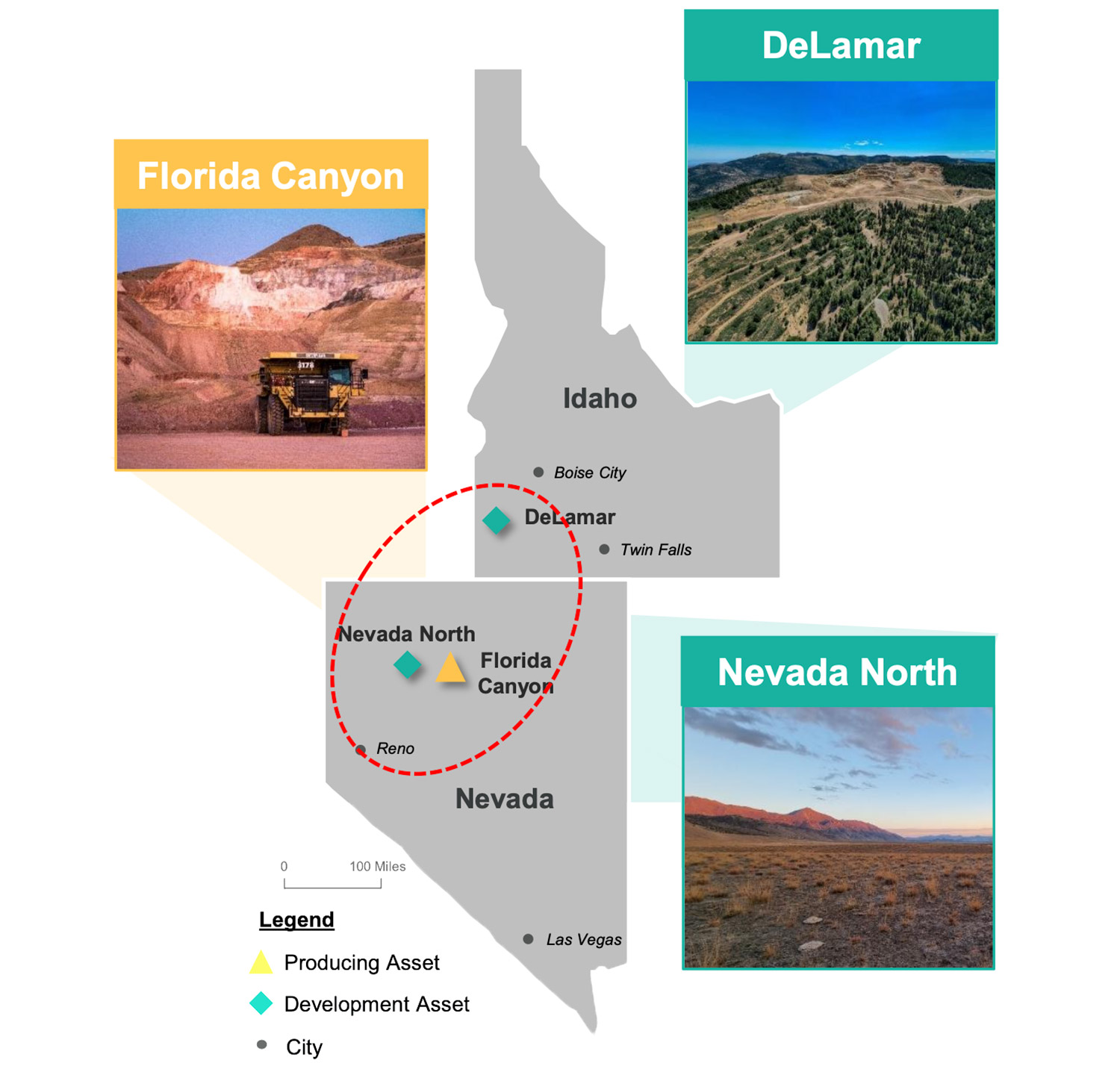

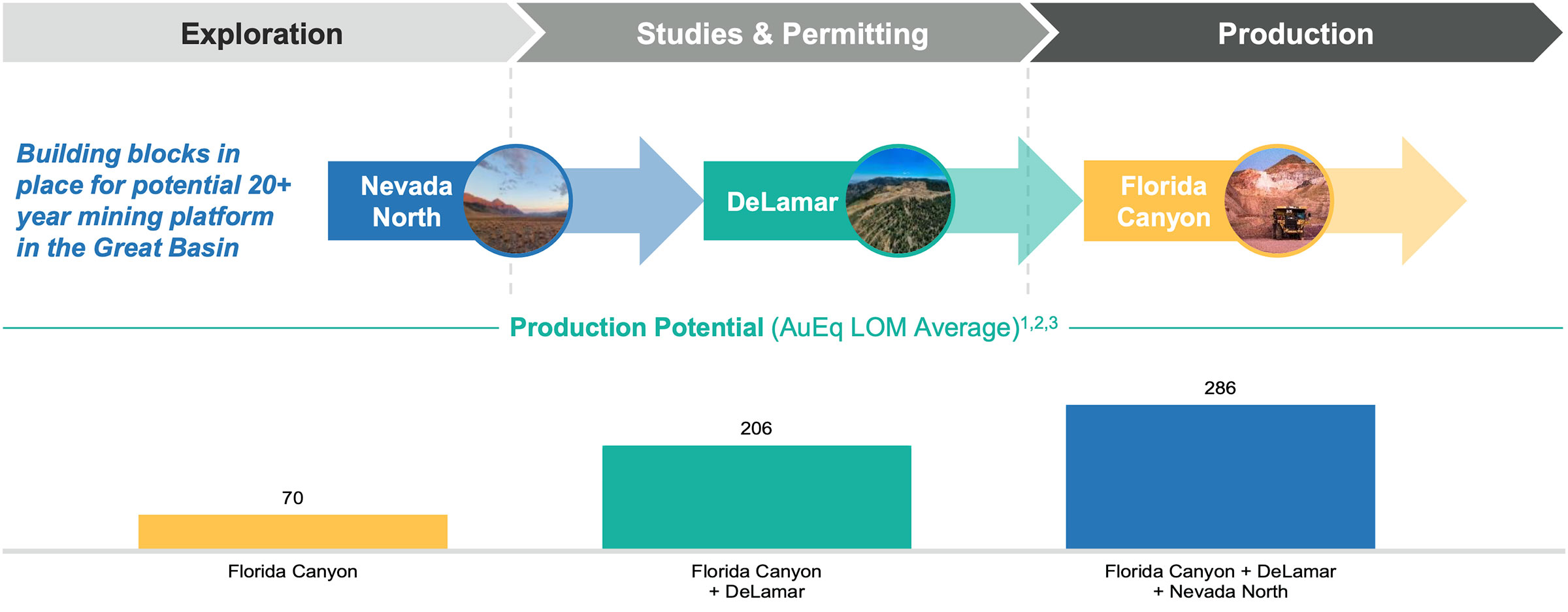

After successfully selling Integra Gold to Eldorado Gold (EGO, ELD.TO) in 2017 and advancing the Idaho-based DeLamar project towards a feasibility study, Integra Resources (ITR.V, ITRG) embarked on an M&A tour in the past two years. It first merged with Millennial Precious Metals to become one of the leading gold project developers in the Great Basin, but the missing piece of the puzzle was the acquisition of a producing gold mine in Nevada, one of the most mining friendly states in the USA.

