The Palladium markets have been red-hot lately, but it is extremely difficult to find decent platinum-group metals (PGM) projects with a nice palladium content in Tier-1 jurisdictions. Most of the larger PGM projects are in riskier countries like South Africa and Russia, and most of those projects are either too low grade or just haven’t reached critical mass yet. ValOre Metals (VO.V) announced the acquisition of the Pedra Branca PGM deposit in Brazil, but it’s Generation Mining (GENM.C) that made a remarkable move in the space by acquiring the Marathon PGM project that had been shelved by Sibanye Gold upon its acquisition of Stillwater Mining.

Not only did Generation Mining enter into a binding agreement to acquire a project with 3.8 million ounces palladium, 940,000 ounces platinum, just over 380,000 ounces of gold and almost one billion pounds of copper, it also secured funding from Osisko Mining (OSK.TO) which invested C$2.5M in Generation Mining, acquiring a 10.5% stake in the company through the purchase of just over 8.9 million shares.

Fully cashed up Generation Mining is now ready to hit the ground running at Marathon and a first glance at the property shows us this could be quite a coup for GENM.

As always, all opinions, calculations and assumptions in this piece are our own and do not represent the official point of view of the company.

Bringing the Pinepoint Zinc team back together

You may remember Generation Mining was spun out of Pinepoint Zinc when the latter was acquired by Osisko Metals (OM.V) which wanted to get its hands on the company’s namesake zinc project in the Northwest Territories. Originally, Generation Mining retained Pinepoint’s interests in the really early-stage exploration projects in Canada, but CEO Jamie Levy wanted to use the company to pursue something bigger. Perhaps even larger than Pinepoint Zinc.

It took the company in excess of a year to find and complete a transaction which overhauled the perception of the company, but last week Generation Mining was finally able to close the purchase of an initial 51% stake in the Marathon property, with an option to earn an 80% stake in the project by committing to certain exploration expenditures.

Management

Jamie Levy – President, Chief Executive Officer and Director

25 years in financing and management of Canadian mining companies. Was CEO of Pine Point Mining which was acquired by Osisko Metals. Formerly Vice President of Pinetree Capital.

Kerry Knoll – Chairman and Director

Co-founded several successful mining companies over 35 years including Wheaton River, Thompson Creek and Glencairn Gold. Former editor of The Northern Miner Magazine.

Phillip Walford, P. Geo

Mr. Walford is the President and Chief Executive Officer of Marathon Gold Corporation, which is developing a gold project in Newfoundland. Previously, he was a founder and president of Marathon PGM Corporation, at the time when that company owned Generation Mining’s recently acquired Marathon palladium project in Ontario. He guided Marathon PGM through advanced exploration until it was taken over by Stillwater Mining Company in 2010 for $US118 million.

Rod Thomas P.GEO. – Vice-President, Exploration and Director

Exploration Geologist with 40 years experience in Canada and abroad. Former Exploration Manager BHP Minerals Eastern Canada and General Manager of VM Canada. President of PDAC 2014-2016.

Paul Murphy

Mr. Murphy has been the chairman of Alamos Gold Inc. since 2014, and is also a director of Continental Gold Inc., where he also serves as chair of the audit committee. From 2010 to 2018, Mr. Murphy was the Chief Financial Officer of Guyana Goldfields, as that company transitioned from explorer to gold producer, raising $350 million in the process. Previous to that Mr. Murphy spent nearly 30 years with PricewaterhouseCoopers LLP, where he was a partner and National Mining Leader. He obtained a Bachelor of Commerce from Queen’s University and was elected Fellow of the Chartered Professional Accountants of Ontario in 2016.

The acquisition terms of the project

Surprisingly, the transaction terms to acquire the Marathon PGM project are in favor of Generation Mining as we have the impression CEO Levy’s negotiation skills sealed a good deal for Generation Mining.

GENM paid C$100,000 upon signing the LOI and an additional C$2.9M in cash upon executing on the transaction. This, combined with issuing 11.05 million shares to Sibanye-Stillwater allowed Generation Mining to immediately acquire a 51% stake in the project. It can acquire an additional 29% (to end up at 80%) by spending C$10M on exploration within the next 4 years (GENM has until July 2023 to spend the C$10M) and needs to cover all relevant taxes on the property.

Now there are two options.

In case Generation Mining does NOT complete the C$10M exploration expenditures, Sibanye can repurchase 31% for a symbolic dollar, and will obtain 80% of the project (with Generation Mining retaining a 20% stake on the project level).

Our default option would obviously be to see Generation Mining completing the C$10M exploration expenditures to complete its 80% ownership earn-in agreement. From this point on, both partners will contribute in an 80/20 ratio to the subsequent expenditures on the project, but should Sibanye-Stillwater elect to not contribute its 20%, it will be diluted down.

If Sibanye doesn’t dilute down and still maintains a 20% stake on the project level after Generation Mining completes a definitive feasibility study, Sibanye has an option to increase its stake again to 51% by spending 31% of the total capex (where after the remaining capex will be funded on a 51/49 basis). To make it less abstract: should the initial capex be US$500M, Sibanye will be required to take care of 31% of this (US$155M) and of 51% of the remaining $345M capex which means Generation Mining would only have to contribute $169M towards building the mine. Long story short: should Sibany exercise the back-in option, Generation Mining will only have to cover 33.81% of the capex to maintain its 49% stake in the project. A pretty decent deal, if you ask us!

