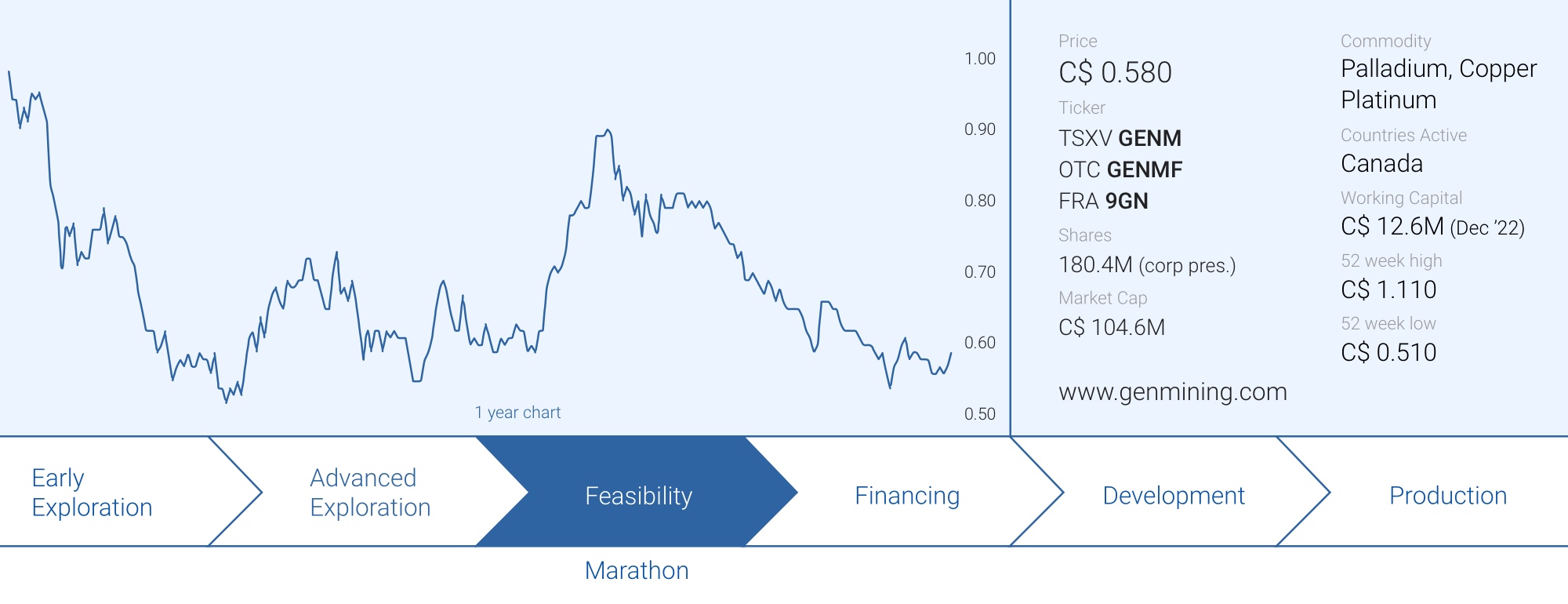

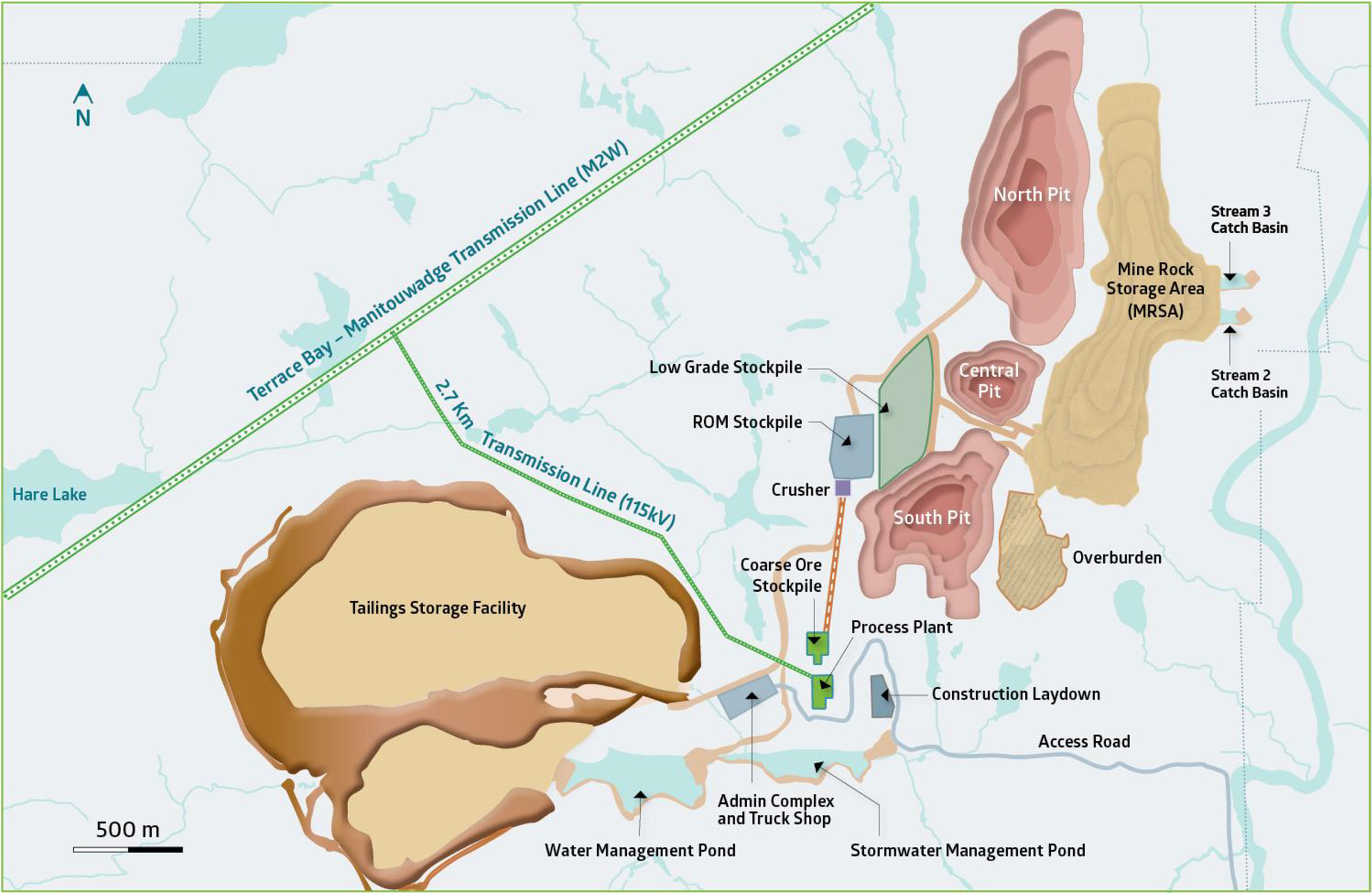

Generation Mining (GENM.TO) acquired the Marathon Palladium-Copper project at a very opportune time in a deal with Sibanye-Stillwater (SBWC) in 2019. Subsequent to the original agreement, Generation Mining negotiated a deal with Sibanye-Stillwater to acquire full ownership and now owns 100% of the subsidiary holding the project.

The 2021 feasibility study indicated attractive economics but as you can’t really start to build a mine based on an outdated feasibility study, the company commissioned an updated study to ensure it has the most up to date information while putting the financing package together.

The updated feasibility comes in, in line with the expectations

The updated feasibility study now contains the most up to date estimate on the initial capex and opex to be incurred by Generation Mining during the construction phase and operational phase of its flagship Marathon Palladium-Copper project.

The initial capex is now estimated at C$1.11B, which is a 25% increase compared with the 2021 feasibility study. While 25% sounds pretty high, it’s actually not that bad compared to other mining companies facing similar issues. Also keep in mind the updated feasibility study contains a C$97M contingency allocation.

