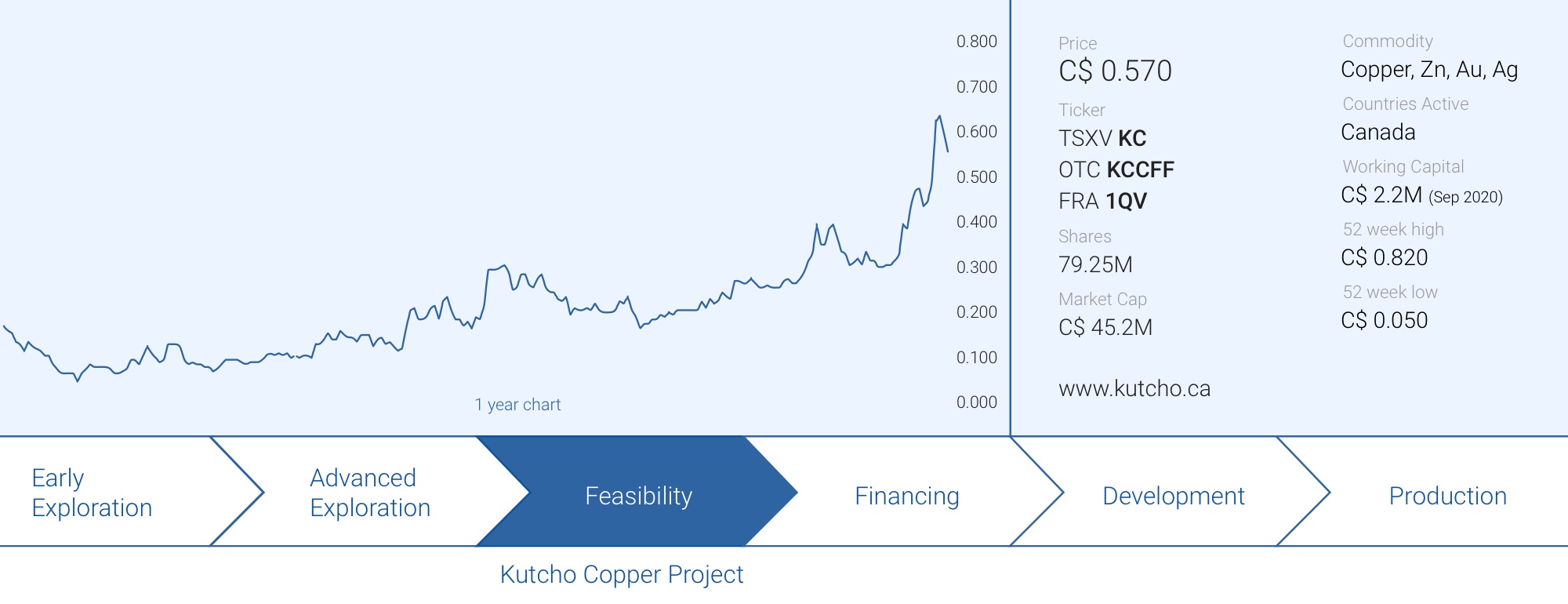

The copper price is exceeding all expectations and that’s positive for the companies owning copper projects that have a chance to be developed. Kutcho Copper (KC.V) saw its share price triple since completing a placement at C$0.20 in September thanks to the high copper price and the recent publication of an updated resource estimate. Considering the vast majority of the revenue it expects to generate comes from copper and zinc sales and those two metals are performing very well, the market seems to be waking up to this near-term developer as a feasibility study is due in June.

