Generation Mining (GENM.TO) has ticked every box it was supposed to tick in the past few years and this resulted in a shovel-ready fully permitted project. The next major part of the puzzle to unlock the value of the Marathon Copper-PGM project will be to secure the main components of the construction financing as we are convinced this will result in a re-rating of the company’s valuation. Generation Mining is currently trading at just 0.2 times its after-tax NPV6% using the base case economic scenario used in the feasibility study.

The recent financing puts the company on a stronger footing

As previously discussed, the company was able to increase the size of its bought deal from the initially announced C$20M to C$34.5M. Each unit will be priced at C$0.72 and consist of one common share and half a warrant with each full warrant allowing the warrant holder to acquire an additional share for C$1.00 during a 24 month period. And even after the upsize, we only received 37% of the units we asked for in this financing from our Canadian broker, indicating there was plenty of interest in this financing.

This financing will boost the company’s working capital position to in excess of C$40M (allowing for underwriting fees and cash burn since the September 2025 financial statements were filed).

The construction financing package will be the next catalyst

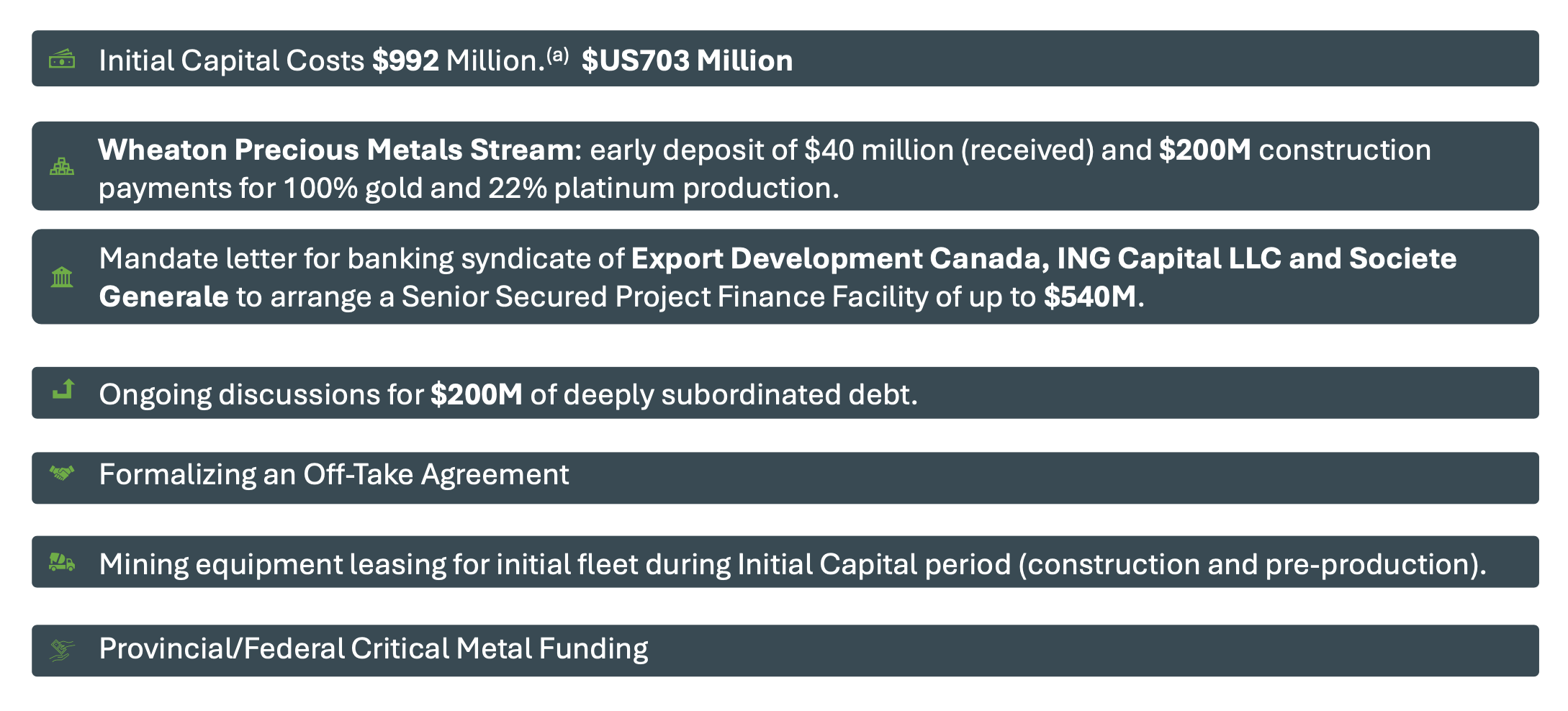

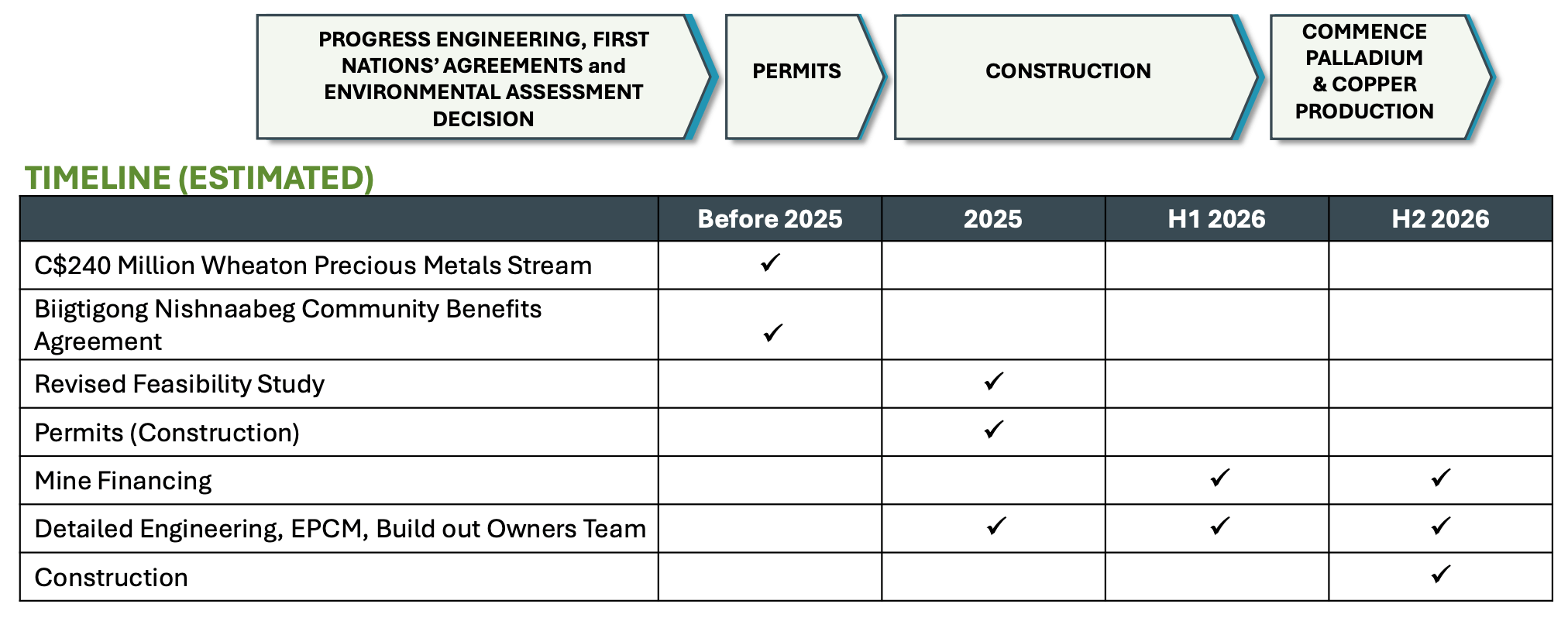

While the C$34M raise will help the company from a working capital perspective, the market of course would like to see additional details on the construction financing package. It’s our understanding the company is juggling with multiple balls in the air, as the initial capex funding will likely consist of about half a dozen components. The image below, taken from Generation Mining’s corporate presentation, provides additional details.

The initial capex is C$992M (in 2025 numbers, so there likely will be an inflation adjustment between 2025 and the time all construction is completed), and we’ll use that number to keep it simple.

The company has signed a mandate letter with a banking syndicate for a senior secured project finance facility of ‘up to C$540M’. The words ‘up to’ are important here as the recent volatility in the palladium price may have resulted in the banks using a more conservative long-term palladium price. It really all comes down on if they use $1000 palladium or $1250 or perhaps even $1500. The lower the palladium price, the lower the willingness of the banks to provide the maximum amount of C$540M. We will be happy to be proven wrong, but we are not counting on receiving the entire C$540M at this time.

An additional C$200M will likely come from Wheaton Precious Metals (WPM) as part of a previously agreed upon streaming deal. Wheaton will receive all of the gold and 22% of the platinum that will be produced at the Marathon PGM project. This C$200M would be seen as equity.

