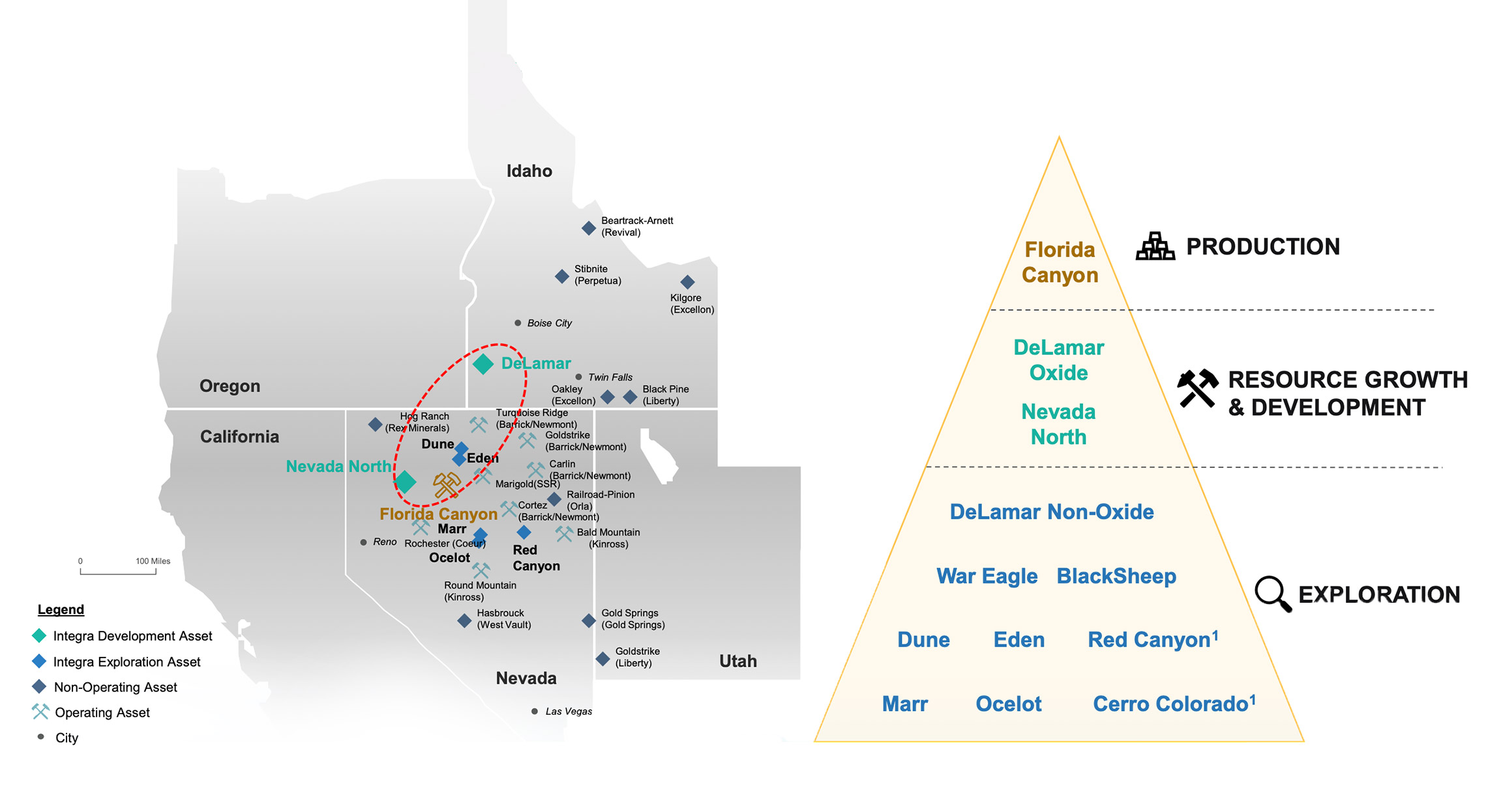

The market is finally catching up to the fact that Integra Resources (ITR.V, ITRG) now really is a gold producer. It took a while before the mental switch was made from being a development company with the advanced stage DeLamar gold-silver project in Idaho to a producer with an anticipated output of 70,000 ounces of gold this year.

