It has been a while since we last discussed Generation Mining (GENM.TO) as the low palladium price reduced the appetite on the financial markets to provide funding for the actual construction of the flagship Marathon copper-palladium project.

And while the copper price gradually gained strength over the past few years, the palladium price had to deal with some severe headwinds which pushed the price per troy ounce to under $1000/oz for a while. While we like the exposure to different metals and commodities, it is clear the project needs a decent palladium price in order to go ahead and secure the funding.

In the past few weeks and months, the palladium price started to catch up, and the current price of almost $1600/oz (the price has been very volatile, recently) represents a 75% increase compared to where we started the year. And this means the momentum could be right for Generation Mining to finally lock in the construction funding.

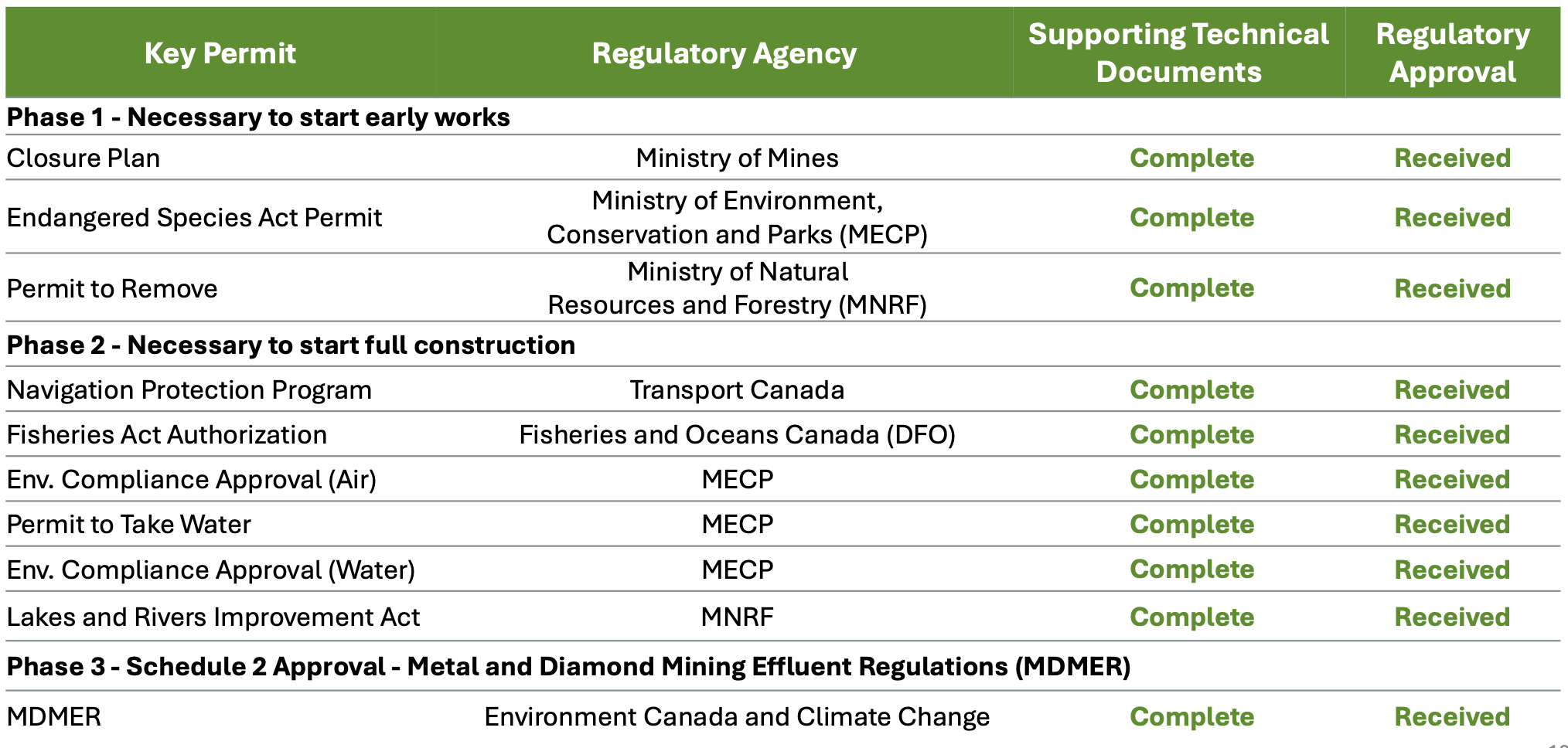

Earlier this year, Generation released an updated feasibility study on the Marathon project, and all important permits have been received by now. This means the Marathon copper-palladium project is the most advanced (and probably only) shovel-ready project in Ontario.

