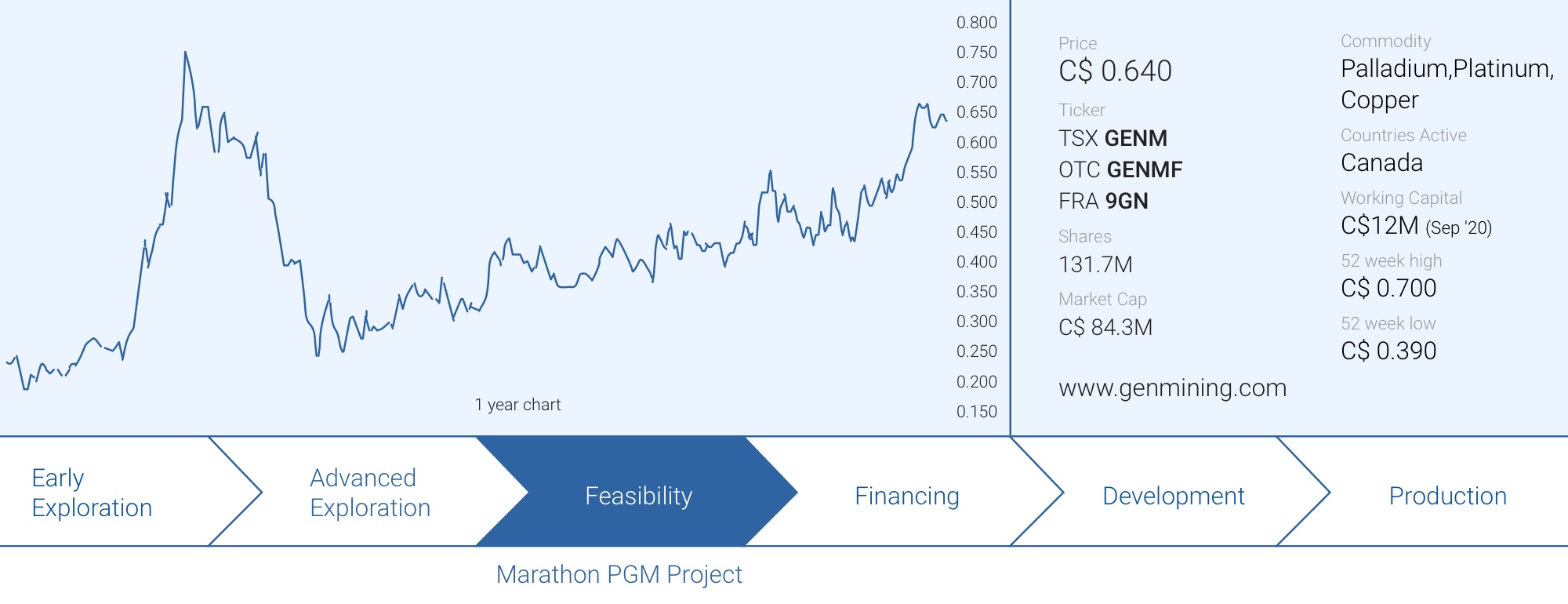

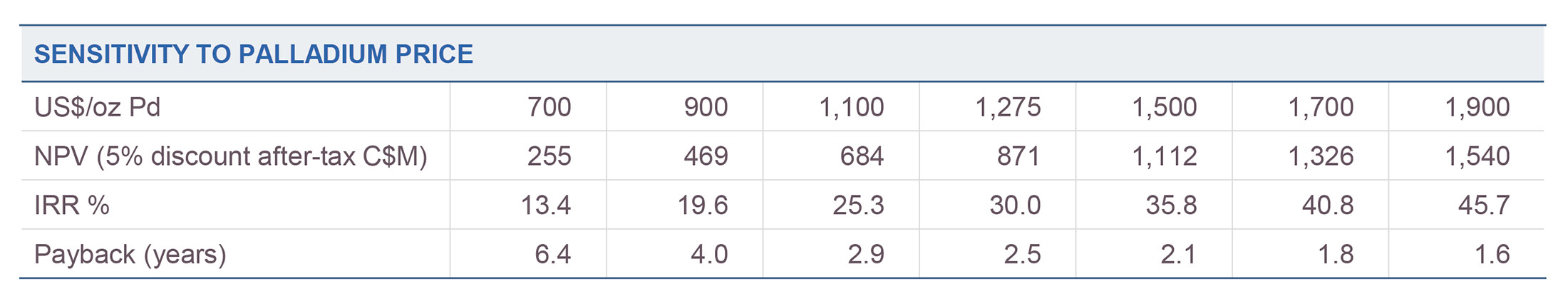

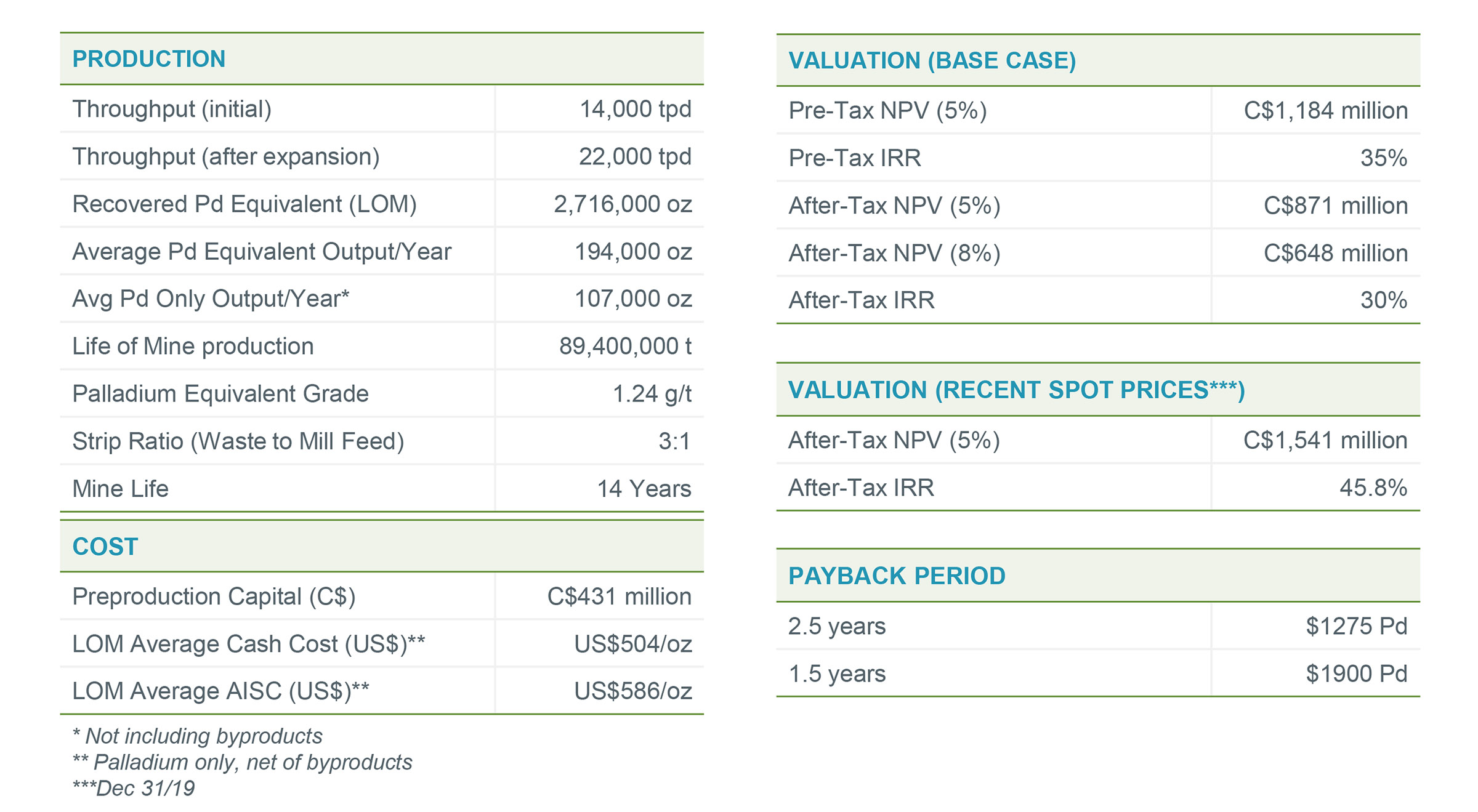

In some cases, a company doesn’t get rewarded for its hard work. While all stars were aligning in 2020 and palladium is trading at record-high prices, Generation Mining (GENM.TO) still doesn’t get too much love from the market. The company is trading at just 0.10X the NPV outlined in its PEA using $1275 palladium. Not only is a multiple of 0.10X NPV already quite low, if we would apply a slightly higher palladium price, the P/NAV drops to just 0.05-0.06.