About the Marathon PGM project

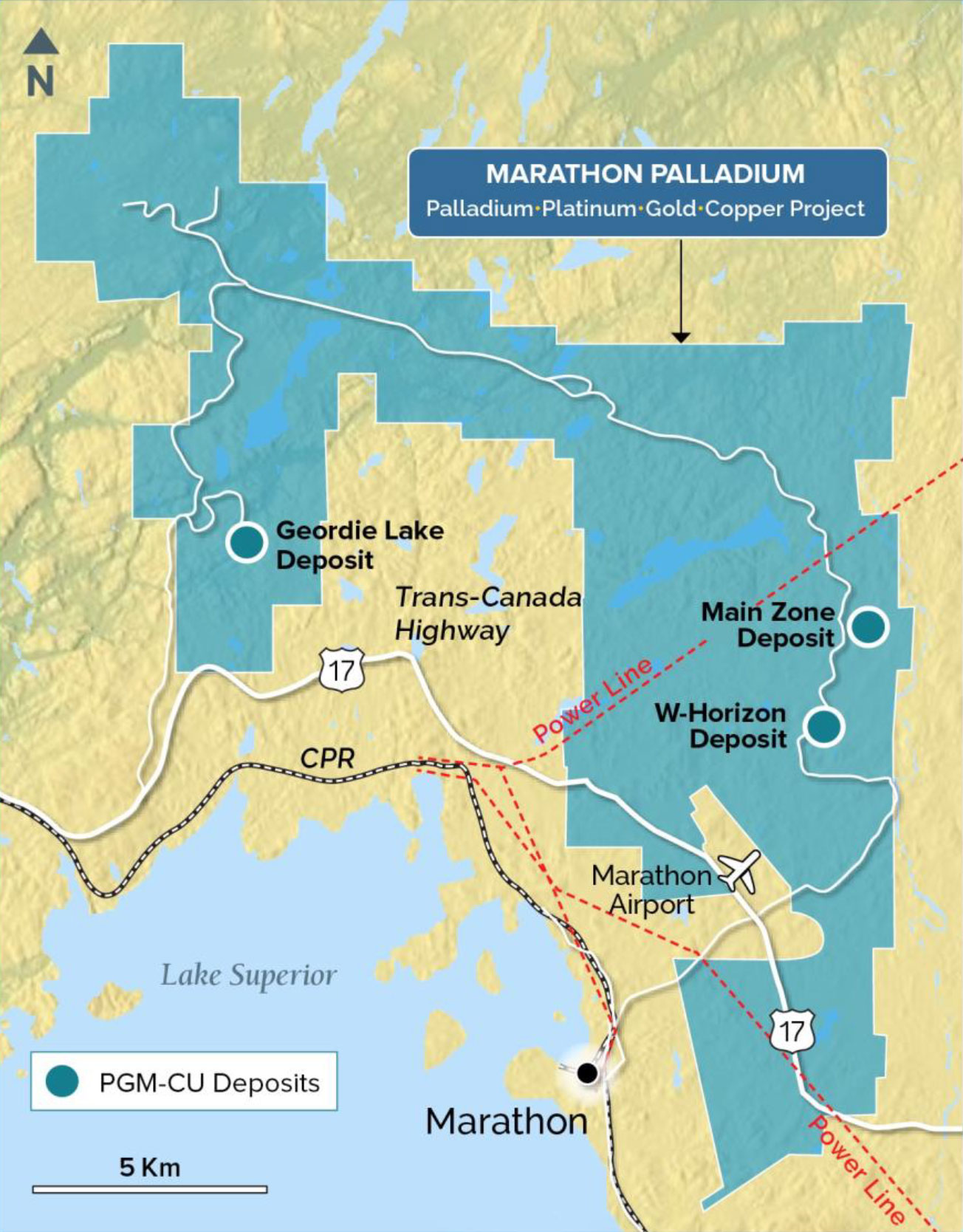

The Marathon project is a large PGM project right next to the town of Marathon (3,200 inhabitants), and within a few kilometers of Highway 17 (the Trans-Canada Highway) which connects Marathon to Sault Ste Marie on the one side, and the city of Thunder Bay (with a commercial airport) on the other side. Infrastructure is excellent, as there’s an existing power line (servicing Marathon) the project could tap into, while just four months ago, the Minister of Environment has approved the construction of a double-circuit 230 kilovolt transmission line between Thunder Bay and Wawa. This line will run right through the city of Marathon (and over part of the property), and should have ample power available to provide any potential development of the project with its power needs. Additionally, the Canadian Pacific Railway crosses the property, providing a direct link with the ports of Montreal and Sept-Iles, should Generation Mining decide to ship its concentrate overseas.

This is a very advanced stage project that was subject of a feasibility study in 2008 (but we won’t discuss those economics as the key elements are outdated and cannot be seen as representative for the economic potential of the property in 2019) so Generation Mining is able to start off with a very sound basis. In excess of 167,000 meters of drilling have been completed on the project, including a 35,000 meter infill drill program in 2007 in anticipation of the feasibility study in 2008 followed by another 20,000 meters for an updated feasibility study that was published in 2010. No serious exploration has been undertaken since 2009.

