Loncor Gold (LN.TO, LONCF) now controls 3.97M ounces of high-grade gold within 220 kilometers of Africa’s largest and Barrick’s most profitable gold mine, the Kibali mine. Kibali (managed in a 50/50 JV by Barrick with a government entity owning a 10% carried interest) has operated uninterrupted for 10 years in the DRC. While Kibali’s resource is significantly larger than Loncor’s Adumbi resource, the exceptional mined grade of Kibali is similar to what Loncor expects at Adumbi. Kibali’s all-in costs (AISC) last quarter were a phenomenal US$819/oz while its guidance for this year anticipates a production of 750,000 ounces of gold at an AISC of $1000/oz, confirming its position as a low-cost gold mine, even in an inflationary environment that pushes up the production costs.

Loncor has been around for 13 years, but after growing the resource aggressively during COVID (at a discovery cost of just US$6 per additional ounce), it has been pretty dormant for the past two years as it was trying to get through a difficult gold market marked by a complete apathy by investors. Loncor announced a positive PEA in December 2021. After the announcement, it conducted strategic discussions with interested potential strategic partners, but under the prevailing depressed market, no appropriate offers came forward.

However, with news flow and finance drying up, Loncor decided to sell the secondary Makapela project for C$13.5M in cash, the transaction being announced in December 2023. That was an important inflection point. Loncor had ended Q3 2023 with a working capital deficit so realistically, no additional work could be done on any of the projects unless fresh cash was raised. And cash wasn’t easy to come by, especially not for African projects. Selling the Makapela project for C$13.5M was a good move as it allowed the company to fill up its treasury and design a new drill program on the PEA-stage Adumbi gold project where the 2024 drill program is specifically aimed at adding approximately 9 million tonnes of higher-grade rock below the existing proposed Adumbi pit shell. Through the drill program the company believes Adumbi should pass the critical 5M oz resource hurdle that pushes it towards the “Tier 1” project classification.

With the sale of the Makapela project now almost completed (the title transfer should be completed in the next few weeks), Loncor Gold will become active again and we hope this year’s 11,000 meter drill program will result in an updated resource calculation, leading onto the potential of an updated PEA, incorporating the likely underground ounces into the project in a way that will undoubtedly again highlight the high-margin nature of the emerging world-class asset, and the likely swift payback and high IRRs .

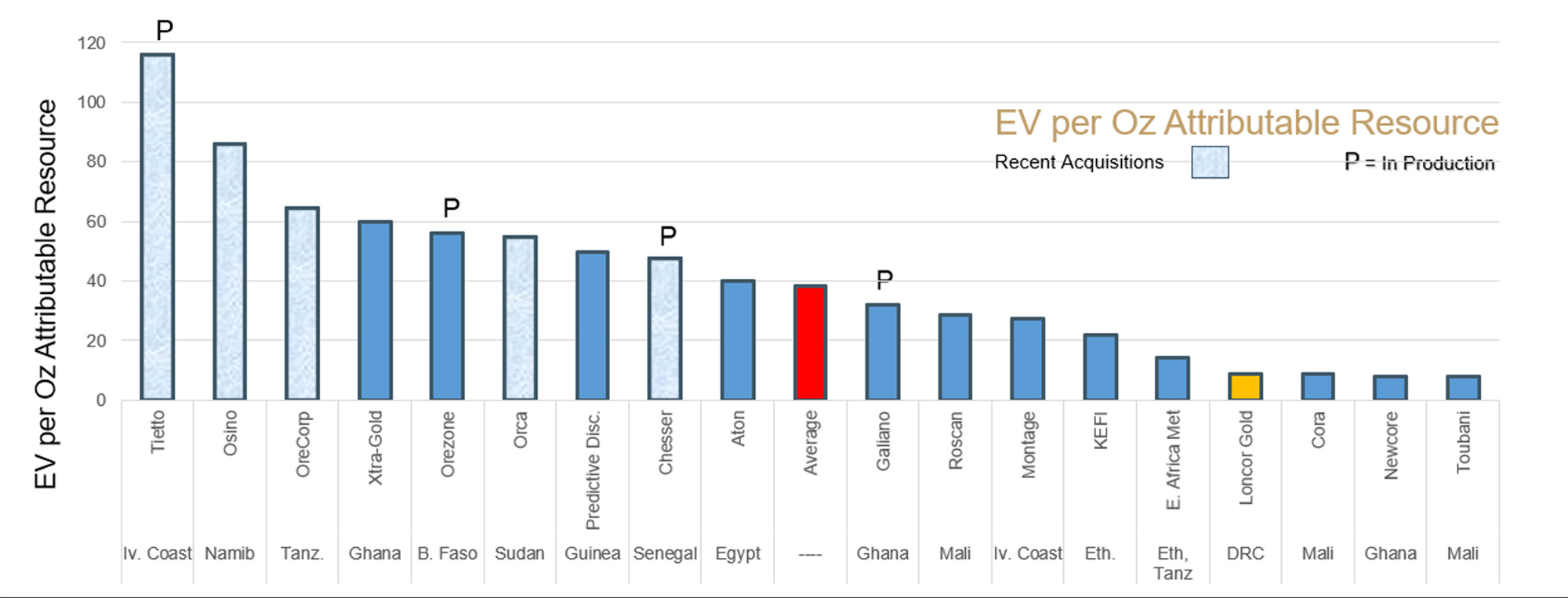

Loncor has now grown one of the largest, highest-grade deposits in its peer group but the story remains relatively unknown. Based on numerous valuation metrics, Loncor’s current valuation reflects none of the fundamental or strategic premium valuations that other players have received.

They have already obtained the necessary permit to mine, (unlike most other explorers) and as a result the DRC government has its direct 10% free carried interest in the Adumbi project while Loncor currently has an effective stake of 84.68% in Adumbi. Again, having a mining permit in hand is not the case for many other early-stage comparables.

In this report, we will look at the flagship asset, the upcoming drill program and the expectations for this round of drilling, and the improving situation in the DRC. We also touch on why this unknown story appears undervalued on numerous metrics and while we will spend some time going over the details of the economics of the project, the company likely isn’t going to build the mine themselves; it just wants to reach the optimal point where a larger company can acquire the asset and actually build the mine. Two key shareholders, the Executive Chairman (Arnold Kondrat) and Resolute Mining (RSX.AX) hold close to 40%, a large voting block that should be positive should strategic negotiations start in earnest. On top of that, Newmont (NEM.TO, NEM) also owns a stake of close to 5%.