Generation Mining has now completed an important step of the earn-in agreement and currently owns 80% of the project. With a feasibility study underway for Q1 2021, next year promises to be an action-packed year again.

Generation Mining made great progress in 2020, and it’s getting ready for the culmination

Generation kicked off a busy year with the publication of the PEA on the Marathon PGM project, in the very first trading week of January. As we had already expected, this PEA was excellent and Generation Mining was subsequently rewarded with a C$5M investment from Eric Sprott who was the cornerstone investor in a financing which ultimately raised C$10.7M. We fully supported the raise as it allowed Generation to fill up its treasury and complete the earn-in to 80% of the project and to complete the feasibility study without having to go back to the markets to raise more money. Also note – Generation Mining just announced a C$3.3M flow-through placement priced at C$0.77 with Eric Sprott, who continues to support Generation.

With the PEA in the bag and the money in the bank, Generation Mining hired Drew Anwyll as COO. This went unnoticed as the markets were completely collapsing due to the outbreak of the COVID pandemic in March, but Anwyll is a heavy hitter as he was the interim-COO and VP Operations at Detour Gold (DGC.TO). Generation Mining won’t just be able to tap his knowledge on building and operating mines, appointing Anwyll as COO provided a massive credibility boost.

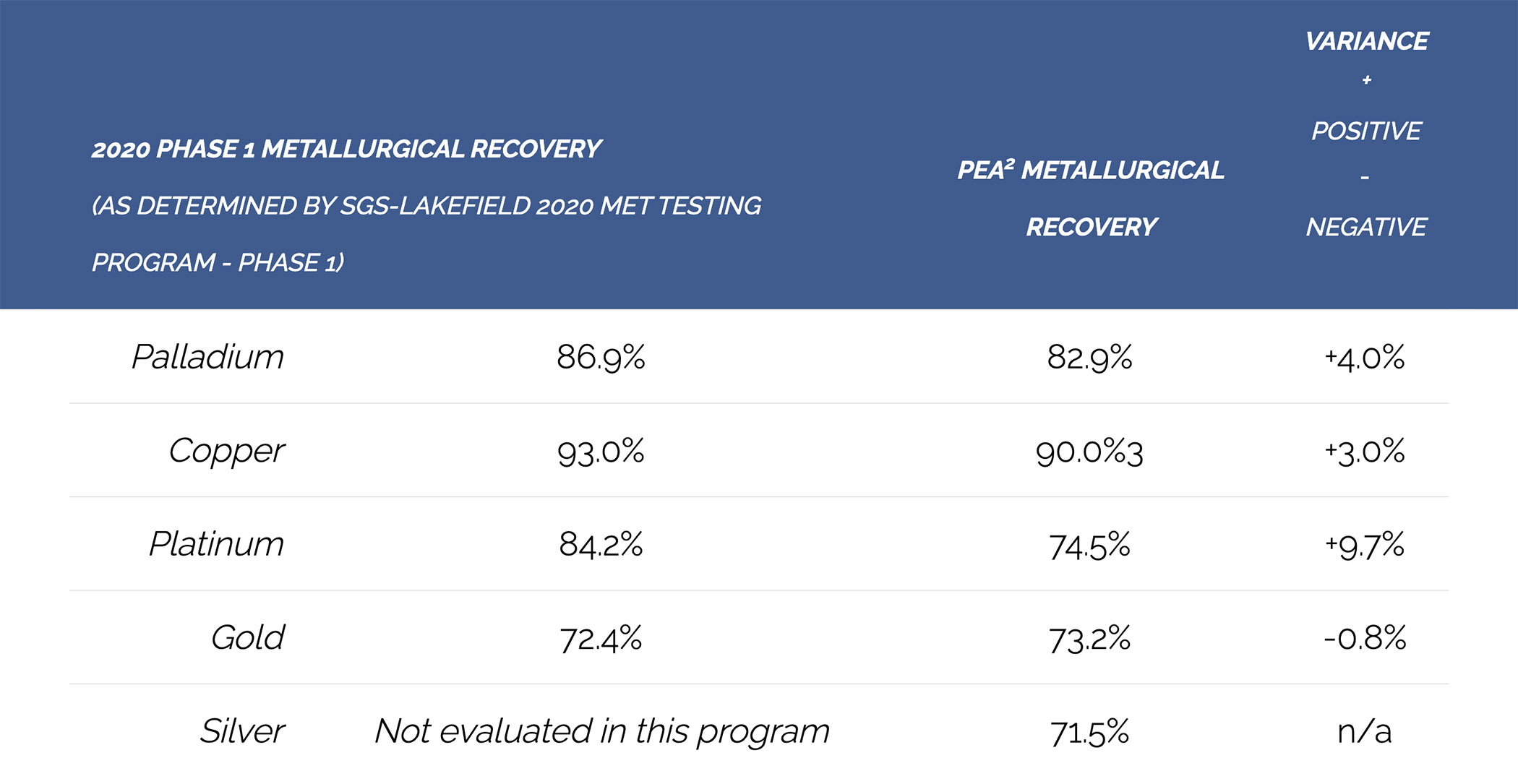

After announcing an excellent update on the metallurgical front, Generation is now moving forward with the second phase of the 2020 metallurgical test work. A pilot plant will process three bulk sample composites from freshly excavated material in the Main Zone, W-Horizon and an old (2012) composite to optimize the design criteria for a full-scale production plant.

More specifically, the Phase 2 program will further focus on the performance of the flotation circuits, defining the optimal grind size and just to validate the recovery results that were published earlier this year in August. As you may remember, the updated metallurgical test work has boosted the recovery rates of the main metals by a significant percentage.

As you can see in the image above, the recovery rate of the oh-so important palladium increased by 4% while the copper recoveries also increased by 3%. Platinum is less important than the palladium, but recovering 84.2% of the platinum content compared to the 74.5% recovery rate used in the PEA will have a clear positive impact on the recoverable and payable metal value. In a previous update, we estimated the positive impact on the NPV (keeping all other elements equal) to come in around C$100-125M.

Generation Mining is ticking all the boxes towards publishing a definitive feasibility study and given the strong palladium price and higher recovery rates for the main metals we have very little doubt the feasibility study will very likely be even better (higher IRR and NPV) than the PEA. But of course, the proof will be in the pudding and we will have to wait for the publication of the feasibility study (expected in Q1 2021) to know for sure.