On top of that, the strong gold price has definitely been a major tailwind and it’s very helpful considering integra is now spending quite a bit of money on sustaining capex this year. This will continue into 2026 and this will position the company to start driving down the AISC per produced ounce of gold from 2027 on as the major initiatives (including the construction of a new leach pad) will be completed.

The Q2 production results

Integra Resources mined approximately 3.07 million tonnes of ore at Florida Canyon during the second quarter, which was added to the leach pads. The strip ratio remained relatively low at just under 1:1 and this helped Integra to keep the production costs in line with the expectations, despite the low-grade zones that are currently being mined.

The Florida Canyon mine produced just under 18,100 ounces of gold, a small decrease compared to the first quarter of the year as the previous quarter was positively impacted by a non-recurring item which added about 2,000 ounces of gold to the Q1 production.

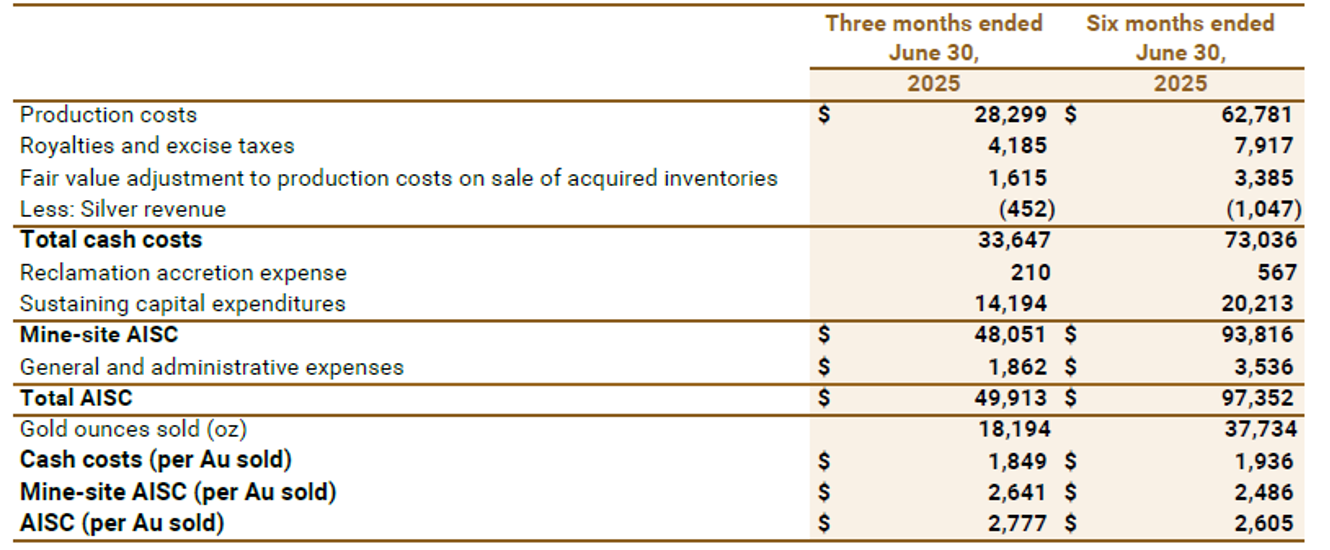

The total cash cost in the second quarter was approximately $1849/oz while the AISC increased to $2641. Fortunately the current high gold price is very forgiving and Integra is still able to generate robust margins at Florida Canyon, without the need for further dilution to fund growth and other project development work elsewhere.

The capex is relatively high as Integra Resources is immediately dealing with the past ownership’s underinvestment in Florida Canyon to avoid issues later. The company has started the construction of the Phase IIIb heap leach pad which should be commissioned by the end of this year. These expenditures will also help to further refine their plan to better optimize the future mining of the Florida Canyon orebodies and, as well, extend the mine life out beyond the current 5 years through reserve expansion. An updated NI43-101 on Florida Canyon is due in the first half of next year and this report should incorporate several of these optimizations, enhancements and reserve increases.

