Of all the ‘cobalt hopefuls’ out there, only a handful will effectively see it through an advanced stage exploration phase and only a minority will effectively be producing cobalt anytime soon. We were introduced to M2 Cobalt (MC.V) and sat down with CEO Simon Clarke, CFO Andy Edelmeier and Graydon Harris.

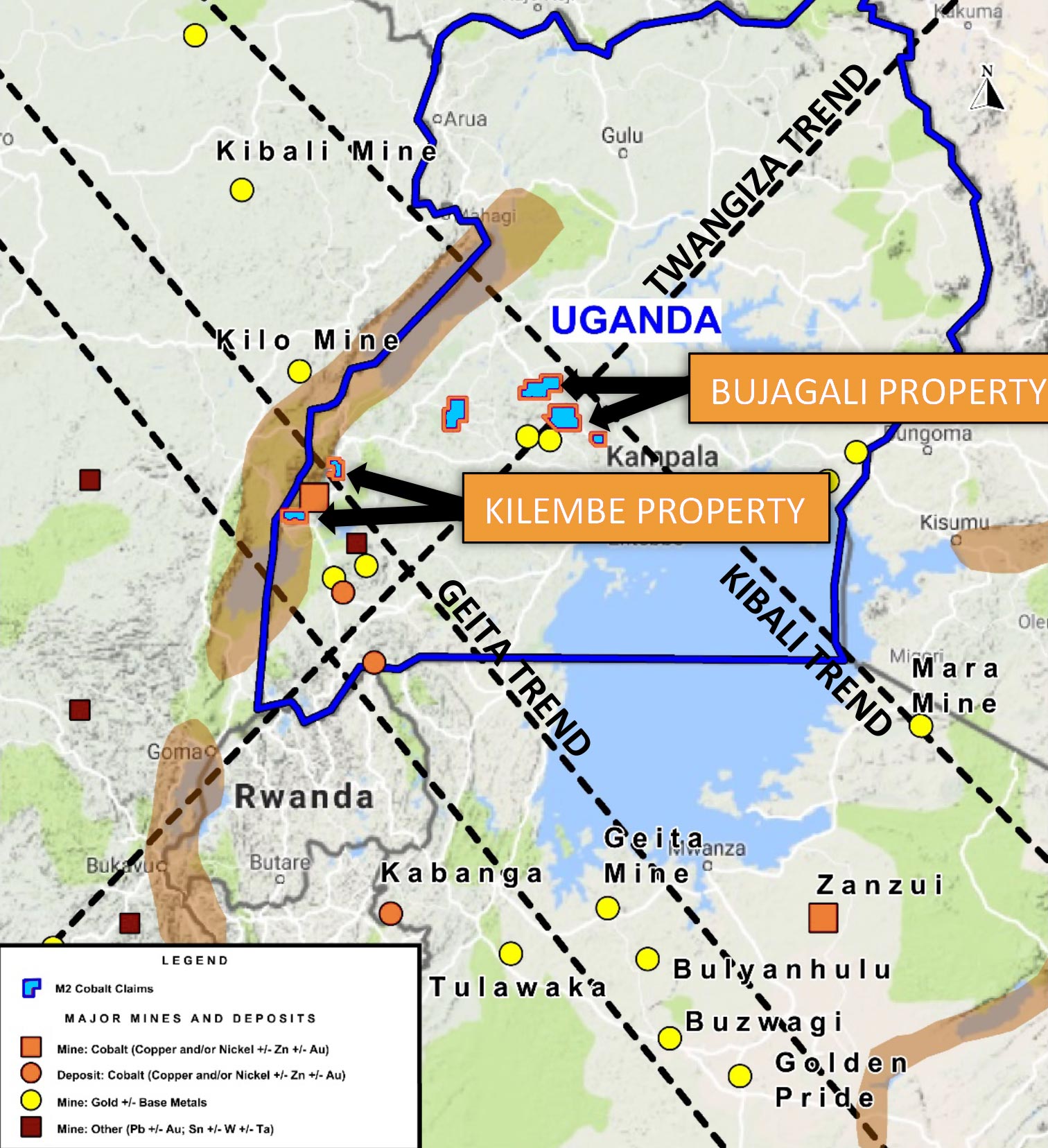

M2 Cobalt has just completed a substantial capital raise on the back of the acquisition of seven cobalt exploration licenses in Uganda. These licenses are either located right across the border from the DRC, which hosts numerous copper-cobalt mines or are on trend with a number of major producing mines in the DRC. M2’s properties consist of the Kilembe property and Bujagali property which are respectively described as ‘rejuvenating’ and ‘developing’ a copper-cobalt region in the official NI 43-101 Technical Report on the properties.

