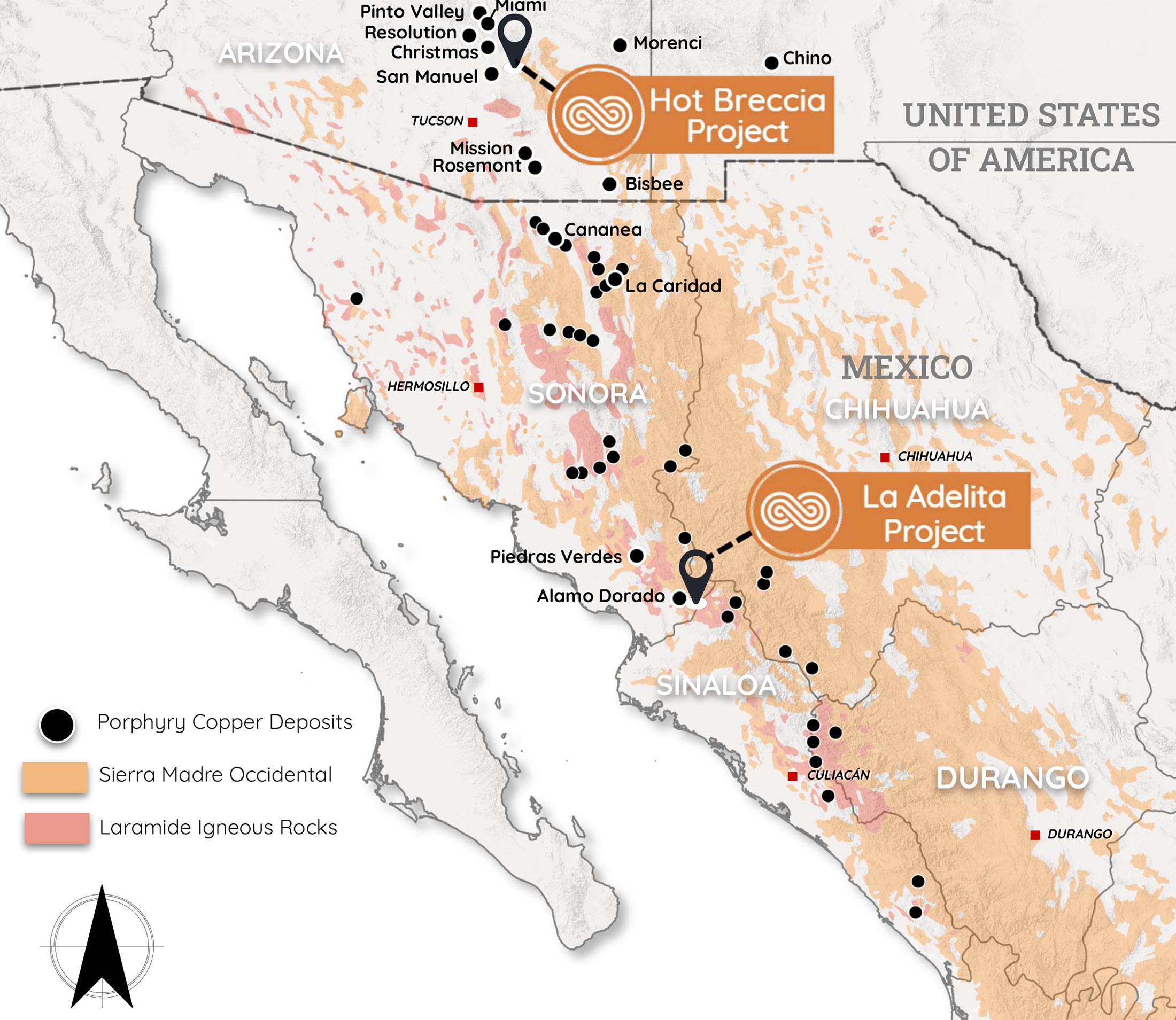

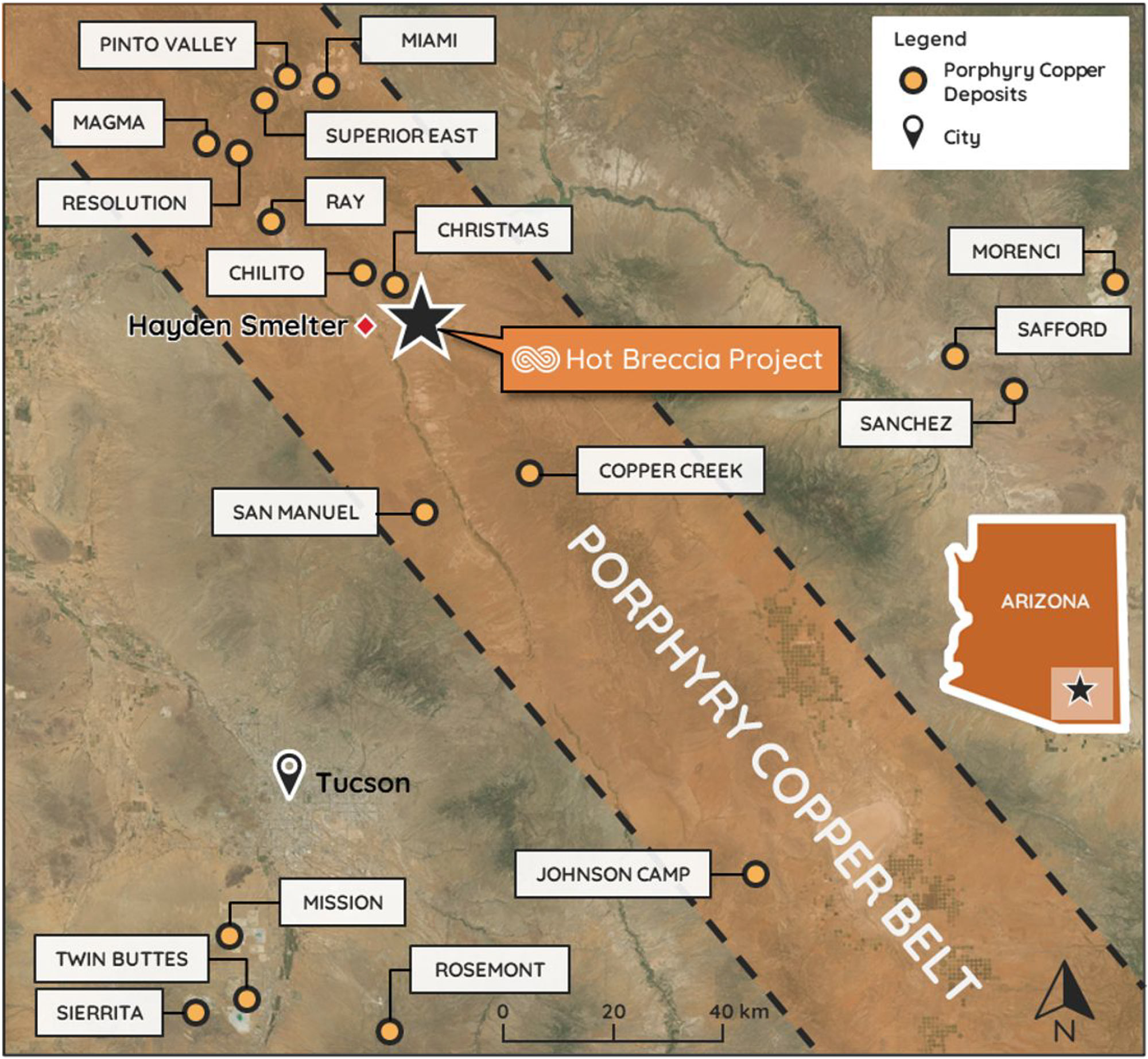

Last week, Infinitum Copper (INFI.V) announced it entered into an agreement with Prismo Metals (PRIZ.C) whereby the latter can earn a 75% stake in the Hot Breccia project in Arizona. Infinitum entered into the initial option agreement to acquire full ownership in the project from private vendors almost a year ago but the deteriorating equity markets meant it was doubtful Infinitum would be able to complete the work commitments on both assets.