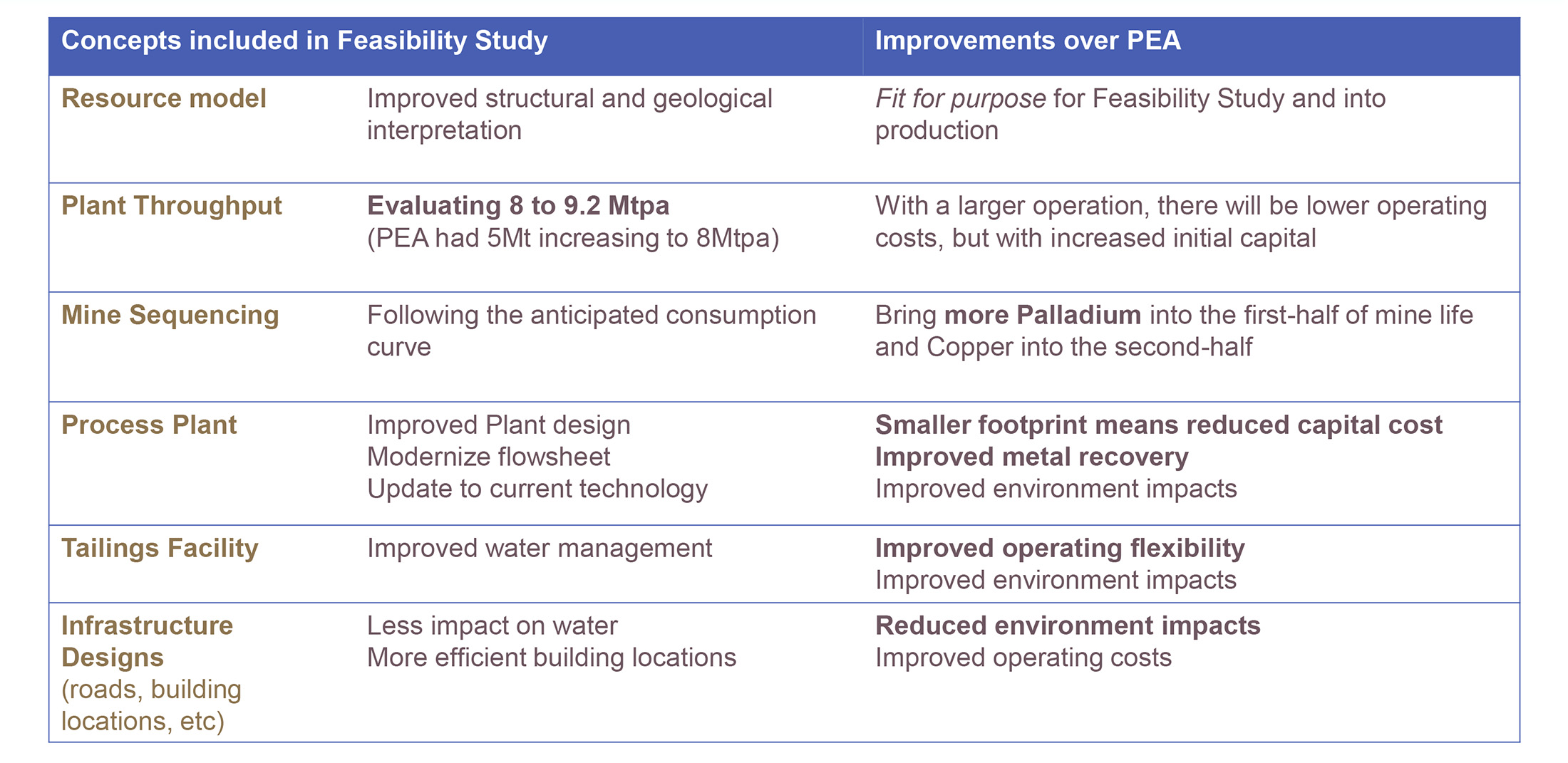

And that brings us to the final section. What should we expect from the feasibility study?

One thing’s certain: it will not just be a ‘validation of the PEA’. The PGM prices remain exceptionally strong and whereas the PEA was focusing on providing a scenario focusing on keeping the potential construction of the mine ‘financeable’, the strong palladium price and the financing window that appears to have reopened for mining companies will allow Generation Mining to further optimize its economic model.

