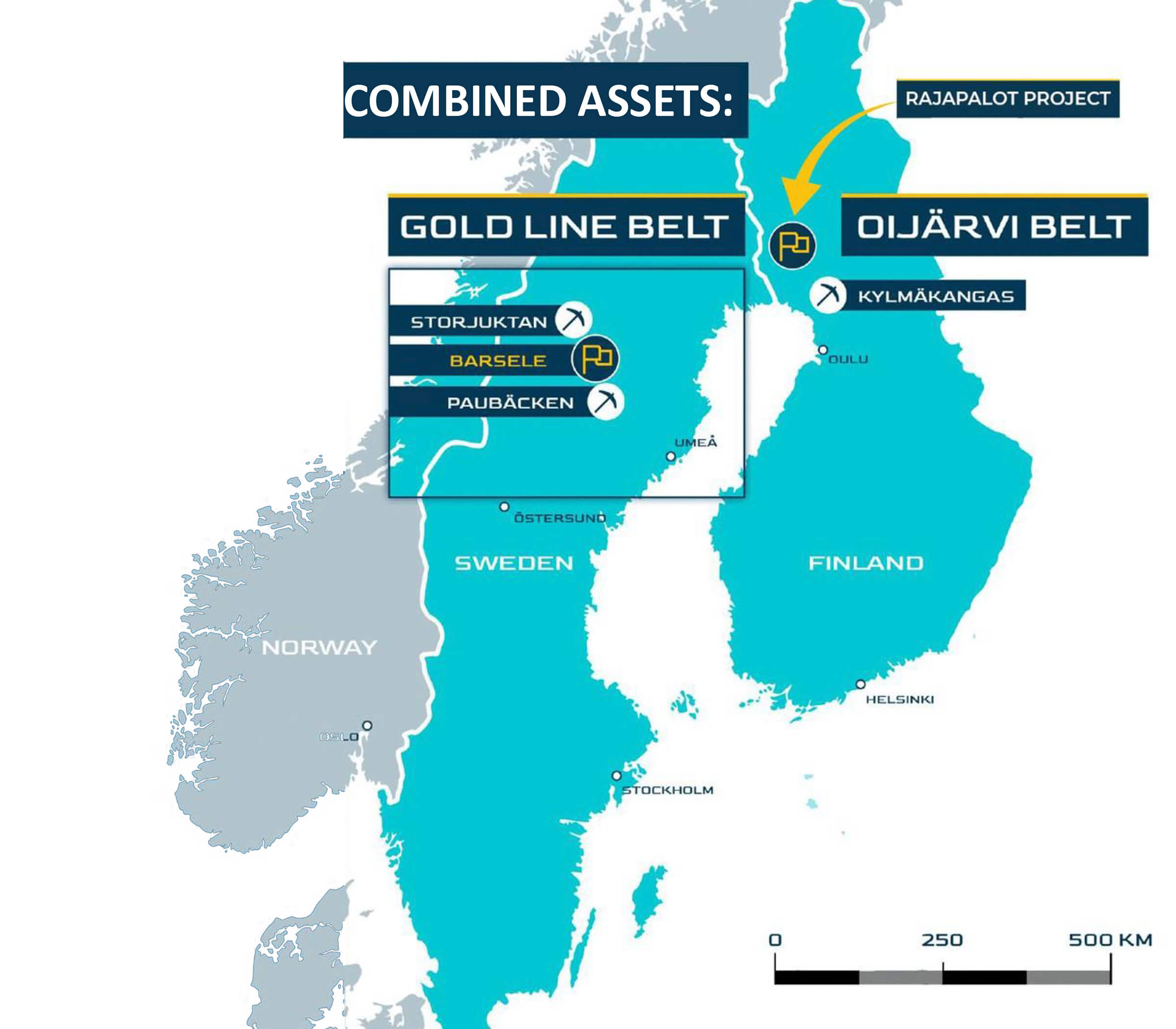

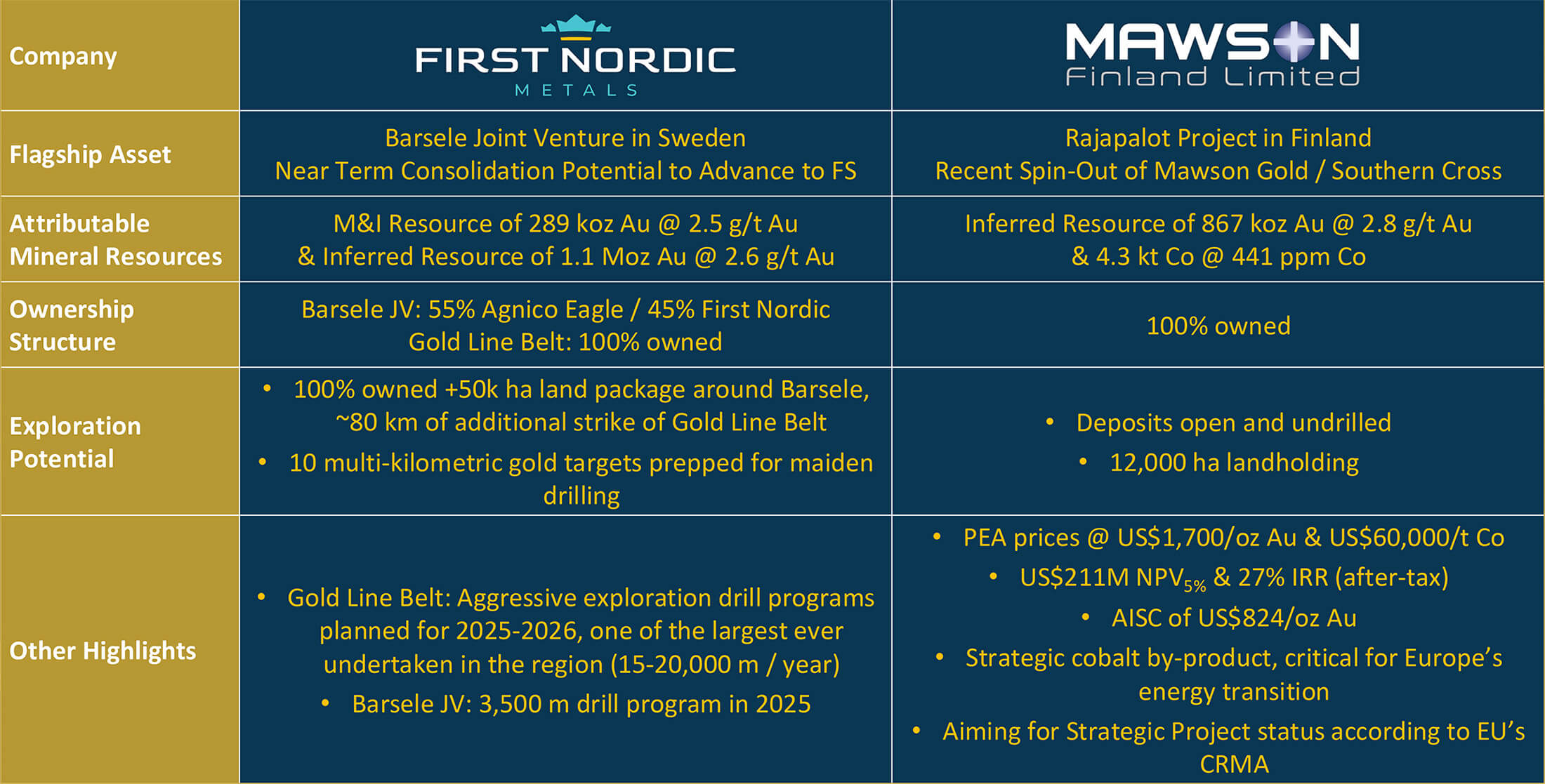

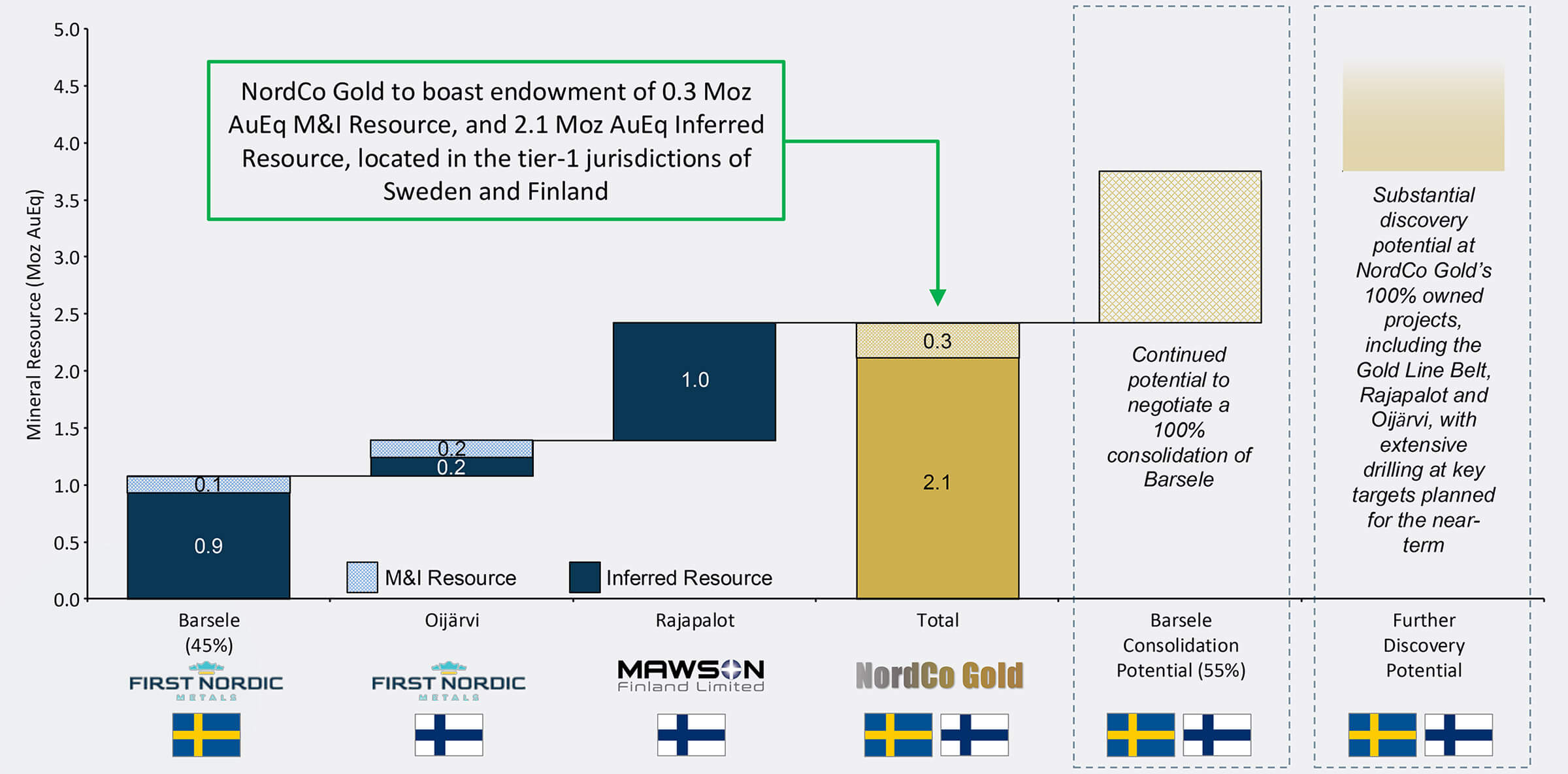

Earlier this week, Mawson Finland (MFL.V) and First Nordic Metals (FNM.V) announced they entered into a definitive arrangement whereby the latter will acquire Mawson Finland in an all-share transaction to create one of the largest Nordics-focused precious metals companies. The focus will remain on gold as the total attributable gold resource across all resource categories will be around 2.2 million ounces for the combined entity.