A brief recap of the marathon copper- PGM project

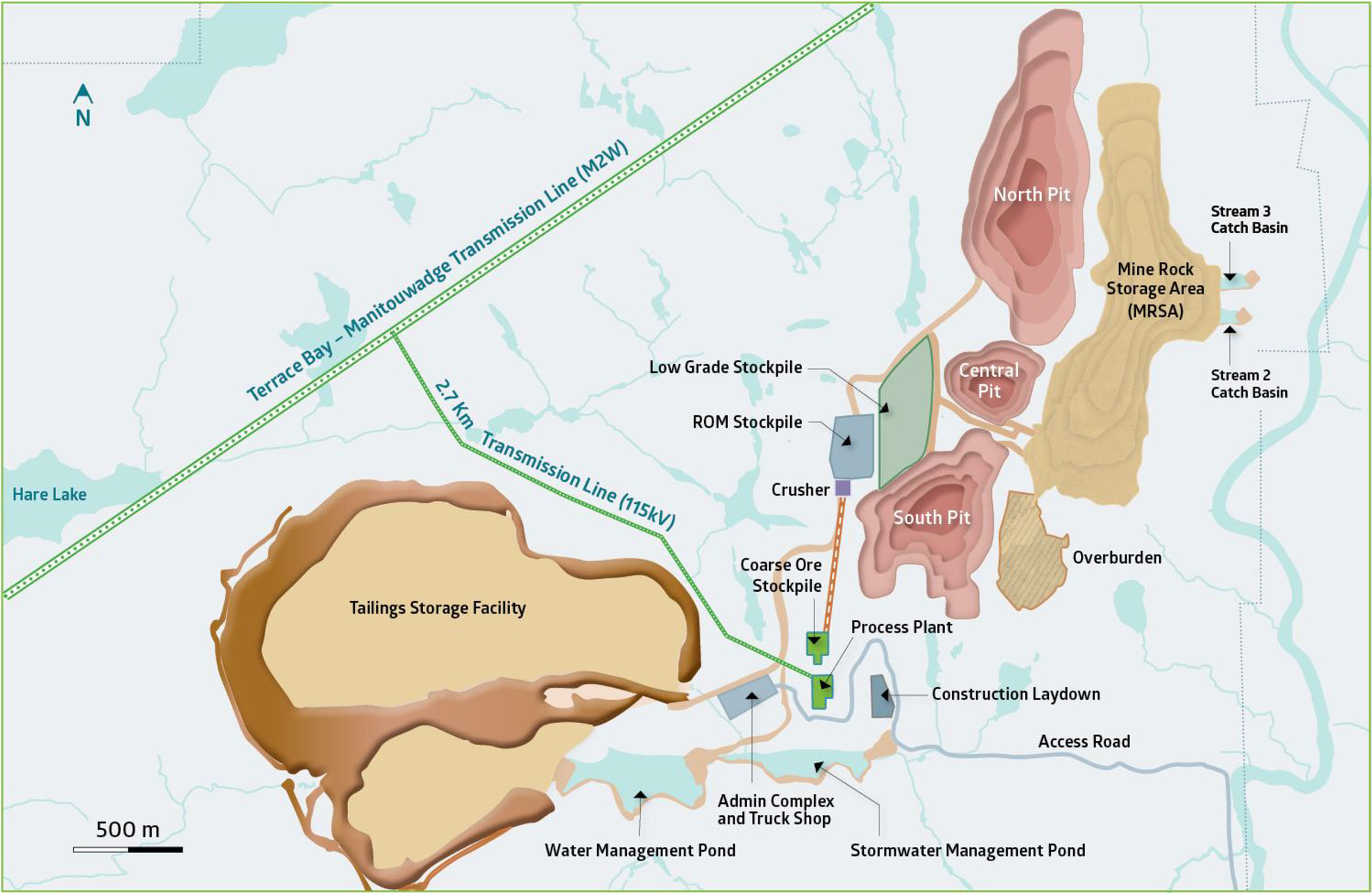

The Marathon project is located approximately 10 kilometers north of the town of Marathon, on the shore of Lake Superior in Ontario. Marathon is a small town with a population of just over 3,000. While that is too small to deal with all the requirements a mine would have, it does mean the presence of existing infrastructure has made it relatively easy for Generation Mining to bring the project close to a construction decision. The project is in close proximity to the Canadian Pacific railway (just a few kilometers south of the property) and the Trans-Canada highway, while there is a small municipal airport at Marathon.