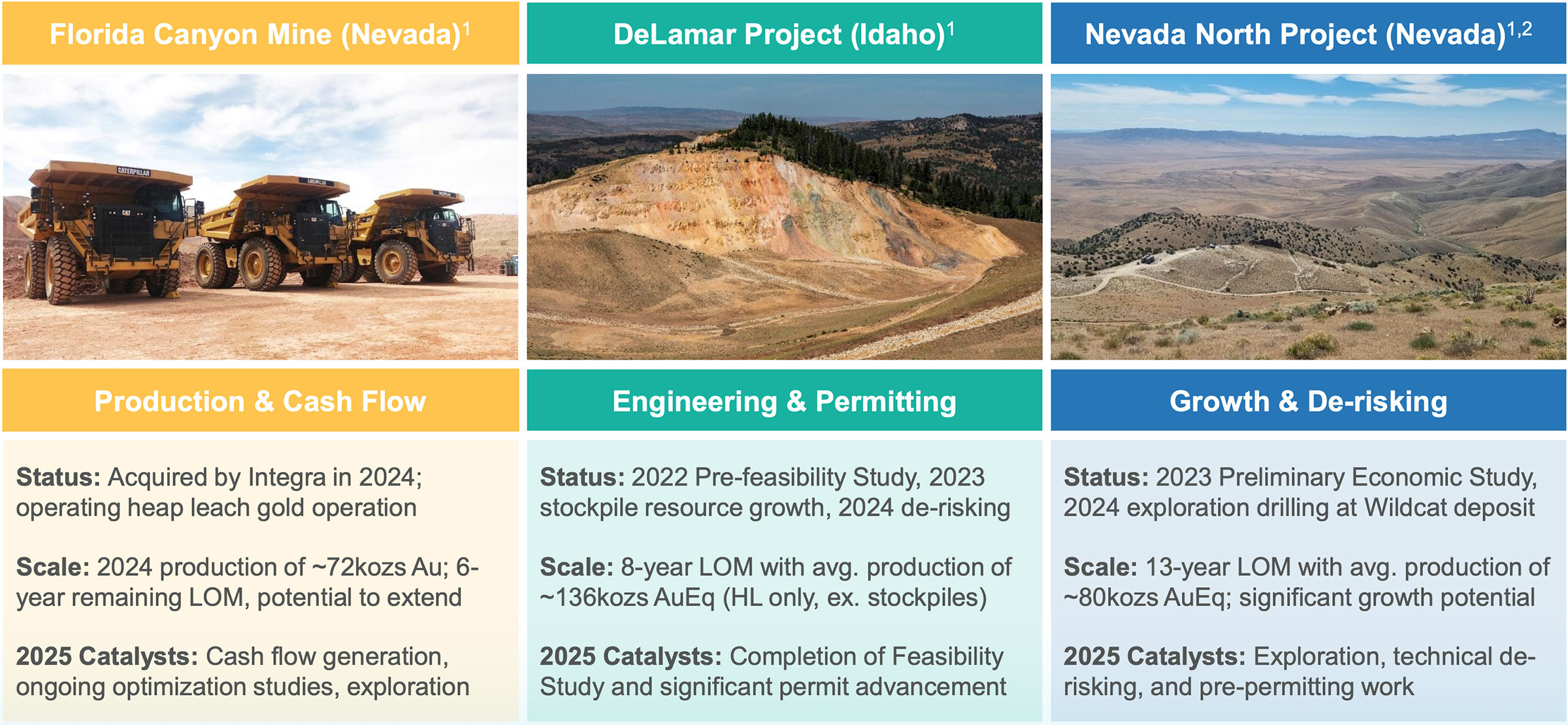

And yet, even with the recent production results under its belt, the market is still discounting Integra as a production story while it shouldn’t be doing that. Integra now owns a mine that produced 72,000 ounces of gold in 2024 (the highest production result in the last ten years) and is anticipated to produce about 70,000 ounces or more of gold this year with an excellent Q1 output of almost 20,000 ounces of gold.

Although the AISC is currently still relatively high (in the low-$2000/oz area) the high gold price is of course very forgiving and at $3000/oz (more than 10% lower than the current spot price), the net operating margin is approximately US$63M per year. Cash that can and will be used to cover G&A expenses and to advance the pipeline of development projects, located within driving distance from the Florida Canyon mine.

Integra initially wanted to acquire Florida Canyon eliminating the need to tap the market for C$25-30M in funding to keep the DeLamar permitting and development process ongoing, but every day the company can sell gold at in excess of $3000/oz is a brilliant day that adds to the cash cushion. Every $100 rise in the gold price is an extra $7M USD (on a pre-tax basis) hitting the treasury. With gold currently trading at $3400/oz, the company makes about US$50,000 per day extra on an after-tax basis versus using $3000 gold.

