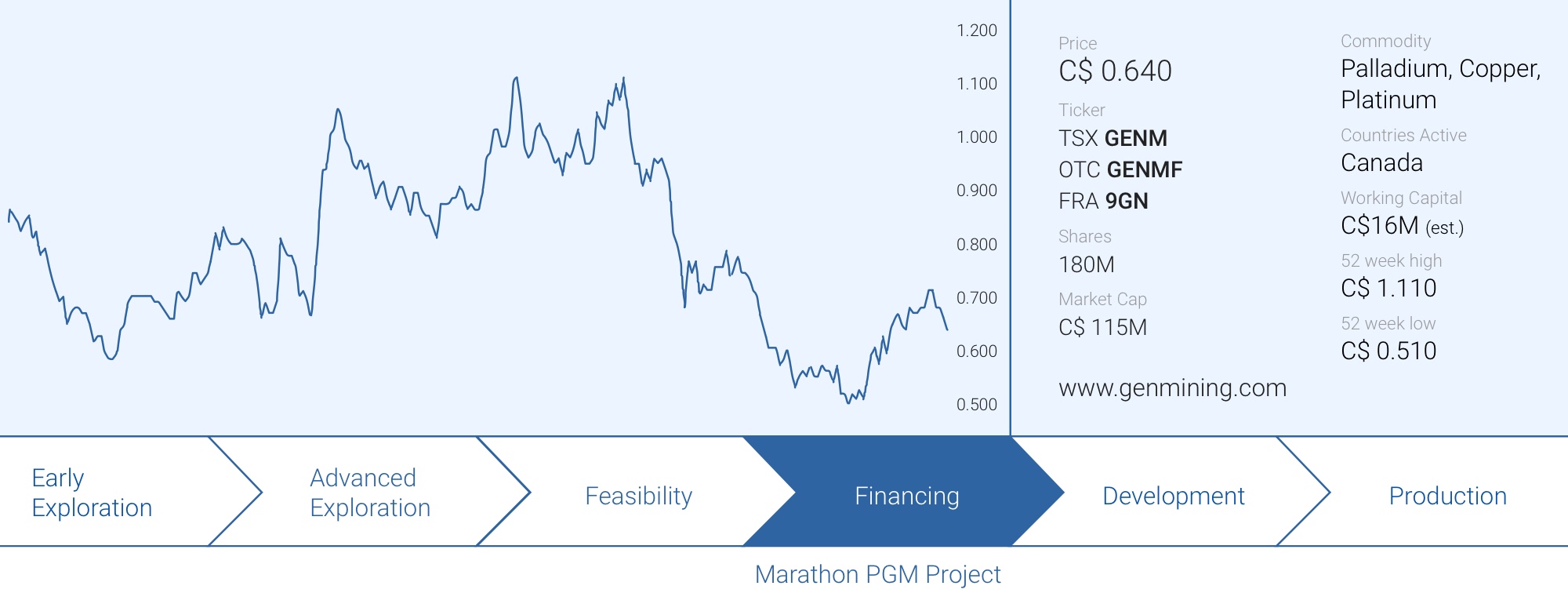

Generation Mining (GENM.TO) when it acquired the Marathon PGM project in 2019. The company needed less than two years to complete a feasibility study and is now in the final straight line of the permitting process. The Joint Review Panel has completed its report and the entire permitting file has now been put on the desk of the relevant authorities to give the nod of approval.

We sat down with CEO Jamie Levy to discuss the most recent developments at Generation Mining which clearly isn’t sitting on its hands. While the Marathon project is being guided through the permitting stage, Generation Mining has already entered into agreements to acquire a camp and second-hand mills. This will reduce the development timeline risks and keep inflationary impacts under control.