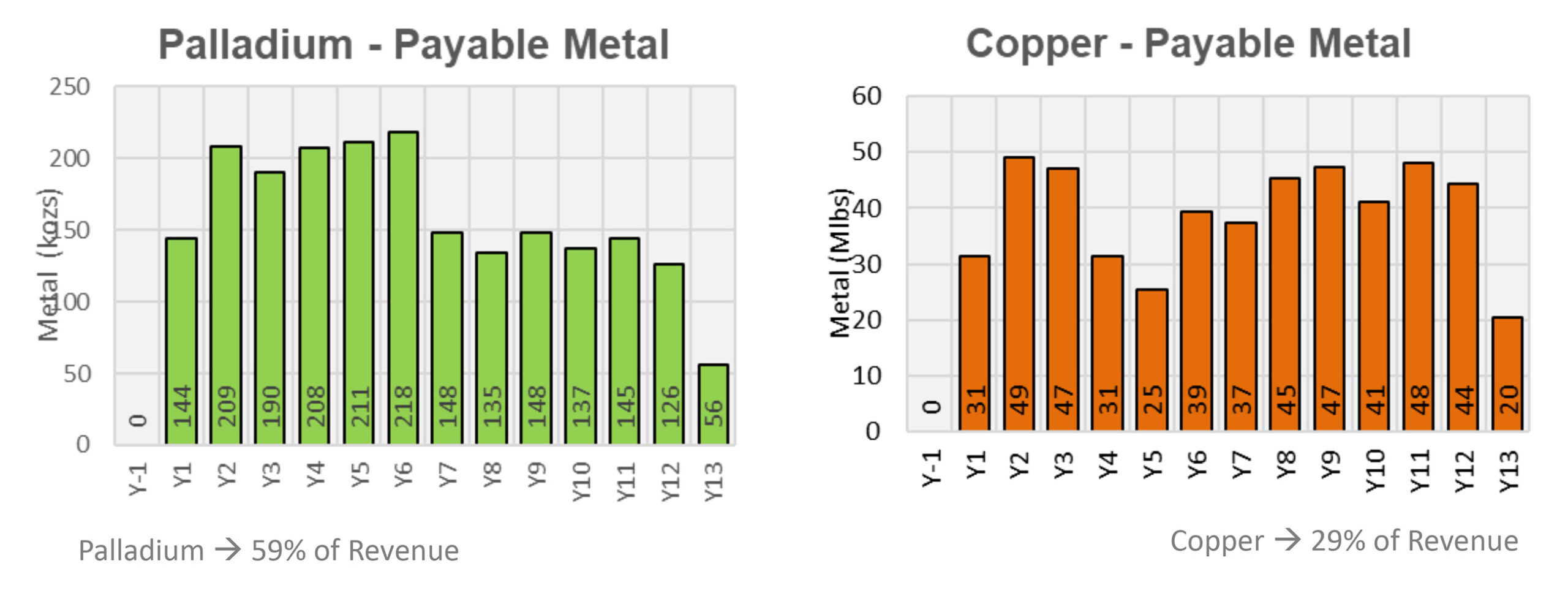

Operating costs and all-in sustaining costs, per ounce of payable palladium-equivalent, each only increased modestly over the life of the mine thanks mainly to greater production of payable metals with the total ounces of palladium-equivalent increasing to 3.6 million ounces from 3.2 million ounces in the 2021 study. Keeping the opex under control is actually a very encouraging element to see.