The cobalt market

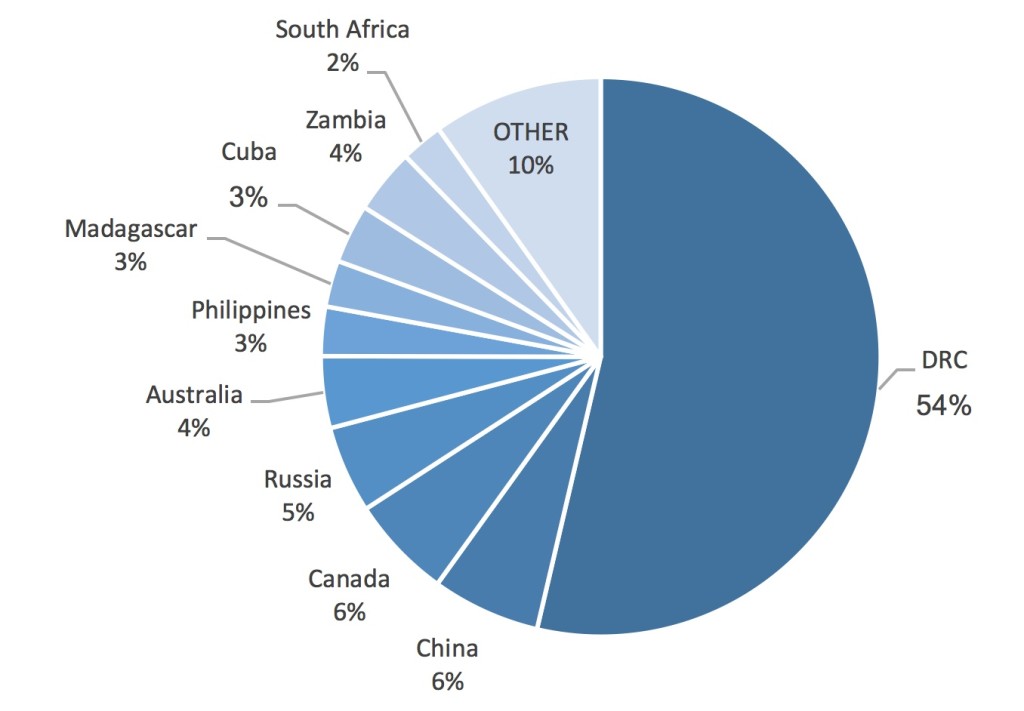

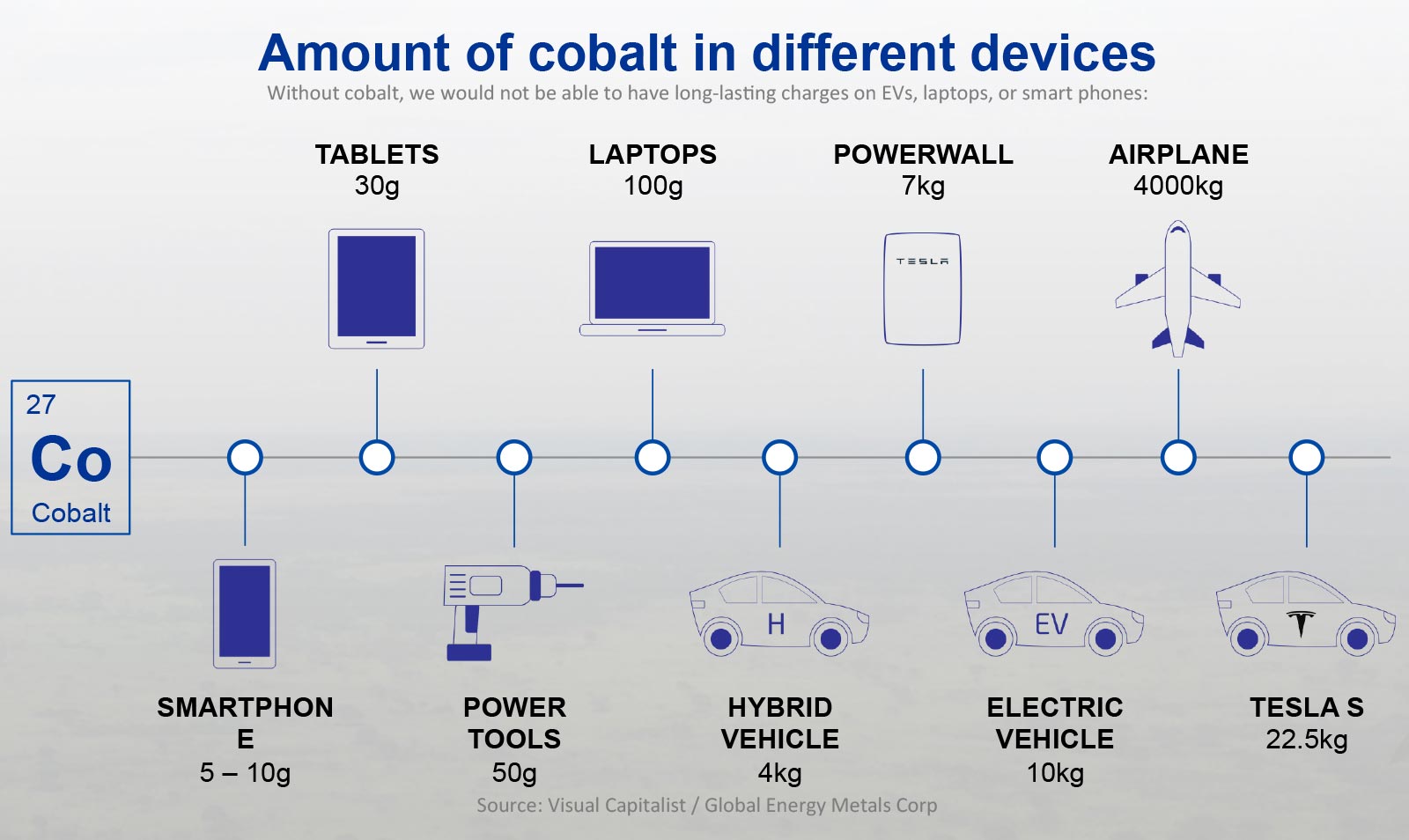

The EV sector is booming and demand for the main components of the batteries used to power these vehicles continues to increase. The main issue with cobalt is the fact the world supply is relying on an uninterrupted supply from the Democratic Republic of the Congo (DRC), which accounts for approximately 2/3rd of the world production of cobalt.

