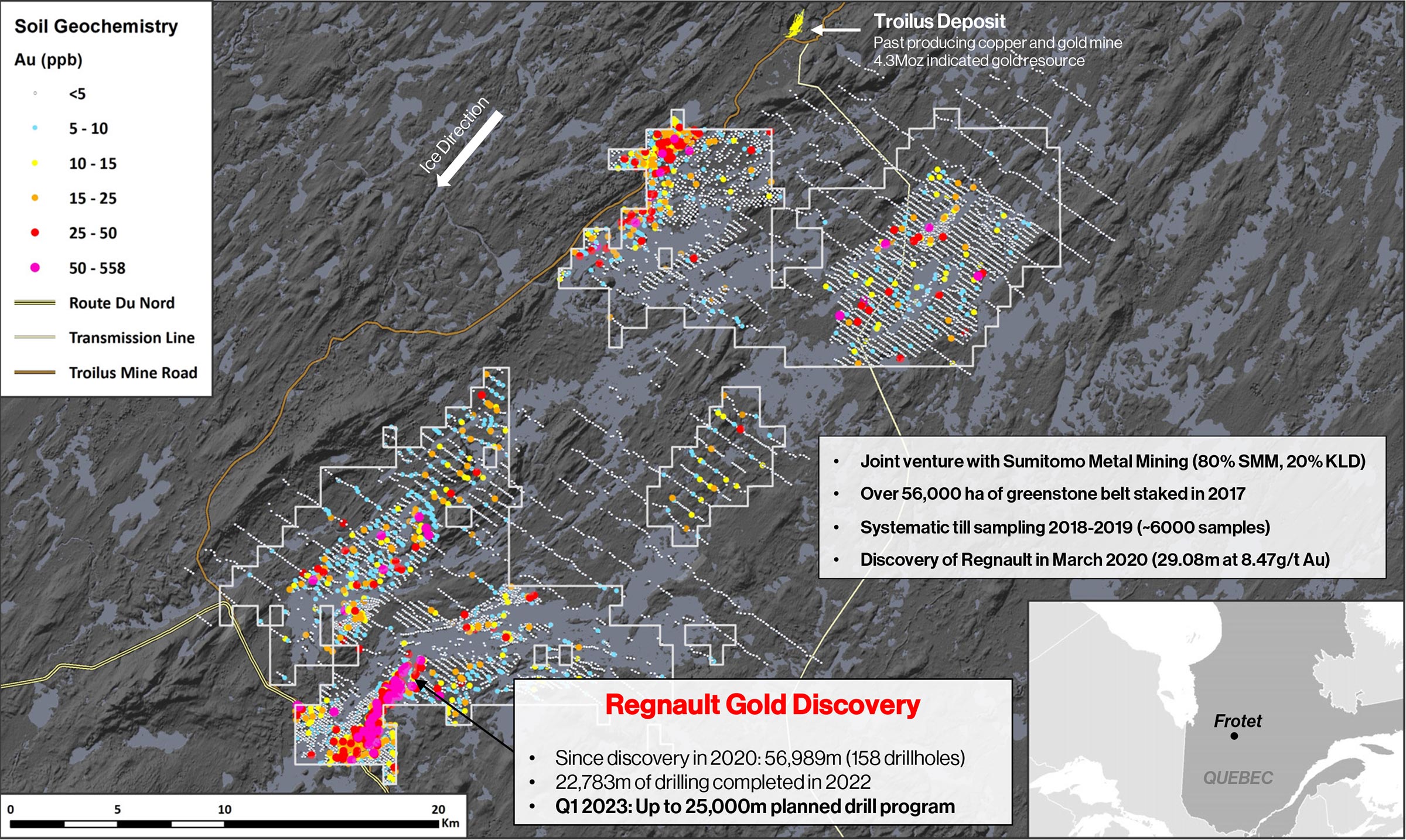

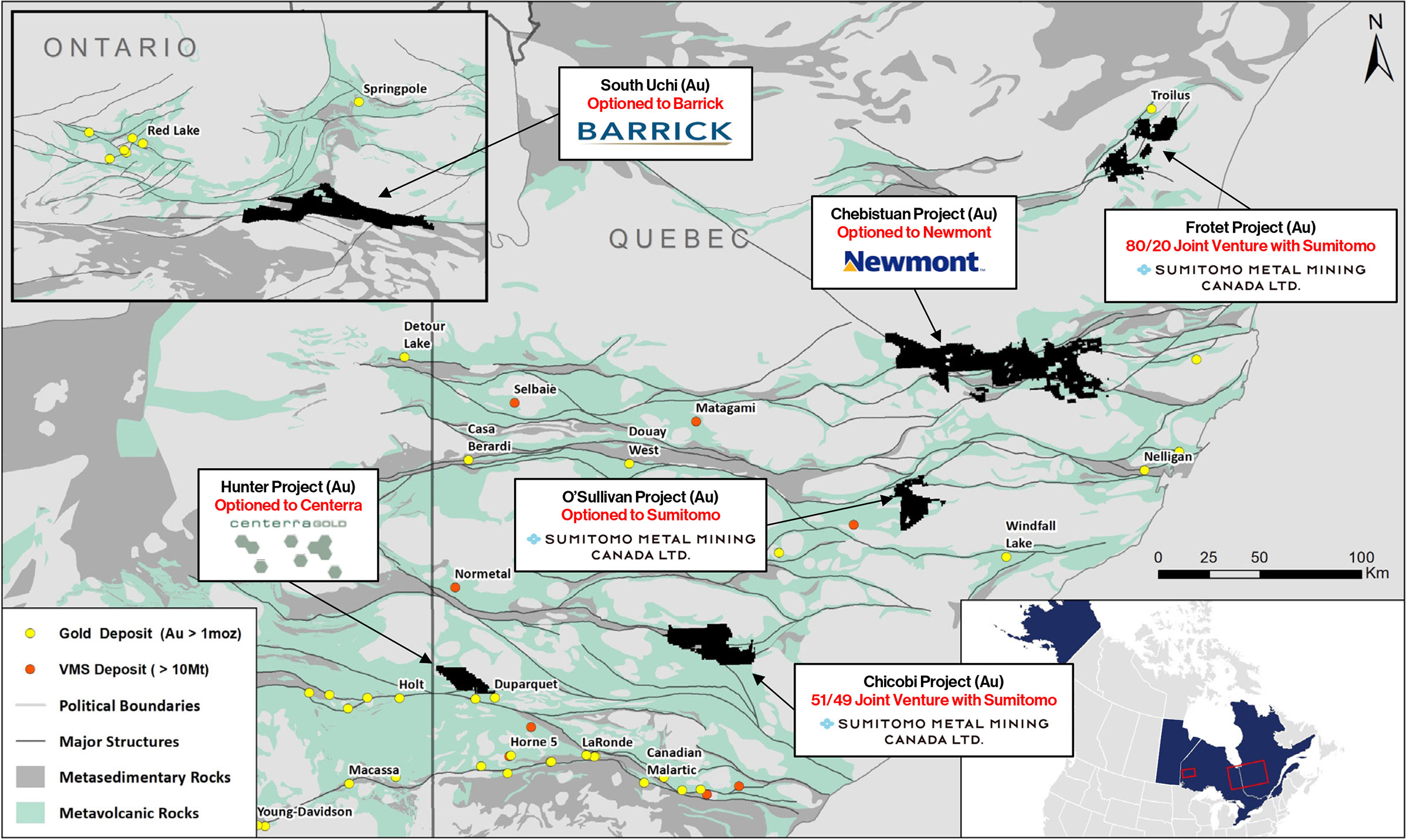

While we thought 2022 already was a busy year for Kenorland Minerals (KLD.V), 2023 may be even busier. Frotet, the company’s flagship project in Quebec will be the subject of a winter and summer drill program in cooperation with joint venture partner Sumitomo. And as Kenorland now appears to be Sumitomo’s ‘preferred partner’, both companies will jointly explore the O’Sullivan grassroots gold project: Sumitomo must spend C$4.9M on exploration to earn an initial 51% stake, Kenorland will be the operator.

