Sometimes a company’s promise or guidance are just hollow words. And sometimes a company is actually able to deliver on its promises. Heliostar Metals (HSTR.V) promised earlier this year to update the existing resource on its flagship Ana Paula gold project in Mexico in November and with a few days to spare, the company indeed released a resource update.

This is an important box for the future development of Ana Paula. As disclosed by the company, Heliostar is now anticipating to develop Ana Paula with a focus on an underground mining operation instead of the open pit that was envisaged by the previous owners.

The updated resource calculation is just the first step. Heliostar Metals should have an economic study out in 2024 and still expects to make a construction decision by the summer of 2025.

The updated resource estimate

In our previous report, we mentioned “Anything below 800,000 would be disappointing; anything over 1.1 million ounces would be excellent.”. We were indeed expecting to land somewhere in between, but Heliostar surprised us with a high-grade resource calculation of 1.15 million ounces of gold across all categories. And that clearly beat our ‘optimistic’ expectation of 1.1 million ounces.

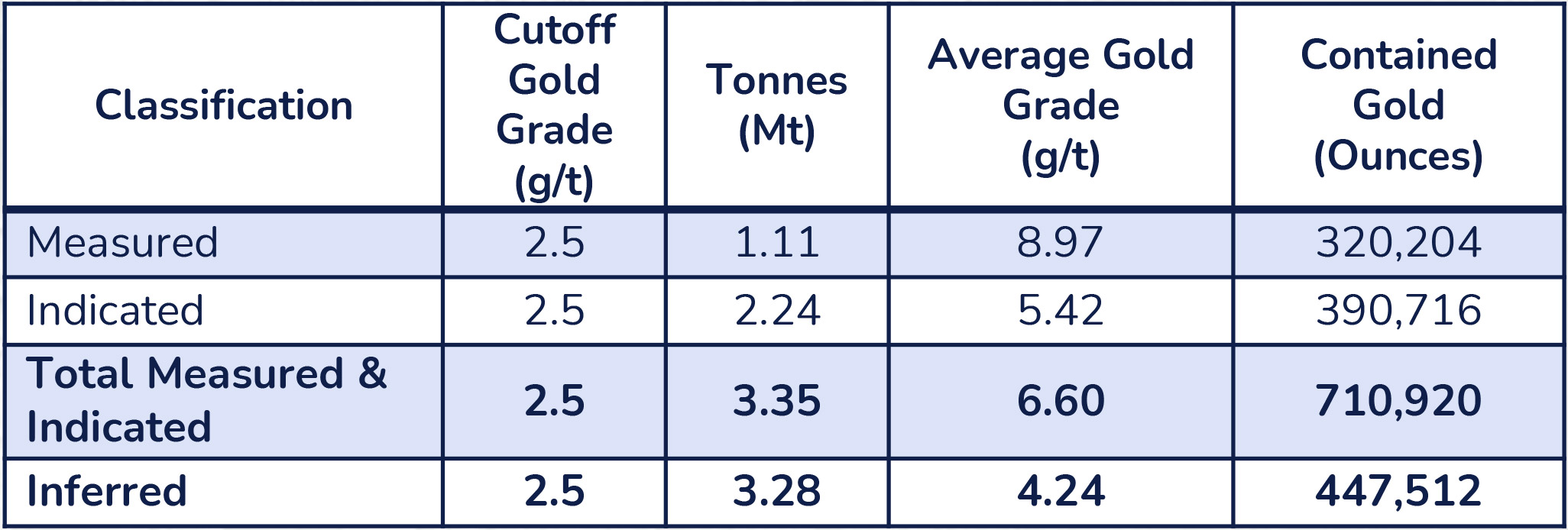

As you can see below, the total resource can be broken up in 711,000 ounces of gold in the measured and indicated resource category at an average grade of 6.60 g/t gold with an additional 448,000 ounces of gold in the inferred resource category with an average grade of 4.24 g/t. There is a global resource of close to 1.9 million ounces of gold, but we are ignoring that for the time being as the underground-accessible high-grade resource with a cutoff grade of 2.5 g/t gold is what really matters for Heliostar.

