Fremont Gold (FRE.V) has been busy this summer as it started to poke its first holes in the Nevada soil on its claims bordering the Gold Bar development project owned by McEwen Mining (MUX, MUX.TO). The drill program has been completed and all assay results have now been released, so we figured this was a good moment to discuss the results with Dr. Clay Newton, Fremont Gold’s Vice-President Exploration.

Fremont Gold is a frugal spender

Before we had a chat with Clay Newton, we also checked the company’s recently filed financial statements. As of at the end of June, Fremont Gold had a net working capital position of approximately C$1.06M, with C$1.08M in cash which allows it to continue its day-to-day operations (excluding exploration drilling).

But the financial statements also indicated something else. Of the total cash expenditures of C$513,000 in the second quarter of the year, $299,000 was spent on exploration which means that for every dollar Fremont Gold spent, 58% was invested in the project. In fact, we are probably even underestimating this percentage as we would expect a large part of the professional fees to be exploration-related as well.

Reaching a 60% ratio of ‘exploration expenses / total expenses’ is an excellent result, especially for a very small company where the fixed overhead expenses can’t really be reduced anymore.

A Q&A with Clay Newton, VP Exploration

Gold Bar / Gold Canyon

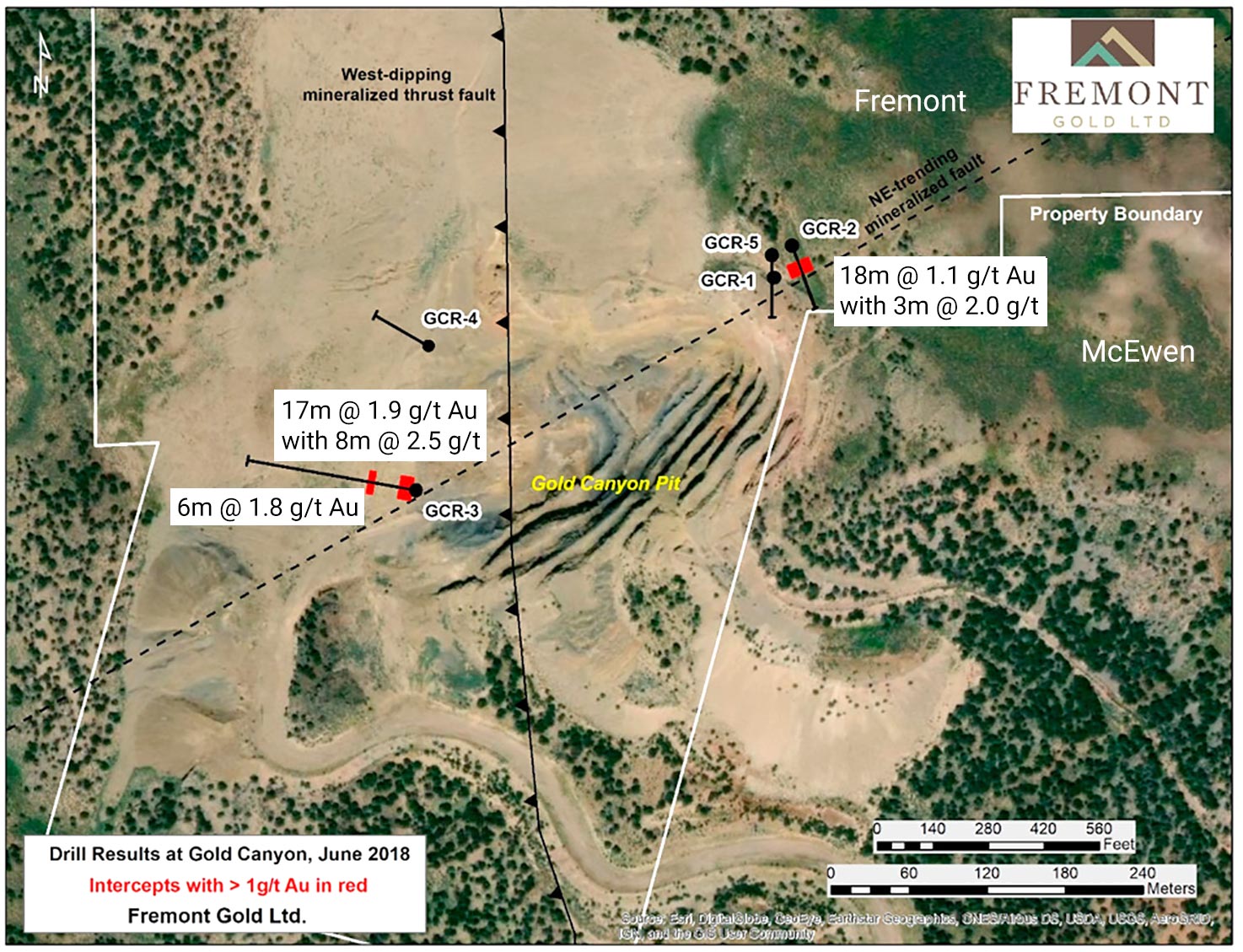

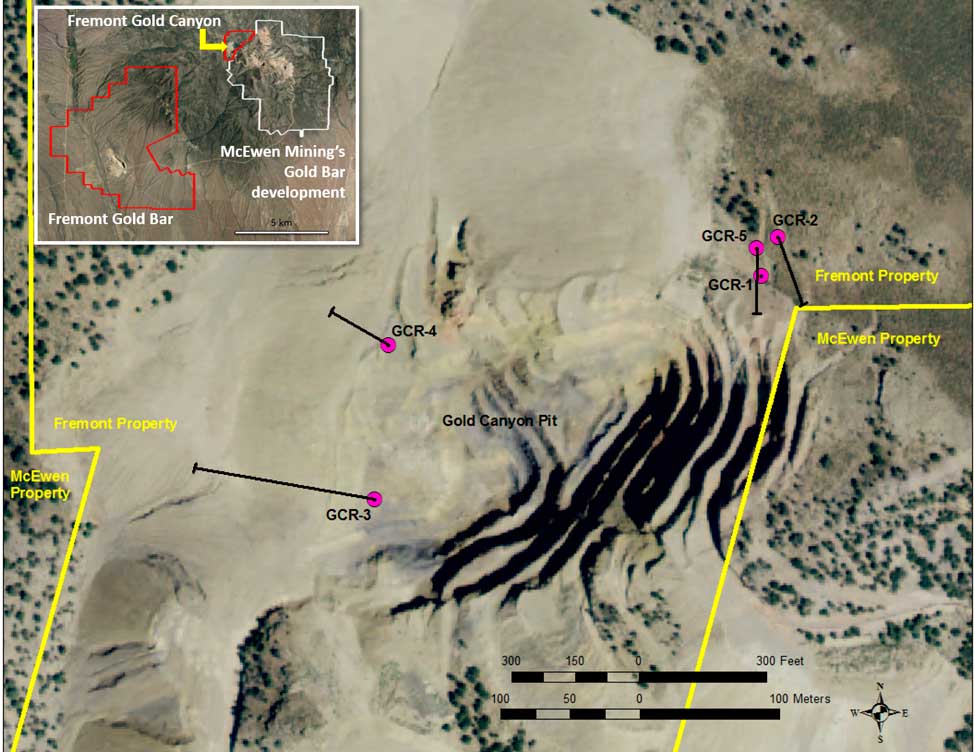

The gold intercepts at Gold Canyon were excellent, with almost 17 meters at 1.9 g/t, 18 meters at 1.1 g/t and a second horizon in hole 3 containing 6.1 meters at 1.8 g/t. How should we interpret the ‘existence’ of this second layer? Does this indicate there might be a second layer throughout the property, but deeper than you originally imagined?

There are two stratigraphic horizons that are mineralized adjacent to and a short distance away from the feeder faults, from hydrothermal fluids moving from the faults out into the sedimentary rocks.

The higher horizon, around 2,400 meters elevation, was the main zone mined, where it intersected the two main feeder faults. There is a second lower zone, around 2,300 meters elevation, that had three very good historical intercepts of around 20 meters at 2.0 g/t Au. We hit the bottom of that zone in GCR-3 with the intercept of 6.1 m at 1.8 g/t Au. This zone is gold mineralized where it is intersected by the feeder faults but probably not too far away from them.

This zone will likely evolve into a resource and it was not touched by the previous mining. Also the faults themselves appear to be fairly continuously mineralized within the fault zones, regardless of intersected stratigraphy, and we will be drilling to intersect the faults at various depths.

