The share price of Kenorland Minerals (KLD.V) had a nice run-up earlier this year as it spiked to about C$1.40 right before the summer months, but unfortunately, the share price came back down right away and the shares are currently trading at just C$0.70, for a market capitalization of C$32.5M.

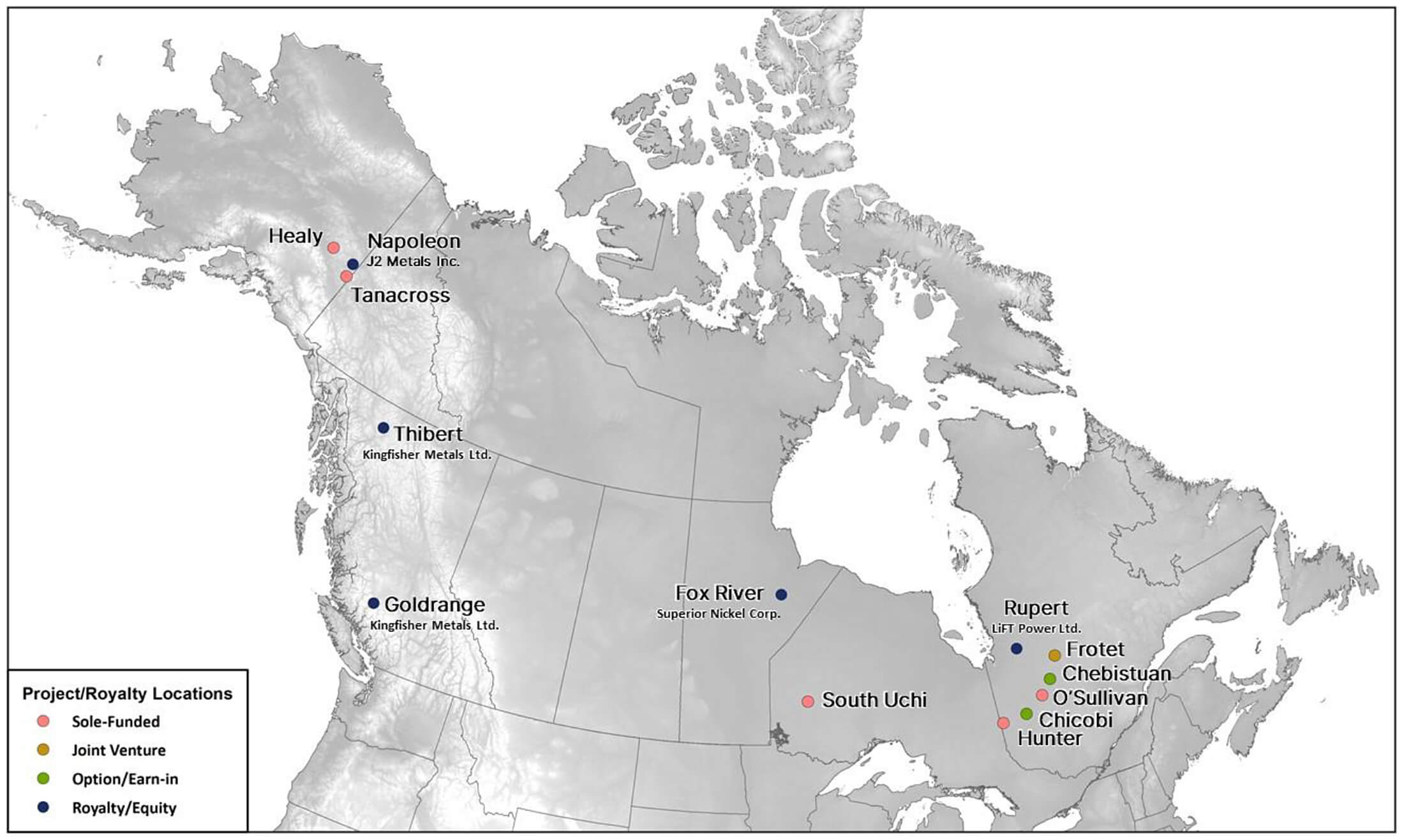

That’s disappointing, as Kenorland continues to advance its projects on all fronts and on all levels as it’s working on its fully-owned exploration projects while Newmont (NEM, NEM.TO) and Sumitomo are spending their dollars on joint venture projects. Kenorland’s extensive land packages in the right mineralized districts tend to attract the attention of Tier-1 operators and in September, Kenorland announced Barrick Gold (GOLD, GOLD.TO) as a new optionor on the South Uchi project. That means a fourth project will now be advanced using the funds of a third party, which will further reduce the cash burn of Kenorland.