Sitting down with Jamie Levy, CEO

We have read the summary of the panel’s report and it appeared to be pretty benign for Generation Mining. While the JRP does not unanimously scream ‘YES THIS MUST GO AHEAD’ as the panel members remained diplomatic in their review, the main concern appeared to be related to the First Nations at and around the Marathon project. Is this a fair interpretation, or is there another element that you think is important here?

We were very happy to finally get the report and that there was very little in it that surprised us, meaning we are still on track to begin construction next year. The concerns presented by the Indigenous groups who participated in the review process are certainly the main ones, those and certain comments related to species at risk. We had already committed to mitigating most of the concerns that were raised during the hearings.

Let’s talk about the First Nations. The JRP mentions the Biigtigong Nishnaabeg would be hit the hardest by the project by removing the use of a trapline and their concerns about discharging water in the Biigtig Zibi river. Are these concerns easily addressable?

For background, it is important to understand that the Project is located within the Exclusive Title Area of Biigtigong Nishnaabeg (BN) and the traditional territory of several other Indigenous groups who have practised their rights and way of life since time immemorial.

We have developed a strong and valued partnership with BN over the years and have undertaken extensive consultation on all aspects of the project to understand how it may affect their community. As part of the negotiation of the Community Benefits Agreement with BN we are discussing the best way to accommodate the community for the loss of access to their trapline during operations. We have also committed to ensuring that BN agrees with the technical approach for post-closure water management, which includes the Biigtig Zibi, that will be included in the Mine Closure Plan. We believe that BN’s concerns can be addressed through these documents and so we don’t expect a delay in construction of the project.

In April of last year, Generation Mining signed an Agreement in Principle with the BN, and in that statement, you mentioned they have been ‘an integral part of the environmental assessment process’. Were the First Nations related elements mentioned by the JRP already discussed back then, or did the trapline & river remarks pop up more recently? Will the Agreement in Principle be upgraded to a binding agreement to settle all remarks and elements brought up in the environmental assessment procedure?

Through our extensive consultation prior to the JRP we were aware of the overall importance of the trapline and the Biigtig Zibi to BN. In fact, we incorporated this information into the design to minimize the effect of our activities during each phase of the project. As previously discussed, we anticipate that the Community Benefits Agreement will include measures to accommodate BN for loss of access to their trapline during the operations. The final agreement is still under negotiation, but both sides have committed to completing it in the near-term. With respect to the Biigtig Zibi, post-closure water management was a new issue that was raised during the JRP as part of the discussion regarding mine closure and end land use. We are actively discussing this concern with BN and expect that it can be addressed as part of the development of the Mine Closure Plan. We plan to work collaboratively with BN to address this concern and have committed to ensuring they agree with the Mine Closure Plan prior to submitting it for regulatory approval. Submission of the plan will occur sometime after the approval of the Environmental Assessment.

The JRP mentions that ‘if there would be caribou, the project would cause a significant adverse effect’. How should we interpret this, considering there have been no caribou on your site? How do you mitigate the impact of something that isn’t even an issue at this point?

The Panel concluded that the project could cause a significant adverse effect on the habitat used by caribou. So the concern is related to the habitat that could be used by caribou if they were to return to the area in the future. There are various options available to mitigate the impact of the project on caribou habitat. We plan to work with the Ontario Ministry of the Environment, Conservation and Parks (MECP), Environment and Climate Change Canada and various Indigenous groups to determine the best mitigation options. Once the options have been determined, we will apply for an Overall Benefit Permit from MECP which will allow us to move forward with project. The application for the permit will occur sometime after the approval of the Environmental Assessment.

Not wasting any time

You have been pretty active this summer. In July, Generation announced it was planning to lease and subsequently purchase a camp near the planned mine site while just a few weeks ago you purchased a SAG and a ball mill from Hycroft Mining. What’s the main purpose of locking in these important pieces of equipment this early?

