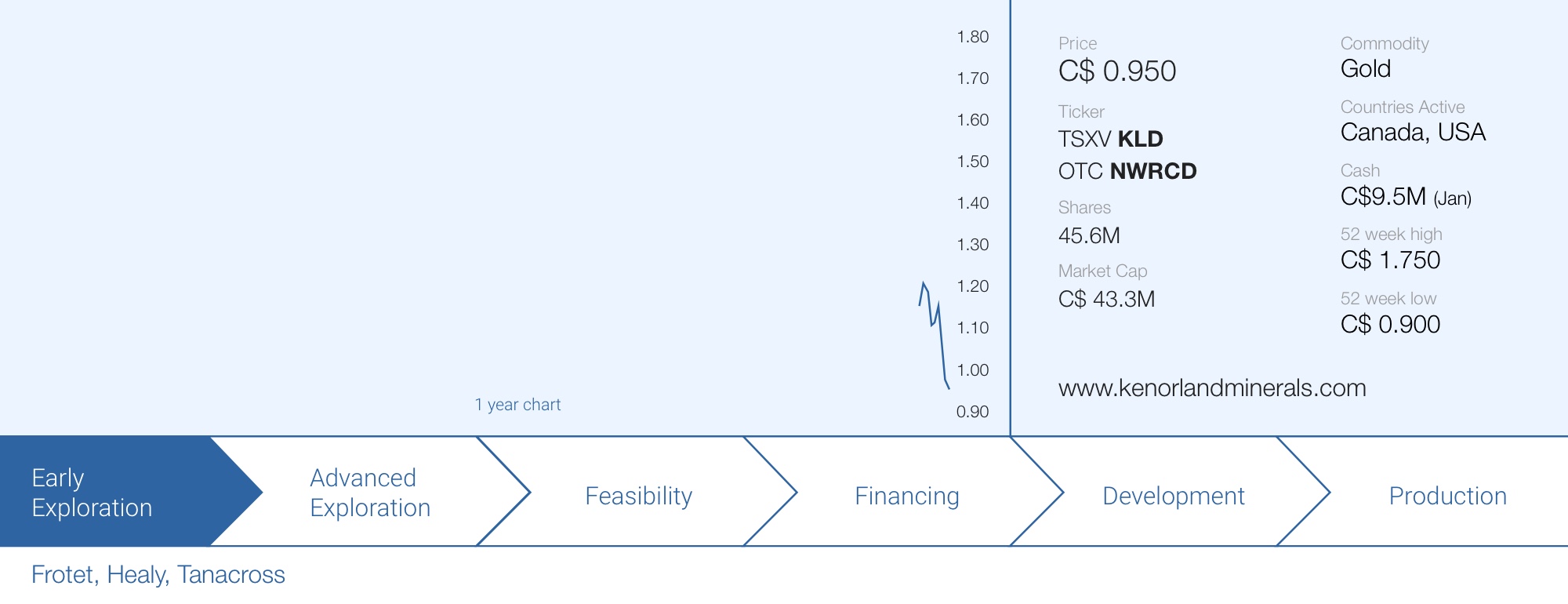

Kenorland Minerals (KLD.V) started trading just two weeks ago after it completed the RTO of Northway Resources. With massive land packages in very prospective belts, strong and well-respected partners and almost C$10M in the bank, Kenorland is ready to hit the ground running in 2021 with three drill programs planned on three projects of its extensive asset base.

But here’s the problem. Kenorland Minerals has such a large project portfolio and we don’t want to bombard you with details, so we will just provide a first quick glance at the three main projects and once the dedicated exploration programs begin, we will be back with more in-depth discussions on each of the specific projects.

A quick introduction to the three main projects

Frotet, Quebec

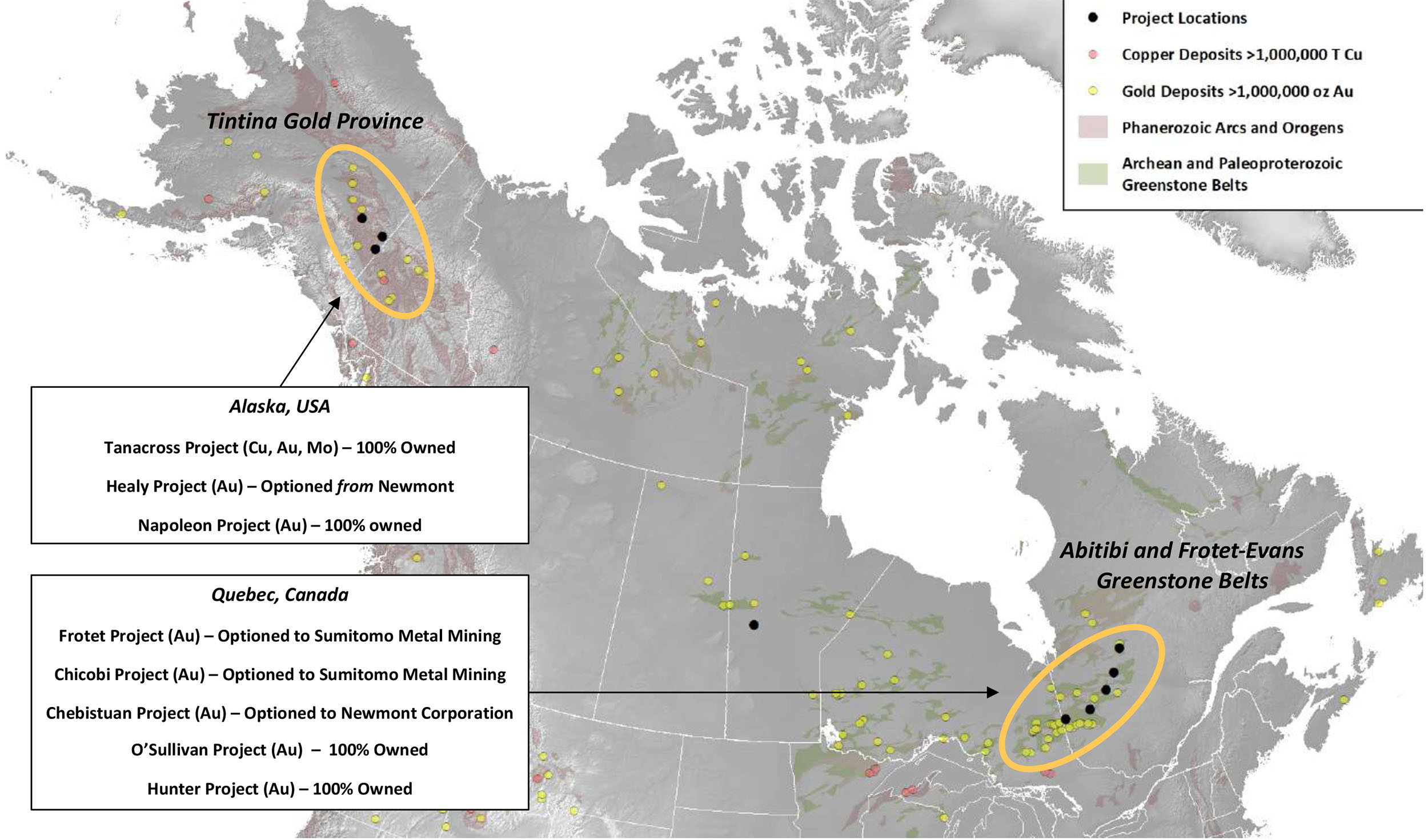

Kenorland actually staked the Frotet project themselves in 2017 when it staked in excess of 55,000 hectares not too far away from the past-producing Troilus gold-copper mine (now owned by Troilus Gold (TLG.V) and in the subsequent years it added more claims (either staked or purchased from third parties) and dropped some claims to end up with the current size of approximately 40,000 hectares.

The company did an excellent job with the groundwork as it was able to attract Sumitomo Metal Mining Canada as a joint venture partner just one year after staking the initial claims. Sumitomo can earn an 80% stake by funding C$8.3M in exploration. The first stake of 65% has been established now, and by August of this year, Sumitomo should have completed the second requirement to spent C$4M (after having spent C$4.3M before August 2020) where after both companies will form a 80/20 joint venture.

Given how good the recent exploration results were, we have very little doubt Sumitomo will complete the earn-in to 80%. After two years of thorough exploration activities to refine drill targets, Kenorland singled out the Regnault target to be drill tested.