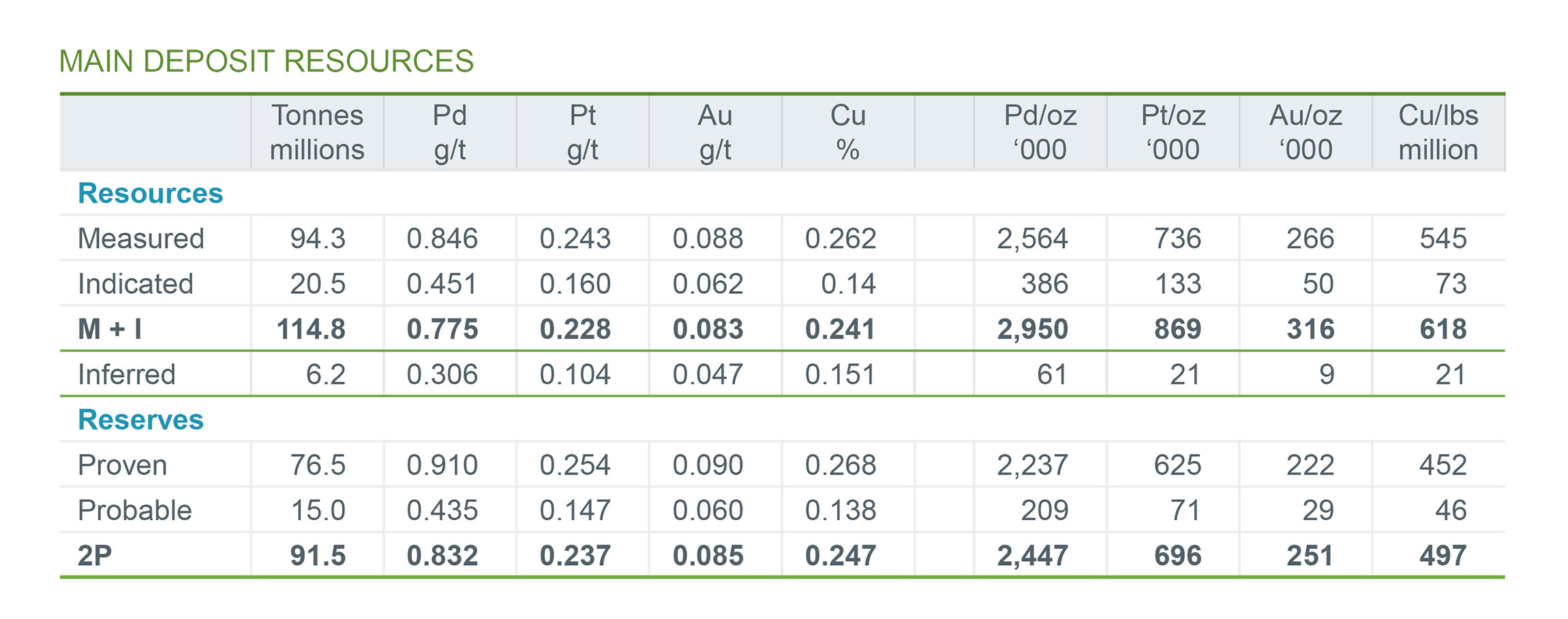

The project currently contains a total of 121 million tonnes in the main zone (there is a second zone which we will discuss later), of which 95% is part of the measured and indicated resource categories. The average grades (as you can see below) aren’t high, but thanks to the high tonnage, the M&I historic resources contain almost 3 million ounces of palladium, 869,000 ounces of platinum, 316,000 ounces of gold and just over 600 million pounds of copper.

Of these 115 million tonnes (Main Zone deposit only) in the measured and indicated categories, just over 91 million tonnes ended up in the reserve categories at a slightly higher grade. To put things in perspective: on a gold-equivalent basis (using $1400 gold, $850 platinum, $1450 palladium and $2.75 copper), the average reserve grade is 1.42 g/t, a very respectable number for an open pit operation right next door to existing infrastructure.

Having a feasibility study also means the previous owners spent a lot of time and money on metallurgical test results. Back in 2010, the feasibility study assumed the production of a copper concentrate with the three PGM’s as by-product credit. According to the old study, the payability ratio of the palladium and platinum was expected to be respectively 92.5% and 88%, but sources told us it’s reasonable to assume a 92% payability for both metals, some standard deductions may apply, but that’s something that will have to be decided in concentrate offtake negotiations further down the road.

This would result in an effective payability of 65% for the platinum and 74% for the palladium (which is by far the most important metal) based on the expected concentrate grade using the 2008 SGS metallurgical test work that was subsequently used in the feasibility study with a 71% Platinum recovery rate and 80% for Palladium (of course all these elements are still subject to change as Generation Mining will obviously commission additional studies).

The deposit also appears to be quite consistent. The average thickness of the mineralized layers is roughly 35 meters but pinches and swells between 4 meters and 183 meters. Overall, the continuity is excellent, but any future open pit mine plan will need to take the strip ratio into account. In the original feasibility study this strip ratio was estimated at 2.88:1 (so to process one tonne of rock, 3.88 tonnes would have to be mined), but we expect this number to improve slightly as the high palladium price could indicate more tonnes would meet the cutoff threshold. The strip ratio is expected to be the highest in the first few years of the mine life (4.65 in Y1, 3.91 in Y2 before dropping off in the subsequent years, but again, everything is still very much subject to change as the project evolves and develops.

Although it shouldn’t be relied upon, the old feasibility study is an interesting read to get a better understanding of the background of the project, and just to make it easier to retrieve, we have uploaded it here.

The upside potential

Although there is a feasibility study on the project, the results of that study are outdated and we don’t think the old study represents a good overview of the economics of the project (just to give you an example, we think the feasibility study has grossly underestimated the initial capex (C$351M) while the operating expenses should be adjusted for inflation as well as we doubt a processing cost of less than $7/t is realistic). But we will try to put a basic economic model together in the near future once we get a better understanding of the intricacies of the project.

