The scenario for copper still looks good as even the CEO of senior producer Freeport McMoRan (FCX) went on record saying a copper price of $3.25 isn’t good enough to consider new projects. So unless a company owns a project with very low production costs and has access to capital at an acceptable cost, the appetite to develop new large copper projects is very low. And that creates an interesting situation as governments have never been so pushy when it comes to the electrification of their nations.

Infinitum Copper (INFI.V) is a newly created company that started trading less than six months ago, in March. The company came out of the gate with an option to acquire 80% of the Adelita CRD Porphyry system and added an Arizona-based exploration project to its portfolio shortly after its listing.

Created by the people behind Reyna Silver (RSLV.V) and Reyna Gold (REYG.V), headed by copper veteran Steve Robertson and having Peter Megaw on the team as Technical Advisor, Infinitum Copper offers credibility.

Two interesting projects

While the strong technical team and human capital is an important element in considering whether Infinitum ‘has what it needs’, the projects also need to have their merit.

La Adelita, Sonora (Mexico)

As mentioned in the introduction, Infinitum has an option to acquire 80% of the Adelita project from Minaurum Gold (MGG.V). The project was gathering dust on the Minaurum shelves as the Alamos silver project has been prioritized in the past few years. An understandable move as exploration dollars have been tough to come by. As Peter Megaw originally introduced the project to Minaurum, we feel he played an instrumental role in ‘brokering’ a deal that would make Adelita get the attention it deserves.