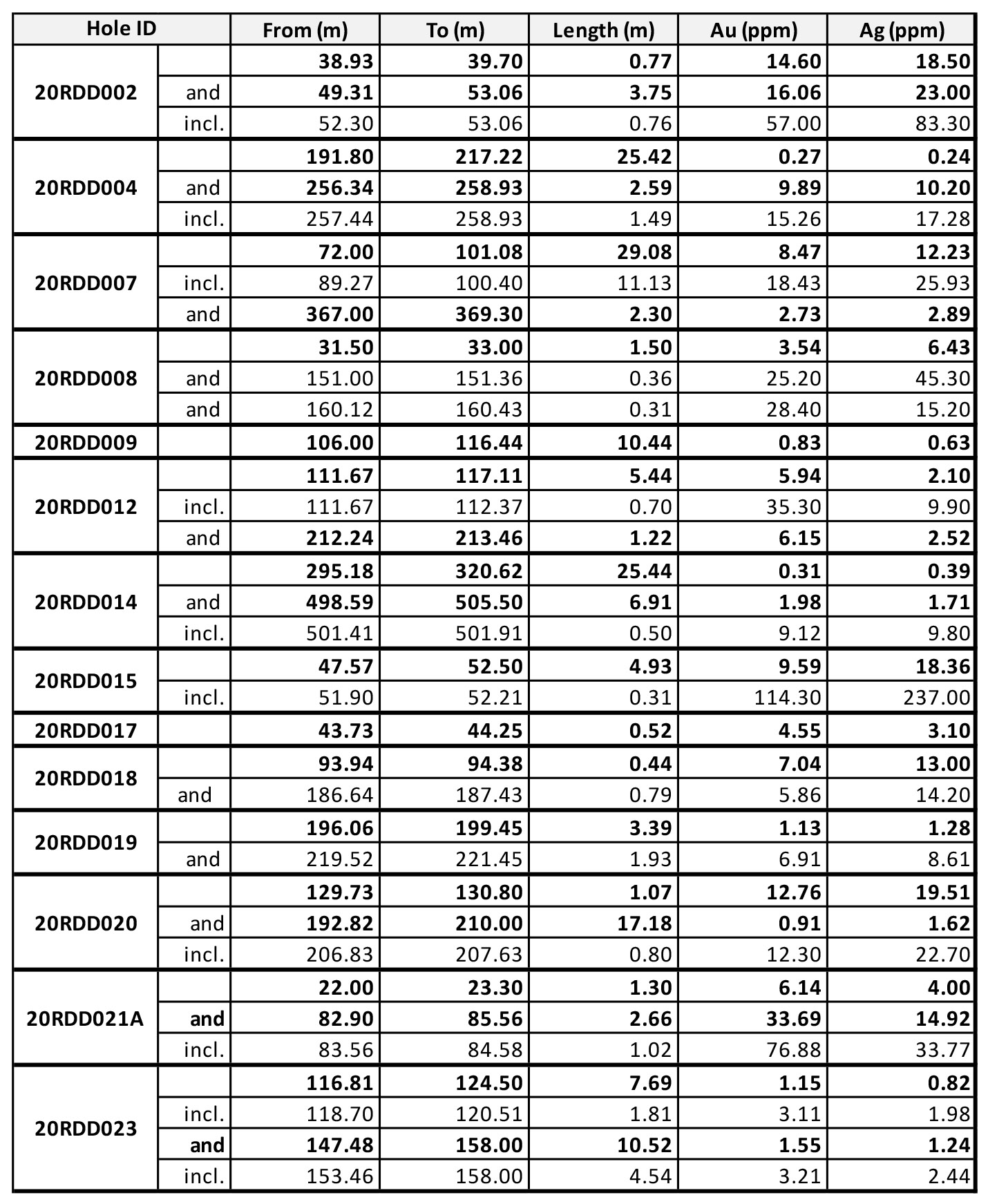

Approximately 15 holes were drilled for a total of 6,000 meters, and just over half of these holes contained significant gold mineralization. While you may think not finding anything (or low grades) in seven holes is a pretty poor performance keep in mind this is the first ever drill program on pretty much a virgin discovery. Having 8 holes hitting the targets in a first-ever drill program is actually a pretty good hit ratio and a subsequent (small) 1,800 meter drill program designed to follow up on these results was kicked off.