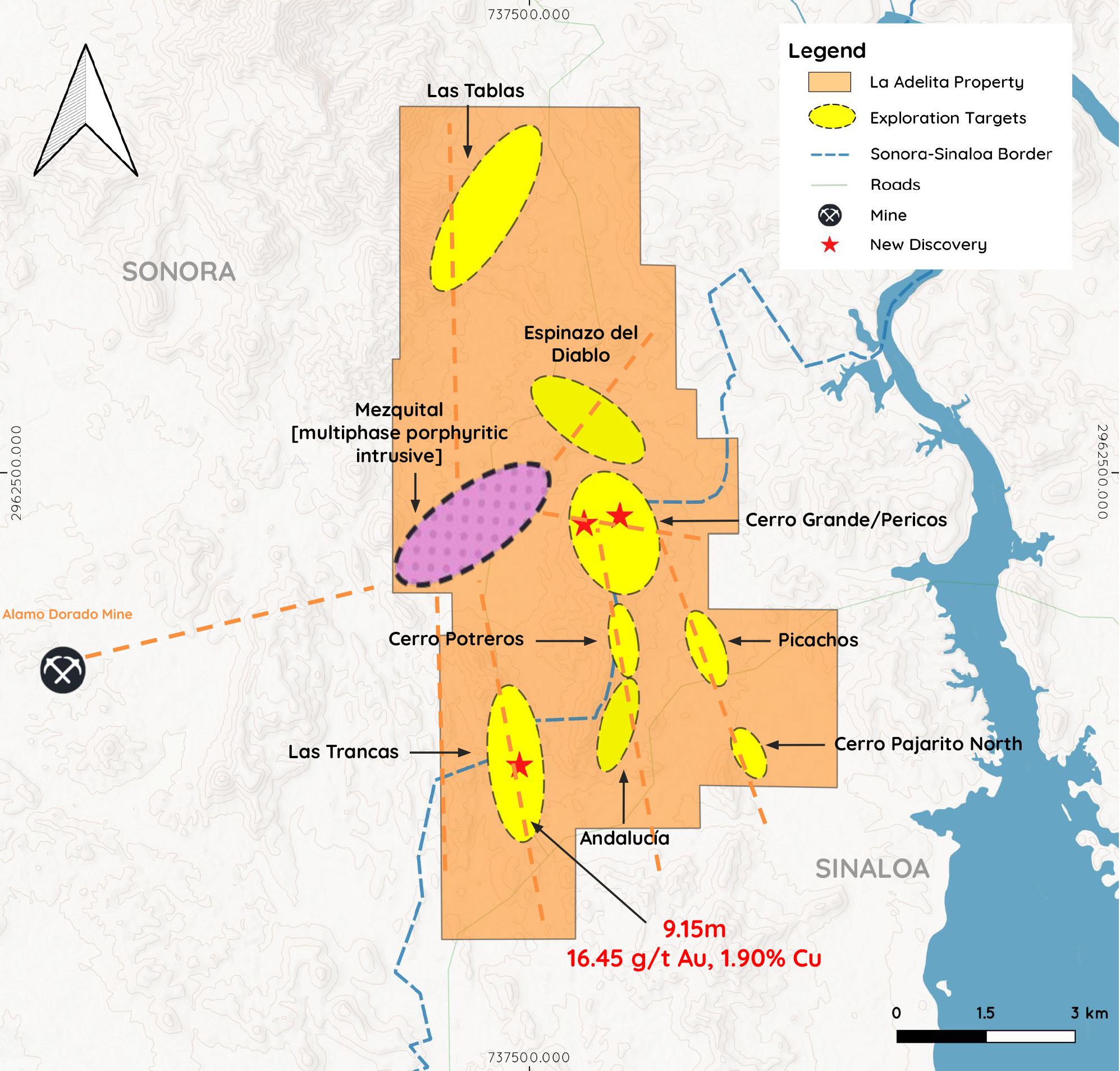

The logical solution was to focus on the Flagship La Adelita project in Sonora, Mexico and find an elegant solution for Hot Breccia. The partnership with Prismo Metals likely is the best of all the options on the table as Infinitum can focus on the high-grade copper mineralization at La Adelita. You can read our opinion on the 2022 drill results here.