The final element of interest to onlookers is the company’s valuation, and it appears that investors have yet to see the upside of the story. Loncor trades at an attributable Enterprise Value per ounce resource of around US$10/oz with an obvious comparable like Predictive Discovery (PDI.AX) in Guinea trading at 5 times that valuation, without yet giving away 15% to the government. Furthermore, the valuations associated with numerous African corporate takeouts over the last 18 months also suggest Loncor is undervalued, with corporate takeouts occurring in the US$50 toUS$85/oz resource range. Add in Adumbi’s US$1B after-tax NPV at US$1840/oz versus Loncor’s current market capitalization of around US$40M, and the potential for further upside in this story appears evident. Still no mainline brokers have picked up this story, with valuations potentially seeing benefit if that happens.

A background to the project

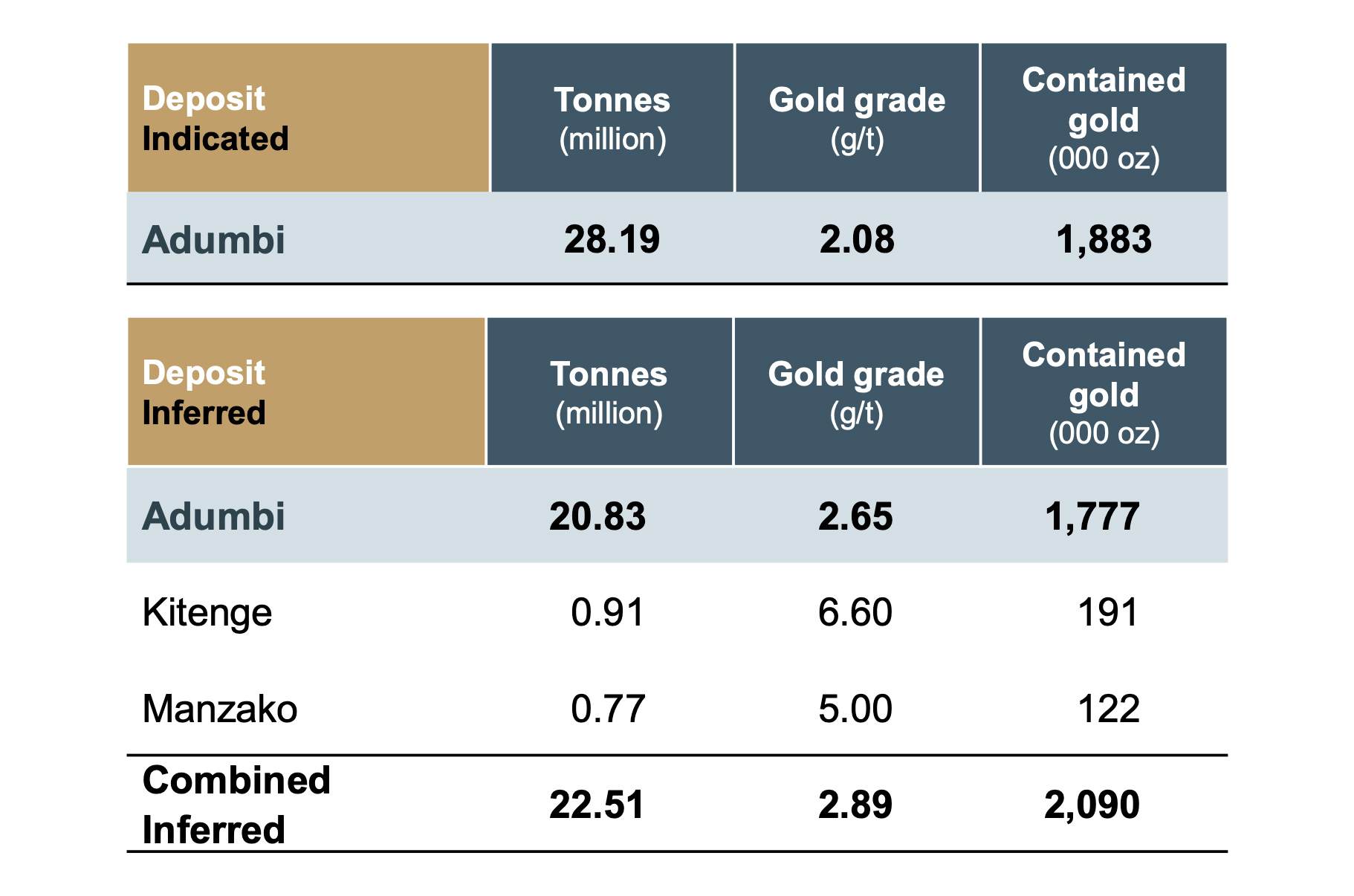

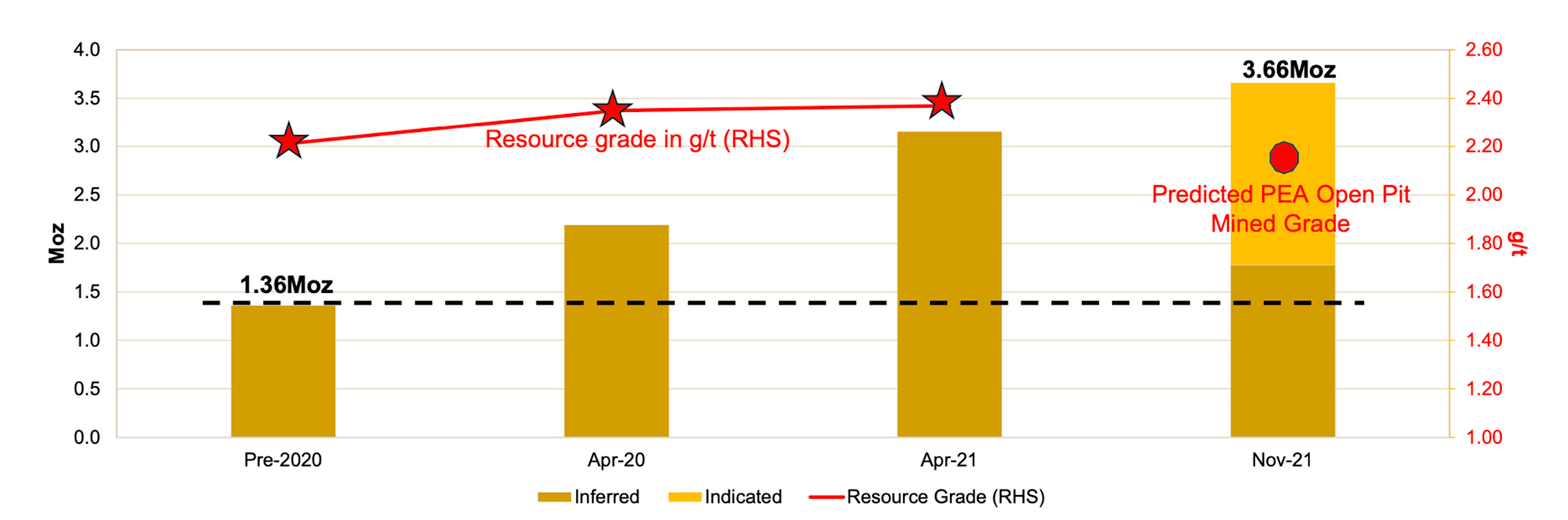

Loncor’s technical team (with Peter Cowley as the most experienced ‘boots on the ground’ while Cowley and Chairman Kondrat were involved with Banro from the beginning) has been active in the DRC for almost three decades now, which means most of the members know the country (or at least the eastern part of the DRC) inside out. Peter Cowley has discovered in excess of 30 million ounces of gold in similar gold-bearing terrain to the Adumbi ground. Loncor is not a ‘new company’ chasing the next ‘shiny thing’. It has a history and a reputation in the country. It built out its flagship asset from 1.36M ounces in 2020 to 1.88 