Needless to say this is a dangerous situation as the DRC isn’t the most stable country in the world (understatement), so the supply chain could easily be disrupted. Combine an uncertain supply with booming demand, and you’ll understand the end users of cobalt would love to diversify their supply sources.

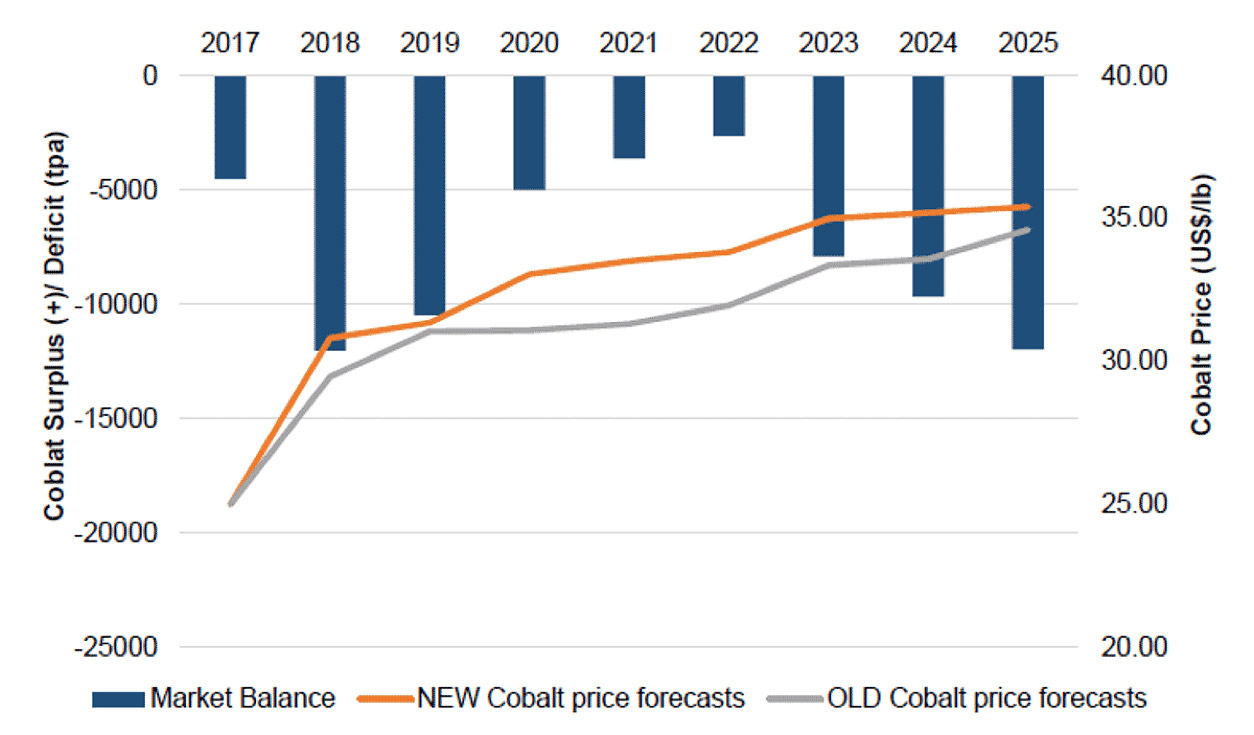

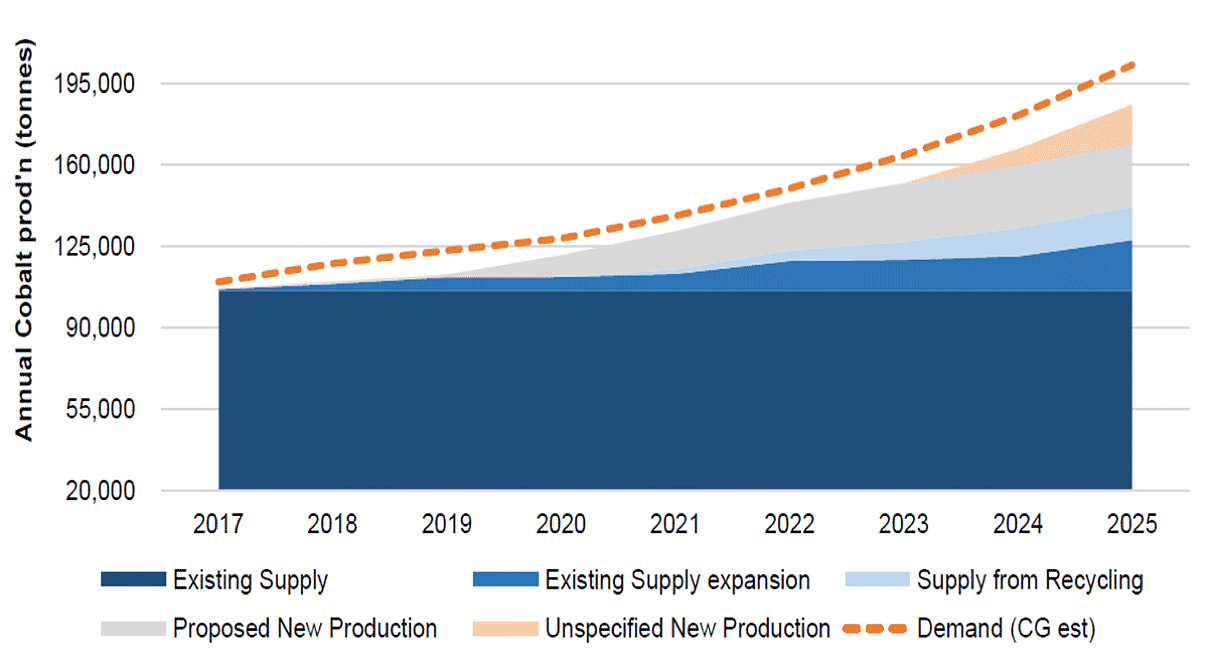

Images can tell more than words and the next few charts don’t need any additional explanation.

Canaccord Genuity cobalt market balance and price forecasts (June 2017) – Source: Canaccord Genuity estimates

Cobalt market – supply vs demand forecast (2017-2025) – Source: Canaccord Genuity estimates

There’s only one conclusion; the world needs more (viable) cobalt projects to make sure the supply deficit doesn’t disrupt the battery sector.

A closer look at M2’s exploration licenses in Uganda

In the fourth quarter of 2017, M2 Cobalt entered into an agreement to acquire 7 exploration licenses in Uganda from three private companies. The seven licenses could easily be divided into two projects with the Bujagali project consisting of five exploration licenses whilst the Kilembe property consists of two licenses. The combined surface area of all seven licenses is in excess of 1,500 square kilometers.