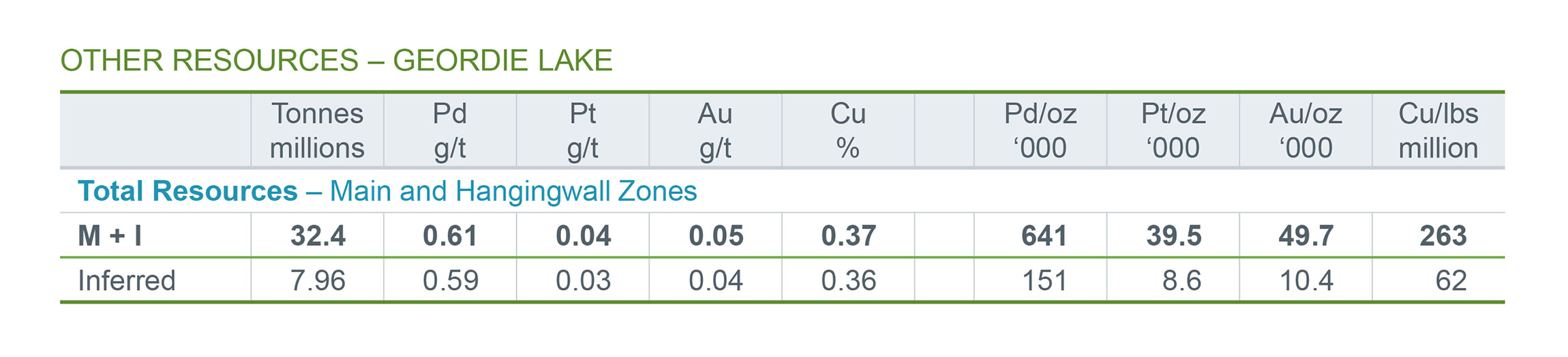

We do think it’s important to emphasize that although there is a historic 91.8 million tonne proven and probable reserve on the project, there still is room for expansion. After all, the previous exploration programs were designed to get a better understanding of the Main Zone, and it looks like the regional targets were a bit ignored. In fact, just 10 kilometers west of the Main Zone and W Horizon there’s the Geordie Lake deposit which already contains just over 32 million tonnes in the measured and indicated resources:

With 800,000 ounces of palladium in the combined measured, indicated and inferred resource categories (641,000 ounces in the M&I categories, 151,000 ounces in the inferred resource category), Geordie Lake could be an interesting satellite deposit for the potential mining operations on the Main Zone. It’s also interesting to see the copper content is roughly 50% higher, so perhaps this could also provide Generation Mining with some ‘optionality’: it could prioritize copper-rich rock from Geordie Lake when the copper prices are strong and PGM prices weak and vice versa.

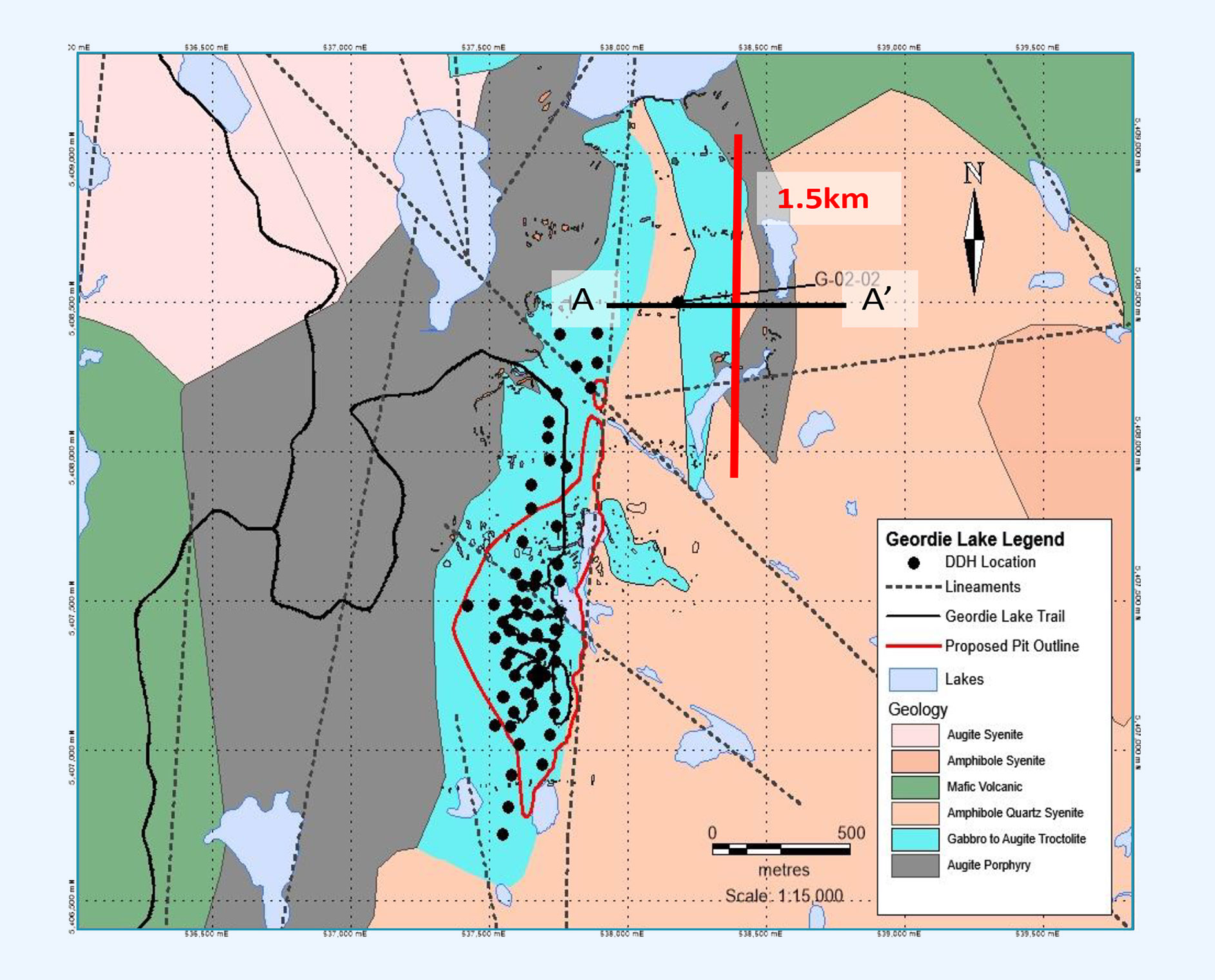

There seems to be additional potential to increase the Geordie Lake resource as there appears to be a sizeable magnetic signature about a kilometer north of the open pit outline of the resource. As this new signature has a total length of 1.5 kilometers, it’s definitely large enough to warrant a follow-up exploration program.