While a lot of companies have tried the prospect generator model before, very few actually succeeded in doing what Kenorland is doing now: attracting multiple top-notch partners to projects that are relatively early stage.

And the most important element for Kenorland is its impressive cash position and securities portfolio. In our November report we said we hoped Kenorland would lock in some of the gains on its stake in Li-FT Power (LIFT.C) as that company’s share price just ripped higher on the renewed interest in lithium deals, and that’s exactly what Kenorland did. The balance sheet now contains almost C$20M in cash while its securities portfolio has a current market value of in excess of C$15M as well. This means that about 70-75% of the current market cap of Kenorland is backed by cash and stock, and you are only paying just over C$15M for the portfolio of assets and project stakes.

The partial sale of LIFT shares boosts the cash position

In our update published in November, we discussed the ‘hidden value’ on Kenorland’s balance sheet. It appeared the strong share price appreciation of Li-FT Power remained completely under the radar and we argued effectively monetizing the share position would highlight Kenorland’s strong financial position. Additionally, as Kenorland is an exploration company and not a holding company, it should focus on what it’s good at: having boots on the ground advancing projects.

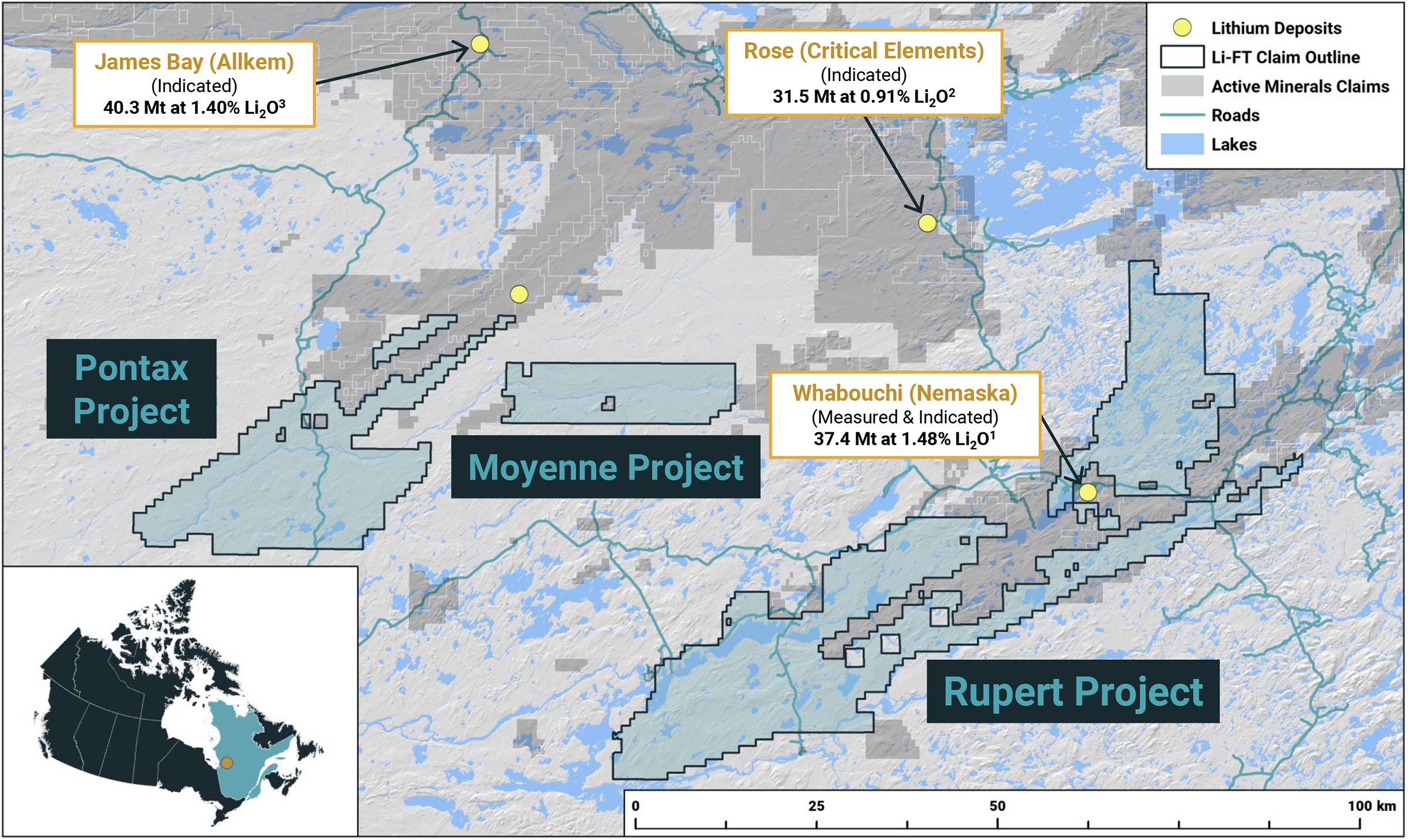

We were very happy to see the company sold 750,000 shares of Li-FT Power at C$12 per share for total proceeds of C$9M. This brings the total cash position to just under C$20M while the company still retains just over 1 million shares of LIFT (with a current market value of C9.8M. Keep in mind Kenorland also owns a 2% NSR over the Rupert lithium project owned by Li-FT so even if it would sell off the remainder of its share position in the future, Kenorland would still partake in the potential economic success of the project.