million ounces of gold in the indicated resource category and an additional 1.78 million ounces in the inferred resource category by 2022. The growth should hopefully continue as this year’s drill program is targeting low hanging fruit below the current resource at Adumbi. On top of that, two smaller areas (Kitenge and Manzako) host an additional 213,000 ounces of gold in the inferred resource category.

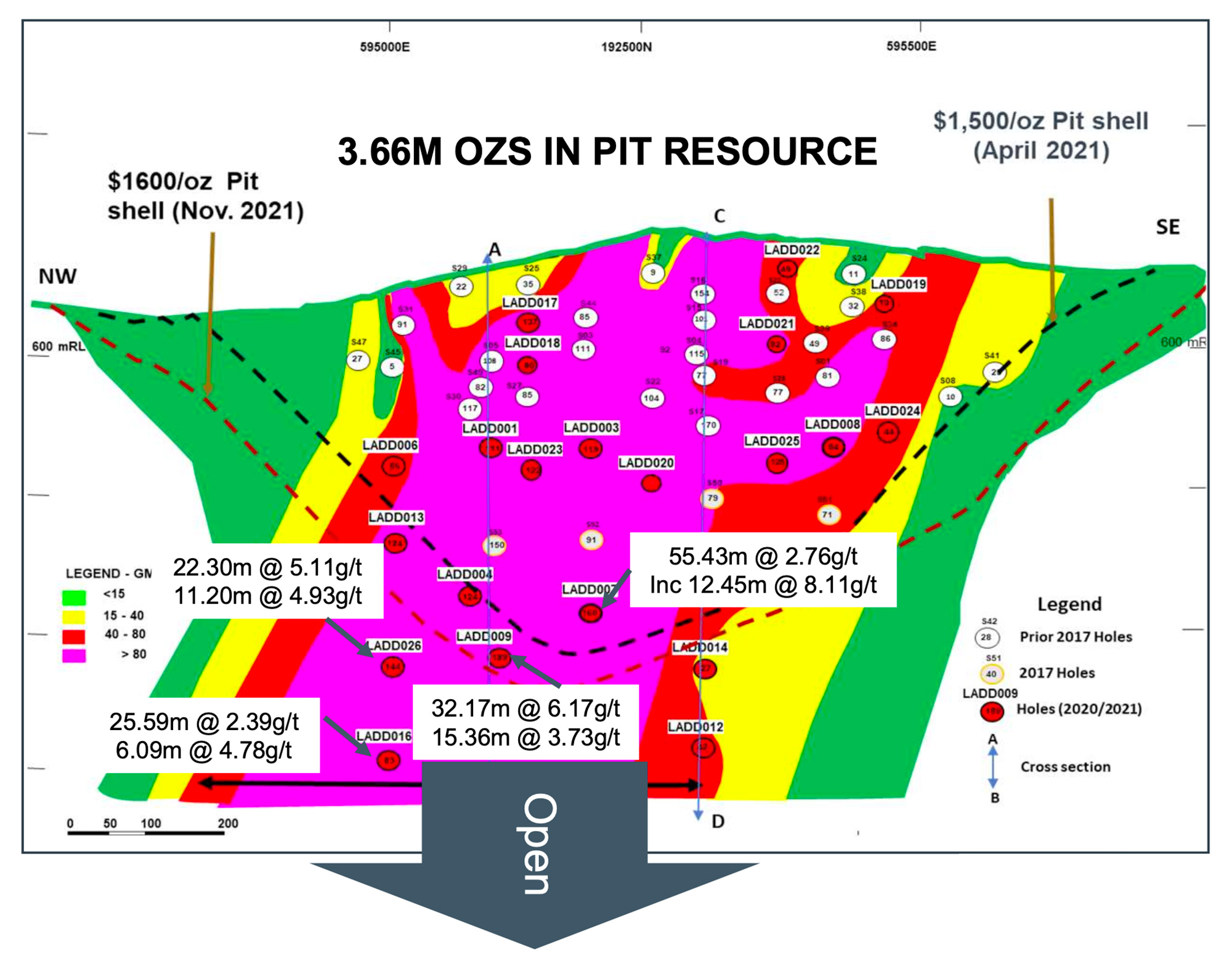

We will mainly focus on the Adumbi resource, as that’s where the company’s independent consultants have completed a Preliminary Economic Assessment on. As you can see below, the project’s resource was almost tripled in just eighteen months.

That tells you a lot about the drill efficiency of Loncor Gold. The resource increase from 1.36 million ounces to 3.66 million ounces happened at a total discovery cost of just US$6/ounce. We were even more impressed with the resource update in November 2021. Not only was the company able to post another 20% global resource increase, it was also immediately able to already report a very substantial portion of the resource in the indicated resource category. Management touted a 95% conversion rate from inferred to indicated in that last drill program, and that is definitely impressive. With some of the highest likely predicted mine grades for an open pit in West and East Africa, these are high-quality ounces. And as the 2021 PEA has shown, these are high-margin ounces that should add tremendous value to the project.

The most recent resource update in November 2021 was used for the December 2021 Preliminary Economic Assessment.

