Heliostar Metals (HSTR.V) has released the assay results from the final two holes of this year’s drill program at Ana Paula. That was the starting point for what likely will be a very busy fourth quarter for the company.

Heliostar previously promised to release the results of an additional metallurgical test run ahead of an updated resource calculation and so far, everything appears to be on track. The outcome of the metallurgical test work was released last week and the results exceeded our expectations and lend more credibility to the company’s plan to work towards an underground mine plan.

The next few months will be important as it will decide on the fate of the Ana Paula project. CEO Charles Funk and his team are diligently ticking all the boxes before committing to a development plan.

The assay results of the last two holes

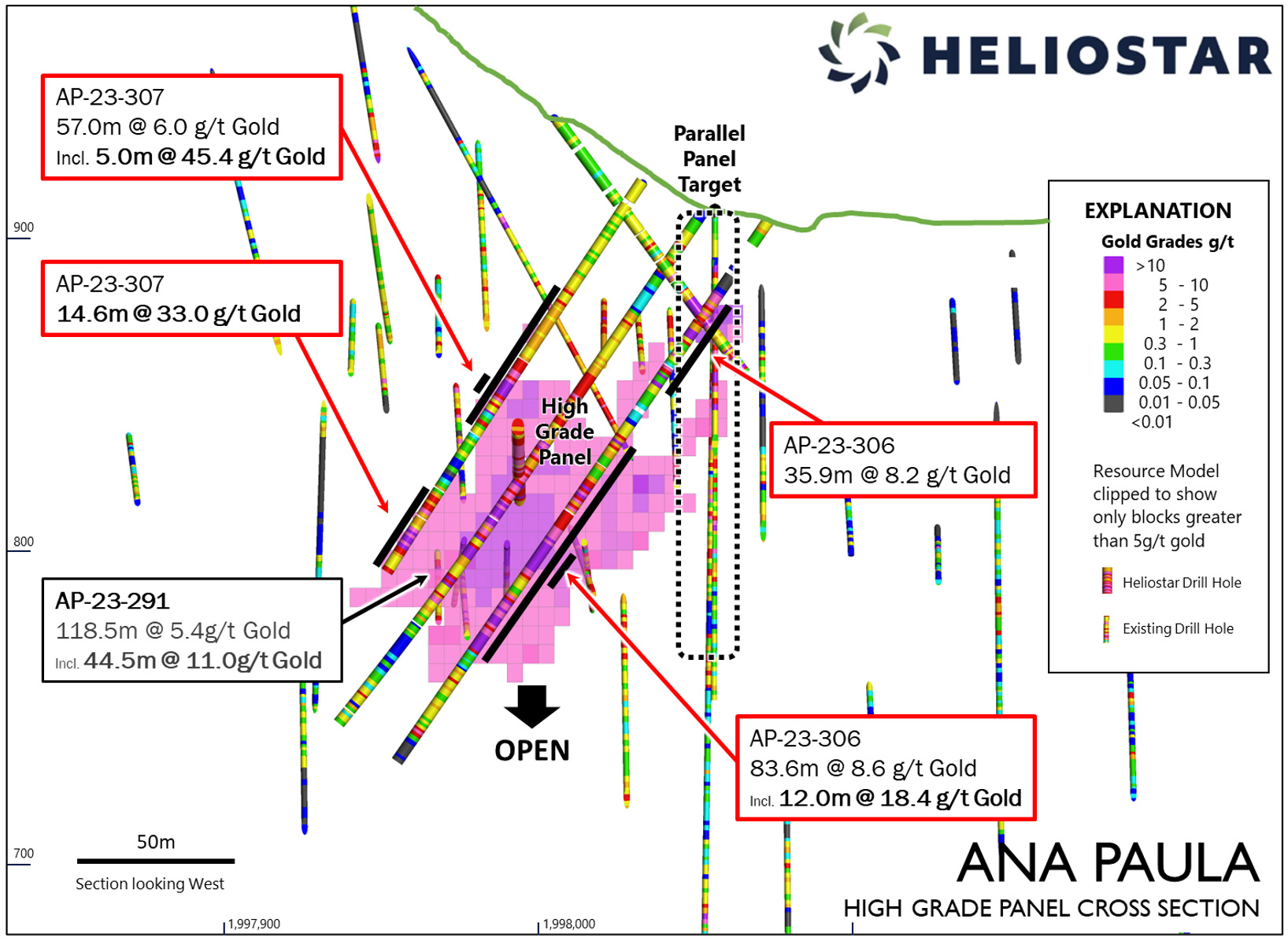

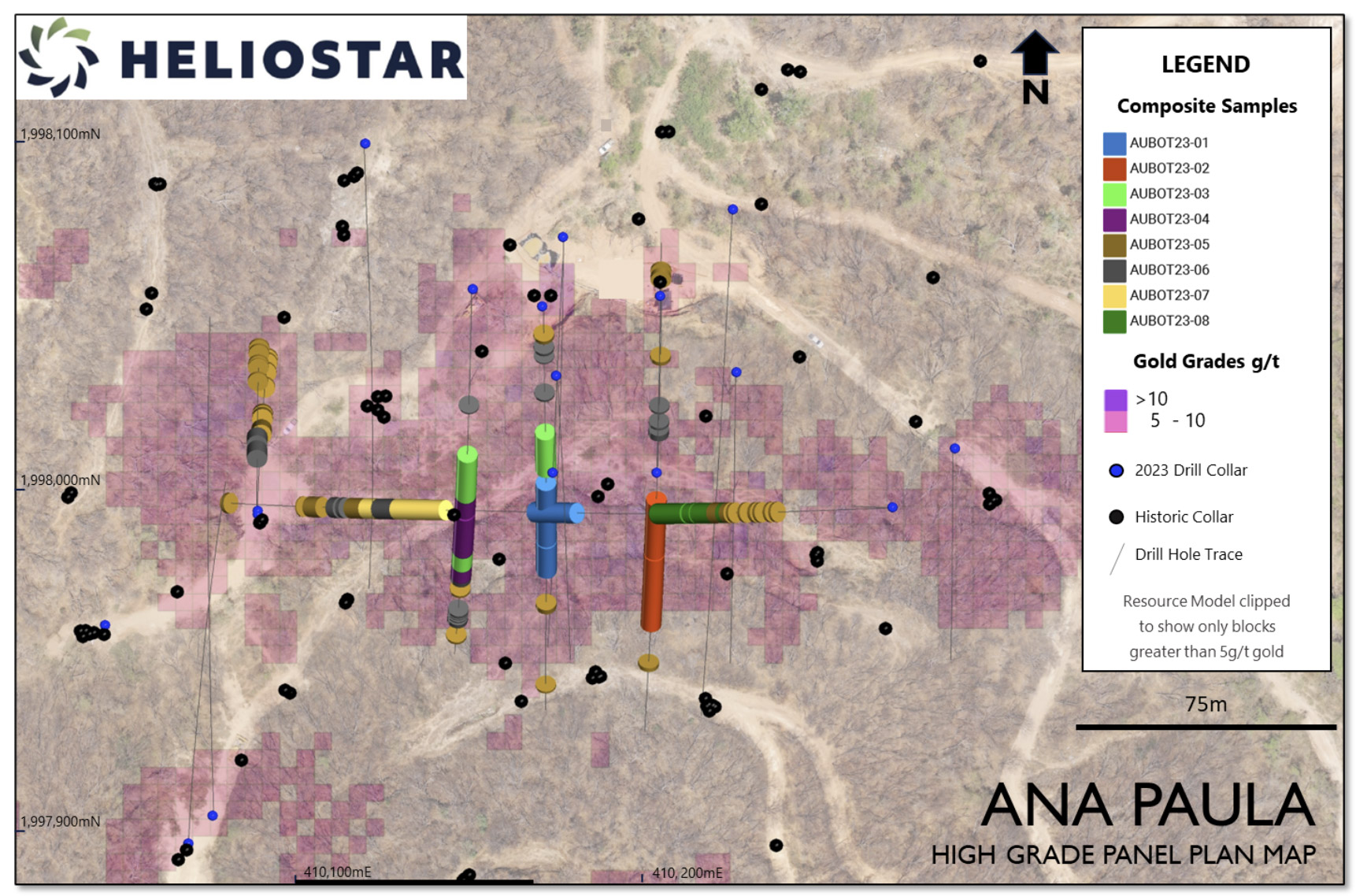

The assay results of holes AP-23-306 and 307 were released last week and the location of these holes is