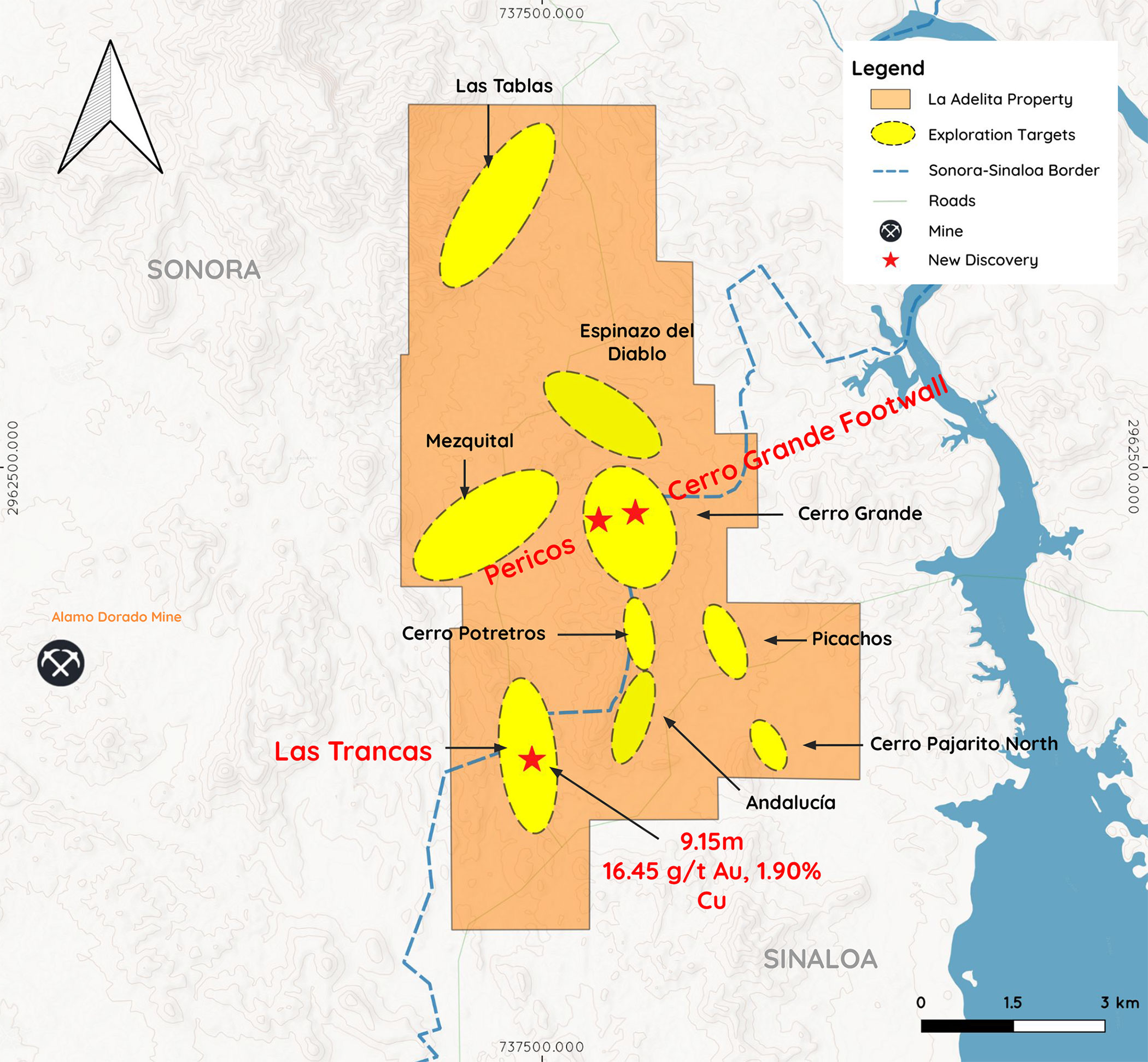

The Adelita project consists of 7 mining claims for a total of just under 6,500 hectares on the border of Sonora and Sinaloa, just a stone’s throw away from the past producing Alamo Dorado silver mine which was owned and operated by Pan American Silver (PAAS, PAA.TO). The Adelita project has always been known for its copper occurrences and (very small-scale) mining activities have taken place since the 1960s. Despite the known copper occurrences, the very first drill program only occurred in 2005 when Kennecott, a division of Rio Tinto, drilled five holes.

This also means Infinitum Copper will be the very first company to embark on a substantial drill program. The company released the assay results from a trenching program on the Las Trancas Zone with plenty of interesting results. Of course not every trench was a ‘hit’ but there are plenty of interesting zones to follow up on with the three most interested intervals highlighted in yellow below, clearly showing there is high-grade copper and gold on the property over very decent widths.

In fact, Infinitum Copper is currently working through a 9,000 meter drill program at Adelita which is essentially more drilling than the total amount of drilling completed during the previous drill programs (which was just about 7,300 meters of drilling).

Drilling has been a bit slower than expected due to the rainy season in Sonora (and drill crews have to take shelter when there’s a thunderstorm) while the skarn altered rock is considerably more difficult to drill due to the presence of garnet in the rock.

The 9,000 meter drill program can be broken down in two phases. Phase 1 consisted of approximately 3,000 meters of drilling targeting the areas close to the currently known mineralized zones while a second phase drill program (6,000 meters) will follow up on the drill results of geophysics, Phase 1 drilling and the results of additional trenching. The combination of both phases of the drill program will likely cost just under US$2M.

As drilling has been slower than anticipated, it is also taking more time for the assay results to be released. Perhaps a blessing in disguise as copper equities haven’t performed well lately and assay results, even good assay results, would likely just be seen as a liquidity event. We recently talked to CEO Steve Robertson while we were in Canada and he expects the company to be in a position to start releasing assay results ‘in the next few weeks’ and hopefully that will spark some interest in this story.

The earn-in terms of Adelita (the contract was signed in February 2021) are quite straightforward and it involved Minaurum Gold getting a substantial equity position in Infinitum. Infinitum issued 0.2M shares to the original owner of the property (who also retains a 2% Net Smelter Royaty) while Minaurum Gold was issued 6.1M shares at a deemed value of C$0.40 per share. Three additional payments for a total of less than C$125,000 including the reimbursement of mining taxes were made and the only additional requirement is for Infinitum Copper to spend C$3M on exploration expenditures over a five year period, ending in February 2026, and we estimate INFI is already over halfway this requirement.

Upon completing the C$3M in exploration expenditures, Infinitum and Minaurum will form an 80/20 joint venture and Minaurum’s 20% stake will be carried until a total of C$4.75M has been spent and PEA has been completed.