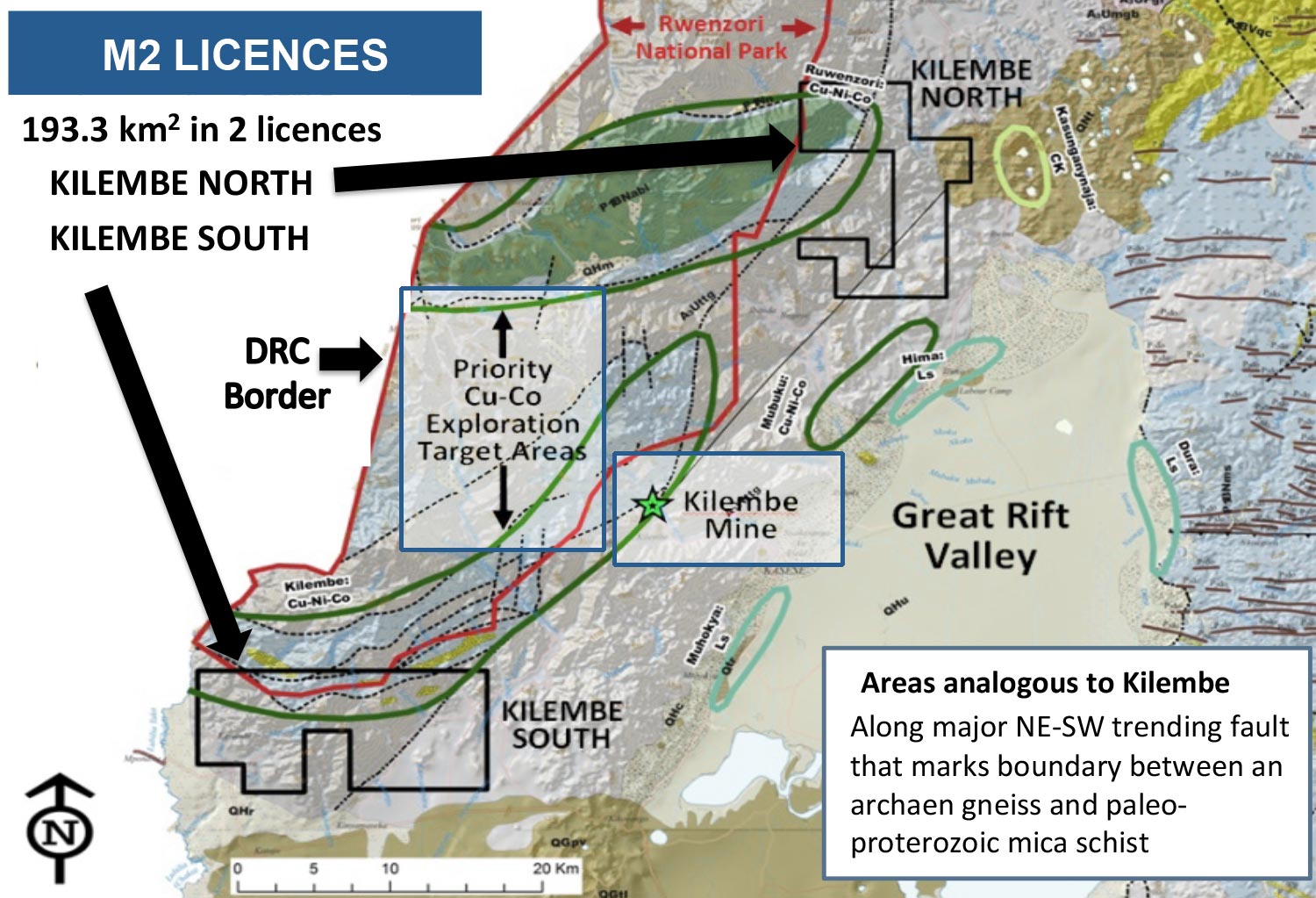

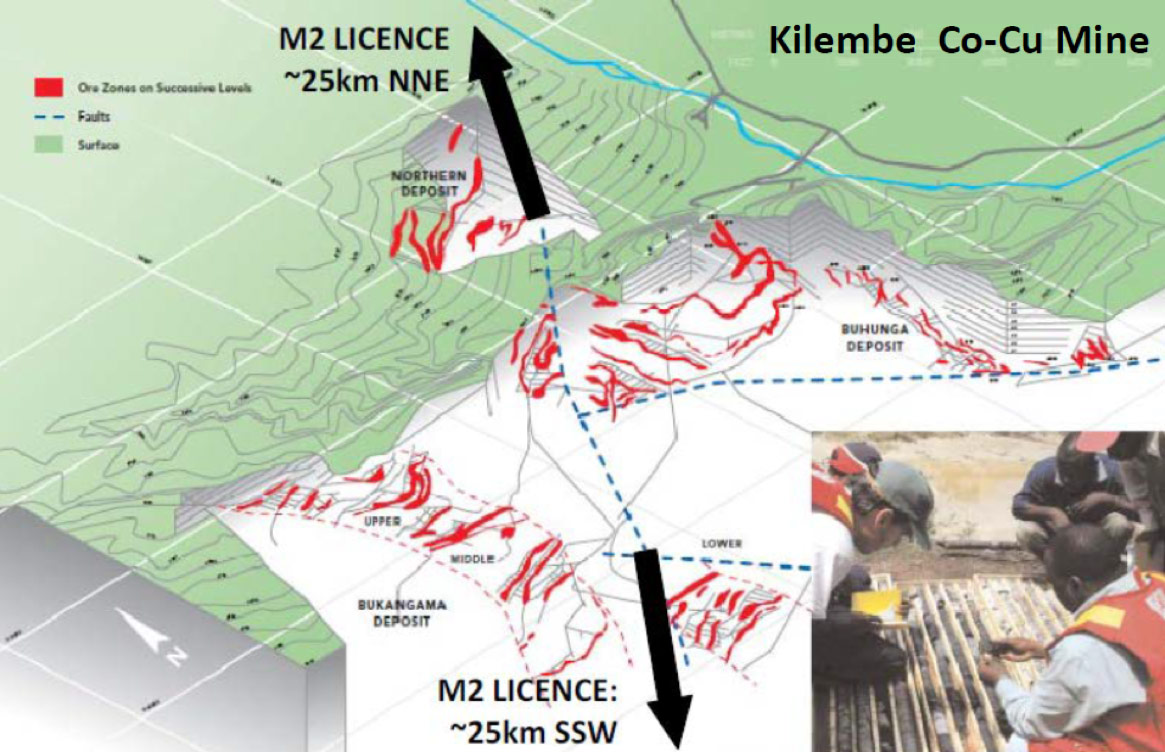

Let’s start with the Kilembe project, which we think potentially offers the most near-term potential of the two. The Kilembe mine (which is located right next to the border in the DRC) was actually one of the highest grade copper-cobalt mines in the world with almost 20 million tonnes at an average grade of 2% copper and 0.17% cobalt. This highly profitable mine was operated by Falconbridge for 20 years from the mid-fifties to mid-seventies of the previous century.

Whilst M2 Cobalt is currently not focused on the old mine itself, it’s important to recognize that GTK (“the Geological Survey of Finland”), which was hired by the state of Uganda and the World Bank to prioritize the mineral potential of the country, ranked the area around the Kilembe mine (including M2 Cobalt’s exploration properties) as high priority exploration targets due to the similar features of the underlying geology compared to the high-grade mine itself.

According to the Technical Report, the Kilembe exploration licenses are underlain by the so-called Nyamwamba fault which appears to be ‘poorly understood’. However, the previous surveys conducted as part of Uganda’s plan to create a legal framework and roadmap for the rejuvenation of the mining sector appear to point in the direction of a potential copper-cobalt system in areas adjacent to the past-producing Kilembe mine.

Since the close of the Kilembe mine, effectively no exploration programs have been undertaken focusing on discovering VMS deposits in the country, despite the fact that the entire Kilembe area remains highly prospective for these types of deposits. That has been confirmed by previous surveys where the same Buganda-Toro meta-sedimentary and volcanic rocks were discovered as the rocks which hosted the past-producing Kilembe mine.

