In a surprise move, M2 Cobalt (MC.V) announced in January it accepted a no-premium, at market merger proposal from its larger peer Jervois Mining (JRV.AX) to create a large battery-metals (cobalt & nickel) focused company with plenty of cash on hand. In this report, we will briefly review the deal, and provide you with the comments of CEO Simon Clarke on our questions.

The background of the deal

Jervois Mining (ASX:JRV), an Australian company with a market capitalization of just under A$60M, has entered into a definitive agreement to acquire all outstanding shares of M2 Cobalt in an all-share deal ‘at market’. Shareholders of M2 Cobalt will receive one new share of Jervois Mining which will also be trading on the TSX Venture Exchange upon the completion of the merger. Using Jervois’ closing price of A$0.275 and the current C$/A$ exchange rate of 1.05, this implies a valuation of C$0.262 per share of M2 Cobalt, a small premium of less than 5% over the share price before the halt.

While, this is indeed substantially lower than the C$0.50 level M2 Cobalt previously raised money at, it does reflect the recent sell off in the sector and the recent trading range for M2 and there seems to be a bigger picture here. First of all, shareholders of M2 Cobalt will receive stock in Jervois Mining, so we will still be able to participate in the further progress on M2’s assets. Secondly, rather than going through a painful raise at these levels, the merger with Jervois seems to be an elegant solution to solve the funding issues. Jervois has approx. A$9M in cash and liquid securities (approx. $10M pro forma with M2) and a 4.54% stake in eCobalt Solutions (which has a value of approximately C$3.7M) as well as some saleable royalties in Australian gold assets. The Australians have already committed to extend a US$3M line of credit to M2 Cobalt, while the Merger process is in process, so it can continue to build on its exploration activities in Uganda.