very interesting as they were drilled on both sides of hole AP-23-291 which returned 119 meters of 5.4 g/t gold including 44.5 meters containing 11 g/t gold.

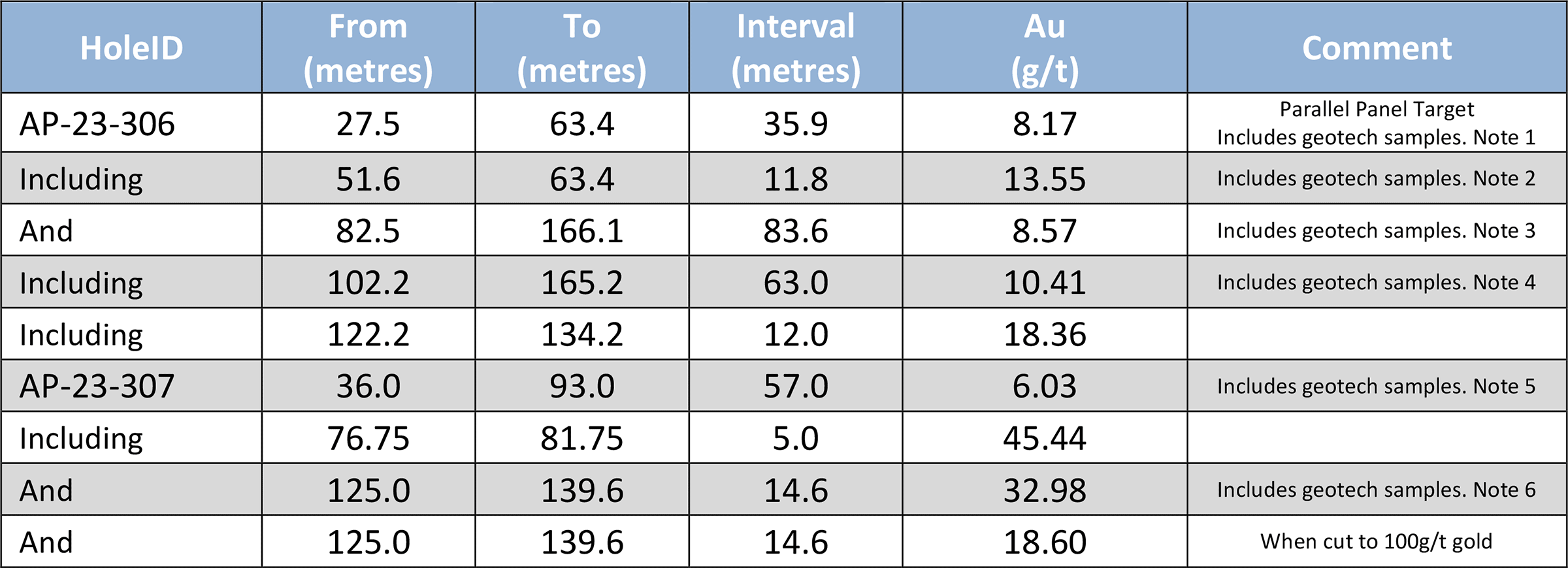

The results of the two new holes did not disappoint. Hole 306 intersected almost 36 meters at 8.2 g/t gold in the upper part of the interval and an additional 83.6 meters containing 8.6 g/t gold in the lower part of the hole. The latter also includes a higher grade interval of 12 meters containing 18.4 g/t gold.

