A small Mexico-focused exploration company is finally waking up from a long hibernation. Minaurum Gold (MGG.V) was able to survive the downturn on the precious metals market in the 2011-2015 era. Instead of having to dispose of certain projects which suddenly become ‘non-core’ like its competitors had to do, Minaurum Gold seems to have gotten out of the turmoil in a stronger position.

Not only does MGG have a few million of cash in the bank (with an additional million in tax refunds on its way), it also owns five exciting exploration projects of which the recently added La Quintera silver district could easily become Minaurum’s flagship project (even though at least three of its assets could be potential company-makers).

The company is also making big headway to acquire the necessary community approvals and drill permits for the Santa Marta VMS, and the company expects to provide an update on this in the current quarter.

We had a long discussion with CEO Darrell Rader and reviewed a number of independent reports to get a better understanding of the project and the company’s plans for 2017.

A brief overview of the projects

Minaurum’s business model is actually pretty simple. It acquires projects with district-scale potential and completes exploration programs on those properties to advance them to the next stage. The company doesn’t care too much about bringing the projects into production as part of the Minaurum-portfolio, but would rather spin the different projects out to its shareholders before they become producing assets, an approach that should maximize the shareholder value.

1. La Quintera

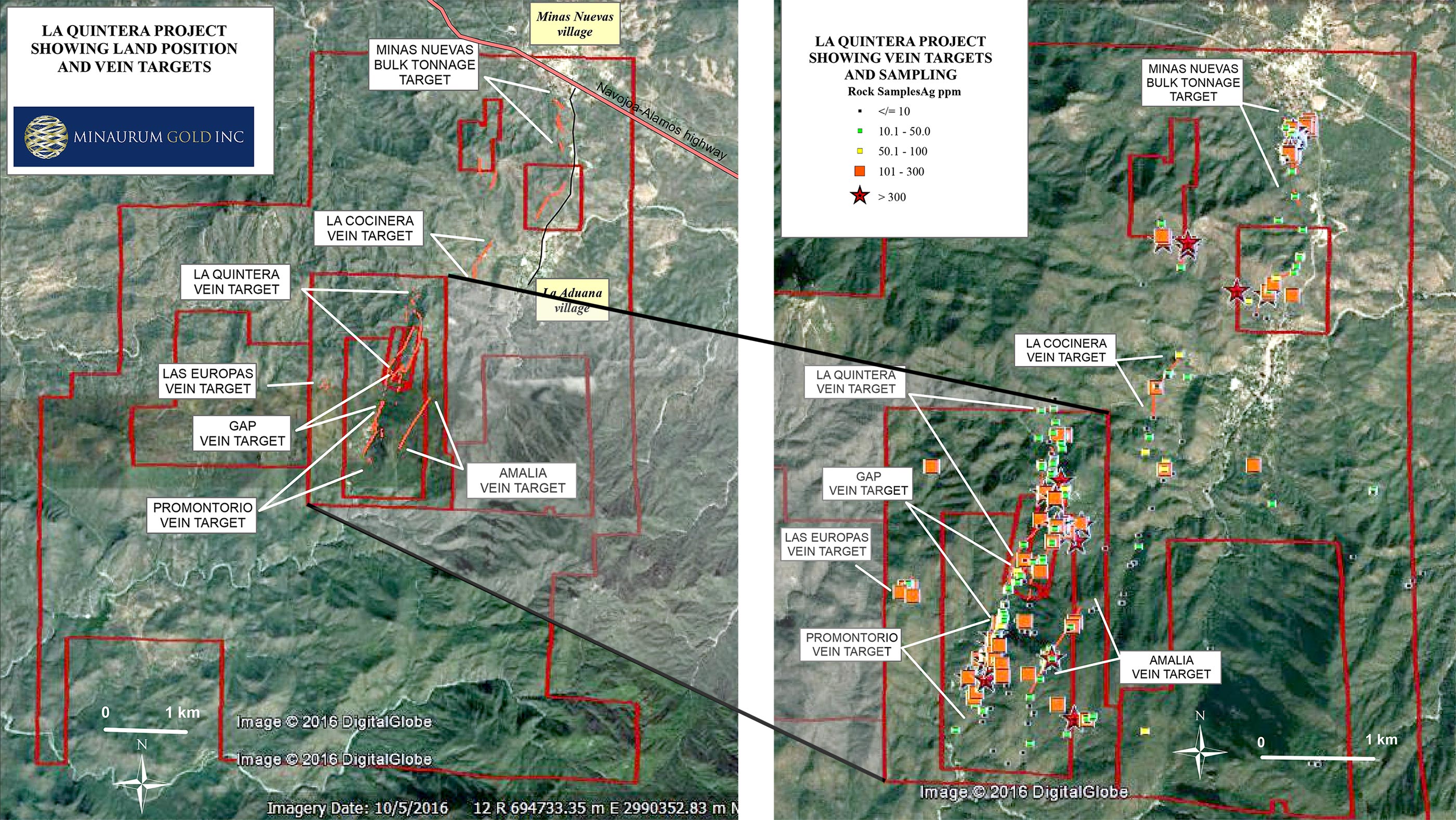

La Quintera is the most recent addition to Minaurum’s project portfolio, and in our opinion, it also is the most exciting precious metals project. Vuelcos del Destino (see later) is also interesting, but La Quintera is in a more advanced exploration stage.

An option to acquire the La Quintera project, located in the Sierra Madre Silver Belt, was signed in September of this year and by paying just C$600,000 in cash, issuing 6 million shares and completing C$3M in exploration, Minaurum Gold will be able to acquire 100% of the project.

Even though these terms sound like an option agreement for an early stage property, La Quintera actually is a past producing property with four mines on the 4,700 hectare land package. Production at La Quintera started in the 17th century and continued to the early 1900’s. During these two centuries, at least 140 million ounces silver have been recovered and that’s an impressive achievement given the lack of modern exploration possibilities and the lack of knowledge on the metallurgical front.

Nobody has touched this exciting property in the past 100 years, with the exception for a small dump-processing operation right after the second world war. The available data from this period reveals impressive results, as the Mexican Geological Services estimated the average grade of these waste dumps to be in excess of 5 ounces of silver per tonne, with excellent gold, copper, zinc and lead credits on top of that. Encountering waste dumps with an average grade that would make exploration companies start to drool is very exciting and it confirms the ultra-rich nature of the La Quintera project.

