We have been keeping track of Integra Gold’s (ICG.V) developments ever since we first visited the company’s project in January 2014. The weather was horrible with a temperature of minus twenty degrees, and even though the company was sitting on just a few hundred thousand ounces of gold, we were impressed. The surface was covered in a thick layer of snow, and there were no obvious signs this would become one of the hottest exploration stories in Québec (or in North America for that matter) even though we walked away from the property, thoroughly impressed with Hervé Thiboutot, Integra’s Senior VP, and our main reason to be positive about this company’s chances to be successful.

But not only did the Integra technical team consistently report exploration successes, ICG was able to take advantage of the downturn on the precious metals scene when it purchased the Sigma-Lamaque mill from Deloitte which had arranged the sale of the asset from it’s receiver after previous owner and operator Century Mining/White Tiger was unable to meet its debt commitments.

The site visit emphasizes the excellent access to infrastructure

Back in August, Integra Gold organized a new, large site visit to make sure Bay Street in Toronto (and all other applicable street names in the rest of the world) were kept up to date on Integra’s achievements and as the company is now working on an updated resource estimate and, more importantly, a new Preliminary Economic Assessment which will include the ounces found at the No. 4 Plug Deposit.

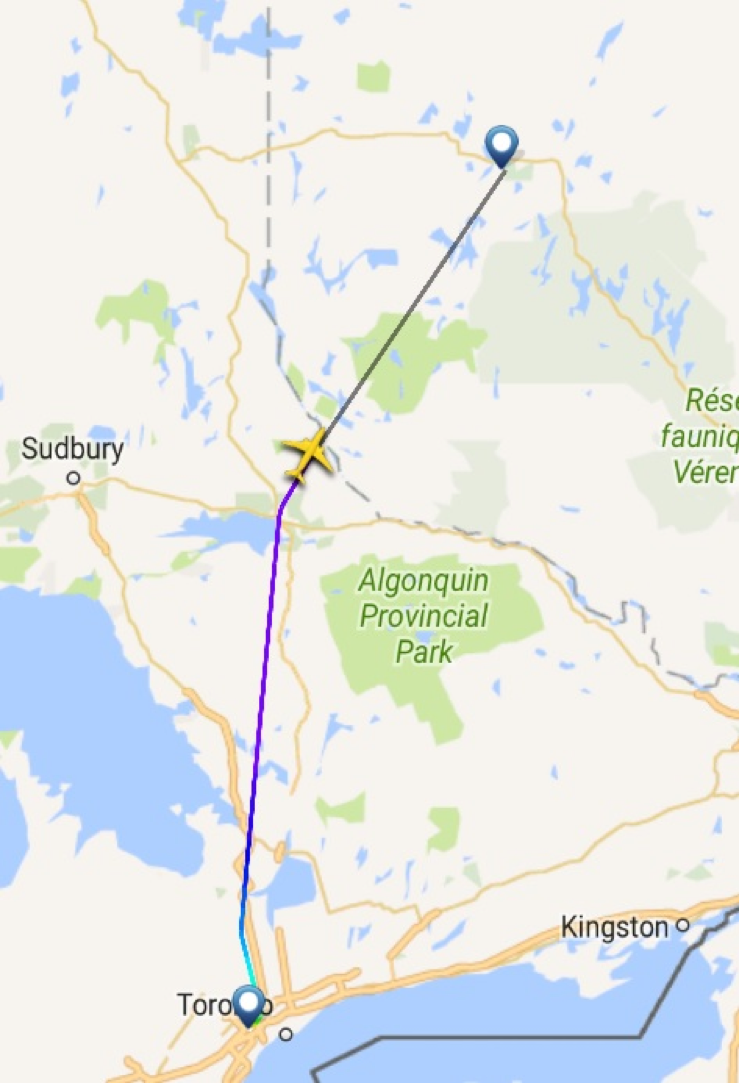

Even though there are several flights per day between Val D’Or and Montréal (operated by Air Canada and Air Créebec), Integra chartered a plane to immediately fly the (70-80) site visit attendees to Val D’Or, straight from Toronto Pearson International airport.