Barrick Gold signed an option agreement on South Uchi

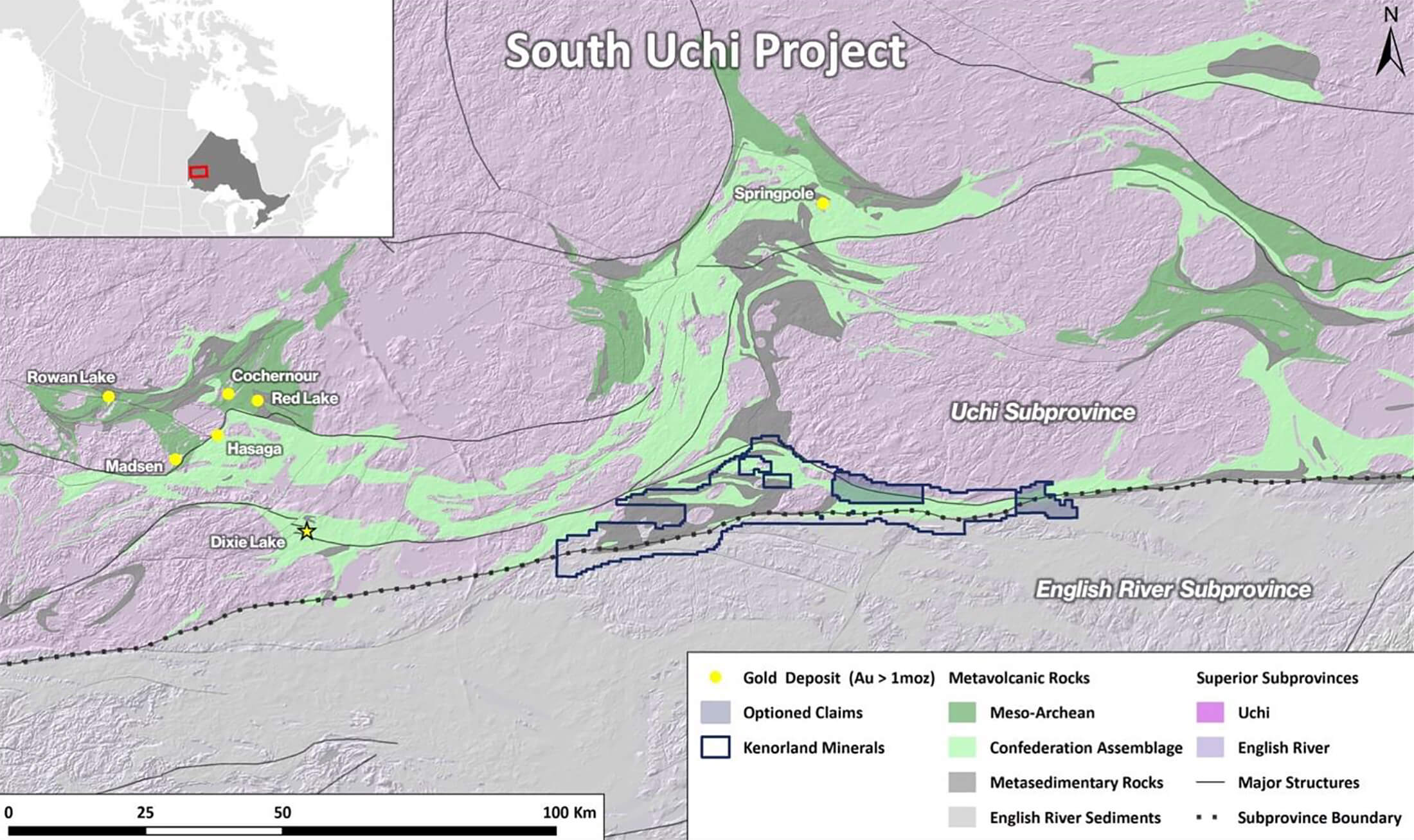

Kenorland recently announced Barrick Gold entered into an option agreement whereby it can obtain a majority stake in the South Uchi project, located within the Birch-Uchi greenstone belt in Ontario. Not only will Barrick spend cash on the ground, it will also reimburse Kenorland for all its sunk costs related to the project, and all costs related to exercising the underlying option which could be estimated at in excess of C$250,000.

The South Uchi project is located about 100 kilometers to the east-southeast of the Red Lake mining district in Ontario where Evolution Mining (EVN.AX) is now operating the Red Lake Gold mine, Pure Gold Mining (PGM.V) is trying to reach a positive free cash flow status and where Great Bear Resources (GBR.V) has been working on its Dixie discovery which will likely result in a multi-million-ounce maiden resource estimate.

While South Uchi isn’t located in the immediate vicinity of the aforementioned projects, the Kenorland team liked the rocks and while the majority of the gold endowment at Red Lake was found in the northern margin of the Confederation Assemblage, the Dixie Gold discovery by Great Bear was actually made on other zones of the Assemblage and the South Uchi claims cover a portion of this Confederation Assemblage volcanic rocks. And clearly, Barrick Gold agrees the rocks are interesting.

There isn’t a whole lot of information available on South Uchi as this project was staked by Kenorland less than six months ago, so it’s impressive to see the company has already locked in a Tier-1 partner to jointly explore the project.