The measured and indicated resource has an average grade of 6.6 g/t but as you can see in the table above, the average grade of the measured resources is almost 9 g/t and this is mainly due to the presence of a very high-grade section which contains approximately 200,000 ounces of gold in an area where the average grade exceeds 10 g/t. Needless to say such a grade would be a major boost in any economic scenario and to make that area even more appealing, Heliostar Metals thinks those ounces could be mined early on in the anticipated mine life which would definitely have the biggest impact on the NPV. Of course we will have to wait for the PEA or pre-feasibility study to see the official mine plan, but high grade ounces early on in the mine life will for sure be value-enhancing.

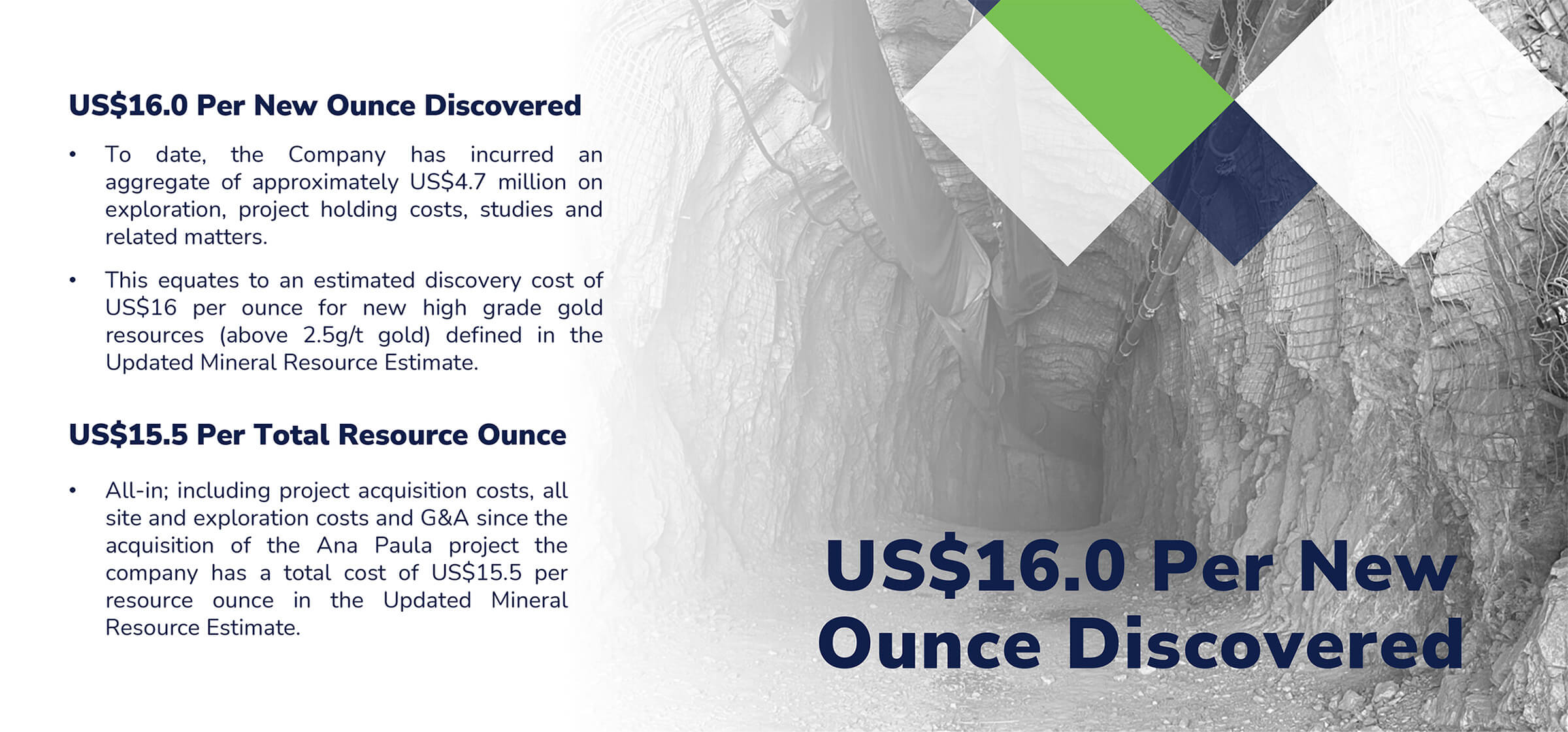

Heliostar is also very proud of its ‘bang for your buck’ ratio. In its updated corporate website, the company dedicated an entire page to the discovery cost and the acquisition cost of the gold ounces at Ana Paula. Rightly so, as the incremental ounces in the updated resource estimate (using a cutoff grade of 2.5 g/t gold) represent a discovery cost of just $16/oz. And that’s in line with the acquisition cost of the project.