Holes 1 and 2 only started to see mineralization at a down-hole depth of respectively 105 meters and 82 meters. What is the true vertical depth? And how could the impact of the depth be mitigated? Finding 18 meters of 1.1 g/t oxide material is nice, but could be tough to mine if the overburden is too thick.

At Gold Canyon, hole GCR-1 was vertical so the downhole meters are true depth. Hole GCR-2 was an angle hole and the true depth of the top of the intercept was about 79 meters. At Gold Bar, GBR-1 was vertical and the top of mineralization was at a true depth of about 179 meters. In GBR-2, top was at 126 meters true depth.

In all cases, the mineralized structures were probably steeply-dipping faults through which we went into through the hanging wall and out through the footwall. The faults would be expected to continue upward above where we intersected them, so there probably is mineralization shallower than what we hit.

What was the purpose of hole 5 at Gold Canyon? Were you trying to drill deeper underneath hole 1 to check why the mineralization in hole 2 (just a few meters away) was thicker and higher grade than in hole 1?

We were still looking to duplicate the historical hole 100-45, which reported 18 m at 3.8 g/t Au, but we couldn’t get to the collar site because it is now under a stockpile. We didn’t feel that hole 1, which was vertical, hit the fault zone where it was mineralized, so we hoped to drill across a broader area with an angle hole and get a better hit.

In both holes, though, we appear to have encountered thick coarse calcite in the fault zone, with little gold. It appears that this is just the nature of the fault in places.

Looking at the drill map showing the locations of the summer 2018 drill program at Gold Canyon, where would you like to drill your next few holes, and why?

We are conducting soil sampling now that will hopefully enable us to trace the mineralized fault, hit by GCR-2 and 100-45, to the northeast and we would like to drill it along strike from the pit. Also, on the southwest side of the pit, we will drill from the west back to the east to intersect the west-dipping thrust fault at various depths.

