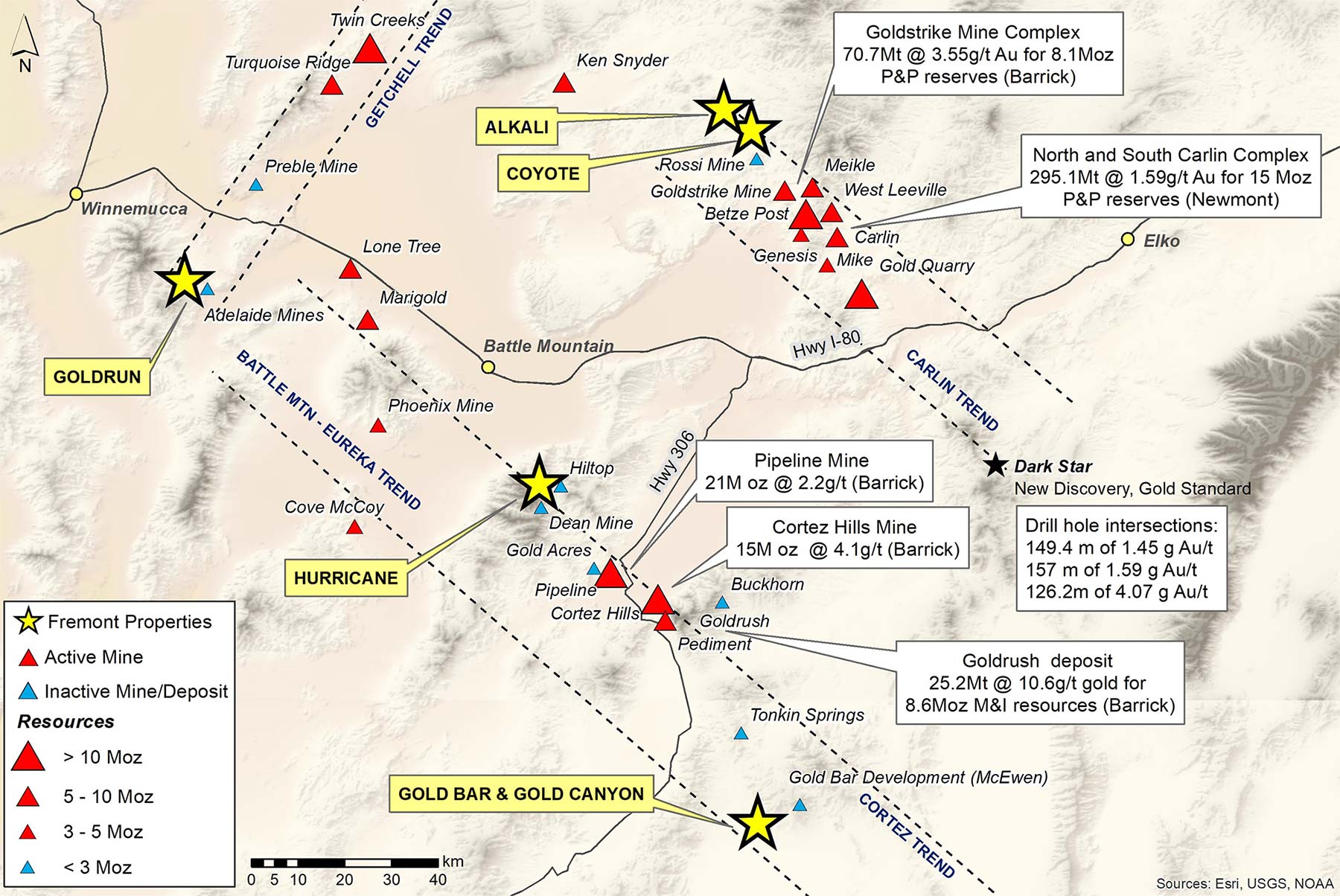

We were recently introduced to Fremont Gold (FRE.V), a Nevada focused gold exploration company headed by two Brazil-specialists: Dennis Moore and Alan Carter. Both gentlemen have enjoyed several successes with their respective companies in Brazil where multiple gold deposits were discovered during their tenure. ‘Time to pick some low-hanging fruit’, they must have thought, as they created Fremont Gold with a vision to advance gold projects in Nevada.