First Nordic’s main asset is the 45% owned Barsele gold project in Sweden, which hosts an indicated resource of 324,000 ounces of gold as well as an inferred resource of just under 2.1 million ounces of gold. Mawson Finland’s flagship project is the Rajapalot gold-cobalt project with an inferred resource of 867,000 ounces of gold and about 10 million pounds of cobalt.

The acquisition terms

As part of the agreement, First Nordic will complete a 4:1 share consolidation but as that hasn’t come into effect yet, let’s just use the pre-consolidation numbers.

First Nordic will issue 7.1534 of its own shares for each of Mawson Finland’s common shares. This means that using the C$0.465 closing price of First Nordic on the Friday before the announcement, the agreement values a share of Mawson Finland at C$3.33.

Concurrent with the acquisition, First Nordic is also planning to complete a financing of up to C$30M priced at C$0.38 per subscription receipt. Each sub receipt will be converted into one common share upon the consummation of the transaction. Should this financing be fully subscribed, a total of just under 79M pre-consolidation shares will be issued. This means that upon the completion of the acquisition and the concurrent financing, First Nordic Metals will have 139.1M shares outstanding on a post-consolidation basis. This includes the finders fee payable to Nuvolari Capital to the tune of C$2.2M, to be settled in 1.4M post-consolidation shares.

This means that based on the terms of the subscription receipt financing, the market cap of the combined entity will be just over C$200M, with approximately C$45M in cash on the balance sheet.

Using the C$0.38 sub receipt financing price as starting point, the shares of Mawson Finland are valued at C$2.72, which is almost 10% higher than its closing price on Monday.

The combined entity

Right after the acquisition announcement had hit the wires, First Nordic immediately published the merger presentation on its website. The image below captures the essence of why both companies are teaming up to create a larger Nordics-focused exploration & development company.