According to historical records, the average grade of the ore recovered from the veins of both the Quintera and Promontorio mines before they were shut down, was 40 ounces of silver and 8% copper per tonne of rock at a depths ranging between 250 and 485 meters. The current value of these metals would exceed US$1000/t (even at today’s soft commodity prices). Grades were so high at the mines that they led to the construction of one of two mints in Mexico in the 1800’s along with financing the construction of a copper smelter located directly on the project. Indeed, the primary target vein originally had a known strike length of 3.5 kilometers, but the company’s geologists have been able to follow the entire vein system over a length of seven kilometers. With an average vein width of 4 meters (and widths of up to 20 meters have been encountered), this system is much wider than the typical Mexican high-grade silver mines and it’s truly astonishing how this property remained pretty much under the radar screen for almost a century. This was due to the fact the ownership of the claims was very fragmented, but an astute Mexican family was able to consolidate the claims in the past few years.

The private vendor (who also assembled and sold the very successful Santa Elena project to SilverCrest Mines-later purchased by First Majestic Silver (FM.TO, AG)) didn’t want to deal with just anyone. It speaks volumes a small outfit like Minaurum Gold was able to pick up this property and this proves the value of having a good in-country team.

Minaurum immediately started to work on the property, and it looks like the company is identifying drill targets everywhere it’s looking. After doing some ground work during the final quarter of the 2016 calendar year, Minaurum already outlined three drill targets on a 2.5 kilometer long section of the 7+ kilometer long vein system. These targets have the potential to host un-discovered silver deposits that could host similar grades as those mined historically. Additionally, an ongoing mapping and sampling program has also discovered a bulk tonnage target at the past producing Minas Nuevas zone. We expect La Quintera to be the main focus for Minaurum Gold in the first half of 2017 as it could be relatively easy to outline a sizeable maiden resource estimate.

Perhaps the most important feature of La Quintera is the permitted status of the project. Not only is the project fully permitted for exploration, the mining licenses are already in place which could allow Minaurum Gold to fast-track the development of the property once a resource is defined. In addition, a small-scale operation could fund the further exploration plans by mining the onsite dumps. There are over 200,000 tonnes of dumps containing an average of over 5 ounces of silver per tonne of rock (+ by-products). A simple 300 tonnes per day plant could very likely produce silver at a cash cost pretty close to zero (keep in mind you don’t have any mining and blasting expenses, you basically just scoop up the rock and truck it to a plant. By-product revenue could cover the milling expenses).