Of course those expenses are now a ‘sunk cost’ and while that is definitely great news for Heliostar and its shareholders, it’s also important to keep an eye on the future discovery potential.

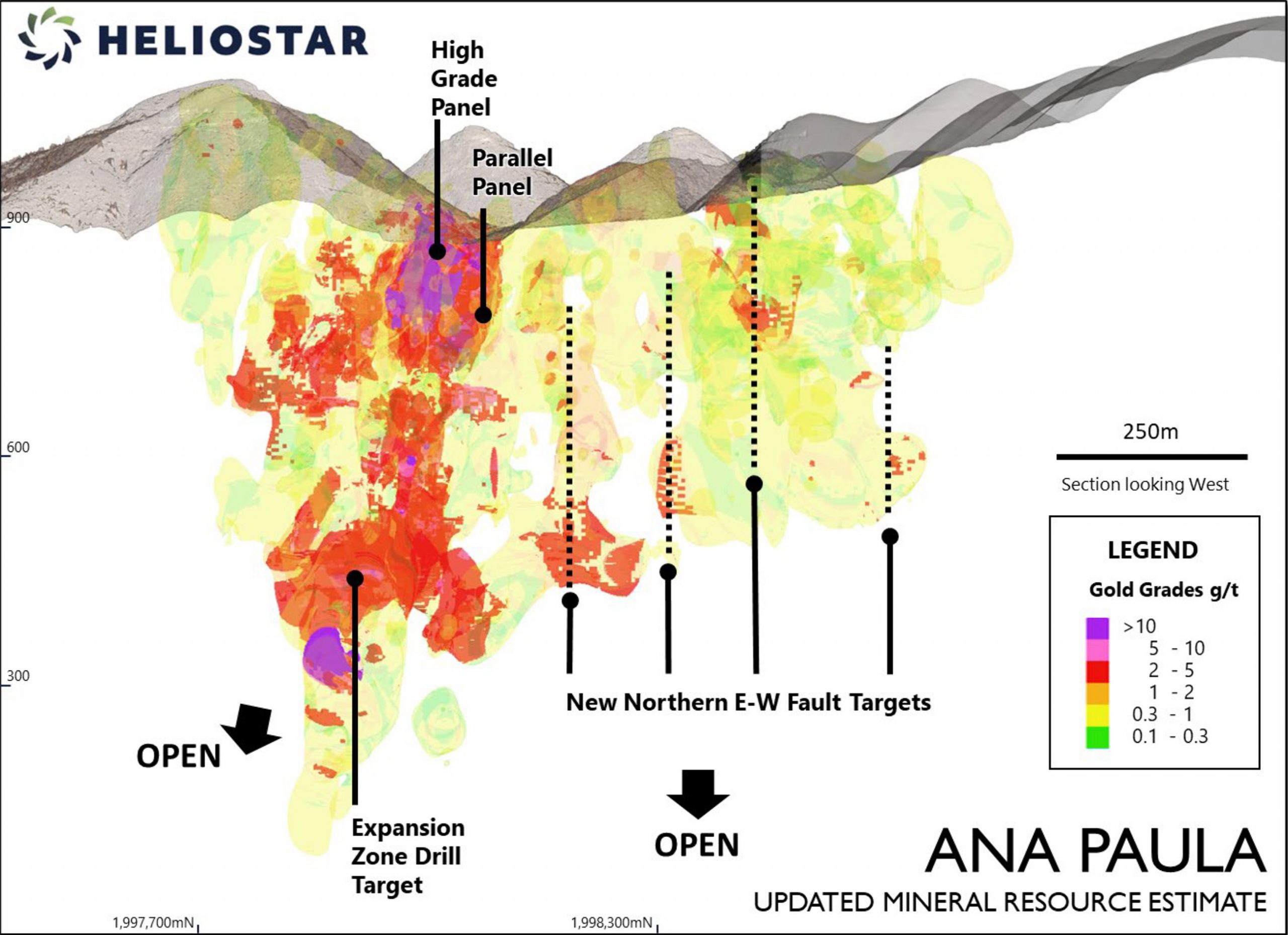

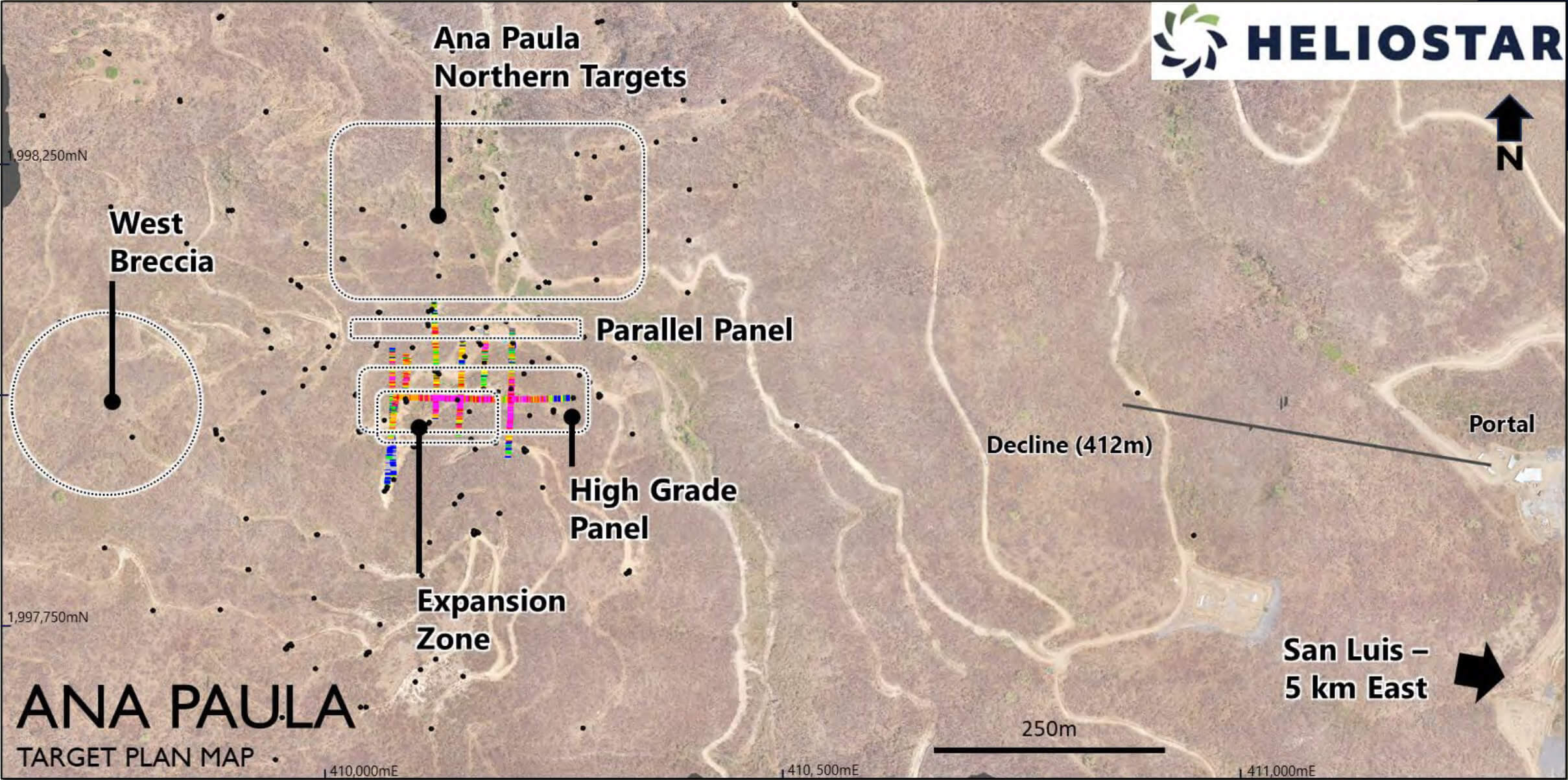

The resource calculation was based on the drill programs until a certain cutoff time. And subsequent to that cutoff date, Heliostar Metals discovered the so-called Parallel Zone. It is important to emphasize that neither the Parallel Panel, nor the other targets along the faults as shown below, have been included in the resource calculation.

