The uranium price has performed very well in the past odd year and after a few ‘false’ breakouts in the past decade on the uranium equities front, it looks like reality has set in. The excess inventories of physical uranium of the past decade is dwindling fast, not in the least because ETFs and uranium holdco’s like Yellow Cake have been acquiring physical uranium in anticipation of a price increase. As the Sprott Uranium Physical Uranium ETF and Yellow Cake currently own approximately 84 million pounds of physical uranium, the supply/demand ratio has been distorted as not all of the pounds that have effectively been produced in the past decade have made their way to utilities as their final buyer. And as ‘holding and owning physical uranium’ is the core business of the two aforementioned entities, that stockpiled uranium is not hitting the market which means the end-users of uranium need to go elsewhere to cover their needs. On the other hand, you could wonder when the uranium bull market would have started if the Sprott ETF and Yellow Cake would nót have absorbed almost 100 million pounds of uranium from the market.

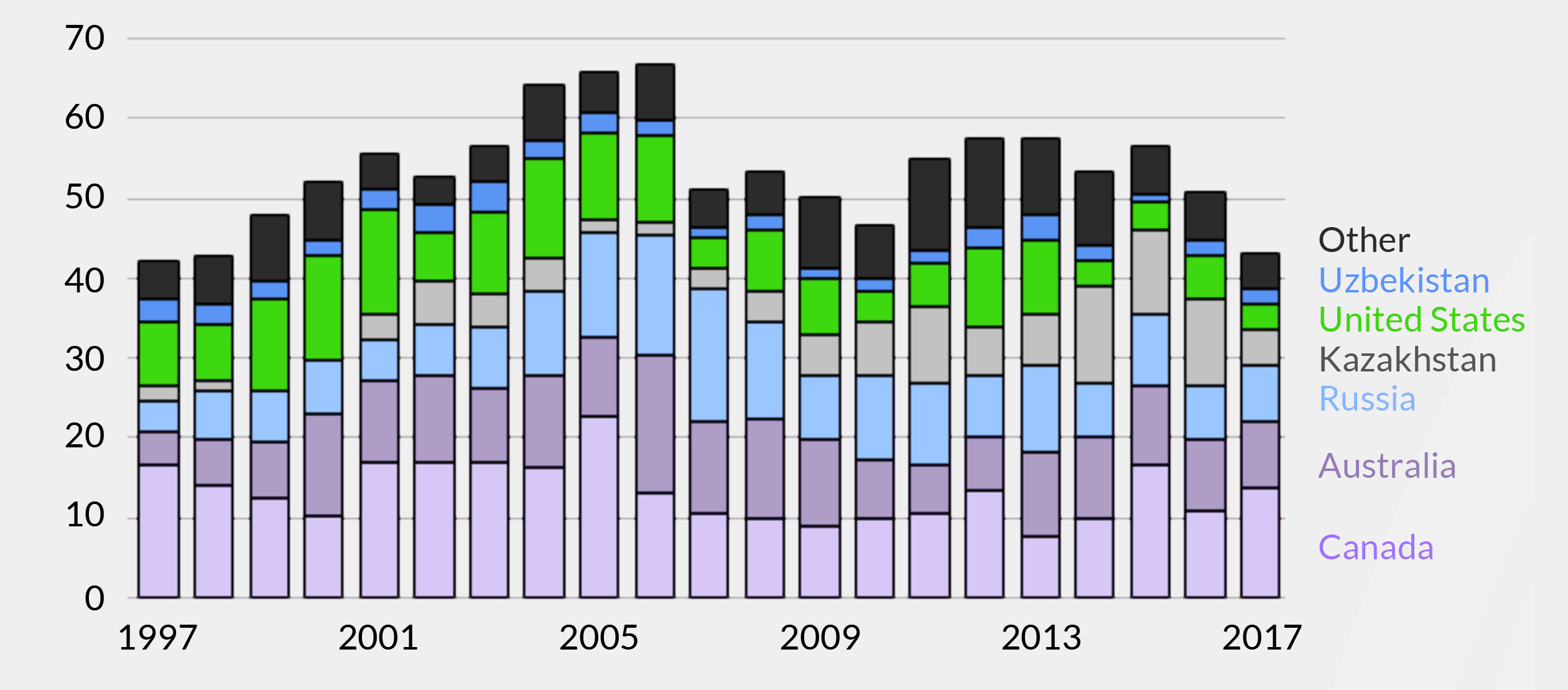

Meanwhile, a very large portion of the current uranium production (and upgrading) happens in countries where the political stability and/or the willingness to supply Western countries with uranium could be questionable, and that’s why having a North American (and ideally, European) supply of uranium would be desirable.

While the USA considers Canada a friendly nation and the Athabasca Basin is a world-renowned epicenter for uranium, we expect the United States to try to (re-)develop a domestic uranium supply chain again. This will help the ‘usual suspects’ which have idled their past production, but it could also provide a tailwind for exploration stage companies like Kraken Energy (UUSA.C, UUSAF) which owns exploration properties in Utah and Nevada. The Utah property is currently being drilled and we should see the assay results in the second quarter.

An overview of the Uranium market

We likely don’t have to dwell on this subject as pretty much everyone has already provided an opinion on the uranium market and the uranium price. After the recent parabolic move in the uranium price, the spot price is currently consolidating around the $100 mark (there is some volatility and the current spot price is trading below $100) but not the spot price but the long-term contract price is what really matters in the uranium sector. That long-term price is currently trading at around $75 and the momentum is still slightly increasing.

