The share price of Integra Resources (ITR.V, ITRG) has performed really well this year. When the company acquired the Florida Canyon gold mine in Nevada, the asset was a ‘marginal producer’; it was generating cash flow, and it would generate enough cash flow for Integra Resources to avoid coming back to the market to raise more equity to get the advanced stage DeLamar project through the feasibility and permitting phase.

Integra was lucky. Smart and lucky. Shortly after completing the acquisition of Florida Canyon, the gold price started to increase and instead of generating a margin of $300-400/oz (as initially anticipated), Florida Canyon will have a margin of approximately $1500/oz (and increasing going forward, at a stable gold price, as sustaining capital expenditures will decrease). It goes without saying ‘luck’ played a big role, but every day gold trades above $4000/oz, Integra is laughing all the way to the bank. The acquisition (unexpectedly) paid for itself in two quarters of production, a fantastic IRR for Integra and its shareholders.

The cash is piling up and the Florida Canyon mine is now generating more cash flow than what’s realistically needed to get DeLamar through the permitting process ahead of making a final investment decision. In fact, Integra is able to hoard some cash that will come in very handy to fund the equity portion of the DeLamar construction capex (assuming the project will get permitted and Integra’s board greenlights the decision to actually build the mine).

The results of the DeLamar feasibility study were recently published and in this report we have a closer look at the initial numbers (the definitive NI43-101 technical report still has to be filed) while we will also discuss the recent Florida Canyon performance and Integra’s current balance sheet with the rapidly increasing cash position.

The DeLamar Feasibility study: a first look

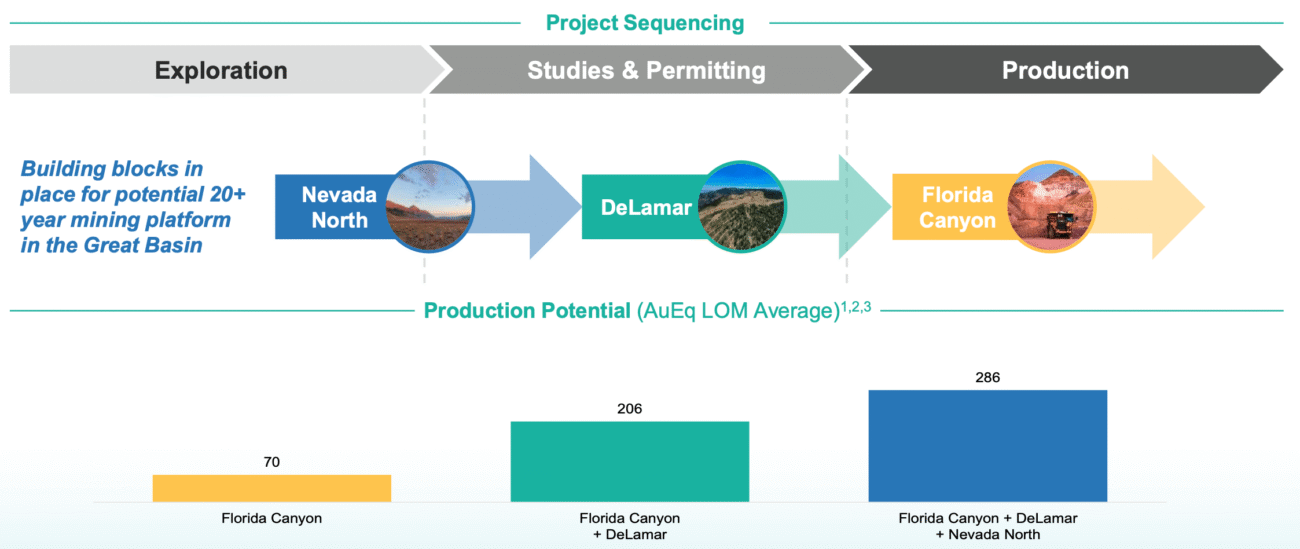

Last week, the company announced the results of the Feasibility Study it completed on the DeLamar gold-silver heap leach project in Idaho. This was Integra’s initial flagship project before it acquired the Florida Canyon gold mine in Nevada, and now it is the next step in the company’s growth trajectory.