That Parallel Panel zone is located just 50 meters north of the high grade panel which means the required critical mass to consider the development of this zone is relatively low as it can likely easily be accessed from the underground workings that are currently being planned to reach the High Grade Panel.

And of course, there’s more than just the Parallel Zone. The company’s corporate presentation highlights all potential growth targets. And as all these targets are within very close distance to the high grade panel, any discovery and future resource on any of those targets could likely easily be accessed. More drilling will be needed on both the parallel panel and the other potential growth targets to fully define and delineate additional ounces, but given the company’s recent exploration successes, we like the odds.

Also keep in mind the company published updated results on its metallurgical test work in October. The company announced recoveries ranging from 74.6% to 88.1% on seven samples. The average recovery rate was 80.4% which is substantially better than we had expected. Recovery rates are a very important element of any economic study, and given the strong recovery rates and the positive resource update, we hope the upcoming economic study will show equally strong economics. We will work on our own back-of-the-envelope model to get a better understanding of what NPV and IRR we could be talking about but we are waiting for the technical report to be filed to get a better understanding of the current resource.

Adding a mine-builder to the management team

Other than finding high-grade ounces for an updated resource, Heliostar had another issue it had to deal with. Its management team didn’t contain any mine builders. During a meeting in Brussels, CEO Funk acknowledged this and mentioned hiring an experienced mine-builder was high on the company’s list of priorities.