In this introduction report, we will take a closer look at what we consider to be the company’s three main projects and why the business strategy does make sense.

Gold Bar and Gold Canyon: Fremont’s two flagship projects

Fremont has five Nevada-based projects in its portfolio, and we consider the Gold Bar and Gold Canyon projects to be Fremont’s flagship assets. A great runner-up would be the Hurricane project, and we will briefly discuss these three exploration projects in this report.

Gold Bar

Gold Bar is actually Fremont Gold’s main project. The company entered into an agreement with Ely Gold and Minerals to acquire full ownership of the Gold Bar project, which was staked by Ely in 2015.

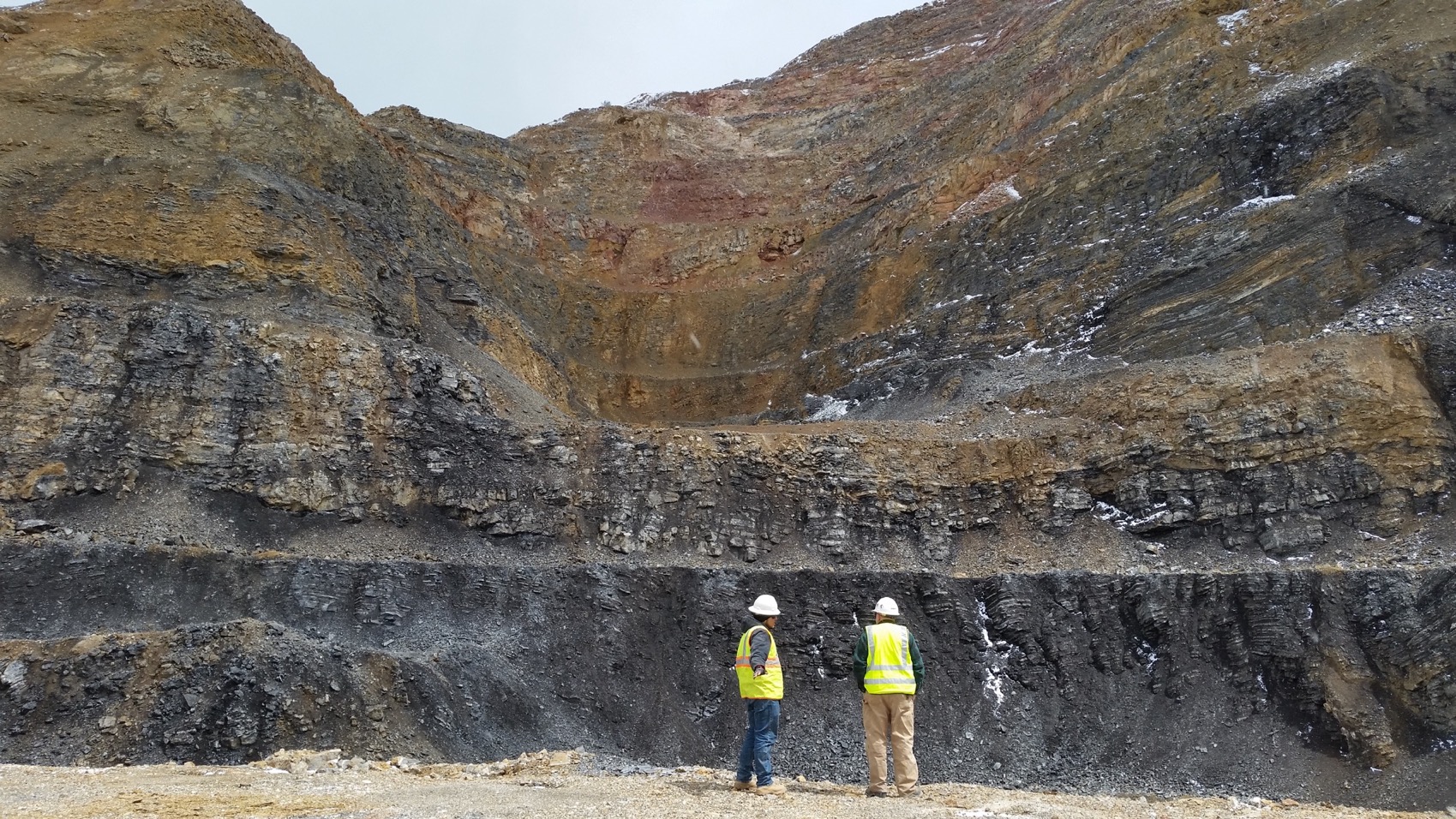

The property has a surface area of 22 square kilometers and is located southwest of the construction site where McEwen Mining is currently building its own gold mine, also called Gold Bar. Fremont’s Gold Bar project actually contains the historic Gold Bar open pit mine that was operated by Atlas Precious Metals Inc. Almost 300,000 ounces were recovered from approximately 4 million tonnes of rock. Needless to say the average grade of the Gold Bar mine was pretty high as approximately 2.33 g/t gold was recovered from the ore, indicating the head grade was very likely 2.5 g/t or even higher.

In fact, the property still contains a historical resource estimate containing almost 150,000 ounces of gold in 1.62 million tonnes (at an average grade of 2.57 g/t), as part of a larger but lower grade resource of 170,000 ounces at 1.84 g/t. Note: these appear to be ‘short tonnes’ and not ‘metric tonnes’, as 2.6Mt at 1.84 g/t would indicate a total resource of 154,000 ounces. This resource is located just a few hundred meters from the historic open pit, and is located right under the old mill (it sounds like Atlas skipped the condemnation drilling program).

This historic resource estimate could allow Fremont to have a ‘flying start’ in the Gold Bar/Gold Canyon region.