Locking up the camp and mills was a real win for us. The camp is already in place and permitted and will allow us to bring manpower to Marathon as soon as the permits are issued. And the cost was well below that of us buying the trailers, installing them along with plumbing and electrical, etc. While the mills were slightly less expensive, even following the cosmetic upgrades and updating the drives for each mill, to that proposed in the original Feasibility Study, they are certainly less expensive than buying new today so we took inflation out of the equation on those items. Just as important, we have heard that mining companies are experiencing wait times of up to 90 weeks for these kinds of mills, so procuring them now was a huge relief.

What is the downside to buying mills that are a bit outsized?

None, really. Having slightly larger mills would allow us to make up for any downtime once the mine starts up, while staying inside the permitted tonnes per day. Also, they have allowed us to drop the pebble crusher which was part of the original flow sheet, which will save money as well.

As a lot has happened in the world in the past few quarters and inflation is causing havoc in the mining industry, do you plan to update the feasibility study before commencing construction?

We are currently in the process of updating the numbers from the Feasibility Study, which has taken longer than we hoped largely due to inflation concerns of the contractors and suppliers themselves. The industry seems to be getting a handle on this, and in fact some of the things like diesel fuel are actually coming down. We expect to update the estimates once we have greater confidence that the numbers are no longer evolving.