2. Santa Marta

Right after the La Quintera project, we think the Santa Marta project is almost as promising. This copper-gold occurrence, located on a 7,300 hectare land package, is very likely is a high-grade VMS system with historical records indicating an average grade of 3g/t gold and 4% copper when the property was mined in the 50’s.

In December 2013, Minaurum Gold and Lowell Copper entered into an option agreement whereby Lowell Copper agreed to complete a pre-feasibility study within 5 years.

Unfortunately, Lowell Copper had to drop the project due to the downturn on the basic materials market, but until this day, Dr. David Lowell (often called ‘the world’s greatest explorer) remains one of the most important shareholders (through JDL Gold Corp) of the company which confirms the validity of the ‘district-scale VMS’ theory.

Dr. James Franklin, considered the world’s foremost VMS expert and current the senior consulting VMS geologist for companies including Teck and Hudbay, visited the project in 2012. He described the Santa Marta project as “showing all of the classic features of highly productive VMS systems”. He goes on to observe that, “Santa Marta appears to be a major massive sulfide deposit. It may be a “super -giant” deposit (i.e. >50 million tonnes). …It has all of the classic features of highly productive deposits…”. Still according to Franklin, the VMS occurrence consists of two different parts; a stringer zone of disseminated copper capped by a silica-oxide zone (in the form of an enrichment zone) which is actually forming a ridge.

That ridge has been traced over a length of approximately 700-800 meters, has an average thickness of 75 meters and an average width of approximately 100 meters.

This indicates that the oxide portion of Santa Marta isn’t a new Escondida, but based on Franklin’s estimates we can definitely see the potential for 15-20 million tonnes of ore on the ridge and this tonnage estimate doesn’t take anything below into consideration. According to his rule of thumb, the average depth of a VMS deposit is 3-5 times the strike length, which could indicate a total depth of 2-3,000 meters. This underground zone could be a ‘mine below a mine’ and offers true blue sky potential.

And of course, the simple fact the mineralization is located at surface (of which a small portion has been mined through an open pit), is a huge bonus as most VMS deposits are located at a substantial depth and require underground mines rather than a large open pit.

Perhaps the best way to compare the value of this project is with Nevsun Resources’ (NSU, NSU.TO) Bisha project in Eritrea, where the high-grade oxide copper-gold zones of the VMS system contained just 12 million tonnes in the final reserve estimate. The grade at Santa Marta will be lower, but the tonnage could be higher as the ridge is just the starting point of Minaurum’s exploration effort.

When geologists with an excellent reputation like David Lowell, James Franklin, David Jones and Peter Megaw like this project, we are really looking forward to what a drill program might unveil!

3. Vuelcos del Destino

Minaurum Gold is pretty much the ‘last man standing’ amongst the junior exploration companies in the 33M oz Guerrero Gold Belt. The belt hosts a who’s who of mining companies including; Torex Gold, Agnico Eagle, Osisko Gold Royalties, Timmins Gold and as of Thursday, Leagold. Leagold, a company put together by Frank Giustra and the Endeavour Mining team, acquired the Los Filos Gold Mine for over CDN$500M. Between Vuelcos del Destino and Biricu, Minaurum owns or controls the largest continguous land package in the immediate belt, sandwiched between Torex, Leagold and Osisko.

Keep in mind Minaurum’s senior geologist is David Jones. He discovered the Los Filos gold mine which currently hosts 16 million ounces of gold and has almost 3 million ounces already mined from it. So when he speaks, we definitely listen up.

Minaurum’s Vuelcos Del Destino project shows the same intrusive outcrop as Los Filos, as you can see in the previous image, and if anything, this does indicate the Vuelcos rock is identical to the rock that hosts one of the richest gold deposits in the world. Keep in mind four of the five known major intrusive complexes in the Guerrero Gold Belt have turned out to be significant gold deposits. This is the last one that remains to be drilled.

Vuelcos Del Destino is pretty much drill-ready as Minaurum has secured the necessary drill permits in December 2015. No drilling took place in 2016, and this property will be on the backburner as well in 2017 as Minaurum will get more bang for its buck with the expected Quintera and Santa Marta drill programs.