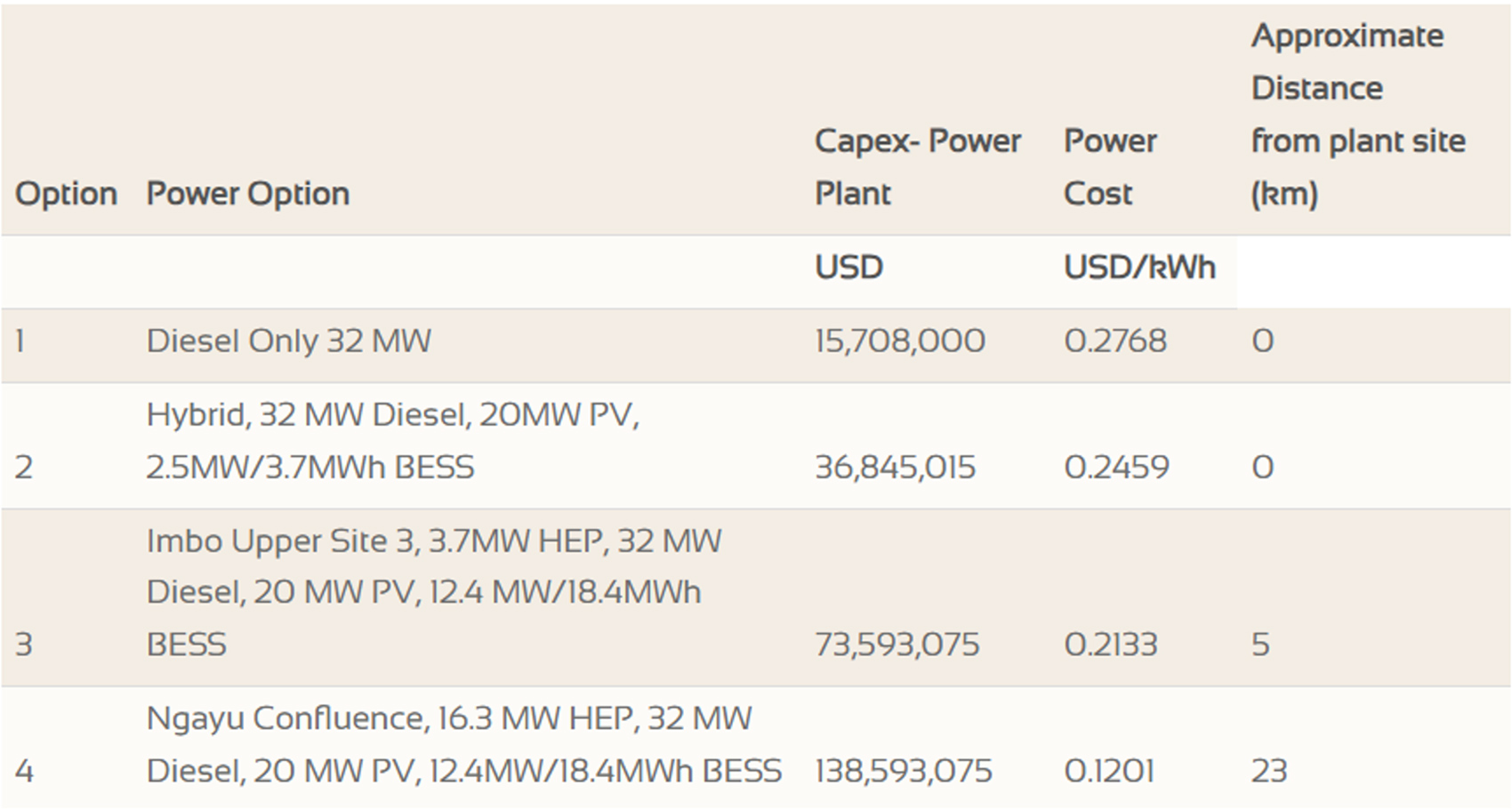

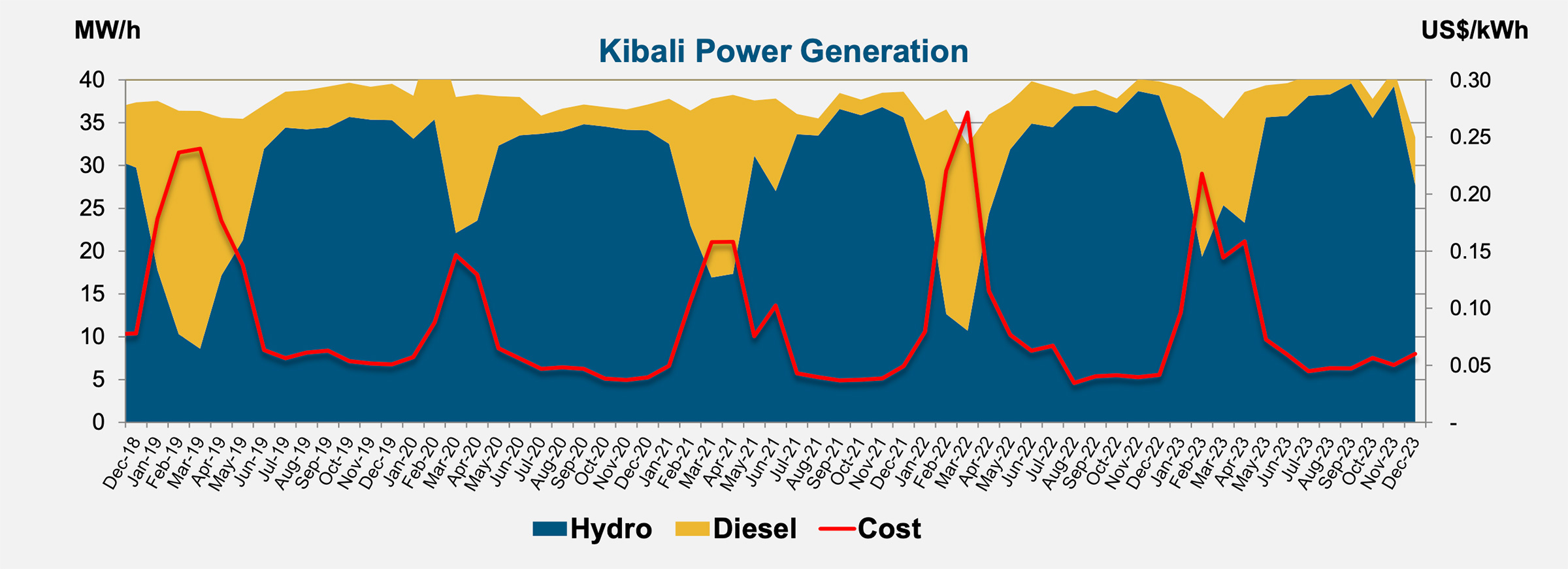

That PEA had two potential scenarios: there’s a ‘diesel-only’ scenario where the entire plant would be powered by diesel generators but there also is a hydroelectric power hybrid scenario (here after the ‘HEP’ case). The company disclosed the economics based on both scenarios and as you can see below, it is pretty obvious the hybrid power case results in a lower production cost and AISC (which is logical as hydropower is cheaper than diesel-generated power) but the flipside is the higher initial capex which was estimated at $530M in the HEP scenario versus $392M in the diesel-only scenario. Adumbi’s closest important neighbour, the Barrick-operated Kibali mine operates hydro schemes which is another major contributor to their record low unit costs. In reality, the construction of Adumbi’s hydro schemes will likely be conducted by an appointed third party who specialises in the construction and operation of such facilities. Adumbi will then purchase the power at a slight premium from the operator – the net effect being a reduction in the overall capex which could have a positive impact on both the NPV and the IRR of the project.