Generation is also in discussions to secure C$200M in deeply subordinated debt (likely provided by a government agency or a pseudo-bank). While this is still debt, it would likely hit the balance sheet as equity-like given the deeply subordinated nature of this debt. It would still rank senior to common equity (i.e. the shareholders), but it would be junior to the project finance facility and classified as equity on the balance sheet as per the accounting standards, so having deeply subordinated debt would not be a deterrent for the commercial lenders.

These three ‘pillars’ would contribute about C$875M of the total capex bill, assuming the senior secured facility would come in at C$475M versus the C$540M maximum.

Generation Mining still has other irons in the fire. It could perhaps lease the mining equipment rather than including it in the capex. The total initial capex earmarked for mining equipment was just under C$70M in the feasibility study. Moving some of this from a capex item to an opex item would help.

And finally, Generation Mining mentions it is pursuing potential provincial and/or federal critical metal funding. This could take the shape of a grant or perhaps a co-investment agreement whereby a government agency matches a pro rata amount of equity invested by Generation Mining.

We strongly believe that completing the major components of the construction financing package (i.e. completing the streaming agreement, the secured financing agreement and the deeply subordinated debt) will not only go a long way to convince the market this project will actually be built, it may also make it much easier to figure out the missing equity components to ensure the budgeted capex is fully funded.

That could be straight equity by issuing stock (hopefully after (and assuming) the share price rerates when the main components of the financing are completed.

A second solution to cover the shortfall would be to investigate the potential to increase the platinum stream. Right now, only 22% of the anticipated platinum production is subject to the streaming agreement with Wheaton. Both companies appear to have a good relationship so it could perhaps make sense to explore a potential increase of the stream towards 40% or 50%. With platinum at $2500/oz, this could be the right time to explore this option.

In any case, we expect that if one or two pieces of the puzzle (beyond the C$200M streaming deal) are falling into place, the rest will follow swiftly.

