Kenorland (KLD.V) has been busy in the past few months as the drill program on the Regnault discovery has yielded some additional exceptional results with gold values approaching three ounces per tonne. Joint venture partner Sumitomo seems to be pleased and the partners have agreed on a summer exploration budget for a program that’s currently in full swing.

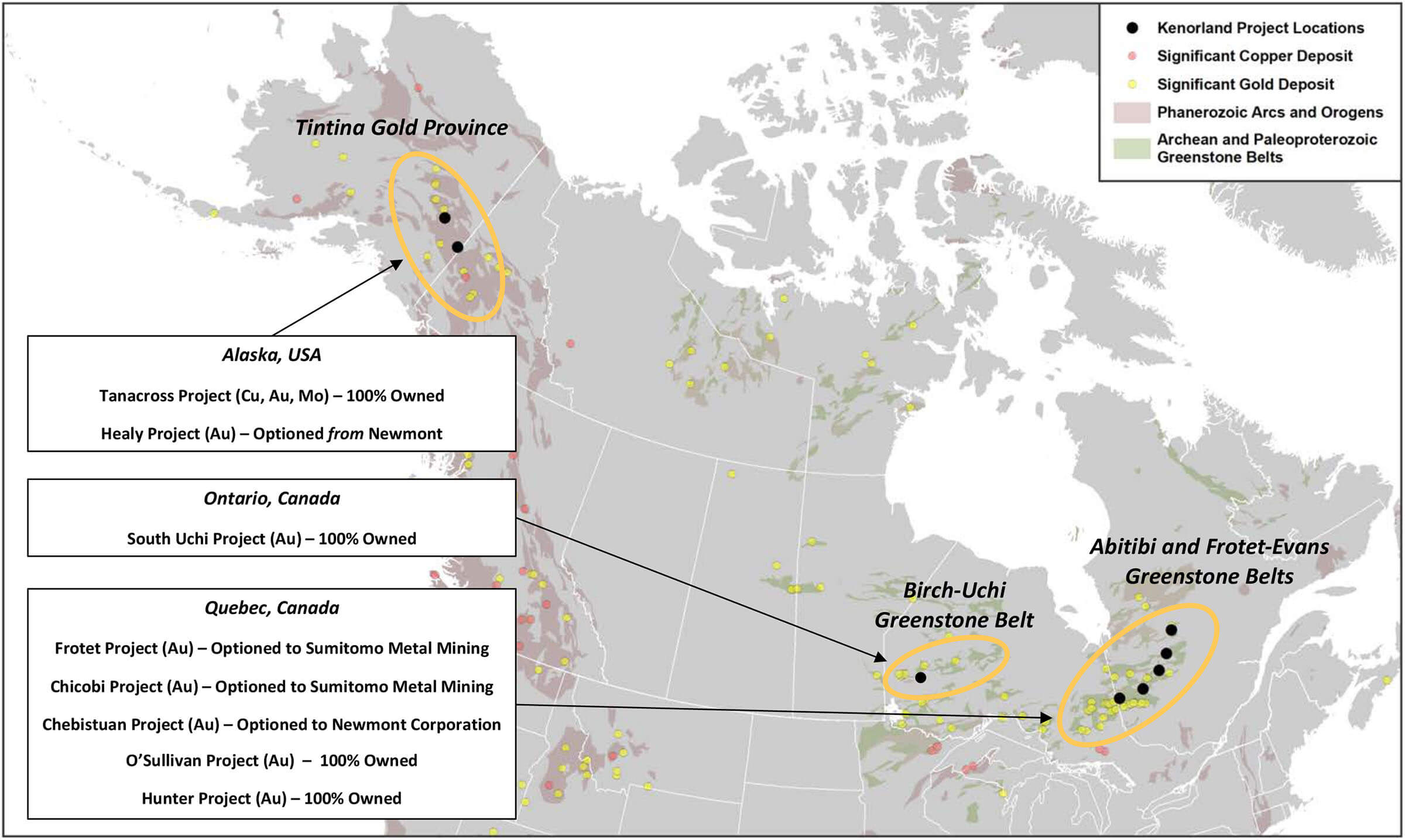

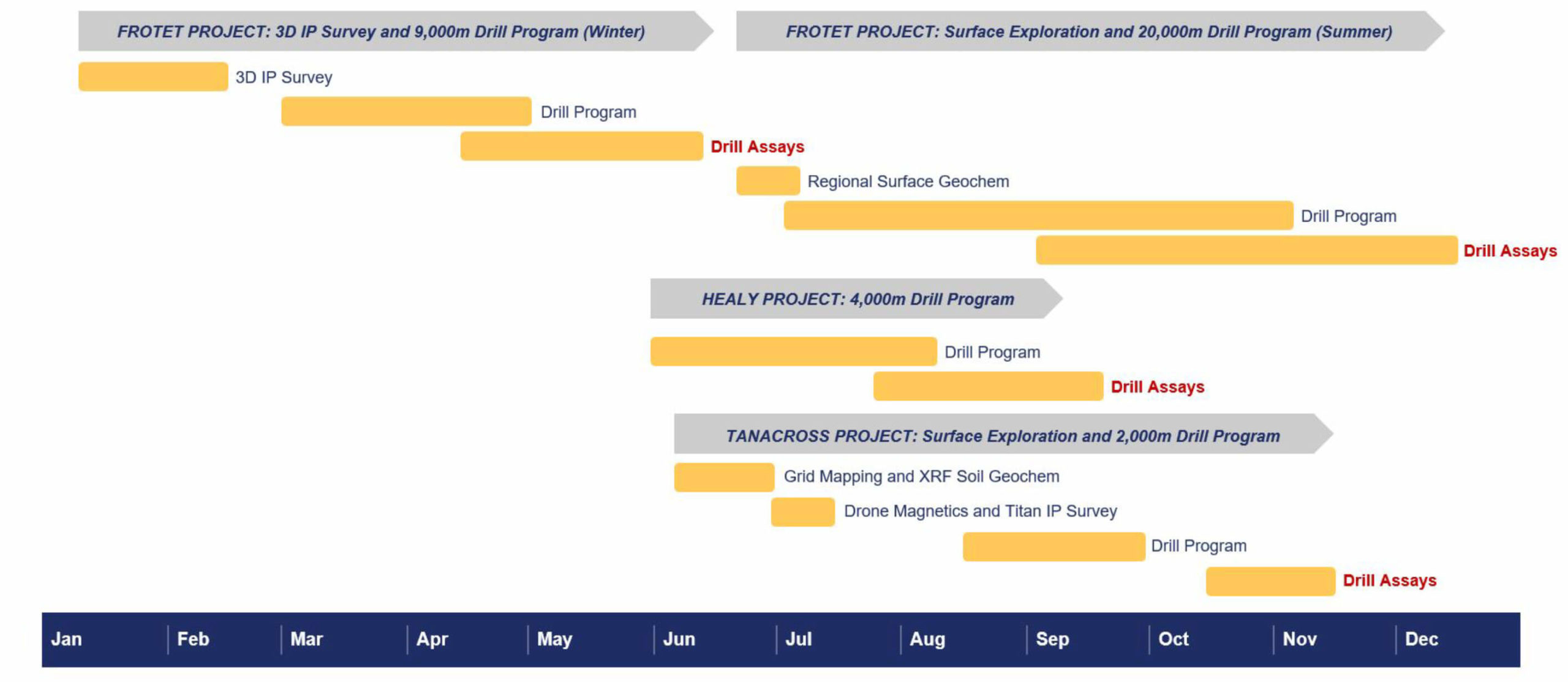

The main feature of the company is its enormous land packages all over North America. Over the past few years, Kenorland was able to secure several district-scale land packages in mineralized belts and it will be active on several fronts this year. The Phase I drill program at Healy has just been kicked off and we can expect a steady news flow to carry us through the summer.

