Exploration isn’t an exact science. Despite a good exploration plan and smart people on the ground, Fremont Gold’s (FRE.V) assay results from the three holes it drilled at Gold Bar didn’t yield the desired results. Too bad, as we came away from the site visit quite impressed.

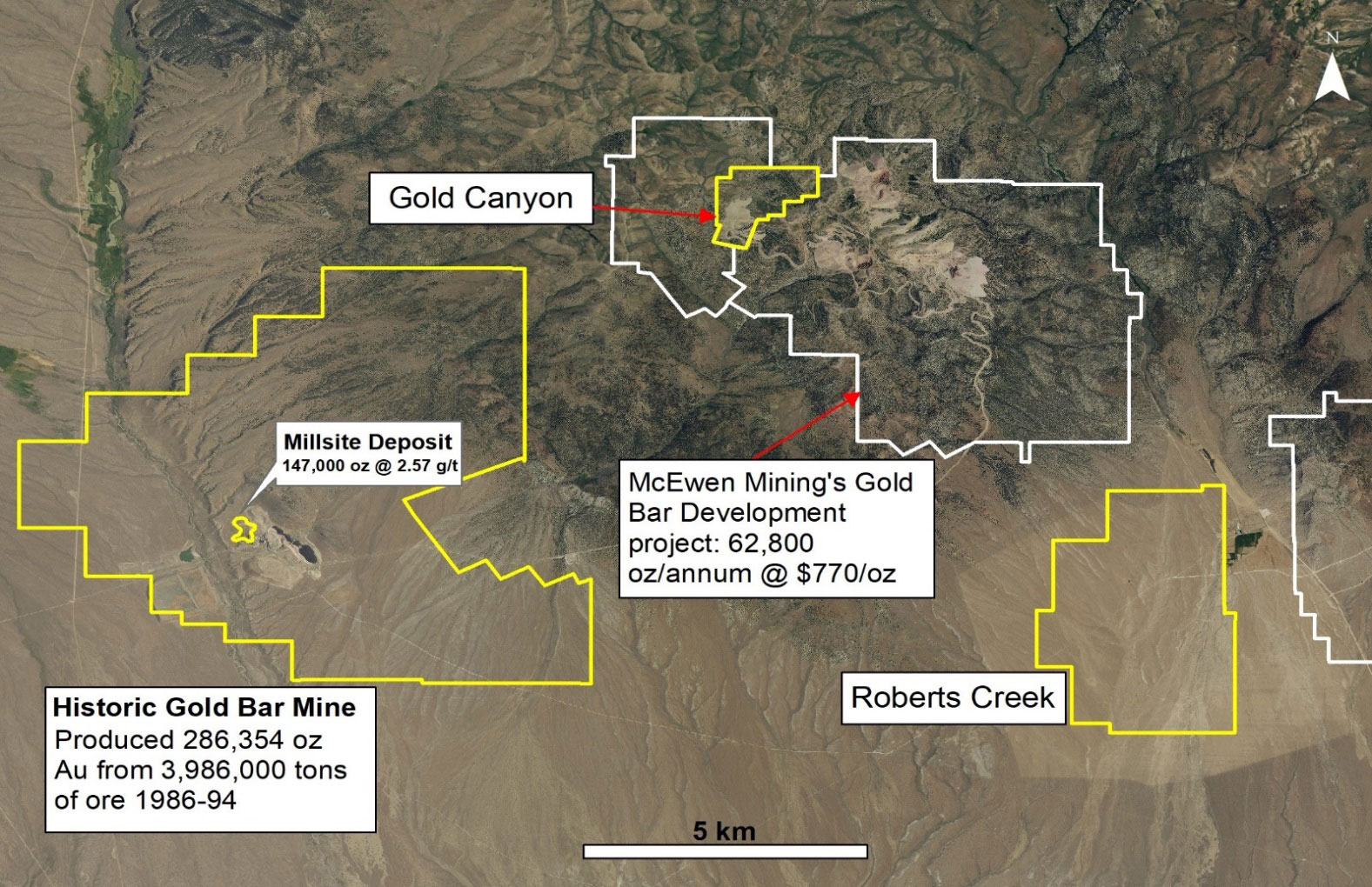

Fortunately, Fremont Gold has more irons in the fire and the company is gearing up to drill the Gold Canyon (also directly adjacent to McEwen Mining’s (MUX.TO, MUX) Gold Bar mine – not to be confused with Fremont Gold’s Gold Bar project) and a first-pass drill program at the North Carlin project, which was staked in 2017.