Hot Breccia, Arizona (USA)

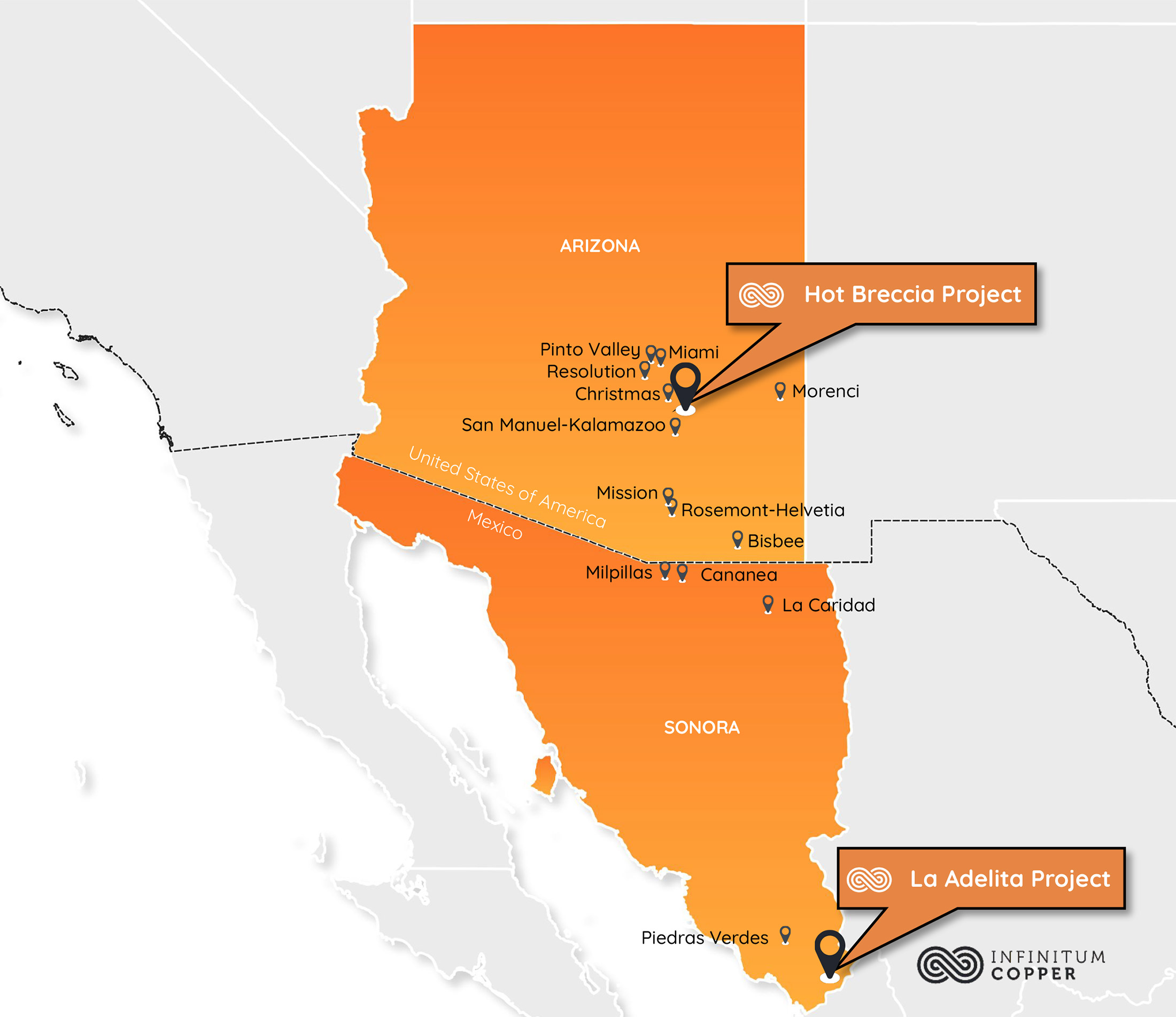

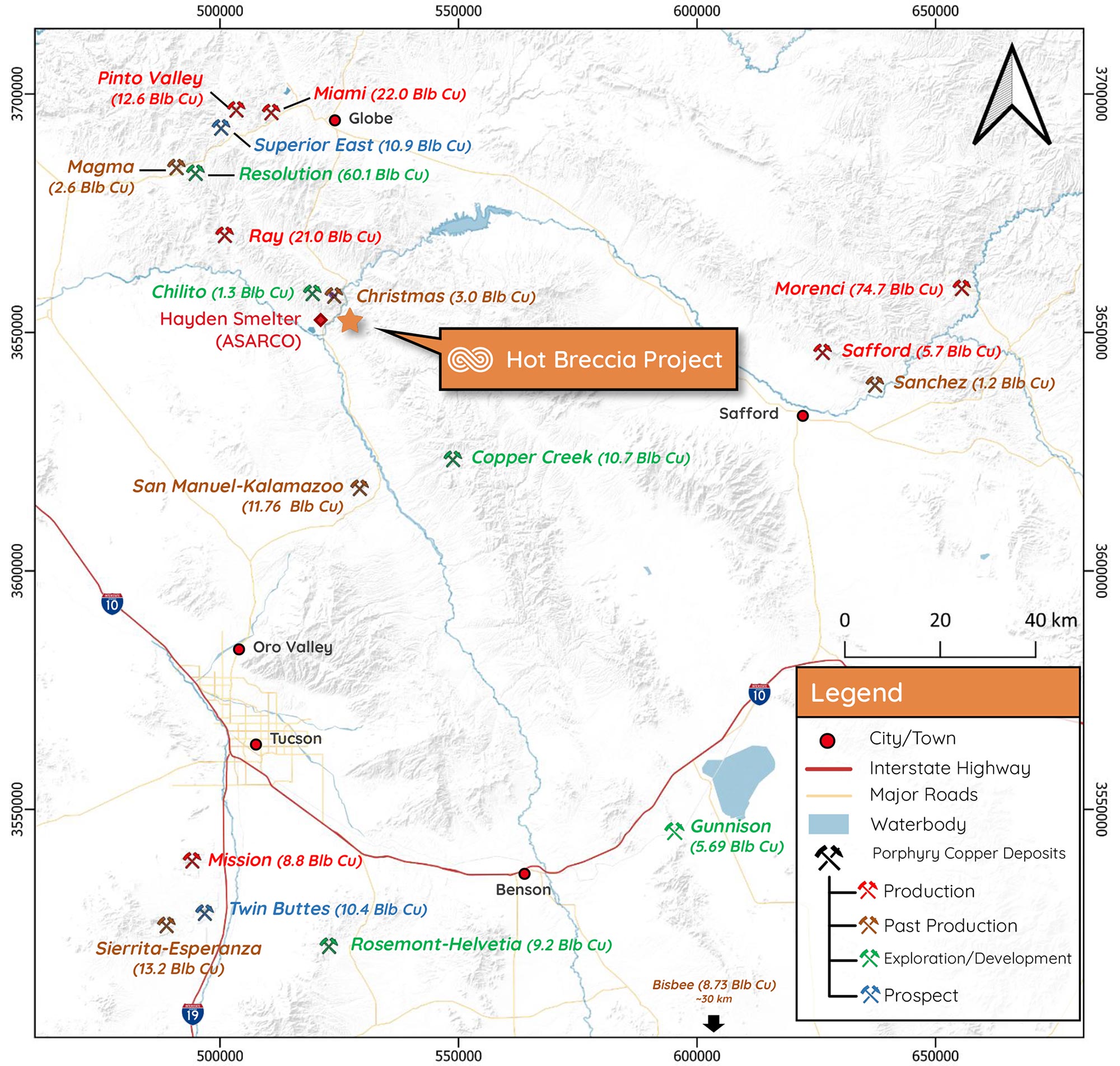

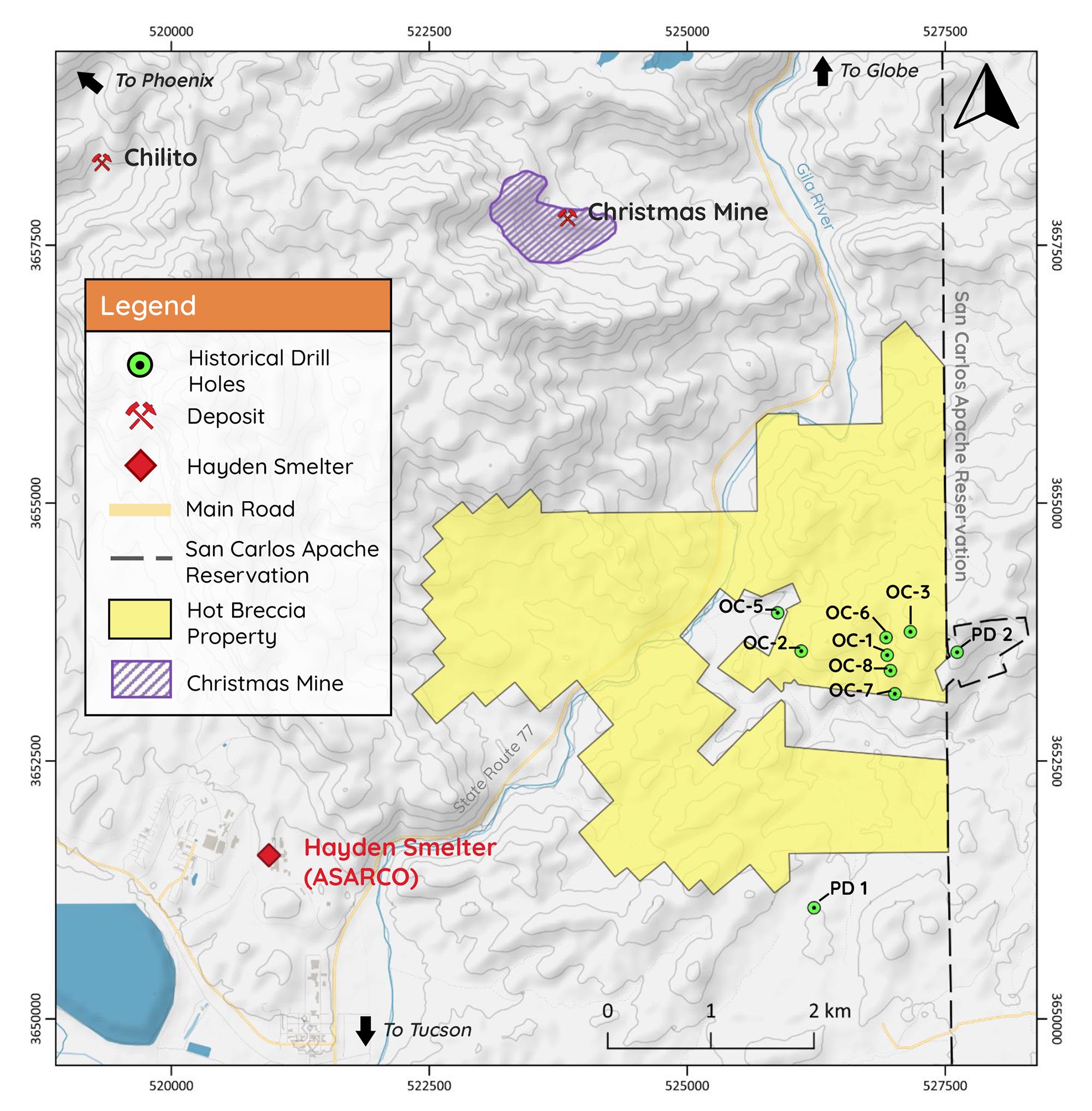

It acquired an option to earn a 100% interest in the Hot Breccia project in Arizona, adjacent to the Christmas mine (which produced about 28 million tonnes at an average grade of 1.5% copper from a combined open pit and underground operation) and just a few kilometers from the Hayden smelter (which process the concentrate from a nearby ASARCO mine), so location-wise, Hot Breccia is in a perfect spot. The map below also shows the presence of exceptionally large copper deposits in Arizona within a pretty narrow radius around Hot Breccia. Of course the simple fact Hot Breccia is close to existing mines and projects with in excess of 10 billion pounds of copper is meaningless as Infinitum is chasing an exploration theory at Hot Breccia. But it does show Infinitum is active in the right postal code.