The project also enjoys access to the Ontario carbon free power grid with one power line crossing the southern portion of the property and another high-voltage power line transecting the property northwest of the Marathon deposit. And with the larger city of Thunder Bay just 300 kilometers away, all mining-related needs can easily be sourced from there.

This isn’t a new project as the Marathon area has a history of mining for copper and nickel since the 1920s. The Marathon deposit that’s currently owned by Generation Mining was initially discovered in the 1960s by Anaconda Copper, which completed in excess of 150 drill holes. The project has changed hands a few times then, and every subsequent owner (which included Teck and BHP) was able to push the project a little bit further forward, until Sibanye-Stillwater ended up with the project when Sibanye Gold acquired Stillwater.

That corporate deal meant the project was ‘surplus’ and just gathering dust on the shelves and that’s when Generation Mining swooped in and negotiated an agreement with Sibanye-Stillwater to obtain full ownership of the project (Generation Mining secured full ownership of the project in Q1 2022).

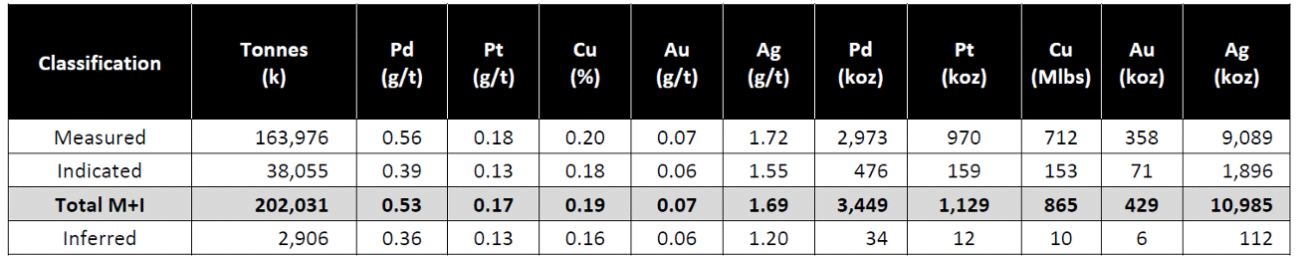

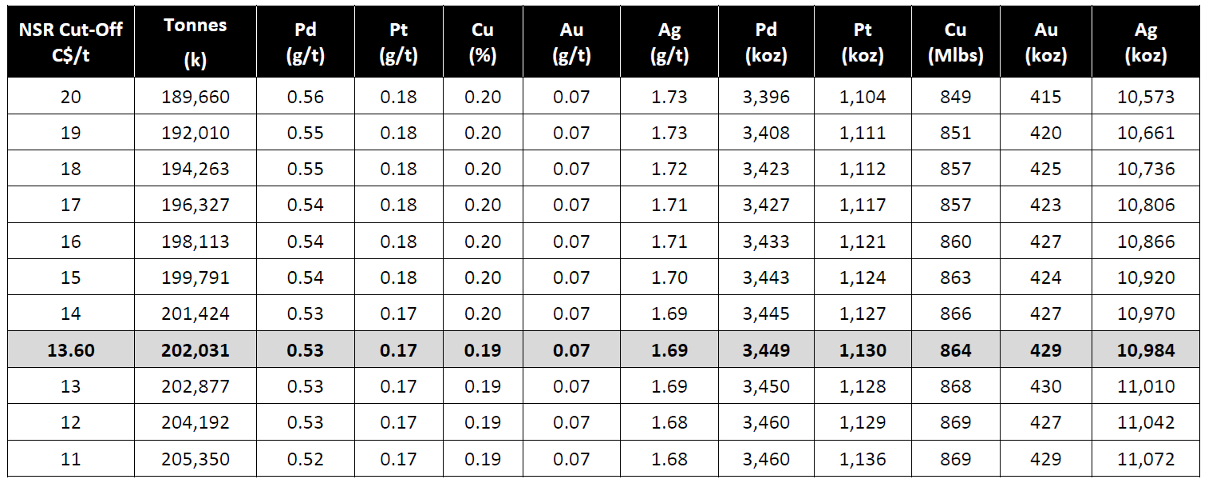