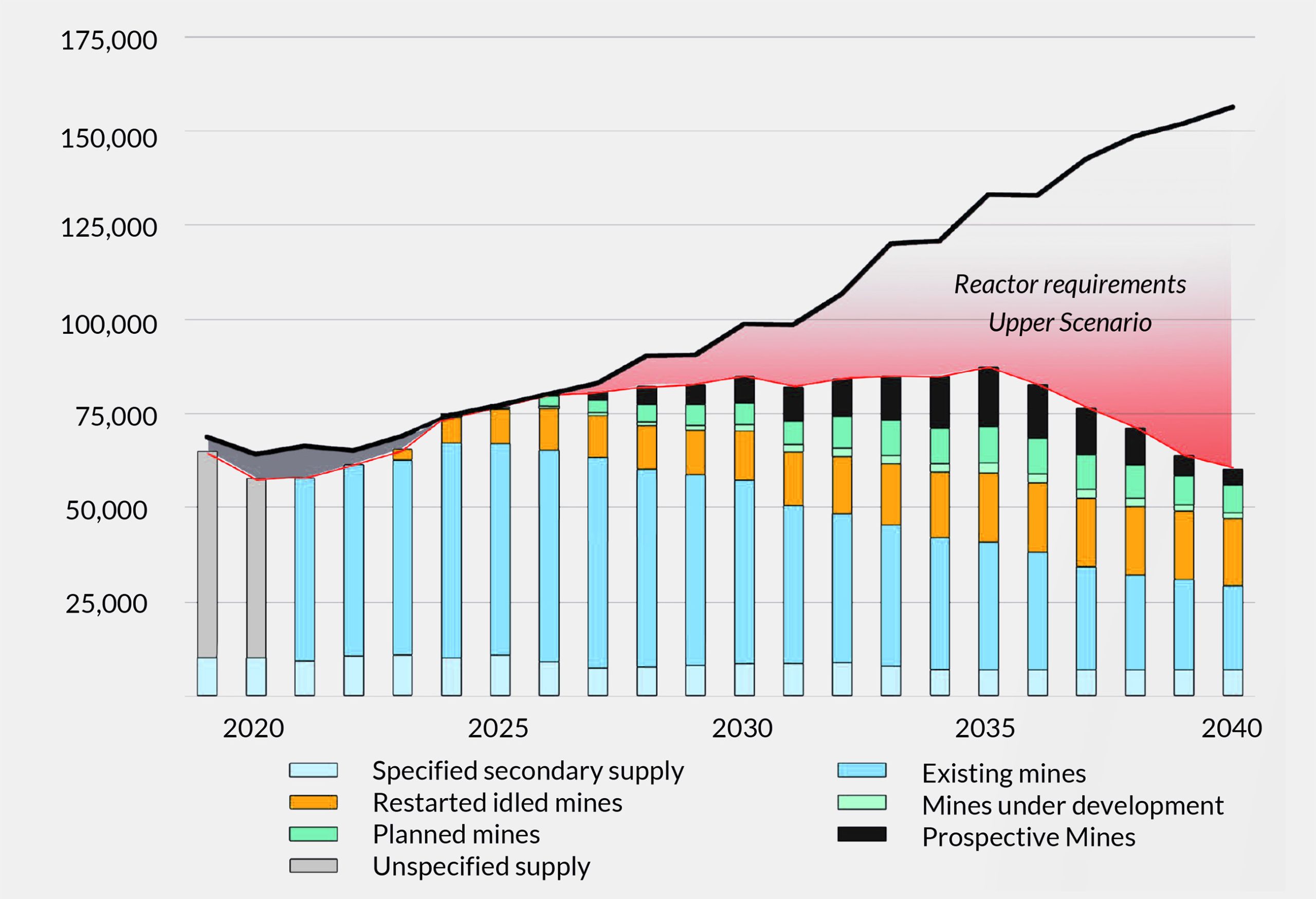

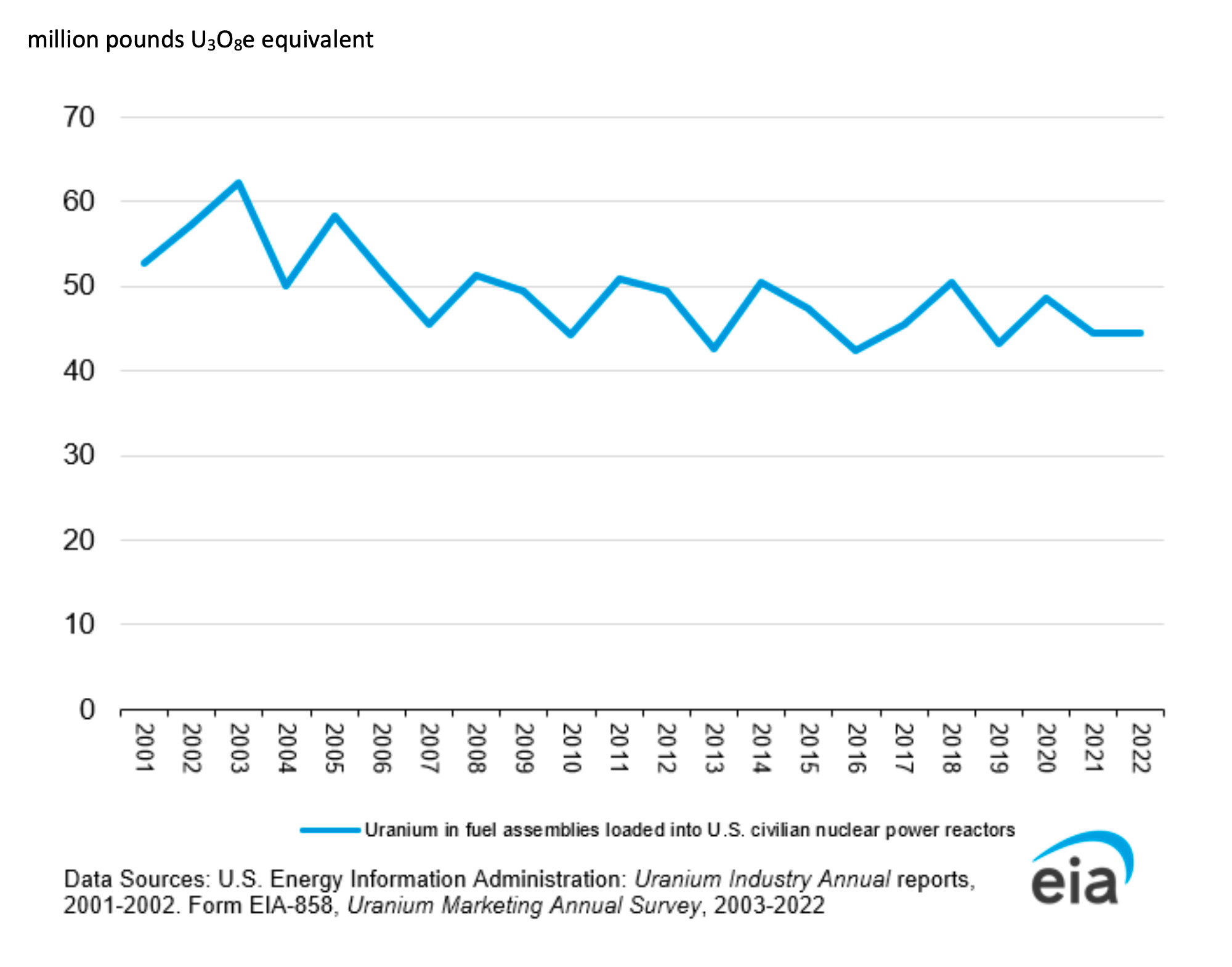

The main thesis for getting exposure to the uranium sector is the anticipated supply deficit. The world continues to use more and more uranium, and especially now that nuclear power generation is suddenly considered a ‘green’ source of energy, the demand for and interest in uranium is likely the highest in the past decade or even two decades.

It is true that worldwide uranium production has been decreasing for several years now, and the supply deficit was covered by inventoried uranium, which was deemed ‘surplus’ and was gradually sold into the markets. Until the ‘point of no return’ has been reached, the nervosity on the uranium markets has increased as utilities need to start looking to lock in sources of uranium for the second half of this decade. While the data below are slightly outdated as they discuss the uranium coverage ratio at the end of 2022 (an updated overview discussing the YE 2023 situation will likely be published by this summer), it does point to one general conclusion: the coverage ratios are dropping fast in the second half of this decade on. And that’s why we have seen an increasing amount of US and European utilities looking to get their hands on uranium and why we have seen a pick-up in tentative offtake agreements.