Another lithium project was vended out

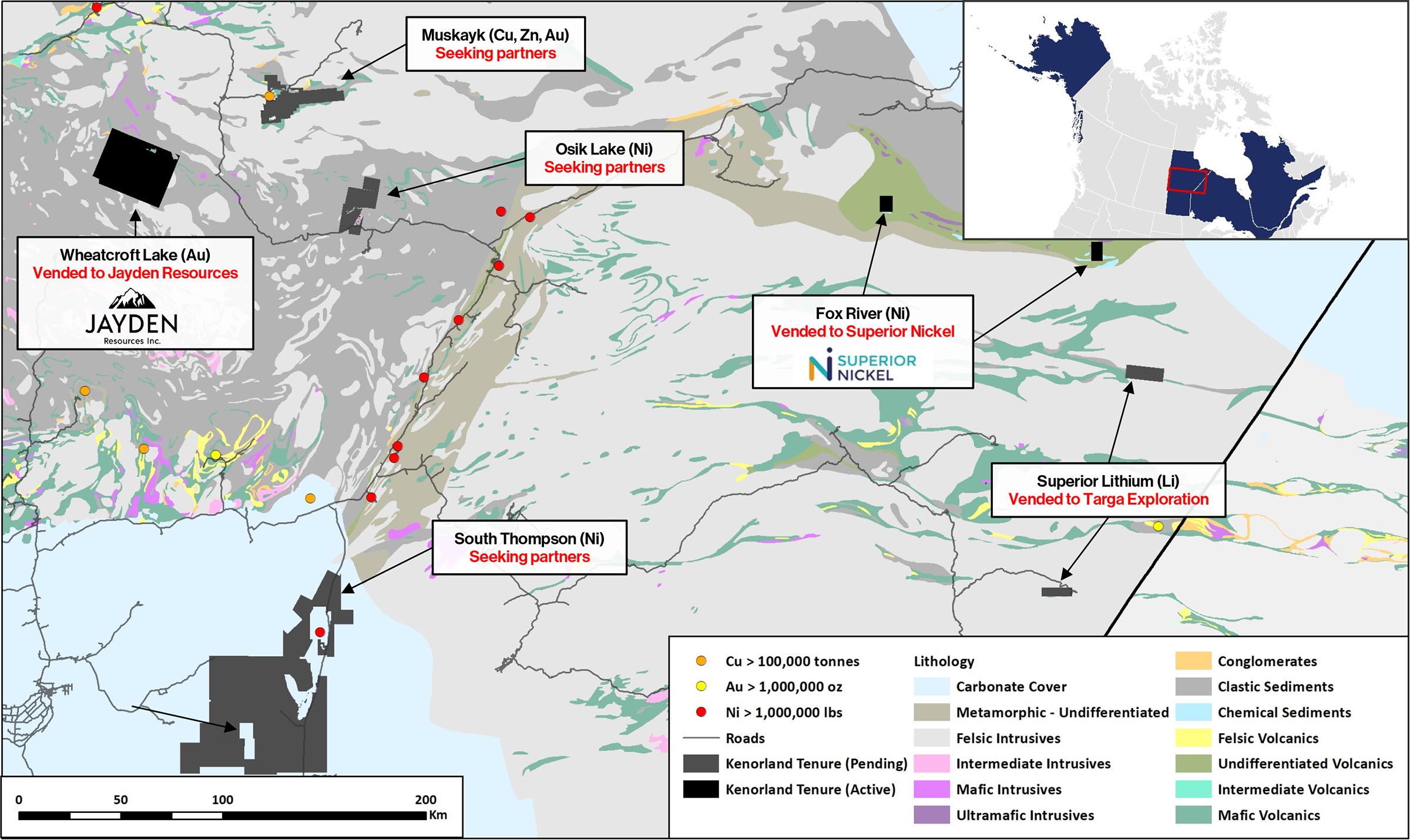

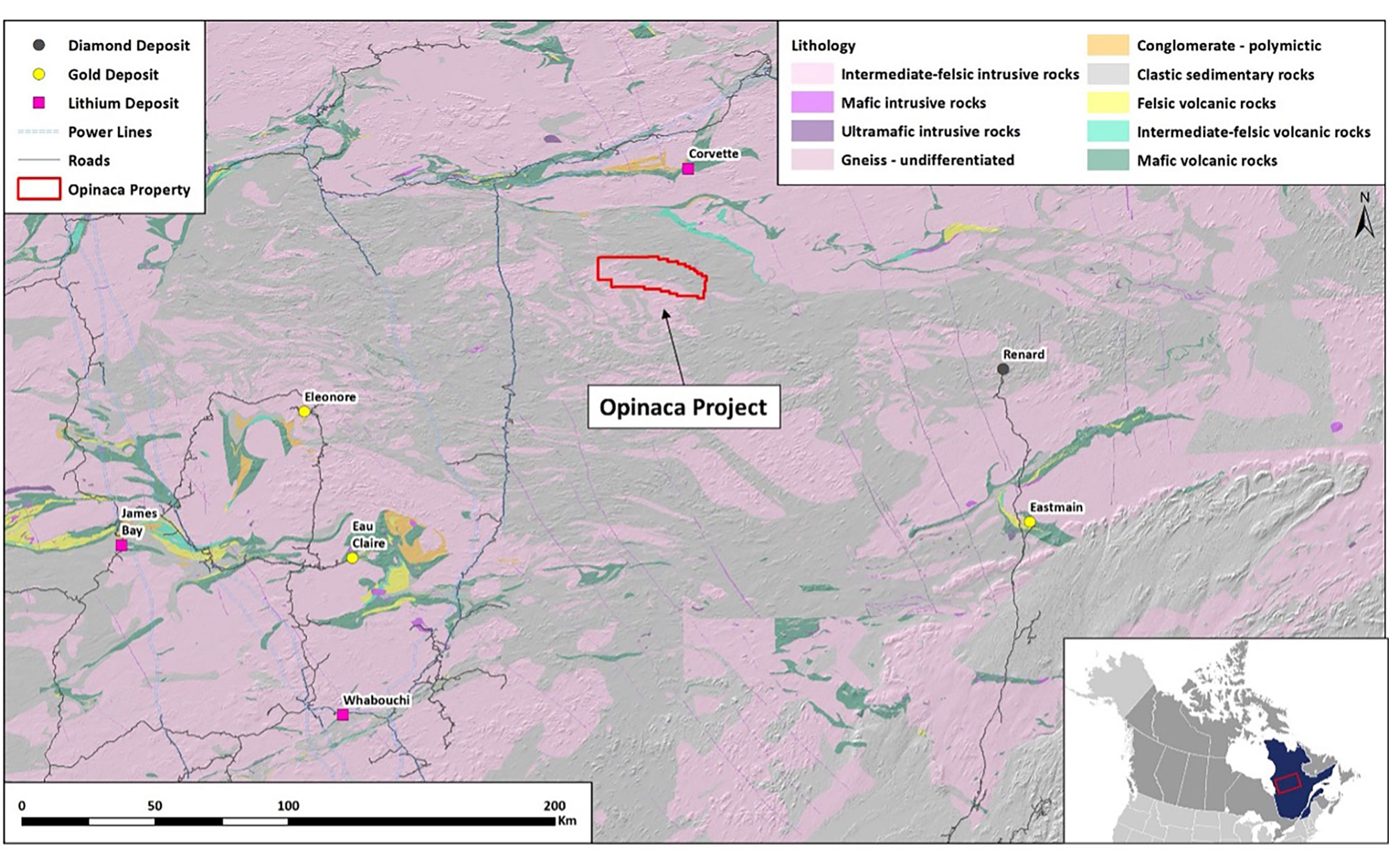

Right before announcing the sale of some of its Li-FT Power shares, Kenorland Minerals announced it had entered into a definitive agreement with CSE-listed Targa Exploration (TEX.C) whereby the latter will acquire full ownership of the Opinaca Lithium project. That project consists of 844 mining claims in the James Bay region of Quebec. Included in the agreement is the acquisition of the Superior project in Manitoba.

The Opinaca project covers in excess of 40,000 hectares of land. The project is a very early stage project as Kenorland was unaware of any historical exploration activities on the asset. According to Kenorland, the project ‘covers a discrete cluster of highly anomalous and coincident