Generation Mining really pushed the project forward, and this resulted in a 2022 resource calculation (which is still current) confirming the presence of in excess of 200 million tonnes of rock in a pit-constrained model with an average grade of 0.53 g/t palladium, 0.17 g/t platinum and 0.19% copper in the measured and indicated resource categories.

This means the project hosts almost 3.5 million ounces of palladium, 1.1 million ounces of platinum and just under 900 million pounds of copper as well as a respectable amount of gold and some silver.

The grade of the mineralization is very consistent. As you can see below, increasing the cutoff grade by almost 50% results in losing just 6% of the tonnes while the average palladium grade increases by just 0.03 g/t. All things considered, the deposit looks pretty homogenous, and that was helpful to start modelling the economics.

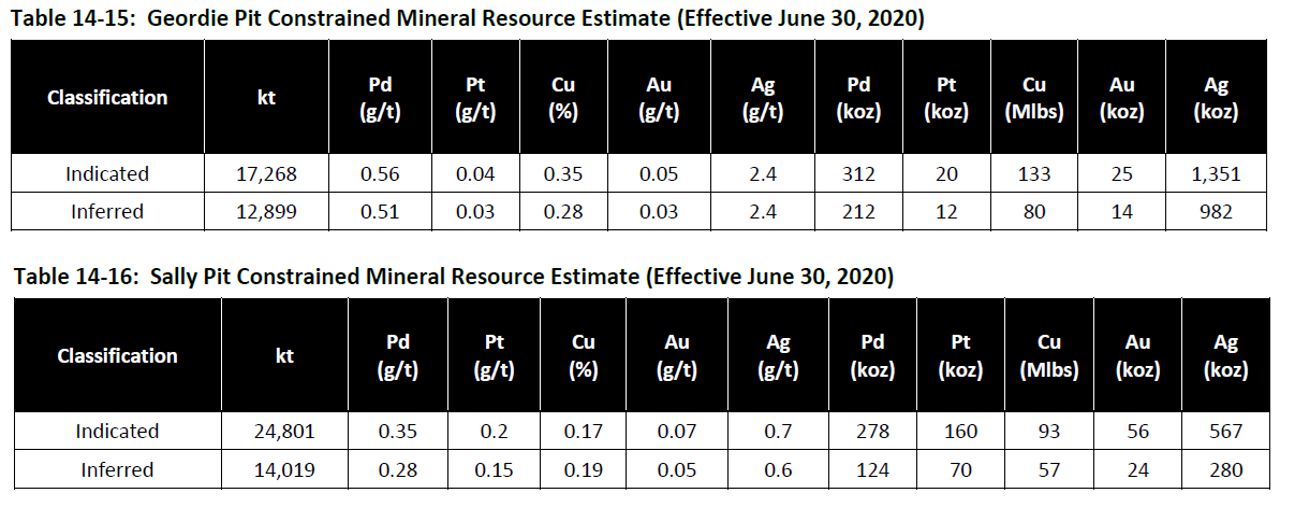

Also keep in mind the resource calculation above focuses on the main pit, and Generation Mining has outlined additional mineralization at the Geordie and Sally prospects. On a combined basis, there is an additional 42 million tonnes of rock in the indicated resource category and about 27 million tonnes of inferred resources.

Of those resources, approximately 128 million tonnes ended up in a reserve calculation. The image below shows an average grade of 0.64 g/t for palladium and 0.21% for copper, resulting in 2.63 million ounces of Palladium and 605 million pounds of copper that formed the basis for the feasibility study.