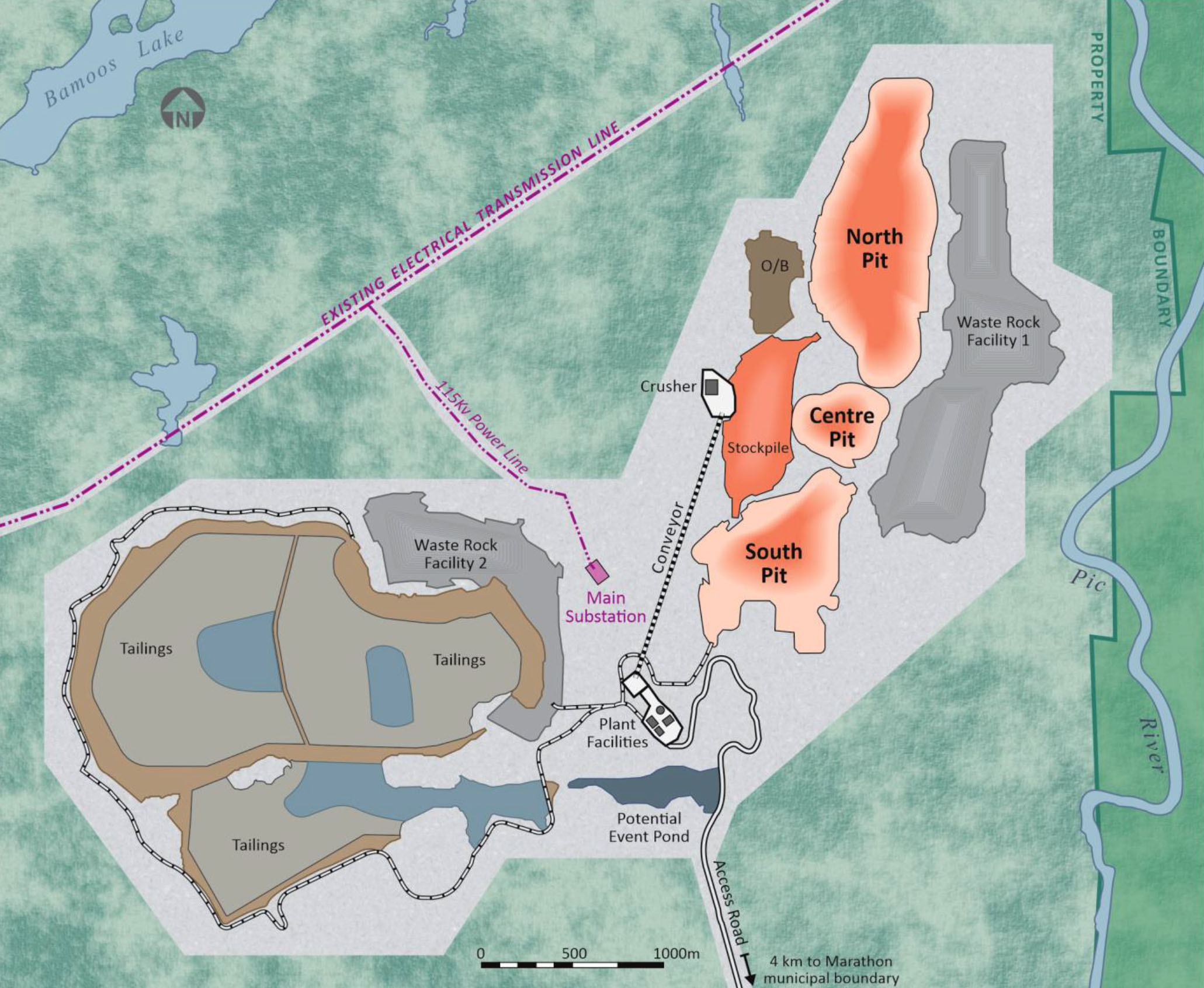

It’s hardly a secret Generation Mining is looking into a development scenario with a higher daily throughput. While this will increase the upfront capex, it will also unlock additional economies of scale and reduce the operating cost per tonne and ultimately, the production cost per ounce of palladium. The higher capex will only have an impact on the financing mix and should actually result in an improved NPV and IRR, keeping all other elements unchanged.