We had a proper chat with CEO Blaine Monaghan, who provided more color on what’s happening at Fremont Gold.

The recent exploration update

Fremont drilled three reverse circulation drill holes at Gold Bar. Unfortunately the results did not meet expectations. The first hole was designed to test a geochemical anomaly to the southeast of the historic Gold Bar mine. Fremont believed that that geochemical anomaly could have represented a possible extension to the historic Gold Bar mine. Fremont drilled a 300-metre vertical hole but terminated it as they had yet to reach bedrock.

The other two holes were targeting a potential feeder system at the edge of the historic Gold Bar mine. And although Fremont did encounter the faults, they also encountered large void spaces. The company had to terminate the first hole because they lost pressure. Fremont stepped back a bit for the second hole and while they were able to drill through the faults, Fremont didn’t get good recovery and the samples they did recover didn’t return significant values. Fremont isn’t planning any further work at either of these target areas at the present time.

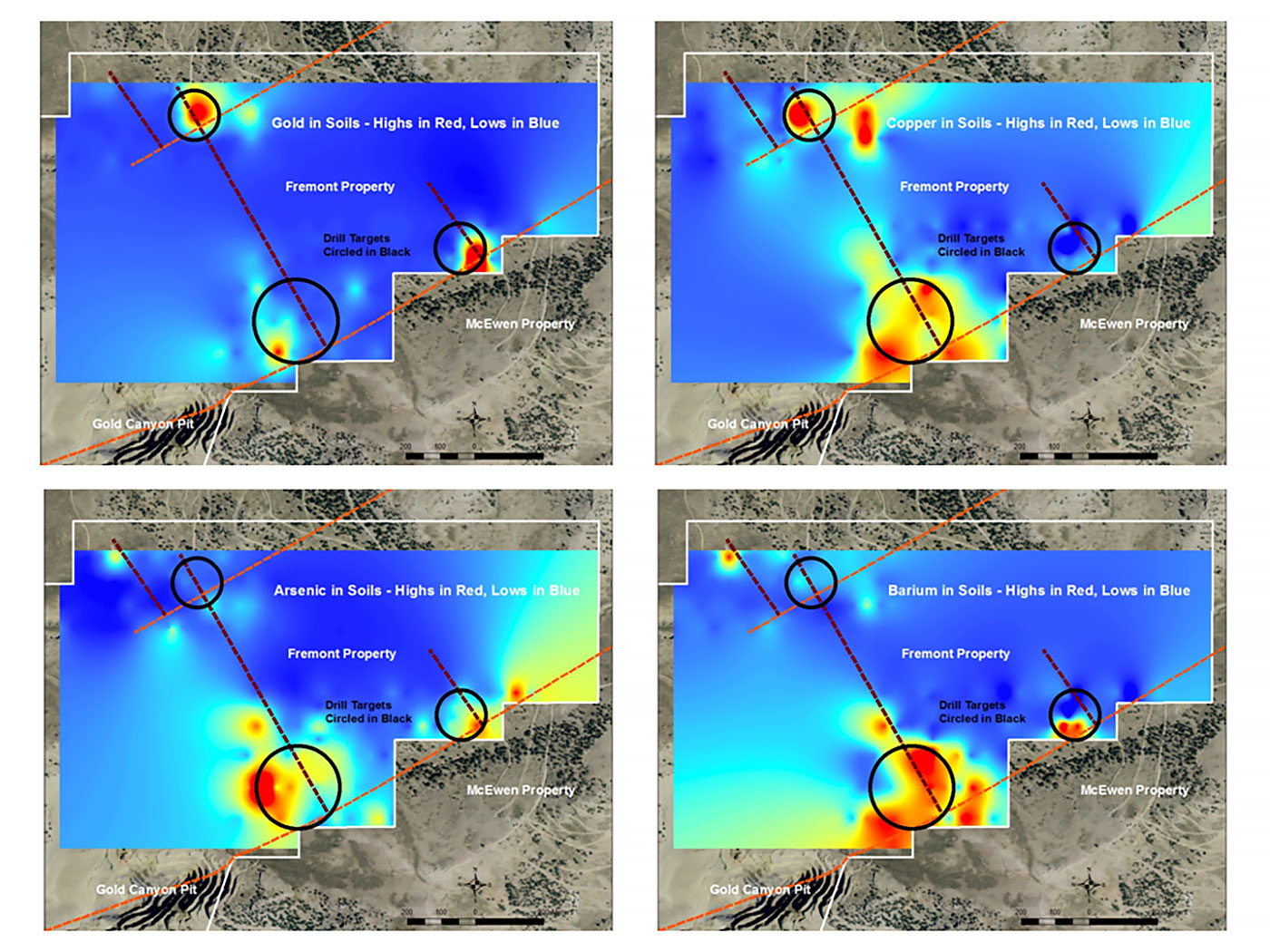

Fremont Gold obviously wants to get the biggest bang for its buck and rather than continuing to poke holes at Gold Bar, they plan to go ahead with a planned drill program at Gold Canyon, which is located right next to McEwen Mining’s Gold Bar mine. The Gold Canyon pit is only 800 metres away from McEwen’s Gold Ridge pit. The program will be relatively small and will focus on targets Fremont further defined within the Gold Ridge and French Trail zones.