regional lithium and cesium lake sediment geochemical anomalies which potentially suggest the presence of Lithium-Cesium-Tantalum pegmatite mineralization.

The Superior project consists of just over 19,000 hectares in Eastern Manitoba and it covers the Red Sucker Lake and Red Cross Lake lithium-bearing pegmatite occurrences. There has been some (low key) historical exploration on this asset as at Red Sucker Lake, historical grab samples returned assay results of up to 3.4% Li2O while the Red Cross Lake has been the subject of drilling and trenching. At Red Cross, the historical exploration programs have outlined a pegmatite dyke swarm with 17 parallel dykes with a width of up to 4 meters within a 50 meter wide corridor.

It’s now up to Targa Exploration to figure out how large the lithium-containing pegmatite zones are and if there could be any economic value. Targa will pay C$100,000 in cash upon the closing of the deal (expected this month), issue a 3% NSR and almost 4.4 million shares of Targa to Kenorland. Targa’s share price immediately jumped and reached C$2+ subsequent to the announcement. The stock is currently trading at C$0.65, which means the pro forma value of the shares issued to Kenorland is roughly C$2.86M.

Strengthening the relationship with Sumitomo in Canada

The relationship between Kenorland and Sumitomo already was strong thanks to a good understanding and good results on the Frotet project, and both companies have now strengthened their long-term relationship. Sumitomo has signed an agreement with Kenorland to obtain a stake of up to 70% in the O’Sullivan project in Québec’s Abitibi greenstone belt.