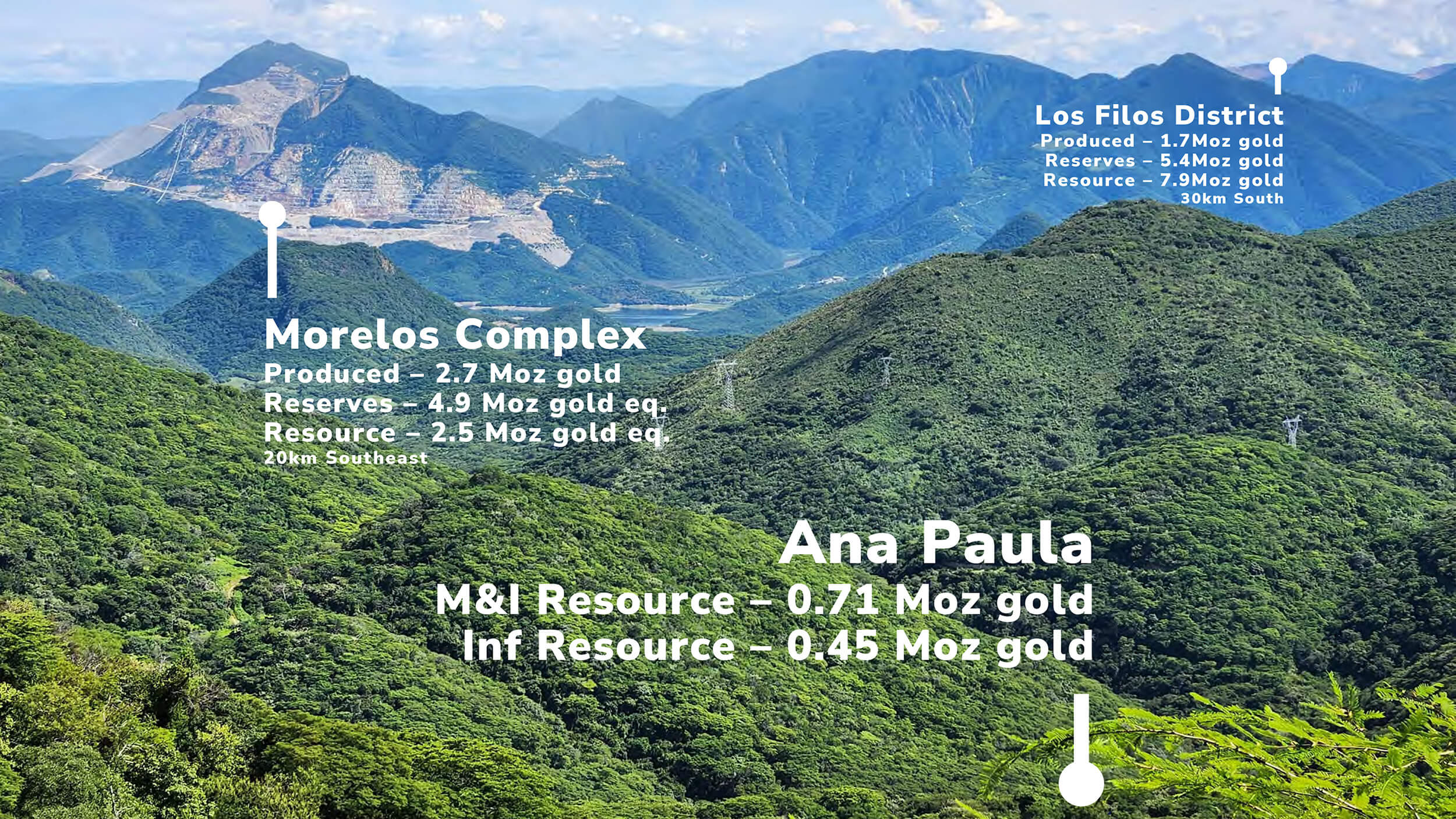

Last week, Heliostar announced it has appointed Gregg Bush as its Chief Operating Officer. Bush was the COO of Capstone Mining (now Capstone Copper (CS.TO)) for eight years before moving to Equinox Gold Corp where he was appointed as SVP of Mexico, responsible for the Los Filos gold mine in Guerrero. That’s an important element as the Ana Paula project is obviously also located in the Guerrero state, so having a COO with plenty of experience in the state should be a benefit to the company (at the very least he will be very experienced in community relations as the Los Filos gold mine has been a headache in the past few years). And perhaps the most important element of his career is the development and the commissioning of the Dolores mine for Minefinders (which was subsequently acquired by Pan American Silver in 2012 which paid C$1.5B to get its hands on that mine).

At Heliostar, Bush’s role is pretty clear: dealing with all the technical and development-related issues to get Ana Paula construction-ready by mid-2025 and subsequently overseeing the construction and commissioning activities at the project.

No near-term cash worries

The main risk and issue for non-revenue exploration and development companies obviously is the market starting to wonder ‘when the next financing will happen’. Heliostar didn’t want to have to deal with this question that could potentially cast a cloud on the resource update, and it announced a warrant exercise incentive program earlier in November. It tried to convince some of the owners of the 46.4 million warrants at C$0.30 to exercise those warrants. In return, those warrant holders will receive an additional one third of a warrant with an exercise price of C$0.40 for a period of two years. Warrant holders had until December 8th to participate in this warrant exercise program.

And to avoid any uncertainty, the company issued an interim update in November stating it has received commitments for approximately C$4.6M in proceeds which should remove any questions about the company’s access to capital to continue its fast-paced strategy to move the Ana Paula towards a construction decision.

Ultimately, Heliostar was able to raise C$5.2M using the warrant incentive program. The company issued 17.6 million shares resulting in proceeds of C$5.27M. A total of 5.86 million incentive warrants with an exercise price of C$0.40 were issued.

At the end of September, the company had a positive working capital position of approximately C$2.44M. We expect the company to end the year with C$5M+ in working capital.

Conclusion

Heliostar Metals continues to diligently tick the boxes it needs to rapidly advance the Ana Paula project. We are very surprised by how fast Heliostar has been able to advance the project as HSTR only completed its company-changing acquisition of the project in March of this year. Thanks to a well-timed capital raise in the summer and the application of a warrant exercise incentive program, the treasury should remain at an acceptable level which avoids the scenario where Heliostar will have to raise money with their backs against the wall.

The updated resource is a confirmation of the company’s strategy and vision. And having access to a half-completed decline should further bolster Heliostar’s plans to develop Ana Paula and use it as a stepping stone to grow the company into a mid-tier producer.

Disclosure: The author has a small long position in Heliostar Metals. Heliostar Metals is a sponsor of the website. Please read our disclaimer.