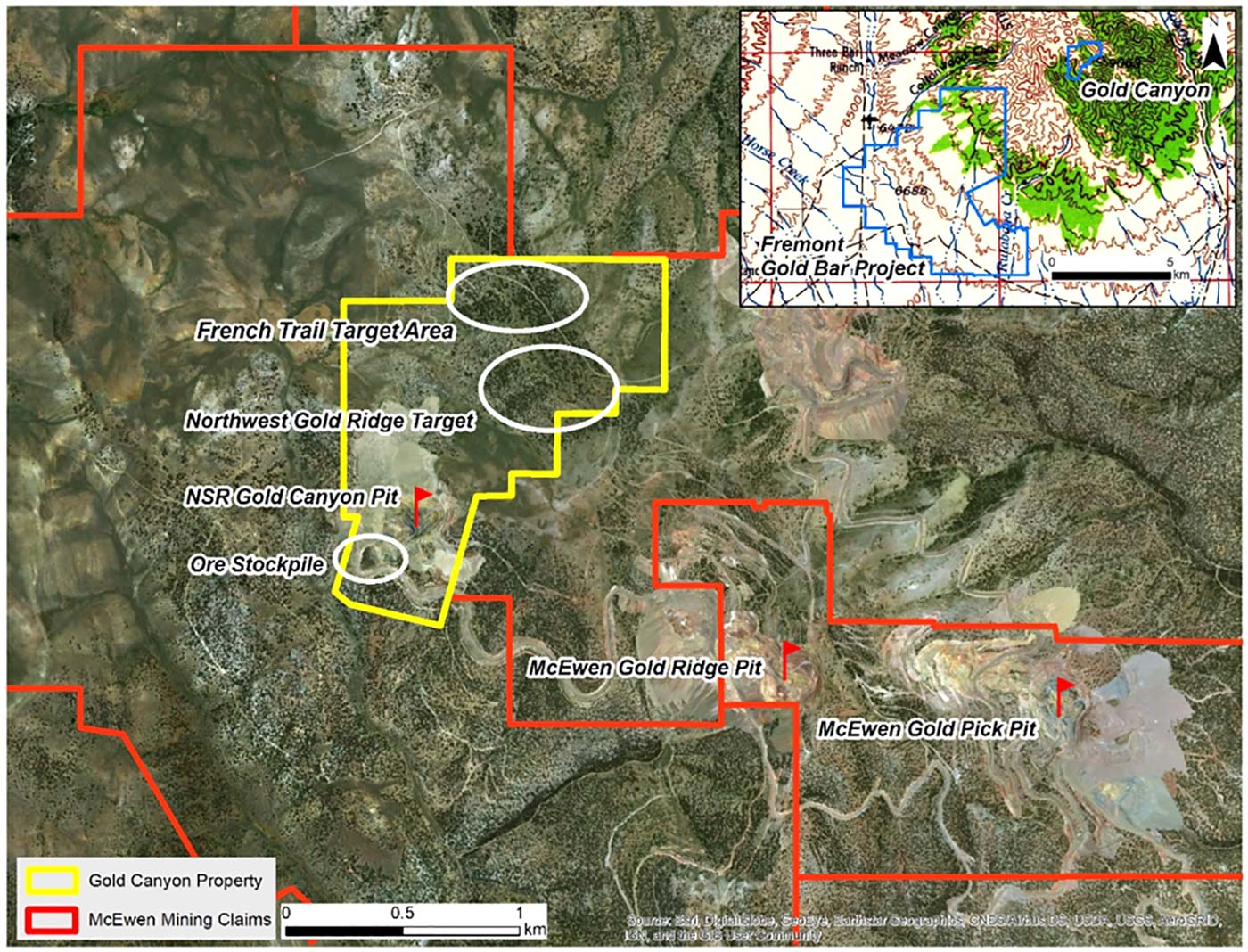

As an exploration company you obviously have to be as efficient as possible with your available cash resources. Will your primary focus of future drill programs be on the oxide zones at Gold Canyon, which could provide leach pad feed for McEwen Mining’s (MUX, MUX.TO) Gold Bar mine? Or do you think it would be better to follow up on the higher grade sulphide interval at your own Gold Bar project?

In the short term we will be targeting oxide resources at Gold Canyon, as this is where we see the low-hanging fruit. However, it is possible, if not probable that McEwen will eventually start mining and processing unoxidized ore in order to increase the life of their mine. So exploration for both oxide and non-oxidized ore is justified with respect to the Gold Bar district, as there is undoubtedly significant tonnage of sulfide mineralization to be discovered, and this will be the future of the Gold Bar district. Secondly, mining companies are figuring out how to mine bulk underground deposits comprising sulfide ore because the shallow oxide material is simply not being found anymore — and to stay in business they will be increasingly reliant on sulfide deposits.