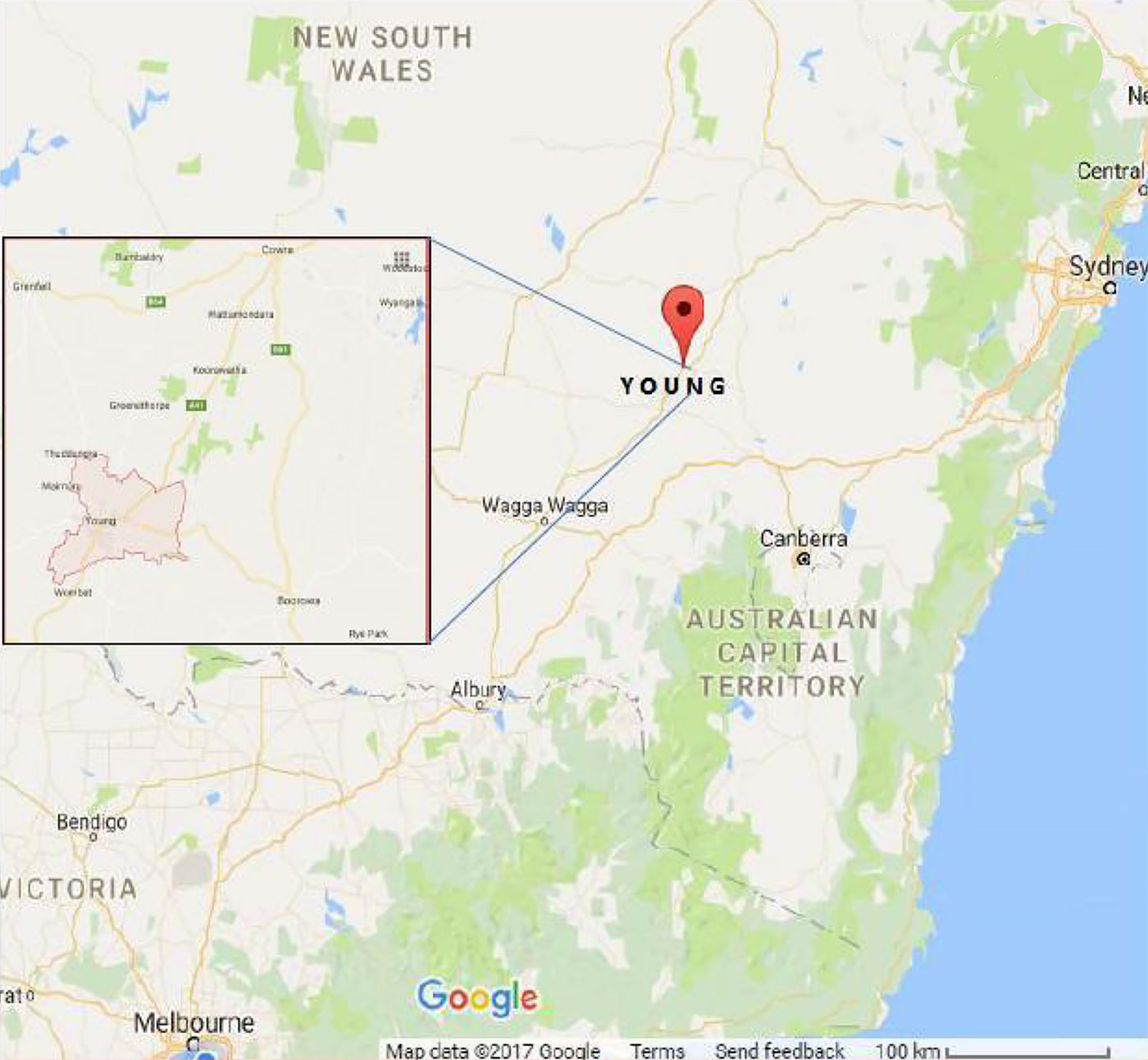

Jervois also owns a large nickel-cobalt asset in Australia. The Nico Young project in New South Wales has an inferred resource estimate (JORC compliant) of almost 168 million tonnes of 0.59% nickel and 0.06% cobalt. A pre-feasibility study will be finalized soon with a 43-101 report also being completed as part of the merger process, focusing on a 3 million tonnes per year heap leach operation. Initial metallurgical test work indicated a recovery rate of 70-75% for the nickel and 80-85% for the cobalt, but acid consumption levels remained high. Solving this issue will be a key focus going forward and Jervois has an ex-Glencore technical team which has run similar operations (Murrin Murrin) in Australia and is confident of doing so.

eCobalt Solutions – Idaho Cobalt Mine

Additionally, Jervois has applied for a prospecting license over the Kabanga Nickel project in Tanzania in May 2018. No decision has been taken yet, but should the license be awarded, Kabanga will be an interesting asset for the combined entity of Jervois and M2 Cobalt as the project has a JORC compliant resource estimate of 57 million tonnes at an average grade of 2.62% nickel, 0.2% cobalt and 0.35% copper. The grade is exceptional, but Tanzania hasn’t been the most stable African mining jurisdiction lately as it’s sorting out tax issues with Acacia Mining (ACA.L). That being said, should Jervois be able to make the Tanzanian project work, it could probably even become the flagship asset with the 3.3 billion pounds of nickel, 440 million pounds of copper and approximately 250 million pounds of cobalt (the combined in-situ value of the deposit is in excess of US$20B using $5 nickel, $2.75 copper and $16 cobalt. As far as we know, there are no economic studies on Kabanga, so the viability of the property will still have to be determined. It certainly would be a strong fit with M2s Uganda assets and creates opportunities to be involved with the potential re-start of the historic Kilembe mine.

Kilembe, Uganda

A brief Q&A session with CEO Simon Clarke

Some shareholders could be disappointed with a no-premium deal, but we think it’s an elegant solution to continue the exploration activities in Uganda without having to dilute the current share structure by having to issue 25M new shares to raise just C$5M (and that is IF there’s that much available for exploration plays these days). How do you explain/defend this merger with Jervois to the M2 shareholders?

“The Transaction brings in a very strong technical team whose depth in development, production, metallurgy etc. complements our strengths in exploration and our unique position of strength in Uganda. This will make the combined group an extremely strong platform not only for some of the large-scale opportunities in East Africa but also globally.