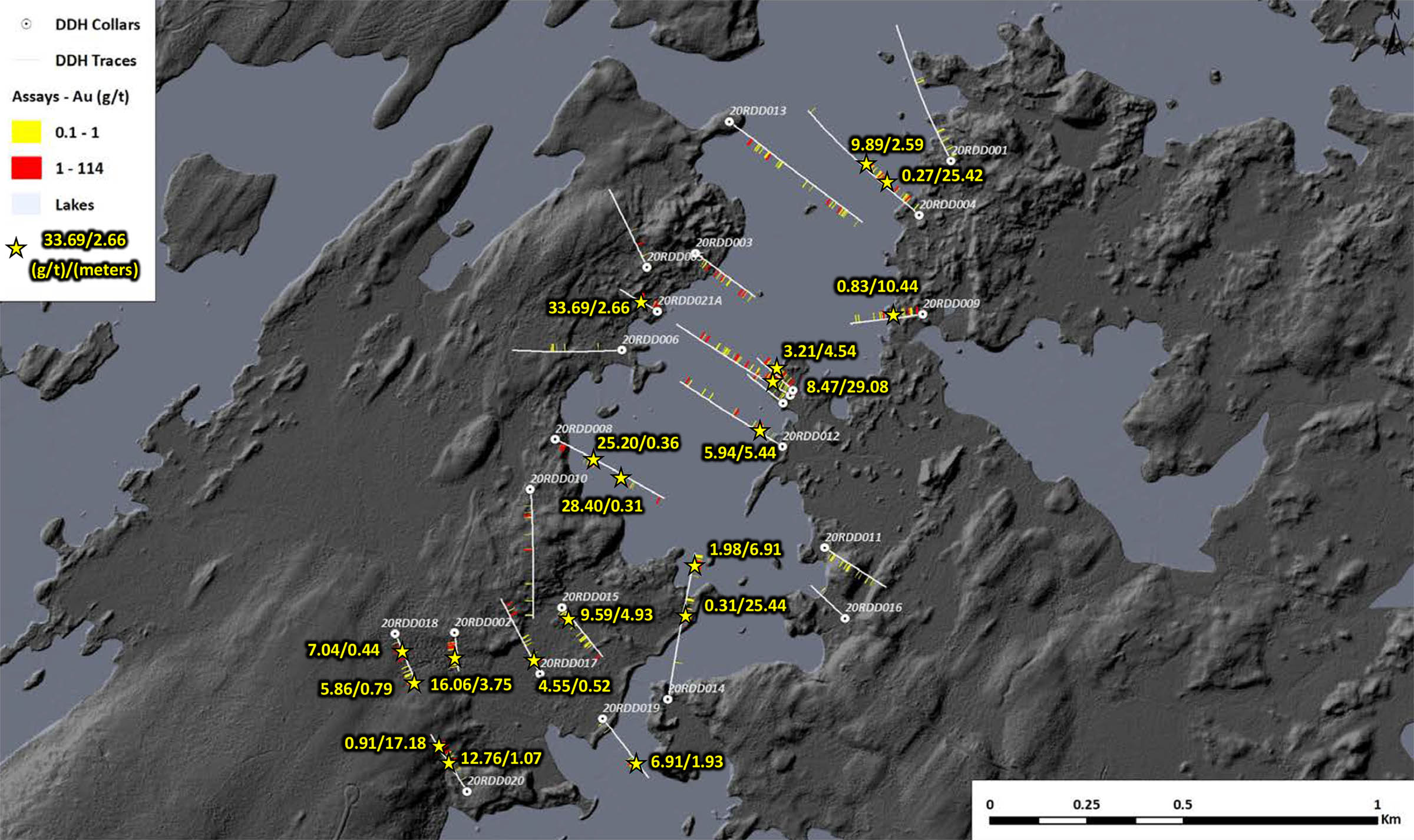

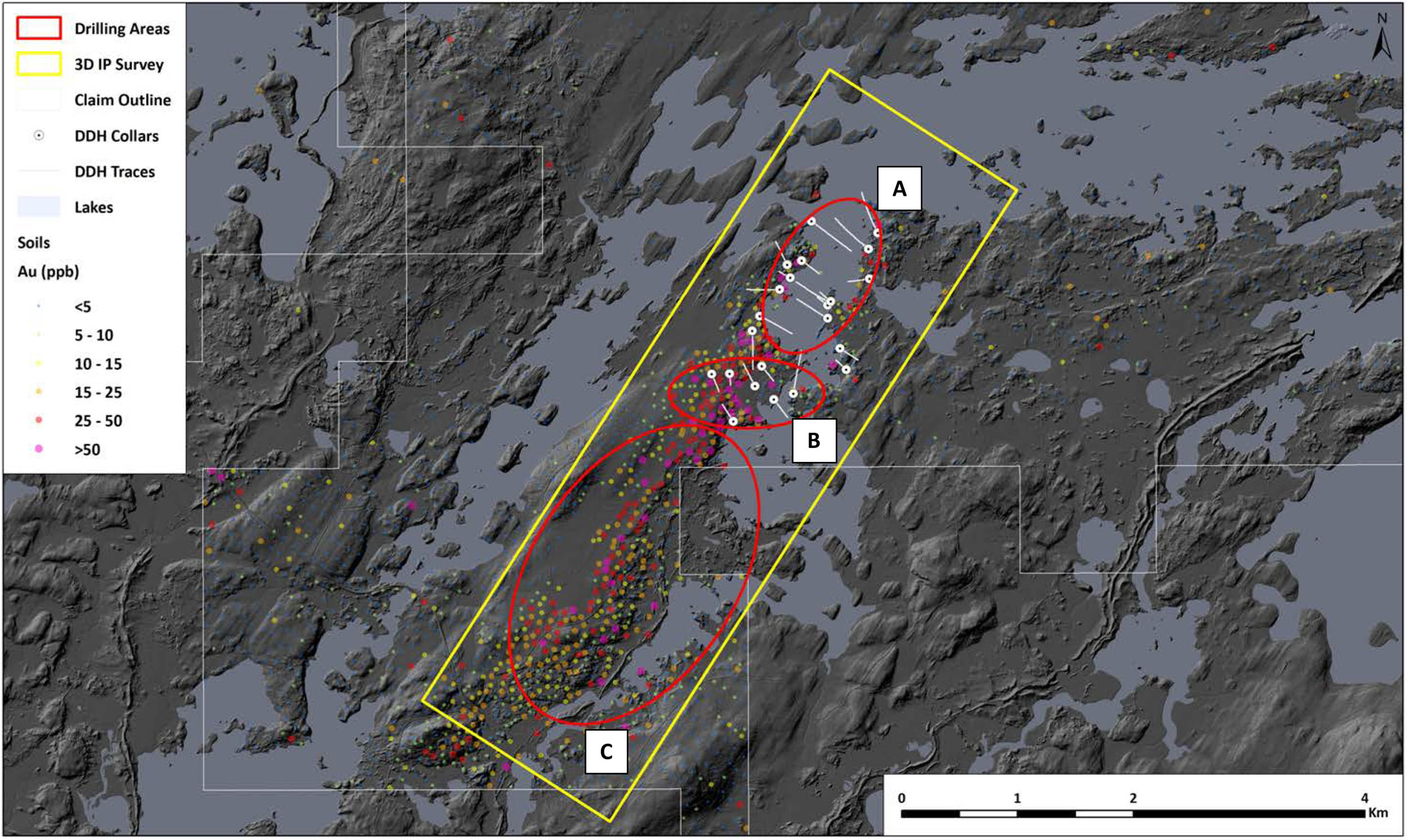

The image above summarizes some of the most intriguing intervals. While the 29 meters of almost 8.5 g/t gold is an absolute eye-catcher, the 3-5 meter intervals in the other holes are also sufficient to gather interest. And as you can also see on the map below, some of the best drill results are pretty close to each other so even within the high-profile Regnault target, there are some high-grade hot spots that will urgently have to be followed up on.

And fortunately Sumitomo is indeed getting ready to complete an additional 9,000 meters of drilling at Regnault as the high-grade gold intervals over what should be mineable widths obviously also spark the interest of their geological team. The drill program should start in March with 6,000 meters earmarked for the Regnault Discovery Area and an additional 3,000 meters to be drilled on new targets along trend on “Regnault South”.

Last week, Kenorland announced an additional update from Regnault South as the length of the gold-in-till anomaly has now almost doubled to five kilometers based on the analysis of in excess of 1,200 soil samples taken on a 50 by 100 meter grid. 59 of those samples (almost 5%) contained a gold grains with 14 samples returning in excess of 50 grains. The location of these samples seems to indicate the mineralized bedrock source at Regnault may continue further to the southwest of the discovery area. Additionally, the assay results of a boulder sampling program encountered very anomalous gold values with the highest values found in one specific type of rock: bleached silicified basalt. And that’s interesting as drilling has yet to intercept this type of basalt at depth. Given the gold grades in the basalt, Kenorland thinks this could potentially be a new bedrock source of the gold.

Given the high-grade mineralization and the fact Sumitomo is only interested in large deposits, we wouldn’t rule out Sumitomo trying to combine the Frotet project with the Troilus gold project owned by Troilus Gold. The latter already contains 7 million ounces of gold in a low-grade resource (0.75 g/t Au, 0.87 g/t AuEq) and a combination of both projects could increase the average grade of the entire district. On top of that, we obviously don’t have to explain the potential synergies and economies of scale that could be generated using one centralized processing plant for the district as the high-grade Regnault discovery is just 30 kilometers away from the Troilus pit (and resource).

Of course, we are getting a bit ahead of ourselves here, but knowing Sumitomo is chasing the projects, it just makes sense to take a step back and look at the region as a whole. There’s a lot more work to be done at Frotet (let’s start with a resource estimate trying to connect all the dots!), but should the Kenorland-Sumitomo partnership be able to prove up a decent-sized resource at a decent grade on the Greater Frotet project, we are certain some smart people will look at this as a district play.