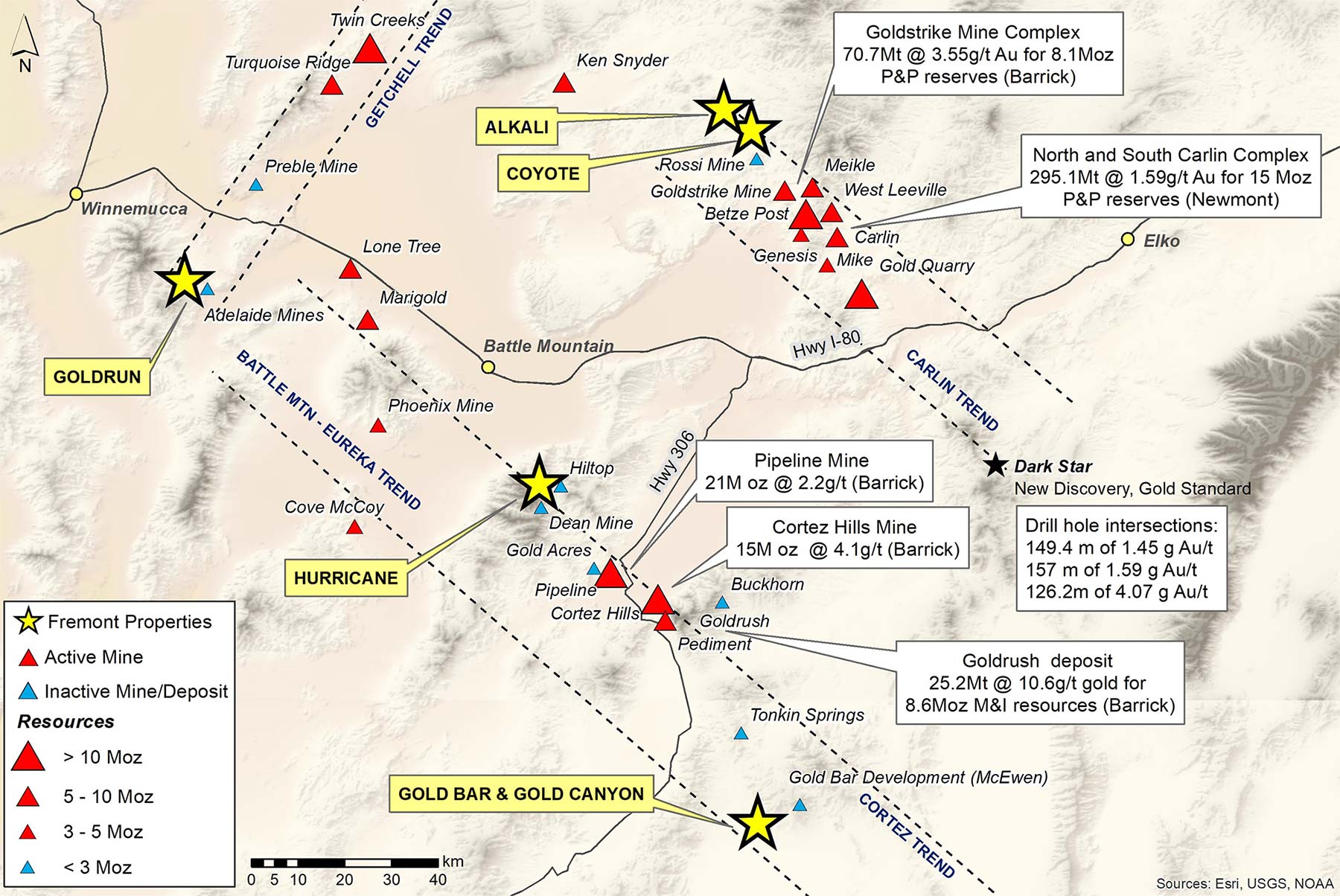

Barrick and Newmont are already doing this on their Carlin-type deposits – commonly developing underground mines in the bottoms of their open pits. Barrick’s Goldrush mine will be entirely an underground operation, below about 500 meters of cover. A few years ago, Newmont Mining (NEM, NEM.TO) paid $2.3 billion to buy Fronteer Gold, primarily for its 2 million ounce gold Long Canyon deposit, which is primarily sulfide.

So whilst most companies appear to focus on the ‘easy’ oxide zones, I think our dual approach is warranted.