Gold Canyon

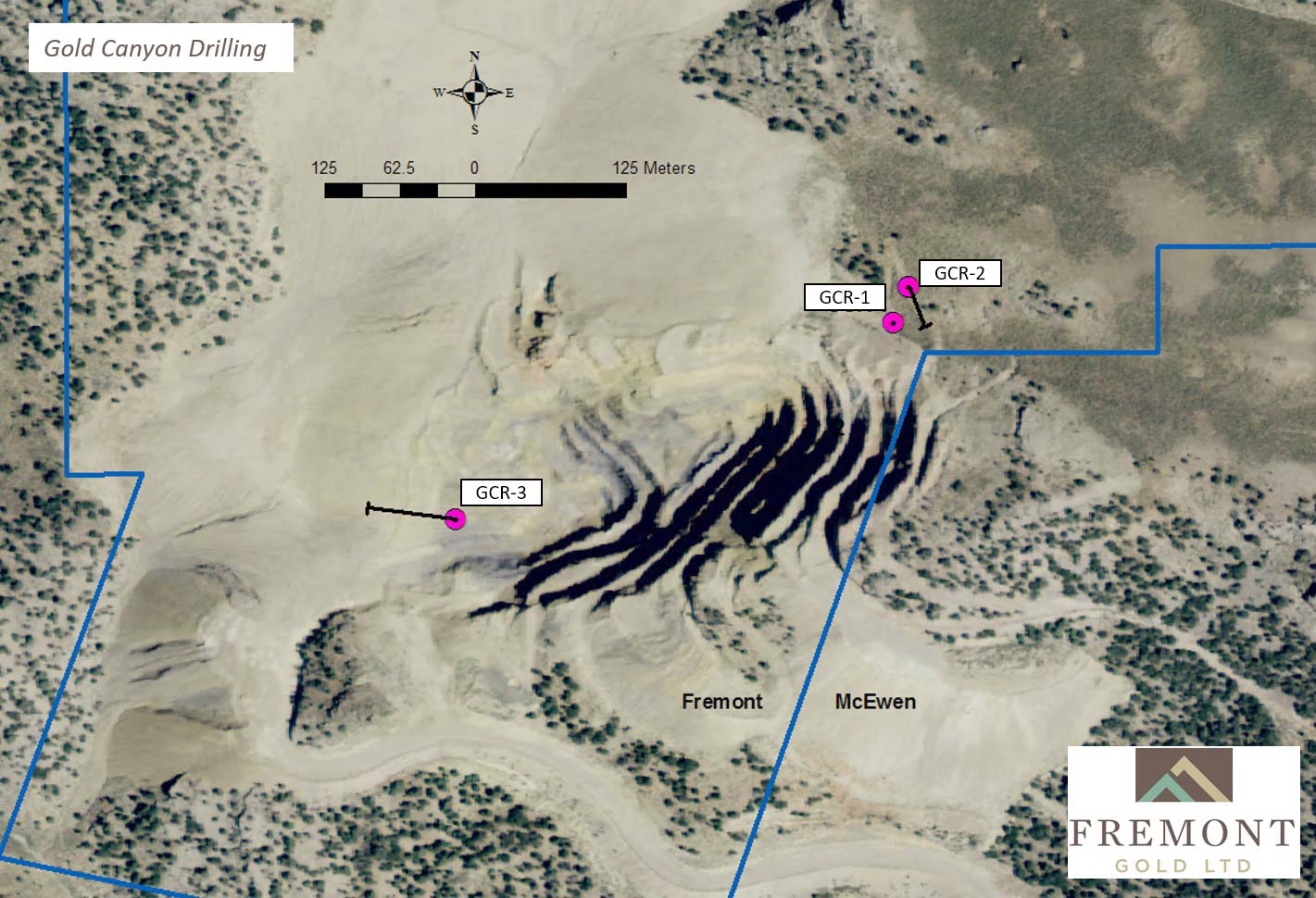

The Gold Canyon property consists of 26 unpatented claims that are actually surrounded by McEwen Mining’s claims that make up the Gold Bar mine, and the open pit at Gold Canyon is less than one kilometer away from one of the planned pits that make up McEwen’s mine and is part of the same mineralized system.

When the original Gold Bar mine was closed in the late-80’s and early 90’s due to the low gold price, the Gold Canyon deposit was mined and just over 40,000 ounces of gold were recovered from the open pit. The previous operator, Atlas Corporation, has left a stockpile behind, which would be viable now.

Considering Gold Bar is directly adjacent to McEwen Mining’s planned development, and considering the mine shut down due to the low gold price and not because it ran out of ore, this project could be seen as a second piece of low-hanging fruit.

A sampling program to test the mineralization at the bottom of the pit and the benches appeared to be successful: 100% of the samples were mineralized, and almost 85% of the samples contained an average gold grade of in excess of 0.15 g/t (which was used as the cutoff grade). The average grade of the samples that met the cutoff grade requirement was approximately 0.42 g/t gold. Low, but doable.

Another important part of the value proposition at Gold Canyon could be the higher-grade feeder zone on the northeast end of the pit. The Optionor took 3 samples, and the reported grades of these samples were 0.37 g/t, 1.56 g/t and 9.15 g/t gold. This resulted in a new geological exploration theory: the zone where these samples were taken is very likely connected to the high-grade