That being said, the new entrant in the Guerrero Gold Belt will obviously be very interested to kick some tires of the surrounding properties and this could put the spotlight on Minaurum Gold and its Vuelcos del Destino and Biricu projects, being the only junior left in the belt.

4. Biricu

Minaurum wanted to consolidate its position as go-to junior in the Guerrero Gold Belt and initially lent ‘competitor’ Guerrero Ventures C$770,000 (repayable in cash or in a project stake) to fulfill its property option agreement with Alamos Gold by initiating a drill program. The recently released drill results hit wide intercepts of favourable gold-bearing mineralization similar to that found near other Guerrero Gold Belt deposits.

This drill program was designed by David Jones, who discovered the Los Filos project and generated the drill target that became Torex Gold’s (TXG.TO) 5M ounce Media Luna Gold deposit. As Biricu seems to host the same intrusive rock type as at Los Filos and Media Luna, it will be very interesting to see the results from further exploration.

Based on the current loan amount found in Minaurum’s financials, if the loan were converted today, it would result in a direct ownership percentage of over 80%.

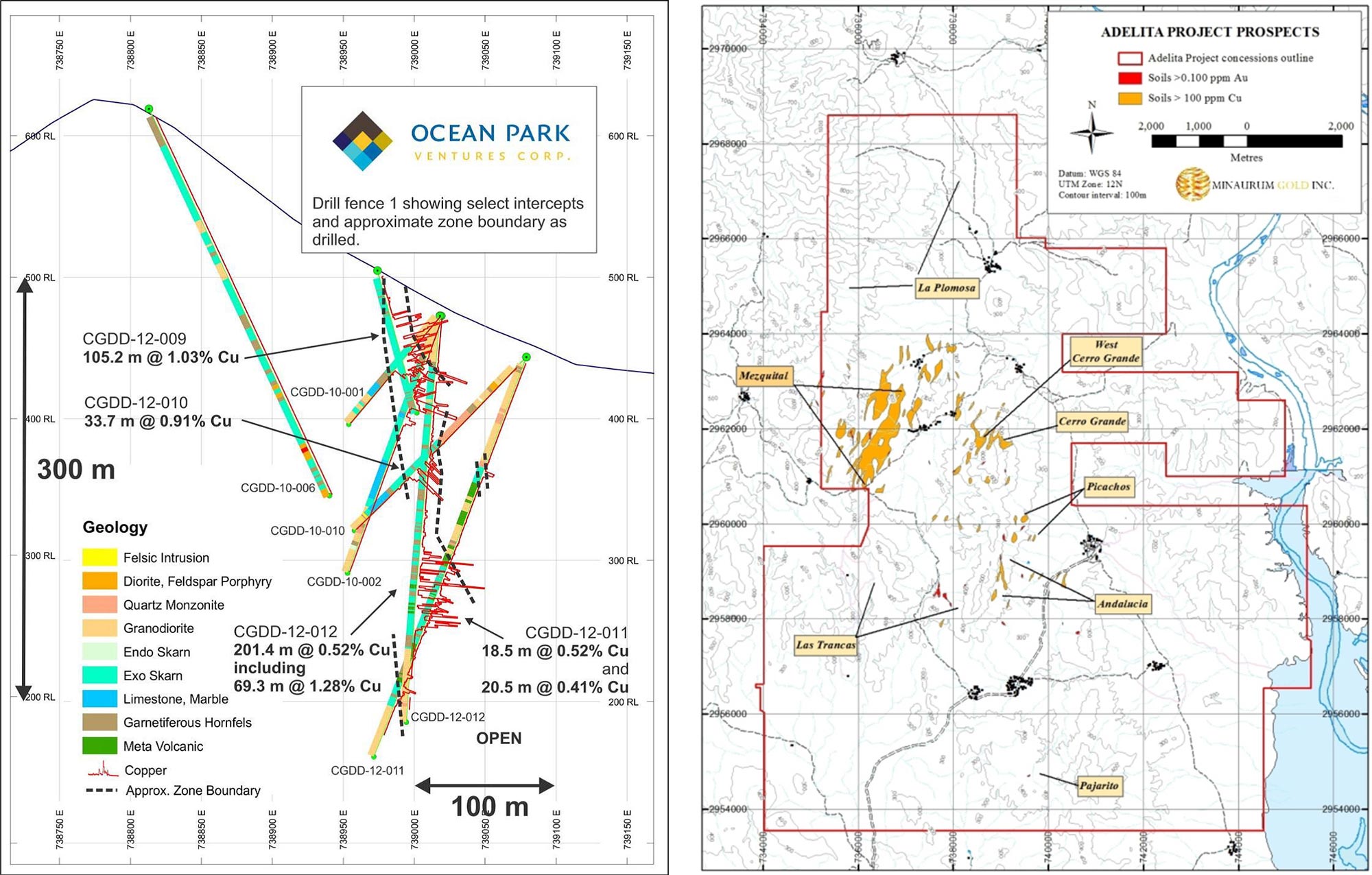

5. Adelita

Minaurum Gold owns 100% of its Adelita concessions which are located in Sonora, within hiking distance from the previously discussed La Quintera project and bordering the Alamo Dorado mine, operated by Pan American Silver (PAAS, PAA.TO).

Even though previous joint venture partner Ocean Park pulled some very interesting intercepts out of the ground at Adelita, the company defaulted on its spending obligations and the property was immediately returned to Minaurum Gold which regained 100% control and a better understanding of the project’s geology without having to spend a single dollar on the property. The copper occurrences at Adelita are very intriguing, as the grades are substantially higher than the copper-gold systems in for instance British Columbia. Drilling returned 105m of 1% Copper and 1 ounce per tonne silver along with 16m grading 1.97% Copper, 0.8g/t Gold and 73g/t Silver.

According to Minaurum’s official filings, it’s entertaining joint venture offers for the Adelita project and we can imagine Pan American Silver could be very interested as its Alamo Dorado mine is currently shutting down. The mining operations at the open pit were terminated in 2015, and the 4,000 tonnes per day mill is now just processing the low-grade stockpiles. As of at the end of 2015, the total reserves ànd resources were approximately 3.7 million tonnes and at a processing rate of 1 million tonnes per year (which is the current processing rate, below the nameplate capacity), Pan American Silver will have to shut down its entire operation before the end of 2019.