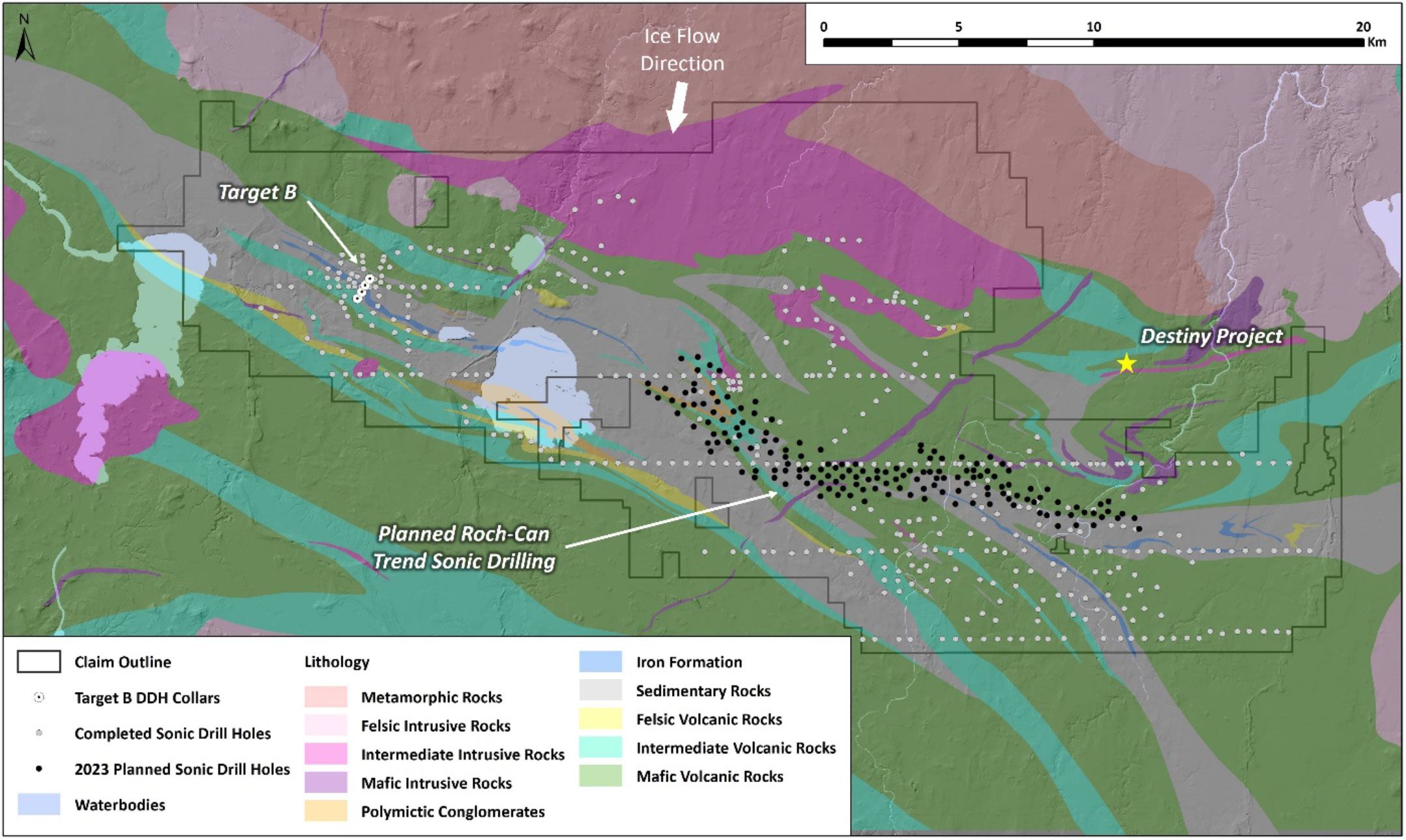

O’Sullivan was staked by Kenorland in 2020, and the company has completed two phases of regional till sampling across the project. A first exploration program was completed in 2020 and consisted of taking 1,300 till samples which confirmed the presence of several gold-in-till anomalies across the property. After completing the successful till sampling program, Kenorland completed an airborne lidar survey covering almost 250 square kilometers of the 276 square kilometer (27,595 hectares) property, which paved the way for a follow up sampling program in 2021. That was a smaller program as it consisted of taking just 500 samples at a 100-200 meter line spacing and 100-200 meters station spacing. This follow-up program confirmed the presence of anomalous gold values and that’s likely what attracted Sumitomo to the property.

There must be a certain level of trust between Sumitomo and Kenorland’s technical teams as you rarely see a large multinational player entering into earn-in agreements on undrilled properties.

The agreement is pretty straightforward and easy to understand. Sumitomo can earn an initial 51% interest in the project by spending C$4.9M on exploration within the first three years of the agreement. Kenorland will be the operator and will earn a 15% management fee. That’s higher than the standard fee in the sector which is about 10%, and this means Kenorland will earn almost C$750,000 in management fees assuming Sumitomo will complete the initial C$4.9M earn in.

Subsequent to establishing that initial 51% stake, Sumitomo will have the option to acquire an additional 19% in the property by completing a feasibility study on the project with at least 1.5 million ounces of gold (or gold-equivalent) in the measured and indicated resource categories. Sumitomo will have seven years from establishing its 51% stake to complete the requirements to increase its ownership to 70%.

Upon reaching that milestone, Kenorland can elect to either form a 70/30 partnership with Sumitomo or to give full ownership to Sumitomo in return for a 4% NSR. Depending on the size of the project and the expected capex to bring it into production (the question whether Kenorland should maintain a 30% stake or convert it into a 4% NSR will only have to be answered after Sumitomo completes a feasibility study on the project so Kenorland’s decision will fully depend on the outcome of that study), one of the options might be more favorable.