interval encountered by Atlas Corporation in one of its historical drill holes just north-east of the existing pit. Encountering 18.3 meters containing 3.48 g/t gold isn’t just a blip on the radar; This north-east trend may be the main structure controlling gold mineralization within the Gold Canyon area. The company t is currently drilling in this area, and has already completed 2 holes in this zone during the past week. Results should be available in around 4 weeks.

In addition, the Optionor of the property, Ely Gold & Minerals (ELY.V) conducted a very preliminary metallurgical test program at Gold Canyon. The results of this test indicated most of the samples showed a CN soluble rate of over 70% with several samples reporting a soluble rate of in excess of 90%. This allowed Ely to conclude that ‘barring silica encapsulation or clay problems, it is expected the rock may be amenable to heap leach’. And that’s exactly what you’d like to see in Nevada. Again, these are very preliminary results based on a sampling program (taken from blast holes which were never excavated before the mine shut down), and Fremont Gold will have to follow up on this.

Hurricane

Although Gold Bar and Gold Canyon are Fremont’s flagship projects, we would also like to take a brief moment to explain why we think the Hurricane project is an interesting horse in the Fremont stable as well.

This was the project Fremont Gold initially used to get its TSX-V listing, so it’s not unlikely it will (have to) spend some money on the property to keep the regulator satisfied. This doesn’t mean Fremont isn’t interested in Hurricane, but it’s just a matter of priorities and getting the biggest bang for its buck.