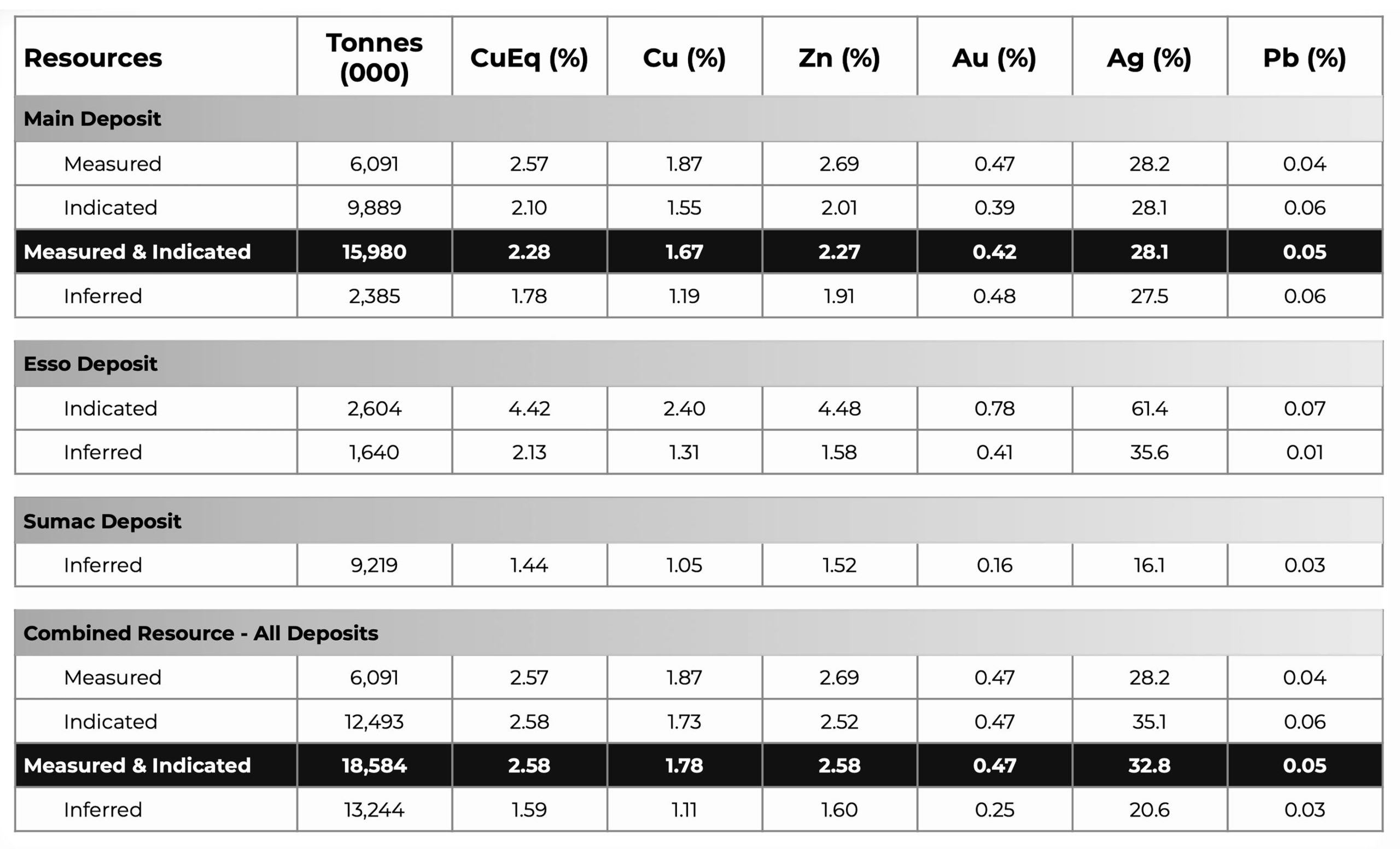

The updated resource now contains in excess of 30 million tonnes in all categories, including 18.5M tonnes in the measured and indicated categories