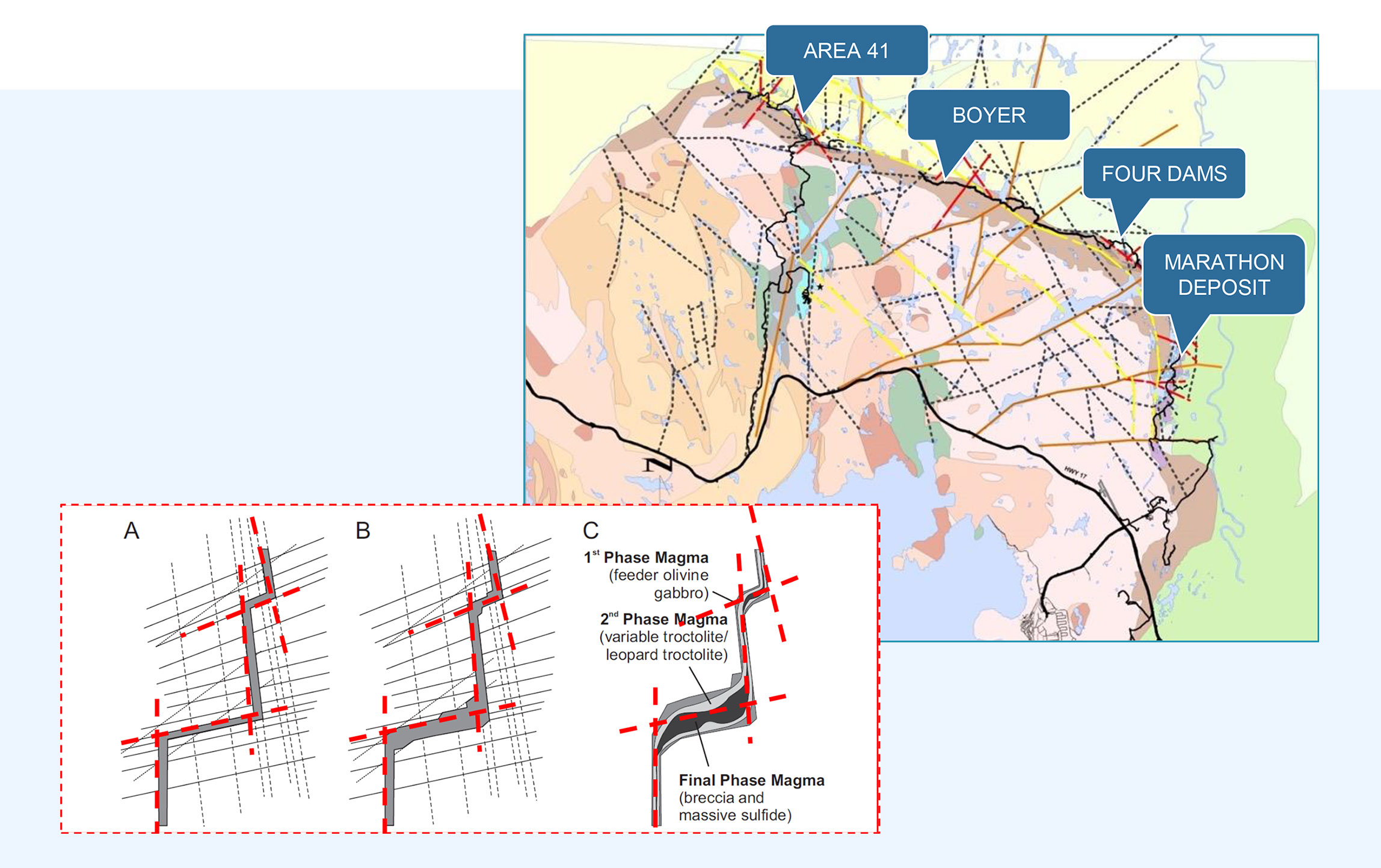

Additionally, there are several other exploration targets along the Coldwell complex (Four Dams, Boyer and Area 41 are highlighted on the previous map), of which Area 41 appears to be the most intriguing as previous drill programs have encountered four mineralized zones with grades that are good enough to justify Generation Mining spending a few million dollars on this zone. With thick drill results of 92 meters containing 0.6 g/t PGM and 0.21% copper and 36 meters of 1.47 g/t PGM and 0.17% copper, Area 41 (which will be renamed the Sally Zone) has the potential to become a satellite deposit to the Main Zone, just like Geordie Lake.

Although there is a feasibility study on the Marathon PGM project, this doesn’t mean there’s no exploration potential. Quite the contrary, as it looks like regional targets were largely ignored. Should Generation Mining be able to find a few satellite deposits that are sufficiently large enough and have a high enough grade to be viable, the Marathon PGM project could be even more valuable than anticipated. But of course, the proof will be in the pudding, and Generation Mining’s C$10M exploration requirement over the next 4 years will answer a lot of those questions.

A quick look at the palladium market

Palladium is predominantly used in the automobile sector as it’s an indispensable metal in pollution-reducing auto-catalysts. Considering the recent focus of most countries on the environmental aspects of a society, one could expect an increasing focus on making exhaust gases as clean as possible.