The current palladium and copper prices are providing a tailwind

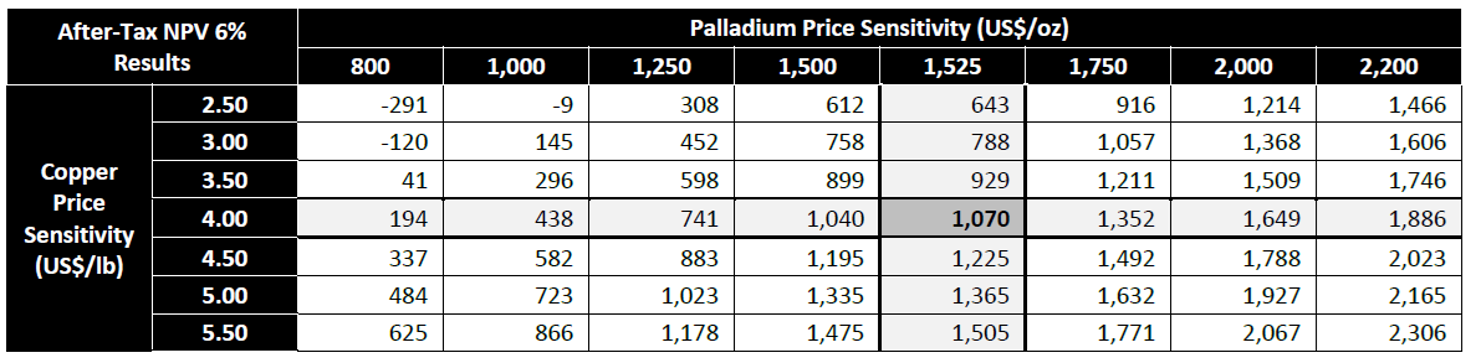

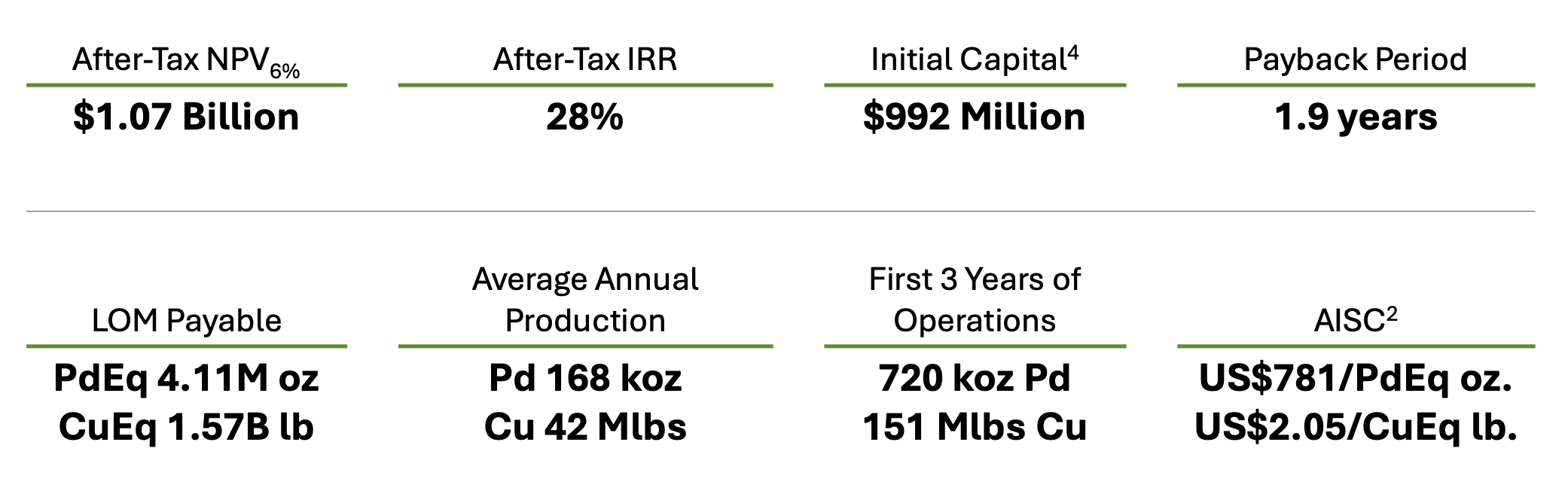

As a reminder, the base case scenario in the economic study used a palladium price of $1525/oz and a copper price of $4 per pound. This resulted in an after-tax NPV6% of C$1.07B and an after-tax IRR of almost 28%.

The sensitivity table below shows the torque provided by the project based on the palladium price. At $1750 palladium the after-tax NPV6% increases by in excess of 25%. At the current spot price, the NPV jumps to C$1.65B.

Given the volatility in the palladium price (the current price is approximately $1900/oz, but we have seen triple digit prices in the recent past), we would understand if the financing syndicate wouldn’t want to stray from the $1525 base case scenario or perhaps it would consider using an even lower palladium price.

With an annual output of 165,000 ounces of palladium and 42 million pounds of copper on an annual basis (on average) as main products with an additional 40,000 ounces of platinum per year, at current spot prices, the annual revenue would exceed C$1B.

Additionally,the copper angle is becoming increasingly important. For every 50 cent change in the copper price, the after-tax NPV6% increased by almost C$150M. Using $4.5 copper and $1525 palladium? C$1.23B in NPV. Using $1250 palladium and $5 copper? C$1.02B in NPV. Using metal prices that are comparable to the current spot ($2000 palladium and $5.5 copper) would result in an after-tax NPV5% of in excess of C$2B while the after-tax IRR in that scenario would jump to in excess of 40%.

That’s of course an optimistic scenario. But the sensitivity table shown above will allow you to use the palladium and copper prices of your choice and see the relevant after-tax NPV6%. But right now, and including the impact of the C$30M financing, the company is trading at just 0.2 times NPV, which is on the lower end of the spectrum for a shovel-ready and permitted mining project in safe jurisdiction.

Conclusion

It’s very rare to see a fully permitted and shovel-ready project in a safe jurisdiction like Canada trade at just 0.2 times its NAV using the base case scenario in the feasibility study. We expect that securing (a substantial portion of) the construction financing will be a key element to see a re-rating of the company’s market capitalization and that should make it easier to work on covering the shortfall.

After a prolonged period of depressed PGM prices, the palladium and platinum price are now in an excellent shape, and as the sensitivity analysis of the 2025 feasibility study indicated, every $100 palladium price increase and every $0.50 copper price increase is a blessing and adds to the value of the project.

Given the heightened interest in copper juniors and the lack of available development-stage companies, Generation stands out as a compelling opportunity that could evolve into Canada’s next major copper development story. A potential comparable could be Foran Mining, a copper-focused development company in the final stages of the construction phase on its flagship underground project. As far as we know, Generation Mining is the only other large-scale shovel-ready project in Canada focusing on copper and PGMs.

Disclosure: The author has a long position in Generation Mining. Generation Mining is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read our full disclosure.