Coyote / Alkali

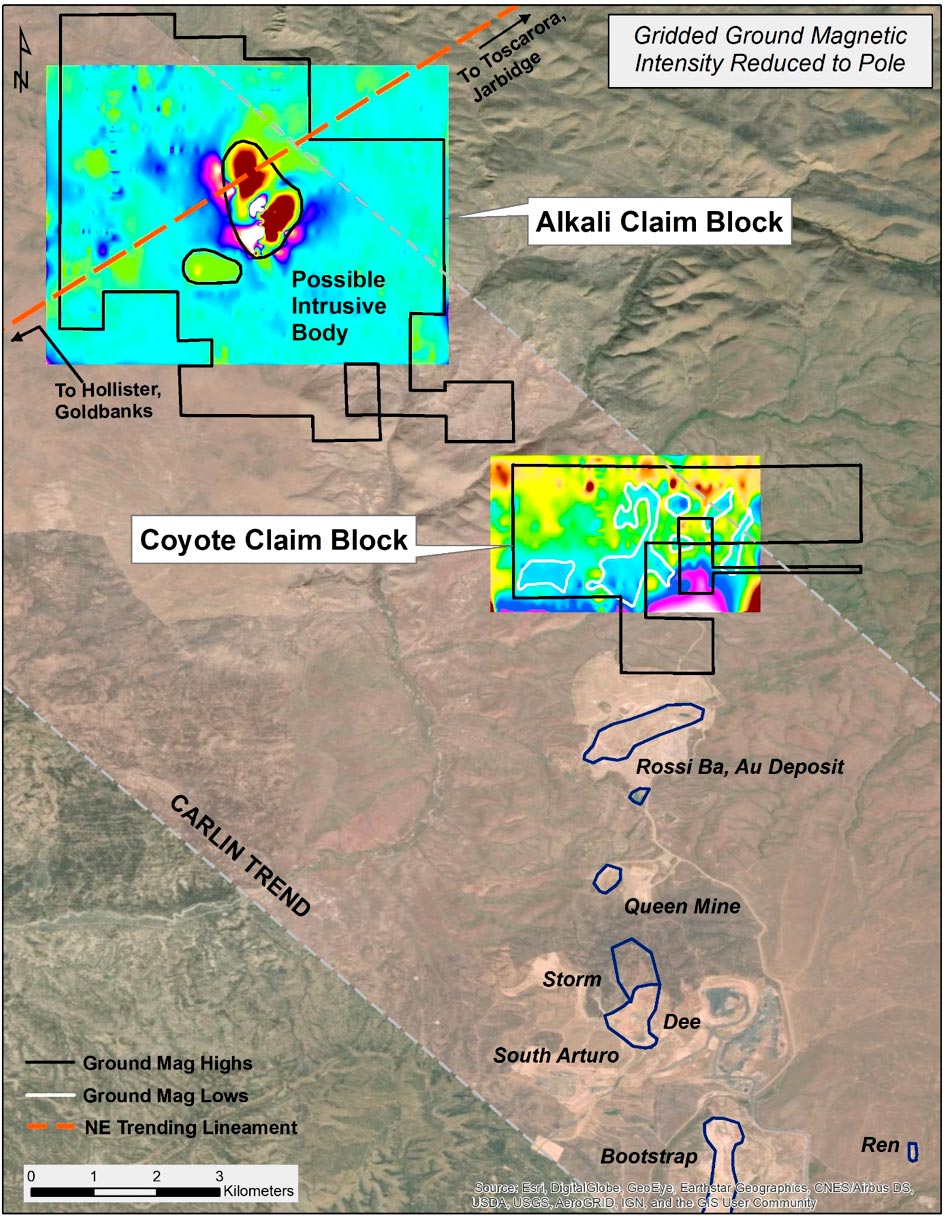

Most of the attention this summer was obviously geared towards your initial drill program at Gold Bar and Gold Canyon, but we shouldn’t forget about the more ‘grassroots’ exploration you conducted over the summer. Can you elaborate on the completed magnetometer and geochemical surveys on the Coyote and Alkali claims, which are part of the North Carlin project?

The location of our North Carlin properties is along the trend of and at the same spacing between deposits as the Bootstrap, Dee/Storm/South Arturo and Rossi gold mines. North Carlin is the next bead on the string, but the ground surface is higher in the stratigraphic section, in upper plate siliciclastic rocks which are usually not great ore hosts but lie above the lower plate carbonate rocks which are the good ore hosts.

So what we are looking for in the upper plate rocks are indications of hydrothermal alteration that may mean gold mineralization at depth. In other words, we are looking for leakage features in the upper plate rocks from a potential ore-forming hydrothermal system in the lower plate rocks.

That is why finding silicification and arsenic and other pathfinder element anomalies in soil samples is important. That is the potential leakage we hope to see. Elements such as arsenic, mercury, antimony and thallium are known to be elevated in Carlin-type gold deposits and these elements are more mobile than gold – that is they can travel farther away from a deposit either in the original hydrothermal fluids or later in groundwater or in vapors particularly up faults.

Silica, barium and calcium also travel upwards away from these ore bodies and can result in silicification, such as jasperoid, and barite or calcite deposits above ore bodies. In the case of Rossi, barite was a large component of the minerals deposited above the gold ore bodies (Rossi is the second largest barite mine in the U.S.). There are also historical barite prospects on our North Carlin property, another indication of possible deeper hydrothermal activity. How deep will be determined by our drilling.

Conclusion

Fremont Gold has barely scratched the surface on its Nevada properties, and the assay results have now been reviewed by the technical team. We expect the company to announce a new exploration program to be executed in the fall, but Fremont will very likely have to top up its treasury before doing so.

At the current share price of C$0.10, Fremont is valued at just C$4.4M which appears to be cheap given the sizeable project portfolio and the simple fact Fremont confirmed the existence of gold zones at Gold Bar and Gold Canyon.

Disclosure: Fremont Gold is a sponsor of the website, we also have a long position. Please read the disclaimer