The company recently appointed Matthew Hudson as its new CEO as former CEO Robertson will move to a chairman role. We caught up with Hudson to discuss the company’s plans and what his ambitions are for Infinitum Copper.

The recently signed agreement with Prismo Metals will make life easier for Infinitum Copper

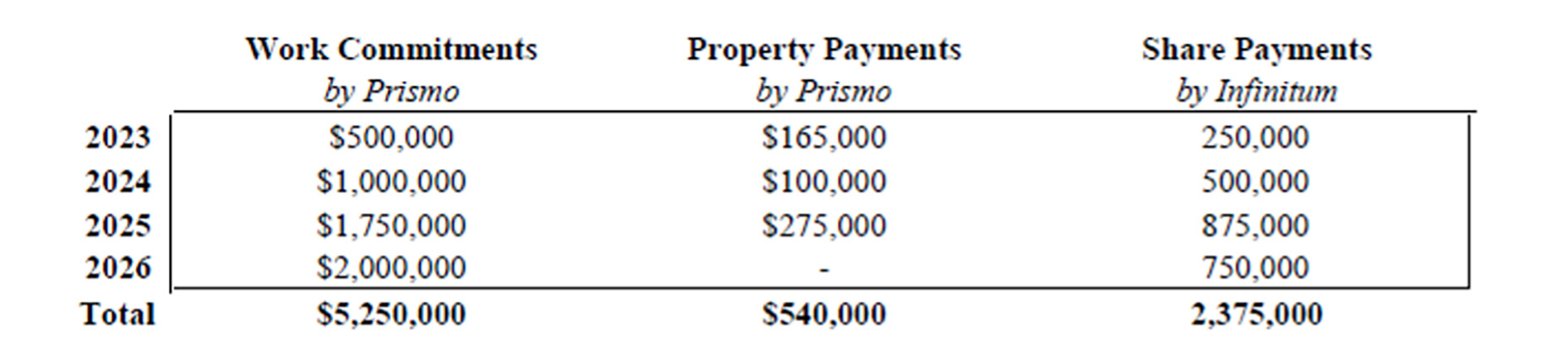

Infinitum Copper and Prismo Metals will now jointly work towards securing full ownership of the project which will result in a 75/25 ownership ratio when the agreement is completed. The deal is pretty straightforward: Prismo takes care of the required work commitments and cash payments, while Infinitum will continue to make the required share payments, issuing 2.375M shares to the vendor.

While Infinitum has to give up 75% of the project, it also means it doesn’t have to fund almost C$6M in work commitments and property payments. Seeing how Infinitum wasn’t even able to complete a C$1M placement in December, making required cash payments and expenditures to the tune of C$665,000 in calendar year 2023 would likely have been too much to ask for given the current state of the markets.

Instead, Prismo commits to spending C$0.5M on the property an making the C$165,000 cash payment to the private vendor while the total required cash outlay increases over the next few years. Prismo will be required to spend C$1.1M in 2024, in excess of C$2M in 2025 and C$2M in 2026 on a combination of exploration and property payments to live up to the contract with the vendors. Meanwhile, there’s no requirement at all for Infinitum to tap into its cash position and it will basically only have to issue just under 2.4M shares to obtain its 25% stake. This means the cash that will be raised by Infinitum this year will be directed towards exploration on the flagship La Adelita project.

The December placement wasn’t a big success

One of the reasons why Infinitum entered into that agreement with Prismo may have been related to the lack of interest in Infinitum’s most recent placement. Infinitum initially wanted to raise up to C$1M in a placement priced at C$0.13 per unit (with each unit consisting of one common share and half a warrant with each full warrant allowing the warrant holder to acquire an additional share for C$0.22). Shortly after announcing the terms of the placement, Infinitum’s share price started trading below the unit price and rather than caving and repricing the placement, Infinitum elected to keep the terms unchanged.

This means Infinitum was only able to raise C$155,000 by issuing just under 1.2 million units. About a third of the financing was taken up by (former CEO) Steve Robertson, investing C$50,050 to acquire 385,000 units, taking his stake to just under 2.4 million shares. While the placement was a dud, it is good to see someone from senior management actually participating at that level.