This emphasizes how accessible the property is. Not only is it just a 55 minute flight from Toronto, a part of the company’s claims covers the airport territory so upon landing it’s just a few minutes to reach the different exploration zones or the 2,200 tonnes per day mill per car or bus. That mill is obviously connected to the power grid, and as Integra will be able to source all labor from the nearby city of Val D’Or.

Visiting the Sigma-Lamaque mill: impressive

Even though it’s been two years since Integra Gold entered into an agreement to purchase the Sigma Lamaque mine and mill from Deloitte, which oversaw the sale of the asset from the receiver after Century Mining was unable to repay debt. Integra moved fast, and acquired the mine and mill for C$1.75M in cash as well as 25 million shares of Integra Gold. Management has confirmed that these shares have now been placed into strong “institutional hands.”

We tip our virtual hats to the Integra management, as they played this really well. Approximately 60% of the cash consideration (C$1.025M) was paid by a local company which was predominantly interested in the waste rock piles to use the rock as aggregate. This basically means Integra acquired the Sigma-Lamaque mill and mine for a total consideration of C$6.4M, of which 85% was paid in shares, which subsequently found a new home in strong hands. Not bad, if you know the replacement value of the mill is approximately C$98M.

We think the current four-stage tailings facility could accommodate the waste generated by approximately 2 years of mining, but it should be fairly easy (and cheap) to increase and expand the embankments of this tailings facility to have sufficient capacity for at least five more years, so we’re not particularly worried about this.

The mill has been on care and maintenance since 2012 but seems to be in a pretty good shape, as you can see in the pictures.

Going from 1,500 tpd to 5,000 tonnes per day?

As you might remember, Integra Gold’s first PEA was based on a scenario whereby the company would process just 1,500 tonnes per day during a 4 year mine life. A lot has changed since then, and not only will the mine life be substantially longer after having increased the resources at Triangle to 1.5 million ounces contained in approximately 6.5 million tonnes.

This means that the Triangle zone by itself could support a mine life of almost 12 years, and that doesn’t even include the drill results from the past 10 months. Needless to say we are expecting the total tonnage at the Triangle to continue to increase and a 1,500 tonnes per day scenario would result in a mine life of 15 years or longer.

This allowed the company to re-think the production scenario. After all, the base case of 1,500 tonnes per day was based on a smaller resource and was also introduced before the company acquired the Sigma-Lamaque mill which is located within walking distance from the Triangle Deposit (without any exaggeration, we think we could walk from Triangle to the mill in less than 30 minutes on the new road Integra built to connect the two sites).

As that mill had a nameplate capacity of 2,200 tonnes per day, it would probably be pretty stupid to not maximize the capacity of the mill. After all, this would unlock additional economies of scale by reducing the processing cost per tonne of rock, but it would also allow the company to reduce its initial capital expenditures by removing the costs associated with downsizing the official capacity.

On top of that, the importance of the No. 4 Plug Deposit continues to increase and we expect a huge triple digit percentage increase in both the total amount of ounces (140,000 ounces) and tonnes (523,000), which would not only validate the company’s plan to start the production at 2,200 tonnes per day, but could also allow Integra Gold to look even further.

After all, Triangle Deposit and the No. 4 Plug Deposit are just two of the company’s zones on the extensive Sigma-Lamaque land package, and we would almost forget about the Parallel Deposit (215,000 ounces and counting, just half a kilometer from the past producing Lamaque mine) and the Fortune Zone (which doesn’t contain a lot of gold yet, but as it’s located just 800 meters from the Parallel Deposit, it could be a perfect satellite deposit).