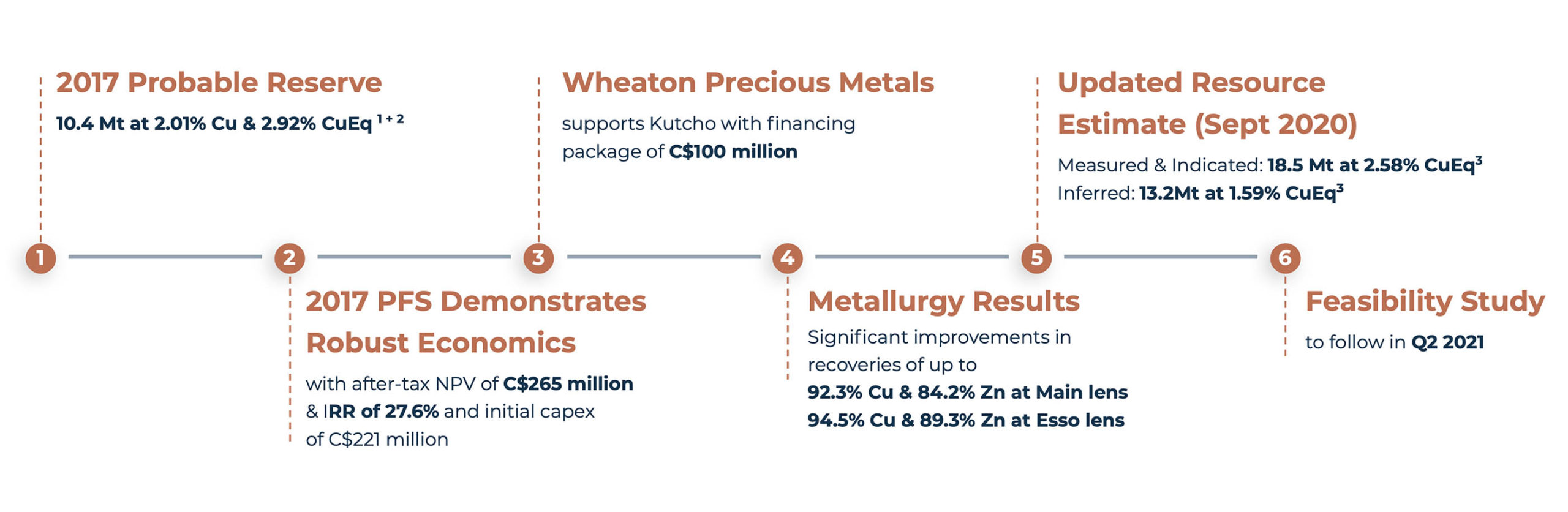

Last week, Kutcho Copper published an updated resource estimate on its Kutcho copper project. An important milestone as this is the resource that will be used as starting point for the feasibility study on this copper-zinc project in British Columbia. Thanks to an excellent metallurgical update (released in the summer of 2020, see later), Kutcho Copper was able to increase the tonnage in the resource estimate as more mineralized tonnes are now deemed to meet the economic threshold.