We would argue there is quite a bit of potential production capacity still on the sidelines, and the majority, if not all, of that available capacity will be brought online. Paladin Energy will restart Langer Heinrich, the past-producing Kaleyekeramine in Malawi can be brought back from the mothballs while large producer Kazatomprom will also scale up the output – albeit at a slower pace than previously anticipated.

Additionally, as the demand for uranium from US utilities is approximately 45 million pounds per year, we notice a lot of interest in rekindling the domestic production of uranium and building out a domestic supply chain. Several production stories that mothballed their projects are now gearing up to restart domestic production in the USA, but based on the current production capacity (that’s just the theoretical capacity, it will take years to reach full capacity, if ever), the USA would still have to import in excess of 50% of its required uranium.

And while it has Canada as friendly neighbor to the north, we expect increasing attention for domestic uranium projects in the USA. The Democrats want the ‘green energy’, the Republicans wouldn’t mind creating more jobs in mining and reducing the average cost of electricity in the country. So rather than going to exotic destinations in Middle Africa (where Niger is getting increasingly unstable), it could make sense to focus on the known mining jurisdictions with a reliable regulatory framework.

Two flagship projects – and one is being drilled right now

Kraken Energy has several projects in its stable and we would consider the Harts Point project in Utah and the Apex Uranium project in Nevada as its clear flagship projects.