The high-grade festival at Regnault continues

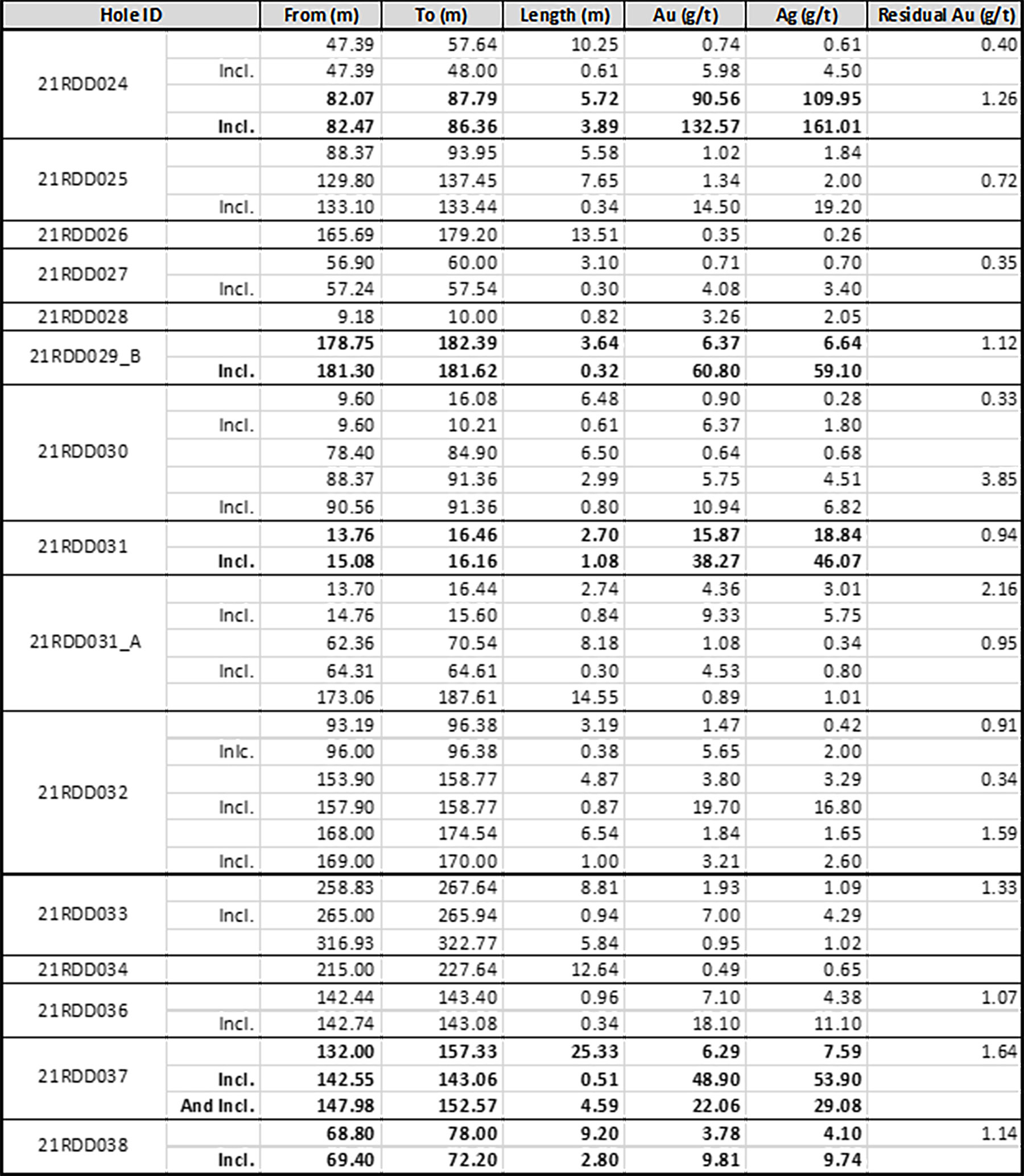

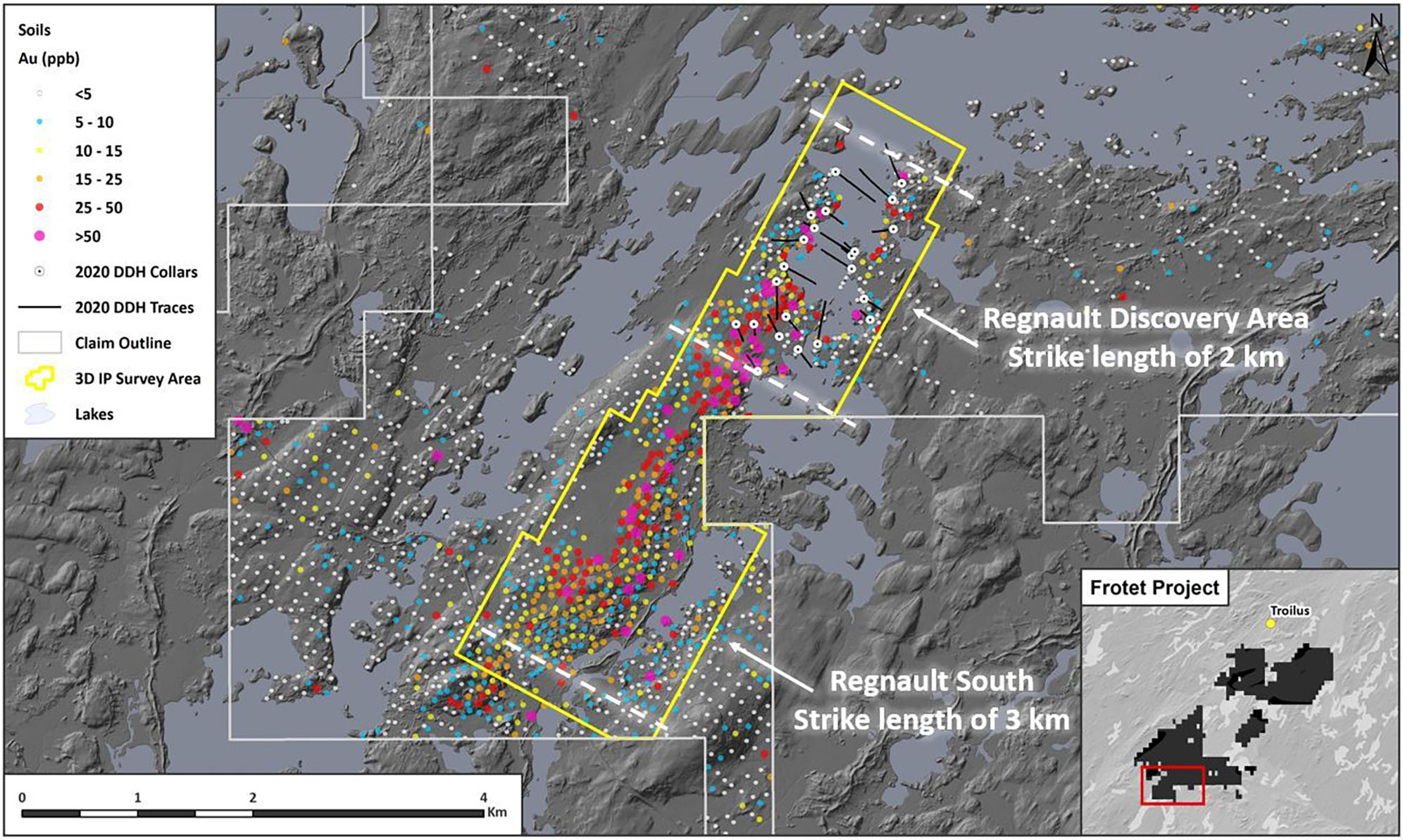

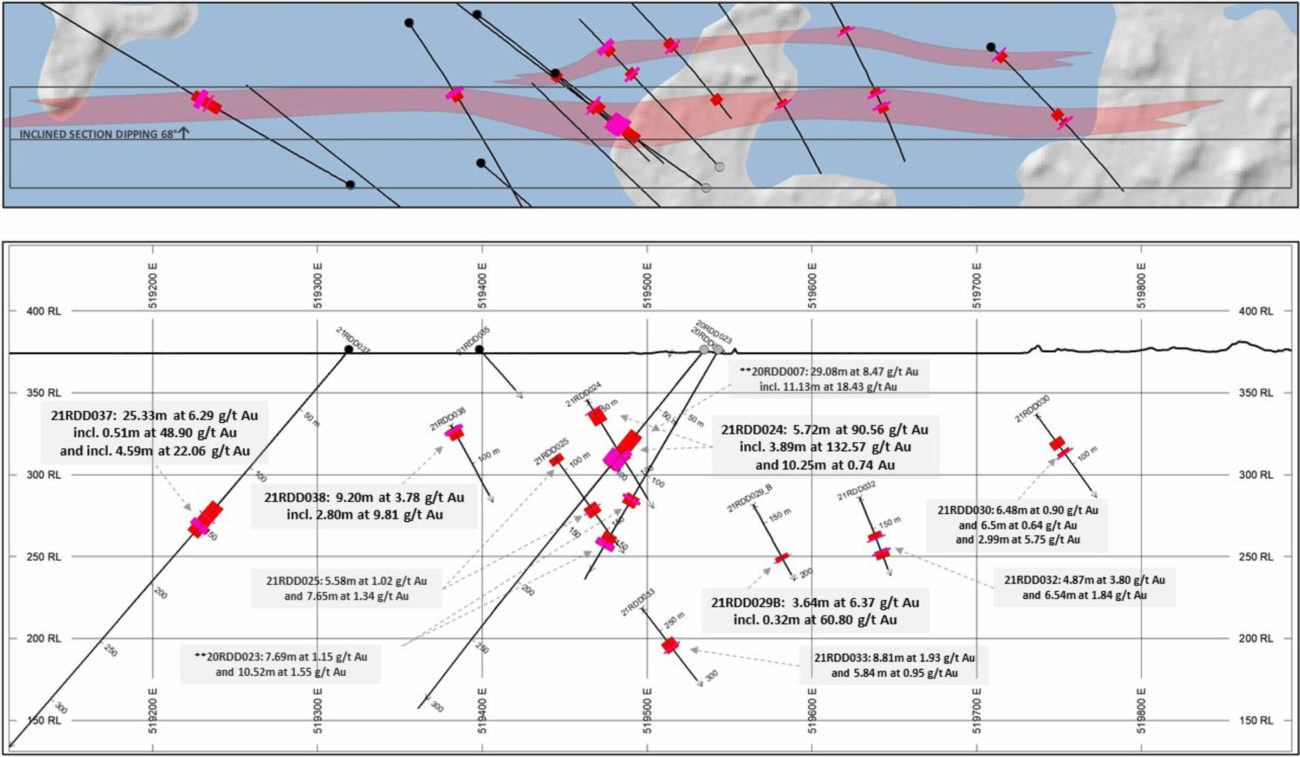

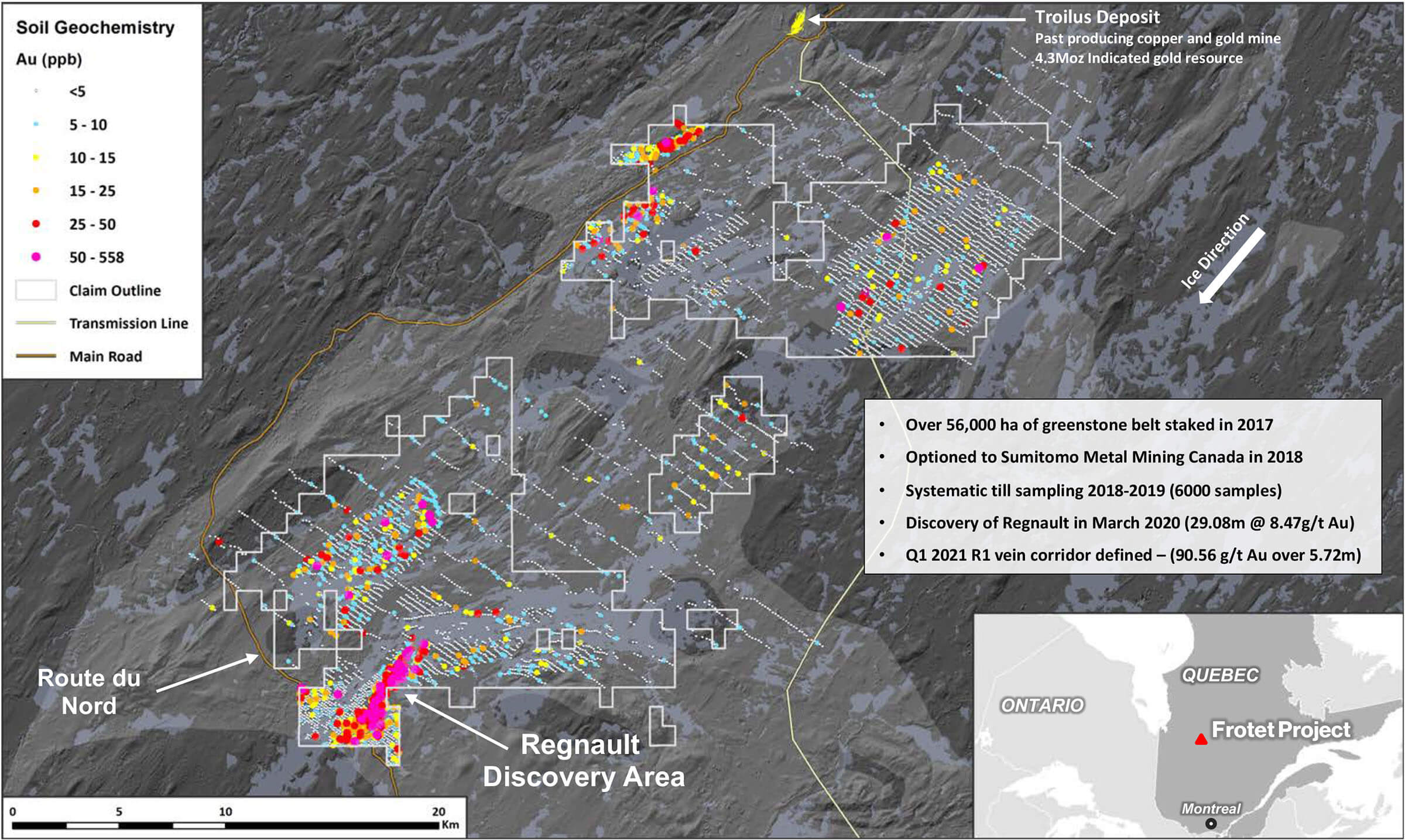

Although the Frotet project in Quebec contains several high-priority drill targets, the attention was recently focused on the Regnault discovery as the joint venture partners Kenorland and Sumitomo encountered ultra high-grade gold results in 2019 and 2020. The 30-hole 8,591 meter winter drill program was focusing on expanding the discovery and getting a better understanding of the controlling structures. The assay results of the first few holes (15 of the 30 holes) have now been released and there were some more jaw-dropping results.