Approximately 65,600 hectares were staked in April, while the company also entered into an agreement with a private vendor whereby Kenorland (and now Barrick) is able to acquire an additional 10,000 hectares of land by making total cash payments totaling C$175,000 and issuing C$175,000 worth of stock over a two year period. Now Barrick is optioning the project this structure gets a little bit more complicated but essentially, Barrick will pay Kenorland the C$175,000 whereafter Kenorland will issue C$175,000 in stock to the property vendor (subject to the floor price of C$0.70 per share). Once Kenorland/Barrick has completed the requirements to acquire the additional claims, the vendor will be issued a 2% NSR of which half (1%) could be repurchased for C$1M in cash or shares.

Going back to the Kenorland/Barrick agreement. In order to obtain an initial 70% interest in the project, Barrick Gold will have to spend at least C$6M in exploration expenditures within the first six years of the option period, whereby a minimum of C$3M has to be spent within the first three years of the option period. An interesting additional kicker is that Barrick also has to release a compliant resource calculation at South Uchi containing at least one million ounces of gold, so it’s not unlikely Barrick will have to spend more than C$6M on exploration in order to get to the required one million ounces to effectively establish the initial 70% stake in the project.

Once that 70/30 joint venture has been established, Barrick may elect to work towards completing a feasibility study on the project before the 10th anniversary of the option agreement. Should Kenorland not be interested in retaining a 30% stake in the project (which would happen in the case Barrick establishes a 70% stake but elects not to continue towards the 80%), Kenorland can immediately decide to convert its stake to a 3% NSR on unencumbered claims and a 2% NSR on claims where a royalty is already present.

Should an 80/20% joint venture be formed, Kenorland can let its stake dilute down to 10%, and should it drop further below 10%, KLD will end up with a 2% NSR on the unencumbered claims and a 1% NSR on encumbered claims.