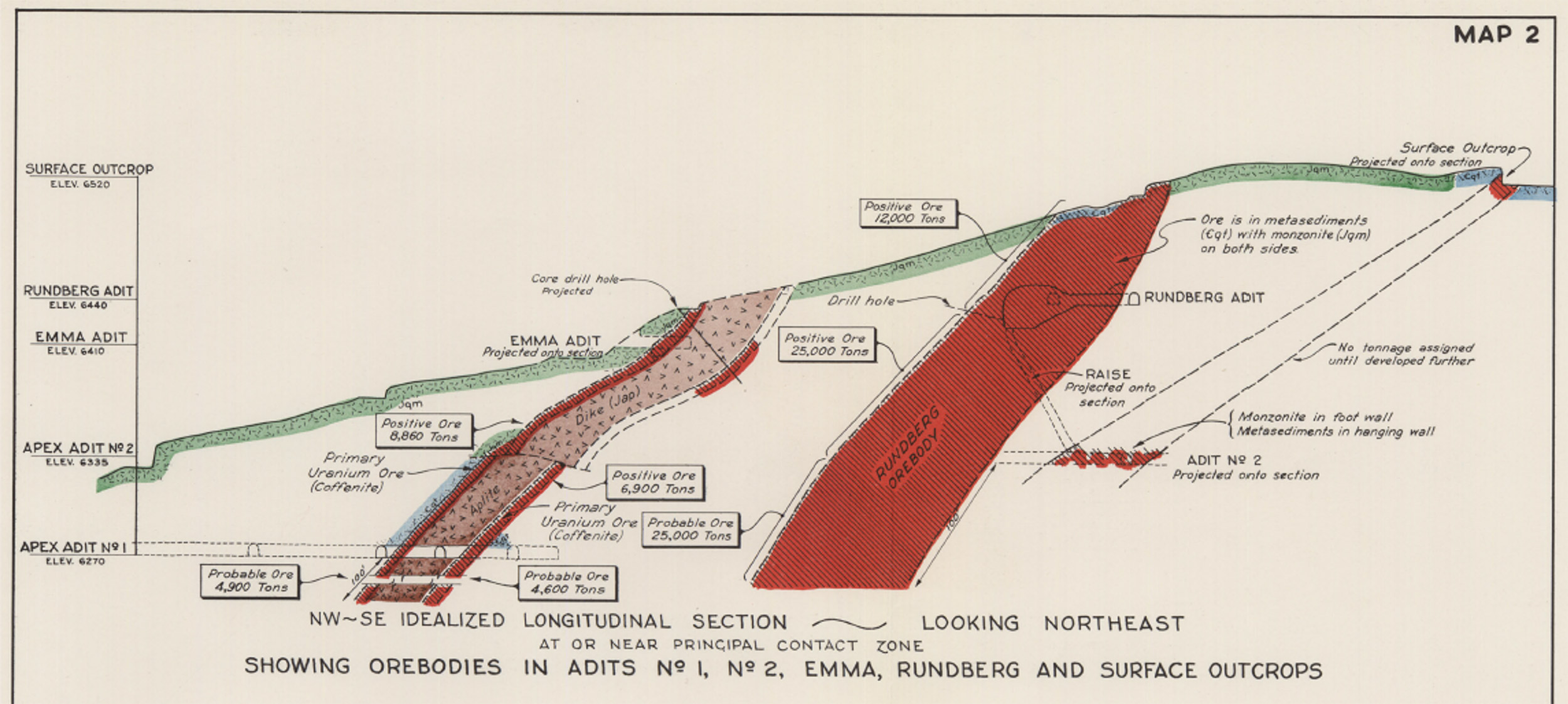

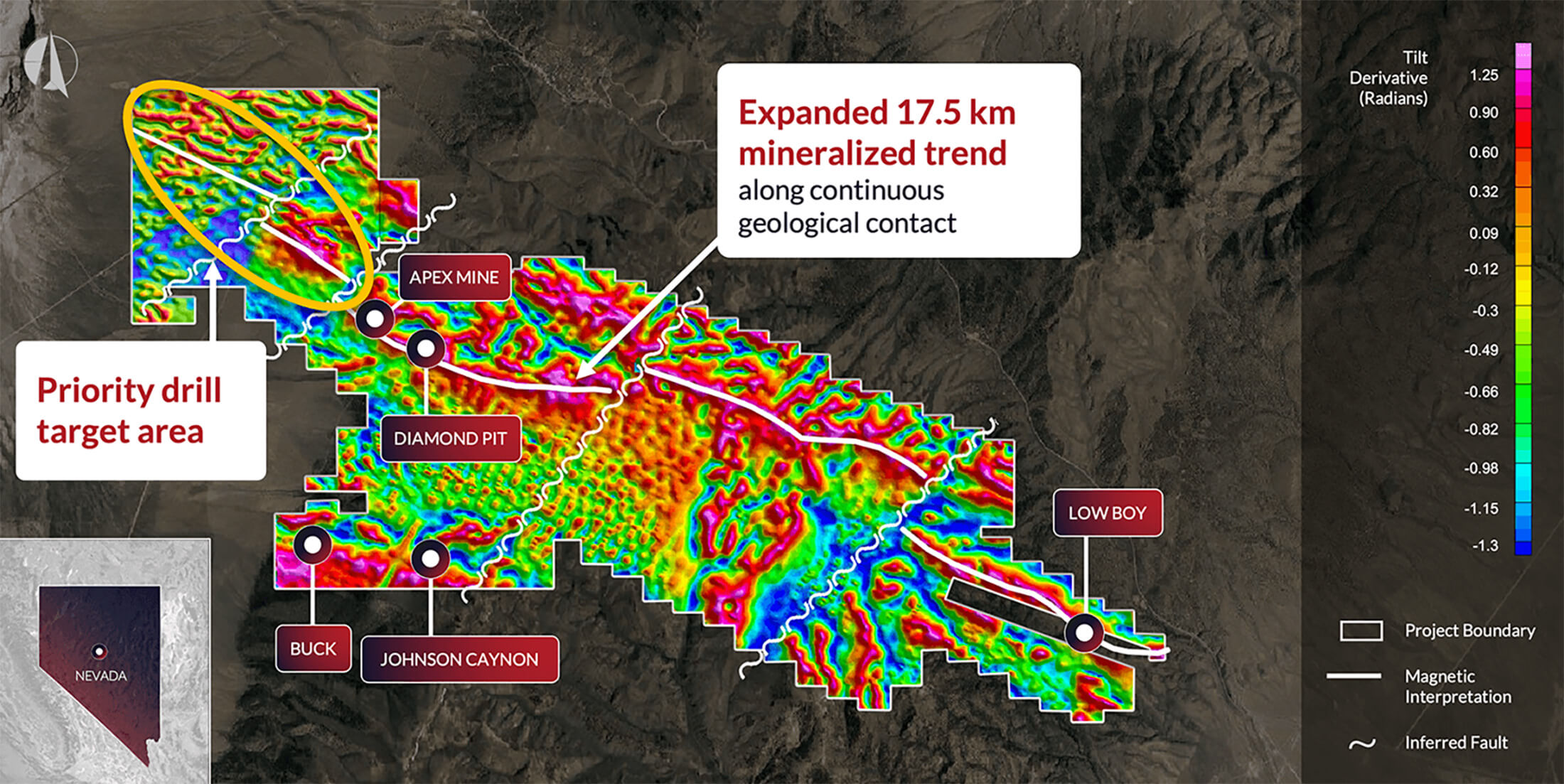

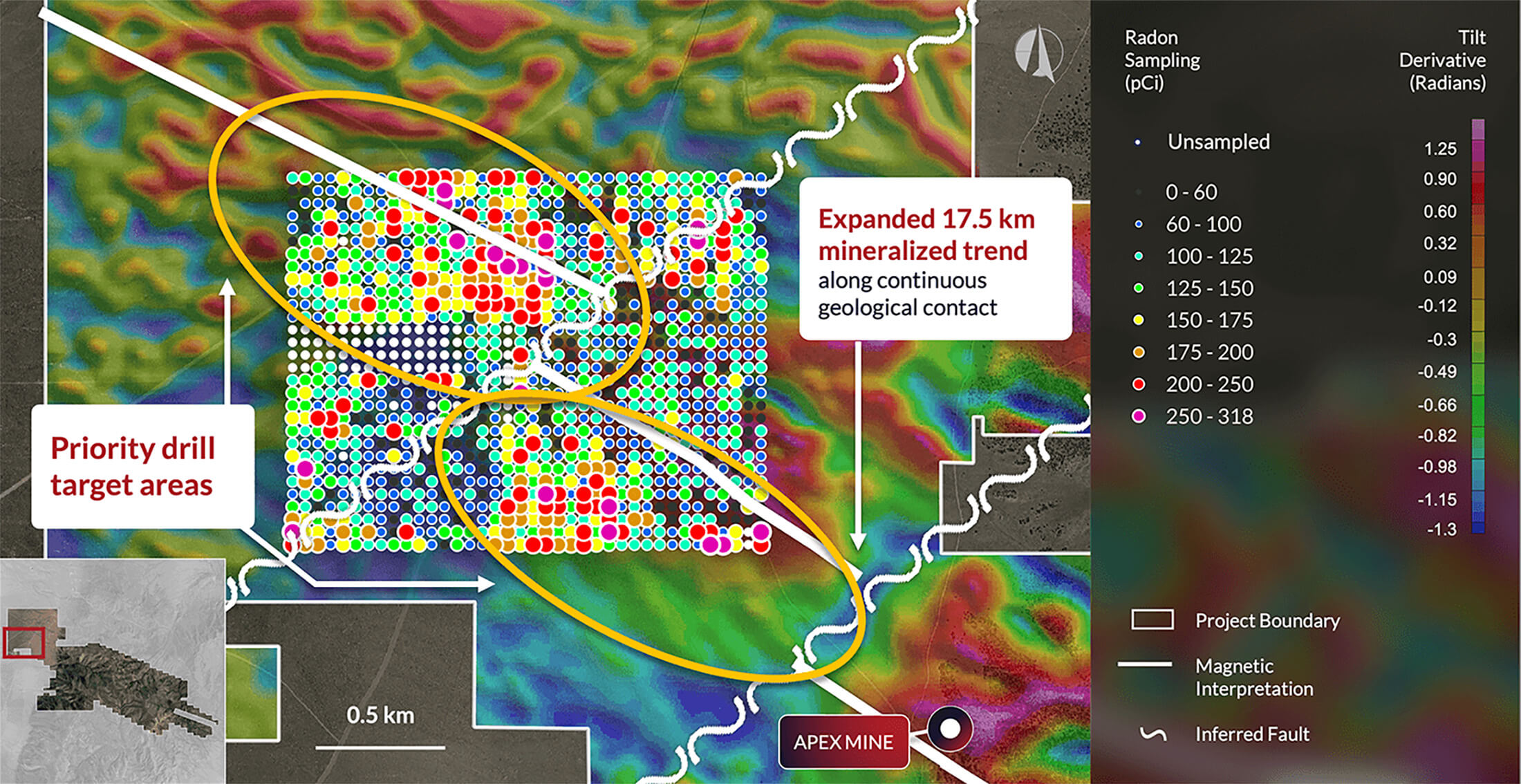

Apex, Nevada

Although the state of Nevada is generally associated with gold and silver, it may surprise you to hear it also has a history in the uranium space. In fact, there are historical reports available on the Apex mine in particular. The company has access to a mining report from 1956 when a consultant who visited what was called the Rundberg mine (named after the discoverers) owned by Apex Minerals, wrote an official report. In that 1956 report, the author mentioned four orebodies that were developed using almost a kilometer of underground drifting, and preliminary production reports from the 1950s indicate the average grade that was mined at Rundberg/Apex was almost 0.30%. Just to put things into perspective: at a uranium price of $60 per pound, this represents a rock value of approximately $400/t. And that definitely warrants attention in today’s uranium market.

Of course, the report and the data are 70 years old and are, per definition, outdated. But the main takeaway here is that Apex is not a ‘new’ uranium project. Its existence has been known for a while, but when the uranium price was trading in the low-$30s, spending too much time and effort on this project didn’t make much sense. But with long-term contract prices trading at $75 per pound, the times have changed.

Unfortunately, the first drill program in 2023 did not immediately hit the desired targets. The company received permits to complete up to 2,200 meters of drilling but the company abandoned the drill program after completing 874 meters in three holes. None of the three holes intersected the bedrock and all holes were abandoned at a depth of approximately 300 meters. The target depth was initially based on the geophysical inversion of the VTEM data collected in 2022. According to that survey, the depth to basement was estimated at 50-150 meters, and as the drill bit did not intersect the basement, the drill program was abandoned and the technical team is now reviewing the data and develop new targets. Back to the drawing board and it goes to show the exploration ‘game’ is never easy.

Back in 2022, the private company that ultimately turned into Kraken Energy signed an option agreement with third-party vendors, securing an option to acquire full ownership of the Apex property, subject to a 3% Net Smelter Royalty. One of the requirements to establish full ownership was to issue the private vendors a total of 29.7% of the share count of Kraken at that time. Those shares were issued in April 2022 and the 7.2 million shares had a deemed value of C$12M as the deemed issue price was C$1.67 per share. The Apex property is basically what ‘launched’ Kraken Energy but the near-term attention will go towards Harts Point where the company recently completed a small initial drill program.