Strong cash flows, despite a relatively high capex

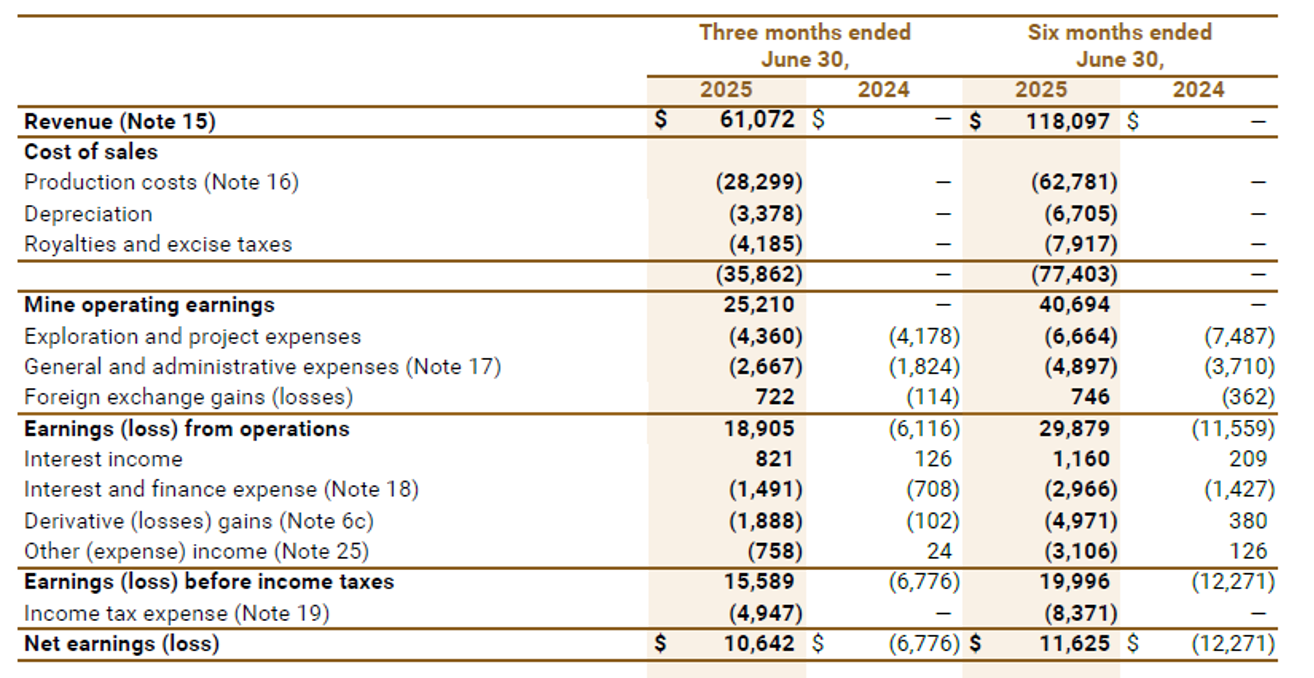

Looking at the numbers, we see the total revenue was approximately $61.1M, resulting in $25.2M in mine operating earnings. As the income statement also shows, the company has expensed approximately $4.4M in exploration activities during the second quarter as Integra obviously remains quite active on the ground.

As you can see above, the company reported a net profit of US$10.6M which represents an EPS of US$0.063. That’s approximately C$0.085 per share using the current USD/CAD exchange rate.