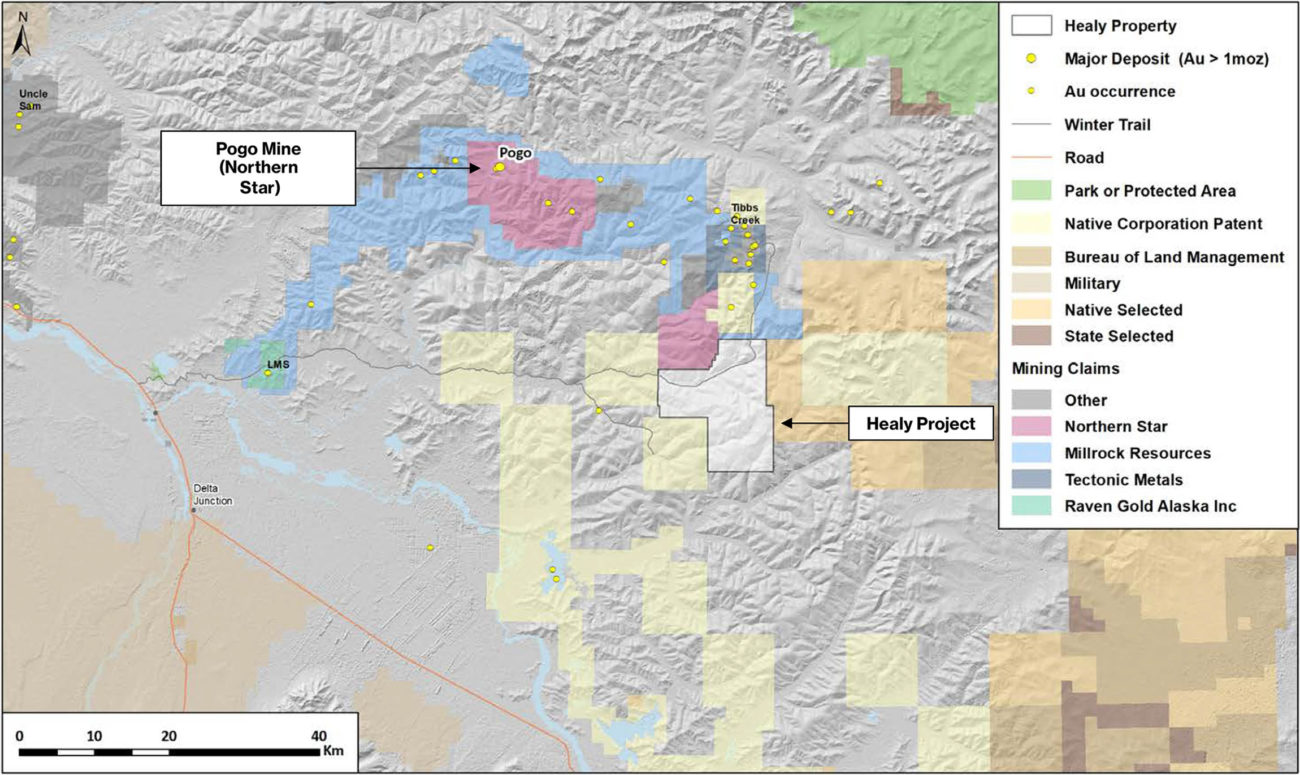

Healy, Alaska

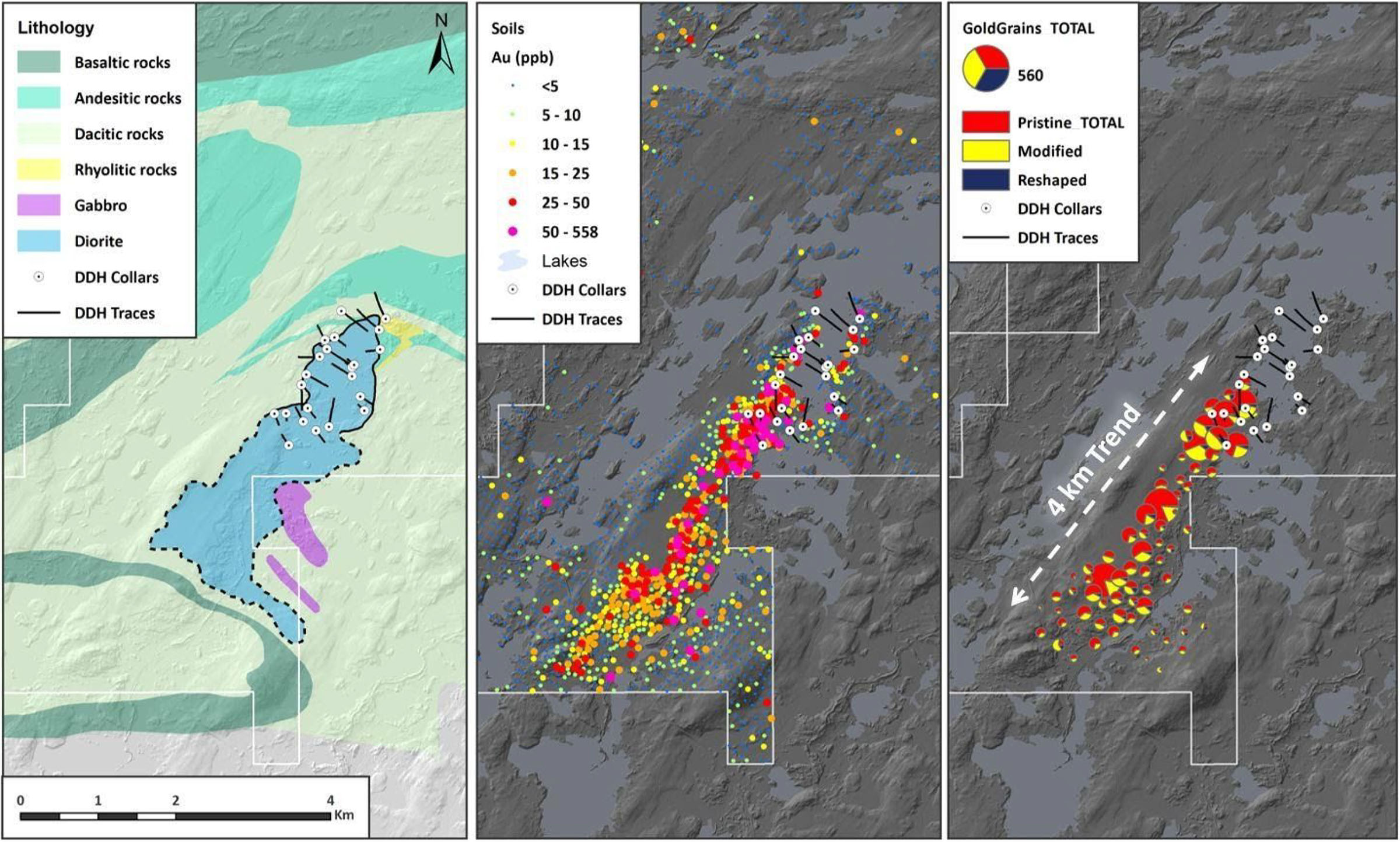

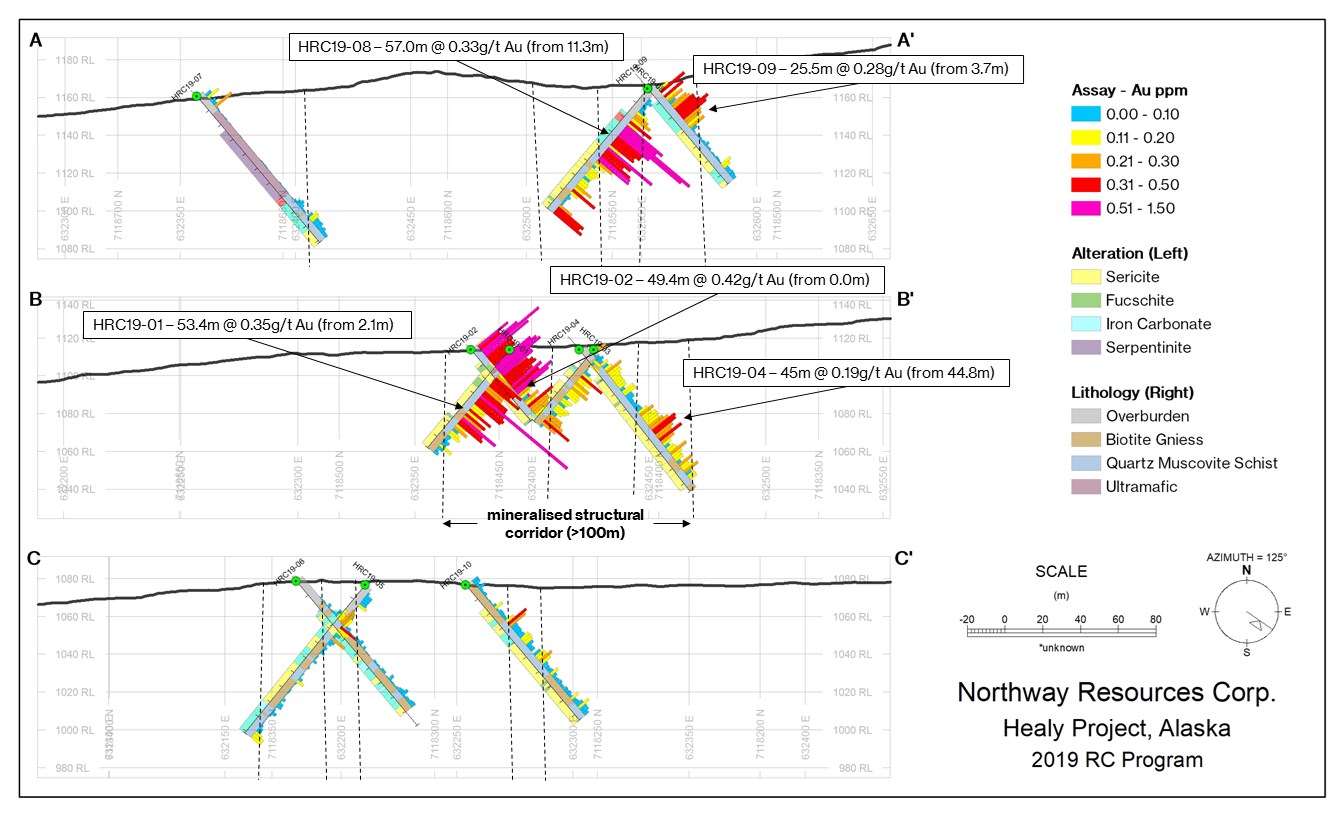

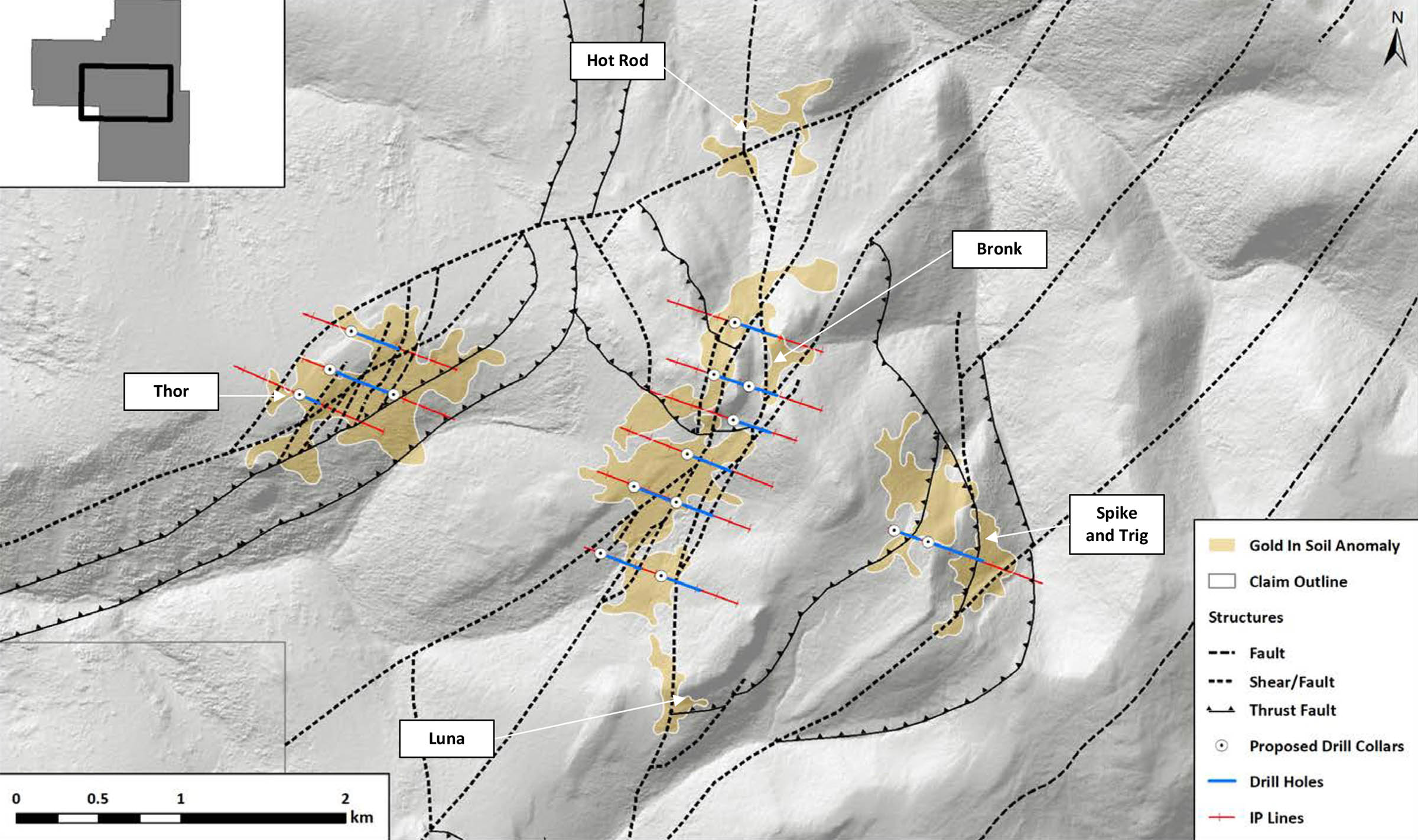

The Healy project consists of almost 20,000 hectares of claims close to the Pogo gold mine, which was acquired by Northern Star Resources (NSR.AX) just a few years ago. There has only been limited exploration at Healy as the first dedicated exploration program was only embarked upon by Newmont Corporation in 2012 and remained untested by drilling when the project was optioned to Kenorland. Kenorland did however drill a few holes in 2019 and the ten RC drill holes confirmed the existence of widespread gold mineralization.