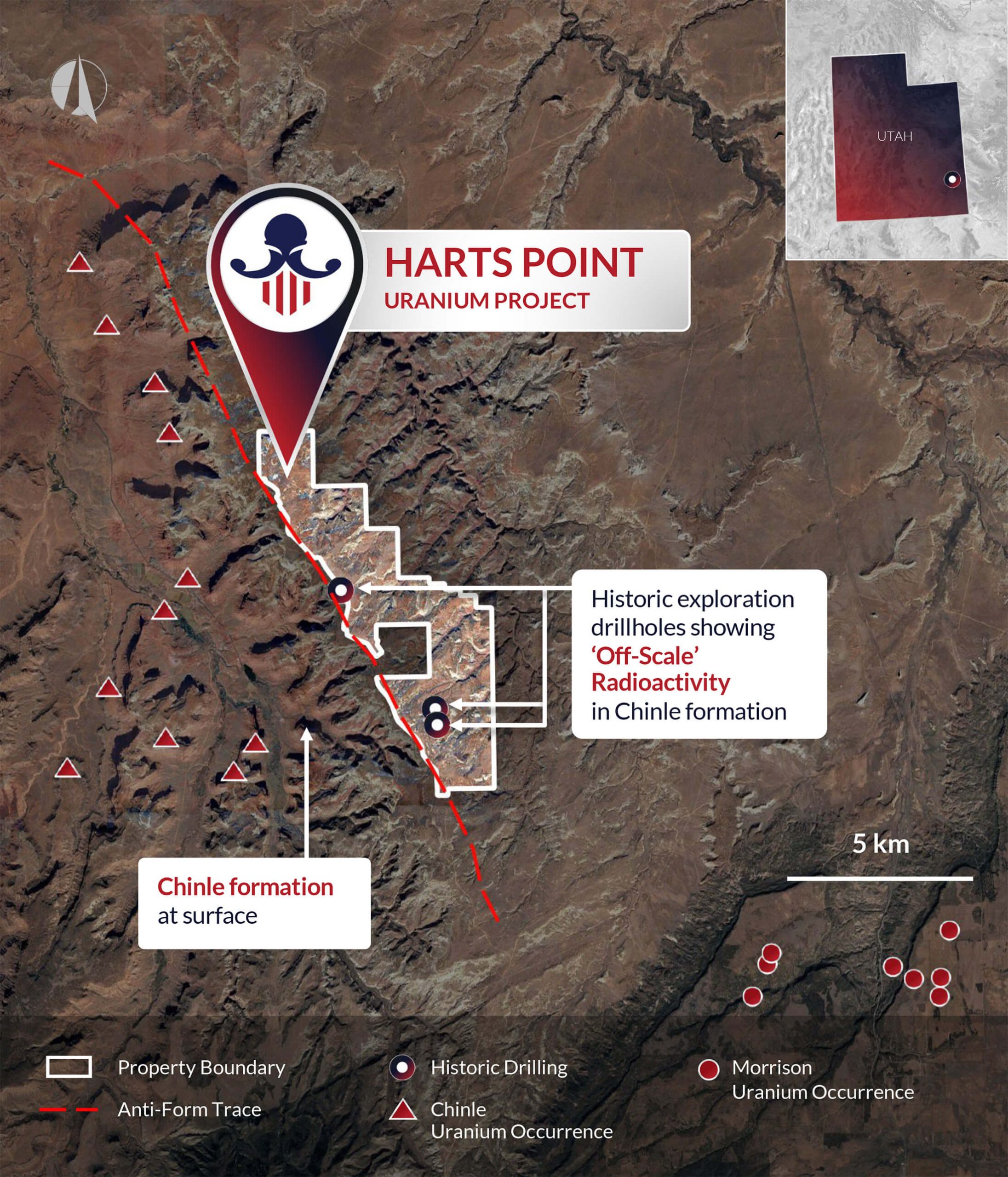

Harts Point, Utah

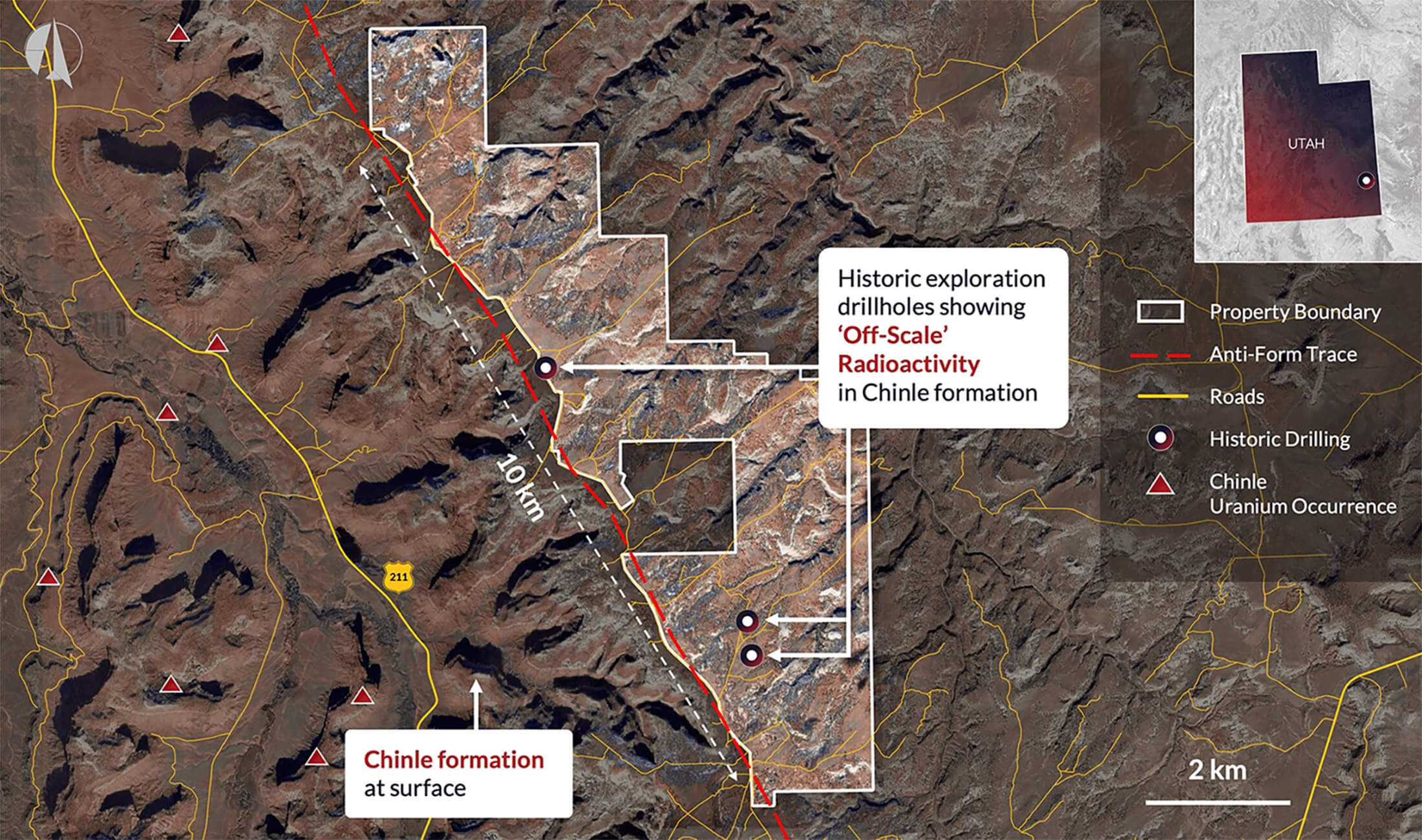

Drilling has now restarted at Harts Point after a brief interruption of the drill program in 2023. Although the company received the official approval from the Bureau of Land Management to construct 20 drill pads in July, followed by actually kicking off the drill program, the BLM requested the company to suspend the drill program, which Kraken Energy complied with. It took the BLM a few months to sort things out, but fortunately, the company received the official approval to resume the drill program in December. Remobilizing a drill rig and the drill crew obviously takes a bit of time, but drilling was resumed earlier this month and is now complete.

Not only were drilling conditions pretty smooth, but it also was a very small drill program: Kraken Energy completed just two holes at Harts Point. And while drilling just two holes sounds pretty silly, it’s all part of a bigger plan. The company has confirmed its drill rig has started the initial 1,000 meter drill program on its Harts Point uranium project in Utah. The initial program will focus on historical oil wells which came up empty, but where off-scale radioactivity was registered at a depth of approximately 400 meters over intervals of 2-4 meters.

The Harts Point Anticline is analogous to the Lisbon Valley Anticline nearby (located about 30 kilometers to the east), and that uranium district hosted 17 uranium mines and has documented total production of approximately 80 million pounds of uranium between 1948 and 1988 at an average grade of 0.34%. On the Western side of Harts point, there are some smaller mines as well, which produced a total of 280,000 pounds of uranium at an average grade of 0.3% U3O8.

Drilling was completed quickly and efficiently and we could see drill results by the end April. We would also expect the company to release the scintillometer results after testing the hole and if the results from the historical oil wells are somewhat representative we hope to see more off-scale radioactivity levels (or at least close to the higher end of the scale).