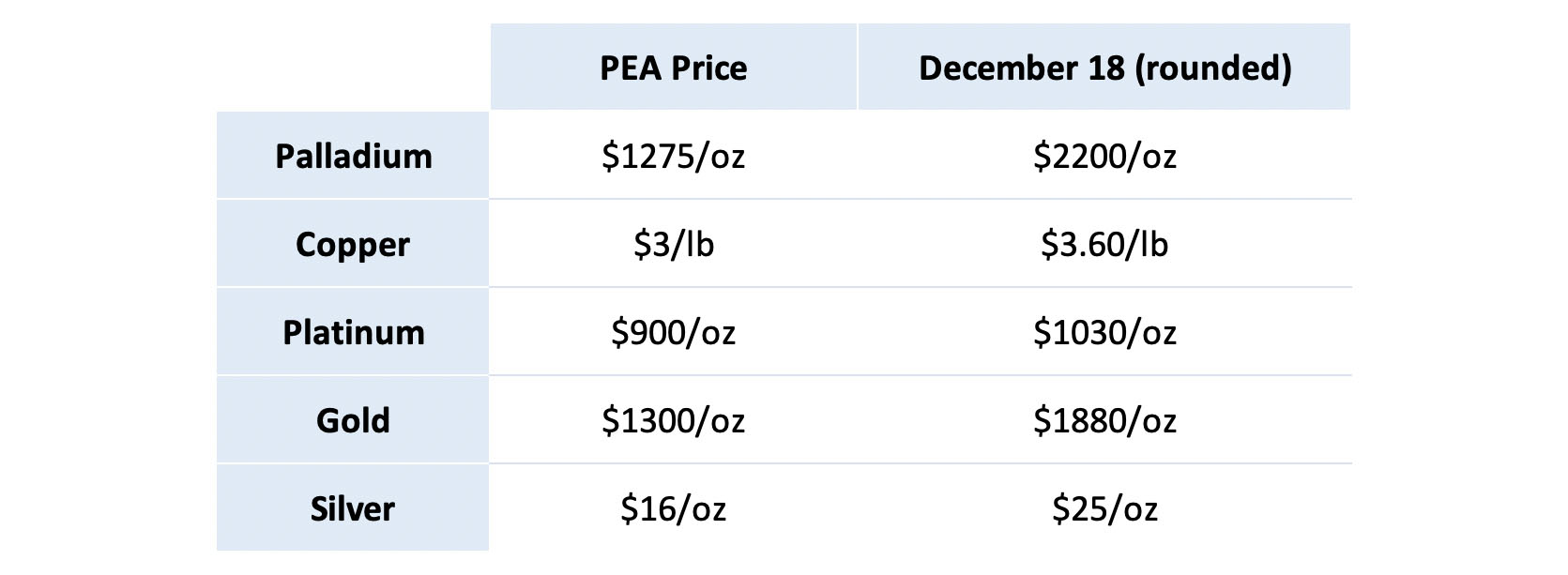

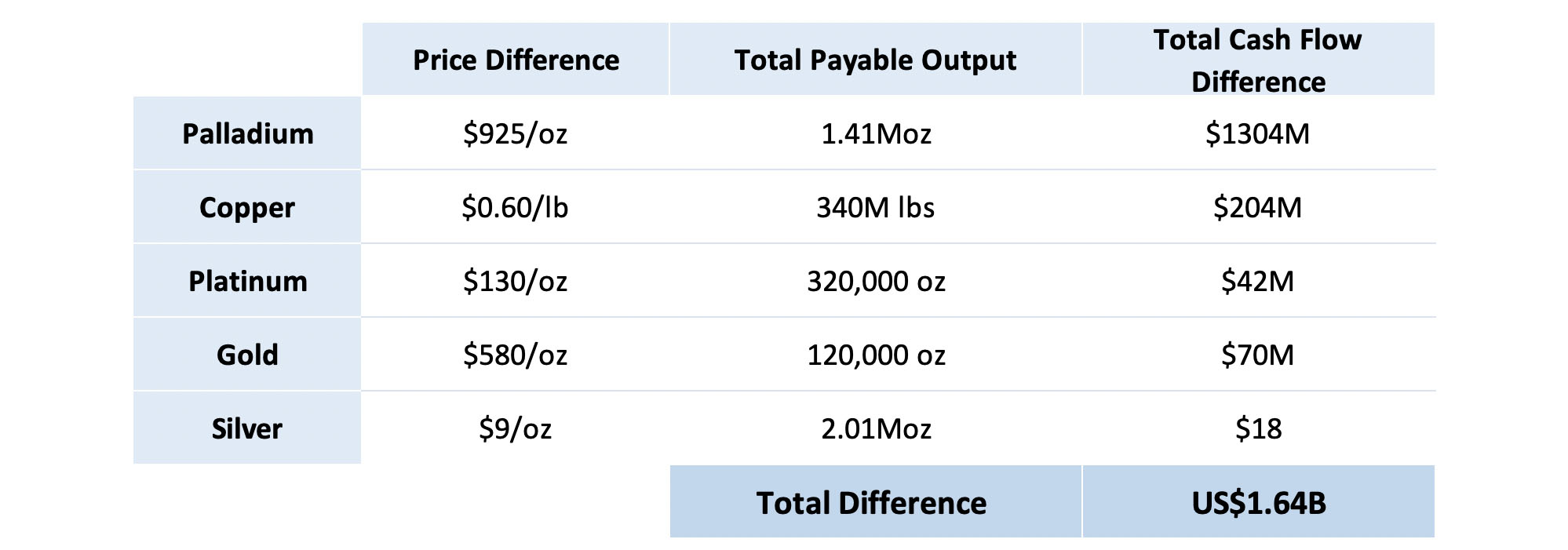

But those other elements won’t remain unchanged. As explained above, the updated metallurgical test results indicate the average recovery rate for palladium, copper and platinum increased and this means more payable ounces (and pounds) will be produced at virtually no additional cost. Additionally, the PEA was based on commodity prices that appear to be outdated by now as gold is trading higher while the palladium price is trading much higher than the level used in the PEA.