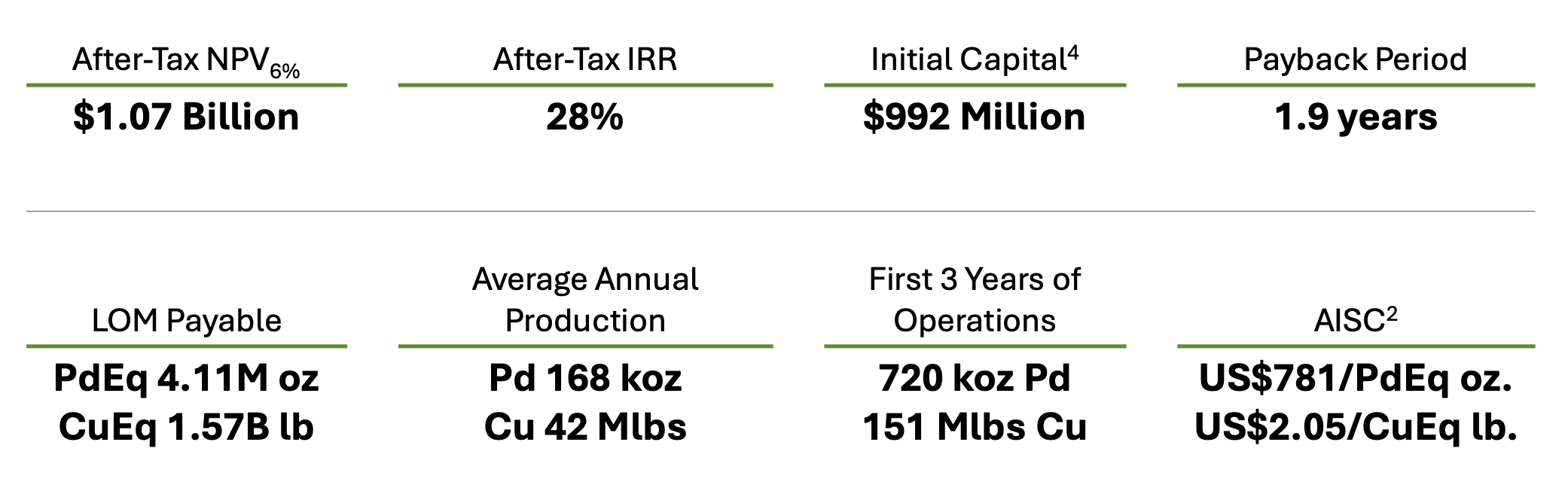

Generation Mining published the results of its first Preliminary Economic Assessment in 2019, and continued to advance the project towards a feasibility study. The most up-to-date study is the update that was released earlier this year. That’s helpful to determine the financing need and the economics of the project while reducing the odds of seeing negative surprise (related to inflation and cost estimates).

The most recent feasibility study update estimates the total initial capex to be just under C$1B and after deducting the almost C$185M in pre-production revenue, the net initial capex comes in at C$809M (assuming the anticipated pre-production revenue effectively comes in as expected and there are no unexpected surprises that have to be dealt with). The total sustaining capex is estimated at C$565M and this will of course be gradually incurred during the 13 year mine life.

The anticipated recovery rates during the actual operational phase are estimated at just under 94% for the copper and 88% for the palladium. The metallurgical test work also indicates a recovery rate of almost 76% for the platinum.