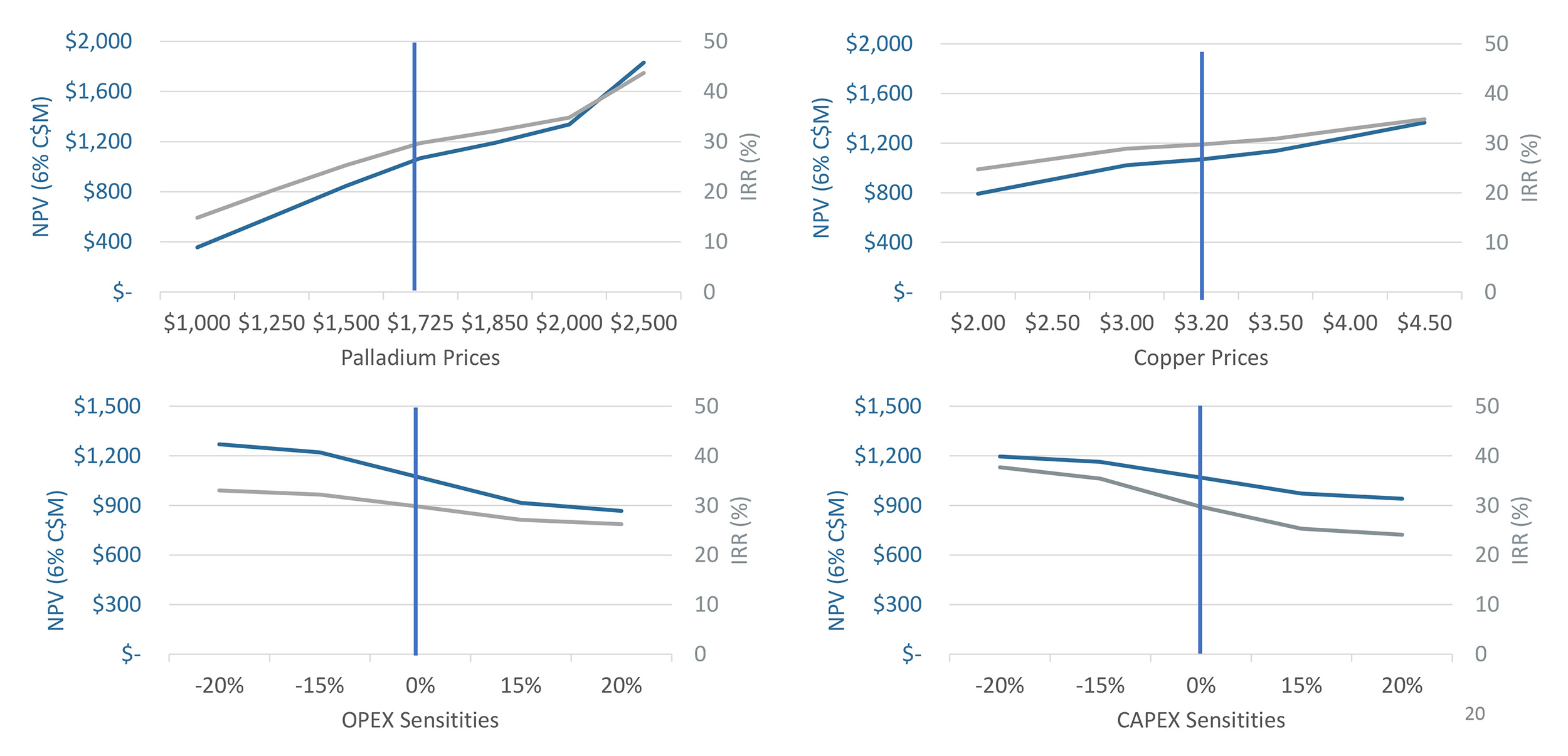

While we should expect a higher capex and opex, could this potentially be mitigated by the strong palladium price which is still trading over $2,000/oz and about 20% higher than the price you used in your base case scenario? The same could be said for copper; GENM used $3.20 copper in its base case but the current copper price of approximately $3.60 adds about 40 cents per pound. Considering the feasibility study estimates the total payable copper production to be 467 million pounds, this 40 cent difference would already add about $180M to the undiscounted and pre-tax cash flow.

It is no surprise to us that metal prices have experienced their own inflation, and in fact more so than the Consumer Price Index. For example copper is up 12% from our feasibility study numbers last year (and were recently up nearly 50%), while palladium is up 26% and was up nearly 80% not very long ago. Meanwhile, costs for many items have been coming down, albeit slightly. That said, we do expect inflation to have an impact, part of which will be covered by our contingency numbers.

May we assume you still consider palladium and copper to be your most important metals and that you don’t want to encumber them with an additional stream or hedge? Would there be any appetite from Wheaton or other streamers to increase the platinum stream? Given the increasing interest rates, a stream likely is the lowest cost of equity capital at this time.

We aren’t contemplating any additional streams at this time but would consider some if the terms were attractive enough and we weren’t able to obtain sufficient financing elsewhere.

Corporate

At the end of June, you had a positive working capital position of in excess of C$16M. May we assume this is sufficient to get you to the construction decision? When is the next payment from Wheaton Precious Metals due?

Wheaton’s next payment of $20 million is due at the end of August, and we do expect that will be enough money to get to the construction decision. We would fall short on ordering equipment however, since due to the recent supply chain issues the down payments required by many suppliers have increased. We are looking at ways to mitigate this, such as we have already done with the ball mill and SAG mill.

You still own about 5.4 million shares of Major Precious Metals (SIZE.V). Are you looking to liquidate this position? While we understand the lack of liquidity is a major pain, wouldn’t every dollar you can get be worth pursuing? As of the end of June, SIZE had a working capital deficit of in excess of C$9M so the company seems to be a ticking time bomb before an implosion happens.

We sold a portion of our Major Precious holdings at much higher prices than it is trading at now to cover our original option costs. We are watching them closely and feel they have a very good palladium project in a relatively difficult location. We expect their shares to respond to what we see is a coming increase in palladium prices, which we expect to occur as auto manufacturers ramp up to full production this year and next.

