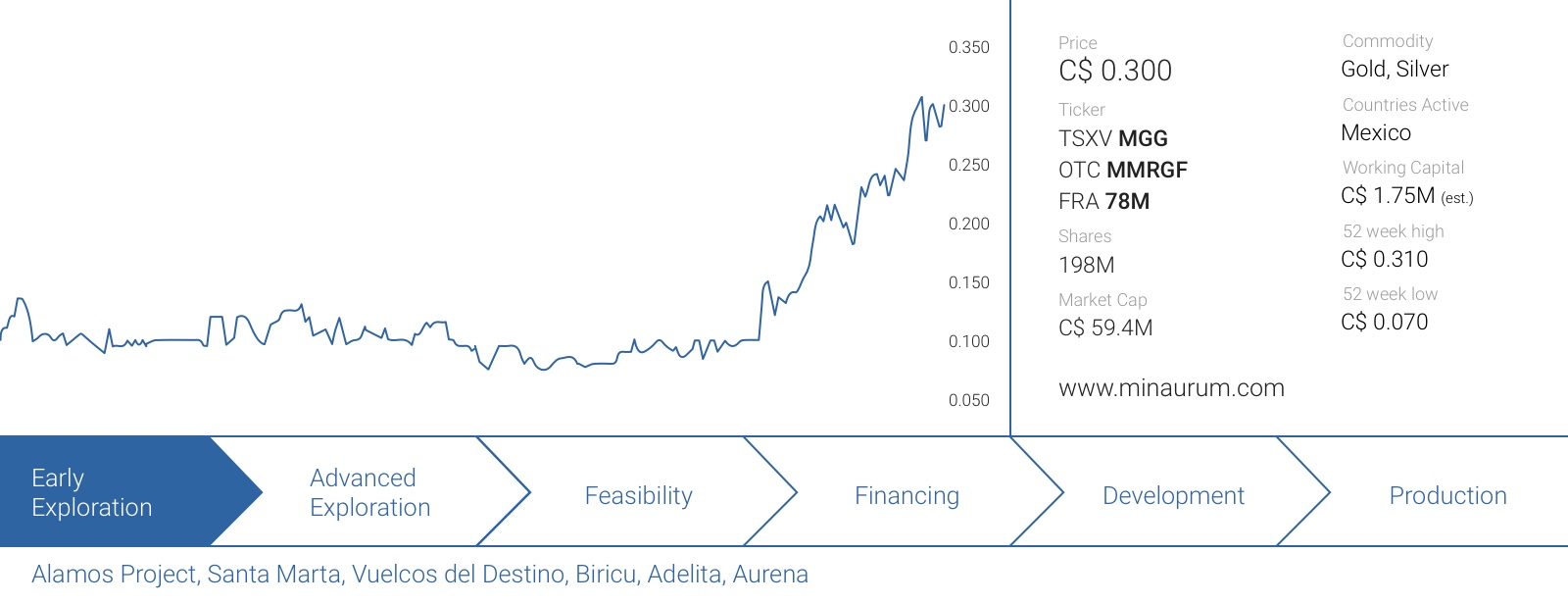

Since we published our previous report, the share price of Minaurum Gold (MGG.V) has more than tripled. We were particularly impressed with the Alamos project (the new name of what we previously called ‘La Quintera’), and at the most recent PDAC conference in Toronto, we met up with Dr. Peter Megaw to discuss the merits of the project.