This means there are lots of potential outcomes as to what Kenorland will effectively own at the end of the day, but the most important part is obviously the firm exploration commitment from Barrick in the first few years of the option agreement to rapidly advance the South Uchi project. Even if the project doesn’t meet Barrick’s requirements and Barrick drops out of the joint venture, every dollar spent on the claims by Barrick is a dollar that doesn’t have to be raised by Kenorland.

Other exploration updates

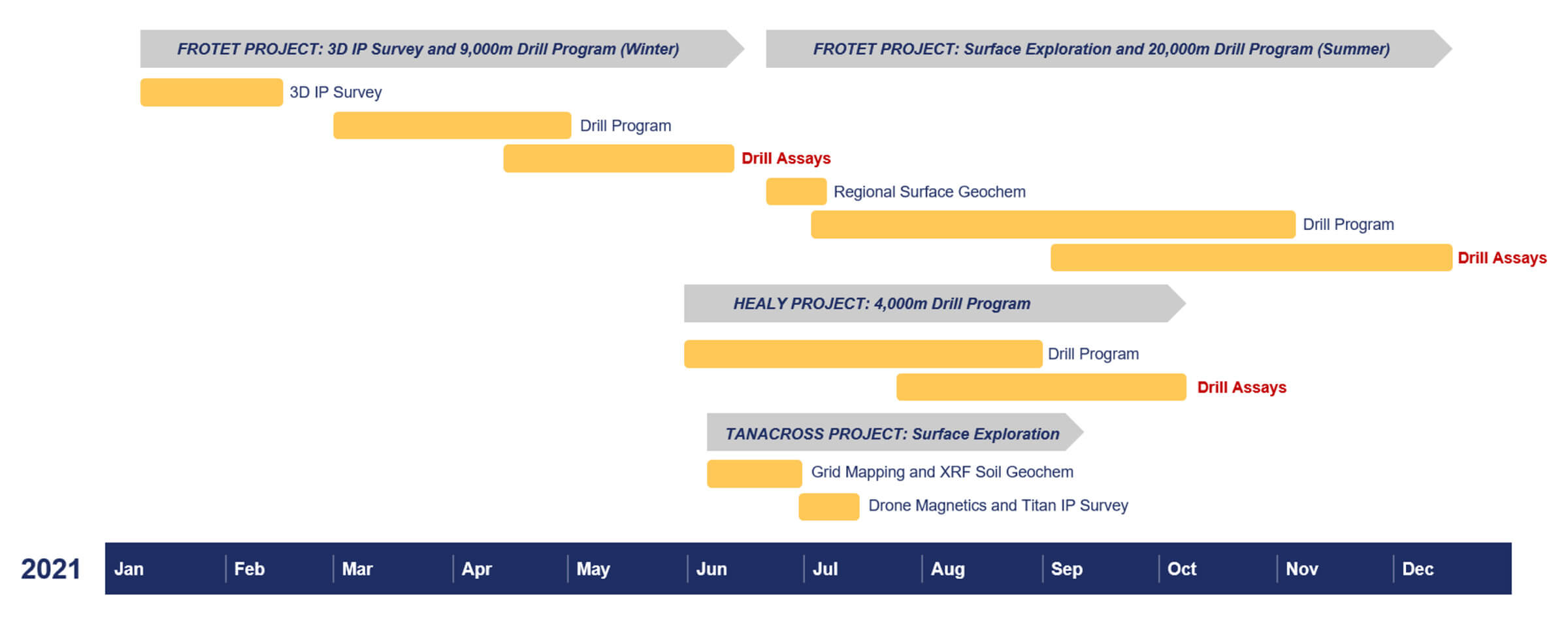

Before announcing the option agreement with Barrick Gold, Kenorland provided an exploration update on all seven exploration projects where exploration programs are currently actively managed, and the summary provided in that press release provides the key elements.