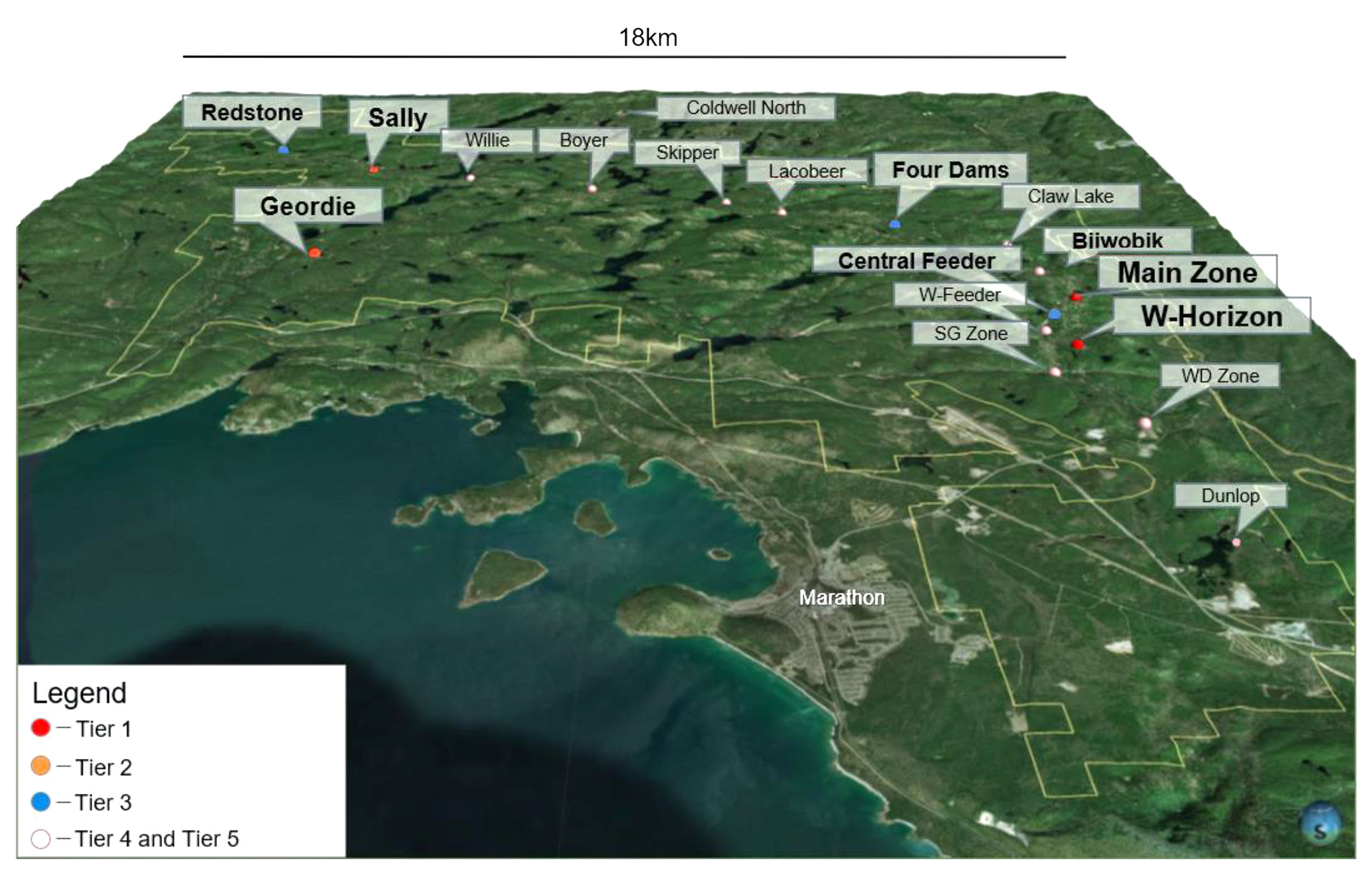

Do you have any plans to do any more exploration or will the entire focus now shift to construction management?

Not at this time. We have a lot of really great exploration targets across 20 kilometres of strike length, but for now the focus will be on getting the mine built.