A brief recap of the Alamos property

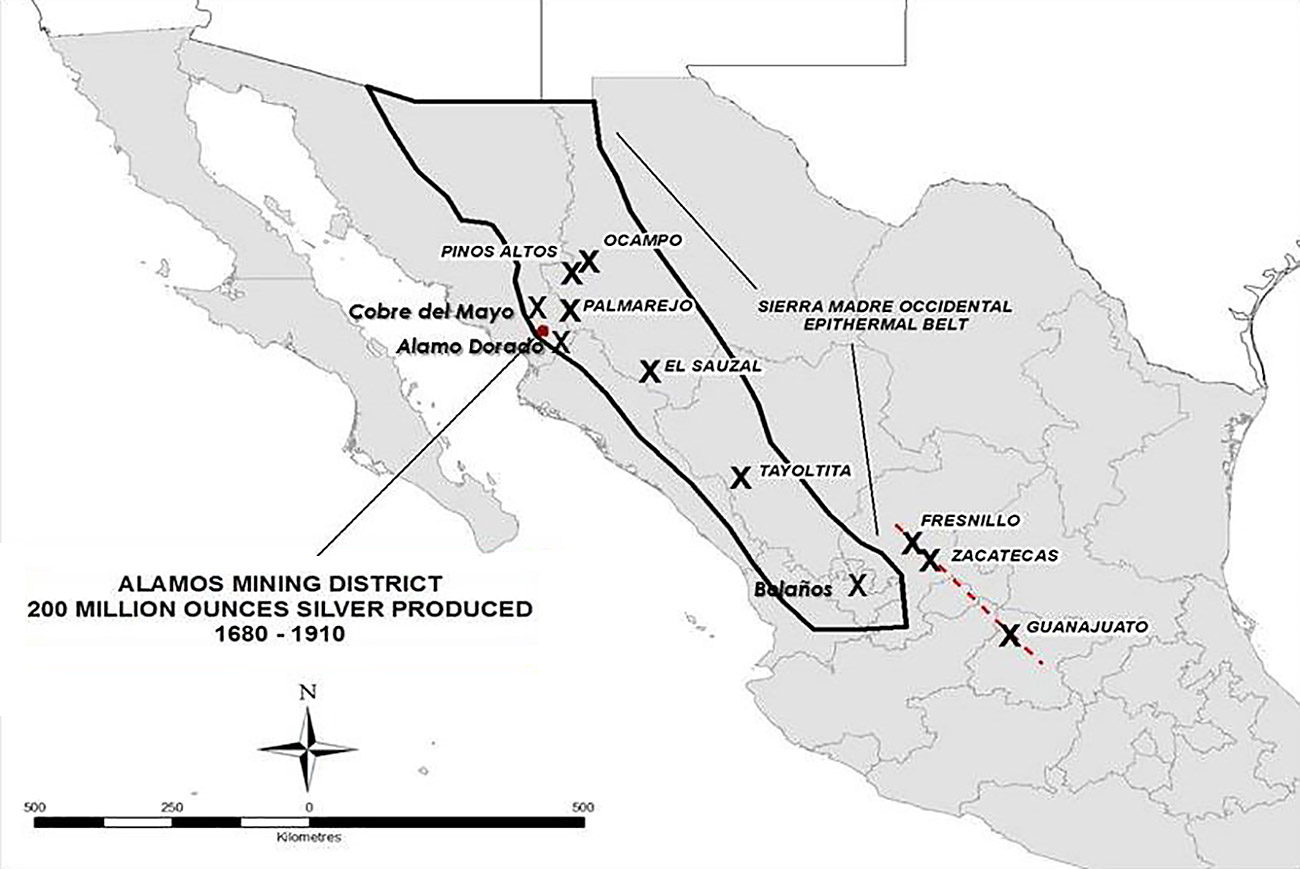

As we mentioned in our previous report, no one has touched the Alamos property in the past 100 years, with the exception for a small dump-processing operation right after the second world war. This paves the ways for Minaurum’s geologists, which are gearing up to have a ‘field day’ in this silver district.

The available data from this period reveals impressive results as the Mexican Geological Services estimated the average grade of these waste dumps to be in excess of 5 ounces of silver per tonne. On top of that, these dumps contain excellent gold, copper, zinc and lead credits resulting in a silver-equivalent grade of approximately 10 ounces per tonne. Encountering waste dumps with this average grade is very exciting and it confirms the ultra-rich nature of the Alamos project.

But of course, Alamos is so much more than just high-grade dumps, and the real money-maker would be to find more of the (previously mined) high grade silver veins on the property.

According to historical records, the average grade of the ore recovered from the veins of both the Quintera and Promontorio mines before they were shut down was approximately 40 ounces of silver and 8% copper per tonne of rock at a depth of 250-500 meters.