The palladium price is recovering, and this makes the project viable again

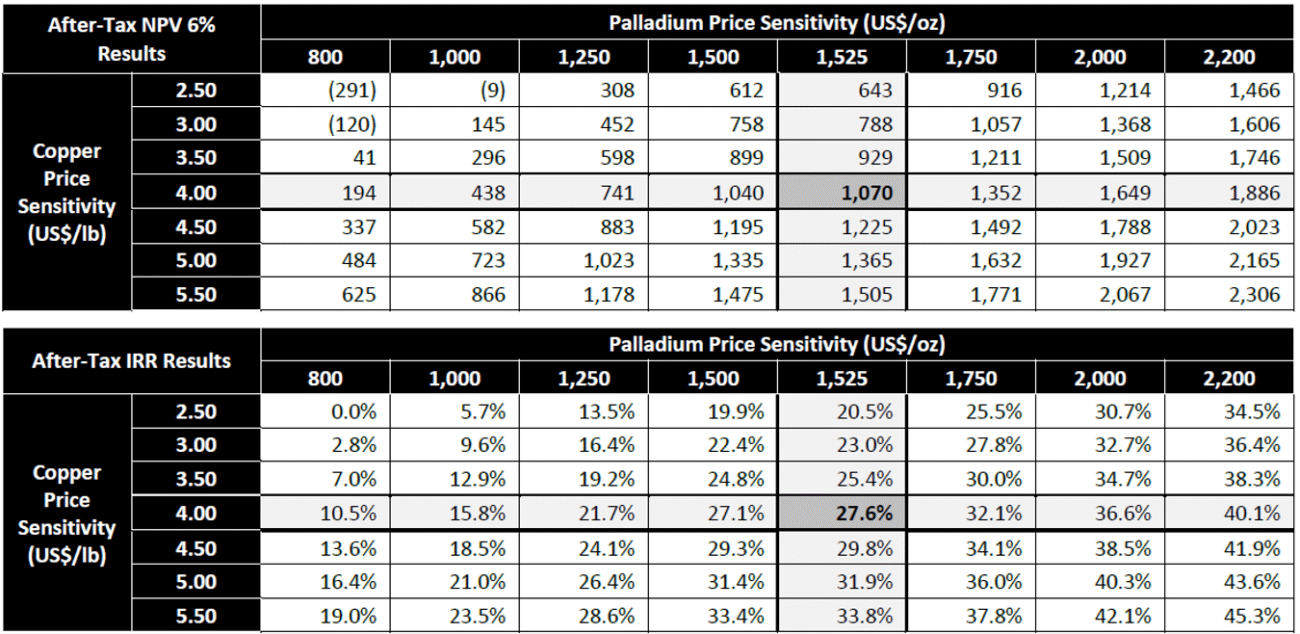

The image below shows the nicely detailed sensitivity analysis which indicates the impact of a changing palladium and copper price on the economics of the project.

As you can see, even at a palladium price of $1000/oz and a copper price of $3.0 per pound, the after-tax NPV6% remains positive at C$296M in NPV6%. However, the IRR drops to less than 13% in that scenario, and that made securing construction financing highly uncertain. But the world has changed now, and the palladium price recently moved back up to (and temporarily beyond) the $1525/oz that was used in the base case scenario. This definitely means things are looking up, not in the least because using a copper price of $4.50 per pound is adding in excess of C$100M to the after-tax NPV6% versus the copper price used in the base case scenario.

As the table above shows, even if you’d use a palladium price of $1250/oz (which is quite a bit lower than the current spot price) and a copper price of $4.50 per pound, the after-tax NPV6% comes in at C$883M but more importantly, the after-tax IRR jumps to in excess of 24% in that scenario. Using a palladium price of approximately $1350/oz would add another C$120M to the NPV while boosting the IRR by about 200 bps to around 26%. Note: all aforementioned numbers exclude the impact of the gold and platinum stream that was sold to Wheaton Precious Metals in 2021.

And that changes the whole picture pretty dramatically. Whereas it was unlikely the project would be built with a palladium price below $1000, suddenly the stars are aligning for Generation Mining and the likelihood of the project actually getting built is improving. As the sensitivity table indicates, the current prices correspond to the $1525 palladium and $4.50 copper scenario, in which case the after-tax NPV6% comes in at C$1.23B with an after-tax IRR of almost 28%.

Not only are the metal prices more cooperative, the local government of Ontario and the federal government of Canada are warming up to securing a domestic source of critical materials and we wouldn’t be surprised to see some government entities or agencies play a role to get this project across the financing finish line.

As you can see below, the relevant authorities have issued all the major permits that were required before kicking off the construction phase of the Marathon project, so there definitely is sufficient political willingness and support to convert the project into a mine.

We consider the PGM Market Report issued by Johnson Matthey to be one of the key reference documents while discussing the palladium market. The document is freely downloadable here.