The study calls for an initial 10 year mine life, focusing on the heap leach operations at DeLamar. During that 10 year mine life, the company expects to recover 910,000 ounces of gold as well as 17.4 million ounces of silver for an average gold-equivalent production of approximately 106,000 ounces in the initial ten year of the mine life, while the average output is slightly higher in the first five years at 119,000 ounces of gold-equivalent per year.

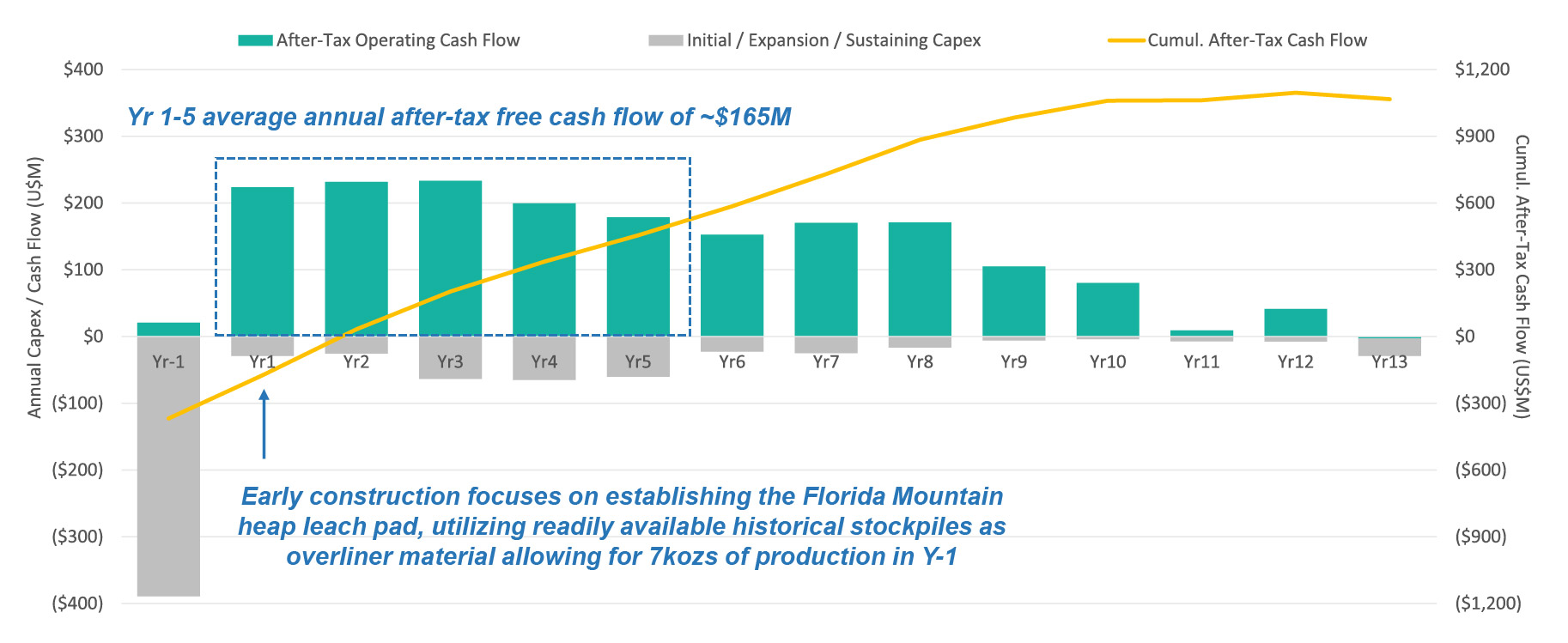

The mine can be built for a total capex of less than US$400M (including contingency and the owners cost) and boasts an anticipated AISC comes in at US$1480 per ounce gold-equivalent assuming gold and silver are co-products. Using the silver credit as a by-product revenue, the AISC per produced ounce of gold drops to $1142/oz (using $35 silver in the base case scenario).