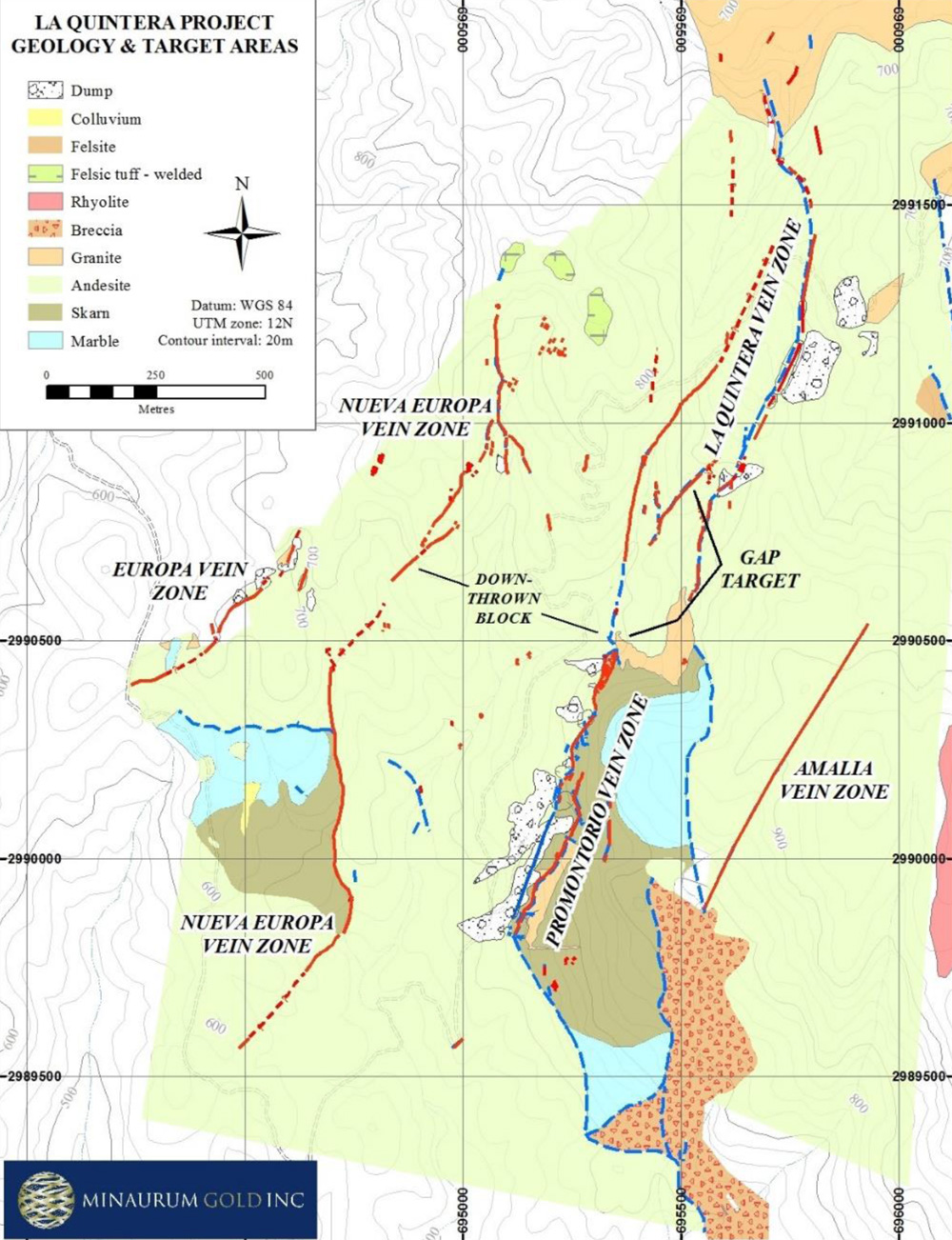

Indeed, the primary target vein had a known strike length of 3.5 kilometers, but the company’s geologists have been able to follow the entire vein system over a length of seven kilometers. With an average vein width of 4 meters (which isn’t overly optimistic as vein widths up to 20 meters have been detected) this system is much wider than the typical Mexican high-grade silver mines. It’s really surprising to see how this property remained under the radar for almost a century, mainly due to the fragmented ownership of the property.

A chat with Peter Megaw

At PDAC, we had a chance to meet with Dr. Peter Megaw, director of Minaurum Gold and Chief Exploration officer of MAG Silver (MAG.TO, MAG) who was awarded the Thayer Lindsley award for the discovery of MAG Silver’s Juanicipio silver project in Mexico. If someone knows how to deal with Minaurum’s Alamos project and to develop a theoretical model, it’s him. We asked him three questions about Alamos and the La Quintera zone, and its potential;

The Alamos property looks very intriguing and based on the past few press releases it does look like you’re finding veins and high-grade dumps all over the place. The main vein has been traced over a length of 800 meters, but you also talked about parallel veins. Could you elaborate a bit more about your technical and theoretical model for Quintera and the system of parallel veins? Do you expect to discover more veins at surface?