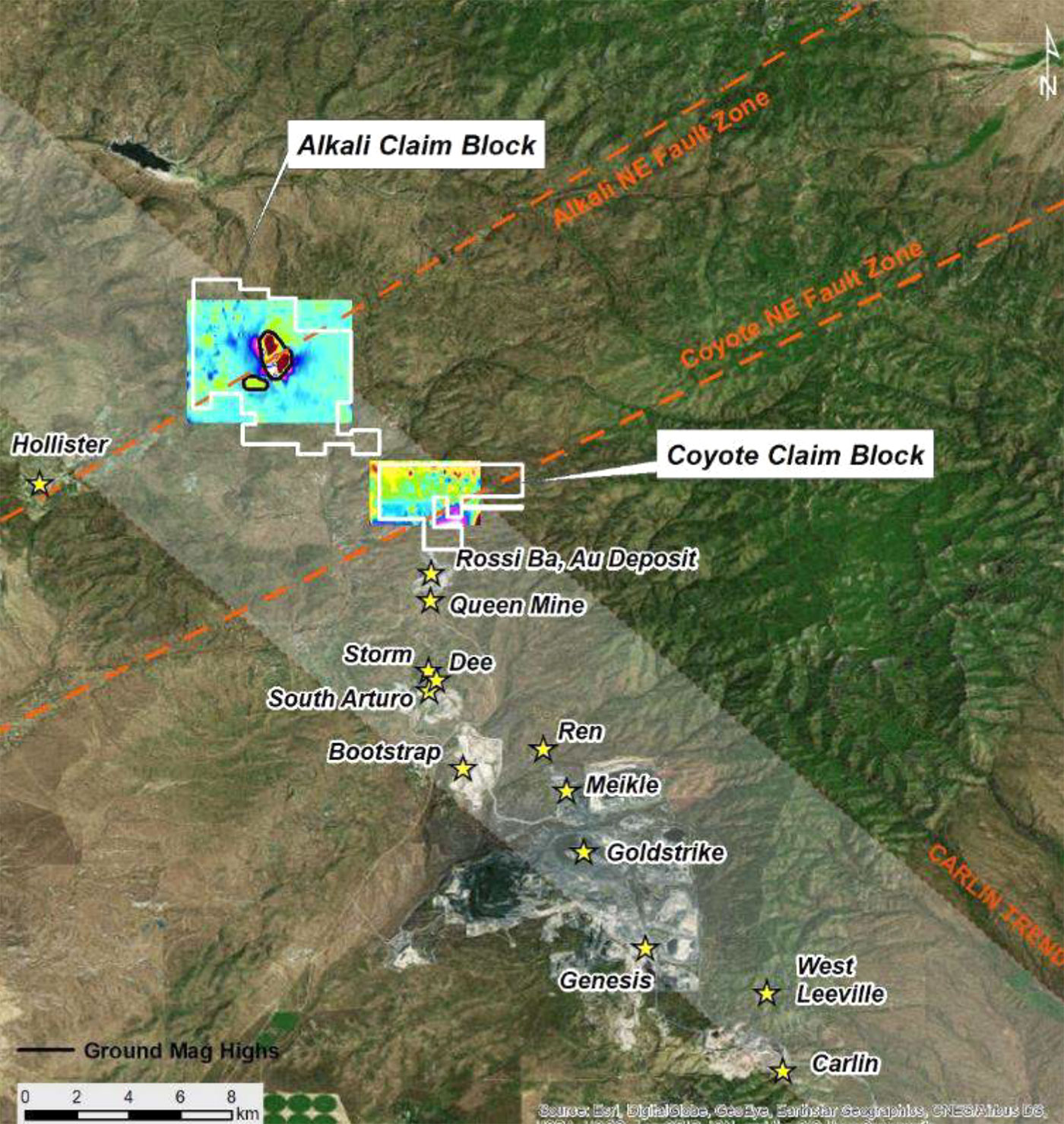

After Gold Canyon, Fremont would like to drill North Carlin. North Carlin is comprised of three claims: Alkali, Coyote, and Rossi. Fremont staked Alkali and Coyote after they acquired the rights to the Rossi claim, which is located directly next to the Rossi gold mine, the most northern gold mine in the Carlin Trend.

The results of a gold in soil anomaly and magnetic anomaly (whereby the gold and mercury anomalies occur right on the northeastern side of the magnetic anomaly) at Alkali indicate ‘the presence of gold mineralization beneath alluvial cover’. Fremont plans to drill two deep holes (500 meters each) to drill-test this target.

A Q&A with CEO Blaine Monaghan

Gold Bar & Gold Canyon

When we visited the Gold Bar project in February, the drill rig had just been set up to drill the first hole. Unfortunately, all three holes yielded disappointing results and the assay results showed only very weak gold values. Additionally, the final two holes encountered several open fractures which had a negative impact on the recovery of sampling material. Could you elaborate a bit on these drilling circumstances?

“Sure. The first hole was set up to test a geochemical anomaly, in the right structural setting, to the Southeast of the historic Gold Bar mine. Based on our structural interpretation of Gold Bar, we believed that this geochemical anomaly may have represented a possible extension to the historic Gold Bar mine.

It represented a very exciting drill target. One that we had to test. Unfortunately, we didn’t encounter bed rock shallow enough and terminated the hole.

The second two holes were designed to test a possible feeder structure at the edge of the Gold Bar open pit. We did encounter the fault in both holes but lost the first one and the second hole did not return significant values. So, although our exploration theory was correct, we did encounter the fault, we didn’t encounter significant gold mineralization, which is always disappointing.”

The first hole was drilled to a vertical depth of 305 meters before being abandoned as it still hadn’t encountered bedrock. How could the lack of bedrock at that depth be explained? Would it make sense to try again and go even deeper?

“Although we knew the target was covered, we expected/hoped to encounter bedrock at a shallower depth. At the present time we have no plans to go back there. However, that could always change.”