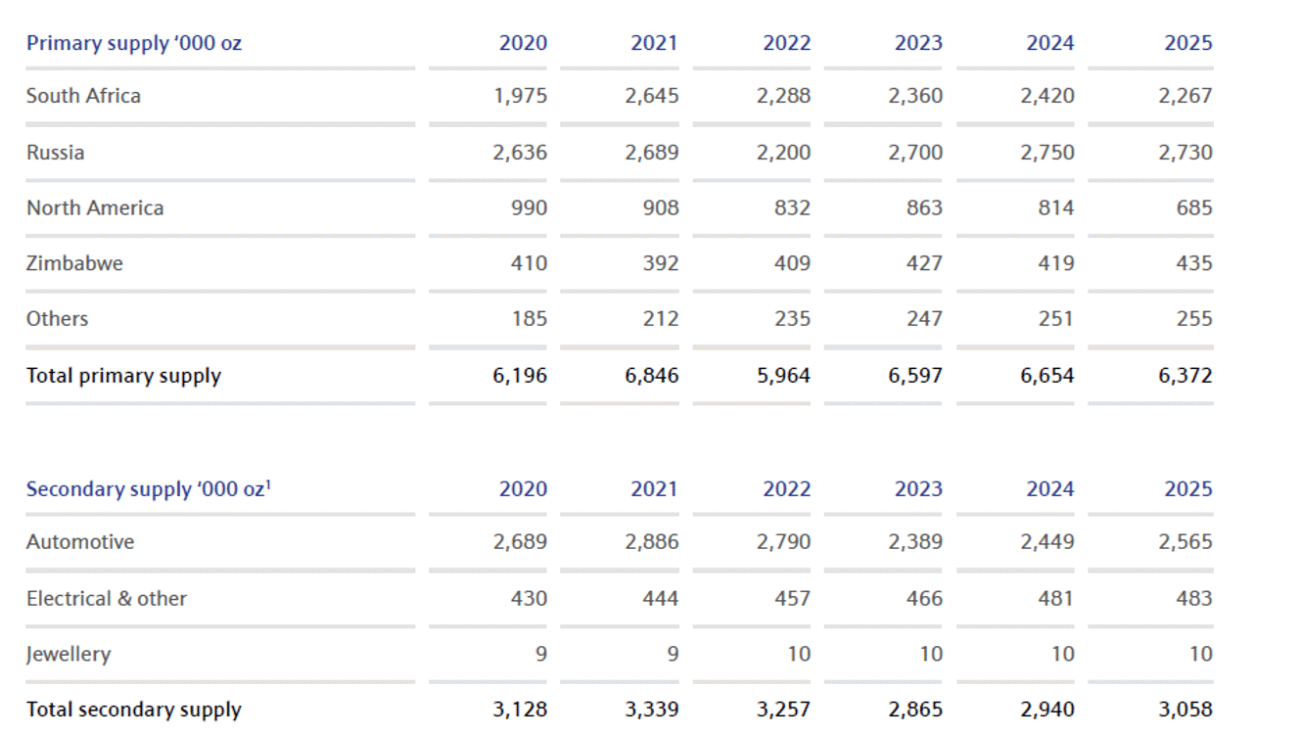

According to Johnson Matthey, the palladium market is close to being in balance with a possible small surplus, as the demand from the producers of auto catalysts is decreasing due to the headwinds in the sector.

The total primary supply is estimated at approximately 6.4 million ounces this year, while an additional 3.06 million ounces of palladium is expected to be recovered from the secondary supply, for a total supply of 9.43 million ounces.

It’s of course also worth highlighting that about 85% of the primary supply and in excess of 50% of the total supply (primary + secondary) comes from the South African and Russian mines. Any major hiccup in those production regions could have a noticeable impact on the price equilibrium. And it goes without saying the geopolitical tensions could also play a role in the supply chain ‘security’. North America produces just over 10% of the world supply, and Generation Mining’s Marathon project could move the needle as the project would produce approximately 20% of the entire North-American supply.