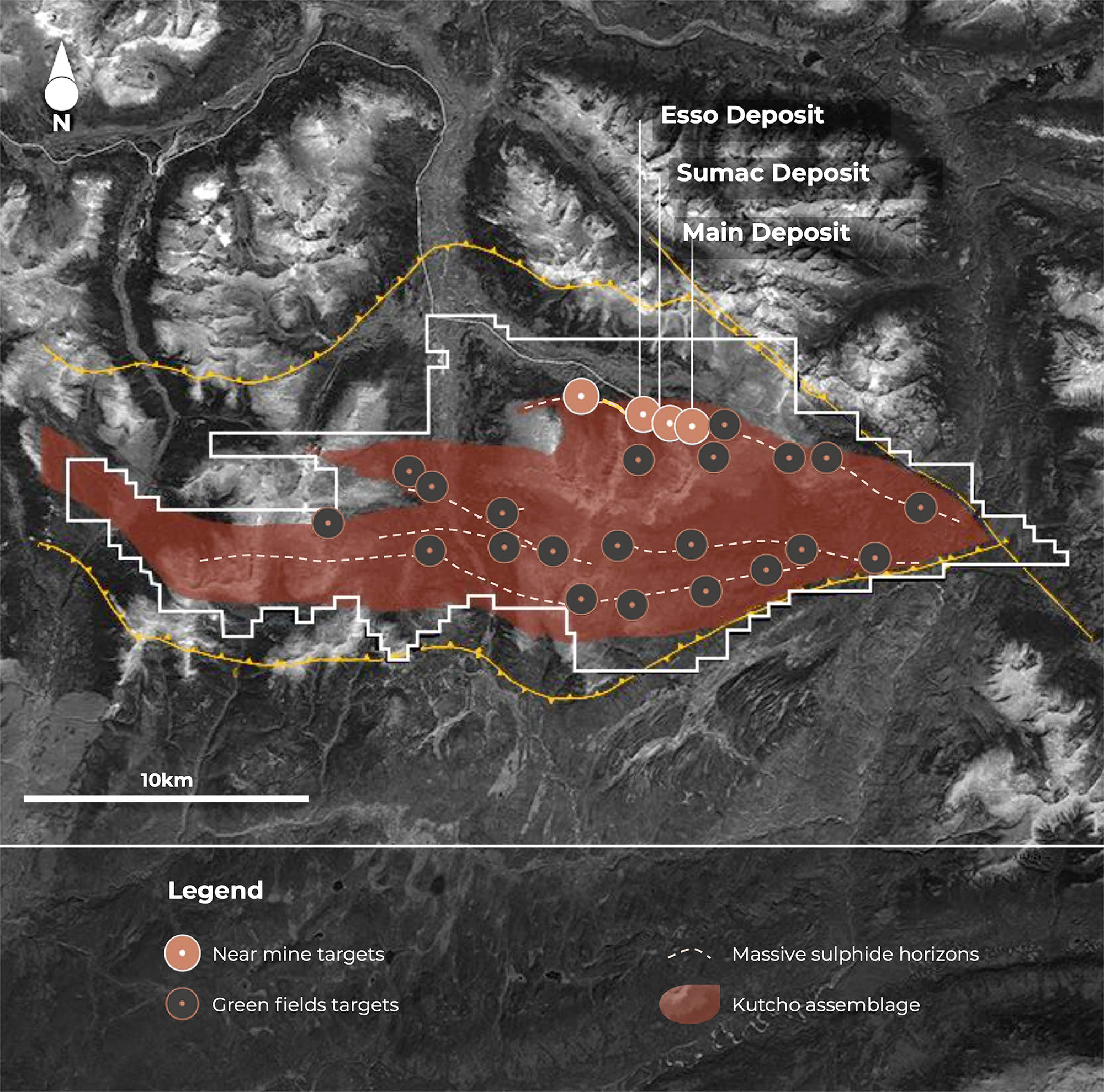

At the Main deposit, the updated resource now stands at almost 16 million tonnes in the measured and indicated resource categories at an average grade of 1.67% copper and about 2.28% copper-equivalent thanks to a healthy average zinc grade of 2.27%. The main zone contains an additional 2.4 million tonnes in the inferred resource category, but the average grade of the inferred resource is substantially lower.

Kutcho Copper also released updated resource estimates for bot h the Esso and Sumac deposits as well and of specific interest are the 2.6 million tonnes of high-grade rock in the Esso indicated resource category: with an average grade of 4.42% copper-equivalent thanks to a high zinc grade of 4.48% these additional tonnes could boost the production profile and the economics as they boost the grade of the indicated resource by quite a bit: the indicated resource at Main has an average grade of 2.1% copper-equivalent but the tonnes at Esso boost this average grade to 2.58% copper-equivalent.

The total measured and indicated resources in all three zones stands at just under 18.6 million tonnes at 1.78% copper and 2.58% zinc (we are ignoring the gold and silver for the time being as the agreement with Wheaton Precious Metals (WPM, WPM.TO) whereby Wheaton will purchase the precious metals as per the existing streaming arrangement won’t have a noticeable impact on the economics). The additional inferred resources on the Kutcho Copper project are now estimated at 13.2 million tonnes at 1.11% copper and 1.6% zinc.