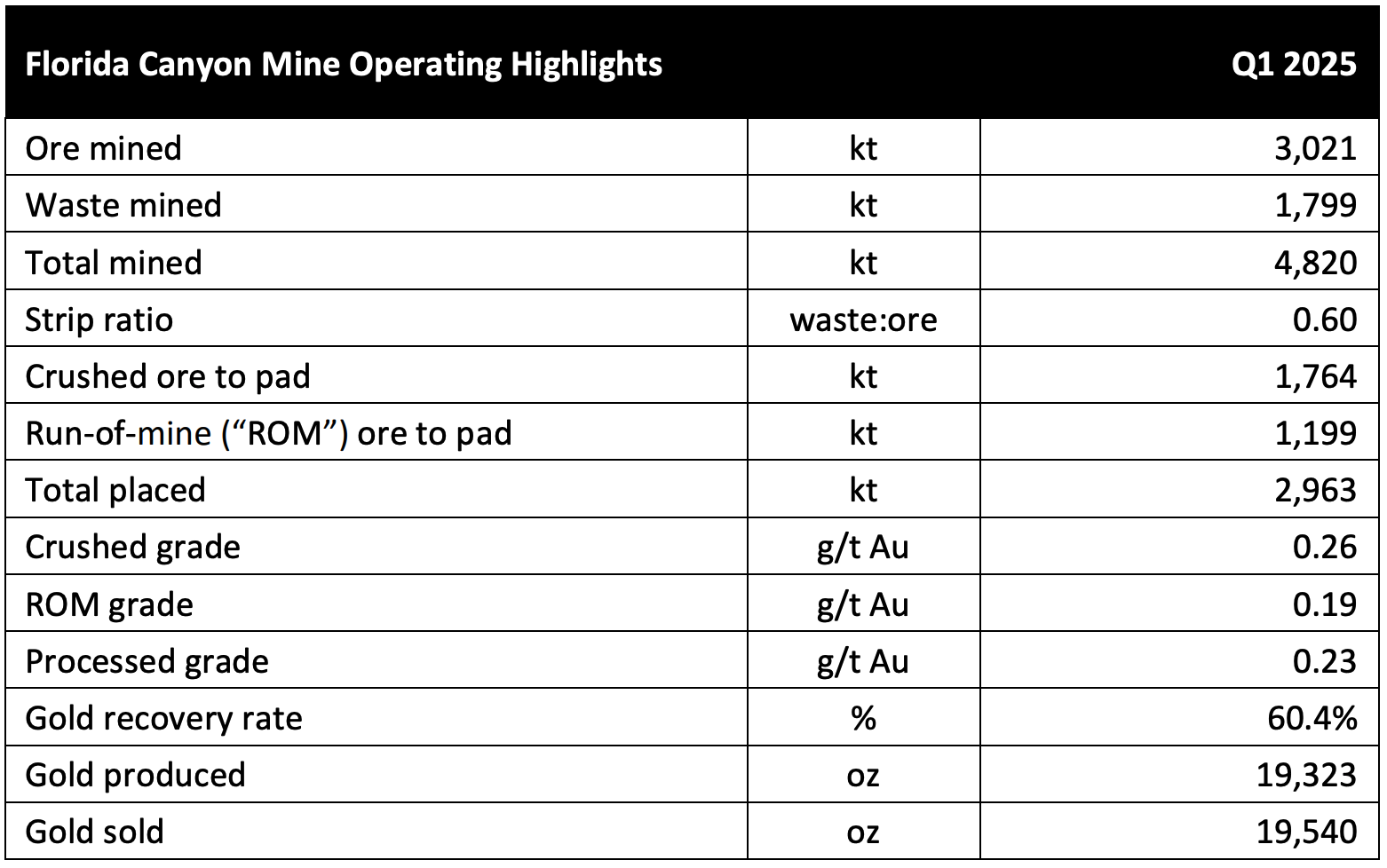

The production highlights at Florida Canyon emphasize the mine is a cash machine

While Integra Resources already published its production results for 2024 in January, we were also quite curious to see the cost profile of those ounces. Integra had been telegraphing to the market the ‘real’ AISC would likely be higher than the projections in the technical studies provided by Argonaut Gold when it still owned the project, but fortunately a gold price of $3000/oz is very forgiving. Let’s remember that the technical study done by Argonaut on Florid Canyon was done to dress the mine up for a sale and thus is likely not 100% realistic so we are waiting to see the official guidance that will be provided by Integra Resources.

As Integra only closed the acquisition in November, its attributable production was just 10,984 ounces of gold in the period from November 8 to the end of the year. Taking a step back and looking at the full-year output, the Florida Canyon Mine produced just over 72,000 ounces of gold, and that clearly exceeded the initial expectations and guidance.

While the company cannot comment on the full-year AISC, the all-in sustaining cost per ounce of gold that was sold between November 8 and December 31 was approximately $2103/oz. Keep in mind the company sold about 4% more ounces than it produced (due to inventory changes), so that AISC number may fluctuate by a few percent going forward.

The company still has to provide its cost guidance for 2025 and has deferred to publish a guidance until the new COO has been sufficiently worked in as he will of course play a pivotal role in the production, mine optimization and development activities going forward.

The Q1 production results

Earlier this week, the company announced its Q1 production result and with a total output of just over 19,200 ounces and a total amount of just over 19,500 ounces of gold sold, it was an excellent quarter for the Florida Canyon gold mine.