The higher initial capex also makes a lot of sense as the capital requirements to build the other power infrastructure elements are higher than just buying ‘off the shelf’ diesel generators. However, in the base case scenario which used a $1600 base case gold price, the HEP scenario ‘won’ in terms of NPV (the after-tax NPV5% came in 4% higher than in the diesel-only scenario) but the IRR of the diesel-only scenario was higher due to the lower upfront capex. In the hybrid power case, the company uses 16.3 MW hydroelectric power, 32 MW in backup diesel generators, and 20 MW in photovoltaic power generation. This was estimated to cost US$139M in 2021 but as you can see below, this scenario is expected to cut the average cost per kWh by almost 57% to $0.12/kWh.

Choosing is losing. In Loncor’s case, the longer the mine life and the more gold produced, the more the hydroelectric power scenario makes sense, as the higher upfront capex can be amortized over a higher amount of ounces. As the all-in sustaining cost is lower, every additional ounce beyond the 3.12 million payable ounces of gold in the PEA would add more value than in the diesel-only scenario.

Both scenarios have their merits, and hopefully, the next round of drilling (and subsequent resource update) will boost the results of an updated economic study.

While it is great to have ‘hard numbers’ from the PEA, let’s not forget all economic inputs were based on 2021 numbers and we have seen a tremendous amount of inflation in 2022 and 2023 so we will likely see inflation having an impact on the capex as well. The operating expenses will also increase but we expect that increase to be less outspoken than the capex increase. We discussed this element with Loncor’s management and they indicated the numbers used in the PEA were already based on forward-looking quotes and likely already capture a substantial portion of the inflation we saw in 2022. As such, Loncor’s capex increase may remain limited to 25-30% (or perhaps even less) rather than the 40-50% we were anticipating and that would be excellent news for the economics.

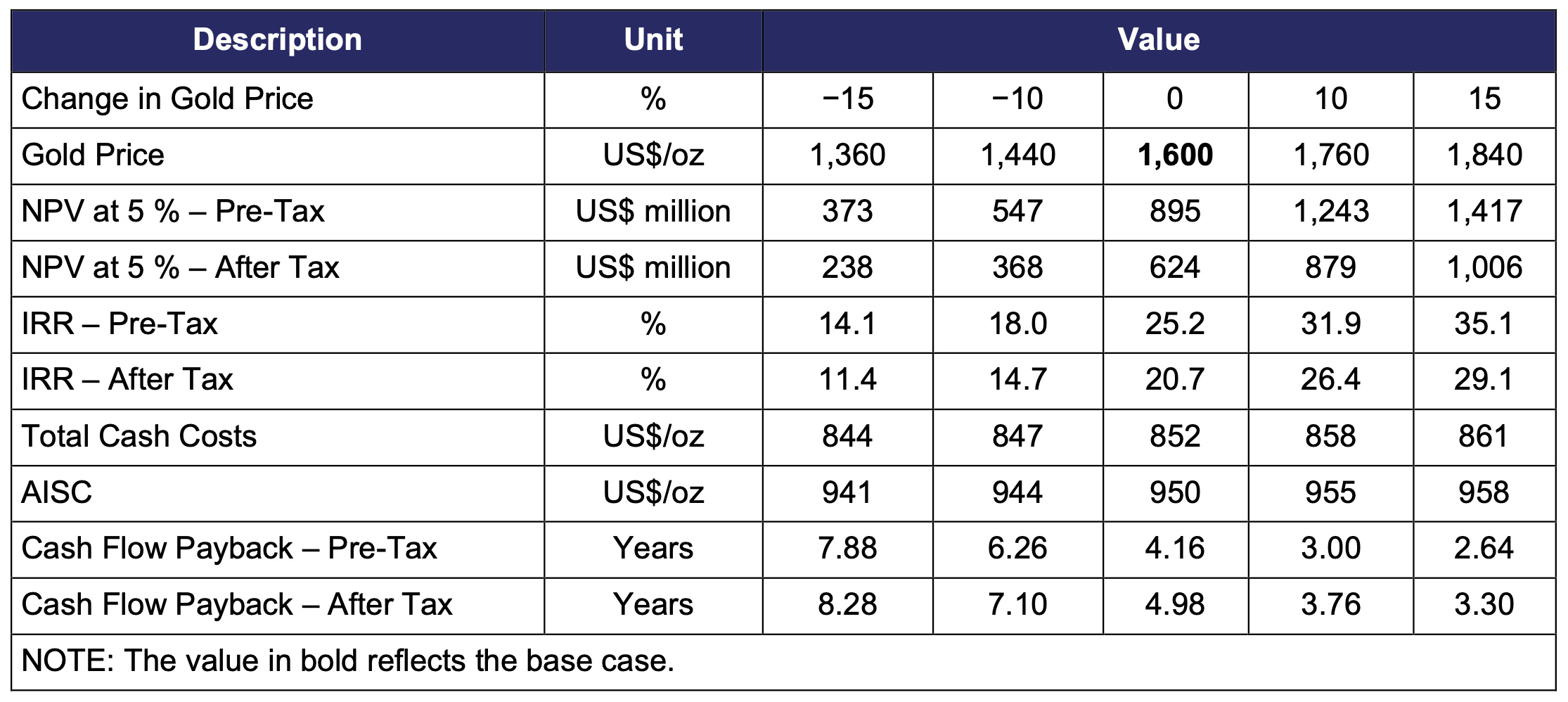

Given the quality of the grade and cheap hydropower alternatives, Loncor believes Adumbi will be a relatively low-cost operator like Kibali. As such, it is not unduly impacted by movements in capex and operating costs. Fortunately, the company has also provided a sensitivity analysis in its 2021 PEA, which allows us to better understand how cash flows are impacted by a higher (or lower) gold price.

The economics will hold up well in the current gold price environment

Given the company’s optimism to add ounces at depth (we will discuss Loncor’s exploration target later in this article), we expect the hydroelectric power scenario to be the most likely way to power the mine. As mentioned before, the longer the mine life the more sense it makes to deal with the higher up-font cost as the benefits over an extended period of time outweigh the higher initial capex.