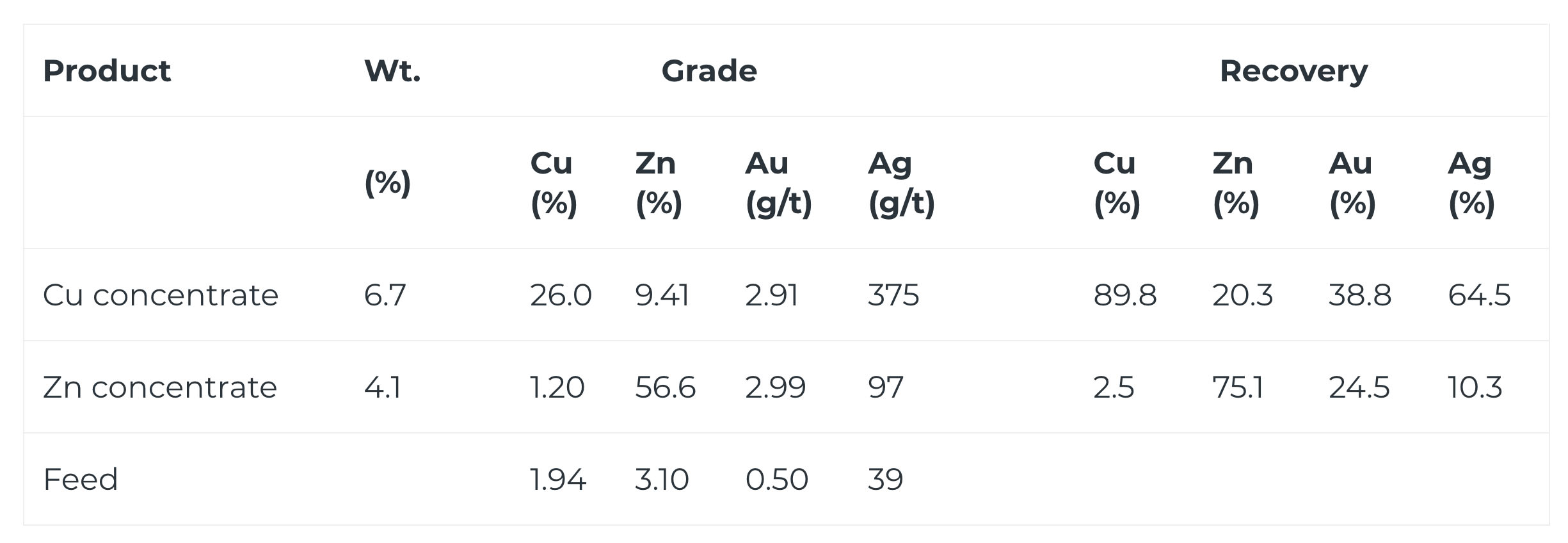

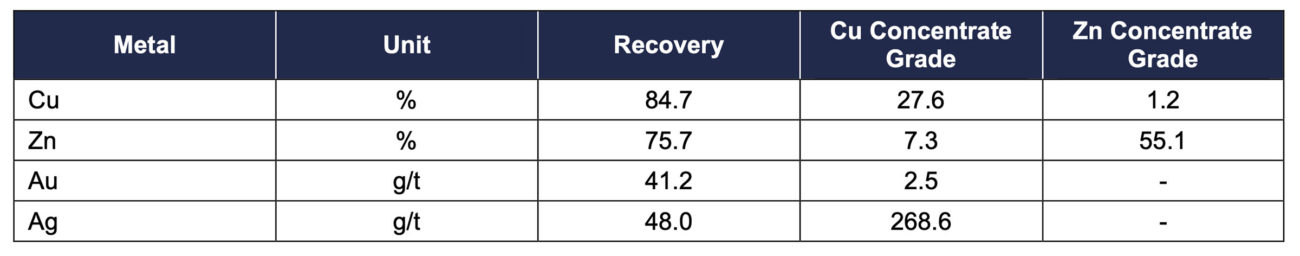

The resource estimate is just one element of what makes the Kutcho project a good project. In the summer of 2020, Kutcho Copper released the results of an updated metallurgical test program which confirmed improved recoveries versus the historical test work that was used to determine the economics in the 2017 pre-feasibility study.

The main lens boasts recovery results of 87.4% copper, 63.8% for the zinc, 36.9% for gold and 59% for silver while the smaller Esso lens enjoys much higher recovery rates of 94.5% for copper, 89.3% for zinc, 49.8% for gold and just over 71% for the silver. Additionally, leaching the tailings stream from both zones will result in an additional amount of metals being recovered (with the recovery rates of the main lens tailings stream being higher than the Esso lens as the latter already enjoys higher recovery rates in the ‘normal’ production process).

This means that on an average weighted basis (75% of the rock in the mine plan will be sourced from the main lens and 25% will be mined from the Esso lens), the total recovery rates( in the primary stage as well as the additional recoveries from leaching the tailings) are estimated to be around 96.4% for copper, 75% for zinc, 70% for gold and almost 83% for silver. The image above does not include the anticipated recoveries from the tailings but is still substantially higher than the recovery rates used in the pre-feasibility study in 2017 (see below).

Catching up with Vince Sorace, CEO

You recently announced an updated resource estimate which now contains in excess of 18.5 million tonnes in the measured and indicated resource categories and an additional 13.2 million tonnes in the inferred category, and that’s a massive increase. Could you elaborate on how you were able to increase the resource estimate by this much?

The Increase in resources since we acquired this asset was accomplished through a number of efforts, primarily the resource expansion drilling we completed in 2018, and most recently the metallurgical program we concluded in 2020, with the increased recoveries.