That initial drill program was very limited and very shallow (10 holes were drilled for a total of just 800 meters, indicating the average hole reached a depth of just 80 meters), but some of those holes contained very interesting gold values: coming up with almost 50 meters of in excess of 0.4 g/t gold is highly anomalous and speaks volumes to the exploration theory which will be followed up on with another drill program this year. And the 49 meters wasn’t just a lucky shot. The same drill program intersected 57 meters of 0.33 g/t gold, and 53 meters of 0.35 g/t gold.

The total area covering multiple gold in soil anomalies is now about 25 square kilometers and right now, it looks like the Healy project could either be a Pogo-type project (high-grade underground) or a Fort Knox project (low-grade open pit heap leach gold) which is literally located further up the road (albeit 200 kilometers away).

With almost 20,000 hectares of land and promising drill results from a first pass exploration program in 2019, Kenorland has plenty of drill targets to follow up on, and several areas it needs to drill-test. About 4,000 meters of drilling has been budgeted to follow up on the exciting first pass drill results and once we get closer to the start of the drill program, we’ll follow up on Healy in more detail with CEO Zach Flood.

Tanacross, Alaska

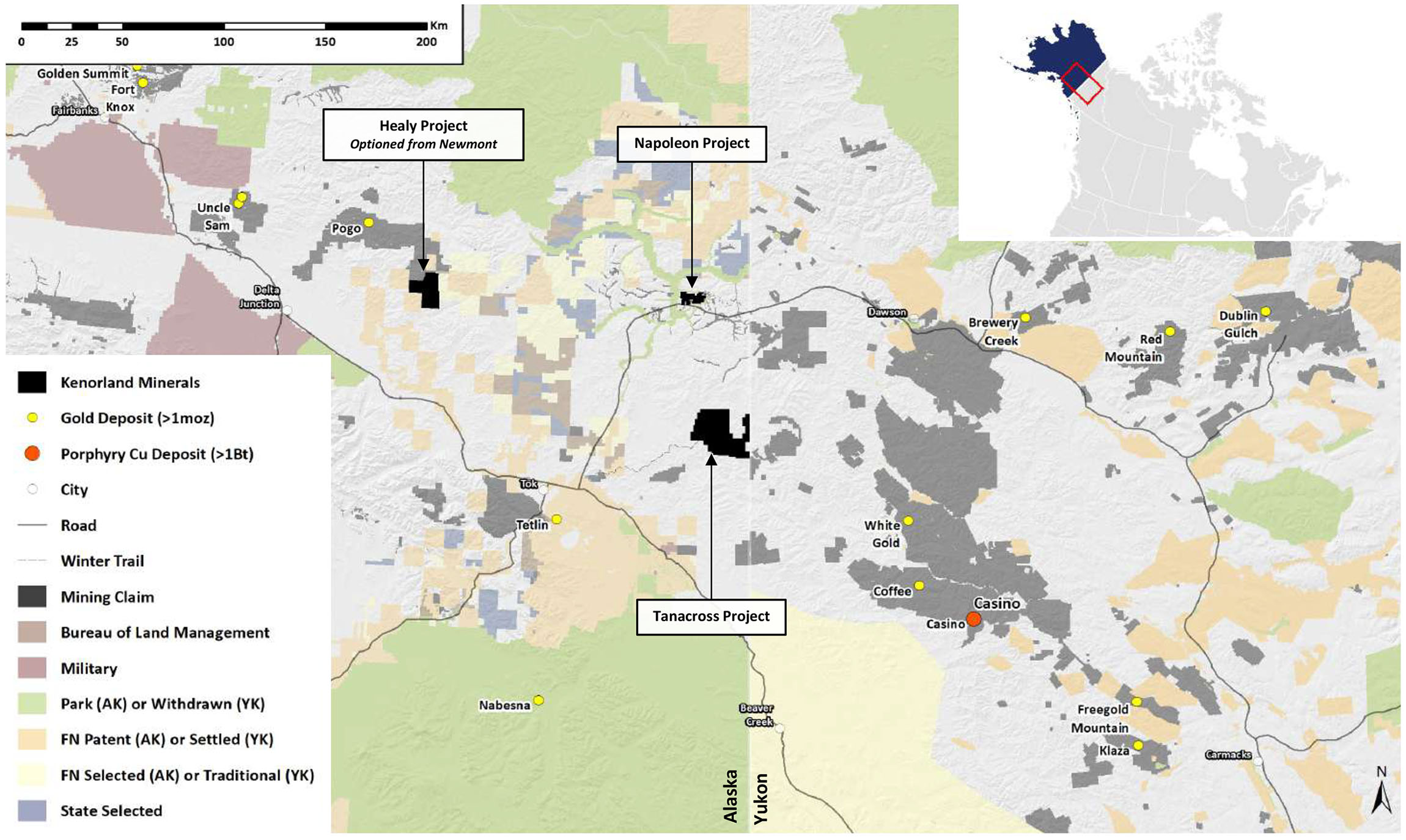

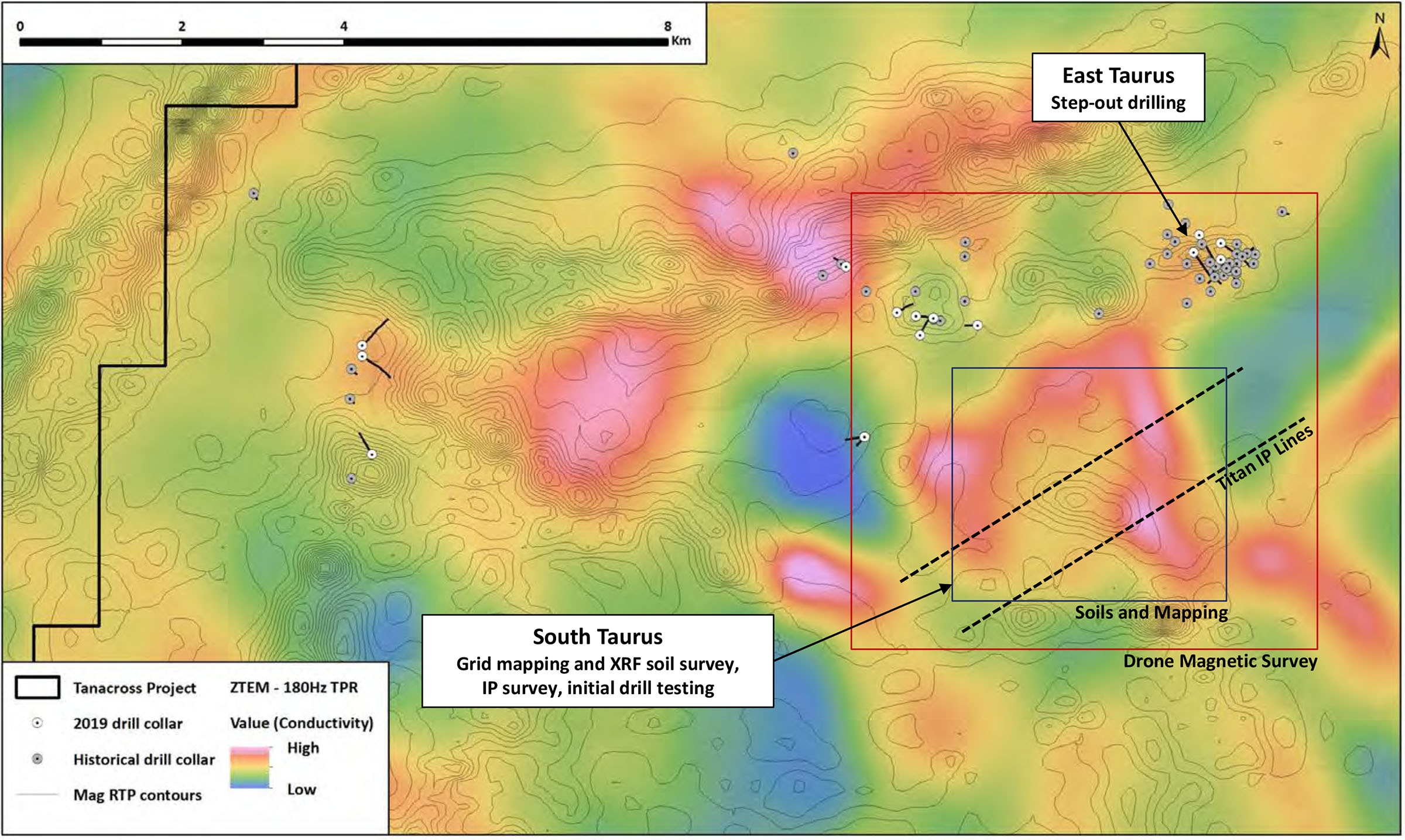

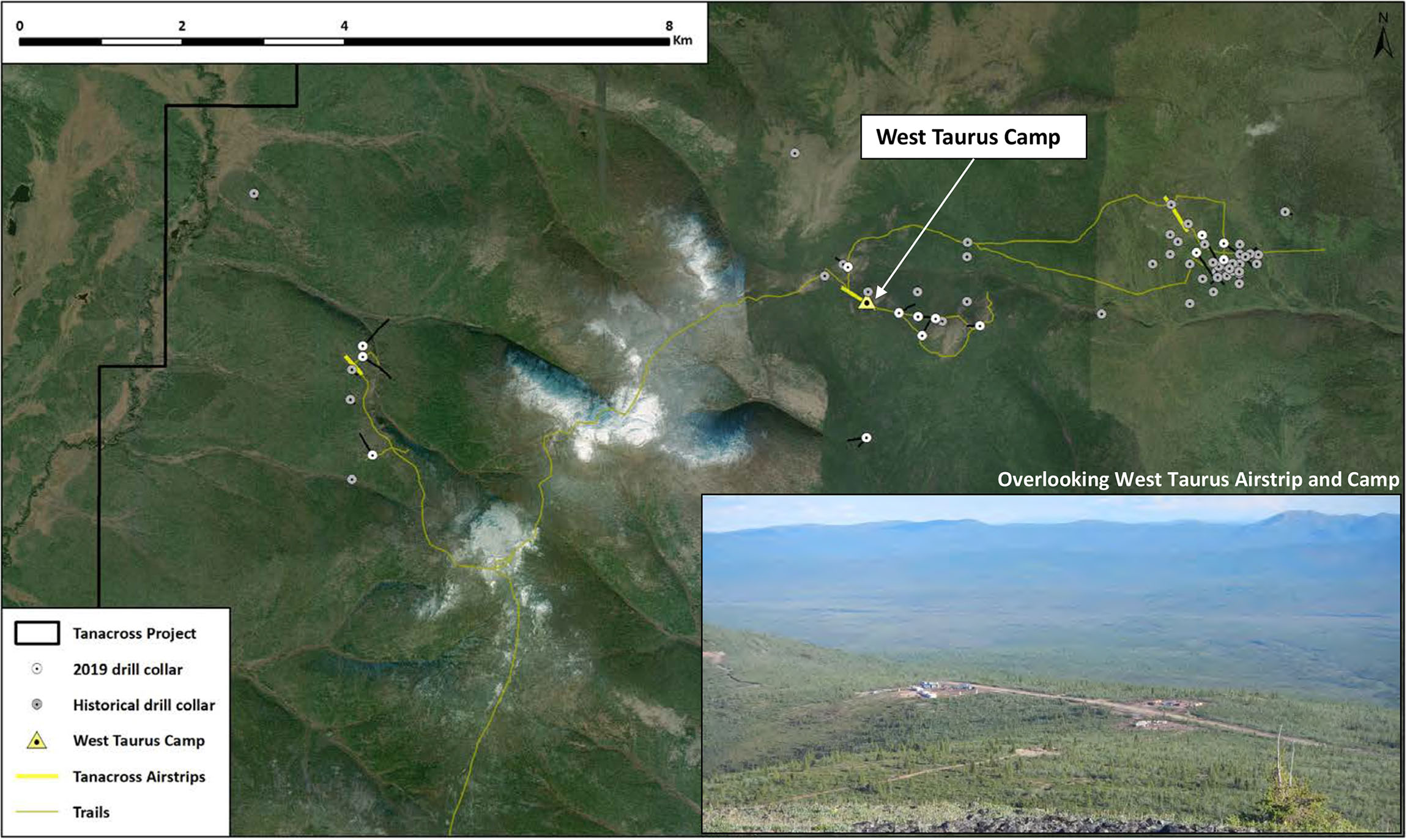

Anyone who looks at the Tanacross project in Alaska will immediately notice the similarities with the Casino copper-gold project owned by Western Copper and Gold, just across the border in Canada’s Yukon Territory. Indeed, the Tanacross project is located on the same trend as much of the White Gold District and whereas that district is predominantly known for its low-grade but heap leachable gold, there are areas where a copper-gold mineralization is dominant. And even more important, the Tanacross rocks roughly have the same age as the rocks hosting the Casino deposit.