• Frotet Project, Quebec (Joint Venture with Sumitomo Metal Mining): 18,000m diamond drill program

Summary of 2021 Summer-Fall Exploration

• Healy Project, Alaska (Optioned from Newmont Corporation): 5,000m maiden diamond drill program

• Tanacross Project, Alaska (100% owned): soil geochemistry, UAV magnetic, and IP surveys

• Chicobi Project, Quebec (Optioned to Sumitomo Metal Mining): Geophysics (UAV magnetics, IP, EM)

• Hunter Project, Quebec (100% owned): Property-wide airborne VTEM geophysical survey

• Chebistuan Project (Optioned to Newmont Corporation): Phase 2 soil geochemistry survey

• South Uchi Project, Ontario (100% owned): LIDAR survey and regional till sampling (planned for fall)

As you see, Kenorland and its partners will be very active this year and the combination of all exploration programs will see a total of about C$17M spent on the projects. The majority of the funds will obviously be spent on the two drill projects as partner Sumitomo is drilling the high-grade Frotet gold discovery and Kenorland is self-funding the 5,000-meter drill program on the Healy gold project in Alaska, where it’s advancing an earn-in agreement with Newmont. These are the two most advanced projects in the portfolio.

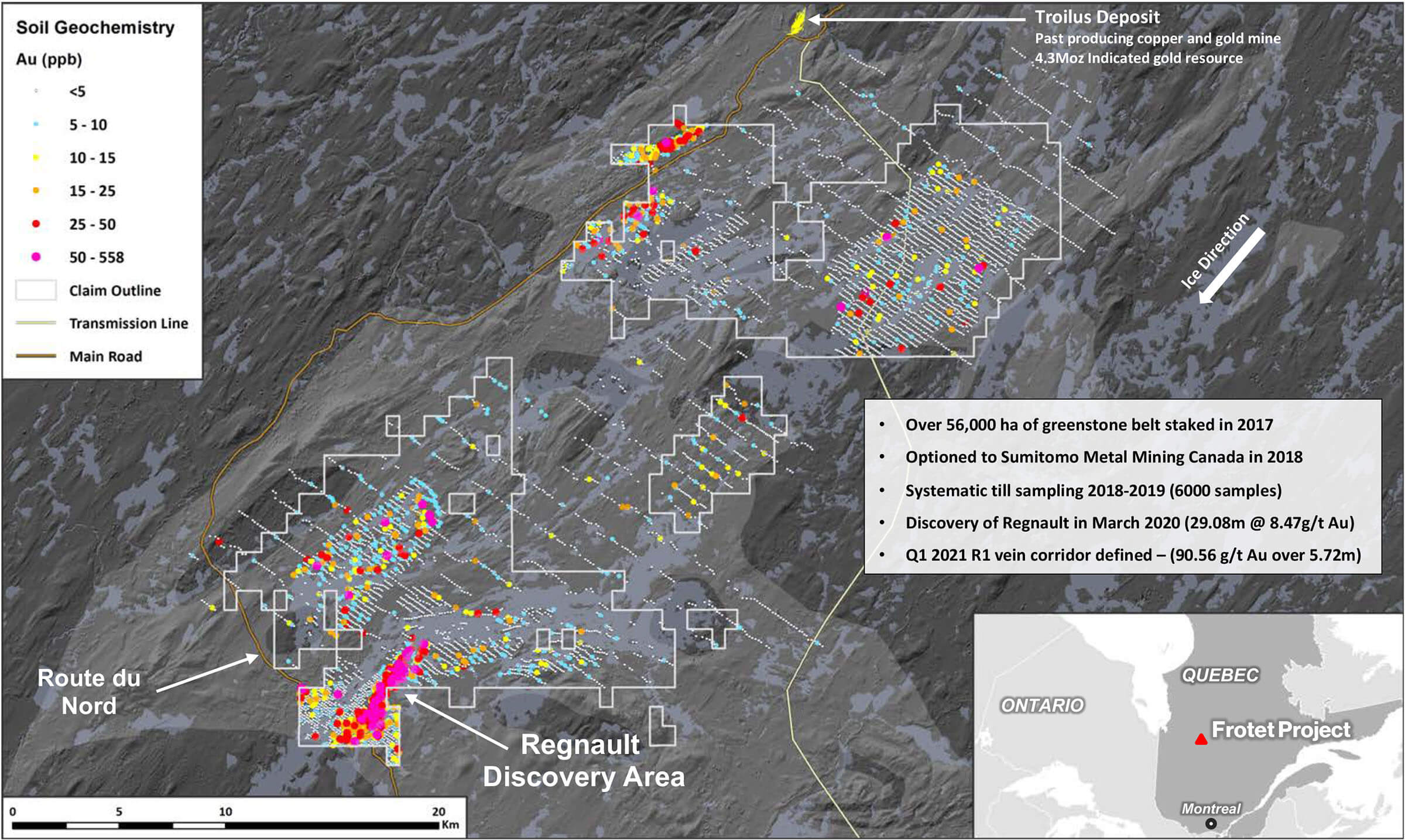

At Frotet, the partners now have completed over 10,000 meters of the planned 18,000-meter drill program which was aiming to step out along the R1 and R2 gold-bearing structures while also doing some infill drilling and following up on additional mineralized zones within the Regnault trend. Meanwhile, field crews have been working on generating additional drill targets which will be part of a regional drill campaign in 2022.