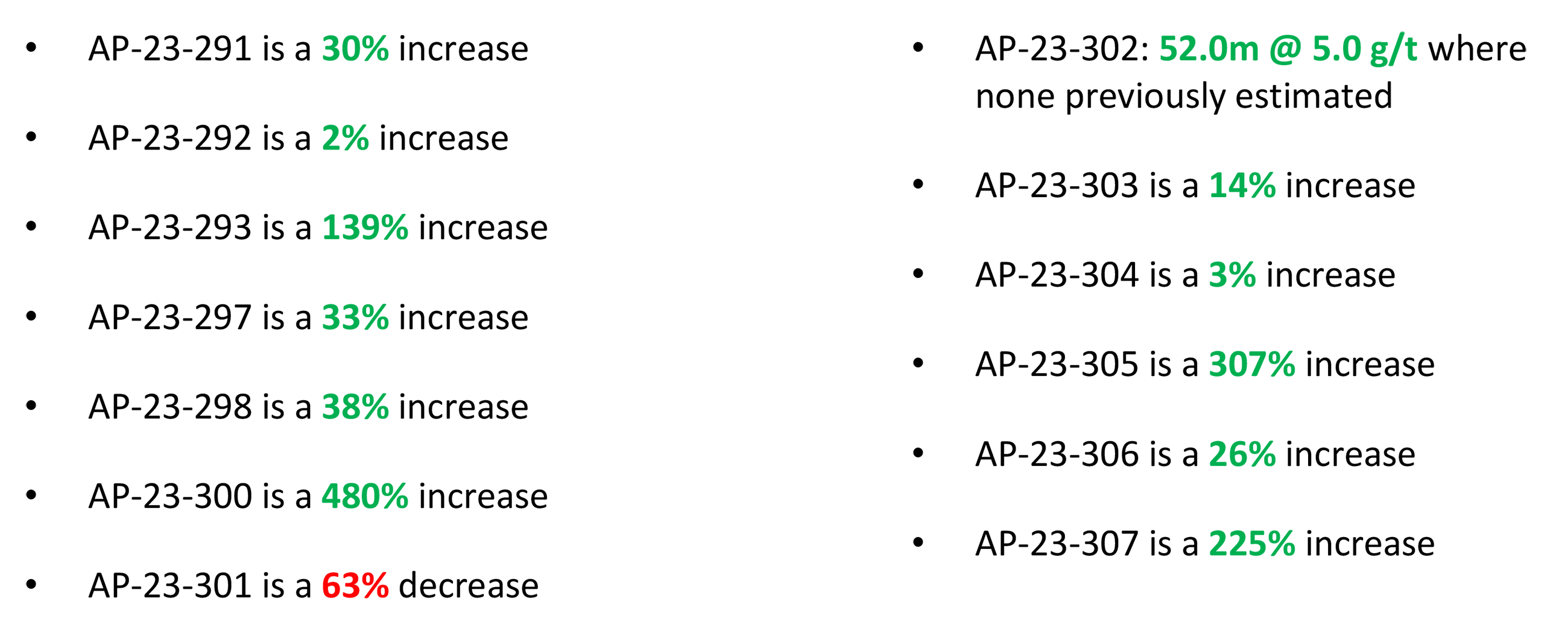

Hole 307 was equally strong. The upper part of the hole encountered 57 meters of 6 g/t gold including an interval of 5 meters with almost 1.5 ounces of gold per tonne of rock. The lower part of the hole subsequently intersected 14.6 meters of 33 g/t gold. Needless to say those widths and grades are excellent and this further strengthens the company’s thesis it should be able to boost the underground grade. As you can see below, most holes drilled by Heliostar encountered gold values that exceed the values expected based on the current resource model.

Having gold is good, having more gold is even better but that still doesn’t mean you are sitting on a gold mine.

The metallurgical test results exceed our expectations

One of the most important boxes to tick -on any project- is the metallurgical test work. When Heliostar acquired the project, it assumed a base case recovery rate of 70% for the gold. That’s pretty low, especially for a non-heap leach mine but the previous owners have never really focused on the perspective of the high-grade gold zones. One of the very first things Heliostar did when it took possession of the asset was to kick off a more detailed metallurgical test program.