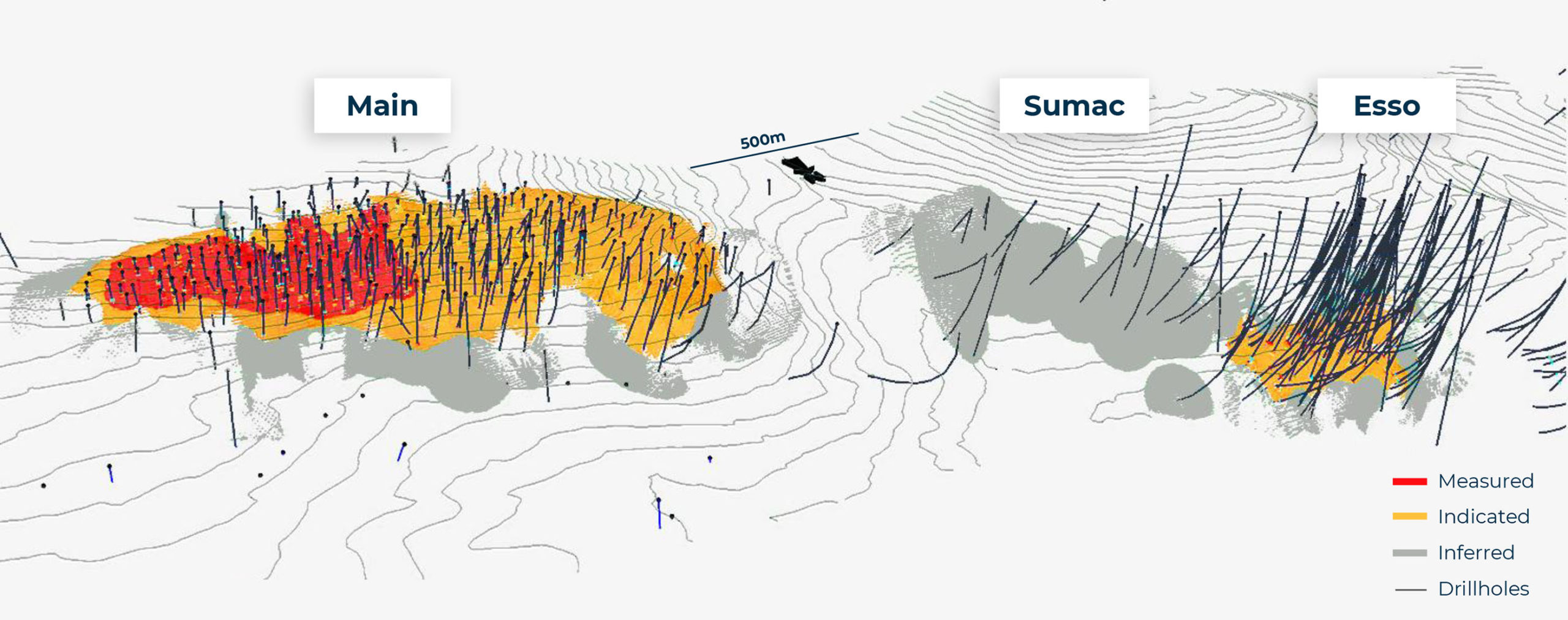

Do you see any more additional exploration upside you’d like to chase (perhaps once you are in production and have the cash flow to do so)?

We believe the Kutcho project has tremendous exploration upside potential, in two categories. Brownfields exploration potential still exists along strike, between and below the current deposits (lenses). In addition, The project yields district-scale green fields exploration potential. We have a very large land package covering all the prospective geology to potentially find additional mineralization similar to the current deposits. Much of the known target areas have not seen any follow-up exploration since the 1990’s, and it is well understood within the industry that VMS districts tend to yield more over time than was originally discovered.

Your feasibility study remains on track to be published in June. In your 2017 pre-feasibility study, only about 11 million tonnes of the previous resource was included in the mine plan. Would it be reasonable to assume the amount of tonnes to be included in the feasibility study will increase as well?

Although we cannot comment on interim results throughout the Feasibility study’s progress, It could be natural to assume that with increased resources comes the potential for increased reserves.