As you can see in the image above, there still is a considerable distance between Casino (the orange dot) and Tanacross, but the historical drill intervals at Tanacross will explain why we think this could be a Casino 2.0.

The project was subject to a drill program of almost 10,000 meters in 2019 as Freeport McMoRan (the joint venture partner back then) bankrolled a 15 hole drill program as part of its earn-in commitments. Despite the encouraging results, Freeport dropped the project but now the copper price is trading almost 50% higher, the interest in these types of large copper-gold porphyries may return. The 2019 drill results included a highlight of 276 meters of 0.23% copper, 0.16 g/t gold and almost 0.04% Molybdenum and while this is still very much on the lower end of the spectrum (even at the current copper and gold prices one should aim for at least 0.25% and 0.25 g/t as the initial construction cost for these types of projects will be several billions of dollars) it is clear there is a very interesting type of mineralization present.

Pretty much all of the holes in the 2019 drill program contained gold and copper. Some of the intervals were good and on the cusp of being economic-grade, others could best be described as finding ‘sniffs’ of gold and copper. In any case, the drill program confirmed the existence of a large copper-gold porphyry system and it will now be up to Kenorland to figure out if the 30 square kilometer alteration perhaps contains a viable copper-gold deposit.

The exploration plans for the three main projects

Right now, it’s looking like all three projects will be drilled this year. Sumitomo will kick off a 9,000 meter drill program at Frotet where it will be following up on the very attractive high-grade intervals encountered in previous exploration programs. Completing this drill program should be sufficient for the Japanese conglomerate to meet the minimum exploration expenditures to establish its 80% interest in the Frotet project.

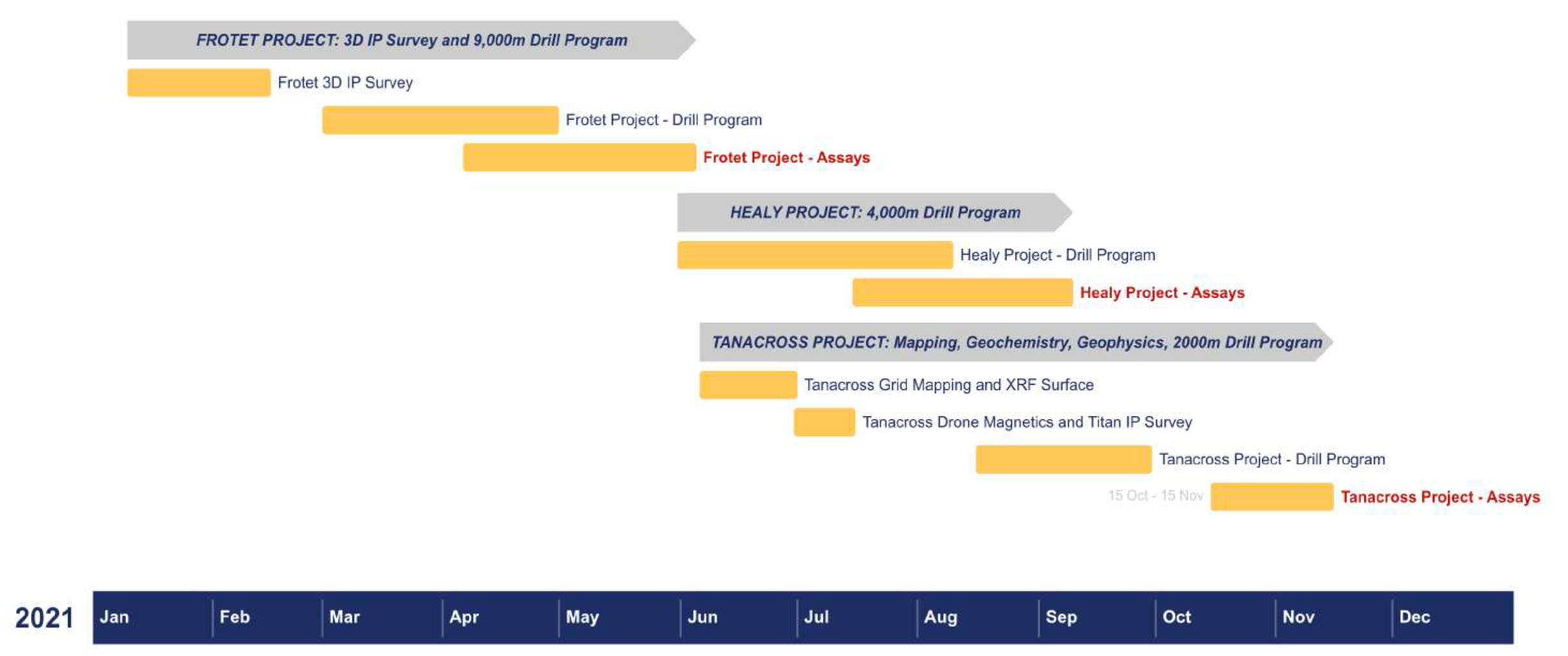

All three main projects will be drilled this year, and given the timing of the planned drill programs (see below), we should see a continuous news flow from Q2 on all the way until the end of the year.