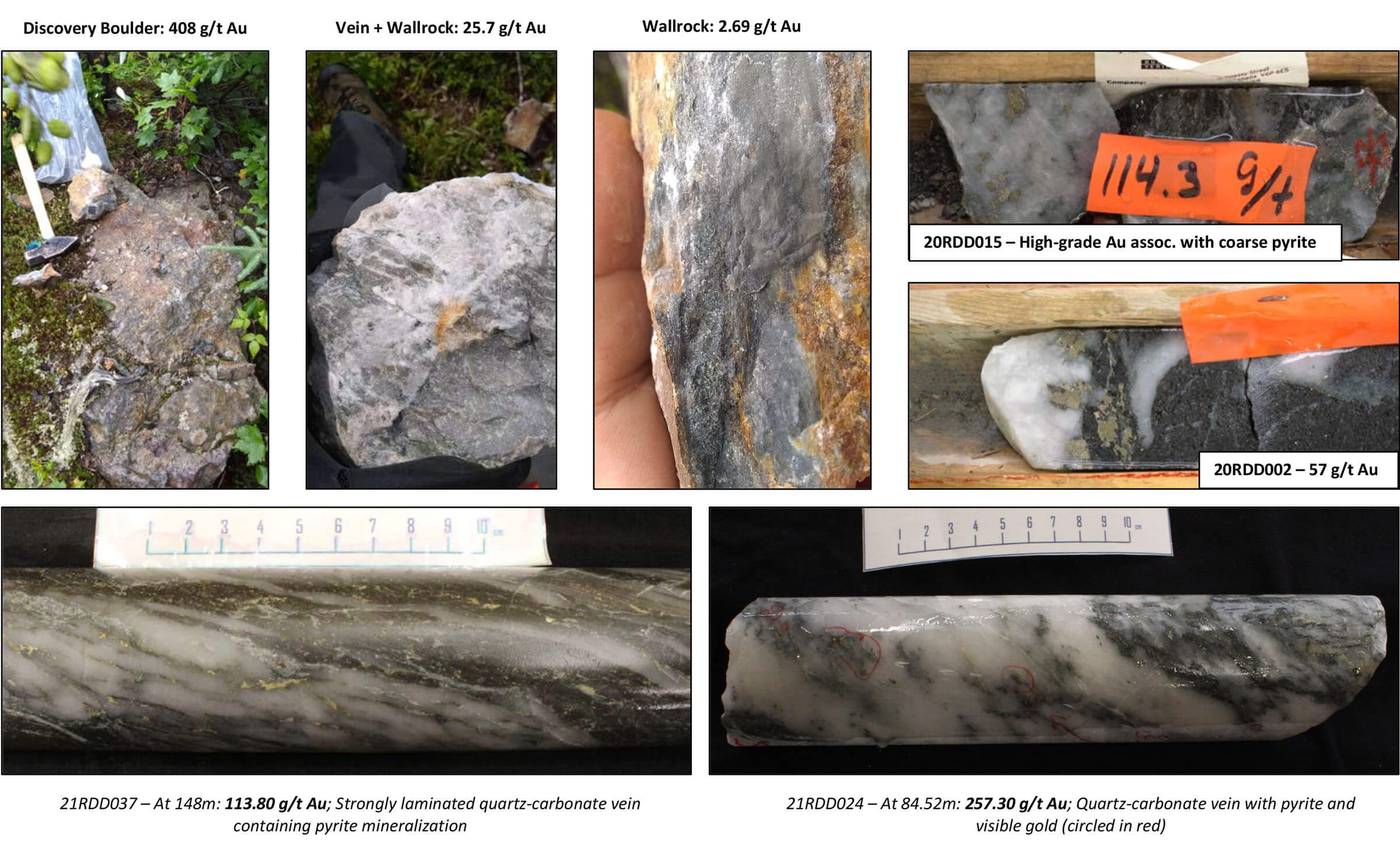

The headline result obviously was the 5.72 meters containing 90.56 g/t gold, a result that will clearly make heads turn. Not only is the gold grade ultra-high, the width also exceeded expectations as this interval comes in at in excess of 500 gram-meters. There were several other high-grade intervals that caught attention as well:

- 21RDD024: 5.72m at 90.56 g/t Au incl. 3.89m at 132.57 g/t Au

- 21RDD029B: 3.64m at 6.37 g/t Au incl. 0.32m at 60.80 g/t Au

- 21RDD031: 2.70m at 15.87 g/t Au incl. 1.08m at 38.27 g/t Au

- 21RDD037: 25.33m at 6.29 g/t Au incl. 0.51m at 48.90 g/t Au and incl. 4.59m at 22.06 g/t Au

- 21RDD038: 9.20m at 3.78 g/t Au incl. 2.80m at 9.81 g/t Au

And of course, not every hole was an ‘instant hit’, but you can clearly see all 15 holes encountered gold mineralization. Some sections could be labeled as high-grade, others likely wouldn’t meet the cutoff grade for underground mine development, but the main takeaway here is that if you encounter gold in every single hole, you’re poking holes in what appears to be a very prolific zone.

Plenty of reason to follow up on the Regnault discovery and while the second batch of 15 holes hasn’t been released yet, the joint venture partners have signed off on a C$6.6M exploration budget for this summer. As Sumitomo has completed the requirements for their earn-in deal, the Japanese company currently owns 80% of the Frotet project (although this still needs to be officially confirmed) which means Kenorland will have to contribute its 20% share of the exploration expenses. That being said, the C$6.6M drill program will cost barely a dime (and we’ll explain this later).

It looks like the joint venture partners will be drilling about 20,000 meters this summer and conversations with CEO Zach Flood indicated there will also be some barge-based drilling at Regnault. That makes sense as the mineralized zone has been tracked all the way under a (shallow) lake.

Using a barge is the most efficient way to continue drilling in the summer season and to add to the current strike length. That should result in additional tonnage that could be included in a maiden resource estimate. Compiling a maiden resource estimate could take a while though and we for sure appreciate and support the methodological approach by Kenorland and Sumitomo. It’s better to do things right and good rather than making the classic ‘junior mistake’ by rushing towards a maiden resource.