But of course, raising just over $150,000 isn’t very helpful and it reduces the odds of being active on two exploration fronts this year. And rather than seeing Hot Breccia gathering dust on the shelf, Infinitum decided to enter into the agreement with Prismo Metals.

Following up with newly appointed CEO Matthew Hudson

While unexpected, it likely is the best decision to move forward on two fronts. And while knowing this is not your core business model, is this an approach you could perhaps repeat in the future? Identify projects and then look for or vending them back out again, or should we see this as a one-time thing?

It’s not our intention when we look at potential new projects as we are first and foremost exploration company as opposed to a prospect generator. But we are also a minnow and we need to be nimble and flexible. The transaction with Prismo is exceptional; we have substantial exposure to the upside and now that the deal has closed we have no downside risk.

Who is the operator of the exploration program? And will the exploration approach be determined by a joint decision?

The operator up until the C$5.5M has been expended is Prismo with input from Steve Robertson but the decision on where to spend that money is really up to them. Once that amount has been spent the arrangement reverts to a 75:25 joint venture.

What happens if Prismo backs out before completing the requirements for its 75% earn-in? Do you retain the underlying right to acquire 100% of Hot Breccia? And what if Prismo decides last minute it won’t meet the work commitments, could that leave you hanging?

Infinitum maintains full back in rights to the transaction so yes we could still acquire 100%. The Prismo transaction mirrors the original transaction with the landowner. We don’t foresee a situation where Prismo will back out last minute. We’ll be working closely with them and will receive exploration updates along the way. We can’t see a situation whereby we wouldn’t have had several months’ warning and therefore have time to make alternative arrangements.

Let’s focus on La Adelita for a moment. Have you done any work since announcing your latest batch of drill results in September?

No, nothing significant although the data from last season is still being processed. We are waiting for two more holes that were sent back for re-assaying. A lot of work is going in to generating this year’s drill targets.

As part of the agreement with Minaurum Gold (MGG.V) to acquire La Adelita, you are required to spend C$3M in exploration on the project within five years (until January 2026) and fortunately there are no annual requirements. How much of the required C$3M have you already spent so far?

To date we’ve spent over C$2.5M We will easily exceed our expenditure commitment with Minaurum at the end of this year and therefore 3 years ahead of schedule. Once our aggregate spend exceeds C$4.75M Minaurum is then required to contribute there share to the project or dilute. We will certainly be there in 2024, potentially this year if we have some great results and accelerate our program.

And, Matthew, you are new to the company. Could you perhaps elaborate a little bit on your background and why you decided on taking on the job?

I’ve been involved in the resources industry for a long time now. Back in 2016 I began remnant mining at an old silver mine in Mexico. I operated this until early 2020. It was during this time that I met Peter Megaw and became a true believer in his high grade district scale mantra. Adelita perfectly fits the bill at almost 6,500 hectares with multiple high grade copper intercepts. So I’m comfortable in Mexico, I already have great relationships with all the team from other projects and I’m a true believer in the potential of the project. We have a market cap of $4m while Oroco, our closest comparable 20km up the road, is $200m. I can see a clear path to success in the immediate future.

You live in Australia. How easy will it be to manage a Canadian company with its flagship asset in Mexico?

It surprisingly easy, the time difference with Vancouver is not bad at all. My 7am is 12pm pacific standard time and I’m an early riser anyway! Hermosillo is only an hour different to Vancouver as well. In some ways it’s an advantage because I can get most of my work done before lunchtime here.

Conclusion

The agreement with Prismo Metals ensures the C$0.5M work commitment in 2023 can be met without having to resort to making a difficult choice between spending money on La Adelita or Hot Breccia. In a perfect world, Infinitum would have been able to work on both assets. But the reality is that even with copper trading at $4 per pound, exploration stage companies still have difficulties to secure funding to be used specifically for exploration an tough choices have/had to be made.

It’s not an easy situation to be in for Infinitum Copper but at least it is now clear this year’s entire focus will be on La Adelita. Steve Robertson is stepping down as CEO to become the company’s chairman and newly appointed CEO Matthew Hudson appears to be keen to hit the ground running.

Disclosure: The author has a long position in Infinitum Copper. Infinitum Copper is a sponsor of the website. Please read our disclaimer.