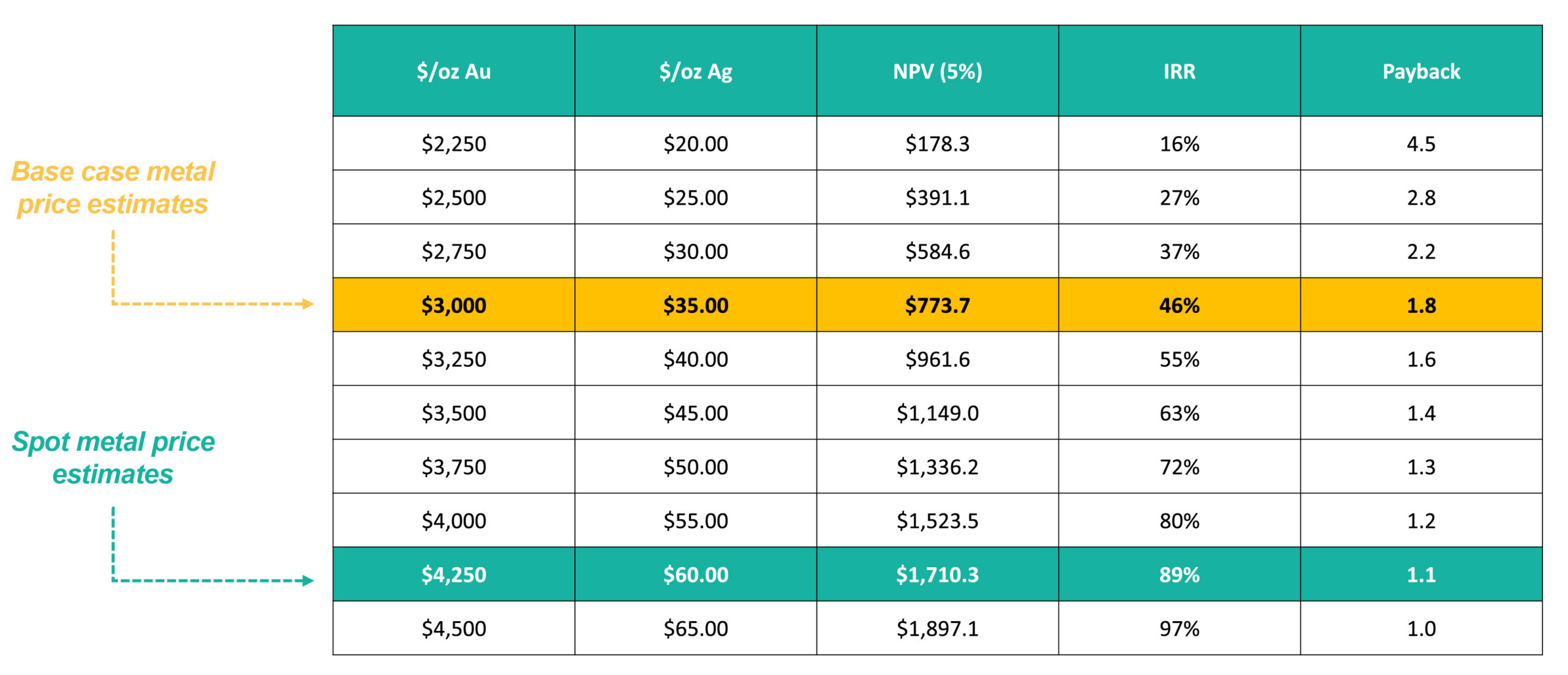

This results in an after-tax NPV5% of US$774M (C$1.07B using an USD/CAD exchange rate of 1.38 CAD per USD), and more importantly, an IRR of 46% on an after-tax basis, using $3000 gold and $35 silver in the base case scenario.

The payback period using the aforementioned gold and silver prices is just 1.8 years while the NPV to capex ratio, an important metric these days, is approximately 2:1.