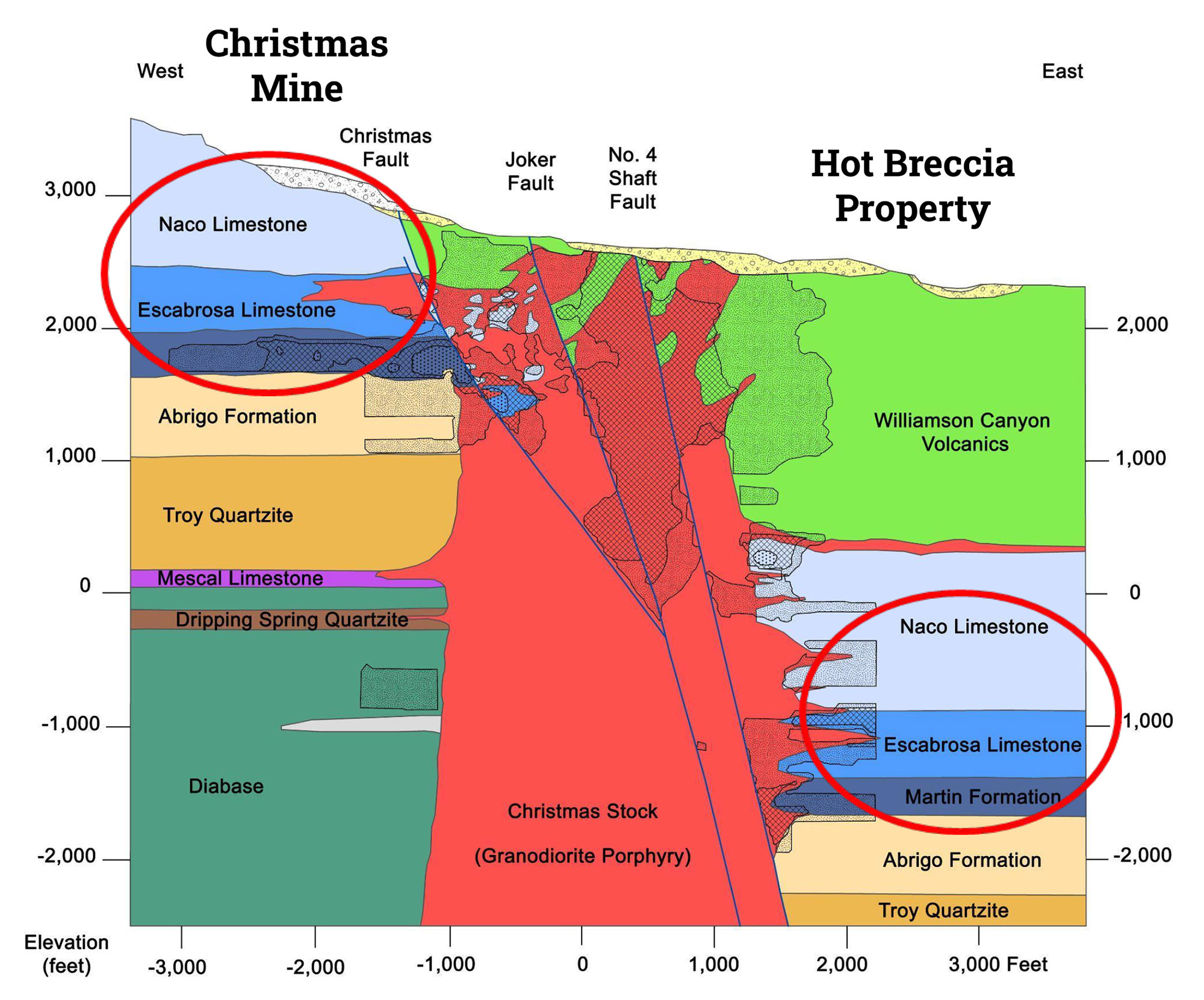

The exploration theory at Hot Breccia is quite simple (as far as these theories are ever really simple). The image below shows a cross section of the area with the Christmas mine on the left. The (high-grade) copper mineralization at Chrismas was hosted in three carbonate host rocks, the Naco limestone, Escabrosa lime stone and the martin formation, the three blue-colored layers on the upper right corner.

These carbonate host rocks are underlaying the Williamson Canyon Volcanics at Hot Breccia. So the plan is to drill through these volcanics to drill-test the two limestone zones and the Martin formation for copper mineralization. And Infinitum knows it’s there. Historical drill holes from the 70s were focusing on the area and while all holes intersected alteration, it was one of the two holes drilled by Phelps Dodge that sparked the interest as it intersected about 400 meters of skarn with several intercepts of in excess of 1% copper with a maximum grade of 3.16% copper. Unfortunately official records have been destroyed or are inaccessible, so Infinitum will have to gather its own data but at least it already knows it’s looking in the right spot.

The company can acquire full ownership of Hot Breccia (subject to a 2% NSR to be issued to the vendor) by making C$693,000 in cash payments, issue 3.125 million shares of Infinitum and committing to C$5.5M in exploration expenditures with relatively light commitments in the first few years of the earn-in agreement as only C$1.75M has to be spent within the first three years of the earn-in agreement. So if the HotBx property isn’t as promising as it looks, Infinitum can just walk away after a few years.