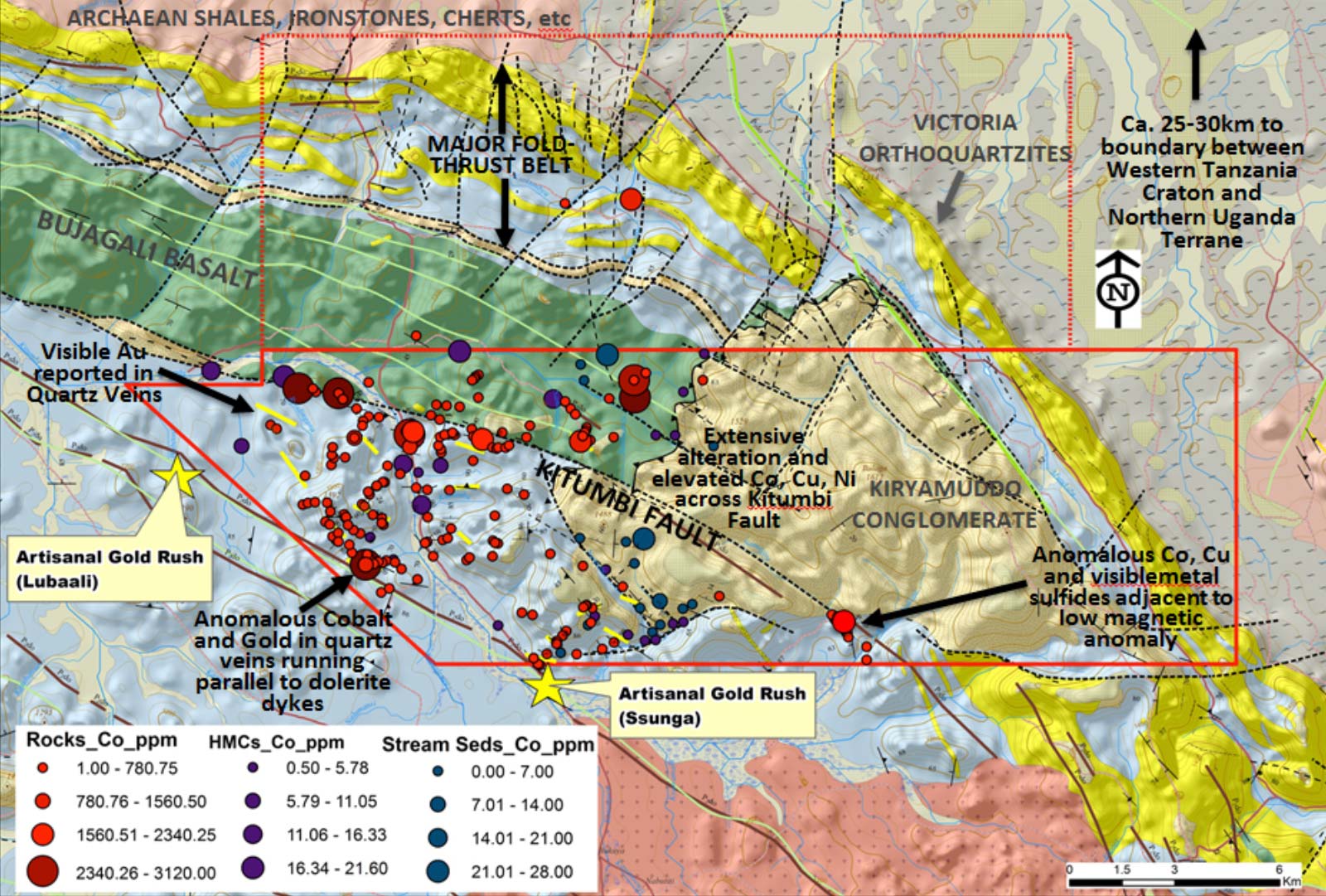

The Bujagali property is located further to the east and was actually subject to an exploration program by the vendors of the assets. Lots of artisanal miners were recently removed from the property by the government, but interestingly enough they were looking for (high-grade) gold rather than cobalt. That’s an interesting detail, as two (known) veins attracted tens of thousands of artisanal miners to the property. Gold obviously wasn’t the vendors’ focus, and a sampling program revealed grades of up to 0.19% cobalt (and some traces of zinc and copper) whilst a subsequent sampling program also discovered a predominantly gold-cobalt system with grades of up to 0.31% cobalt, 3.5 g/t gold and 0.17% copper.

This could indicate the Bujagali property is somewhat complex (as exploration projects often are) and could host a mix of poly-metallic zones.

Uganda: risky or a massive opportunity?

Doing business in Africa is never easy, but although Uganda isn’t very well known (yet) for its mining sector, it does look like the country now has its ducks in a row to attract mining investment. We discussed several aspects of doing business in the country with M2 Cobalt’s management team to make sure we have a good idea of what they and their investors are getting into.

First of all, the Uganda mining law was actually overhauled relatively recently as the country wanted to capitalize on its natural resources. The World Bank helped the country to appoint experts tasked to update the mining law, to bring it in line with the legal framework of western countries.

The new laws and regulations came into effect a several years ago, and we are not aware of any companies running into legal or regulatory issues since. All exploration licenses remain valid for three years and can easily be renewed for subsequent two-year periods. M2 Cobalt’s 7 licenses were all renewed in 2017 and remain in good standing until 2020. They can also convert into 21-year mining licenses at any stage.