And to explain why the Harts Point property merits quite a bit of attention and is the flagship project, in our opinion. We already discussed the Lisbon Valley district has produced a total of 80 million pounds of uranium, but that’s just a fraction of the total cumulative uranium production on the Colorado Plateau which accounted for a total production of almost 590 million pounds at an average grade of 0.2-0.4% U3O8. The Lisbon Valley district is a subset of the Colorado Plateau and the 17 uranium mines are all sandstone-hosted uranium deposits with very similar characteristics. The average thickness is 2-13 meters while the length and width are generally 100-3,000 meters and 31-425 meters respectively.

As you may remember, the historical oil wells encountered off-scale radioactivity over a length of 2-4 meters which is pretty consistent with the thickness of the uranium layers in the Lisbon Valley district.

In the second quarter of last year, Kraken Energy entered into an agreement to acquire a stake of up to 75% in the Harts Point uranium project in Utah from Atomic Mineral Corporation. There obviously were some requirements that had/will have to be met in order to establish the 75% stake: Kraken Energy is required to spend US$1.5M in eligible expenditures to earn an initial 65% stake (we expect this threshold to be reached after completing the current drill program). Once that initial stake has been acquired, Kraken can increase its interest from 65% to 75% by incurring an additional US$2M in expenditures and issuing Atomic Mineral Corp two million shares while granting a 2% NSR on the asset. Half of that NSR can be repurchased for US$5M in cash.

Once Kraken Energy has met all the requirements to establish the 75% stake in the asset, Kraken and Atomic Mineral Corp will form a 75/25 joint venture and Atomic will have start contributing to the expenses on a pro rata basis.