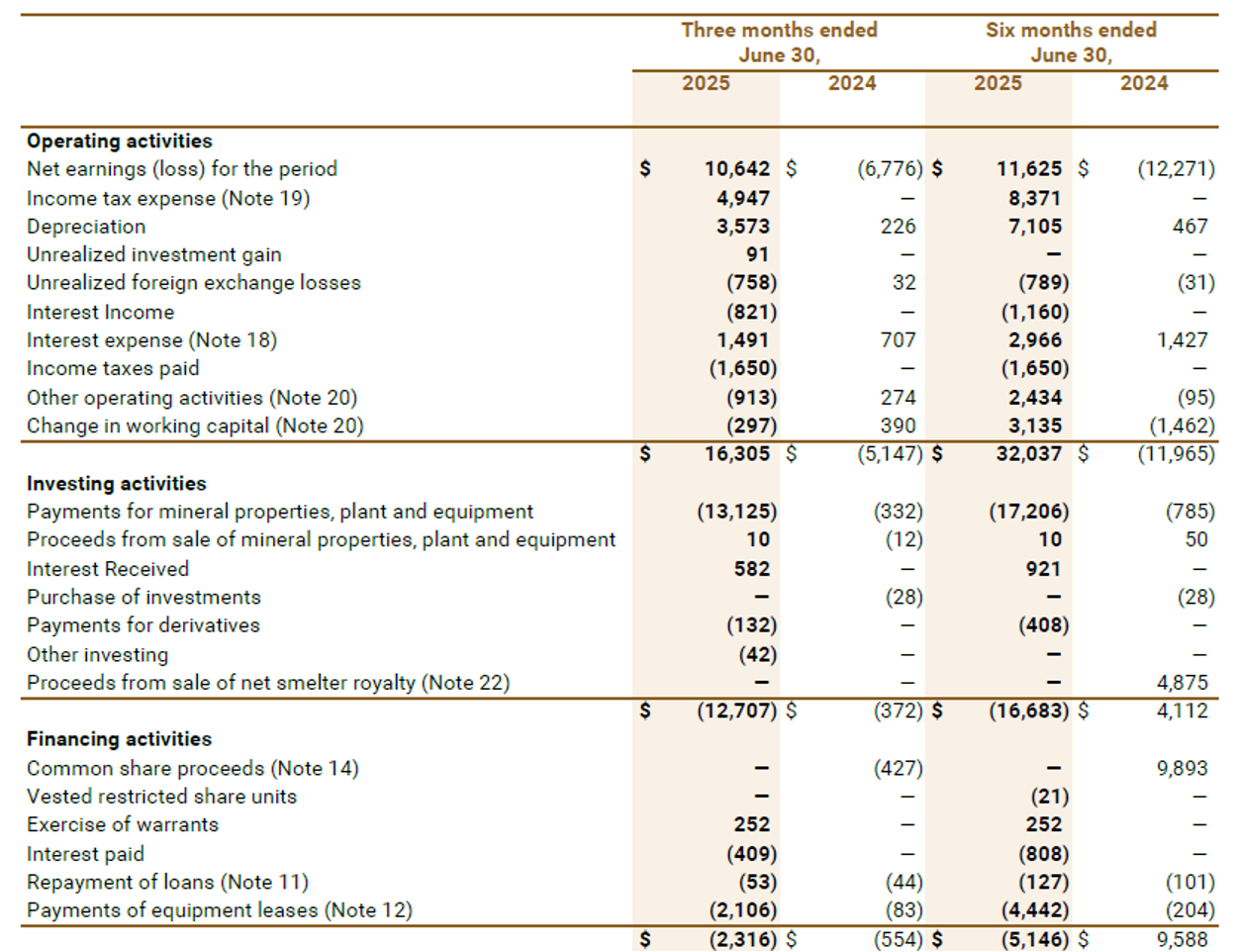

In the previous section we already mentioned Integra Resources’ capital expenditures are currently relatively high (before trending down from 2027 on), and as that’s an investing cash flow, it obviously does not show up in the income statement (as investments are capitalized and not expensed).

The cash flow statement provided by the company provides more clarity. The operating cash flow was $16.3M. This does not yet include the lease and interest payments nor does it take the $0.3M investment in working capital elements into account. After making the necessary adjustments, the adjusted operating cash flow was approximately $14.7M and this was just sufficient to cover the $13.1M in incurred capital expenditures.

Integra Resources also provides a detailed breakdown of how it reached its cash cost, mine-site AISC and general AISC. The table below provides all the necessary details.