While we wouldn’t have dreamt of using a gold price of $3000/oz in a base case scenario just six months ago, times have changed. Even SSR Mining recently used $3100 gold in its updated study on the CC&V mine (which, granted, is a producing mine), and considering $3000 gold still represents a 30% discount to the current spot price, it’s not too far fetched. In addition, Consensus Pricing of the entire mining research industry is $3000/oz or higher and we recently saw Goldman Sachs confirming its outlook for 2026 using $4900 gold.

Integra also provided an extensive sensitivity table. As you can see below, using $3500 gold and$45 silver would get you US$1.15B in after-tax NPV5% and at $4250 gold and $60 silver (which – surprisingly – still is below the current spot price), we are talking about a US$1.71B after-tax NPV5%. Meanwhile, the after-tax IRR jumps to almost 90% with a payback period that’s measured in months instead of years.

But the pendulum of course swings both ways. The sensitivity table also shows that at $2000 gold or even $2250 gold, the project likely won’t get built, like so many others who are aiming for development. But at $2500, the after-tax IRR still is a respectable 27% while the after-tax NPV5% still comes in at approximately C$550M. So based on the sensitivity analysis shown above, it looks like Integra’s board should make a positive Final Investment Decision on DeLamar as long as the gold price remains above $2500/oz (and of course assuming the company will receive the required permits in 2027).

This is just a first look, and we may circle back once the NI43-101 technical report will be filed, while we also expect Integra to kick off the permitting process in Q1 2026.