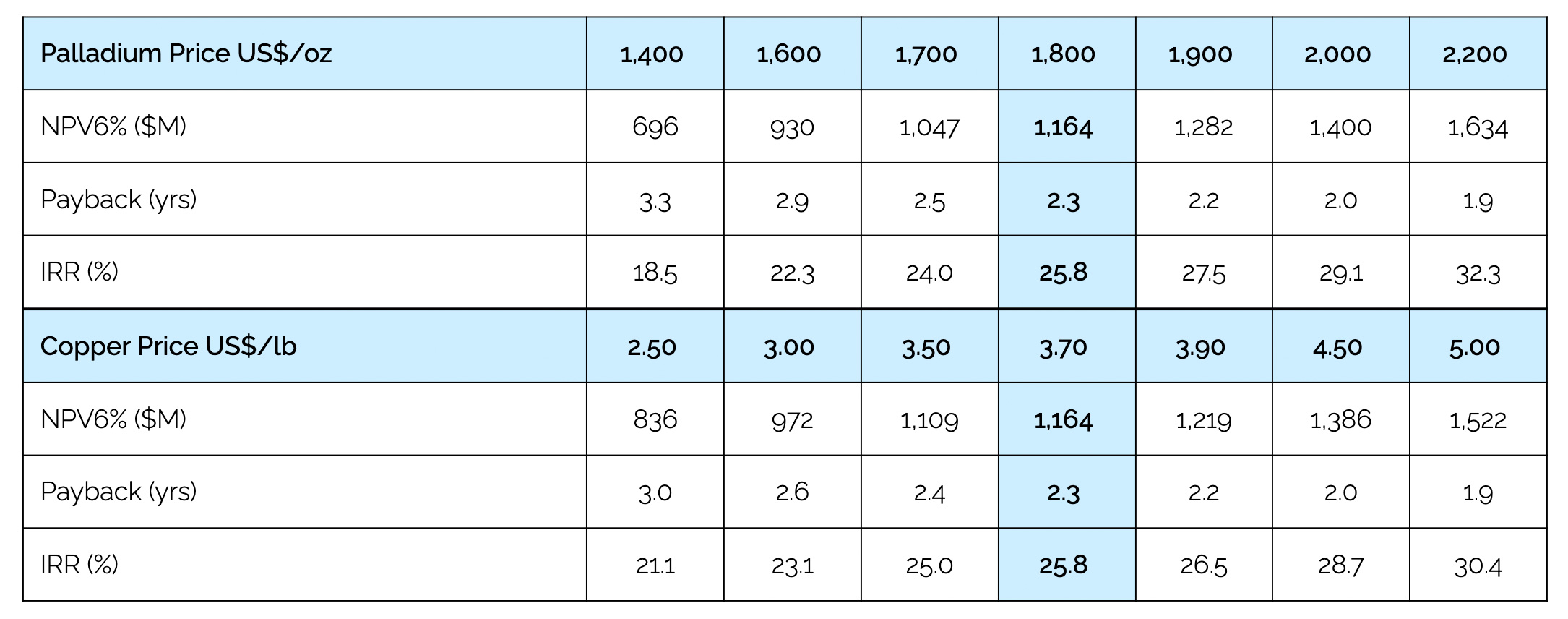

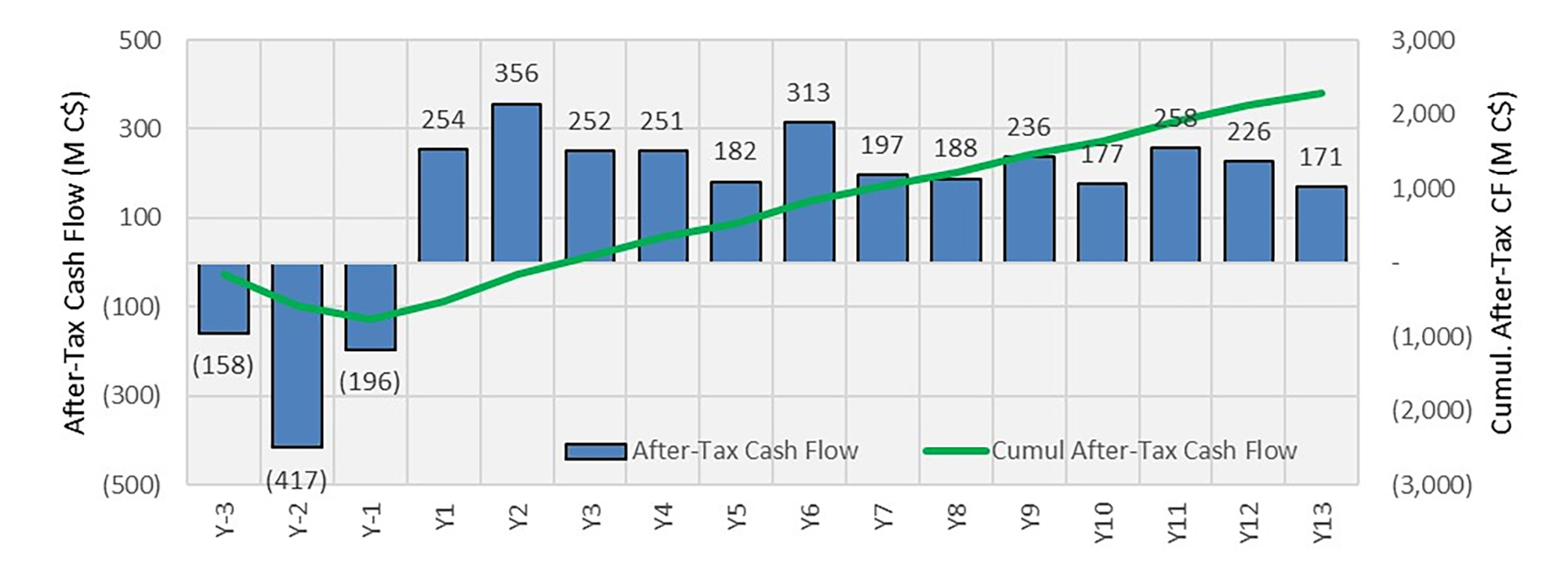

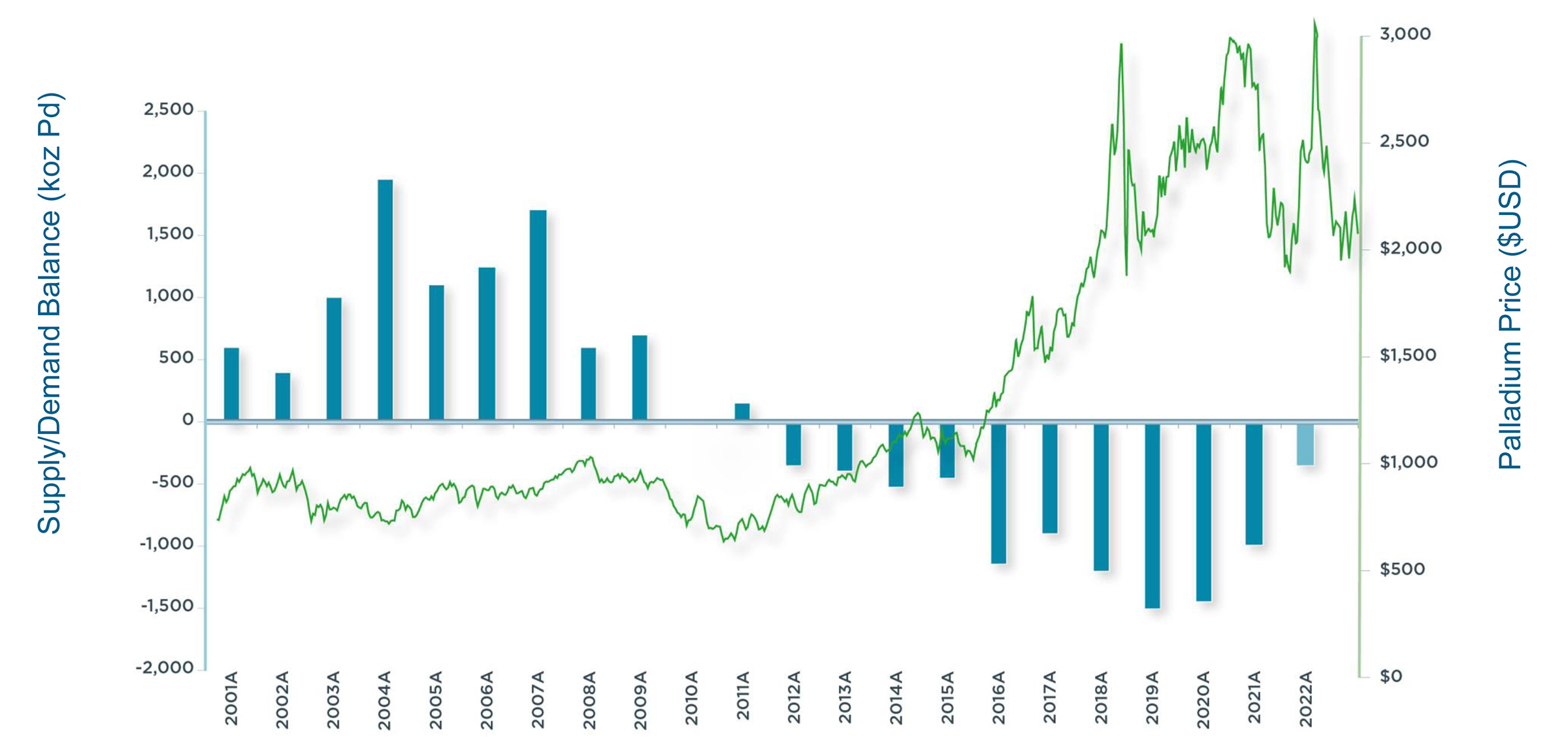

In the updated study, Generation Mining used a base case scenario with $1800 palladium per ounce and $3.70 copper per pound. While the copper price used by the company is realistic, it’s a little bit counterintuitive to use a palladium price that’s not only higher than the base case scenario in the 2021 study but is also higher than the current spot price. Fortunately, the company also provided a sensitivity analysis which showcases the NPV6% using a 25% lower palladium price. The after-tax NPV6% is still positive at C$696M which means the total after-tax operating cash flows (including sustaining capex but excluding the initial capex) will be approximately C$1.8B , still discounted at the same 6%.