But Kenorland’s portfolio contains much more

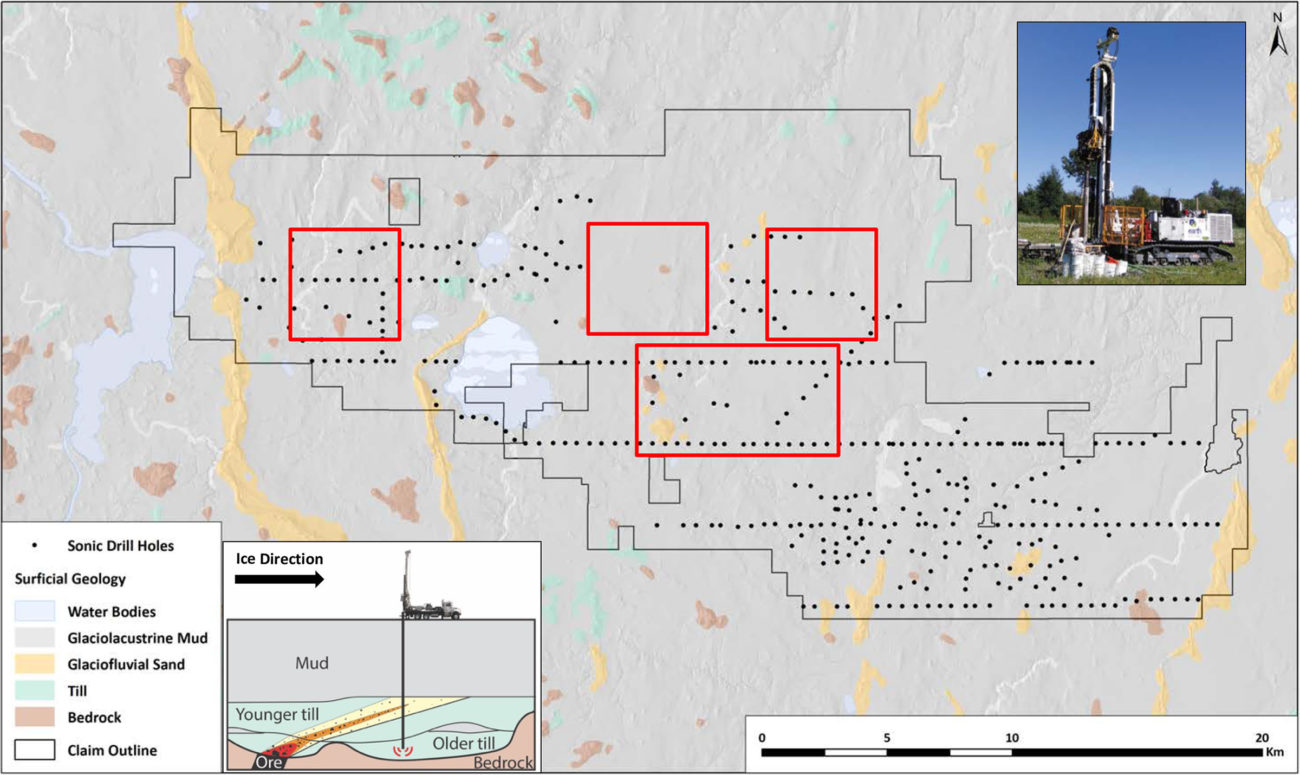

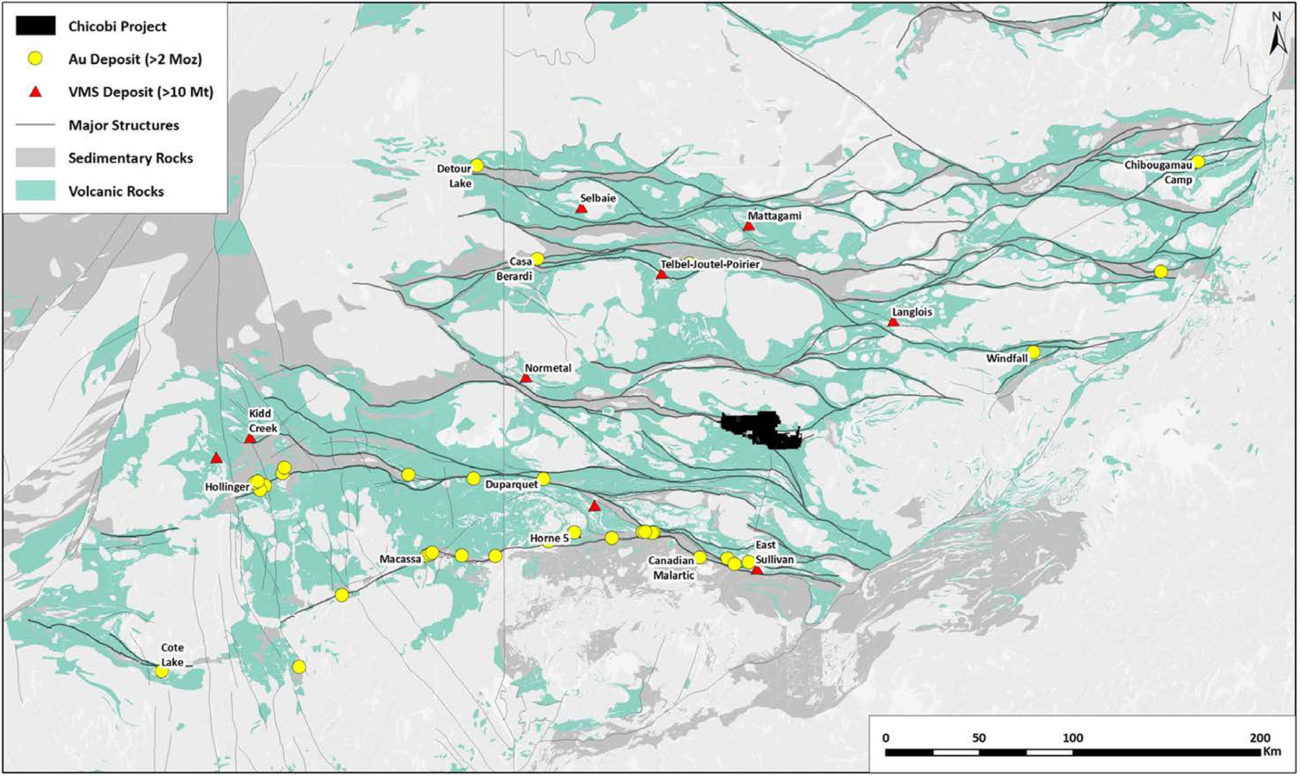

We have now highlighted just three projects, but investors should know Kenorland’s project portfolio is quite substantial. And while most projects are still in the early exploration phase, Sumitomo was charmed by the Chicobi project and entered into an earn-in agreement with Kenorland as well. Sumitomo can earn an initial 51% by spending C$4.9M on qualified exploration expenditures while it can acquire an additional 19% (to earn a 70% stake) by spending an additional C$10M in exploration. A good deal for Kenorland as the Sumitomo cash will greatly reduce the risk while Kenorland will retain a 30% stake (if Sumitomo completes its earn-in to 70%).

Again, Chicobi is just one of the several assets in the Kenorland portfolio, and although it’s a very early stage project, the reason for Sumitomo to be so interested is pretty clear when you look at t he map below. The project consists of about 52,000 hectares of land in one of Canada’s most prolific gold systems.