Meanwhile the Florida Canyon gold mine is a cash machine at $4000 gold

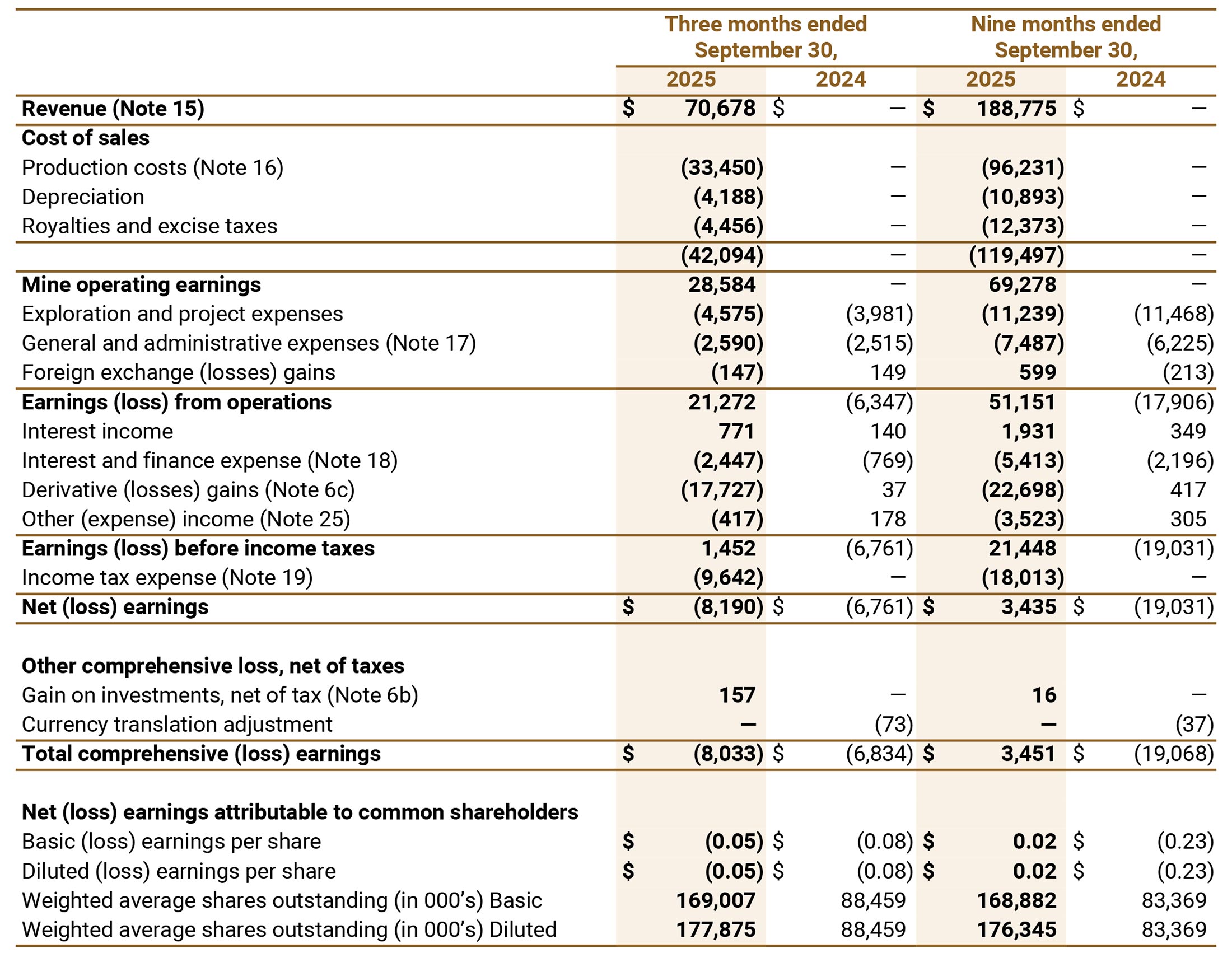

In the third quarter of this year, the Florida Canyon mine produced just over 20,600 ounces of gold, and 98% of the gold production was effectively sold during the quarter. The average realized gold price was just under $3,500/oz.

This resulted in a total revenue of just under US$71M (Integra is a Canadian company but it reports its financial results in US Dollars) allowing Integra to report almost US$29M in mine operating earnings after taking the production costs, royalty payments an depreciation expenses into account.