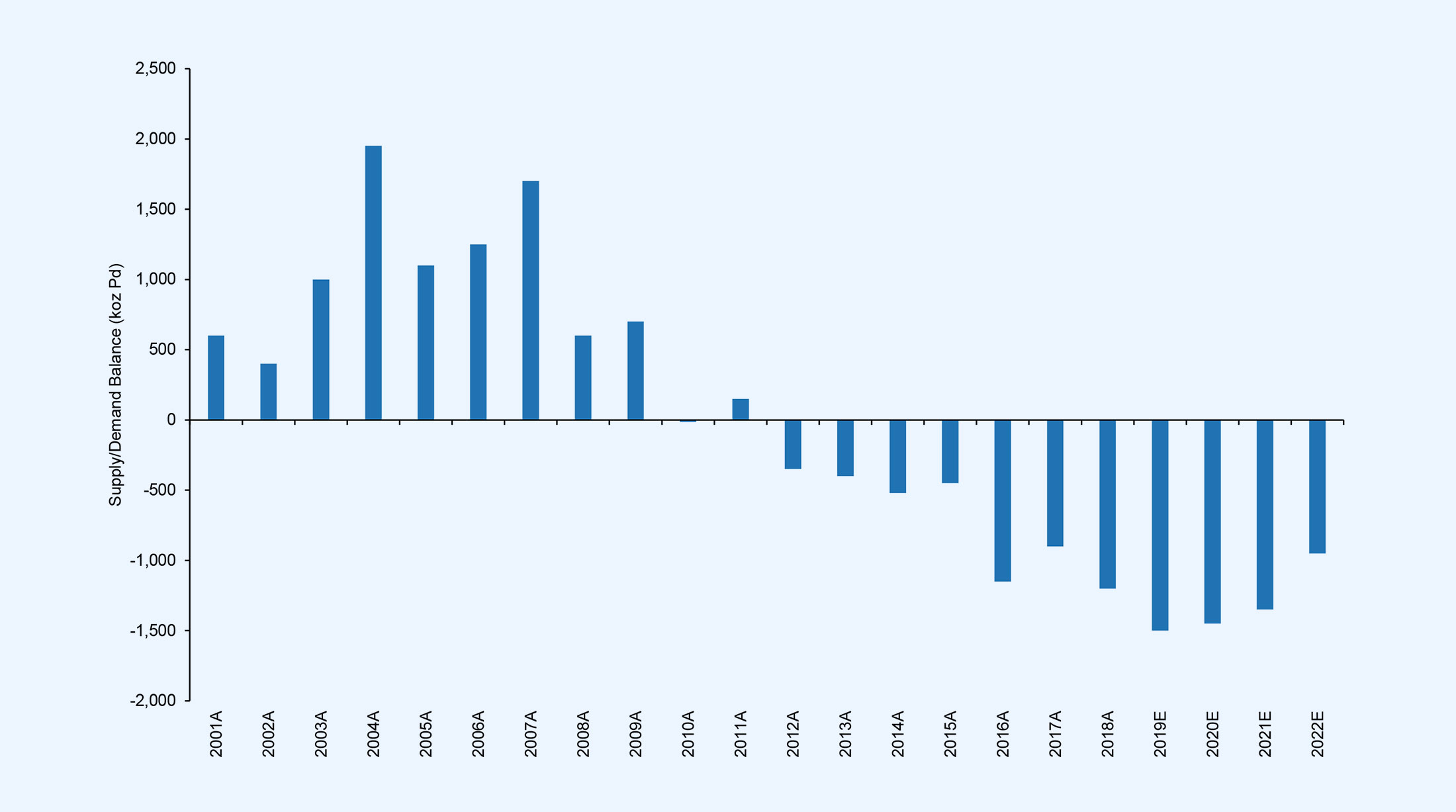

You could argue that electrical vehicles will reduce the demand for palladium and while that may absolutely be true, conversion to all-electric cars is expected to take several decades and we also shouldn’t forget about the current supply situation on the palladium market, which remains in a relatively large deficit.