Applying these spot prices to the amount of payable metals as defined in the PEA (note: this excludes the improvements on the metallurgical front!) results in an increase of the undiscounted pre-tax cash flows of in excess of US$1.6B, and north of C$2B.

Generation Mining obviously won’t use spot prices in the feasibility study, but the tables above indicate how much additional value could be unlocked at Marathon should the current metal prices prove to be resilient. And just as a reminder, using a palladium price of $1900 in the PEA (keeping all other metal prices unchanged) resulted in an after-tax NPV5% of C$1.54B with an IRR of almost 46%. At the current metal prices, it’s almost impossible to screw up this project.

There also still is exploration upside on the property, but those potential additional resources won’t be included in the mine plan and we consider potential additional resources to be the icing on the cake at this point. If the market is currently valuing Generation Mining at less than 0.10X the NPV at $1300 palladium, adding more tonnes won’t move the needle at this point.

Upon the completion of the feasibility study, the clock starts ticking for Sibanye-Stillwater

So Generation Mining is in the final straight line to complete the feasibility study on the Marathon PGM project. The completion of the feasibility study won’t just provide a more detailed, reliable and credible look under the hood of the project (including the updated economics using a higher throughput), but it also starts the clock for Sibanye Stillwater (SBSW).

As you may remember from the original acquisition agreement, Sibanye-Stillwater has one (just one) opportunity to exercise some sort of a clawback right. Upon the completion of the feasibility study, and once Generation makes a positive production decision, Sibanye has a one-time option to decide within 90 days if it wants to earn a majority stake in the Marathon PGM project. Should Sibanye elect to do so, it will have to pay 31% of the total capex (bringing its total to 51%) and will subsequently have to cover that portion of the remaining capex. So if the capex in the feasibility study comes in at C$600M, Sibanye will have to cover C$186M in capex and 51% of the remaining C$414M (C$211M), or a total of about 66% of capex.

From a NPV and IRR perspective, it will make a lot of sense for Sibanye-Stillwater to exercise this option. However, the Marathon project is very Palladium-dominant while Sibanye’s other operations appear to be more geared towards platinum. So rather than it being a question of economics and returns, the decision by Sibanye will likely be based on whether or not it wants to increase its exposure to palladium in its product mix. As a reminder, according to the PEA, Marathon is expected to produce 1.41 million payable ounces of palladium and just 320,000 payable ounces of platinum.

An additional (small) complication is that Generation Mining has already completed the earn-in to reach 80%. We asked CEO Jamie Levy what happens if Sibanye-Stillwater gets diluted down now until the completion of the feasibility study, but subsequently decides to exercise its right to get to a 51/49 joint venture. According to Levy, Sibanye-Stillwater would have to make a payment equal to three times the exploration expenditures it was required to contribute before subsequently exercising the back-in right. So in other words, if Generation now spends C$2M to which Sibanye doesn’t contribute a dime, Sibanye will be required to make a C$1.2M payment to Generation Mining (three times 20% of C$2M) before it can exercise its claw back right. So even if Sibanye doesn’t contribute its 20% right away, we probably shouldn’t read too much into it.

Conclusion

As of the end of September, Generation Mining had a working capital of in excess of C$12M and on top of that, a total of 11M warrants (9.8M at C$0.45 and 1.3M at C$0.28) are expiring on July 9th, 2021. As all warrants are currently deep in the money, Generation Mining can likely expect an additional C$4.75M of cash inflow in the first half of 2021 and we expect the company to head into the summer with a cash position of around C$10M.

This puts Generation Mining in the drivers seat. It has earned an 80% stake in Marathon and can now just wait for the results of the feasibility study to be published and we expect that will be a catalyst.

Disclosure: The author holds a long position in Generation Mining. Generation Mining is a sponsor of the website. Please read the disclaimer.