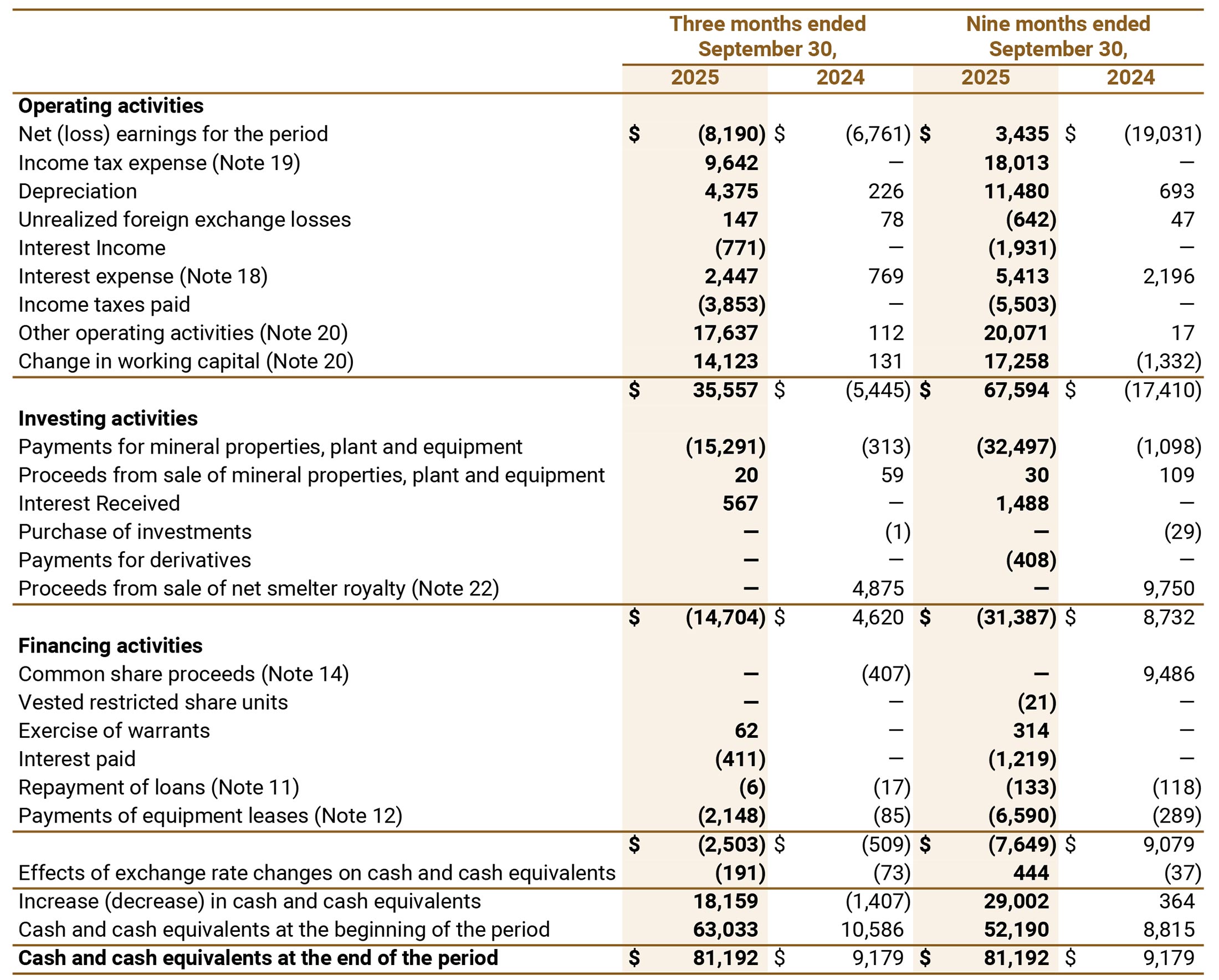

As the company also expensed in excess of US$4.5M of drilling and recorded US$2.6M in overhead expenses, the total operating income was $21.3M. Despite that solid result, the bottom line showed a net loss of approximately $8.2M.

As the image above shows, there are two important elements that had a very negative impact on that bottom line result.

First of all, Integra recorded a $17.7M derivative loss in the third quarter. This is a non-cash charge and is predominantly related to the conversion feature of the convertible debt facility with Beedie Capital. A higher share price means a theoretical higher ‘loss’ on issuing shares in lieu of a cash repayment of the convertible debt.

There was a minor impact from realized and unrealized bullion contract losses to the tune of just US$8,000 (the realized loss was almost fully covered by an unrealized gain). It goes without saying the current high gold price will result in additional hedging losses, but those will be minimal compared to the incremental revenue from selling the gold at a substantially higher price.