Kraken has enough cash on hand to complete the drill program

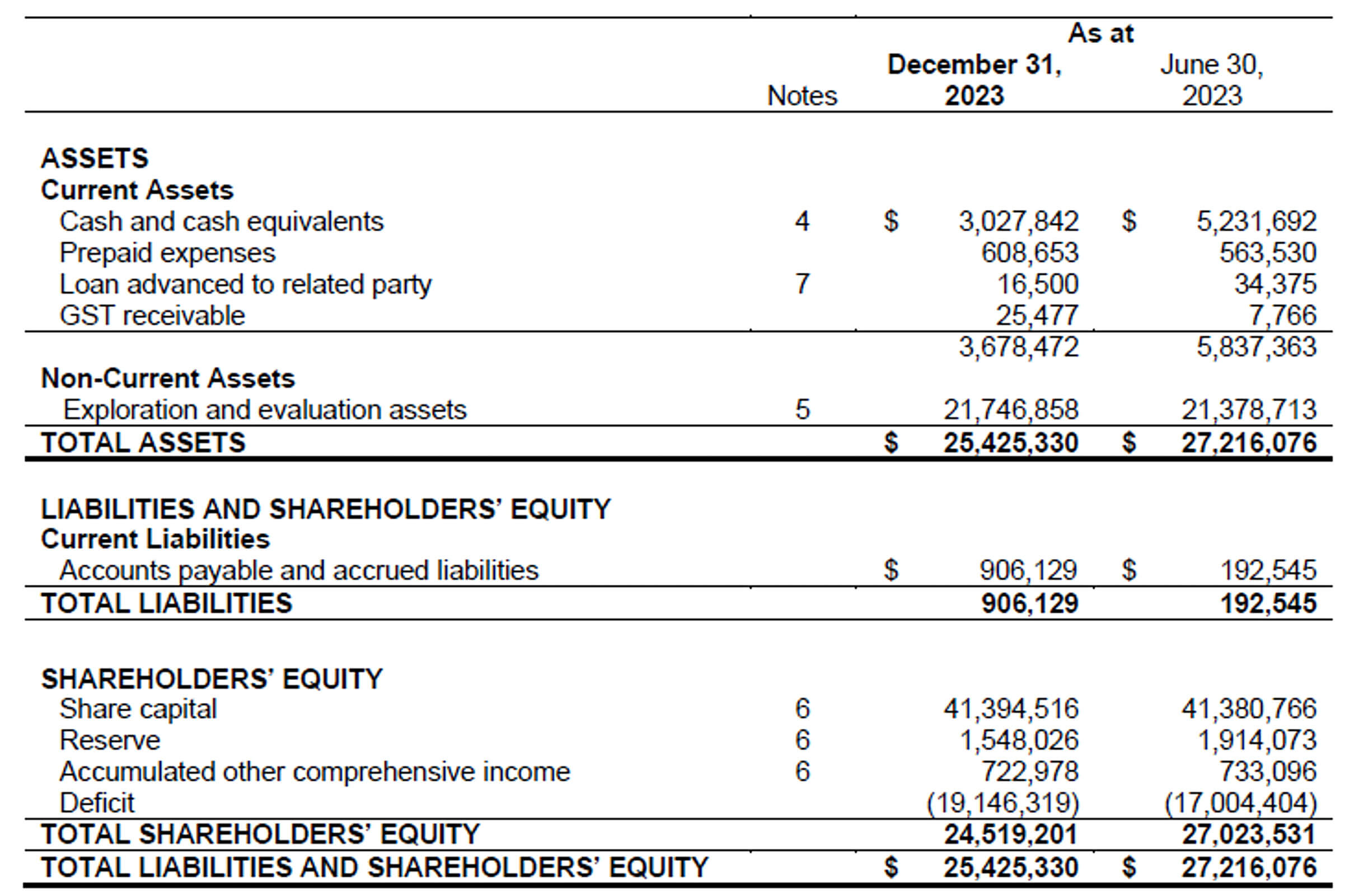

At the end of December, Kraken Energy had approximately C$3M in cash on the balance sheet while its total working capital position was a positive C$2.7M.

This should be sufficient to cover all expenses related to the current small drill program but the company will need to raise more money to continue its activities on the flagship projects in Utah and Nevada. While exploration money is still hard to come by, the renewed interest in uranium and more specifically, the interest in domestic uranium properties should help Kraken Energy. We don’t anticipate the company will raise money at the current share price but rather wait for the assay results from the two holes drilled at Harts Point as those could prove the exploration theory.

Management & board

Matt Schwab – CEO, Director & Qualified Person

- Recently appointed as Technical Advisor to the Board of Advisors of Stallion Uranium, hosting several projects in the Athabasca Basin

- Previously, co-founder and SVP of Axiom Exploration Group Ltd.

- Former Senior Exploration Geologist at NexGen Energy Ltd. and instrumental in discovery of Arrow uranium deposit in 2014

- Member of the Hathor Exploration Ltd. development team contributing to sale of Roughrider deposit to Rio Tinto for $654M

Madeline Berry – Senior Geologist

- Experienced geologist having worked with several mineral exploration companies, including NexGen Energy Ltd., Northern Star Resources and White Gold Corp.

- Has been involved in a full spectrum of exploration activities, including logging core, overseeing QA/QC, collecting samples and planning and managing drilling programs

- Earned a Bachelor of Science in Geology from the University of Regina in 2016

Garrett Ainsworth – Chairman

- Former VP Exploration & Development at uranium and exploration companies such as; NexGen Energy and Alpha Minerals

- Took a lead role in the discovery of the Patterson Lake South high-grade uranium boulder field, and drill discovery of the Triple R uranium deposit

- Co-recipient of the AMEBC Colin Spence Award for the Triple R discovery, and PDAC Bill Dennis Award for the Arrow discovery

Carson Halliday – CFO

- Experienced financial reporting professional with a background in serving public companies in various sectors, primarily in mineral exploration and mining

- Provides advisory and financial reporting support to several publicly traded companies with Sentinel Corporate Services

- Previous manager with Deloitte Canada, serving clients across the mining life cycle

Conclusion

While the initial drill program at Harts Point is very small, it should provide the company with plenty of data to decide on and design the next round of drilling. Encountering off-scale radioactivity in oil and gas wells that came up empty is a pretty good indication there is ‘something’ in the ground there, and there is only one way to figure out what the company is dealing with, and that’s drilling.

The main unique selling point for Kraken Energy is its location. Utah is very well-known for uranium occurrences and local authorities know how to deal with permit applications as it certainly is not a ‘new commodity’ for them.

We are looking forward to seeing the drill results from the Hart Point uranium project in Utah, and hopefully, that will create some momentum in the stock.

Disclosure: The author has no position in Kraken but will likely initiate a long position in the near future. Kraken is a sponsor of the website. Please read the disclaimer.