Should Integra be successful in increasing the resources at Fortune and Parallel, and should the company find more gold at Lamaque Deep (see later), it should be fairly simple to increase the throughput of the mill. And let’s not forget the acquired Sigma-Lamaque mine, which was part of the mill acquisition, contains 2.5 million ounces of gold, of which almost 600,000 ounces are part of the measured and indicated resource categories. As the M&A resources at Sigma-Lamaque have an average grade of 4.96 g/t, this material could be blend with the higher grade ore from other satellite deposits. Integra is currently evaluating/modeling the existing resource at Sigma and will focus on any mineralization between 0 and 400 metres vertical.

Lamaque Deep – Stairway to heaven?

The company is in the middle of a 90-100,000 meter drill program which has been budgeted at C$12-14M, and even though there’s a backlog of tens of thousand meters of drilling, Integra Gold isn’t slowing down at all. The company is constructing an exploration ramp into the Triangle Deposit to conduct underground exploration at the zone. This ramp will be advanced at an average rate of 150-175 meters per month, at a cost of approximately C$2200-2300/meter and will reach the upper zones of the deposit in the fourth quarter of next year.

One of the most exciting targets which is currently being drilled, is the Lamaque Deep zone. As you might know, a lot of high grade mines in Québec are continuing at depth for thousands of meters, and there’s no reason why the Lamaque mine should be the exception. Lamaque is a past producing mine, producing almost 5 million ounces of gold at an average grade of 5.9 g/t.

Whereas the Sigma mine produced gold from a depth of 1,850 meters, the Lamaque mine was shut down when the miners reached a depth of 1,100 meters. As both mines are located just 500 meters apart from each other, we would be very surprised if the 1,100 meter level would indeed be the ‘end point’, and that’s why we agree for 100% with Integra’s claim the Lamaque Deep zone is ‘the most obvious untested gold target’.

And we are actually pretty excited about the potential here, if you know the Lamaque mine was one of the most prospective mines in the Abitibi region with a total gold content of approximately 4,000 ounces per vertical meter. So if Integra would be able to confirm the mineralization is continuing towards the 1,850 meters just like Sigma, the Lamaque Deep zone might easily contain 2-3 million ounces of gold.

As Herve Thiboutot mentioned during one of his presentations at the site visit ‘You can’t test a target with a few holes and a few thousand meters of drilling. You need to drill at least 5,000 meters on any given target to really know if you might have something or not. I now have the money, so I will drill’.

Thiboutot will have fun at Lamaque Deep as Integra Gold will drill a 2,000 meter deep pilot hole, where after no less than 15 wedged holes will be drilled, originating from the deep pilot hole. The entire program, including the pilot hole and wedged holes, will consist of 10,000 meter of diamond drilling, indicating each wedged hole will be several hundred meters long. This should give Integra Gold a pretty good idea of what’s underneath the historic mine workings at the Lamaque mine.

Conclusion

Integra Gold’s Lamaque South project hosts approximately 1.7 million ounces of gold at an average grade of in excess of 9 g/t (using a cutoff grade of 5 g/t), which excludes the resources at the Sigma-Lamaque mine which were included in the mill acquisition, but there’s little doubt an upcoming updated resource estimate will lift the Lamaque South resources to in excess of 2 million ounces, and probably closer to 2.25 million ounces using the same cutoff grade of 5 g/t.

This will reconfirm Integra Gold’s status as a potential takeover target, as multi-million ounce assets with a permitted mill in a safe region are quite scarce. It’s difficult to build an economic model as long as there’s no updated resource estimate (and especially the No. 4 Plug will play a very important role as we expect the mining dilution to be lower as Integra will very likely mine thicker stopes), but after our site visit we are upgrading our expectations and are now aiming for an after-tax NPV5% of at least C$600M, using a gold price of US$1300/oz and an USD/CAD exchange rate of 1.30 (resulting in a gold price of almost C$1700/oz).