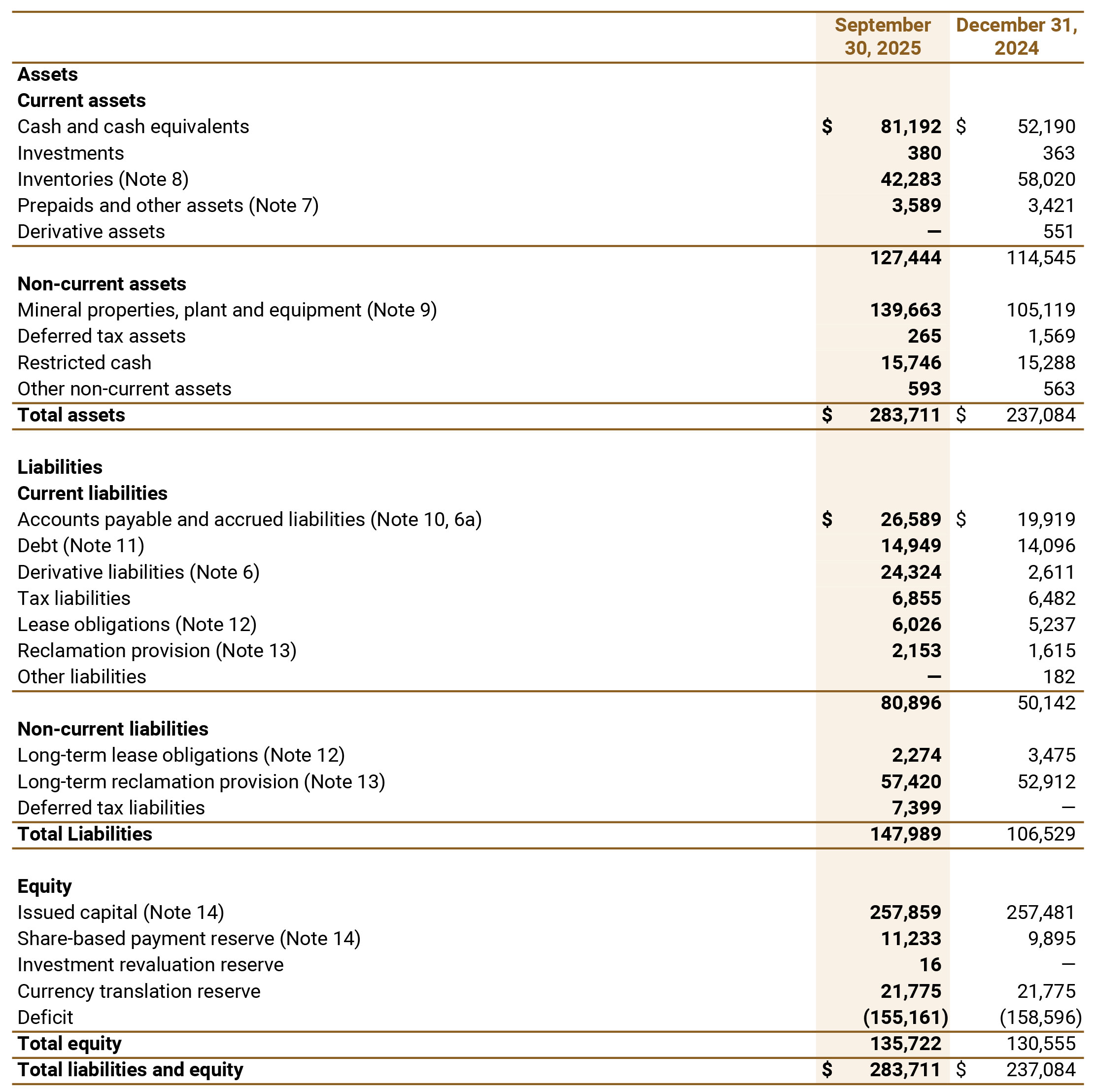

Both elements are non-cash elements, and are added back to the net loss to calculate the cash flows generated by Integra. As you can see below, the company reported an operating cash flow of US$35.6M but this includes $14.1M in working capital contributions and excludes $2.5M in lease and interest expenses, partially offset by $0.6M in interest income. The underlying operating cash flow was approximately $19.5M.

The cash flow statement also indicates $15.3M was spent on capital expenditures, resulting in an underlying net free cash flow of just over $4M.

That sounds underwhelming, but there are a few side notes to highlight here.

First of all, the total amount of sustaining capex in Q3 was relatively high, both vis-à-vis the first half of the year as well as the full-year projections. The company is guiding for a full-year production of 70,000-75,000 ounces of gold at an AISC of $2450-2550/oz versus a $1850/oz cash cost. Using the midpoint of the guidance, this indicates there are approximately $650/oz in sustaining costs per produced ounce of gold. The sustaining capex per produced ounce of gold in Q3 came in above that, at approximately $750/oz. That being said, Integra now expects its AISC to slightly exceed the higher end of the AISC at $2550/oz but this should have no impact on the anticipated free cash flow as the high gold price is of course very forgiving.

Secondly, keep in mind the average realized gold price was less than $3,500/oz in the third quarter. Applying a gold price of $4000 would have boosted the revenue by US$10M and the net free cash flow by approximately US$6.5-7M for the quarter. So while the working capital adjusted free cash flow wasn’t all that great in the third quarter, this was mainly related to timing issues. Timing of the sustaining capex payments as well as the timing of the gold price increase.

