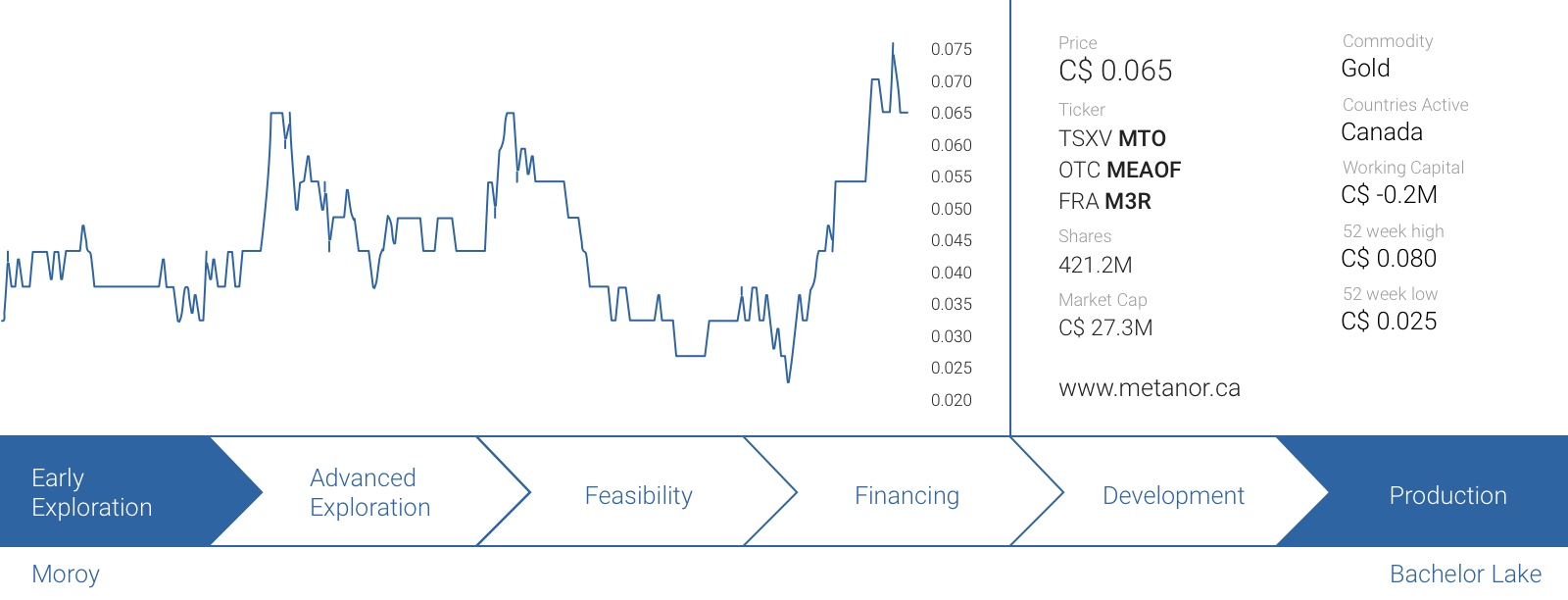

In our previous report, we already expressed our disappointment with the operating performance in the first quarter of the financial year, so we were looking forward to see if Metanor Resources (MTO.V) was able to reduce the cash burn in the second quarter of the year, despite the low production results.

The Q2 FY 2016 production results were below expectations, but will improve

In the second quarter of the year, the average grade remained stable at 4.6 g/t and despite a slightly higher recovery rate the total gold production fell by an additional 550 ounces to 7,774 oz on the back of a lower mill throughput.

The low average grade was caused by Metanor’s current mine plan which is focusing on the A-vein which apparently is narrower than the other veins on the Bachelor property. Due to the limited width of the vein, the mining dilution rate is much higher than anticipated, resulting in the mill having to process waste material as well. As long as the A-vein will be the only vein where the ore will be sourced from, Metanor still won’t be able to produce as much gold as originally anticipated.

Metanor says the average grade should start to increase soon, as the contribution from the Hewfran zone will gradually increase. As the mineralization is thicker, the dilution will be lower which should have a positive impact on the average grade. Even a ‘moderate’ boost from 4.6 g/t to 5.1 g/t should result in a production increase of almost 800 ounces per quarter which could boost the revenue and cash flow by C$4M+ per year without incurring any additional efforts.

What does this mean for the financial statements?