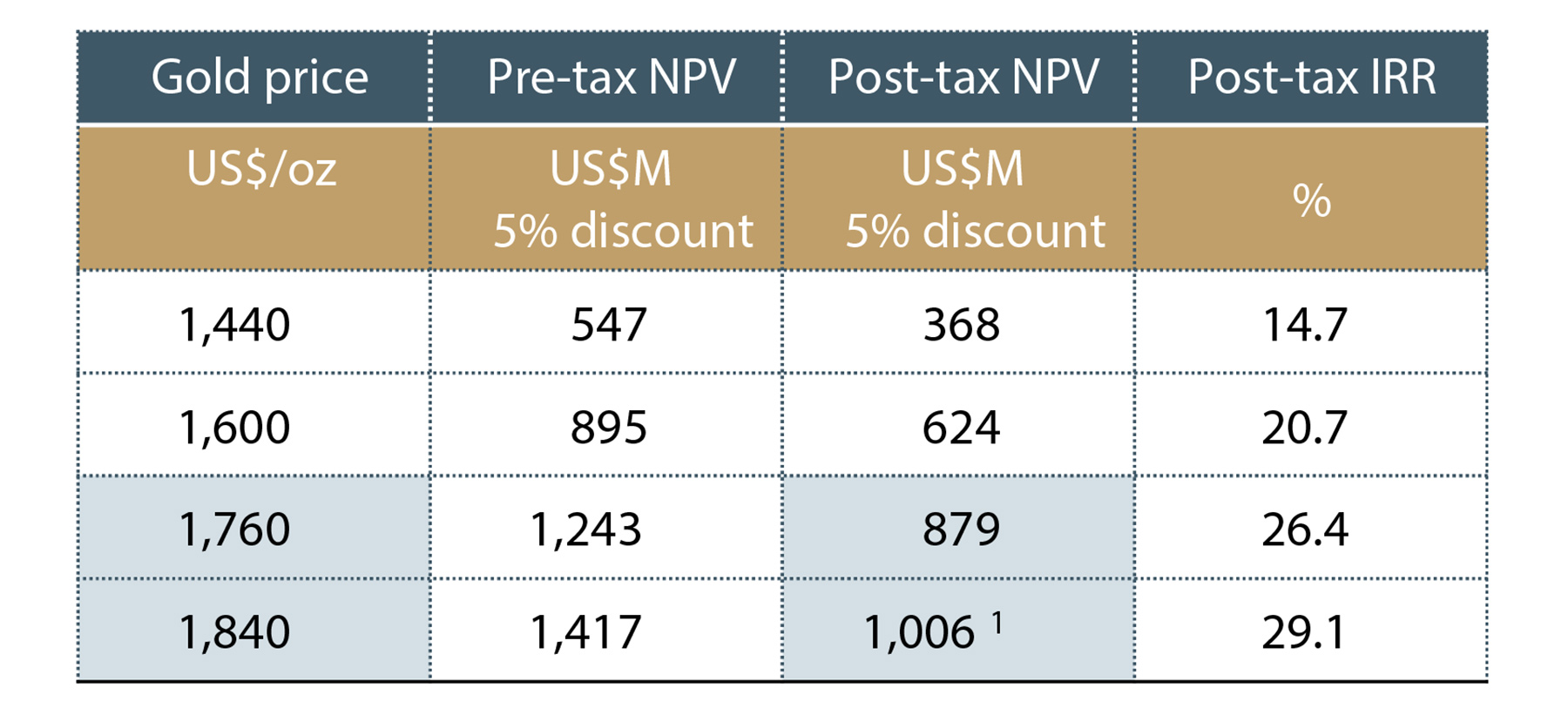

The 2021 PEA includes a sensitivity analysis showing the IRR and NPV of the project at the $1600/oz base case gold price scenario, a 10% increase and a 15% increase. The table below maxes out at a gold price of $1840/oz and in that scenario the after-tax NPV5% is estimated at US$1B.

This indeed means that a gold price increase of $240/oz adds about $400M to the net present value. And even if we would take a 30% capex increase into account, the benefits from the higher gold price will still outweigh the impact of the higher upfront capex. At $2000 gold, for instance, the after-tax NPV5% would come in at about US$1.2B at an unchanged capex. If we included a $150M capex increase (still using the hydropower scenario), the after-tax NPV5% would still come in close to $1B at a gold price of $2000/oz. And with a spot gold price at around $2,400/oz, there’s even more upside potential as this represents a 50% higher gold price compared to the base case used in the PEA.

That’s the theory. There still are a lot of moving parts. The company will soon start drilling the zone directly under the open pit and the potential resource addition there would come on top of the base case scenario. If successful, that could result in a mine life extension with a higher amount of produced ounces and thus a lower capital intensity (expressed as capex per produced ounce).

Secondly, the initial PEA also allows the team at Loncor to finetune certain other elements based on the findings in the 2021 study. The pit design could be updated and perhaps a smaller pit with a lower strip ratio followed by an underground mining scenario (subject to a successful 2024 drill program) or the mill feed could be sequenced differently.

Third, the 2021 PEA used a plant with a throughput of 5 million tonnes per year. Depending on the outcome of this year’s drill program, the company could look into the economics of a smaller mill. A good example would perhaps be Tietto Minerals in Cote D’Ivoire which recently commissioned a 4Mtpa mill but has been able to exceed nameplate capacity by 10-12% on a pretty consistent basis.

Fourth, the hydroelectric power scenario assumes Loncor (or anyone who buys Loncor) would build all power-related infrastructure. As mentioned earlier, the odds are a third party could be attracted to construct and operate the power supply. In that case a chunk of the sunk cost would be removed from the initial capex and this would translate into a higher operating cost as the power would be sold at a mark-up so the third party owner/operator can recoup its investment and make a profit.

These are just ‘possibilities’ to optimize the economics of the project even further and readers are warned that the 2021 PEA is the only official study that has been published. The aforementioned potential improvements are just ‘musings’; almost every improvement possibility is a trade-off and we hope to see some of these possibilities being discussed in an updated PEA (hopefully in 2025).

For now, the main focus will be on the very first element we highlighted, as the company will soon start drilling right under the open pit in an attempt to drill-test its exploration target.

The resource remains open at depth, with 5M ozs of resource being targeted via the upcoming drilling

In December last year, Loncor Gold provided an interesting update on the exploration target for the Adumbi project as it provided an estimate to the potential resource addition below the current pit shell.

According to Loncor’s technical team, the priority exploration target right below the Adumbi pit is estimated at 8.9 to 9.6 million tonnes of rock at an average grade of 4.7-4.9 g/t gold. The pit shell, as designed in the PEA, reached a maximum depth of 550 meters, and the exploration target, which implies a total gold content of 1.35 million ounces to 1.5 million ounces, solely focuses on the first 250 meters below the pit shell.