Conclusion

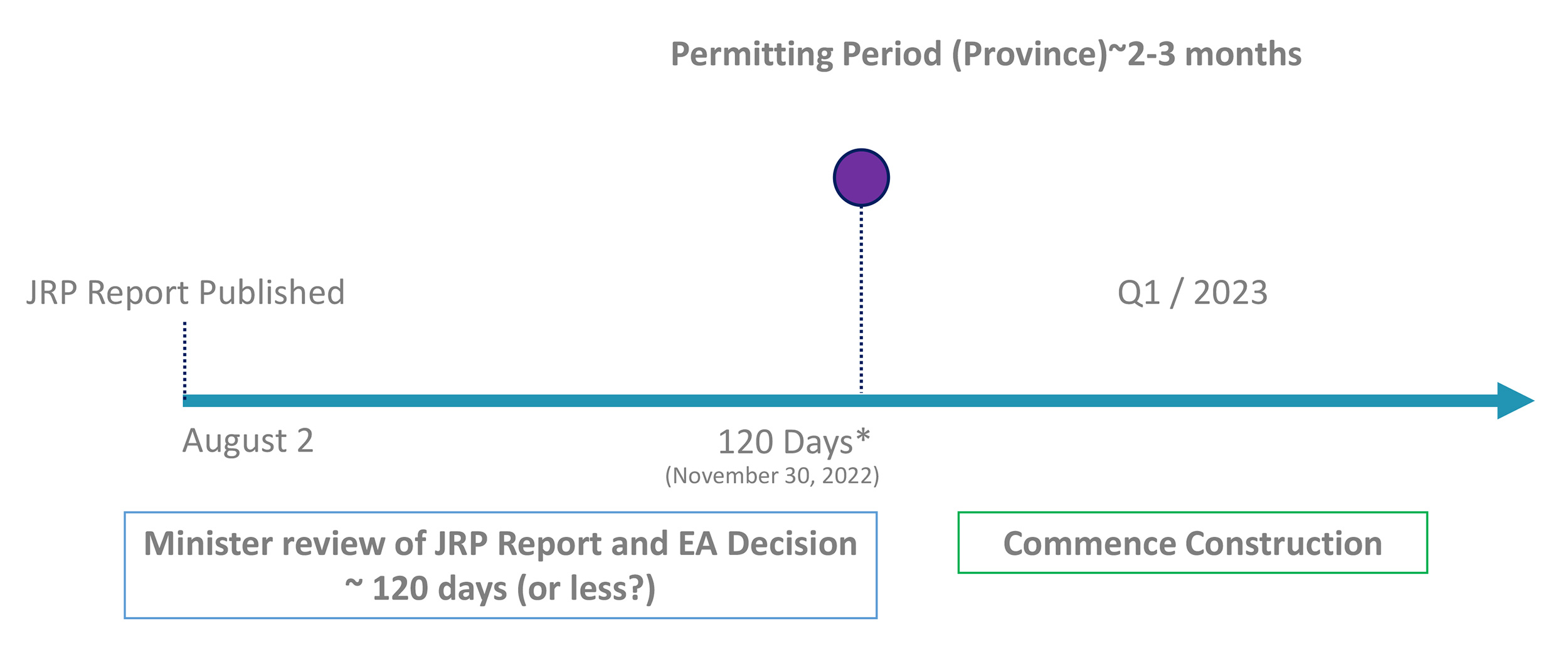

The fate of the Marathon project is now in the hands of the relevant authorities and the theoretical deadline to announce a decision is November 30th. That’s indeed just theoretical as there is no sanction if the ministerial decisions take longer than the standard 120 days but we will very likely see news in November or December.

Upon a positive permit decision, Generation Mining can kick off the next phase of the development of the Marathon project by securing project financing and actually kicking off the construction activities. Securing a construction camp and mills is a strong signal, confirms the company is proactive and shows it is willing to hit the ground running and actually build the mine.

Disclosure: The author has a long position in Generation Mining Ltd. Generation Mining Ltd. is a sponsor of the website. Please read the disclaimer.