potential to host an economic deposit with a minimum of 1.0 million ounces of gold.

Corporate

Back in September you had a positive working capital position of around C$425,000 but that was mainly because the share price of McEwen was in excess of C$2. Now the share price has recovered to almost C$1.70 after the capital raise conducted by MUX, you would still be looking at a monetary value of around half a million for those shares. Would it be safe to assume there is no ‘urgent’ need for Fremont to raise money in the next few weeks and you can get through the quarter waiting for an opportune time to raise money?

The shares are currently worth CAD$500,000 so I would agree that there is no “urgent” need to raise money. However, we will most certainly need to raise money to conduct exploration at both Cobb and Griffon.

With the recent addition of Cobb and Griffon, is it safe to assume that hunting for additional acquisitions is no longer Fremont’s top priority?

Cobb and Griffon are excellent projects that will keep us busy for the foreseeable future. I think its safe to assume that our priorities have now shifted from project acquisition to advancing Cobb and Griffon. That being said, we are always open to new opportunities.

What will the annual land/claim fees be for both projects?

Approximately US$28,000 for Cobb and US$15,000 for Griffon in claim fees. In addition, we have to make payments to Clover and an underlying vendor totalling US$490,000 over nine years for Cobb. For Griffon, we have to make payments to Pilot totaling US$325,000 over four years.

Conclusion

Investors can again look towards the future as Fremont exited the Gold Bar camp and has acquired two new gold projects that they believe have the potential to host a million ounces of gold.

The 300,000 McEwen shares received for the Gold Canyon project will be monetized soon (or may have already been monetized by the time this interview is published) which should help Fremont get through the next few months while the company puts together its 2020 exploration plans and the budgets to execute those plans.

Fremont went into hibernation mode over the summer but with two new, exciting exploration projects, Monaghan and his team appear ready to hit the ground running in 2020.

Disclosure: The author holds a long position in Fremont Gold Ltd. Fremont Gold Ltd. is a sponsor of the website.