Meanwhile, Kenorland is kicking off the Healy summer exploration program as well

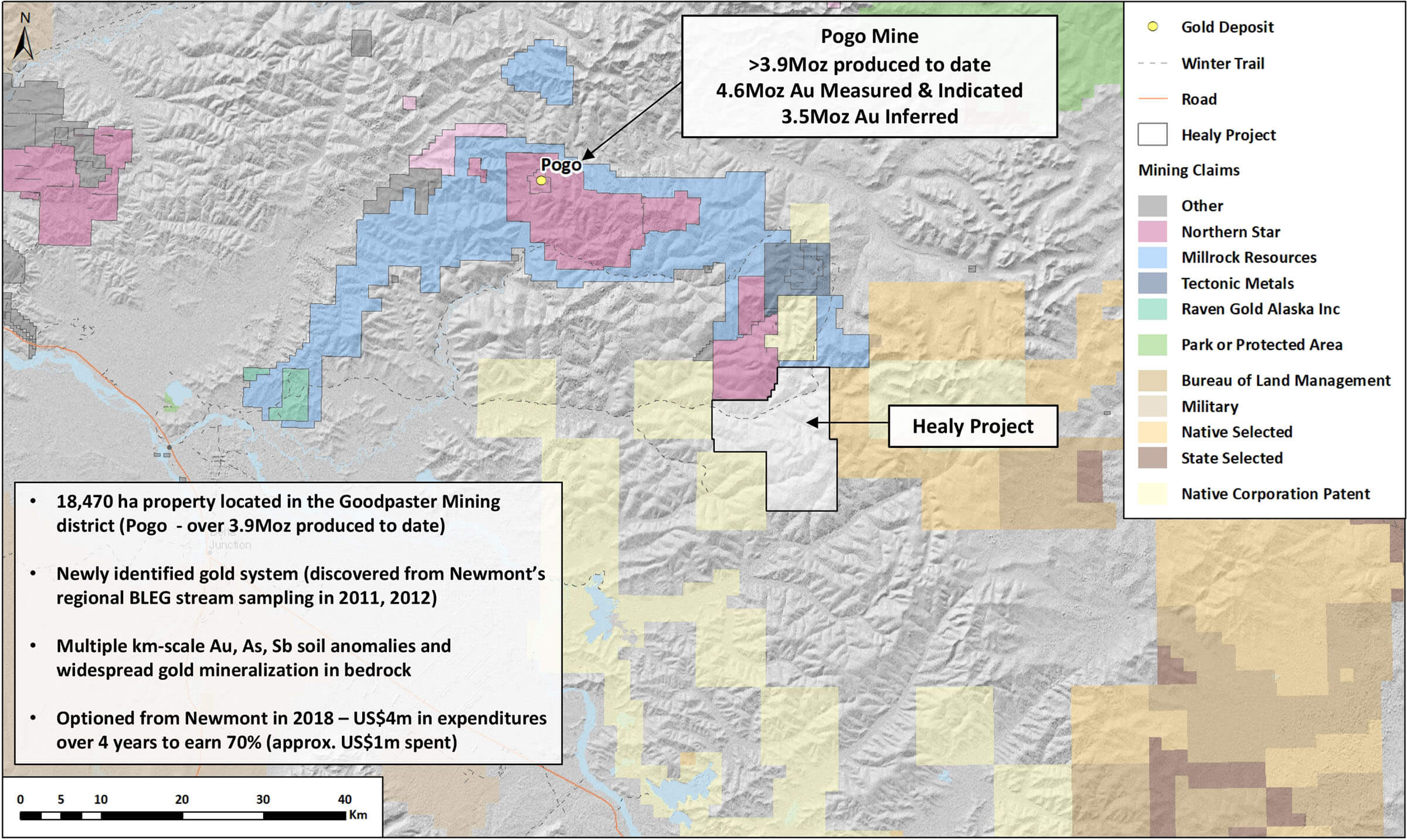

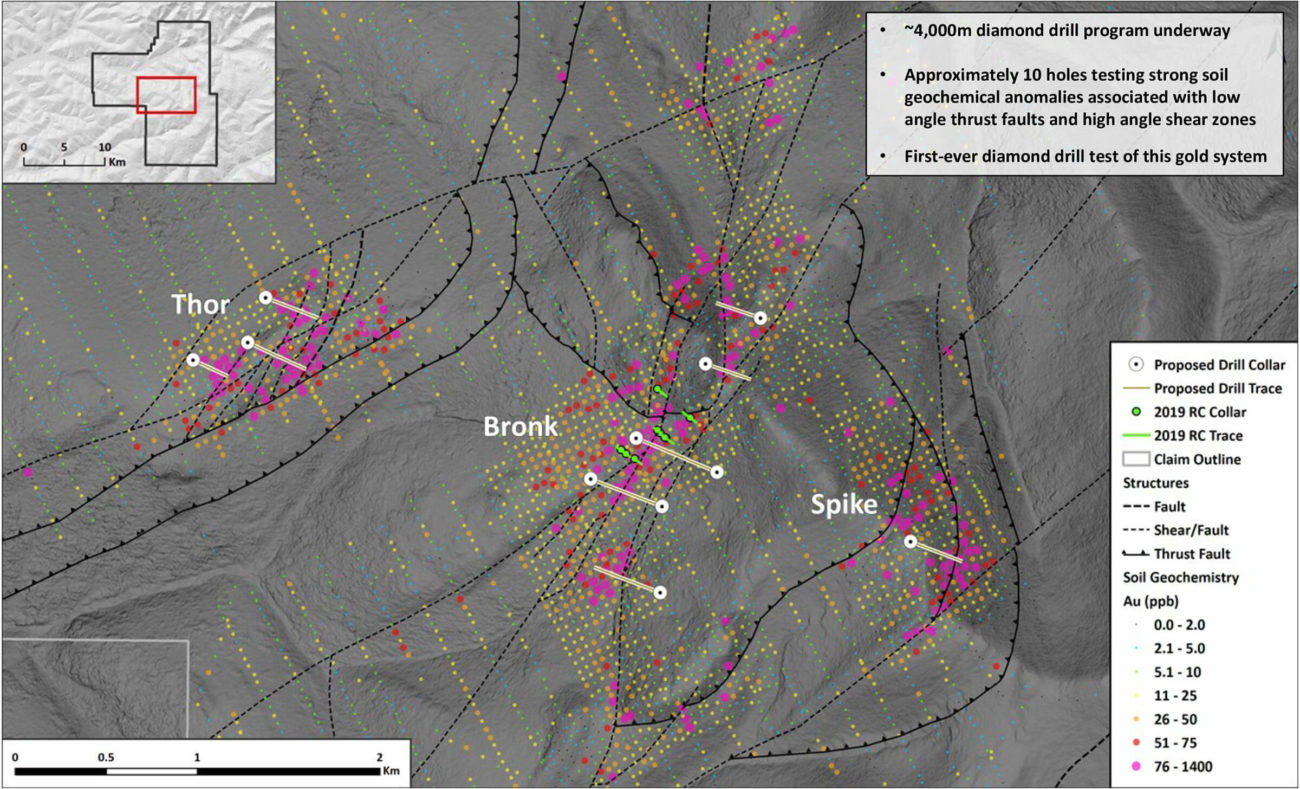

While the Regnault discovery is grabbing the headlines thanks to the ultra high-grade gold mineralization discovered there, investors should keep in mind Kenorland is still applying a multi-pronged approach. While the Kenorland-Sumitomo joint venture will continue to drill Regnault, Kenorland has kicked off a 4,000-meter drill program on its fully-owned 18,000+ hectare Healy gold project, located in Alaska.

This 4,000-meter drill program will consist of 10 holes and will drill test three high priority areas that were ranked based on the results of an extensive soil sampling program. The prospectivity of the Healy project is quite obvious as Newmont already conducted exploration activities in 2010-2013 but the project was dropped despite identifying the existence