Integra’s balance sheet has never looked this healthy

Keep in mind the Florida Canyon mine was acquired to avoid having to continuously issue new shares to keep the DeLamar asset on track through the permitting process.

At the end of the third quarter, Integra Resources had a positive working capital position of approximately $46.5M, including $81M in cash and north of $40M in inventories. This was partially offset by the higher current liabilities including the US$15M convertible debt facility.

However, the working capital position on a reported basis does not do the strength on an underlying basis any justice. As you can see above, the total amount of derivative liabilities increased to in excess of $24M. The vast majority of these liabilities are related to the equity component of the convertible debt. These ‘liabilities’ are a direct function of the share price versus the conversion price and given Integra’s strong share price performance in the fourth quarter, we should anticipate an additional derivative loss (which is not very relevant as the entire focus now shifts to the free cash flow profile of the Florida Canyon mine and Integra as a corporate entity). It has an impact on the income statement and on the balance sheet, but these are non-cash liabilities. This means the ‘true’ underlying working capital position – adjusted for these non-cash liabilities – is substantially higher at in excess of $70M. And keep in mind that if the convertible debt is converted into stock, almost the entire ‘derivative liability’ position will evaporate.

In any case, the $81M cash provides a very comfortable starting point to deal with the anticipated additional sustaining capex heading into 2026. We expect Integra to be caught up with the sustaining capex baclog by the end of 2026 and 2027 should have a lower sustaining capex and thus a lower AISC per produced ounce of gold. And while the working capital position may be impacted by the higher share price (which really is a perverse mechanism, but accounting rules are accounting rules), we expect the general financial wellbeing of the company to continue to improve.

Conclusion

The DeLamar feasibility study result beat our expectations as we had feared a substantially higher initial capex. The company chose to start out with a smaller leach pad (thereby reducing financing risk and permitting risk – important elements in the development landscape these days) while we also notice the initial three-crush stage in the pre-feasibility study was reduced to a two-crushing stage. The trade-off between a smaller crushing size versus just slightly higher recovery rates but a higher upfront capex was an easy one to make. And with an anticipated recovery rate of just over 72% for the gold and 33% for the silver, the production profile and recovery rates remained strong enough to forego a third stage crushing circuit. Throw in the anticipated easier road to get the project permitted, and the feasibility study certainly met the expectations.

With this good feasibility study in hand, the focus can now shift towards securing the necessary permits for DeLamar, and we expect the company to update the market on this in the first few months of 2026.

Meanwhile, the company continues to be in an absolutely excellent shape to move the DeLamar project ahead through the permitting process to a construction decision. Despite the (temporarily) elevated AISC in 2025 and 2026, the net incoming cash flow should remain very robust thanks to the excellent gold price.

We also expect to see an update feasibility study on Florida Canyon which will contain an updated mine plane and an updated NPV. As the project has changed a lot since Integra took the reins and as the drill bit has continued to deliver in 2025, we are hoping to see a mine life extension and we are looking forward to seeing an update Net Present Value using $3000 gold. As you may remember, the 2024 Florida Canyon technical report used a decreasing (!) gold price with just $1900 gold from 2027 on. Given the current gold price, it’s unthinkable we won’t see a major NPV increase.

From 2027 on, the sustaining capex at Florida Canyon should decrease and this should – assuming a stable gold price – have an additional positive impact on the free cash flow generation. $4000 or $4250 gold means the Florida Canyon acquisition couldn’t just fund the DeLamar project through permitting, but could also contribute a potentially substantial portion of the equity component of the DeLamar capex.

With the feasibility study at DeLamar now in hand and with the Florida Canyon gold mine printing approximately $100M per year in pre-tax cash flow on the mine level (assuming 70,000 ounces gold at an AISC of $2600/oz and a gold price of $4100/oz in 2026 – note: the company as not yet provided a production and cost guidance for 2026, so these are just our arbitrary assumptions), Integra Resources now likely is in the best shape it has ever been.

Disclosure: The author has a long position in Integra Resources. Integra Resources is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.