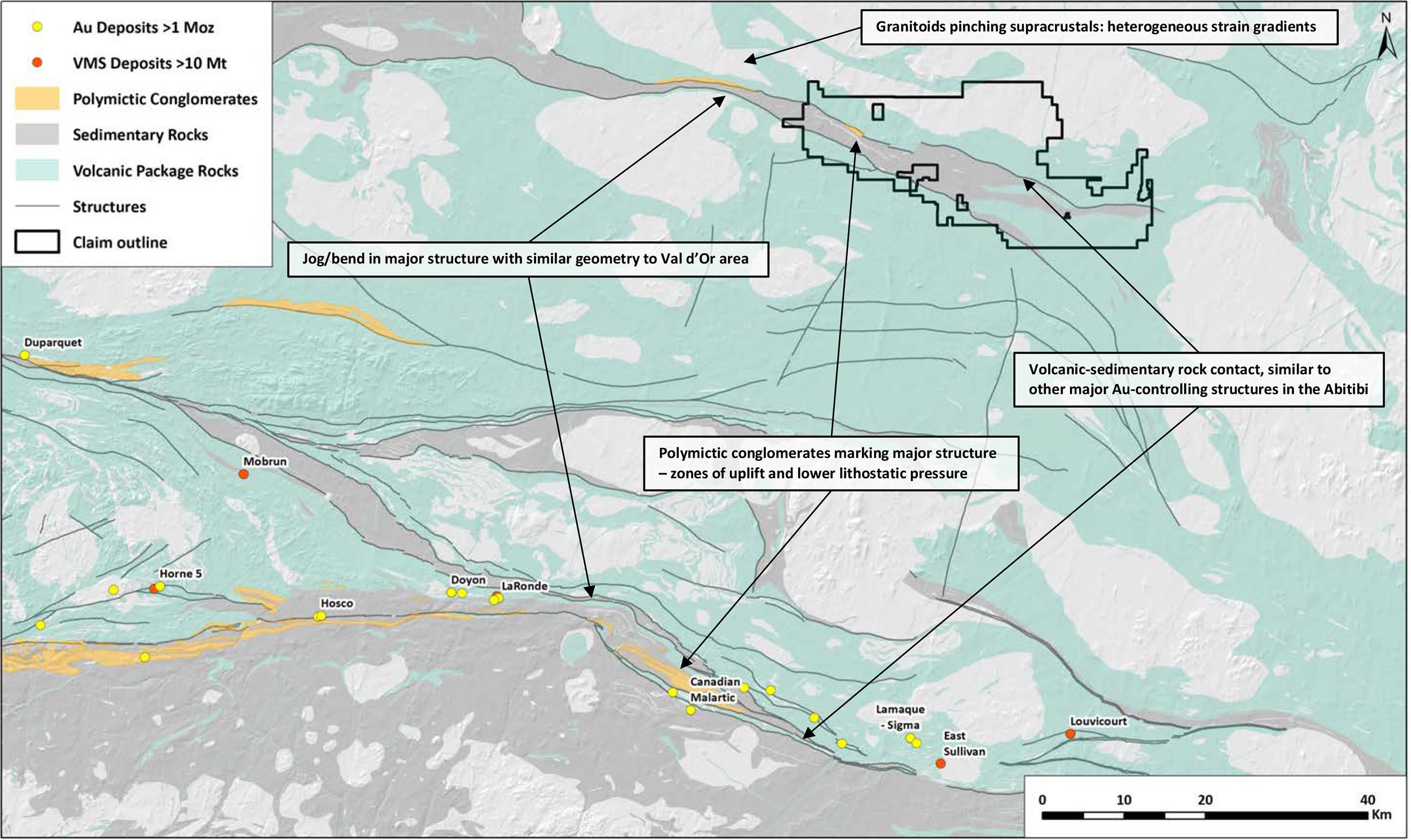

And when we zoom into the Chicobi land package, you can clearly see the rational for staking that specific zone as the signature is quite similar to the east-west trend about a hundred kilometers south around the town of Val D’Or where tens of millions ounces have been mined so far.

So yes, the Kenorland portfolio consists of early stage exploration projects and while one could argue Kenorland appears to be just a ‘land bank’, the company is so much more than this. If anything, the recent exploration success at Frotet has shown the methodological exploration model is working well as the first ever drill holes confirmed the existence of high-grade gold mineralization.

And while Kenorland will continue to spend its own dollars to fund the early stage exploration activities on its grassroots projects, the company has made it clear it will continue to look for farm-out opportunities by bringing in a bigger partner using their cash resources to do the heavy lifting.

A second project optioned to a major is Chebistuan, which consists of just over 161,000 hectares of land and has been optioned out to Newmont. Newmont has to spend approximately C$2M in exploration expenditures (on top of a completed C$0.7M soil and till sampling program) to earn an initial 51% stake in the project. Subsequent to establishing 51% ownership, Newmont can increase this to 80% by completing a pre-feasibility study on a resource of at least 1.5 million ounces of gold. Having three early stage exploration projects optioned to two heavy hitters in the industry speaks volumes to the quality of the ground work completed by Kenorland and its technical team.

And Kenorland is sitting on almost C$10M in cash to help fund exploration

While it’s great to have partners funding a substantial portion of the exploration budget, Kenorland still has a bunch of fully-owned projects it will have to spend its own dollars on in order to advance it to the point it may attract a partner (or just keep on developing projects themselves).

That’s why Kenorland raised a substantial amount of cash ahead of its listing. In early November, it closed a C$10M brokered no-warrant financing priced at C$1 and this obviously is a big boost to the treasury which currently still contains approximately C$9.5M. While we totally understand Kenorland wanted to pull off a no-warrant financing, the lack of warrants also means that once the company runs out of cash it will have to tap the equity markets rather than hoping for warrant money to come in. But then again, there will be no warrant overhang this year and anyone who wants to buy the stock will have to do so on the open market as there will be no pressure from warrant exercises or lock-up periods as the C$1 financing was immediately tradeable.

So long story short, there’s no warrant overhang at all. There are approximately 7 million options as well as 1.9M warrants from previous financings but this should not have a major impact as any exploration success should result in the market demand easily absorbing the potential exercise of these warrants. Those warrants are the historical remains from Northway Resources, the company Kenorland was rolled into, and all warrants had an exercise price of C$0.10 which now is C$0.70 after the 7:1 share consolidation. With various expiry dates (just a few hundred thousand will expire this year, 400,000 in 2023 and about 1.2M in 2024) we don’t see any issue with the warrants as there is plenty of time and there will be plenty of opportunity for an orderly exercise.

The management

The technical team is actually one of the reasons how we originally bumped into Kenorland. An industry connection told us to ‘keep an eye on Francis MacDonald’ as he is held in high regard in the mining community. And that pretty much was how we first heard about Kenorland Minerals when it still was a private company last year. And MacDonald is just one of the members of the geological team and it’s worth emphasizing the Kenorland people have a very strong technical background.

Zach Flood – President and CEO, Director

Mr. Flood is an experienced geologist who has managed mineral exploration in countries around the world including Mongolia, China, Dem. Rep. Congo, Peru, Argentina, Canada, and the U.S., over the past 15 years. Mr. Flood co-founded Kenorland Minerals Ltd in 2016. Prior to co-founding Kenorland, Mr. Flood spent numerous years within the Ivanhoe Group, undertaking project generation and business development along with evaluating early to advanced stage M&A opportunities in the mining sector.

Francis MacDonald – Executive VP of Exploration

Francis is an exploration geologist who has spent the majority of his career with Newmont Mining Corporation managing grassroots exploration projects in North America, West Africa, and East Africa. He has extensive knowledge of exploration and targeting techniques related to orogenic gold and VMS deposits in Precambrian terranes.

Scott Smits – Chief Geologist

Scott has been involved in a broad range of positions and responsibilities, including mineral exploration and project evaluations since 2007. He honed his technically driven skillset during his time as a leading geologist on the Madrid deposit, at the Hope Bay Project for Newmont Mining Corporation. Scott’s ability to develop comprehensive three dimensional geologic models integrating wide ranges of datasets has been an integral part of his success from grassroots exploration to resource development. His most recent role was Senior Geologist within Newmont Mining Corporation’s Exploration Development Group conducting project generation and evaluations.

Dave Stevenson – Chief Geophysicist

Dave is a mineral exploration geoscientist with over 10 years combined experience in mineral exploration and geoscientific research throughout Canada, Australia and South America. He has worked with a number of junior and mid-tier companies focusing on regional scale targeting to deposit scale resource definition. His current PhD research (being concluded at The Centre for Exploration Targeting; The University of Western Australia) involves developing and implementing an integrated structural geology and potential field geophysical approach to identifying crustal-scale architectural controls on mineralized systems. With combined experience in mineral exploration and exploration focused academic research Dave is positioned to be a leader among the next generation of mineral exploration geoscientists through applying sound scientific reasoning to develop exploration strategies capable of unlocking the mineral potential in previously overlooked terranes.

Janek Wozniewski – Exploration Manager

Janek is an exploration geologist and geoscientist with experience in early to late stage mineral exploration projects as well as mid-stream oil and gas projects in Canada, US, Australia and Peru. Since 2009, Janek has consulted with several junior to major energy and resource companies and has gained a broad multidisciplinary skillset with a focus on program planning and project management.

Conclusion

Here’s the tricky part. How does one value a company with no resources but with plenty of exploration potential? The straightforward answer would be ‘your guess is as good as ours’. Do we look at Kenorland as an early stage exploration company? Do we look at Kenorland as a prospect generator considering it will continue to look for farm-out opportunities while it has already attracted Sumitomo which needs to commit in excess of C$20M on exploration expenditures to secure an 80% and 70% stake in two projects in Quebec?

Perhaps we should look at the company as some sort of hybrid model for now: Yes, it does have three projects that have been optioned out, but the majority of the projects are still 100% owned by Kenorland and the company is planning on drilling two of those on their own dime. This means we cannot push Kenorland into one specific box and need to just keep an eye on the ‘sum of the parts’ of Kenorland. And while most projects should now be valued based on a ‘the price is what a fool wants to pay for it’, every single one of those projects is prospective. This doesn’t mean Kenorland (or its partners) will be finding future mines on each and every one of them. But with in excess of 400,000 hectares of land in its asset portfolio, every block of 100 share investment in Kenorland basically represents almost 1 hectare of land.

Kenorland came out of the gate at approximately C$1.15/share (up from the C$1 financing price) giving it a market capitalization of just over C$50M but is currently trading just under the IPO price for a market cap of just C$45M and an enterprise value of around C$35M. While some would consider this to be rich for a pre-resource stage company, we beg to differ. Thanks to the multitude of prospective projects (albeit early stage) and almost C$10M in cash, the risk/reward ratio appears to be very favorable right now. Vanstar Mining (VSR.V), for instance, is trading at a market cap of C$65M for its 25% stake in the 3.2 million ounce Nelligan gold project, also in Quebec. So Kenorland’s current market cap of around C$45M is most definitely not outrageous given the massive land packages with promising first-pass exploration results.

And we’d like to end with this. Kenorland’s website is one of the websites containing more data than you’ll even need to make an investment decision. The key projects all have their dedicated pages on the website and link directly to a technical report and/or technical presentation, making the Kenorland website very easy to navigate, facilitating doing your own due diligence.

Disclosure: The author has a long position in Kenorland Minerals. Kenorland Minerals is a sponsor of the website. Please read our disclaimer.