of what could potentially be a significant gold system. Kenorland picked up an option on the land in 2018 and has rapidly finetuned the exploration targets with three of these targets now drill-ready.

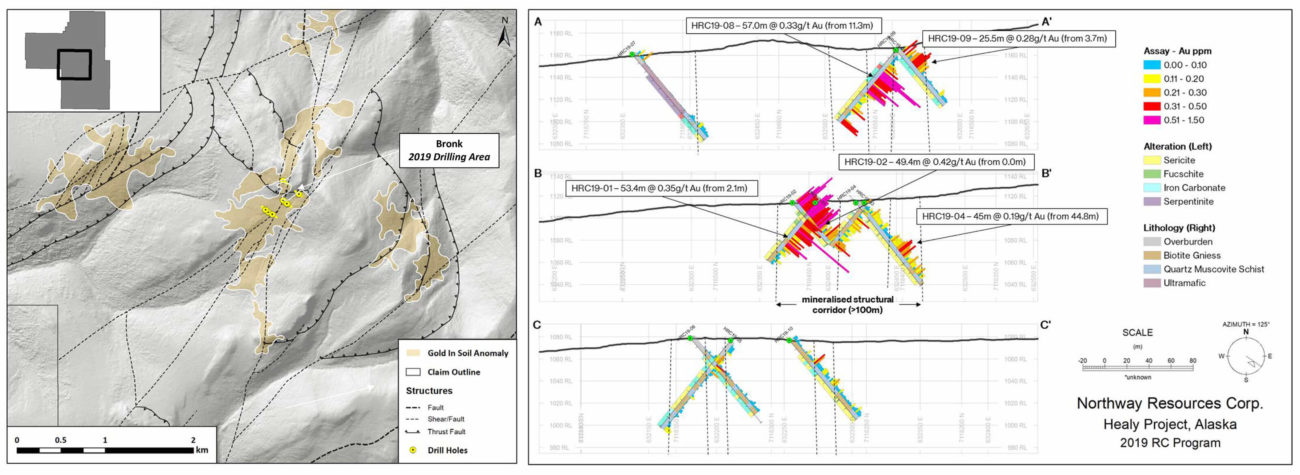

Keep in mind this isn’t just a wildcat drill program as Kenorland has worked in a methodological fashion to get the property drill ready. Back in 2019, a first reverse circulation drill program was completed by the company which could be considered a first-pass drill test. The RC rig barely scratched the surface as the 10 holes only reached an average depth of about 80 meters.

What’s interesting is that all ten holes actually encountered gold mineralization, in some instances starting right at surface. Of course, not all grades were economical but obtaining a 100% hit ratio is remarkable and it’s easy to understand why Kenorland is so keen on getting back in the field at Healy.

