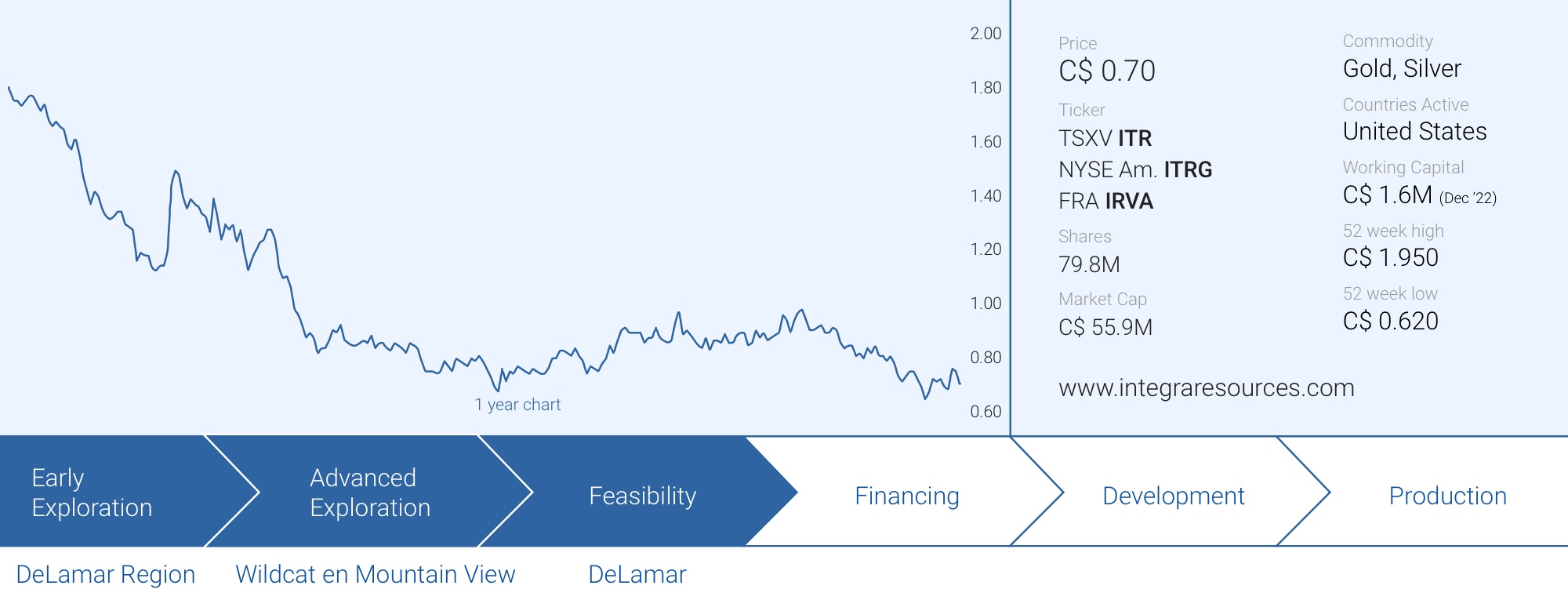

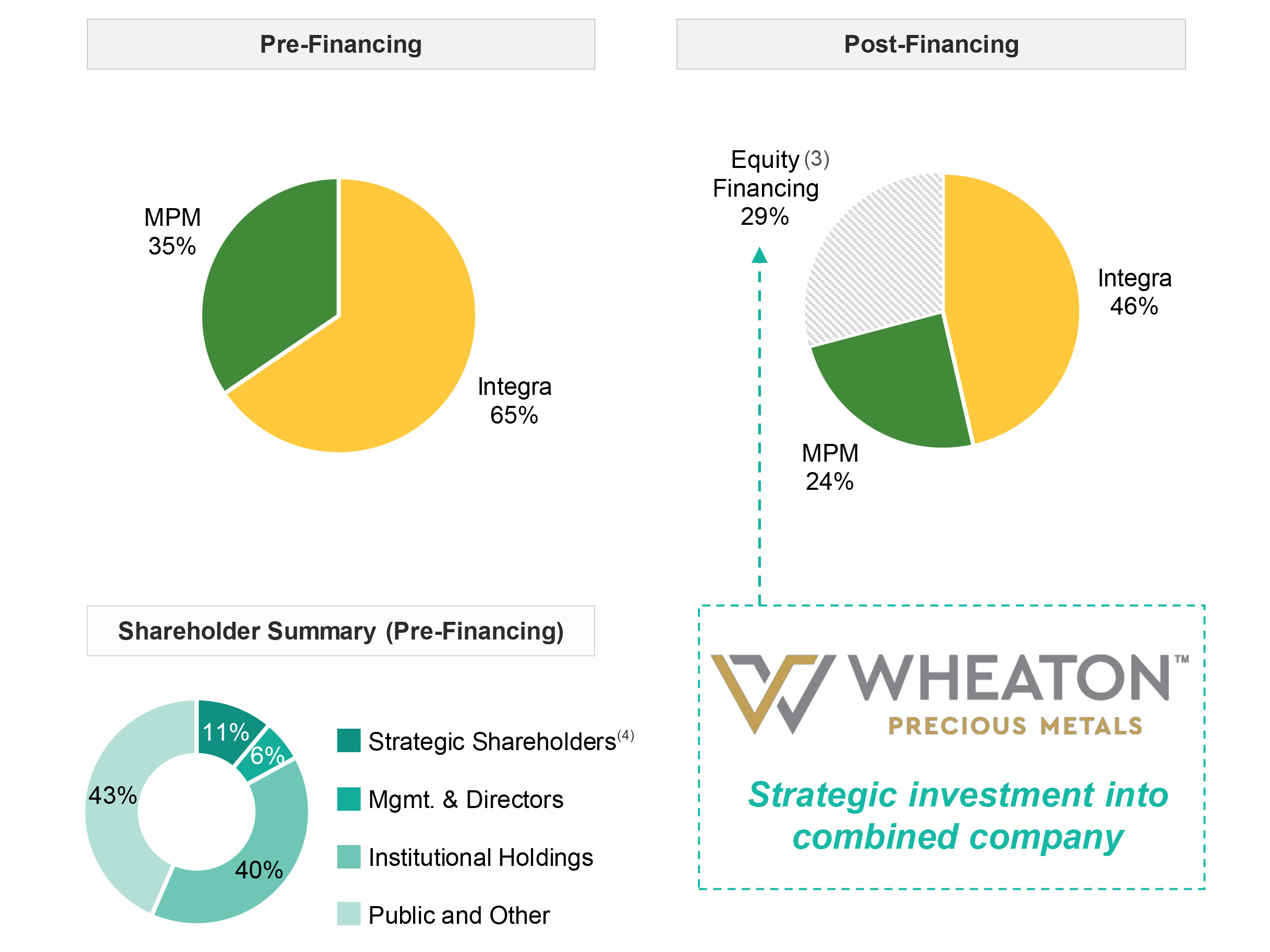

Integra Resources (ITR.V, ITRG) and Millennial Precious Metals (MPM.V) announced earlier this week an at-market merger whereby Integra Resources will absorb Millennial. Shareholders of Millennial Precious Metals will receive 0.23 shares of Integra per share of Millennial they own. Directors and officers of Millennial, owning about 9.2% of the shares, have already entered into voting support agreements. Please note: the share data and the working capital position in the snapshot above are showing Integra Resources’ current data on a standalone and pre-merger basis.

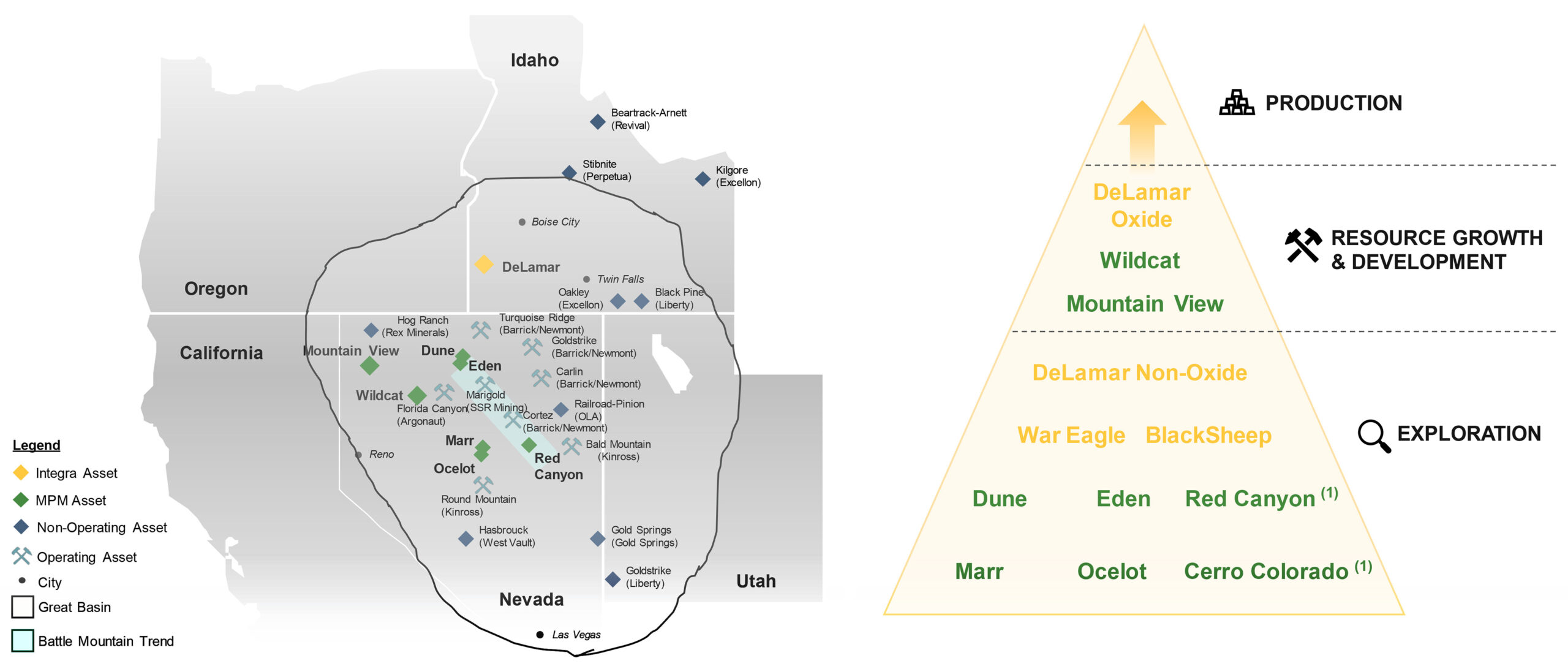

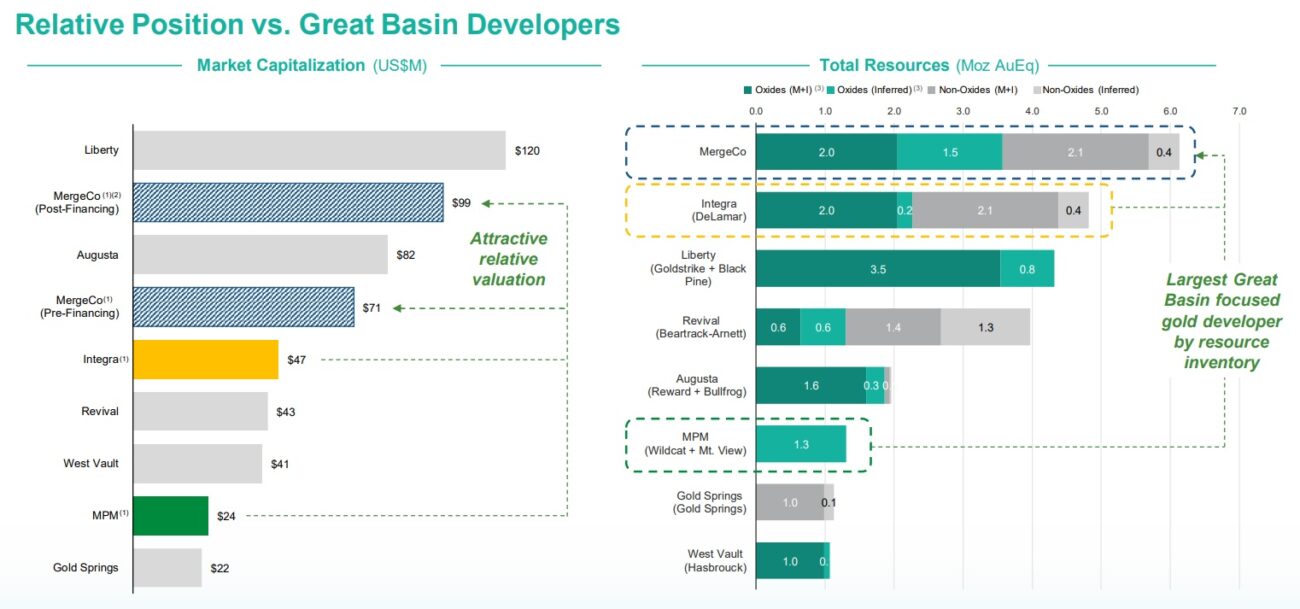

The combination of both companies will create a leader in the Great Basin and the current resources which contain in excess of 4 million ounces of gold and almost 150 million ounces of silver are likely just the starting point for this company. Integra Resources is still drilling the old stockpiles at DeLamar while Millennial is anticipating to update the Wildcat and Mountain View resources. All those resource updates will only happen once the merger is completed but this clearly means there’s plenty of news flow to be expected including a maiden PEA on the Wildcat project in Nevada.

We sat down with George Salamis and Jason Kosec as the latter will take the reins of the combined entity.

The background of the merger

Although there are very little synergy benefits (Integra’s project is in Idaho, Millennial’s assets are in Nevada), the merger does create a large oxide-focused gold company in the Great Basin. The company will own in excess of 4 million ounces of gold and about 143 million ounces of silver across all resource categories, while it will have one project in the PFS stage (DeLamar), one project in the PEA stage (Wildcat, with a PEA expected by this summer) and one project in the resource stage (Mountain View).

Perhaps even more important than creating a large Great Basin focused exploration (and hopefully development) company is the access to tens of millions in funding. There will be a bought deal for 35 million subscription receipts priced at C$0.70 to raise C$24.5M (which could be upscaled to C$28.2M) while Wheaton Precious Metals (WPM, WPM.TO) has committed to invest the lesser of C$15M or the total amount needed to obtain a 9.9% stake in the company once the merger closes. That bought deal has now been completed with total proceeds of C$24.5M which means Wheaton Precious is contributing C$10.5M at the same terms. The subscription receipts will convert into common shares upon the completion of the merger, which is expected in the second quarter of this year.

Sitting down with Jason Kosec (Millennial) and George Salamis (Integra Resources)

The projects

Will you maintain the current implied ‘sequencing’ of the projects? DeLamar is obviously the most advanced project in the combined portfolio while Wildcat would likely come in second considering a PEA will be published by this summer. Is it fair to assume the current order will be maintained or could for instance Wildcat gain ground on DeLamar if the permitting process in Nevada is anticipated to be easier/faster?

DeLamar will remain the flagship asset, and the current sequencing will be DeLamar-Wildcat-Mountain View. The real value add of this merger is having multiple horses in the race so if one passes the other on the way to a record of decision we can pivot quickly. The value multiplier effect of having multiple resources with multiple developable assets is obvious from a combined resource and production perspective. Also serves to mitigate risk, sharing permitting and development risk amongst not just one asset but three.

And what if/when Wildcat’s initial capex comes in much lower than DeLamar? Would it then make sense to start focusing on Wildcat with the lower capex hurdle and subsequently use those cash flows to work towards developing DeLamar?

For right now DeLamar is first in line, that said we believe now with multiple assets plus the stockpiles, there is some time-value of cashflow optimization work to be done to determine the best strategy.

Of course you like each others’ projects but if you had to name one or two elements that really stood out for you during the merger talks, what would that be?

To be honest the team’s culture and ability to work together to get this complex deal done under tight timelines was one of the best we’ve ever experienced. The total lack of social issues that commonly plagues these deals was absent. We shared a common vision for what the future could look like on a combined basis.

Jason, what do you like most about DeLamar and Integra?

One of the biggest attractions was the team that George put together and the work that they have done de-risking DeLamar. One of the biggest weaknesses this industry is facing is people and Integra has amazing people. As I mentioned, this transaction was about securing assets and people. – on the asset side, we saw tremendous value in the stockpiles to add significant low cost ounces to the production profile. On the exploration side, War Eagle, Black Sheep add material optionality that is in not built into the current valuation.

George, what attracted you to go ahead with the MPM merger?

I would have to say the exploration upside to this transaction is tremendous. There was a lot of low hanging fruit that can significantly grow the oxide resource base at Wildcat and Mountain View. Permitted oxide resources in the Great Basin command a premium value over all others. The MPM team did a great job defining the current oxide mineralization, establishing very decent potential heap leach metallurgy, etc but were unable to drill the high priority targets under the current permit (Notice of Intent or Notice of Operation). The MPM team submitted the Explorations Plan of Operation in January which moves them from 5 acres to 400 acres of disturbance on both Wildcat and Mountain View. Once received in H2 this is expected to add significant exploration excitement to the combined company while DeLamar goes into a permitting stage, avoiding the dreaded Lassonde Curve of single asset, permitting development stage companies.

How difficult will it be to advance three projects simultaneously? Does this mean Mountain View will disappear a little bit into the background?

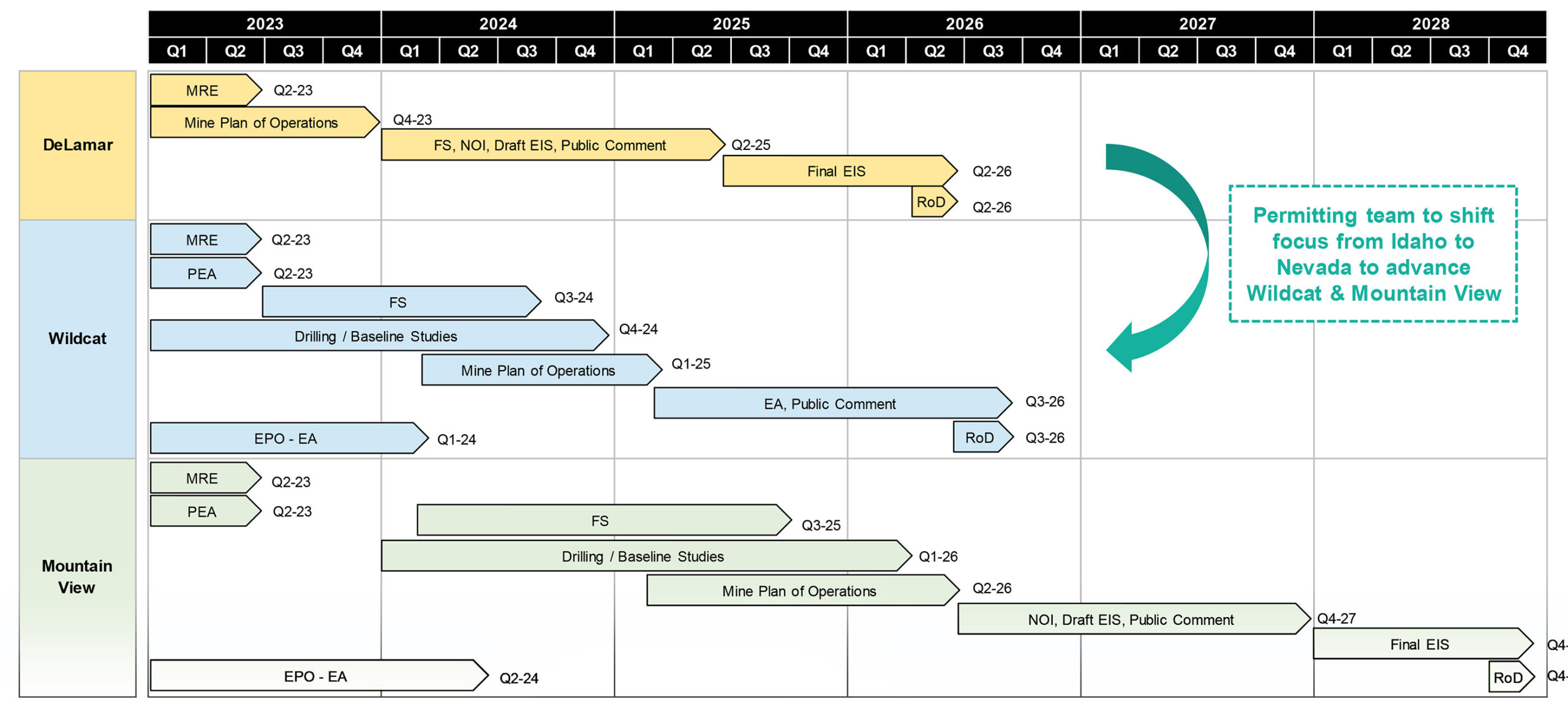

They will not be done simultaneously, the DeLamar mining permit is the priority and will be submitted by the end of 2023. That team will then shift its focus to de-risking Wildcat and get that MPO submitted by the end of 2024. Mountain View is third in line as we believe we can grow Wildcat significantly to make up for the Mountain View production later in the combined company’s mine life. Also, Mountain View will require an EIS and much more baseline geochem and Hydrology work.

While the merger will take some time to implement, what will happen ‘in the field’ while the deal advances towards closing?

Everything will keep moving forward including stockpile drilling, DeLamar resource update, MPO preparation, Wildcat & Mountain View PEA will all be completed shortly following the close of the transaction. Post close, will move the exploration team to Wildcat to start that program and have the engineering team complete the submittal of the MPO.

The merger and corporate

George, you are moving to an executive chairman role, what does that mean for you?

My primary job over the next three years is to ensure that DeLamar gets its permits and record of decision as soon as possible. The transaction gives me more time to focus on engaging with stakeholders and regulators.

Jason, you have always been pretty ambitious with Millennial Precious Metals from the get-go. It’s not very common to see the CEO of the smaller entity in a merger actually taking the reins at the combined entity. Are you looking forward to it?

Very loaded question, but really looking forward to building the next go-to mid tier production and growth story in the Great Basin. I think there is going to be tremendous value creation over the next few years and looking forward to doing it with a great team surrounding George and I.

Jason, you are obviously from a different generation than George is, how do you both see the tandem Kosec-Salamis work together? Do you both have strengths that complement each other?

JK: George has and very long and successful track record and will be a great mentor and partner for me, as he shares his wisdom with me and helps be advance my career with Integra. He also has much more patience and is more reserved than I am, so I hope that wears off on me as well.

GS: Jason is a young and very enthusiastic and energetic guy that has run a very lean team. I expect he shares that energy with myself and team. As you know from my Integra Gold experience with Steve de Jong, I’m a strong believer in mentoring the next generation of mining industry leaders.

MPM is headquartered in Toronto, Integra Resources is a Vancouver-based company. Do you think there’s a difference in culture that will have to be overcome?

The headquarters of Integra will remain in Vancouver. Like we said earlier, I think the one reason this transaction worked was the culture and values in both companies were very similar and we don’t see that changing with the combined company, regardless of where team members are based.

What are the total costs associated with the merger (legal, banking, staff termination fees,…)?

The total costs associated with the merger will be US$3M.

How important is the vote of confidence from Wheaton Precious Metals? Getting a substantial equity investment while only ‘giving up’ a ROFR on royalties and streams is a pretty good deal from your perspective as you don’t even hàve to pursue a royalty or streaming deal in your financing mix. Just a few years ago a streaming company would only take equity stakes if it also obtained a definitive royalty or stream on a project.

Having Wheaton participate in the deal after a very competitive process was a major stamp of approval and provides serious project and strategy validation. Companies often fall in love with their projects and can be blind sided by issues they missed. Through the competitive process, Wheaton did a deep dive through both Millennial and Integra’s data rooms. Having that third party validation to what we are doing was very important and also provides a pathway to future project financing at the development stage.

Is this also a sign of royalty and streaming companies having to go lower on the food chain to find attractive capital deployment ideas?

These companies are currently sitting on significant cash and the space is getting more and more competitive, with quality projects with scale and optionality shrinking. The royalty and stream providers are now coming down market to deploy capital in more creative ways, especially in top tier jurisdictions like Idaho and Nevada.

You will now be one of the largest (maybe the largest?) junior exploration company in the Great Basin in terms of ounces of gold across all categories. Do you feel this sets you apart from other companies in the same region?

This transaction creates gap in between us and our peers group, with integra now boasting a resource base of 4.2 M ounces of gold and in excess of 140 million ounces of silver likely going to 5M+ ounces of gold in the near term. As we looked projects on our own (ITR and MPM) we both noticed that there are several assets across the spectrum that can have the potential to produce 40-60kozs per annum, very few that could produce 60-90kozs per annum and only a handful that could produce +100kozs per annum. The pro forma company will have the ability to produce 230,000 ounces between DeLamar, Wildcat and Mountain View, which would make us one of the leading mid tier gold producers globally once fully developed, with a significant resource endowment and exploration upside. This set-up should be recognized as being very rare and should attract a larger investment audience.

Conclusion

Admittedly, we were only lukewarm on the proposed deal when the news hit the wires. But after talking to CEOs Salamis and Kosec we now understand the rationale of the deal. The path towards 5 million ounces of gold and in excess of 150 million ounces of silver is real and realistic, and whereas Integra has been touting the ‘optionality’ of the DeLamar project, the combined entity will now have ‘project optionality’. If the DeLamar permitting process goes slower than anticipated Wildcat could jump the queue and become the first mine to be built. And that’s a luxury the ‘current’ Integra does not have.

We have a long position in both Integra and Millennial Precious Metals and will vote in favor of the transaction. Millennial’s Special Meeting of shareholders is scheduled for April 26.

Disclosure: The author has a long position in Integra Resources and Millennial Precious Metals. Integra Resources is a sponsor of the website.