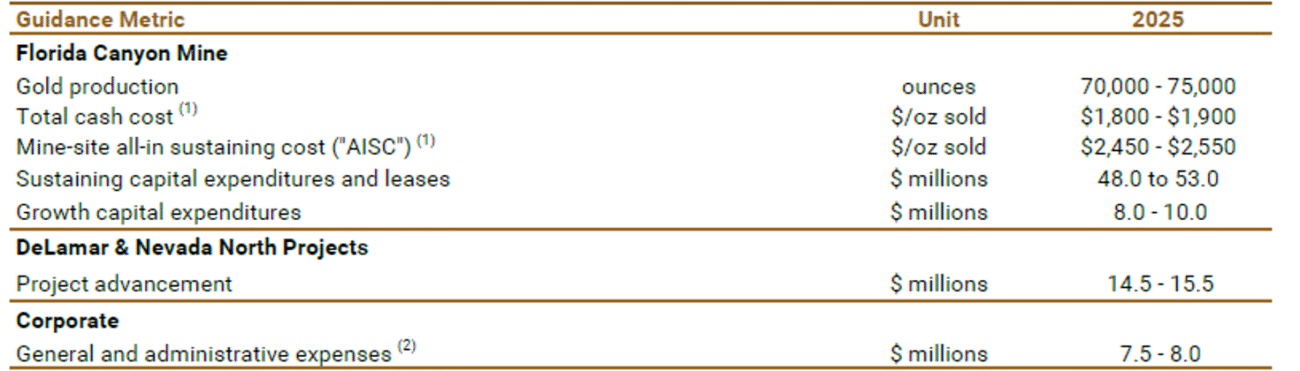

This also allows us to derive the implied guidance for the second half of the year. As you may remember, Integra Resources is guiding for a full-year production of 70,000-75,000 ounces of gold at a mine-site AISC of $2450-2550.

We know the company has already produced 37,734 ounces at a mine-site AISC of $2486/oz in the first half of t he year, and using the midpoint of the full-year guidance (representing 72,500 ounces of gold at a mine site AISC of $2500/oz), the H2 production will be just under 35,000 ounces at a mine site AISC of $2520/oz (note: this is solely based on the company’s guidance and additional fine-tuning is possible after the third quarter).

Assuming a net realized gold price of $3250/oz for the year, this means the Florida Canyon Mine will generate approximately $50M in pre-tax cash flow.

Integra also plans to spend $8-10M on growth capex, which can easily be funded by the incoming free cash flow from Florida Canyon, while the $15M in DeLamar and Nevada North expenses as well as the corporate overhead expenses ($8m) should also be comfortably covered by the incoming free cash flow based on the current assumptions & guidance.

Signing an agreement with the Shoshone-Paiute tribes is good news for DeLamar

In August, the company also announced it had entered into a Relationship Agreement with the Shoshone-Paiute Tribes of the Duck Valley Indian Reservation, whose territories cover much of the Idaho-Nevada-Oregon tri-state are. This is the first-of-its-kind agreement in the Lower 48 states and is the culmination of a five year collaboration between the tribe and Integra.

The agreement provides a framework to work on a mutually beneficial long-term relationship, by aligning both parties’ interests and make the potential construction of DeLamar a win-win situation.

Integra aims to sign similar relationship agreements with the other Tribal Nations that would have to deal with the DeLamar mine.

Recent exploration results are encouraging

Earlier this summer, Integra also published the initial assay results from its drill program at Florida Canyon.