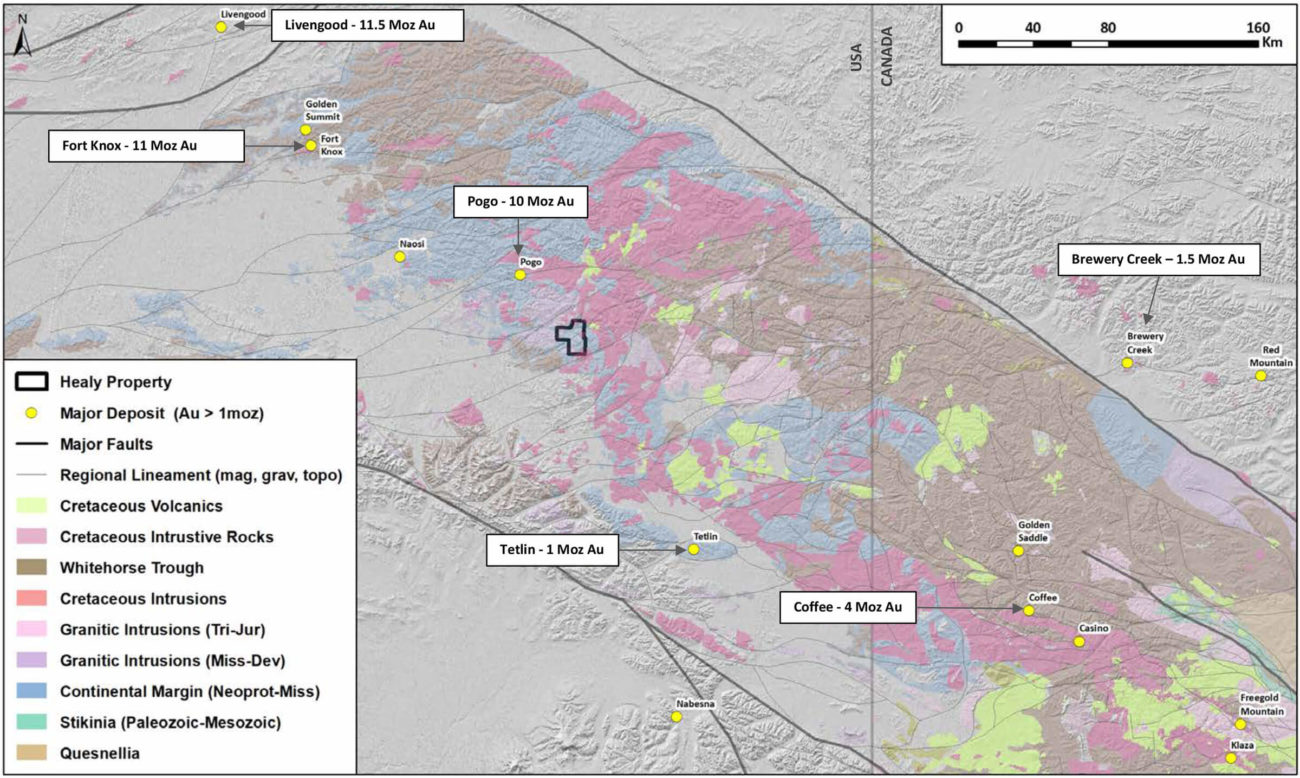

And when we zoom out, we clearly see the Healy project is located in the right postal code. There’s plenty of multi-million-ounce deposits (some of them even exceeding 10 million ounces gold) in the Goodpaster mining district in Alaska which extends into Canada’s Yukon Territory.

The total area covering multiple gold in soil anomalies is now about 25 square kilometers and right now, it looks like the Healy project could either be a Pogo-type project (high-grade underground) or a Fort Knox project (low-grade open pit heap leach gold) which is literally located further up the road (albeit 200 kilometers away).

With almost 20,000 hectares of land and promising drill results from a first pass exploration program in 2019, Kenorland has plenty of drill targets to follow up on, and several areas it needs to drill-test.

The first phase of the first-ever diamond drill program has started, and assay results could be expected in August.

The exploration programs are funded with the cash on hand

While the Frotet/Regnault and Healy projects will be drilled, Kenorland has also announced a field exploration program on its Chebistuan project, one of the largest contiguous land packages in Canada with a total surface area of in excess of 160,000 hectares (so in excess of 1,600 square kilometers). Chebistuan isn’t drill-ready yet, so this summer exploration program will be focusing on doing additional groundwork. Kenorland has budgeted for 800 soil samples and 220 till samples from 15 areas of interest which will be analyzed for grain counts. Additionally, about 1240 soil samples will be taken from the 35,000 hectares of land that were added to the total package in Q4 last year.

The entire sampling program will cost about C$400,000 and Newmont (NEM, NEM.TO) will cough up the entire budget as part of its earn-in agreement at Chebistuan where it’s working towards establishing a 51% stake in the project.

So, the Chebistuan exploration budget will be taken care of by Newmont, while the vast majority of the Frotet/Regnault drill program will be funded by Sumitomo but there’s more than meets the eye here. Of the C$6.6M exploration budget, Kenorland is required to contribute 20%, which is approximately C$1.3M. However, Kenorland will also receive a 10% operator fee on the entire exploration budget, which means Sumitomo will wire KLD C$660,000 in cash as operator fee. This means the immediate cash outflow related to the C$1.3M drops right away to just about half that.

But there’s more. Kenorland will receive a reimbursement from the Quebec province as it will spend C$1.3M of non flow-through money on exploration. Assuming a reimbursement of 38%, that’s another C$0.5M of cash that will be received from a third party. Which means the net cost of the C$1.3M drill program to Kenorland will be just about C$0.2-0.3M. It will take a while before the company gets the mineral exploration incentive payment reimbursed so there will be a working capital element as there will be a cash outflow this year while the reimbursement will likely follow in 2022.

While we heard from some investors they are disappointed Kenorland is ending up owning just 20% of Frotet, we shouldn’t dismiss the project at all. Owning 20% of what will hopefully turn out to be a multi-million-ounce discovery could still be very valuable down the road, especially if that 20% could be maintained by spending just a fraction of that amount thanks to the operator agreement and the Quebec exploration incentive. The Frotet project will likely need hundreds of thousands of meters of drilling (if it isn’t closer to a million meters) and it’s just unlikely Kenorland would ever be able to fund those mega-programs themselves. So having a strong joint venture partner with deep pockets will keep the dilution limited and the drill rigs going.

The 4,000 meter Healy drill program will be the most expensive exploration program this year. Anticipating a drill cost per meter of US$600, including camp construction, the all-in cost of the Healy summer exploration program would be just about C$3M.

As of the end of March, Kenorland Minerals had a positive working capital position of almost C$10M so we anticipate this year’s exploration programs to be fully covered by the existing cash position. But of course, Kenorland should always keep its eyes peeled for financing opportunities and financing windows. The company isn’t too keen on issuing flow-through shares nor warrants, so it will have to carefully pick its moments to fill up the treasury again. There’s no immediate need to do so, but it goes without saying Kenorland should entertain any reasonable financing offers on the table.

Conclusion

Kenorland will be busy this year. The assay results of the final 15 holes of the Regnault winter drill program should be out soon while the joint venture partners at Frotet/Regnault have signed off on a C$6.6M summer exploration budget.

The summer will likely provide a continuous news flow as Kenorland will be working on three projects at the same time and all three projects could be company makers for this C$46.5M market cap exploration company. Even if Kenorland ends up owning only a minority stake.

Disclosure: The author has a long position in Kenorland Minerals. Kenorland Minerals is a sponsor of the website. Please read our disclaimer.