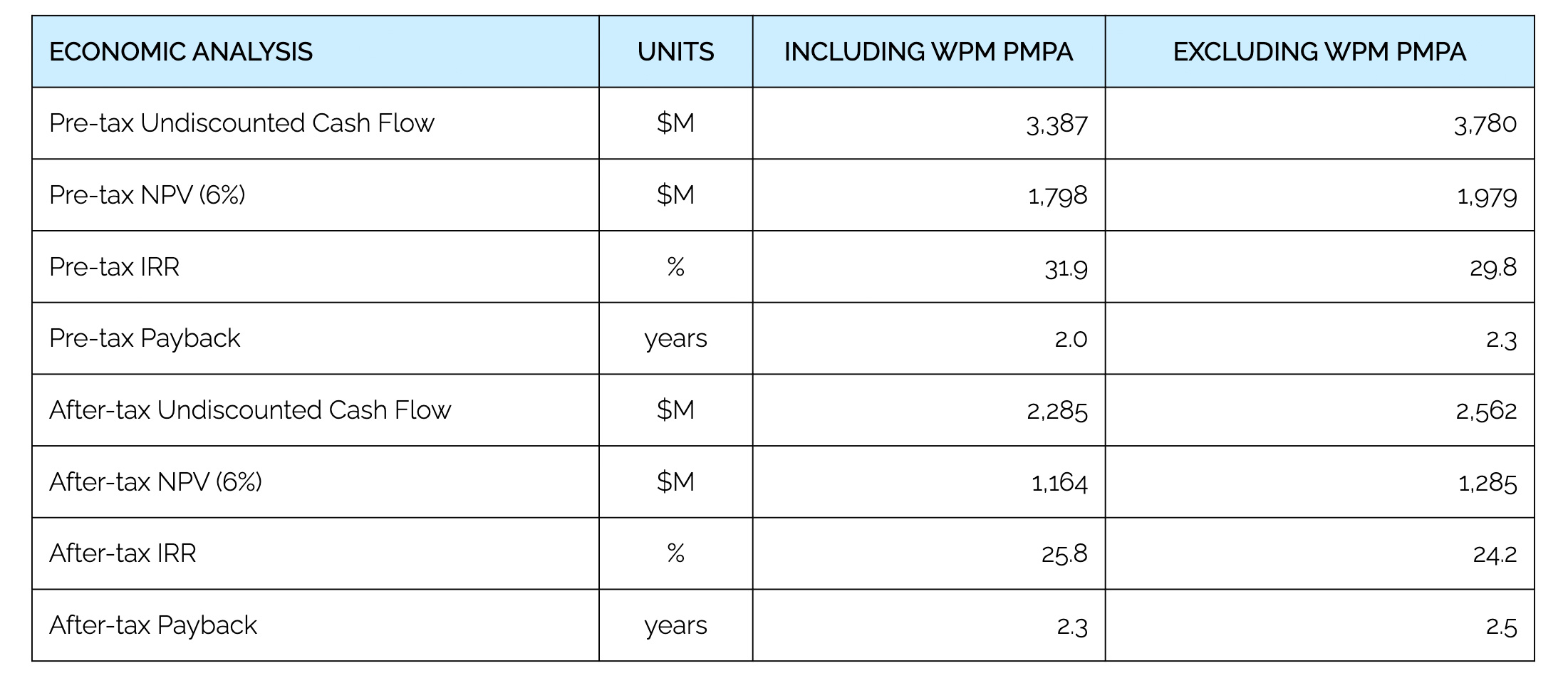

An important element to consider is that the updated feasibility study includes the impact of the streaming agreement with Wheaton Precious Metals. So it really is a ‘what you see is what you get’ type of study. Generation also highlighted the impact of the precious metals stream agreement and as the table below shows, the stream has a negative impact on the pre-tax NPV6% of just C$181M. On an undiscounted and pre-tax basis, the impact is less than C$400M.

This once again emphasizes the streaming agreement with Wheaton Precious Metals is a very strong deal: the company gives up less than C$400M in pre-tax and undiscounted cash flow over a 16-18 year period in return for C$240M upfront. A very solid deal and for sure the lowest cost of equity capital available to the company. Discounted by 6%, Wheaton Precious Metals is actually paying 1.3 times the pre-tax NPV6% of the stream. A very, very solid deal which we think CEO Levy and his team haven’t gotten enough credit for.

Now Generation Mining can focus on securing construction financing

Now the main boxes of the permitting process have been ticked and with the results of the updated feasibility study confirming the viability of the Marathon Palladium-Copper project, Generation Mining can now start to focus on funding the construction and development of the project. The current net cash and working capital position (C$18.8M and C$12.6M respectively as of the end of December 2022) indicate the company is in a good position to work on these negotiations as it should be sufficiently funded throughout the negotiation process.

It goes without saying everyone was expecting a higher capex and opex given the impact of inflation on the mining sector (and the world economy as a whole). As Generation Mining’s feasibility study was completed in Q1 2021, an update was necessary to ensure it would be able to assemble the proper financing mix for the actual construction of the project.

The initial capex is now estimated at C$1.11B, which is a 25% increase versus the 2021 Feasibility Study. A substantial increase is never nice to see but a 25% bump is very much in line with what the sector is experiencing right now and perhaps even on the lower end of that range – and that’s a testament to how robust the initial feasibility study was. Adjusted for equipment financing and pre-commercial production revenue, the net capex is estimated at C$898M. We will have to take this with a grain of salt as about C$156M of this delta is related to the pre-commercial production revenue and this may come in lower than anticipated while this revenue will only come in towards the very end of the construction and commissioning process. So we should use the C$1.11B capex as starting point.