While that exploration target obviously is just conceptual in nature at this point, it appears to be low-hanging fruit Loncor is more than willing to pursue. As the pit shell already reaches a depth of 550 meters it is unlikely the open pit will be expanded to include potential resources right below the pit shell. Despite 4.7-4.9 g/t being a very ‘forgiving’ grade, the strip ratio would likely be too high to make it worthwhile. On the other hand, it would make sense to pursue an underground mine scenario that starts from the bottom of the pit. At 4.7 g/t and assuming a recovery rate of 88%, the net recoverable rock value would be approximately US$265/t using $2000 gold in this scenario (and the drill bit will obviously has to confirm the anticipated grades). This aligns with what Kibali is currently mining underground at the neighbouring mine.

Of course, everything we mentioned above is just a concept, a theory. Loncor’s technical team ‘thinks’ it’s there, but it will be up to the drill bit to effectively drill-test the theory and add the underground ounces to the consolidated resource calculation.

And that’s exactly what the company will do this year. It has issued tenders for a total of 11,000 meters of drilling, with all of the holes directed to the zone immediately below the bottom of the pit. As Loncor has a very specific target in mind, it should be able to pinpoint the desired area pretty easily and the company aims to drill nine ‘main’ drill holes and six deflections/wedges for a more cost-efficient drill program.

This drill program is planned to begin imminently, so we can likely expect to see assay results during the summer and perhaps as early as late July. While the economics shown in the 2021 PEA indicate the project has reached critical mass, the assay results from the 2024 drill program will be important to unveil the additional potential at Adumbi. Adding the additional ounces should make the company stand out even further on an EV/Ounces basis, as shown below.

The DRC – an improving jurisdiction

With the exception of a few countries, being active in Africa has always been seen as a riskier proposition. However, you see a clear tendency in Africa as countries that had a good track record and reputation are going downhill fast (think Mali, Burkina Faso, Tanzania in some cases) while other countries are actually gaining traction. This is not unique to Africa, we for instance see the same pendulum-like movements in South America where for instance Ecuador has been working hard to restore (or create) a reputation as a mining jurisdiction.

While there still is a lot to be said about the DRC on the level of corruption (it scores a 162nd place out of 180 observed countries on the Corruption Perception Index), we do have the impression the situation is improving fast for larger companies in the mining industry while – unfortunately – we understand the daily life for the Congolese still is a struggle. About 10-15 years ago the government-controlled vehicle Gécamines was meddling into the affairs of copper producers and this has caused several entities to leave the area and/or sell out. And while the gold sector does not fall under the Gécamines mandate (and never was a part of it), it also had to deal with the negative perception surrounding the DRC.

That has changed. Ivanhoe Mines opened a massive and high-grade copper mine (and has not run into any issues doing so) while in the gold space the Barrick Gold (ABX.TO, GOLD) owned Kibali mine remains one of the company’s cornerstone assets. Ivanhoe is now re-developing the world’s highest grade zinc deposit in the DRC, a further vote of confidence.

The DRC held elections last year, and the incumbent president was elected for another term. While the organization of the presidential elections is not up to the same standards as in Western Europe or North America, the result means one important thing: stability. The losing candidate did not start a fuss and did not ask his followers to take up arms, and that’s encouraging for the nation as a whole.

The DRC updated its mining code in 2018 to include a higher government cut on the mining and production of strategic minerals which has no impact on the gold mining sector. The updated mining code is however worth mentioning as the DRC government is resorting to actually updating the legal framework for the sector rather than pursuing some sort of ‘at will’ semi-expropriation.

As Loncor’s exit strategy is to sell the asset rather than building the mine themselves, having an increasingly reliable legal framework will make a potential acquirer more at ease. Some companies would likely never invest in the DRC (think Agnico Eagle Mines) but companies like Barrick Gold with an active presence there, or an Endeavour Mining (which is mainly active in the sub-Saharan space where the uncertainty is increasing) will have a better understanding of local and regional politics. Barrick Gold also owns 45% of the large Kibali gold mine in a joint venture with AngloGold Ashanti (also 45%) and SOKIMO (10%). The mine will produce approximately 750,000 ounces of gold this year (the midpoint of the production guidance provided by Barrick) at an all-in sustaining cost of around $1000/oz.

With a total remaining measured and indicated gold resource of 15 million ounces (including in excess of 10 million ounces in the reserve categories), the Kibali mine is an excellent example of a low-cost and high-grade gold mine in the DRC that hasn’t seen much government interference. At $2400 gold and based on Barrick’s attributable production of 340,000 ounces of gold this year, the mine will generate close to half a billion dollars in economic value to Barrick this year, and in excess of 1 billion dollars to the three joint venture partners. Also useful information: Barrick also uses hydropower and as shown below, the vast majority of its power consumption is actually covered by the cheap hydropower and the diesel generators only have to kick in when hydro isn’t generating enough to cover the mine’s needs.

Barrick (and its partners) continue to invest in Kibali. The company is currently constructing a solar park and battery storage solutions that will allow it to further reduce its use of diesel-generated power. Barrick obviously feels confident enough to continue investing in the DRC, and that’s a nice vote of confidence for the country’s mining sector.

Kibali also is an important contributor to the local economy. Not only does the mine employ close to 3,000 people (including contractors), the indirect job creation likely is a multiple of that number. The area around the Kibali mine has developed into a ‘mining hub’ with easy access to experienced labor (including drill crews) and logistical advantages.