Secondly, the booming oil sector has also helped the country (and the perception of the country by the international investment community). A joint venture of three oil majors (Total, CNOOC and Tullow Oil) is currently developing the large Albert Lake oilfield which will have a peak production rate estimated at approximately 120,000 barrels per day. That is a massive oilfield and it goes without saying the three companies (based in France, China and the UK) wanted to make sure their investments are protected by a transparent and robust legal framework.

We acknowledge the country still has to earn the respect and its credibility, but the development of the oil project and M2 Cobalt’s exploration licenses could prove to be a good step in the right direction.

We spent a considerable amount of time with CEO Clarke and CFO Edelmeier to discuss the geopolitical risks related to doing business in Uganda, and both executives appeared to be very comfortable operating in the country. Edelmeier was part of the private companies which vended the properties into M2 Cobalt, and has plenty of in-country experience.

We also shouldn’t forget that Dr. Jennifer Hinton (Ph.D Geological Engineering from the University of British Columbia) has been working in the country for over a decade, and has the right contacts and credibility in Uganda. She is, indeed, well known throughout the East Africa Region. Dr. Hinton was instrumental in assembling the land package now owned by M2 Cobalt.

In addition, Tom Lamb has also worked on these Uganda assets for over five years and has worked in country for a large part of that time. Tom has an in-depth knowledge of the legal and regulatory regimes as well as operational processes in the country.

As the key people of the management team have been able to operate in the country for several years now, we are confident the existing relationships with the government and mines department will be a huge help to unlock the value of the properties.

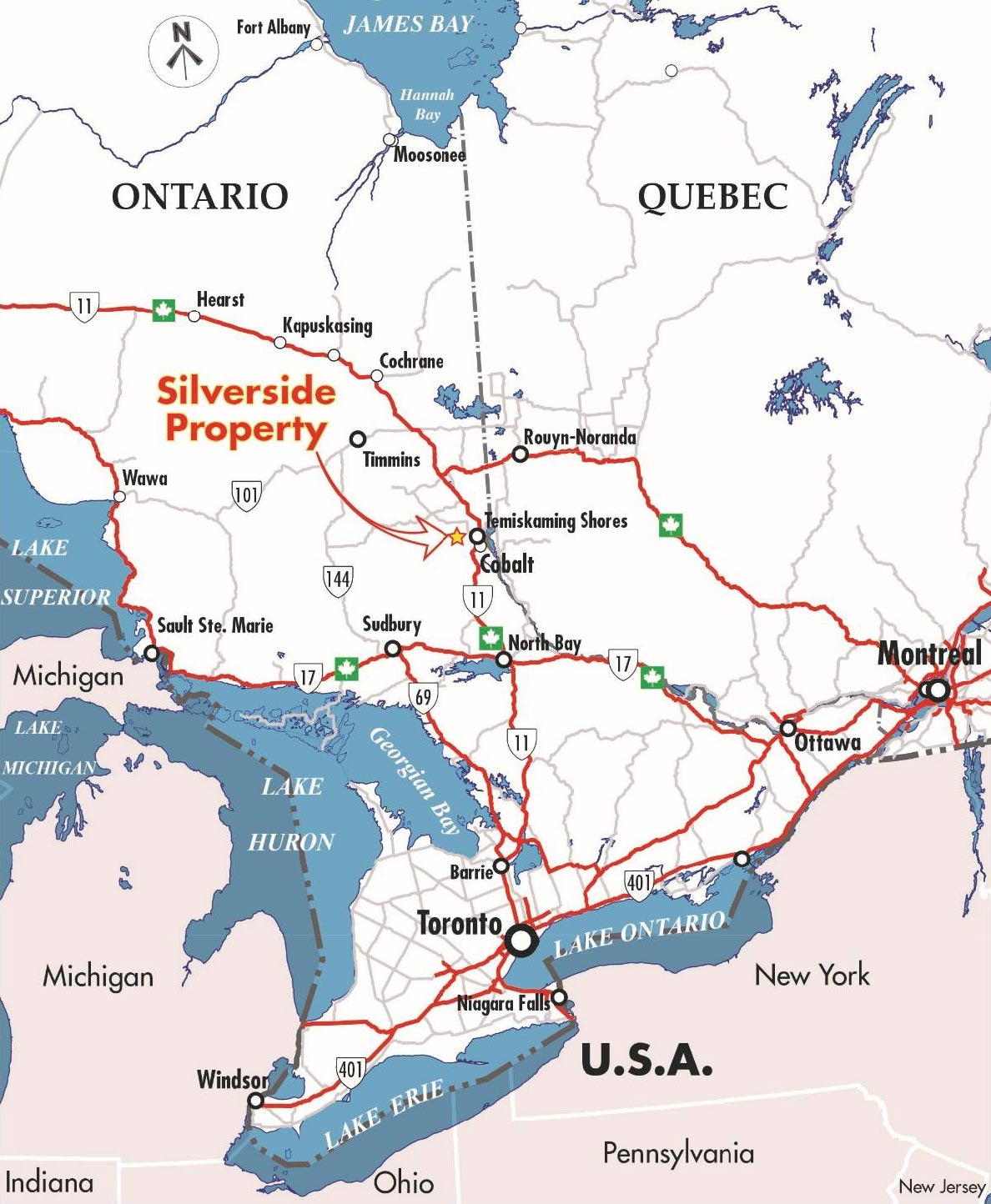

Silverside: the secondary property in Ontario

Before M2 Cobalt acquired the cobalt exploration licenses in Uganda, its focus was the Silverside project in Ontario, located just 30 kilometers northwest of the town of Cobalt, and 450 kilometers north of Toronto.