I like what the Quintera Vein/Block tells us about the potential to find entirely virgin and previously unsuspected blind high-grade veins throughout the Alamos District as a whole.

Several major recent discoveries have been made in other historic camps by applying modern vein concepts to areas outside where historic mining was focused and Alamos looks like a great place to try this again.

The Alamos District, which Minaurum controls most of, appears to be characterized by “piano-key” faulting that generated a series of parallel elongate fault blocks many kilometers long that alternate as up and down thrown blocks. Think of what happens when you press down every other key on a piano, the white ivory surface that starts at the same level is alternately up or down. If we think of the ivory as the surface at the time of mineralization, veins in the high-standing blocks (keys) will have been eroded to a deep level…what we see in the historically mined parts of the district. In contrast, veins in the down-dropped blocks (keys) were protected from erosion…we think enough so that erosion never worked deep enough to expose the mineralized part of the vein at all.

This means the narrow stringer veins that we see on the surface throughout the down-thrown blocks may just be the wispy upper tendrils of intact veins lying at some depth. The old timers dug a lot of holes on these stringers, so we’re pretty comfortable they were on to something, but they had no idea what. We think we do and if we’re right, the entire zonation from upper Bonanza Zones (eroded off the top of the historically mined veins) through to the deep “root” zones (comparable to what was mined) should be present and intact.

Given that the root zones of the known veins were very silver-rich, it is possible that the Bonanza zones could really live up to their name.

We believe a 5,000 meter drill program to allow you to provide a ‘proof of concept’ of the geological structures at Alamos/La Quintera is being planned. What would you need to see/find in order to consider the theoretical model to be proven?

We have to have an advantage over the old-timers who just dug on rich veins that stuck out of the ground and followed them to depth, because they didn’t leave much that was visible untested. Fortunately, we have a pretty good idea how these veins formed, how they are zoned from silver up high to increasing base metals at depth and what things look like in the 100-300 meters of altered rocks that overlay the mineralized zones.

Think of a slice through one of these veins as looking like a slice through a mushroom. The vein is like the stem…a few meters wide beneath a cap which extends for hundreds of meters on both sides of it. Finding the narrow vein is one thing, but the next trick is that mineralization only gets part way up the vein (stem)…it stops 100-350m below the bottom of the cap. Now remove (erode) the cap so all you can see is stem with a weak metals signature and you understand where we think we are with the veinlets in the downthrown blocks….the old timers had no idea that they were “only” 100-200 meters above a potential Bonanza.

We can’t really tell how deep to drill to get into mineralized vein but in simplest terms all we need to prove our concept is to cut a vein a few tens of centimeters wide with relatively high silver and low base metals values anywhere beneath the surface in one of the virgin downthrown blocks. Wide and well mineralized would be great, but if we can target smarter and shallower we can get more holes out of those 5000 meters and increase our chances of proving our concept. We gain some comfort in knowing that Alamos District veins run deep (>500m) so we probably can’t drill too deep.

Based on your extensive experience with this type of epithermal system, what kind of exploration potential do you see at Quintera (and the larger Alamos District) – assuming your proof of concept-drilling will provide the results you are hoping for? What would be the ounce-potential based on your experience and the available data from historical mining activities in Quintera?

We start knowing that the Quintera Block alone produced over 250 million ounces of silver at high grade, so Alamos has already demonstrated geologically that it is a Premier League district…the question is whether it can repeat its long-ago championship?

Given the new recognition of favorable geologic features throughout the essentially unexplored downdropped blocks flanking the narrow productive block I am very optimistic about the potential to the Alamos District dramatically. It’s hard to talk sensibly about numbers at this point, but the ounce potential is only limited by the grade of what we find and the number of blind veins lurking out there.

Conclusion

Minaurum’s recent announcement focusing on the discovery of two new high-grade silver vein systems wasn’t a coincidence. Peter Megaw sounded quite upbeat about the exploration potential at La Quintera and Alamos, but the proof will be in the pudding.

We do expect Minaurum Gold to start a more extensive exploration program later this year, which will include a drill campaign. This will allow us to get a better understanding of the project, and whether or not Megaw’s theoretical model can be confirmed.

Disclosure: Minaurum Gold is a sponsoring company. We have a long position. Please read the disclaimer