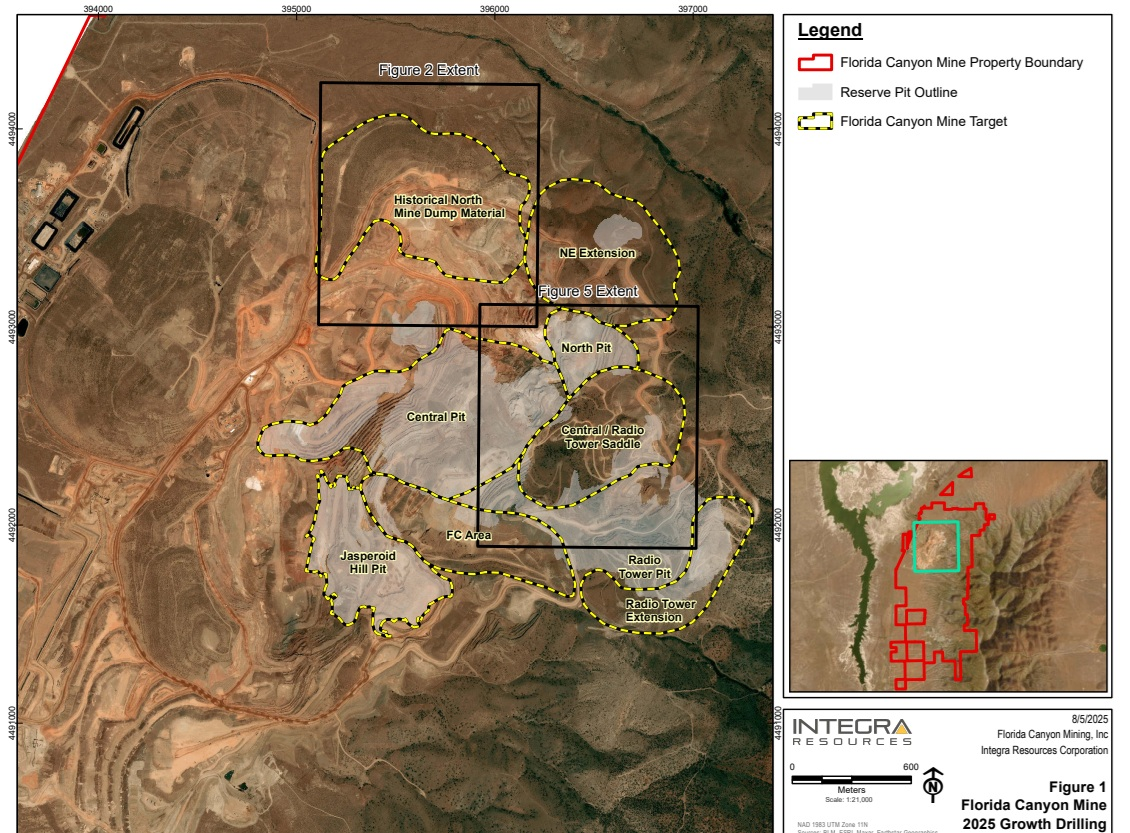

The current drill program, which has been increased by 60% to approximately 16,000 metres of reverse circulation and sonic drilling was focusing on three key elements.

First of all, the company wants to determine if rock that was previously categorized as waste could now perhaps be economical given the current gold price now it is strongly trading above $3000 an ounce. A second focus point was to expand the resources between the existing open pits while the third key element was to test lateral extensions and complete an in-pit infill drill program.

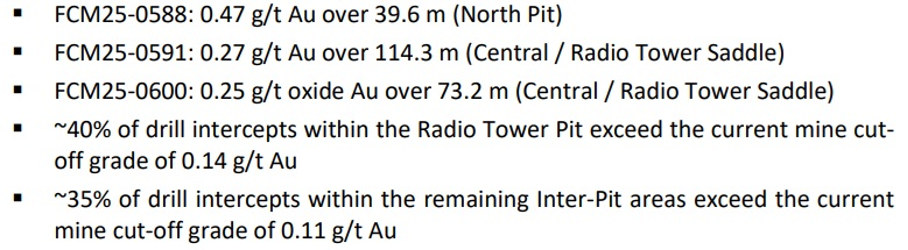

These initial results seem to confirm the theses as some of the holes intersected thick intervals of low-grade material that very likely wouldn’t work at $2000 gold, but could be viable at $3000+ gold. With almost 69 meters of 0.28 g/t gold, almost 72 meters of 0.36 g/t gold and 47 meters of 0.37 g/t gold, the North Dump could potentially host some economic material. Integra Resources mentioned approximately 70% of the drill intercepts exceed the 0.11 g/t cutoff grade that’s currently used at the mine.

Integra also completed some holes in between the existing pits (shown in the image on top of this page), and highlighted some intervals in the bullet points here below.

As mentioned, drilling is ongoing, and Integra should release assay results and exploration updates on a continuous basis.

Investment thesis

Integra’s share price has almost tripled this year on the back of the company finally being more appreciated as a producer while it goes without saying the current gold price provides an amazing tailwind. We ran our numbers at $3250 gold but it is clear that every ounce that gets sold at $3500+ adds to the bottom line, and pays for development expenses elsewhere without the need for share dilution. Meanwhile the company continues to progress DeLamar towards a construction decision and signing the Relationship Agreement with the Shoshone-Paiute Tribe is an important intangible asset.

Disclosure: The author has a long position in Integra Resources. Integra Resources is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.