The project is located approximately 100 kilometers west of Elko in Nevada, and within hiking distance (30 kilometers) from Highway I-80 and a stone’s throw away from the Hilltop deposit, owned by Barrick Gold (ABX, ABX.TO). Previous operators drilled a few dozen holes in the eighties and encountered some average to high grade intervals. Pretty interesting assay results with 17 meters at almost 2 g/t gold and another 17 meters containing 2.86 g/t combined with some shorter intercepts as well. Surprisingly, most intervals started at very shallow depths with at least 4 holes encountering mineralization at surface.

That’s a good start, but what intrigued us more was the result of a trenching program conducted by Fremont in the last quarter of last year. A total 303 meters of trenching was completed on three parallel cuts over a length of approximately 101 meters. Trench number 2 yielded the best results with 102 meters at 0.56 g/t gold, including 63 meters containing 0.77 g/t gold, which are really good values for any surface sampling program. According to Fremont ‘mapping reveals that the better grades are centered around a low angle fault that may be a conduit for mineralizing fluids. This fault is possibly the structure associated with the gold mineralized zones intersected in the historic Pegasus RC drill holes. Down-dip projections of this fault may host unrecognized gold-mineralized zones, and can as well be a vector to a feeder structure.’

So, although the main focus of this year’s exploration efforts will be directed towards Gold Bar and Gold Canyon, we feel the Hurricane project could be very promising as well.

The 2018 summer exploration plans

A few months ago, Fremont Gold received the approval from the US Bureau of Land Management to execute a drill program on the Gold Bar and Gold Canyon properties. A minimum of 1,000 meters has been approved, and Fremont immediately secured a drill contractor.

The drill program commenced two weeks ago and was announced as a minimum 5 hole program. The first two holes will be drilled at the Gold Bar site. Hole 1 will be an infill drill hole to follow up on the mineralized area on the western part of the historic pit in an area that has never been drill-tested. A second hole at Gold Bar will be focusing on the southeastern side of the historic pit to check if the mineralization is continuing along strike.

The three remaining holes of this first-pass exploration program will be drilled at Gold Canyon, where two holes will be aiming to replicate the previously mentioned high grade interval of 18.3 meters containing 3.48 g/t gold. The impact of these two holes could be very important; not only could it potentially encounter similar high-grade gold results, even lower grade results could confirm the continuation of this northeast trend.

The final hole of this initial 5-hole drill program will test the western extension of the Gold Canyon pit. It will be interesting to see the results of this hole as the hole will target a different mineralized zone located lower and separated from the Gold Canyon pit.

Again, the 2018 exploration program could easily be upsized from the currently proposed 5 holes and 1,000 meters, depending on how good the initial drill results areas well as the cost and efficiency of the program.

Why Nevada?

As Nevada is an established mining jurisdiction; the fourth largest gold producing area in the world, we are confident about the geopolitical advantages of doing business in Nevada. Not only is it a mining state, making it easier to obtain exploration and mine permits, the regulatory framework in place is one of the best in the world.

And you don’t have to believe us. The independent Fraser Institute provides an extensive ranking of how easy it is perceived to do business as a mining company in a certain region. Nevada was ranked third in the ‘Investment Attractiveness Index’, indicating it’s scoring better than Québec and Ontario. In fact, Nevada is by far the preferred state for mining companies to be operating in.

Not only is Nevada policy-wise an excellent region, there are also plenty of arguments on the geological side to be exploring in Nevada, Fremont Gold has a really good ‘About Nevada’ page on its website, explaining the geological and technical merits of the state (read it here). It’s written in a style to ensure even non-technical people understand the geological prospects and reasons to be exploring in Nevada.

The end game? Seeing Gold Canyon and Gold Bar being developed as a satellite deposit of McEwen Mining’s Gold Bar mine

It’s no secret Fremont originally acquired the properties because it had a strong belief it would be able to develop a resource estimate on both projects which could serve as additional leach pad feed for McEwen Mining’s Gold Bar mine (which is currently under construction). Considering all infrastructure will already have been put in place by McEwen Mining, satellite resources won’t even have to be large to be viable: just a few hundred thousand ounces would be enough.

Why would McEwen be interested? The feasibility study of the Gold Bar project provides the answer.