The ‘Cobalt Camp’ in Ontario was previously owned and explored by companies like Agnico Eagle Mines (AEM, AEM.TO) and Teck Corp (TCK.B, TECK). M2 Cobalt’s assets are located in this ‘Cobalt Camp’ and were explored historically with a focus on silver and the land was recently staked by private vendors who sold it to Accend Capital (M2 Cobalt’s previous name).

The property consists of a core property, ‘the Silverside Property’ of approx. 400 hectares as well as 2,400 additional hectares, contiguous to and surrounding the core property which were recently acquired by M2 Cobalt through the exercise of an option agreement entered into at the time the core asset was purchased. This brings the total land package to approx. 2,800 hectares. Recent airborne and ground geochem work carried out in 2017 identified a number of anomalies and targets and validated some of the historic work done on the property which had intersected cobalt mineralization ranging from 0.62% to 0.74% as well as high grades of silver.

All this being said, we do expect M2 Cobalt to focus on the much larger scale potential of its Uganda exploration licenses where the risk/reward ratio appears to be better and we wouldn’t be surprised to see the company monetizing the Silverside property in one way or another.

An outright sale would potentially be the easiest, but there is also the potential for M2 Cobalt to pursue a farm-out strategy whereby a new company can earn a majority (or 100%) stake in the property by making staged payments and spending money on the property. In any event, it is clear that interest in Ontario continues to increase and quality properties are in demand.

M2 Cobalt’s management team and share structure

It’s also interesting to mention M2 Cobalt was actually ‘incubated’ by the team behind Millennial Lithium (ML.V) whose share price is now continuously trading above C$4 for a 400% gain since the summer of 2016 when we initiated coverage. Millennial’s Executive Chairman, Graham Harris, is a director of M2 Cobalt and on top of that, M2 is operating out of the offices of Millennial Lithium in Vancouver. Needless to say M2 has some serious backing, which has attracted what we believe to be a top-notch management team to the project:

Simon Clarke, Director & CEO

25 years in senior roles focused on resources / energy / energy technology. Original Co Founder OSUM Oil Sands, Former EVP RailPower Technologies. LLB University of Aberdeen

Andy Edelmeier, Director & CFO

Senior Investment Banking / M&A background including JP Morgan Chase and Credit Suisse First Boston in London. President Braemar West Capital Inc., MBA London Business School, CPA, CMA

Thomas Lamb, Director & VP Operations

Ex Securities lawyer. Co-founder of Goldgroup Mining, Ex Director Uzhuralzoloto Group (Russia’s 3rd largest gold producer). Current CEO of Auranda Minerals focused on East Africa exploration. MSc and Sloan Fellow at London Business School

Jennifer Hinton, Director East African Operations

World renowned expert on Local and Artisanal Mining in East and Central Africa. Based in Uganda for 12 years. Ex. consultant to World Bank, UN agencies, and multinationals. Has key local relationships and heads East Africa operations. Ph.D in Geological Engineering University of British Columbia

Dean Besserer, QP / Technical Advisor

Vice President of Exploration – Cedar Mountain Exploration Inc. VP APEX – significant geo experience globally, including Africa

Graham Harris, Director

30 years Finance Industry experience, Former SVP & Director Canaccord Capital, Has raised over $250m in development capital. Current Chair, Millennial Lithium Corp (TSX-v: ML)

M2 Cobalt has recently closed a C$8.5M private placement, issuing 17 million new shares at C$0.50 per unit with each unit consisting of one common share and half a warrant. Each full warrant allows the warrant holder to purchase an additional share of M2 Cobalt at C$0.80 (which could potentially bring in an additional C$6.8M if all warrants would be exercised). The warrants will expire within two years after issue, but the expiry could be accelerated by the company if the share price trades above C$1.40 for at least ten consecutive trading days.

After having completed this placement and after having acquired the licenses, M2 Cobalt now has a total share count of approximately 61M giving it a market capitalization of approximately $41.5 million, whilst it has a net cash position (after acquisition and financing costs etc.) of approx. $8.0 million.

Conclusion

M2 Cobalt is the newest cobalt company on the TSX Venture Exchange and whilst most ‘competitors’ are focusing on the DRC or past-producing projects in Canada, M2 Cobalt is exploring new frontiers. Frontiers with a very similar geological footprint, right next door to the DRC where in excess of half of the world’s global cobalt production originates. As the first (and only) mover in the Uganda cobalt space, the company could have a considerable advantage over other Cobalt exploration companies and this without the child labour and conflict minerals issues typically associated with the DRC.

M2 Cobalt is now cashed up and will hit the ground running in Uganda as many of the team have been working on the properties for the past few years and know exactly what the next steps are. We expect the company to release an official update on its exploration plans soon, and are looking forward to seeing the exploration licenses being subject to a systematic exploration program.

Disclosure: M2 Cobalt is a sponsor of this website, we have a long position. Please read the disclaimer