The results were published last week and exceeded our expectations. It was widely expected Heliostar would be able to improve on the historical recovery rates of 70% and we would have been happy with a jump to 75-77%, but Heliostar did better than that.

Heliostar announced recoveries ranging from 74.6% to 88.1% on seven samples. The average recovery rate was 80.4% which is substantially better than we had expected. Just to put things into perspective, if a mine plan includes 800,000 ounces that will be processed (this is an arbitrary number just to explain the impact), a 5% recovery rate means an additional 40,000 ounces could be recovered while incurring hardly any additional operating expenses. That would boost the pre-tax and undiscounted cash flows by about US$72M over the entire mine life (using $1800 gold).

A strong recovery rate is important for any project in the world and although 80.4% already exceeds our expectations, it looks like there are additional optimization possibilities. An easy one would be to work on the processing sequence by putting the gravity circuit and CIL process in the right sequence and optimize the setup. In a worst case scenario this would reduce the consumption of cyanide (and thus reduce the operating expenses) but in a best case scenario the average recovery rate could increase by a few additional percent. And in the theoretical example mentioned above, recovering an additional 2% of 800,000 ounces would add another 16,000 ounces and $29M to the additional revenue and cash flow (again on a pre-tax and undiscounted basis).

The next catalysts

It won’t be long before we see the actual impact of these strong drill results on the underground resource as Heliostar aims to publish the results of an updated resource calculation in November. And that updated resource will be an important milestone as it will allow Heliostar to re-think the project as a high-grade underground gold project.

Earlier in this update we discussed how the assay results from this year’s drill program outperformed the expectations in twelve of the thirteen holes. One hole even intersected gold in an area where no gold was estimated to be present. That hole encountered 52 meters of 5 g/t gold and that obviously helps to further improve the understanding of the mineralized areas.

The takeaway from the 2023 drill program is pretty simple. Holes that outperformed the expectations (in this case, holes that confirm the mineralization is either wider or has a higher grade or offers a combination of both elements) will likely contribute to an improved resource model (a higher average grade and a higher tonnage could be expected, that’s just common sense). The company obviously is not guiding for a specific resource size, but based on the currently available information, we like Heliostar’s odds to reach the 1 million ounce mark, which appears to be a mental threshold for a lot of investors. Again, this is just our interpretation based on the available data, but it is not an official guidance provided by the company.

We will know soon enough though, as Heliostar expects to release the updated resource estimate in November, and that resource will be used to work out a mine plan that will be used in the pre-feasibility study. That pre-feasibility study should be ready by the summer of next year.