A portion of the higher than expected gold production came from an efficiency effort as the company was able to recover about 2,000 ounces of gold that were previously unrecovered. This means the normalized production run-rate is slightly lower but seems to be tracking our anticipated output of 70,000 ounces of gold this year. And it goes without saying recovering and selling an additional 2,000 ounces for US$6M+ provides a nice additional cash inflow.

The HR department has been busy

In the first quarter of this year, Integra announced several key appointments.

In February, the company appointed Dale Kerner as Vice President of Permitting. An important appointment as Kerner joins Integra Resources straight from Perpetua Resources which he helped guide through the tricky permitting process at Stibnite until the project received its Record of Decision in 2024. Stibnite is America’s newest, large gold-antimonyproject to be permitted. Based in Boise, Idaho, Kerner appears to be in an ideal position to complete DeLamar’s permitting process. With this appointment, Integra Resources is making it very clear that DeLamar is the very first priority in its development pipeline, taking advantage of the current political climate with the current Administration trying to get new mines developed.

Just one month after the appointment of Dale Kerner as VP Permitting, the company finally completed the recruitment process to hire a new COO. Integra hired Clifford Lafleur as its new Chief Operating Officer, a newly created function that’s obviously useful given the company’s switch from a development company to an actual gold producer.

Coming from a narrow-vein underground operation to join a company focusing on open pit heap leach operations is an interesting move, and we are looking forward to seeing Lafleur’s input on finetuning the Florida Canyon asset and his general contribution to the corporate structure as Integra Resources now has a well-filled pipeline of projects.

Lastly, the company added a very well-connected retired US 3-star General to their board advisory committee, named Leonard Kosinski. He has a very impressive resumé, a former US Joint Chief of Staff from the Pentagon and obviously well connected to Capital Hill in Washington, DC, where the company is now lobbying to get the Delamar project permitted.