Of course there are no guarantees the O’Sullivan project will ever become a mine so there is a chance Sumitomo just walks away if it no longer thinks the project has its merits. That being said, we also know Sumitomo doesn’t give up easily: it continues to work on the Chicobi project with Kenorland although the 2022 drill program failed to intersect any precious or base metal mineralization of any significance.

Conclusion

We are pleased to see Kenorland selling a substantial portion of its stake in Li-FT Power and hope the company will monetize the remaining shares later this year. An exploration stage company should focus on exploration and cash is more important than owning stock in an inherently volatile vehicle. Selling a portion of the LIFT exposure is a good start, and we hope Kenorland won’t shy away from selling more shares when the opportunity presents itself. Should the Rupert project ever become a mine, Kenorland’s 2% NSR will be worth a multiple of the stock.

It is good to see the LIFT deal is now used as a blueprint for other lithium deals. The company’s focus on its gold joint ventures is great and spinning off lithium assets for stock, cash and a NSR is a good idea to maintain a certain level of exposure. Should Targa’s initial exploration programs be successful, there’s no reason why Kenorland wouldn’t be able to monetize its share position either while retaining a 3% NSR on the project.

We also believe strengthening the relationship with Sumitomo is a good thing. Sumitomo is clearly ‘on board’ on the Frotet project where we expect substantial exploration programs to be completed, and seeing the Japanese company entering into a new joint venture agreement on the O’Sullivan project means Sumitomo and Kenorland are now partners on three exploration projects.

As Kenorland now has seven active earn-in and joint venture agreements, odds are the operator and management fees it receives on those projects will be sufficient to cover the company’s entire G&A bill for this year.

Disclosure: The author has a long position in Kenorland Minerals. Kenorland Minerals is a sponsor of the website. Please read our disclaimer.