Loncor’s financial situation is now stronger than ever

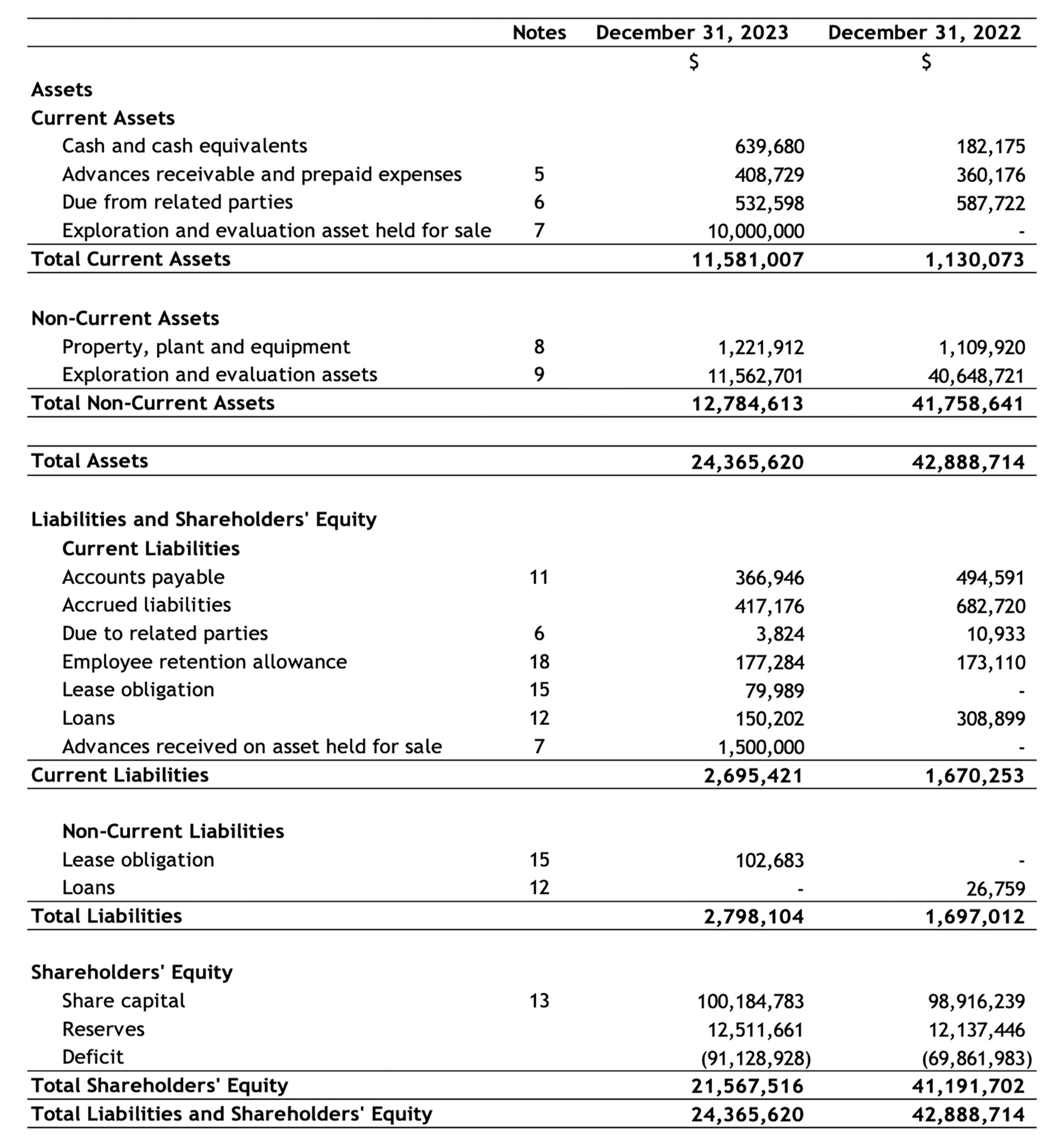

Cash is one of the hardest assets to come by, even at $2300-2400 gold. Fortunately, Loncor Gold will soon have plenty of that as soon as it completes the sale of the Makapela gold project to the Chinese counterparty. The company is awaiting the official transfer of the ownership title to the buyer where after all cash payments will be settled. This is already reflected on the balance sheet. As you can see below, the asset side now shows a US$10M asset held for sale, offset by a US$1.5M liability related to the initial cash receipt.

The initial US$1.5M has already been spent, and the company will receive the final US$8.5M within the next few weeks. That cash will be immediately used to kick off the new drill program in May.

Management & board highlights

John Barker – CEO

Mr Barker has 17 years’ experience as a leading mining analyst, including with RBC DS, where as Managing Director, he headed up their London-based Global Gold Mining initiative, focussing on African mining equities. He was also the Chairman of The Association of UK Mining Analysts. Subsequently, he was Vice President of Corporate Development for TSX-listed SouthernEra Resources, which was taken over by Lonmin, and was instrumental in the Guinor Gold sale to Crew Gold. More recently, he has been involved in various copper, diamond, and platinum initiatives in Southern Africa. During his career, he has been involved in numerous asset sales and equity issues raising over US$600m in Canada, Australia, Europe and RSA.

Peter Cowley – President and Director

Mr. Cowley is a geologist with 40 years of mineral industry experience and a history of major exploration successes in Africa, including the DRC. Among his major accomplishments, Mr. Cowley was Chief Executive Officer and President of Banro Corporation from 2004 to 2008, during which time he led the exploration team that delineated major gold resources along the Twangiza-Namoya belt in the DRC.

Prior to joining Banro, Mr. Cowley was Managing Director of Ashanti Exploration, where he led the exploration team in the discovery and development of the Geita mine in Tanzania. Prior to Ashanti, he was Technical Director of Cluff Resources which discovered and developed mines in Zimbabwe, Ghana and Tanzania. He holds an M.Sc from the Royal School of Mines, an MBA from the Strathclyde Business School and is a Fellow of the Institute of Materials, Minerals and Mining. Mr. Cowley is also a director of Deltic Energy plc.

Arnold Kondrat – Executive Chairman and Director

Mr Kondrat is the Founder, President and CEO of Sterling Portfolio Securities Inc, a private venture capital firm based in Toronto, Canada. He is the founder and Executive Chairman of Loncor Gold with over 30 years’ experience in the public markets, primarily in the resource industry. His 27-year history in the Democratic Republic of the Congo has enabled the Company to secure a number of highly prospective gold assets.

Conclusion

Loncor is unknown and completely undervalued under the current market conditions. At S$1840/oz gold prices, the attributable after-tax value to Loncor of the 5% NPV is close to US$850M (taking the minority ownership into consideration). Loncor’s current market capitalization is closer to US$40M. At prevailing spot prices the discrepancy is even higher. A similar trend is seen when compared to comparables such as Predictive Discovery, which operates in Guinea and has an enterprise value per ounce resource that is 5 times higher than Loncor’s. They have a Preliminary Feasibility Study and reserve but with a lower grade deposit, no mining permit and no government free carry yet (which is likely to be 15% in Guinea). The fact Loncor already has its mining permit is an important yet overlooked intangible asset.

After a few years of hibernation, Loncor Gold is ready to hit the ground running again. The next few milestones that will be announced by the company are the title transfer of the Makapela project to its buyer (which will unlock an additional US$8.5M in cash payments) and kicking off the drill program in May. As Loncor is planning to use two drill rigs and considering lab turnaround times aren’t too bad, we may see some results in July. The company’s technical team appears to be pretty confident in the exploration target it has published and every additional high-grade ounce should add value to the project.

And that’s what Loncor Gold is all about. Optimizing the Adumbi project to make it as appealing as possible for a potential acquirer. And with gold at $2400/oz, Loncor could hopefully be ‘in play’ sooner rather than later.

Disclosure: The author has a long position in Loncor Gold. Loncor Gold will likely become a sponsor of the website. Please read the disclaimer.