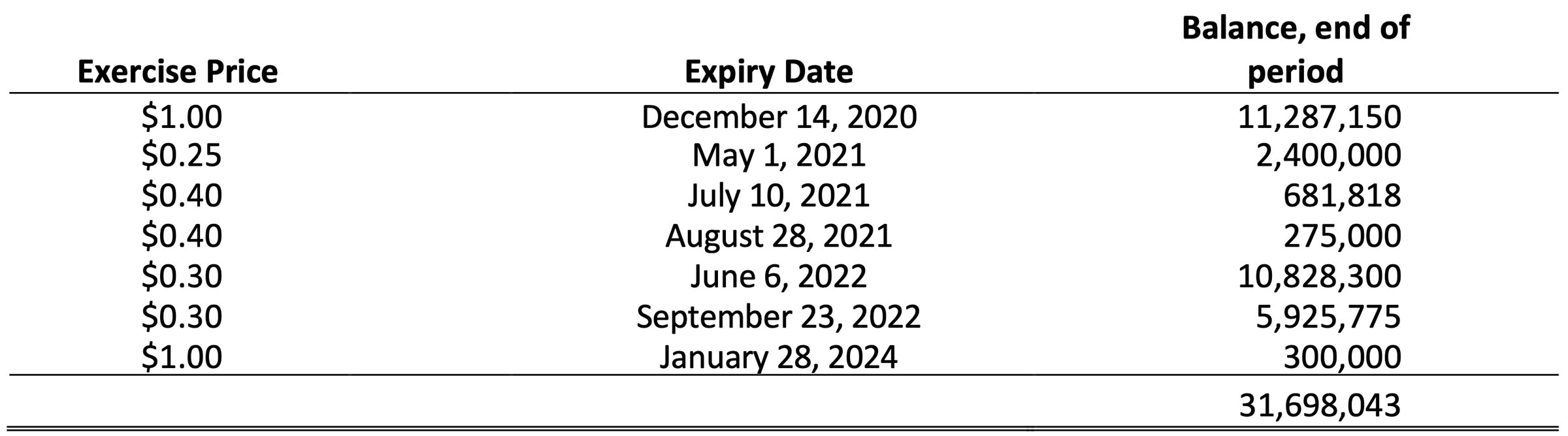

You raised C$2.2M in September and this should get you through the completion of the feasibility study. You will likely also continue to receive cash from warrant exercises with 2.4M warrants at C$0.25 expiring in May followed by almost 1M warrants with a strike price of C$0.40 expiring in July and August that now also are in the money which could result in about C$1M in proceeds from warrants that are expiring. And of course, there’s the almost 17 million warrants with a strike price of C$0.30 which will likely continuously be exercised over the next 18 months. May we assume the warrant exercises are a welcome addition to keep your treasury filled and remain on track?

Yes, we are seeing some warrants get exercised, which is welcome capital as it limits the amount of further dilution required from future financings.

With your share price trading at C$0.60, a good resource update in your hand, a feasibility study nearing completion, and more importantly, having the ‘metal du jour’, copper, has it become easier to raise cash compared to, say, half a year ago?

Instrumentally different. Market sentiment in the Copper markets have changed dramatically, obviously with the rise in the price of the metal, but also its future prospects for sustained price appreciation. We have seen a significant level of interest in financing and strategic opportunities.

And Vince, we obviously have to discuss the elephant in the room, the in excess of C$25M in debt on the balance sheet related to the Wheaton Precious Metals loan which helped you to fund the acquisition of the Kutcho copper project in 2017. Wheaton seems to be a good partner (as it obviously wants to get its hands on the gold and Silver from the Kutcho project) as it agreed last year to defer the semi-annual interest payments and extended the maturity date of the credit facility to the end of this year. May shareholders expect a solution for the Wheaton debt this year?

This is one of my top priorities… stay tuned!

Conclusion

The 2017 pre-feasibility study on the Kutcho Copper project is now quite outdated and investors should be looking forward to the publication of a feasibility study which should be out in June this year. The updated feasibility study will likely include a higher amount of tonnes in the mine plan while the higher metal prices and higher recovery rates for both the zinc and the copper will likely boost the economics.

While the company obviously cannot provide selective updates and we, just like everyone else, will have to wait to see the outcome of the feasibility study, this could be a rare case where the economics of a project are improving in the FS compared to the PFS (even at a similar base case copper price). The jury’s still out but after the recent resource updates and the 2020 metallurgical test work, we are looking forward to the feasibility study and the economics of the Kutcho copper project at a $3 copper price.

Disclosure: The author has a long position in Kutcho Copper but has recently sold shares to exercise warrants. Kutcho currently is not a sponsor of the website but has been a sponsor within the past 12 months. Please read our terms & conditions.