The Merger gives us access to a stronger balance sheet with approximately. C$10M in cash and liquid investments (on a combined basis), with a 4-5% stake in in eCobalt Solutions (ECS.TO) and saleable royalties on top of that. This merger indeed does avoid the need to raise capital now and significantly dilute – as you correctly point out. We can now raise capital at the right time and on the back of a trigger event;

The Nico Young project at 167m tonnes (JORC) – is a large asset in a great jurisdiction and provides good diversity. While nickel laterites are complicated – the Jervois team is recognized to have turned around the Murrin Murrin mine for Glencore (GLEN.L) and will be great operators.

And finally, in these markets greater scale and size definitely makes us stronger especially given the quality of the combined team.”

Nico Young Cobalt-Nickel Project, Australia

An important reason for M2 Cobalt to accept a no-premium deal is obviously gaining access to Jervois Mining’s cash position which will allow you to continue to explore for cobalt mineralization in Uganda. It’s also interesting to see Jervois wiring you US$3M as some sort of bridge loan so you can continue the ongoing exploration programs in Uganda. Could you perhaps provide a brief overview of how the money will be spent? What are the current priorities in Uganda?

“Our current priorities are to build on the 2018 work programs including the initial 2,000 meters of diamond drilling. The results of our 2018 programs will provide the base for our 2019 programs and with an initial US$3M we will be able to continue to build momentum in Uganda with additional drilling as well as advanced geophysics. We will also do some phase 1 work on the licenses we acquired in October. Full details will be announced shortly.

Our goal in 2019 remains to find the next major discovery in Uganda in decades and this transaction and capital it brings enables us to continue on that path and continue to build momentum.”

The termination fee of C$550,000 is relatively low. Was this on purpose?

“There are very few circumstances in which the merger could be terminated, this is also a friendly merger and we already have approx. 40% support out of the gate from management and directors and other significant shareholders making it very likely to proceed. In those circumstances getting our costs back would be the main goal.”

Bujagali, Uganda

After reading the Arrangement Agreement between Jervois and M2 Cobalt, it looks like no ‘golden parachutes’ will be paid to the M2 Cobalt management as the team is sticking together and only those who will effectively be let go will receive a severance package. Is this a correct interpretation?

“Yes – the goal is for the teams to combine and continue on current terms.”

Your drill program was completed a few weeks ago, when can we expect to see the assay results?

“As announced a couple of weeks ago, we currently anticipate being able to announce full details of the assays on the initial drill program around Mid-February – we should be in position to provide detail on our 2019 programs in and around the same time.”

Will the Africa-focused team of M2 Cobalt also play a role in trying to secure the licenses to the very high-grade nickel-cobalt-copper project in Tanzania?

“The initiatives on this have been initially driven by Jervois, but now our team will become fully involved as well and having a quality, well positioned Uganda based team which can support initiatives across East Africa is one of the key drivers for the deal from the Jervois point of view. From our perspective having a deep team technically from exploration to production will position us very well for a number of large-scale opportunities, including Kilembe and Kabanga, that we believe will evolve across this most prolific region.”

Who will be M2 Cobalt’s nominee on the board of Jervois Mining?

“This is yet to be determined. The exact roles / titles will be agreed over next few weeks and this is part of that. But our current senior team will be fully involved going forward.”

Conclusion

A no-premium deal may have come as quite a surprise to the market but teaming up with a cash-rich and asset-rich peer makes more sense than diluting the existing shareholders into oblivion. While we originally expected more from M2 Cobalt as a standalone deal, the reality of the lower cobalt price and weakness in junior markets has caught up with M2 Cobalt as well as many others in the sector. Rather than issuing 25 million new shares, a merger with Jervois appears to be a win-win situation. M2 Cobalt gains immediate access to cash while the M2 Cobalt shareholders are now exposed to several properties in different countries. From the Jervois side, the strong technical team with a specific focus on and dedication to the African continent could play a pivotal role in effectively securing all the needed licenses for the high-grade nickel-copper-cobalt project in Tanzania and a potential Kilembe re-start In Uganda.

As mentioned before, we support the merger, and we have entered into a voting agreement for a part of our position in this company. It’s not an ideal situation, but the merger with Jervois very likely is the best deal on the table right now and still provides strong ongoing exposure to M2 and its assets.

Disclosure: M2 Cobalt is a sponsor of this website, we have a long position. Please read the disclaimer