The company is led by a veteran

Two interesting copper projects, that’s for sure. But even a good project can be screwed up by a bad team. When Infinitum Copper was put together, Steve Robertson as hired as its CEO. Robertson has plenty of experience in the copper exploration sector as Vice-President at Imperial Metals (III.TO) and more recently CEO of Sun Metals until it merged with Serengeti Resources to form Northwest Copper (NWST.V).

Steve Robertson – CEO & Director

Geologist with 30+ years experience in exploration, mine operations and executive roles in mining. Steve Robertson is a Canadian geologist and mining executive who earned a BSc. in Geology from the University of Alberta.

After graduation, he spent five years conducting exploration with Corona Corporation and then 24 years working at Imperial Metals, a mid-tier mining company that has been involved in the development and operation of five mines, primarily in British Columbia.

He is currently a director of Cassiar Gold and he joined Infinitum Copper as director, and founding President and CEO in early 2021.

Jorge Rafael Gallardo – Senior Exploration Manager

Mr. Gallardo Romero is graduated from the University of Sonora as with a BSc in Geology in 1984, he has more than 35 years of experience in exploration of mineral deposits in precious metals and base metals in different styles of deposits, mainly in Mexico and part of South America .

From 1992 to the present, Mr. Gallardo has been a consultant for Minera Cascabel working for more than 35 Canadian and Australian companies as Exploration Manager.

In October 2019, he was appointed Director of Prismo Metals and was recently appointed as Exploration Manager for Infinitum Cooper and Technical Advisor for Reyna Gold.

It’s also important to have a good team and Infinitum has renowned and well-respected guys like Peter Megaw and Douglas Kirwin as senior technical advisors.

Dr. Peter Megaw – Senior Technical Advisor

Geologist and co-founder of MAG Silver, has 40+ years involvement in Mexican geology with multiple discovery credits.

Douglas Kirwin – Senior Technical Advisor

Geologist with 50+ years of international exploration experience, including Executive VP for Ivanhoe Mines Limited 1995-2012.

The recent cash injection will help to reach the objectives

Infinitum raised a total of just under C$4.1M before the completion of the RTO. The majority of the financing was conducted at C$0.40 per unit with almost 6 million units issued consisting of a share and half a warrant with a strike price of C$0.60 valid for a period of 24 months. A previous raise was conducted at C$0.15 for a straight-share financing to raise about C$1.65M. While a total of C$4.1M was raised before the completion of the RTO, that RTO took seven months which is longer than expected and by the end of March Infinitum’s working capital position had already decreased to C$1.65M.

As exploration is a cash drain, Infinitum Copper needs to make sure its treasury remains at a healthy level throughout the year to avoid the market starting to speculate against the company. To ensure a strong enough working capital level throughout the summer, Infinitum Copper raised C$1.1M in a financing priced at C$0.20 per unit (with a first tranche closing in July while a second tranche closed earlier this month). A total of 5.7 million units were offered with each unit consisting of one share and one warrant allowing the warrant holder to acquire an additional share of Infinitum Copper for a period of two years at C$0.45.

This increases the warrant count to just under 9 million with 3.3 million warrants (at C$0.60) expiring in September/October 2023 with an additional 5.7 million warrants at C$0.45 expiring in July/August 2024. Should all warrants be exercised, the total proceeds would come in at approximately C$4.5M but considering the share price is currently trading below C$0.20 we aren’t anywhere close to seeing warrants being exercised.

The stock is pretty illiquid but hopefully that will change once the drill results start rolling in.

Conclusion

There are currently approximately 45.6 million shares outstanding which means the market capitalization is just under C$9M at this point. Although Infinitum is still earning into both properties, the earn-in requirements are very much exploration-centered as the two deals require very little cash to be paid to the vendors but require millions of dollars to be spent on exploration. Dollars that would be spent anyway to get a better understanding of the copper targets.

The initial batch of assay results from the Adelita drill program should be released in the next few weeks and hopefully the company can replicate some of the high-grade trenching results. This still is an early exploration story so we obviously shouldn’t expect the first hole to be the best hole. A methodological approach will be needed but there is a reason why Minaurum Gold held onto this property for so long.

Disclosure: The author has a long position in Infinitum Copper. Infinitum Copper is a sponsor of the website. Please read our disclaimer.