McEwen Mining decided to go ahead with the construction of its Gold Bar mine after a feasibility outlined a 7-year mine life, producing almost 63,000 ounces of gold per year at a cash cost of $770/oz. Using a base case scenario of $1250 gold, the after-tax NPV5% was estimated to be just $54M. That’s quite low as the initial capex of $81M and short mine life (6.5 years) are very restrictive.

But imagine the Gold Bar Mine could produce an additional 200,000 ounces and extend the mine life to 10-11 years? Using the same metrics (a gold price of $1250/oz, a cash cost of $770/oz and a discount rate of 5%), an additional 3.5 years of 60,000 ounces per year would create an additional (pre-tax) value of US$64M to McEwen Mining (discounted to the present value as of today). So even if you included the additional capex (which would be low anyway), adding just a few hundred thousand ounces of gold to the existing mine plan at Gold Bar would really move the needle for McEwen Mining.

It’s not a certainty, but it’s definitely a potential option.

CEO Moore wanted to keep the share structure tight

During our conversation with CEO Dennis Moore, it became clear he was closely monitoring the company’s share count, as he would like to keep the share structure as tight as possible.

That’s also why the most recent private placement where Fremont Gold raised C$1.55M at C$0.16 was conducted at virtually no discount to the market price, and didn’t include a warrant at all. We believe this is a good way to keep the ‘warrant clippers’ out of this financing.

After issuing these 9.72 million shares, Fremont’s share count has increased to 44.3 million shares as most of t he 1.67 million warrants with an exercise price of C$0.133 which expired on April 29th have been exercised. If all warrants have been exercised, in excess of C$200,000 would have been added to Fremont’s treasury, resulting in a cash position of approximately C$1.75M. This should definitely be sufficient to complete this summer’s drill program and Fremont could raise more money on the back of the assay results.

Management

Dennis – President, CEO, Director

- Personally discovered Tocantinzinho (2.2M oz) & Cuiú Cuiú (1.5M oz) gold deposits

- Identified several gold deposits in Bolivia that were acquired by DaCapo Resources

- Vended TZ to Brazauro Resources, which was later acquired by Eldorado Gold. Dennis and partner, Alan Carter, retain a 3.5% royalty on the 2Moz deposit

- Founder with Alan Carter of Magellan Minerals ̶ IPO in Feb 2008― Cuiú Cuiú and Coringa were the main assets

- Magellan was acquired by Anfield Gold in May of 2016

- Identified and acquired prospective gold properties in Nevada with Dr. Clay Newton (since 2012)

Alan Carter – Chairman, Director

President and CEO of Cabral Gold. Director Anfield Gold, Peregrine Diamonds and Altamira Gold. PhD Geologist with extensive corporate experience in Canada. Ex-Rio Tinto and BHP Billiton. Co-founder of Peregrine Metals and Peregrine Diamonds. Former President and CEO of Magellan Minerals. With 30+ years in the industry, Carter could easily be seen as a ‘veteran’.

Clay Newton – VP Exploration

Ex Kennecott PhD geologist, having spent the bulk of his +30years career targeting gold and copper in Nevada. Newton was also involved in the discovery of the Midway gold deposit.

Conclusion

We absolutely like it when a company has a well-defined business plan. In Fremont’s case, it will explore the Gold Bar and Gold Canyon properties in an attempt to define two resource estimates that are appealing enough for McEwen Mining to acquire the company. And the willingness to pay will be (or at least, should be) much higher than Fremont’s current market capitalization of C$6.7M.

There’s no real ‘muscle flexing’ about thinking or pretending to bring the deposits into production themselves, and a corporate transaction seems to be the ultimate objective of Fremont Gold. A clean sale of the entire company would probably be preferred, but considering Fremont also has some other properties in Nevada where it’s earning a majority stake, these could be spun off.

CEO Dennis Moore – a proven mine finder – has a plan, and although the initial drill program will be relatively small (Fremont is expecting to drill a minimum of 1,000 meters this summer), it could have a high impact as Fremont really doesn’t need much to drum up the interest in the properties.

Disclosure: Fremont Gold is a sponsor of the website, we also have a long position. Please read the disclaimer