Fortunately, the company has made good progress in strategizing on how to tackle the financing package which will obviously consist of a mix of debt and equity. If we assume a 35% equity and 65% debt breakdown, Generation Mining will need about C$400M in equity.

A very large portion of that amount has already been secured with the Wheaton Precious Metals (WPM, WPM.TO) platinum and gold stream. Generation will receive C$200M in cash from Wheaton and this will cover about half of the equity needs (note: we are assuming a 35/65 equity/debt ratio but the final ratio may be different. As such, please use our example as a theoretical example subject to the final equity/debt ratio).

On the debt side, a 65% debt ratio will require about C$700M in debt funding. About C$60M (C$58M according to the feasibility study) will be sourced through equipment leases. That is the net amount as the total drawdown will be close to C$100M while lease payments will already start during the construction period.

In the March presentation (issued before the results of the updated feasibility study were published), Generation Mining mentioned it was working on a C$540M debt package with a banking syndicate of which about half would come from the Export Development Corporation. This, in combination with the C$60M net equipment lease would already take care of about 85% of the required debt financing and it’s not unthinkable the debt financing provided by the commercial banks could be increased based on a recent development.

A few days before the results of the updated feasibility study were announced, Generation Mining confirmed it has finalized an offtake term sheet with Glencore (GLEN.L) for about 50% of the copper concentrate. The concentrate will be shipped to Glencore’s Horne 5 smelter for further processing.

But that very same press release contained an even more important element which could prove to be a very important piece of the financing puzzle. Generation announced it has ‘finalized an offtake term sheet with a European integrated copper group’. Other than Glencore there aren’t a whole lot of ‘European integrated copper group’s and our money would be on Aurubis, the German copper smelter group.