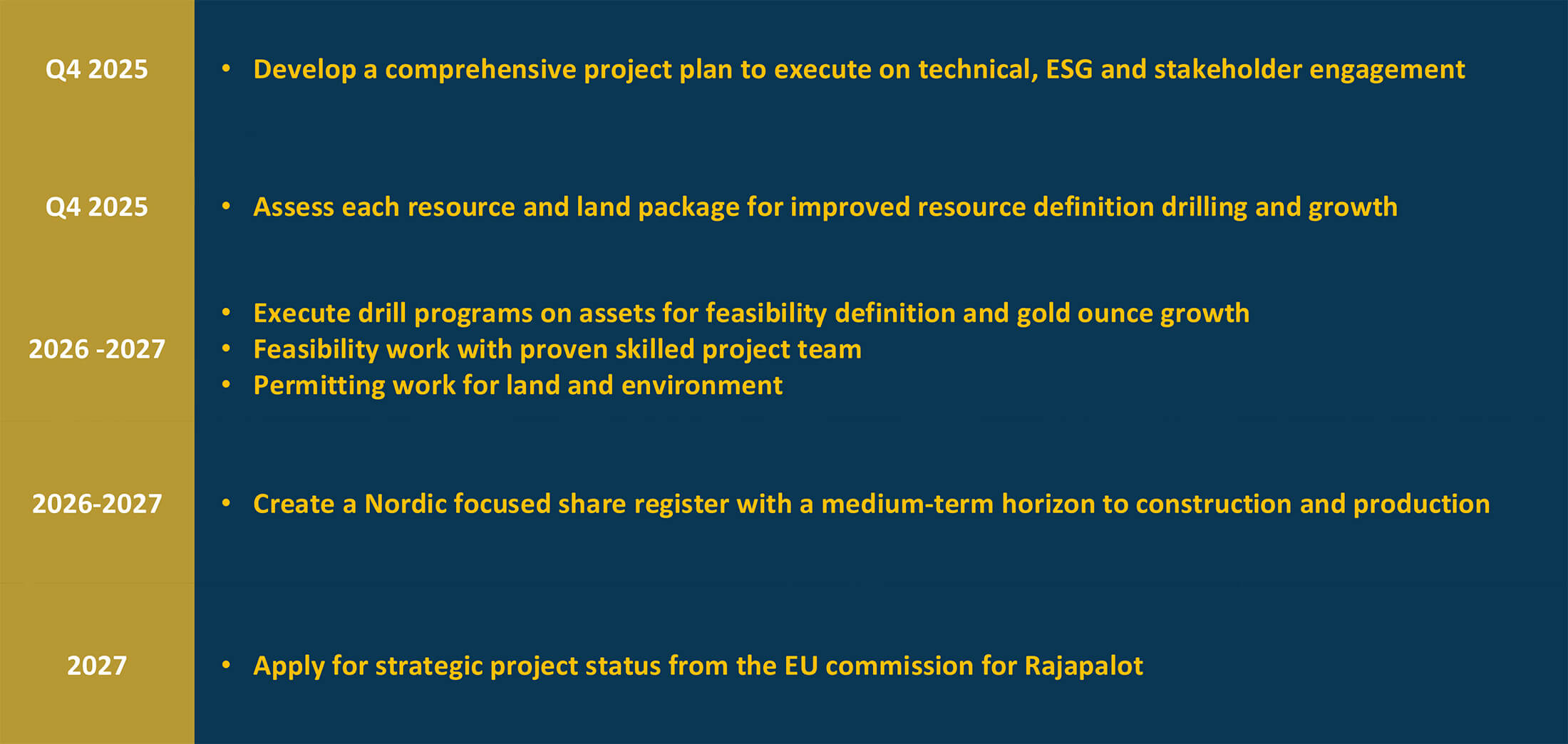

The timeline for the next two years is also interesting, as the emphasis remains on further exploration activities to ensure the projects in the portfolio achieve critical mass before working on (updated) economic studies and advancing them towards a production decision.

The plan for 2027 in the image above is interesting. As per the current timeline (which of course may shift as things are going faster/slower than planned), the combined entity expects/hopes to submit the Rajapalot project to the EU Commission to get the designated strategic project status. As there virtually is no domestic cobalt supply within the European Union, we expect the Rajapalot project to have a good chance to get the status, perhaps after a resource update and an updated economic study. Getting the strategic project status should simplify and shorten the permitting procedure for the project.

One of the presentation slides, shown below, also shows there is ‘continued potential to negotiate a 100% consolidation of Barsele’ and that would be a good move (subject to the price) for the combined entity. The market values full ownership of a project materially different than owning a minority stake in Barsele.

The new management

We are very happy to see the combined entity will have a new management team as the post-transaction company will appoint a new CEO and chairman, while current Mawson CEO Noora Ahola will move to a position where she will be responsible for the local operations in her capacity as Managing Director Nordics. Also worth mentioning: the new CEO will receive C$1.9M in free shares, and we can only assume this will be a sufficient incentive to get the combined entity across the next few hurdles towards making a development decision.

Conclusion

Investors that are convinced tis deal will go ahead now have an excellent opportunity to engage in some arbitrage. Based on the current respective share prices, it makes sense for First Nordic shareholders to sell their shares on the market, as there are two possibilities to re-acquire the shares. Either through a participation in the C$0.38 sub receipt financing, or simply by buying shares of Mawson Finland on the open market and tendering those shares into the acquisition offer.

After all, using the 7.1534 share exchange ratio, picking up Mawson Finland at C$2.48/share represents buying First Nordic at C$2.48 / 7.1534 = 34.7 cents per share. As both parties get closer to closing the agreement (expected in December of this year), the gap between both valuations should decrease and the implied value of Mawson’s share price should better reflect the fair value of the offer. Interested parties should keep an eye on the implied valuation of Mawson Finland (and vice versa, First Nordic) as discrepancies in the next three months could create opportunities. That being said, the Mawson Finland stock is thinly traded so this strategy wouldn’t work for larger blocks of stock.

We currently have a long position in Mawson Finland, and will tender our shares into the buyout offer (or sell them on the open market). The management changes at First Nordic and a concurrent C$30M financing were the key elements in our decision-making process.

Disclosure: The author has a long position in Mawson Finland. Mawson Finland is a sponsor of the website. This post is for educational purposes only; be mindful investing in junior mining stocks is risky and you may lose your entire investment if things go wrong. Please read the disclaimer. Please read our full disclosure.