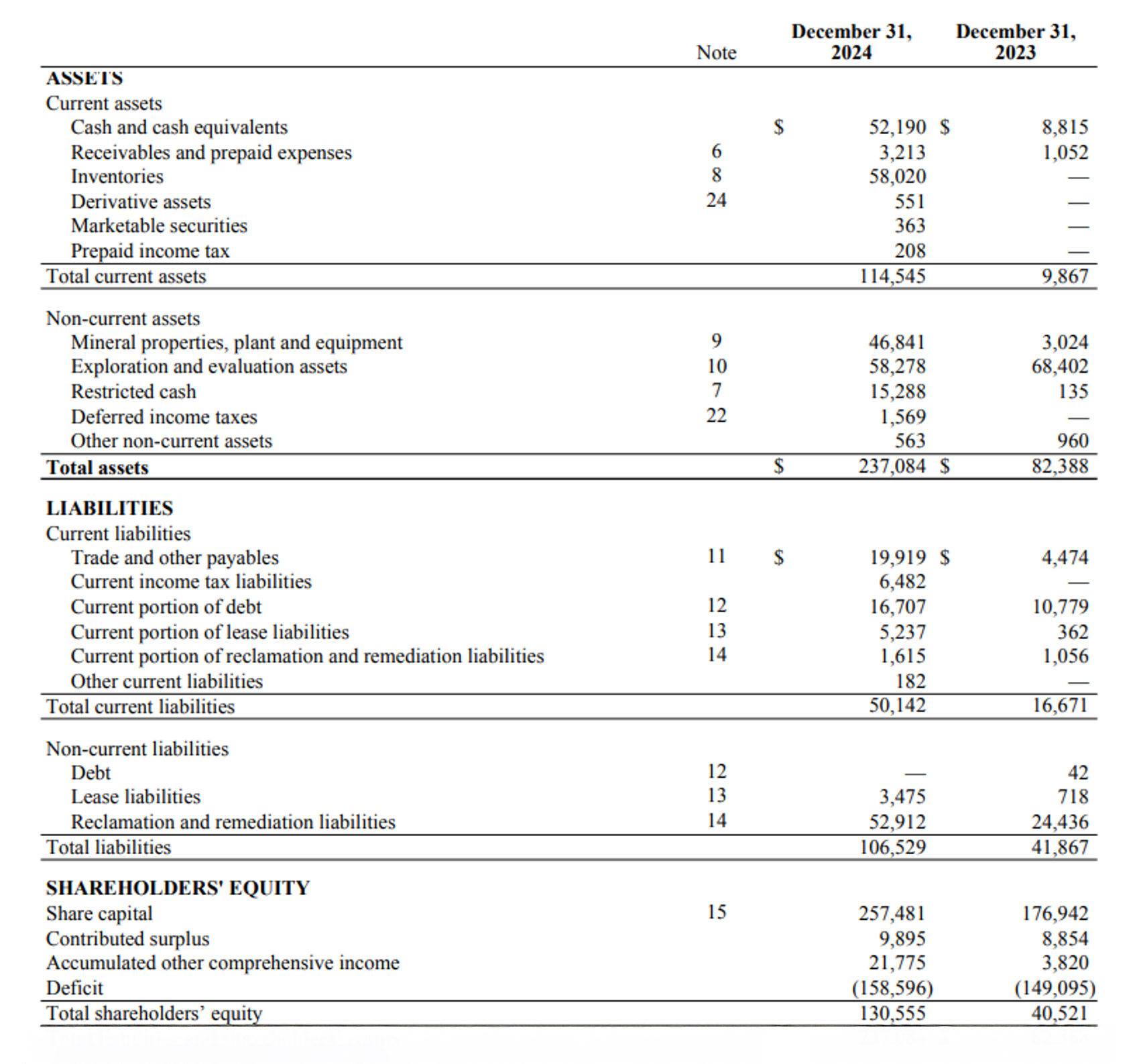

The balance sheet remains very strong

One of the key elements that provides Integra with wind in its sails is the very robust cash and working capital position. At the end of 2024, the company had US$52M in cash and a positive working capital position of approximately US$62.5M. While the company still has to publish its Q1 financial statements, the recent quarterly production update also confirmed the balance sheet now contains about US$61M in cash, and a positive working capital position of almost US$70M.

Going back to the year-end 2024 results, it is important to note that the working capital position includes the US$16.7M in current liabilities related to the convertible debt. We hope Integra looks into repaying that convertible debenture sooner rather than later as running a debt-free balance sheet could allow the company to also sell call options on its anticipated gold production, which could then fund the put-buying program and result in a cost-free collar hedging. A Call $3500 for September currently yields $165 per ounce in premium, so selling call options on 5,000 ounces would bring in US$800,000+. Those proceeds could then be used to start buying put options on the cheap, considering P2400’s for January 2026 are selling for just $7 while P2500’s are trading at just $10 per ounce.

What will 2025 bring?