The three holes at Gold Bar were part of a drill program designed by your VP Exploration Clay Newton, a structural geologist who really seems to know what he’s doing as we came away from the site visit with a good impression of him. The assay results of the three holes are obviously disappointing. How has this impacted his exploration thesis? Does he still think there must be an extension to the historic Gold Bar mine somewhere towards the east-southeast of the open pit? Or is this the definitive end of that exploration approach?

“Exploration is part art and part science. And because you often only get one chance to drill a target, due to budgetary reasons, a lot of thought is put into generating drill targets. You drill your best targets first and if you don’t have enough encouragement to return to a target, you have to move on. Right now we would rather focus our exploration efforts on other projects where we might get a bigger bang for our buck.

That being said, there very well could be an extension or additional deposits in and around Gold Bar but, for us, it makes more sense to test other targets that we’ve identified, like the targets at Gold Canyon and North Carlin.”

Could you shed some more light on the exploration plans for Gold Canyon? How many holes/meters would you like to drill, and what exactly are you chasing there?

“We have identified several targets that haven’t been drilled before to the north and northeast of the Gold Canyon pit. These targets are located within the French Trail and Northwest Gold Ridge areas. These areas were previously identified by Atlas Precious Metals but we further defined them with a soil sampling program. We plan to test these targets with approximately 1,000 metres of RC drilling.”

North Carlin (and others)

You recently announced Fremont Gold will conduct a drill program on its North Carlin project. Could you elaborate a bit more on your drill targets; how did you define them, and what’s your plan of attack?

“We are very excited about the potential of North Carlin. My analogy for North Carlin, if we have success, is Gold Standard Ventures (GSV.TO, GSV). North Carlin is at the very northern end of the Carlin Trend and is therefore prospective for the discovery of a Carlin deposit. However, we feel that the potential also exists for the discovery of a low sulphidation epithermal deposit. Hecla’s Hollister is approximately 10-km to the southwest.

We have identified a mag high with a coincident gold and mercury geochemical anomaly on the flank of it. That is the target. And if we have success, it could be a game changer for the company.”

Briefly about the history of North Carlin, how were you able to pick up this piece of real estate?

“The ground became available in the fall of 2017. The previous owners did not make their payments to the Bureau of Land Management (‘BLM’) and their rights to the claims subsequently lapsed.

It’s not very often that you can acquire prime real estate like this by staking, and we immediately acted on this opportunity.”

Do you have any plans for Roberts Creek this year? And what about Goldrun (close to SSR Mining’s Marigold Mine) and Hurricane (close to Barrick’s Hilltop mine)?

“At present we are focused on Gold Canyon and North Carlin. In addition, we are actively looking to acquire a new project that could create the highest possible shareholder value.”

Corporate

What is your current cash position now the Gold Bar drill program has been completed? Once the Gold Canyon and North Carlin drill programs have been completed, are you considering taking a breath to analyze all data and preserve cash?

“We ended March with approximately C$400,000 in cash. While we need to make sure we are spending our money wisely and as efficiently as possible, we would aggressively follow up on exploration success from North Carlin and/or Gold Canyon.

However, let’s wait to see the results of those exploration programs.”

Is Fremont actively looking to rationalize its asset portfolio (shedding non-core assets and/or looking for new additions?)

“We are not presently looking to rationalize our asset portfolio, but I would entertain other partners funding exploration work at Hurricane and Gold Run. Acquiring a new, advanced-stage asset is a priority for us.”

Conclusion

Fremont Gold should get the drill rig up and running pretty soon at Gold Canyon, where it will explore for gold just a stone’s throw away from where McEwen Mining’s Gold Ridge pit is located. Once the Gold Canyon drill program will be completed, Fremont will direct the rig to the North Carlin project where it will drill-test the geochemical anomalies for the very first time.

With a current market capitalization of just C$5M, the risk/reward ratio has just gotten more attractive.

Disclosure: Fremont Gold is a sponsor of the website, we also have a long position. Please read the disclaimer