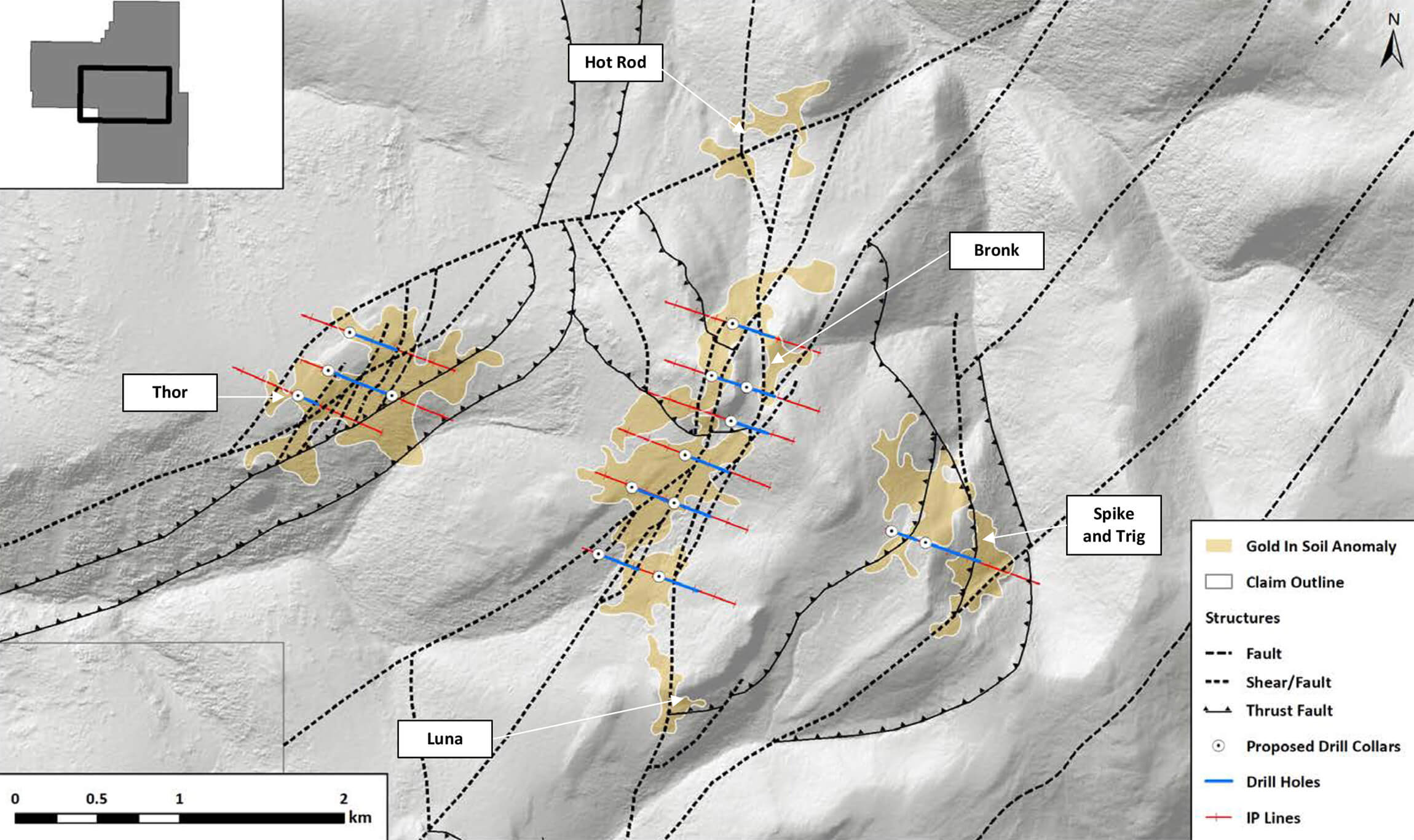

The Healy drill program should be completed by now as it had reached a 96% completion rate in the first week of September. The 5,000 meters of diamond drilling were designed to systematically drill-test the Bronk, Thor, and Spike target areas. Assay results should be available in the fourth quarter.

Kenorland (and partners) are also doing some early-stage work on the properties that aren’t drill-ready yet.

Frotet Project, Quebec (80/20 Joint Venture with Sumitomo Metal Mining Canada Ltd.): The Company has completed 9,889 meters of diamond drilling from the recently announced program consisting of up to 18,000 meters (see press release date July 14, 2021) allocated for infill and step-out drilling along the R1 and R2 gold-bearing structures as well as follow-up on additional zones of mineralization within the Regnault trend. In addition to drilling at Regnault, till and soil geochemical surveys as well as prospecting campaigns were completed on several regional areas of interest within the Frotet Project. This work has yielded a number of robust geochemical anomalies which warrant follow-up exploration including detailed geophysics in preparation for drill targeting. Drill testing of these regional target areas is tentatively planned for Q1 2022.

Healy Project, Alaska (Optioned from Newmont Corporation): The ongoing drill program at Healy (see press release date June 3, 2021) has been extended to include over 5,000 meters of diamond drilling to systematically test the Bronk, Thor and Spike target areas. The Company has also completed 5 line-kilometers of high-powered induced polarization (IP) and magnetotellurics (MT) which transects the entire Healy gold system. A total of 4,821 meters has been drilled to date and complete assays from the drill program are expected to be announced in Fall 2021.

Tanacross Project, Alaska (100% owned): The Company has completed an extensive soil geochemical and mapping survey covering East Taurus, West Taurus, and South Taurus prospects as well as the Big Creek target. A total of 1870 soil samples have been collected and sent for analysis. Detailed UAV magnetics surveys, consisting of over 600 line-kilometers, was flown over the same target areas. The Company has also completed 5 line-kilometers of high-powered IP and MT over the South Taurus target. Due to delays of the geochemical and geophysical surveys, the previously announced drill program planned at Tanacross has been put on hold until further notice, and the budget was reallocated to complete additional drilling at the Healy Project.

Chicobi Project, Quebec (Optioned to Sumitomo Metal Mining Canada Ltd.): The Company has received all assay and gold grain counts from the Phase 3 sonic drill-for-till geochemical program. A coherent, multi-element (including gold) anomaly, ‘Target B’, was identified from multiple sonic drilling campaigns which began with a property-wide regional survey in 2019. Detailed geophysical surveys are now being planned to refine drill targets within the anomaly. These geophysical surveys, which include drone magnetics, IP, and electromagnetics (EM), are planned for fall 2021. Initial diamond drill testing is tentatively scheduled for Q1 2022.