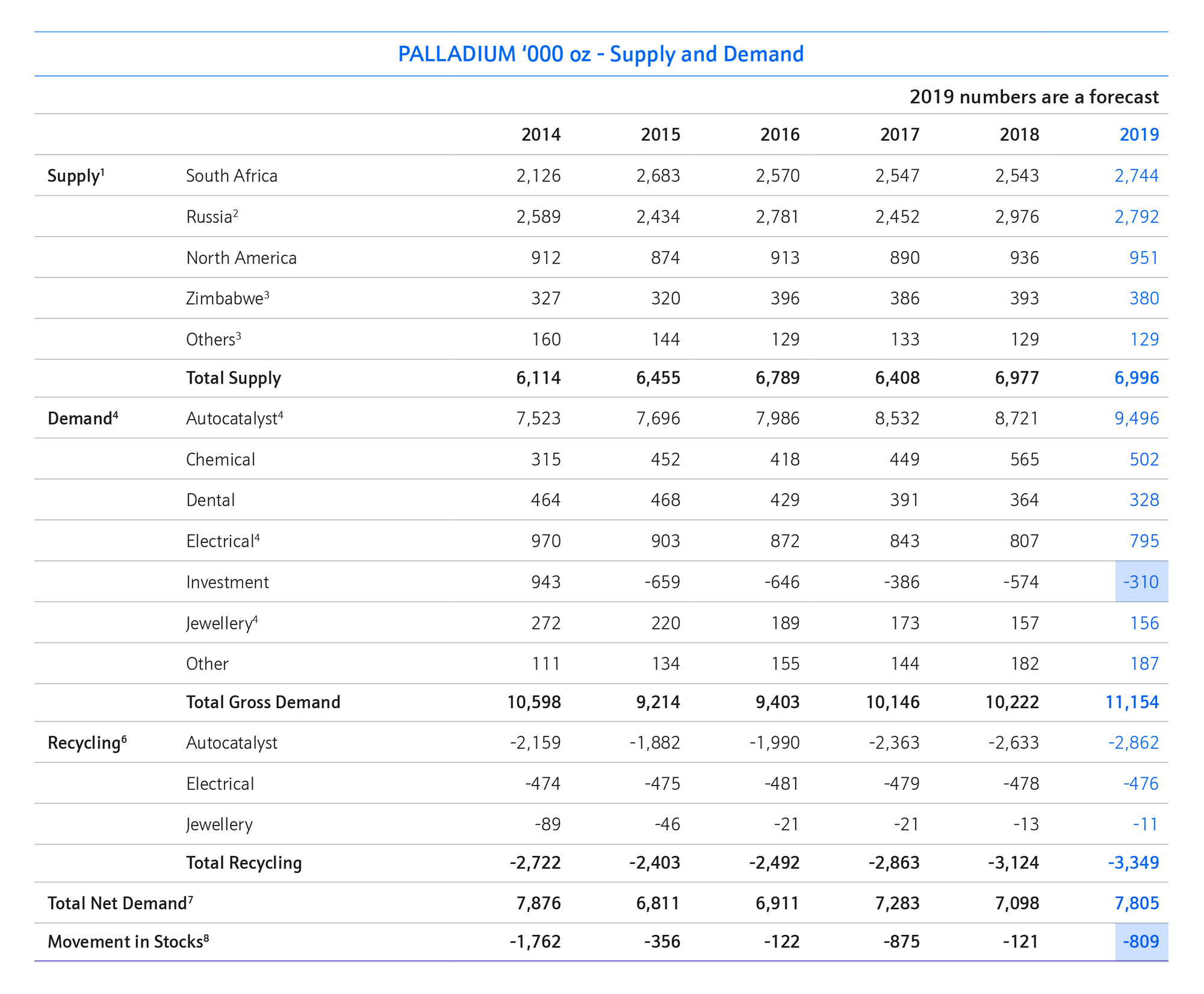

According to a recent study published by Johnson Matthey, one of the largest producers of emission control related catalysts in the world; the world is heading towards a supply deficit of around 810,000 ounces of palladium this year, despite an expected 7% increase in the total amount of palladium that could be recovered through recycling activities.

While we acknowledge recycling will become more important (Belgium’s Umicore is for instance heavily investing in recycling activities), we should also take future supply disruptions into account. With almost 80% of the mined palladium coming from either South Africa or Russia, future output reductions would have a negative impact on the palladium market. But for the time being, let’s assume South African and Russian operations will continue to keep their production results at the current levels.

The average palladium content in a car catalyst is approximately 3 grams (the total PGM content usually ranges from 4-6 g/t PGM’s, consisting of Palladium, Platinum and Rhodium). This means that in order to remove the current 810,000 ounce per year deficit to bring the demand and supply back in balance at 10.3 million ounces of palladium (mine production + recycling), 8.4 million combustion engine cars would have to be removed from the road.

So while nobody can deny an increasing demand for electric vehicles, we don’t believe in an or/or story, as an and/and scenario whereby electric vehicles and combustion engines will (continue to) co-exist. In order to rebalance the market, approximately 8.4 million combustion engine cars could be switched over to electrical vehicles without jeopardizing the total palladium demand. So there is a certain margin of safety on the market.

The recent supply deficit of physical palladium has been covered by ETF’s selling part of their stocks, but that’s a situation that’s per definition finite. In fact, the market could be setting itself up for a perfect storm should the investor interest in palladium increase together with the continuously high demand for industrial usage. If we would start seeing a net INFLOW in Palladium ETF’s (compared to the outflow we have seen over the past few years), the total supply deficit could increase to well in excess of a million ounces of palladium per year as industrial end-users ànd ETF’s will be looking to secure the same supplies of palladium.

In fact, if we would exclude ETF selling from the equation, the underlying palladium supply deficit is approximately 1.1 million ounces per year.

With C$4M in cash on hand, Generation Mining is sufficiently funded for the next 12 months

One of the conditions to close the purchase of an initial 51% stake in the Marathon PGM property was Generation Mining raising at least C$8M on the back of the proposed deal.

GENM succeeded, raising C$8,000,160 by issuing 28.57 million subscription receipts at C$0.28. Each sub receipt will be (or has already been) converted into a common share and half a warrant whereby each full warrant allows the warrant holder to acquire an additional share for C$0.45 within two years after the escrow release conditions were satisfied (July 2021).

After deducting the 7% commission payable to the underwriters (Haywood, Canaccord and PowerOne) and making the C$2.9M cash payment to Sibanye-Stillwater, we expect Generation Mining to currently have approximately C$4.0 in cash as well as the 12.6 million shares in Eastern Zinc (EZNC.C) which currently have a market value of almost C$900,000 based on a share price of C$0.07 (note: Eastern Zinc is extremely illiquid, so we don’t think the monetization of these shares at a reasonable price will be possible anytime soon). An additional 5 million shares (and C$50,000 cash) will be issued on the first anniversary of the Clear Lake sale agreement to Eastern Zinc.

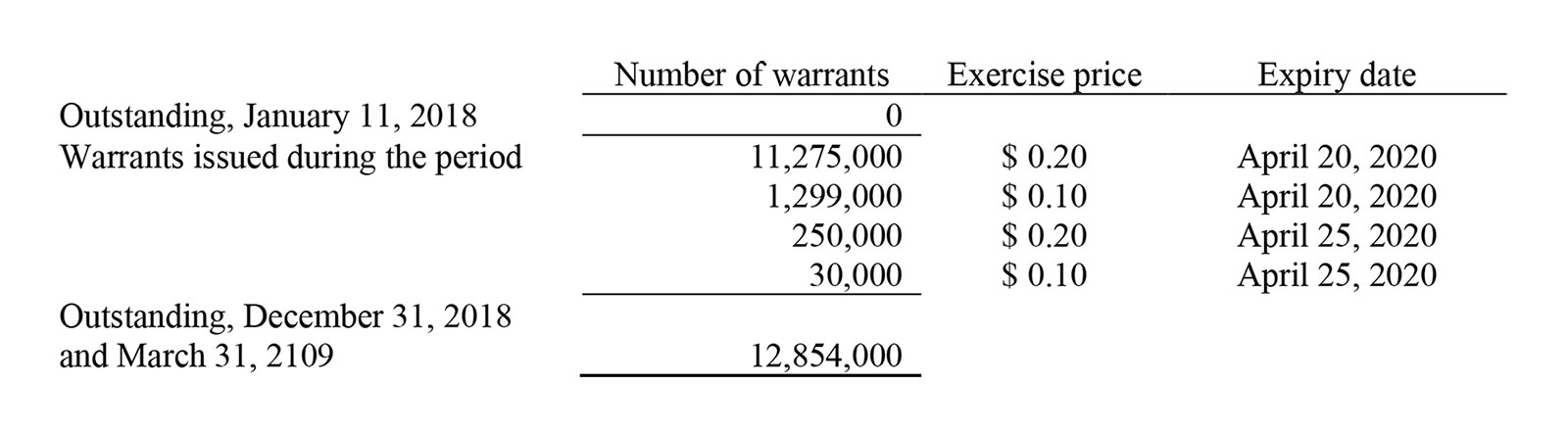

What’s interesting in Generation Mining’s capital structure is that it has some sort of ‘secondary financing’ lined up as all the older warrants are now ‘in the money’, and are expiring within the next 9 months:

Should all warrants be exercised, Generation Mining will receive an additional cash injection of C$2.4M. Given Generation Mining’s current cash position and the April expiration date of the warrants, we think it wouldn’t be unreasonable nor unrealistic to assume Generation Mining won’t have to raise additional money before the end of next year, but this all depends on how aggressive Generation plans to explore. Perhaps it could consider taking advantage of flow-through funds scrambling to deploy money in December to raise an additional C$1-2M at the usual flow-through premiums.