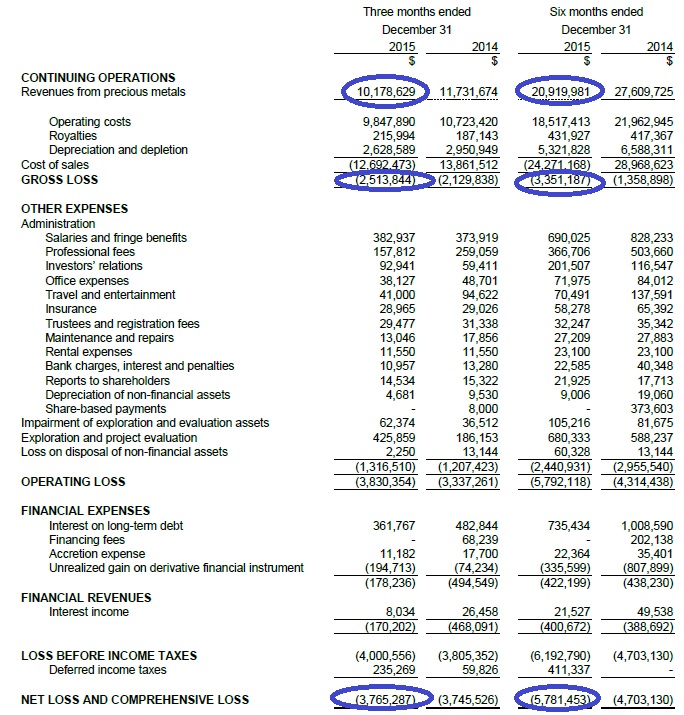

In the second quarter of Metanor’s financial year 2016, the company generated a total revenue of C$10.2M but as its cost of sales was almost C$13M, Metanor reported a gross loss of C$2.5M and an operating and net loss of C$3.8M. For the first semester, the net loss was approximately C$5.8M and that’s obviously not something we can be terribly excited about.

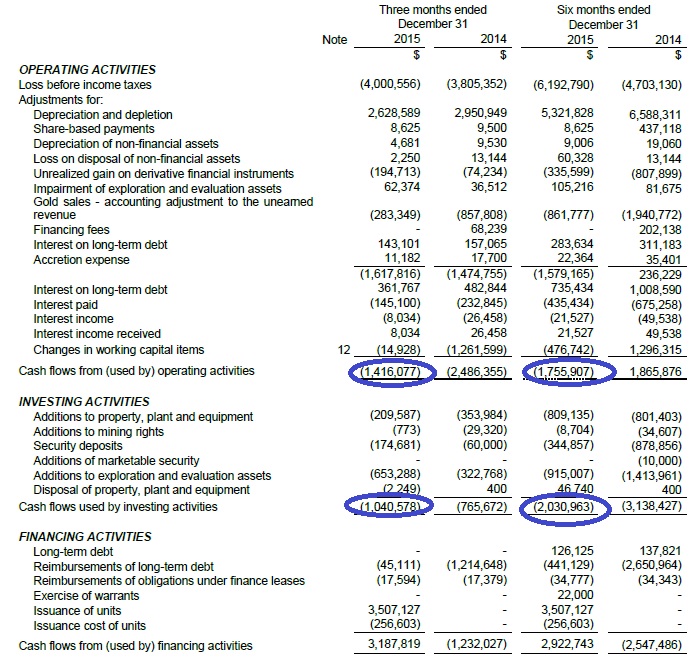

Of course, in the mining sector the cash flows are more important than the income statement, and as Metanor’s income statements contained some non-cash charges, we would be hoping to see the net cash outflow to be lower than the C$5.8M net loss in the first half of the financial year.

There’s good news and bad news. The bad news is the fact the company was even losing cash on the operating cash flow front, and after deducting a total of C$2M on capital expenditures and exploration expenses, the net outflow in the first half of the year was approximately C$3.8M. The cash flow result is C$2M better than the income statement, but it’s undeniable Metanor is still losing cash, and the C$3.5M cash infusion right before the end of last year was necessary.

If the company is cash flow negative, how will the Moroy drill campaign be funded?

There are only two ways to fund a drill campaign and that’s either by spending the operating cash flow or to issue new shares to raise cash for an exploration program.

As Metanor is free cash flow negative it can’t really rely on sustainable operating cash flows for the time being, fortunately the flow-through market remains quite hot. At the end of last year, Metanor already raised C$1.8M in flow-through funds (which will have to be spent on exploration-related activities before the end of the current calendar year). However, if Metanor is indeed serious about its massive 60,000 meter exploration program, it will very likely have to raise more funds in another flow-through financing. Fortunately the share price is currently trading almost 100% higher compared to when we re-started to cover Metanor, and a flow-through financing at C$0.09 or C$0.10 is not an unrealistic assumption.

The impact of a higher gold price should not be underestimated

The gold price and weak Canadian Dollar are now working in Metanor’s favor. The USD/CAD exchange rate is still trading at 1.33 which is a pretty good rate for any Canadian gold producer as it’s selling gold in the strong currency but incurring a large part of its expenditures in the weaker currency. The longer the Canadian Dollar remains weak, the better for Metanor Resources.

However, the most important and most likely way to see an increased cash flow will be due to the higher gold price. As you can see on the next chart, the average gold price expressed in Canadian Dollar is definitely much higher compared to the previous quarter, and this should expand Metanor’s margins. Even based on a total production of 15,000 ounces per semester, the C$150 increase in the gold price would reduce the net cash outflow by 2/3rd and once the ore from the Hewfran zone will be added to the production mix, Metanor should be in a position to break even and become free cash flow positive again.

A free cash flow positive situation is definitely something Metanor should be aiming for as not only will it allow the company to start reducing its net debt again, it will also allow to spend more cash on either the Moroy discovery (without having to issue new shares) or on rethinking the strategy for the Barry project.

Conclusion

Metanor’s operating performance remained weak in the final quarter of calendar year 2015, and the company continued to lose cash. However, the recent increase in the gold price will definitely have a positive impact on the company’s financials, whilst adding ore from Hewfran to the production mix should increase the amount of gold that will be recovered per processed tonne.

Moroy is a really exciting exploration project, but with a negative working capital position and no positive cash flow in the first semester of the financial year, Metanor will have to plan its next steps very carefully.

The author holds a long position in Metanor Resources. They are a sponsor of the website. Please read the disclaimer