Chebistuan Project, Quebec (Optioned to Newmont Corporation): The Company has completed the Phase 2 geochemical survey following up on multiple anomalous areas of interest defined from the initial regional program in 2020. A total of 2,121 soil samples were collected for geochemical analysis and 225 till samples collected for gold grain analysis. A follow- up prospecting campaign is tentatively planned for the Fall.

Hunter Project, Quebec (100% owned): The Company has completed a property-wide airborne Versatile Time Domain Electromagnetic (VTEM) geophysical survey covering the 18,177-hectare project aimed to identify potential volcanogenic massive sulphide (VMS) targets for follow-up exploration. A total of 1,104 line-kilometers were flown at a spacing of 200m.

South Uchi Project, Ontario (100% owned): The Company has completed a LIDAR survey and surficial geology map covering the 76,511-hectare project. This data has been used for planning a first pass till geochemistry program scheduled for the Fall.

2021 Exploration Update

And of course, there are some smaller projects that have been vended into third parties, whereby Kenorland Minerals usually ends up with an equity stake and/or a Net Smelter Royalty. The September update from Kenorland also included a brief update on those projects.

Rupert Project (LiFT Power Ltd – Private) Kenorland recently optioned the Rupert Lithium Project, located in Quebec, to LiFT Power in return for a 10% equity interest in the company upon listing and a 2% uncapped NSR. A first-pass regional till sampling program has been completed covering ~1000 km2 of the prospective geologic sub-province boundary that hosts the Whabouchi lithium pegmatite deposit.

Napoleon Project (J2 Metals Inc. – Private) – The Company recently vended the Napoleon Project, located in Alaska to J2 Metals for a significant equity position and 2% uncapped NSR. J2 is currently carrying out a 3,000m rotary air blast (RAB) drill program to test multiple gold-bearing structures.

Fox River Project (Superior Nickel Corp. – Private) – The Company recently vended two mineral exploration licenses covering prospective Ni sulphide targets in the Fox River Belt in Manitoba in return for a significant equity position and 2% uncapped NSR, as well as an exploration commitment to complete 2,000m of diamond drilling to test various Ni-sulphide targets within the belt.

Goldrange and Thibert Projects (Kingfisher Metals Ltd. – TSXV: KFR): The Company holds a 2% uncapped NSR on the Goldrange and Thibert Projects as well as a significant equity position in Kingfisher. A 5,000m maiden diamond drill program is currently underway at Goldrange to test a large-scale gold-in-soil anomaly related to a previously undrilled gold system.

Prospector Royalty Corp. (Private) – The Company owns an approximate 40% stake in Prospector Royalty Corp., a private royalty generation and acquisition company which recently received a C$2 million strategic investment from Gold Royalty Corp. (NYSE: GROY).

Koulou Gold Corp. (Private) – The Company owns a 20% stake in Koulou Gold, a private West Africa-focused gold exploration company.

Other Equity and Royalty Interests

Of the C$17M total 2021 budgets, about C$11M will be funded by third parties, which means Kenorland will be on the hook for about C$6M in exploration expenditures this year but this amount will likely be reduced with the Barrick Gold announcement as the planned LIDAR survey (sunk cost) and regional till sampling program that is planned for this fall will now be (re-)funded by Barrick Gold.

Also, keep in mind Kenorland usually is the operator of all exploration projects and earns an operator fee for doing so. In the early September update, Kenorland estimated it will generate C$2M in management fees and cash payments from option deals and this, in combination with the tax credit for exploration expenditures, means the net cash outflow for Kenorland will be substantially lower than C$6M.

Conclusion

Kenorland Minerals is advancing multiple projects at the same time so there should be plenty of news flow going forward. Adding Barrick Gold as a new option partner on the South Uchi gold exploration project lends even more credibility to Kenorland and its approach, as this is the third Big Name optionor working on a property.

Assay results from both Frotet (Québec) and Healy (Alaska) could be expected in the next few weeks, and hopefully, this will attract some attention to the story as the current share price for sure is frustrating.

Disclosure: The author has a long position in Kenorland Minerals. Kenorland Minerals is a sponsor of the website. Please read our disclaimer.