In any case, by raising C$8M in June, Generation Mining has taken a lot of pressure off as there’s no immediate need to tap into the equity markets again.

Conclusion

We think it’s fair to say the earn-in agreement to acquire an 80% stake in the Marathon PGM project is a transformational acquisition for Generation Mining. The purchase of an initial 51% stake has already been established, and the C$10M exploration commitment will help to further increase the value of the project and to improve the economics.

There is a historic feasibility study available on the project, but Generation Mining won’t rush things and first kick the tires in a regional exploration as especially Geordie Lake has the potential to become a satellite deposit to the Main Zone which already contains almost 100 million tonnes in a proven and probable reserve estimate.

And with Osisko Mining (10.5%), the Lundin trust (13%), Sibanye-Stillwater (13%) and management (9%) as main shareholders, almost half of the outstanding shares of Generation Mining are in strong hands.

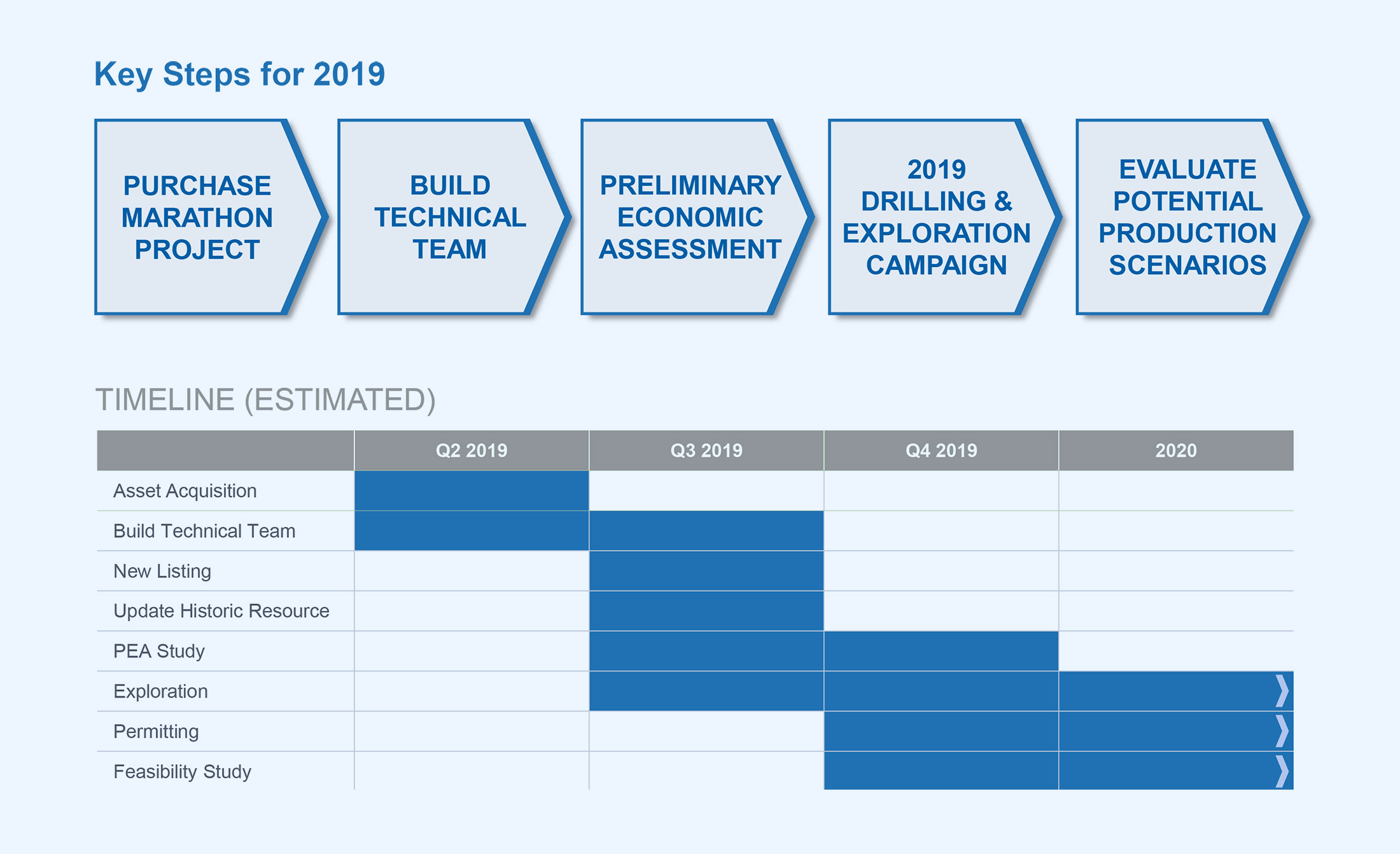

An update PEA should be out in in early 2020 and we expect this study to put the Marathon PGM project back in the spotlight as it will provide the market with a ‘tangible’ value slapped on the project. Thanks to the current high palladium price, Generation Mining’s current enterprise value of just C$20M appears to be just a fraction of the NPV that could be unveiled in the upcoming PEA.

Disclosure: Generation Mining is a sponsoring company, we have a long position.