This also mitigates the often-heard comments about Integra’s share count because even if you would use the fully diluted share count of 500 million shares, the after-tax NPV5% per share would still be in excess of C$1/share (still excluding further resource expansion beyond this year’s drill program, excluding all ounces on the Lamaque North zone, and excluding the potential at Lamaque Deep).

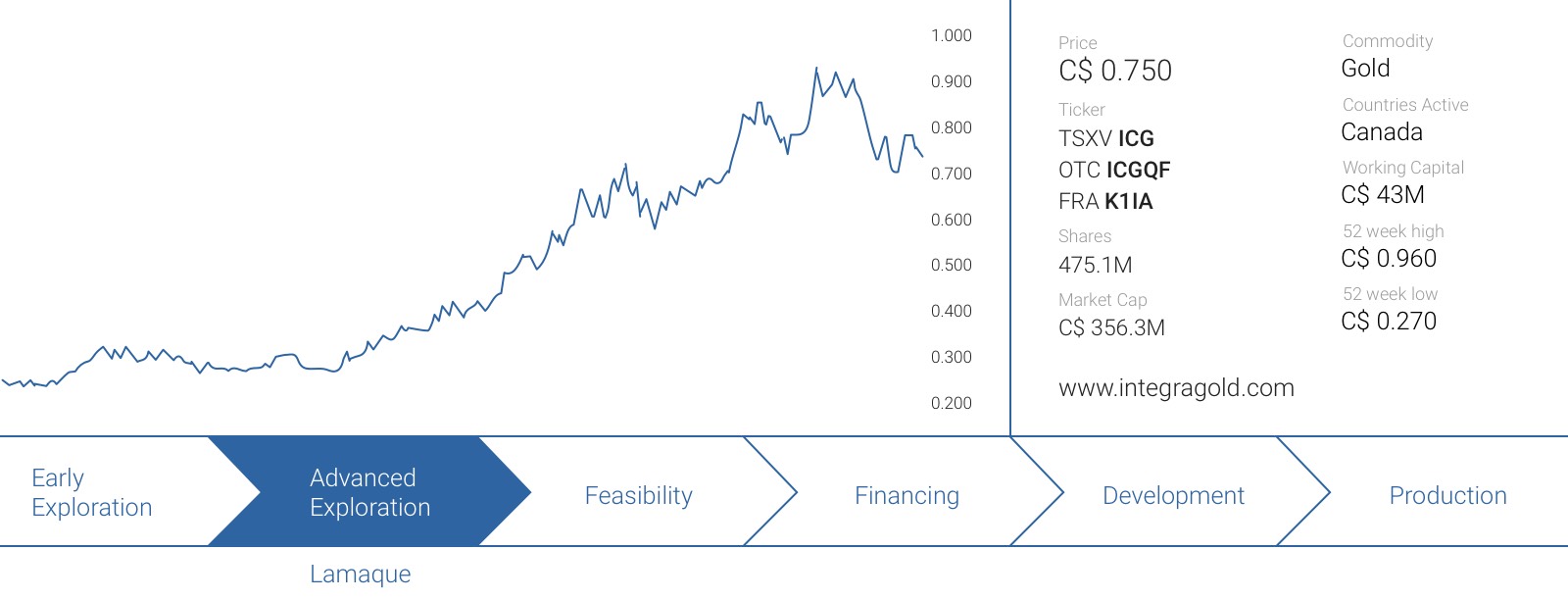

The company’s share price fell from C$0.96 in August to a low of C$0.68, which we consider to be a healthy correction, but at the current share price of C$0.80, Integra is trading at less than 0.7 times our anticipated Net Present Value.

As the Novastar-song goes ‘the best is yet to come. And if you need a good reason, I’ll give you one’. We hope we have now given you plenty of reasons to keep an eye on Integra Gold, as the company is getting ready for an action-packed final quarter of the year.

The author holds a long position in Integra Gold. Integra Gold is a sponsor of the website. Please read the disclaimer