This would make sense because at that point the German loan guarantee scheme comes into play (and Generation Mining specifically – yet still vaguely – mentioned ‘certain loan guarantees’). This is a very specific mechanism whereby the German government provides a state guarantee on the portion of the debt financing related to the project, pro-rated for the percentage that goes to a German offtaker. So if a German offtaker takes 30% of the total concentrate output of a mining project, the German state guarantee could cover 30% of the debt.

That’s important for two separate reasons. First of all, it will make it an easier decision for the lenders to commit to a higher borrowing base. It’s better to lend C$600M of which 30% (arbitrary number) is covered by the German state than lending C$540M without this partial guarantee. And secondly, due to the lower-risk nature of a portion of the debt, the average cost of debt may very well come in slightly lower.

And to emphasize again, it may not be Aurubis after all, as Generation Mining has not disclosed the name of the European counterparty. But there are only a few European integrated copper groups and Aurubis is by far the best-known entity out there. We expect the company to announce more details once the term sheet has been converted into a definitive agreement.

So based on the C$1.11B anticipated capex, the known C$200M equity contribution from Wheaton Precious metals and anticipating C$660M in commercial bank debt and lease liabilities, there still is a funding gap of about C$200M in equity and C$40M in debt. At that point, the Canadian government initiatives related to the Critical Mineral sector come into play (including the recently announced 30% investment tax credit on machinery and equipment). That’s not secret information as the company’s corporate presentation has been mentioning this. The exact nature of how this could potentially help in the financing mix is currently unknown. In an ideal world, there would be a cash grant that could be used as equity, but we are leaning towards equity-like debt as main source of funding. In corporate finance, a deeply subordinated debt offering still has all the characteristics of debt but counts for equity on the balance sheet due to its subordinated nature. This would be an innovative approach but it would ensure the commercial bank debt still enjoys seniority over any deeply subordinated debt while Generation Mining can try to keep dilution to a minimum.

Because we aren’t naïve. Although Generation Mining will very likely be able to keep the fallout of the higher capex pretty limited, it is unlikely the company will be able to secure a financing package without having to issue additional shares. Hopefully, Generation can convince the market about its funding package and increase the confidence of the market in its ability to pull it off, as we would obviously like the company to avoid issuing shares at or around the current share price.

We would even prefer to see a higher percentage of the platinum committed to a streaming deal or perhaps even do something with the silver as about 378,000 payable ounces of platinum and 3.15 million payable ounces of silver are not subject to any streaming agreement just yet. While a silver streaming deal would likely result in just C$30-40M in cash proceeds, increasing the platinum stream to 50% of the anticipated production would likely result in an additional cheque of C$70-90M.

Conclusion

The higher initial capital expenditures should not come as a surprise as inflation-impacted capexes have been a major concern in the mining sector so this is hardly new information. The main task for mining companies is to figure out if a higher capex kills a project. That’s not the case for Generation Mining as despite the capex increase to just over C$1.1B, the project still works. Even in a more conservative scenario using $1600 palladium and $3.50 copper, the after-tax NPV6% would still be approximately C$900M.

There are two elements that will help Generation to boost its share price and unfortunately both are related. First of all, the palladium price is currently pretty low and the base case scenario in the feasibility study uses a palladium price that’s approximately 29% higher than the current spot price of $1400/oz. While we usually ignore companies trying to play that trick, we do believe in a higher palladium price by the time production starts. And the sensitivity analysis shows that even at $1400 palladium, the NPV6% is still about C$700M on an after-tax basis (and would likely be closer to C$800M if you use the current spot price of copper). Secondly, securing a definitive financing package will also help the company as it would mean the lenders and financing partners are signing off on the study and the economic viability of the project, even now the palladium price is trading below the base case scenario.

CEO Jamie Levy and his team have done an excellent job of getting the project from a resource to a full feasibility study and through the most important part of the permitting process in what feels like a record time. The project is close to the finish line, but there still are a few hurdles to jump over and we expect Generation Mining to get all its ducks in a row over the next few months and quarters and start breaking ground before the winter hits.

Disclosure: The author has a long position in Generation Mining Ltd. Generation Mining Ltd. is a sponsor of the website. Please read the disclaimer.