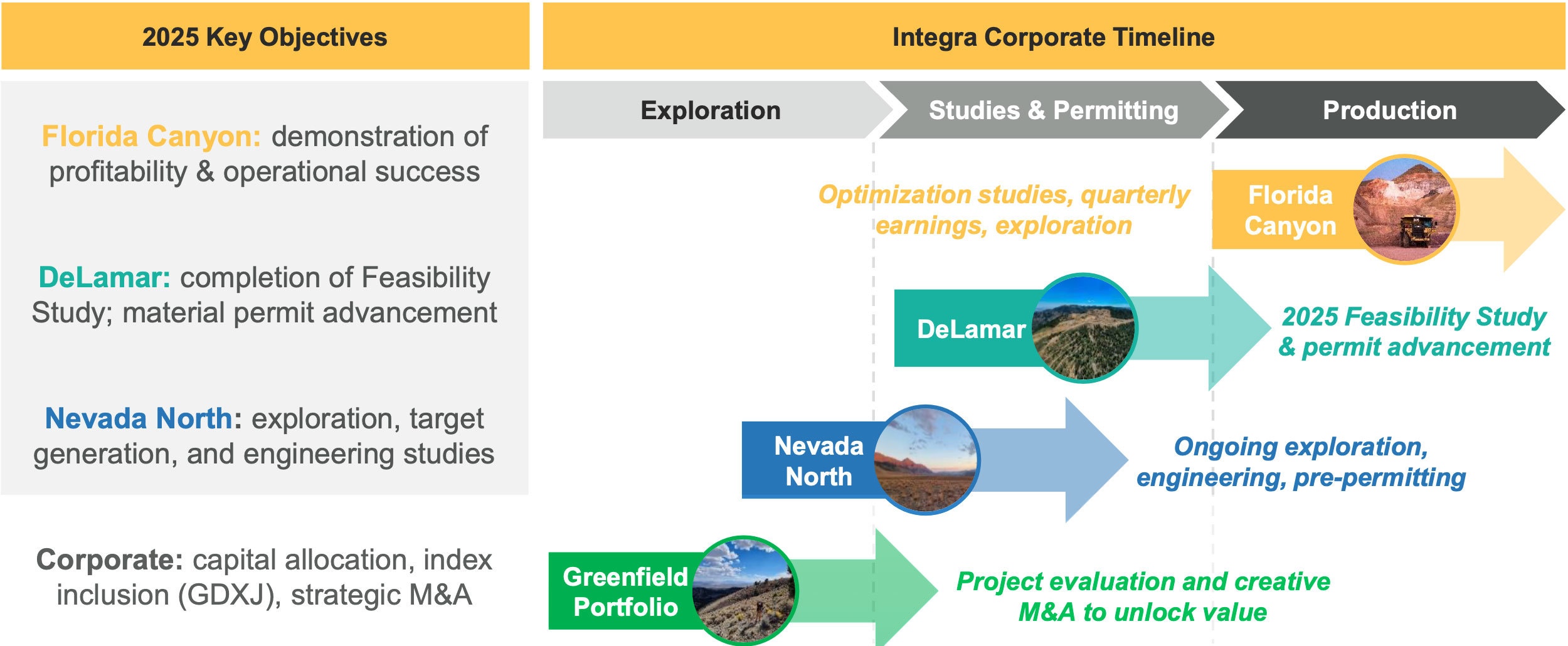

The company’s team will continue to hit the ground running this year.

At Florida Canyon, Integra Resources is working on some optimization studies. Some of those studies will be completed with the recommended measures implemented before the summer, other portions will need more time. We have no doubt the recently appointed COO has a few ideas as well beyond the current review of the usage of the mobile equipment fleet, mine sequencing and pit slope calculations. We are looking forward to seeing more details on this in the very near future. Included in the 2025 budget is the US$12M expansion of the South Heap Leach pad.

Additionally, the company is gearing up for an exploration program at Florida Canyon which could start as early as this quarter. The initial focus will be on drilling the extensions to existing mine deposits in an attempt to increase the oxide-hosted gold resource (and hopefully ultimately also the reserves) to further extend the mine life beyond 6 years.