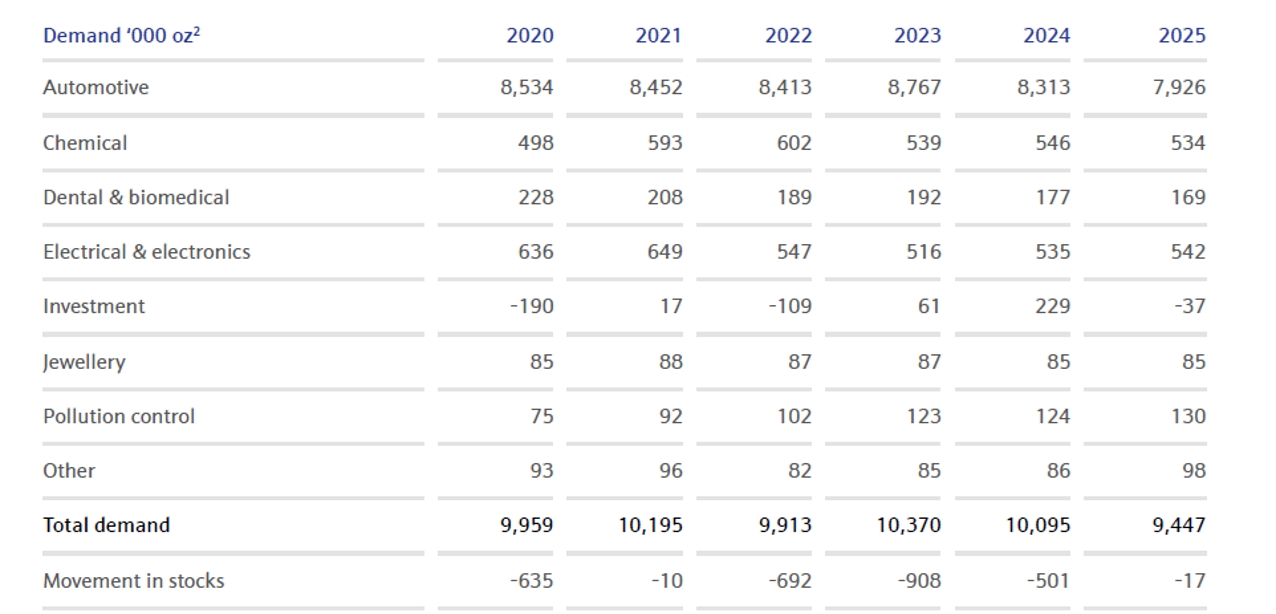

As shown in the table below, the total demand is expected to come in around 9.5 million ounces, mainly due to a decrease in the demand from the automotive sector while the demand from the industrial sector should remain pretty stable. It is also interesting to see an expected net contribution of 37 million ounces from investments in palladium, and that’s a delta of 266,000 ounces compared to 2024.

That’s an interesting assumption because the investment demand/supply could be a swing factor in determining whether or not there will be a deficit on the palladium markets.

Generation Mining is cashed up

Right before the summer, Generation Mining completed a C$11.5M raise as it issued just under 31.1M units at a price of C$0.37 per unit. Each unit consists of one common share as well as half a warrant with each full warrant allowing the warrant holder to acquire an additional share at C$0.48 for a three year period (expiring on August 24, 2028). Given Generation’s current share price, these warrants are now in the money and could bring in an additional C$7.5M in cash proceeds. While that won’t move the needle from a construction financing perspective, it would be a welcome addition to the working capital position during a busy time.

The financing was not subject to a statutory hold period and all shares that were issued as part of the financing were freely tradeable on the first day. This means there should be no real ‘overhang’ as anyone who wanted to ‘play’ the financing for a quick flop likely already exited the position.

While Generation Mining hasn’t published its Q3 2025 financials yet, we are expecting the company to still have a healthy cash position. At the end of June, Generation Mining had a positive working capital position of around C$10.5M with a burn rate of approximately C$1.7M per quarter.

Generation Mining also still owns 9 million shares of Moon River Moly, a position that was obtained through the sale of the Davidson molybdenum-tungsten project to Moon River. Some of these shares are still escrowed, and while Generation Mining can’t just dump the shares on the open market, this hopefully is a financial asset that could be (partially) monetized in the future.

Conclusion

While it has been a bit quiet around Generation Mining in the past few years, the company continued to diligently work towards unlocking value from its flagship Marathon copper-palladium project. The updated feasibility study confirms the viability of the project at the current spot prices, and this means Generation Mining now actually has a chance to lock in the construction funding to build the project.

We think the next 6 to 12 months will be absolutely crucial for the future of the company. It looks and feels like the stars are aligning right now thanks to a more robust palladium and copper market, and the increased sense of urgency in the western hemisphere to rethink the supply chain of critical metals and commodities. The USA has been very active to support new mining projects, and we have the impression things are moving in Canada as well. Hopefully this political support results in something ‘tangible’ further down the road and government assistance could be a welcome addition to the construction financing mix.

And now it’s up to CEO Jamie Levy, Executive Chairman, Kerry Knoll and theirteam to execute on the plans and kick off the construction of the asset within 5 years of establishing full ownership of the Marathon copper-palladium project.

Disclosure: The author has a long position in Generation Mining Ltd. Generation Mining Ltd. is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read our full disclosure.