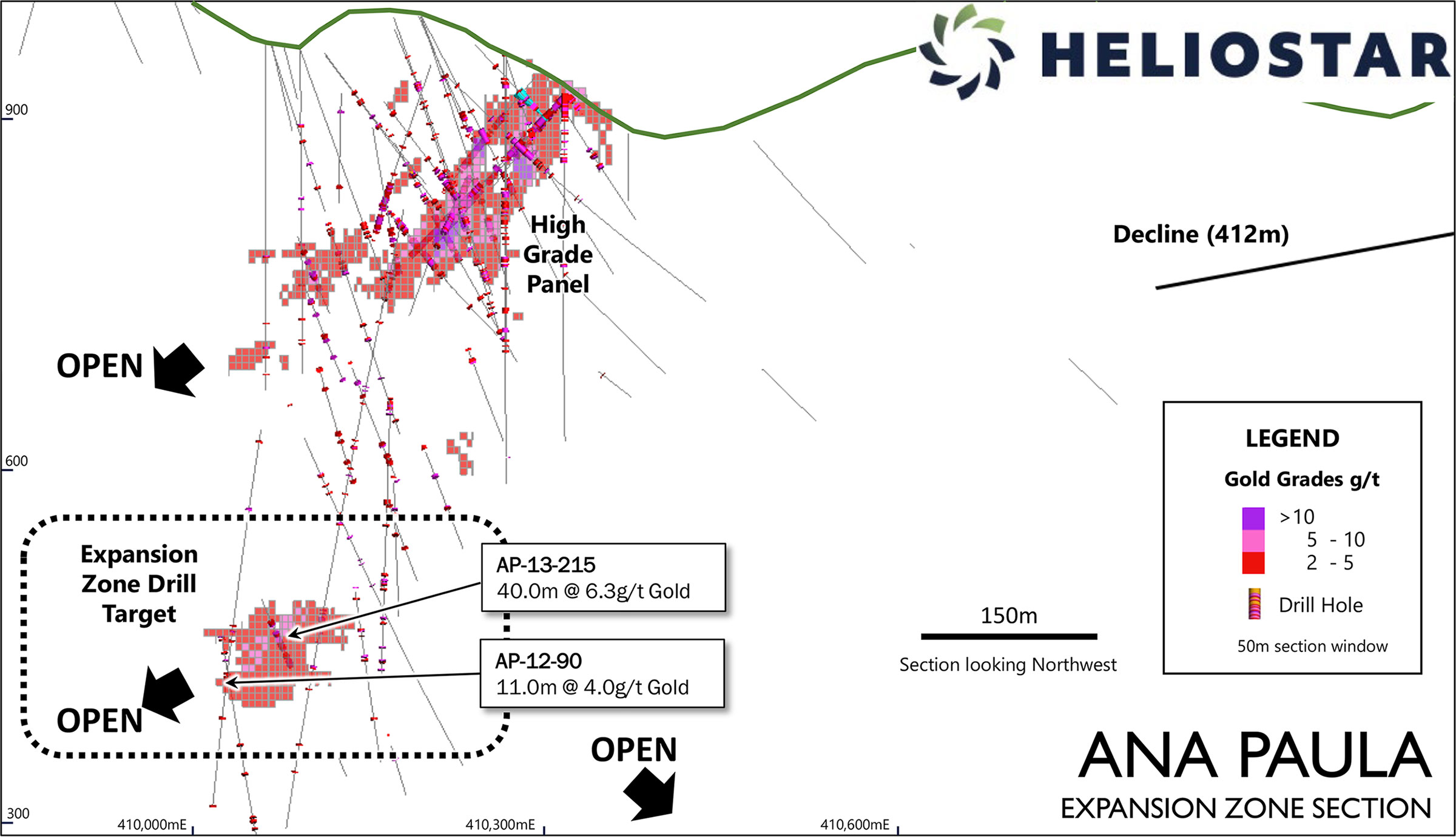

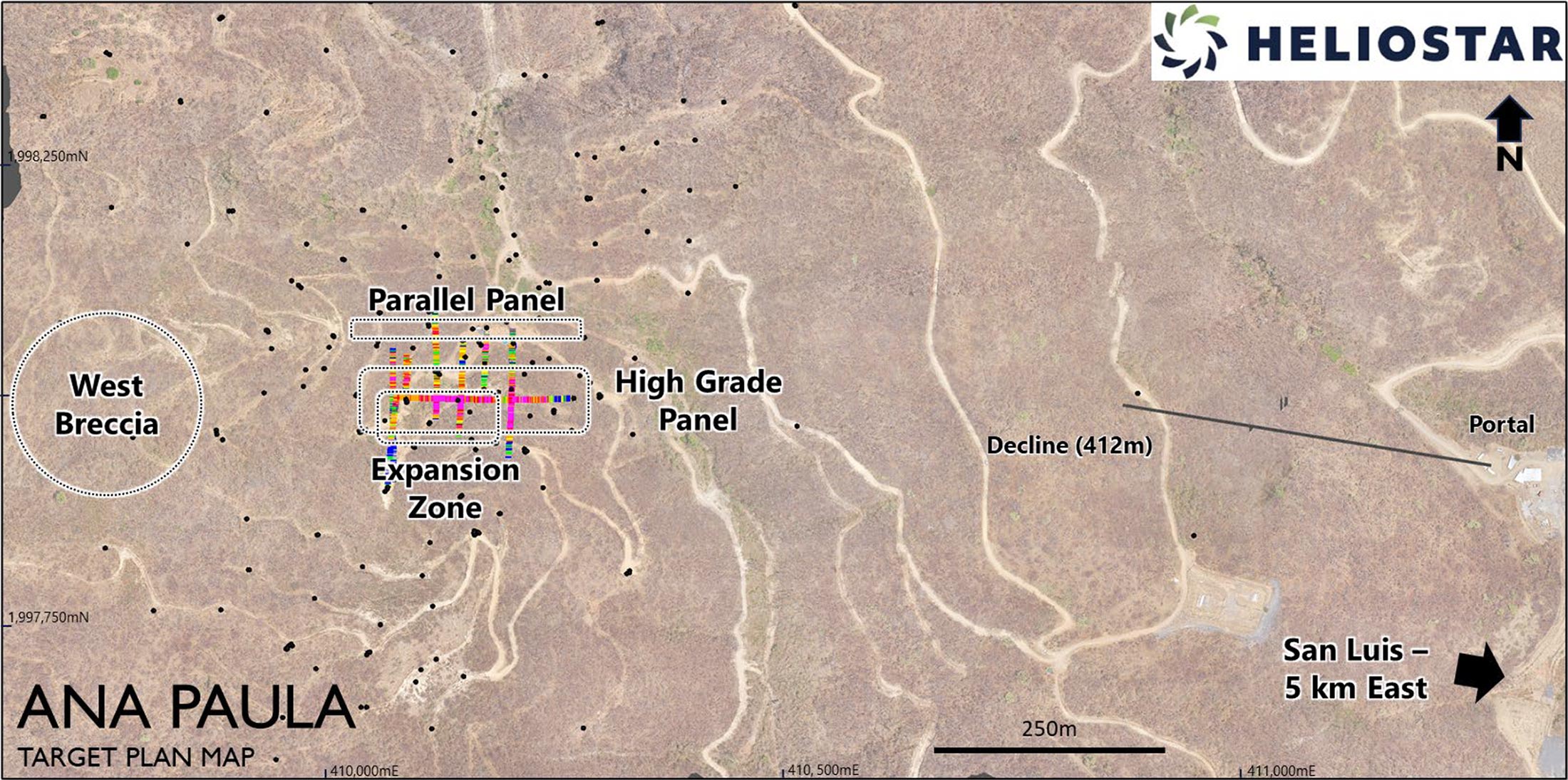

While working on the pre-feasibility study, Heliostar Metals also plans to continue to drill its growth targets (subject to securing funding to do so). As you may remember, recent exploration results indicated there may be a parallel panel less than 100 meters north of the high grade panel. Initial drill results were definitely encouraging and the parallel zone, in combination with the expansion zone, offers upside exploration potential.

The total potential will only become clear after another round of drilling which will likely take place in the first half of next year (again, subject to budgets and availability of cash). The ultimate purpose is to publish a feasibility study by the end of next year which will include another updated resource calculation incorporating the growth targets. It’s too early to estimate what the positive impact could be but an additional few hundred thousand ounces of gold will very likely move the needle on the NPV front. But again, these steps will take time.

Conclusion

For now, let’s focus on the upcoming resource calculation, followed by hopefully a drill program in H1 2024 and a pre-feasibility study in the second quarter of this year. Once the company publishes a resource calculation we can start to try to work on an economic model to get a rough idea of the economics and given the grade and improved understanding of the underground zones, we expect the resource calculation and subsequent pre-feasibility study to be positive.

Additionally, the potentially low initial capex to bring Ana Paula into production, Charles Funk and his team are now in a position to rapidly advance the project towards an official pre-feasibility study by the summer of next year.

But first things first; we are looking forward to the updated underground resource calculation. Anything below 800,000 would be disappointing; anything over 1.1 million ounces would be excellent.

Disclosure: The author has a small long position in Heliostar Metals. Heliostar Metals is a sponsor of the website. Please read our disclaimer.