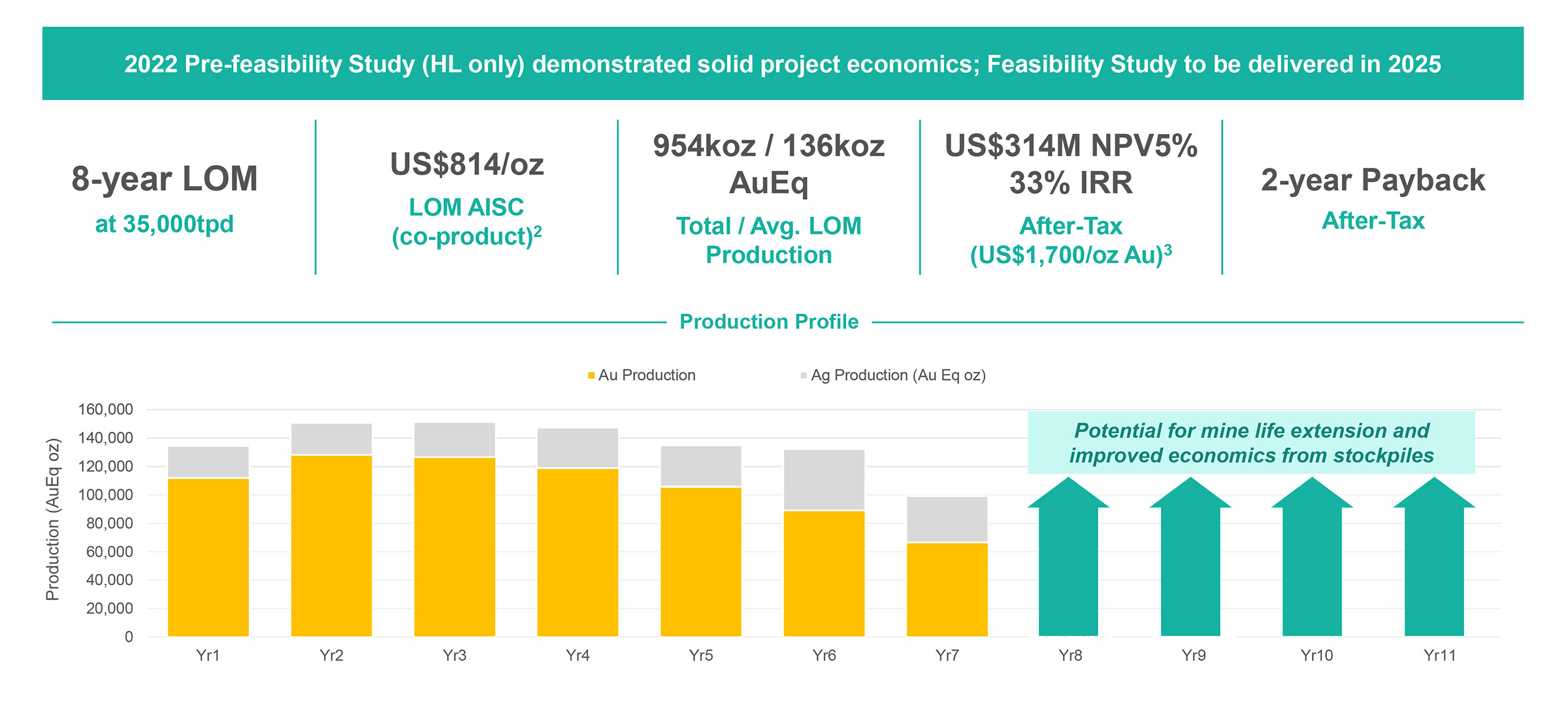

Integra Resources is still going full speed at DeLamar, where it completed the final engineering and metallurgical test work in the final quarter of last year. The acquisition of Florida Canyon should help streamline the entire operation as the precipitate from the Merrill Crowe process will be shipped to Florida Canyon for final refining. This should be very helpful in securing the air quality permit while the lack of on-site refining should reduce the capex and opex.

Integra has also made good progress optimizing the heap leach pad footprint which should also have a positive impact on the initial capex (and sustaining capex earmarked for leach pad expansions).

The recent met work also indicated that tertiary crushing will be unnecessary. Not only will this reduce the operating costs, it also means the project could get hooked up to the existing power supply of Idaho Power. As it currently stands, the mine would only need a transformer upgrade while the refurbishment of eight miles of transmission line shouldn’t be a big deal either. Gaining access to reliable and low-cost power could further enhance the economics of the project and it goes without saying DeLamar is for sure Integra’s flagship development project.

The feasibility should be ready in the next few months, and we are looking forward to seeing the economics of DeLamar sometime this summer.

At Nevada North, Integra completed just under 2,000 meters of drilling at the Wildcat deposit to refine geological, geotechnical and metallurgical data. The infill holes that were completed within the PEA pit shell confirmed the continuity of the mineralization, and this should help to convert resources into reserves further down the road.

The exploration-focused holes below the pit shell encountered anomalous (but non-economic) gold grades over pretty thick intervals like 213.8 meters of 0.25 g/t sulphide-hosted gold. The drill bit confirmed the presence of intense alteration and brecciation which confirms the thesis to find a high-grade breccia feeder system. The main focus of course remains on the planned open pit heap leach operations but with tens of millions of incoming cash flow per year from the Florida Canyon operations, we wouldn’t mind seeing some wildcat holes (pun intended) to figure out what may be hosted under the existing pit.

Integra completed the Environmental Assessment for the Exploration Plan of Operations in 2024, but the company hasn’t heard back from the government agencies on the Finding of No Significant Impact and the Decision Record. Integra now anticipates to receive these sometime around the summer. Having their new VP of Permitting, Dale, pushing this and leading the permitting charge at Wildcat as well, will be a bonus.

Conclusion

At $3000 gold and assuming the AISC will remain stable at around $2100/oz, the Florida Canyon mine should generate approximately US$63M in after-capex net cash flow on a pre-tax basis. This creates plenty of breathing room to cover the G&A (US$4.5M in 2024 but this will increase given the expanded asset base of the company) and the activities elsewhere in Nevada and Idaho (where Integra spent US$14.2M in 2024).

It’s never easy to be a non-revenue exploration or development company, especially so for the last 5 years. But once you have a meaningful production story while the precious metals prices are cooperating, you are off to the races, and should expect a re-rate on share valuations from being a producer. That’s exactly what Integra Resources is doing now as the robust cash flows from Florida Canyon can be used to aggressively advance DeLamar (and Nevada North) without having to print tens of millions of new shares per year to bankroll those expenses. And who knows, maybe they do some other creative things with their cash to further drive value, i.e more exploration, pay down their small debt, look at scenarios to expand production at Florida Canyon while the gold prices are high, etc.

And yet, the market appears to be heavily discounting Integra Resources. There are very few (frankly, none come to mind) gold producers with a market cap of US$310M and an enterprise value of US$250M that will generate US$60M+ in sustaining free cash flow on the asset level this year.

Disclosure: The author has a long position in Integra Resources. Integra Resources is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer.