Sometimes even the companies with the most promising projects get caught in a downturn and despite an already sizeable resource estimate and its ability to raise C$17M in a no-warrant capital raise, Integra Resources (ITR.V) saw its share price get hit by tax loss selling.

Sometimes even the companies with the most promising projects get caught in a downturn and despite an already sizeable resource estimate and its ability to raise C$17M in a no-warrant capital raise, Integra Resources (ITR.V) saw its share price get hit by tax loss selling.

The company’s management team saw this as an opportunity to buy more stock and the market –correctly – interpreted this as an additional vote of confidence, and Integra’s share price is now up almost 50% compared to its December lows.

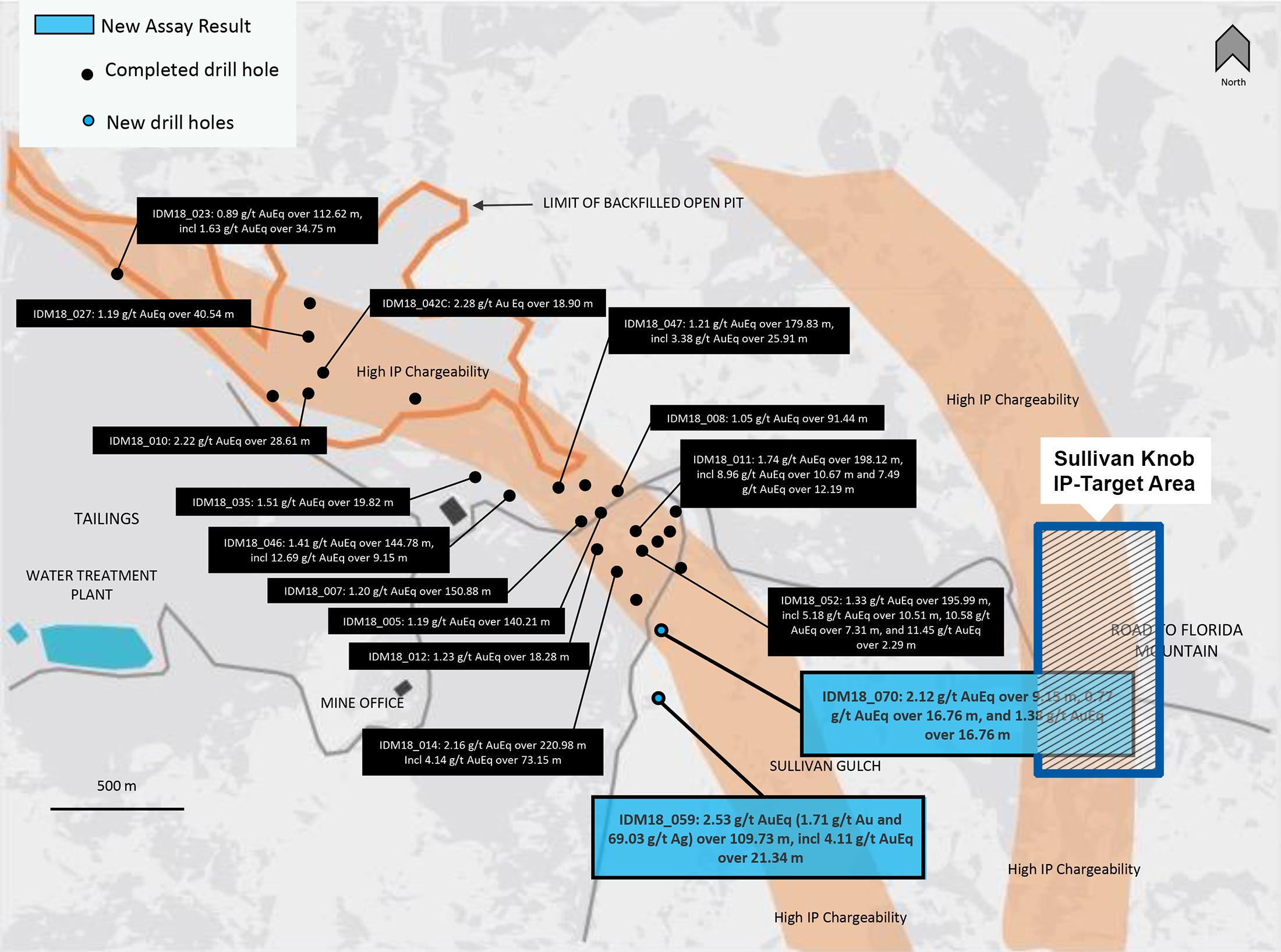

The company’s most recent exploration update obviously also helped to attract more attention to this story. Integra released the assay results of yet another step out hole and confirmed a thick layer of gold-silver mineralization even further away from the current resource envelope.

The recent exploration results confirm our expectations

When companies are still looking to define the limits of a mineralized zone, a step-out drill program is the only way to find out the real extent of a mining project. Some companies aren’t too confident and drill their step-out holes at a short distance from known mineralization, but other companies make bolder moves.

Integra Resources belongs in the latter category, as it has been drilling step-out holes several hundred meters away from the current resource envelope. And the 2018 drill program has been extremely successful as several step out holes continued to intersect gold-silver mineralization.

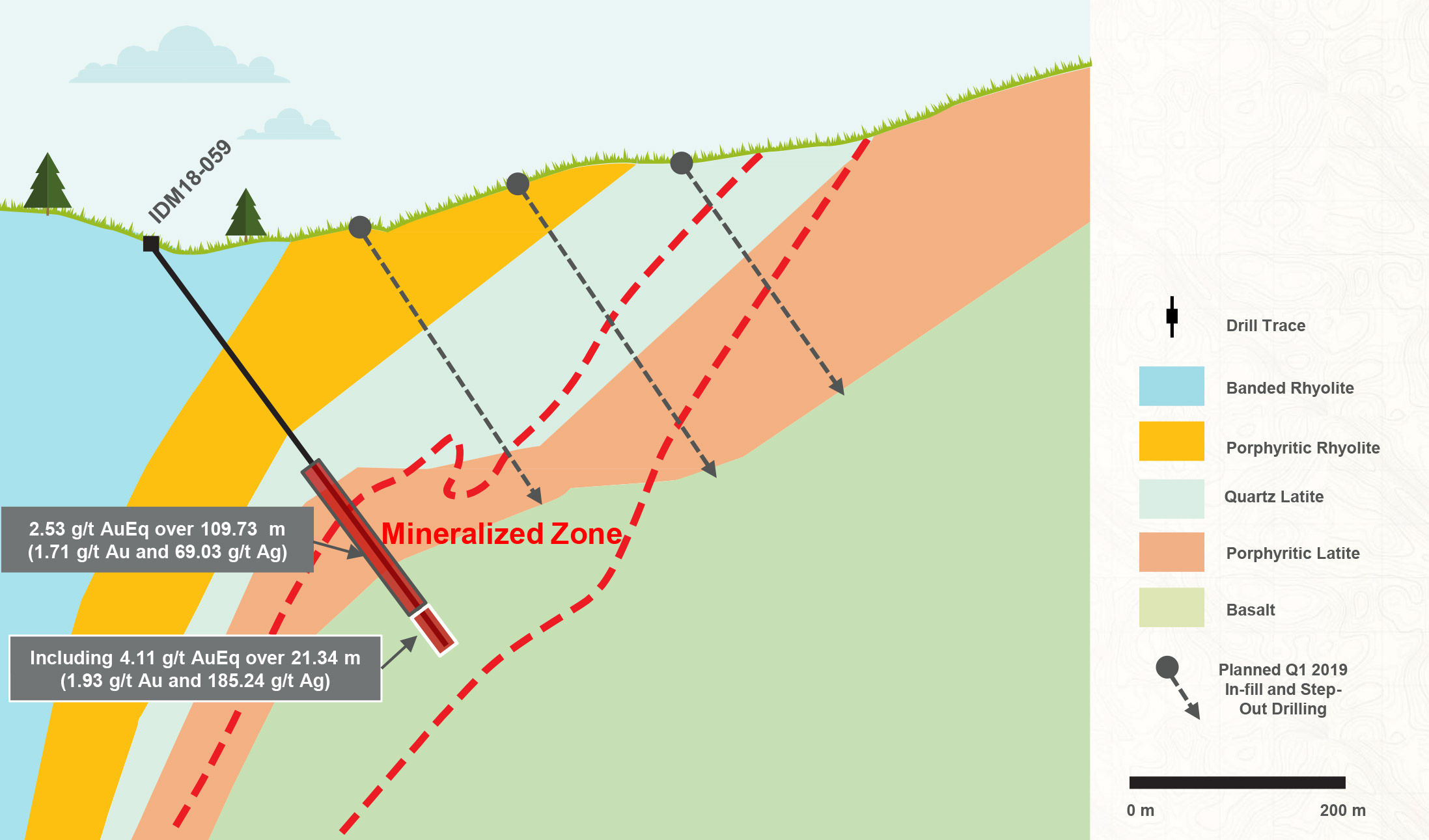

The assay results of the step-out hole that was released last week wasn’t any different. Although Integra released the assay results of a bunch of holes, hole 59 was the one that got all the attention. And deservedly so. With 109.73 meters of 1.71 g/t gold and 69.03 g/t silver (for a gold-equivalent grade of 2.53 g/t) including a higher-grade interval at the bottom of the hole consisting of 21.34 meters of 4.11 g/t AuEq, 2019 is starting very well for Integra Resources.

Yes, the mineralized zone was encountered at a depth of almost 340 meters down-hole (approximately 275 meters vertical depth), and this could indeed be seen as pushing the limits of an open pit scenario. Although the viability and the economics of this mineralized zone obviously still have to be calculated and confirmed, there are some mitigating factors why mineralization at this depth could still be viable.

First, the strip ratio. Yes, an open pit could easily reach depths of 300 meters, but the main question is how this will impact the strip ratio (the ratio between waste rock and paydirt). We do agree that on some parts of the potential mining sequence (using this word is obviously very preliminary as Integra hasn’t even completed a PEA yet) there will be a double-digit strip ratio. But there are two reasons why this won’t have to be a deal breaker.

First of all, if the viability depends on the correlation between strip ratio and average grade. A strip ratio of 10:1 on a low-grade Nevada target with a gold grade of 0.4 g/t won’t work. But a strip ratio of 10:1 (note, this ratio is just illustrative, the potential strip ratio at a potential DeLamar open pit is obviously unknown at this point) to gain access a zone with an average recoverable grade of 1.62 g/t gold and 51.8 g/t silver (using a 95% recovery for gold and 75% for silver in a mill scenario) is still reasonable as the recoverable rock value would be approximately US$90/t (using $1250 gold and $15 silver). So to decide whether or not a mineralized zone is ‘too deep’ really is a game of numbers, and that’s something the PEA consultants will have to have a good look at.

A second reason why this mineralization could be viable are the technical implications of the recent drill results. And we see technical implications on both the micro- and macro level.

Let’s look at the micro-level first. Integra’s press release contained an interesting image of how the company’s technical team is now interpreting the size, structure and direction of the mineralized zone. As you can see on the next image, the mineralization is projected to come much closer to surface than at the location the hole was drilled:

This could potentially help to reduce the strip ratio concerns as the level of pre-stripping could be relatively benign, while the stripping activities could potentially be bankrolled by processing the low-hanging fruit close to surface. Again, not a certainty, but a potential option that will be drill-tested in the future.

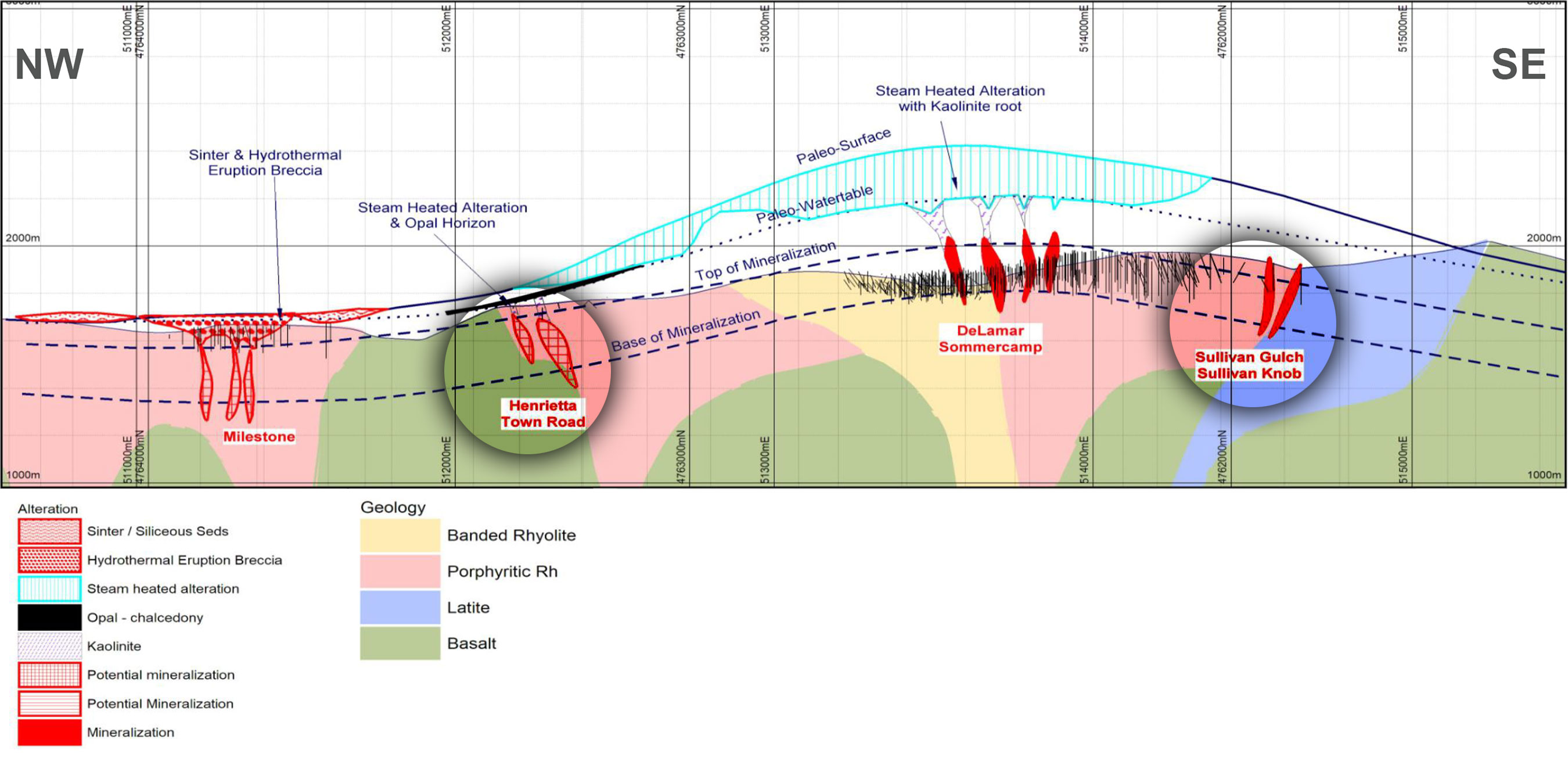

Another reason why this drill result is important on the technical front (on the macro-level) is that it once again proves the IP anomalies to be an excellent pathfinder for gold mineralization. A second IP chargeability has been found just a little bit further east (in a North-South direction rather than a Northwest-Southeast direction) and the Sullivan Knob high-priority target is currently being drilled. It is interesting to see both IP anomalies appear to be trending in the same direction, and perhaps they suggest a larger connected mineralized zone at depth, but that’s yet to be explored (and we aren’t necessarily counting on it).

Integra has also reported the assay results of one hole at Henrietta (320 meters away from the high-grade discovery hole at the Henrietta zone) which returned almost 26 meters containing 0.51 g/t gold and just over 27 g/t silver (for a gold-equivalent grade of 0.83 g/t). Not spectacular, but it’s still early days at Henrietta to increase its understanding of the lower-grade zone.

At the Town Road target, Integra seems to have discovered a mineralized zone starting at surface. At an average grade of 0.91 g/t gold and a marginal amount of silver over in excess of 21 meters and starting at surface, this part of the Town Road target seems to be promising as well.

Insiders bought a lot more stock during the tax loss selling season

Just like most other resource stocks, Integra’s share price was extremely weak during the final weeks of the year as investors were reshuffling their portfolios by taking losses on poor-performing stocks to offset gains elsewhere (although it’s difficult to imagine which other sector, except for the cannabis industry, performed well in 2018).

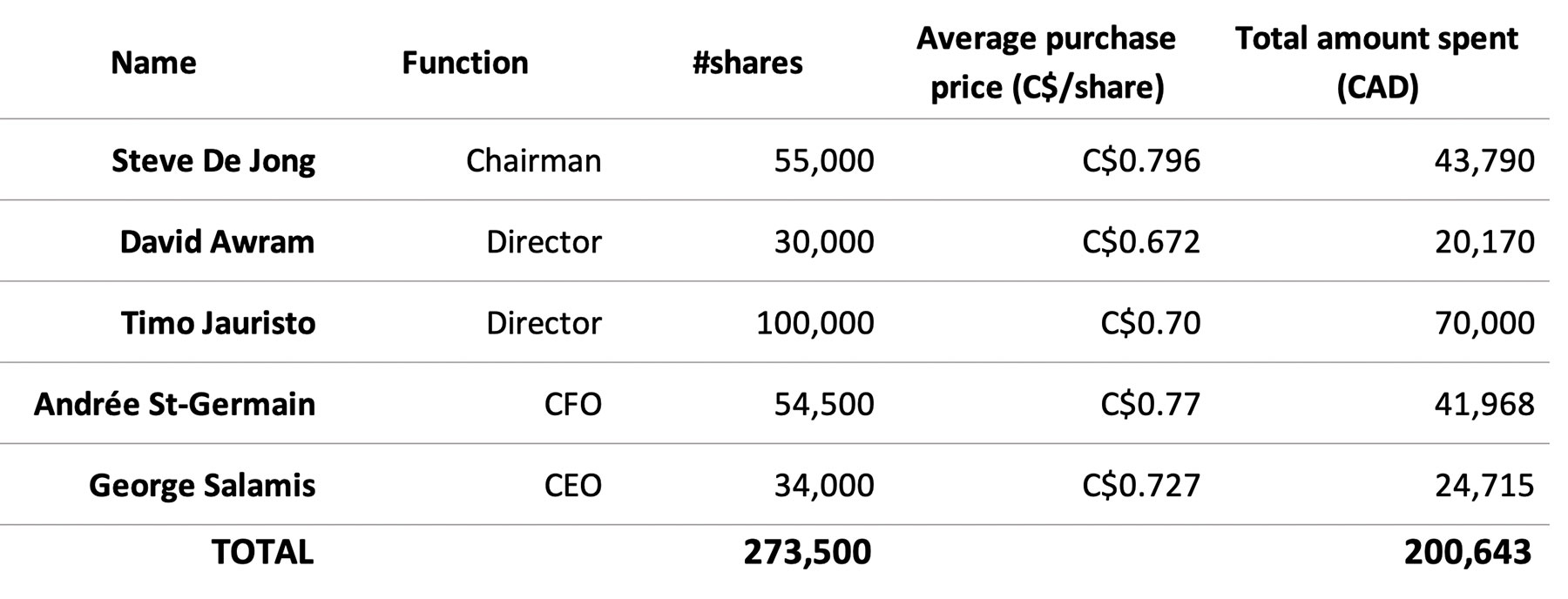

The share price weakness proved to be a good opportunity for Integra’s management team and board members to buy more stock on the open market, as the share price fell to almost 25% below the recent placement price of C$0.80. We have summarized the total insider purchases that have been filed since November 1st and provided a weighted average of the purchases.

The three board members, CEO and CFO have purchased a combined 273,500 shares by spending just over C$200,000 on on-market purchases. This is perhaps the best way for a management team to show its confidence in the future of a company, and Integra’s team doesn’t just talk the talk, but also walks the walk.

Also keep in mind these purchases are only the purchases executed by key people that have to report their trades. Other (non-executive) employees of Integra Resources don’t have to report their transactions but have also added more stock to their positions.

Conclusion

Integra took advantage of a small window of opportunity to top up its treasury in October, and the C$17M it raised in a straight-share no-warrant financing (predominantly taken up by ‘smart money’ like Pierre Lassonde and clients of JP Morgan Chase) at C$0.80 will go a long way to fund the 2019 resource update, exploration programs, the metallurgical test work and a maiden Preliminary Economic Assessment. The updated resource and timing of the PEA have now been postponed until Q2 and H2 2019 respectively. A logical move as this will allow Integra to drill more holes into the Sullivan Gulch target to further define the potential of this zone.

Integra Resources seems to be on track for a busy and promising 2019. The company is fully cashed up, the insiders have bought more stock, and we are now more confident than ever to see a gold-equivalent resource estimate of in excess of 5 million ounces. And then it will be up to Integra’s team and consultants to bring as much of those ounces as possible into a mine plan for the PEA.

Disclosure: Integra Resources is a sponsor of the website. We have a long position.