6. Aurena

The company’s Aurena project is located in Mexico’s Oaxaca state not too far away from the San Jose mine, operated by Fortuna Silver Mines (FVI.TO, FSM). The property has been the subject of just over 7,000 meters of drilling, which defined two different gold zones.

A first zone has a strike length of approximately 1.8 kilometers (open along strike and at depth) whilst a second zone seems to be open in three directions. Several of the previously drilled holes have encountered economic gold grades at or close to surface with for instance 29 meters at almost 2 g/t gold from surface as well as 43.5 meters starting at a depth of just 4.5 meters as most notable intercepts. A back of the envelope calculation on the few holes drilled in the first zone would already return over 100,000oz gold (half of which would be oxide). Both targets remain open along strike and at depth and could, with similar drill results, return over a million ounces gold.

As the company will be focusing on Santa Marta and La Quintera this year, Minaurum might decide to secure a joint venture deal on Aurena. It shouldn’t be too difficult to outline 80-120,000 ounces of gold in oxide zones which could be amenable for heap leaching.

Keep in mind this oxide layer is just the beginning. Underneath the oxidized mineralization, the company has already detected a substantial footprint of sulfide material, and the potential for a multi-million ounce sulfide resource is a realistic assumption.

We are specifically impressed with Santa Marta and La Quintera – The plans for 2017

Let’s start with Santa Marta. Not only is this also one of the past-producing mines in Minaurum’s portfolio, the average grade of what appears to be a high-grade VMS system at surface is mind-blowing as well.

Santa Marta has been dormant in the past few years, as Minaurum has been working on securing the approval of the local community which needs to give a formal ‘green light’ for any drilling activities to start. Minaurum originally anticipated to receive this ‘go-ahead’ in 2016, but this target date has now been pushed to 2017. That being said, we don’t have the impression Santa Marta will be delayed indefinitely, and we’re quite optimistic to see the community approval later in the quarter, and a first drill program commencing once the government’s drill permits have been issued.

Don’t expect Minaurum gold to blow its cash position on a drill program. The company has always been very cautious with how it’s spending its cash, and we expect Minaurum to remain prudent. That being said, it will be very exciting to start drilling the Santa Marta VMS system and as the mineralization can be traced on surface, it shouldn’t be too difficult to design a very efficient drill program to figure out the extent of the mineralization.

We would expect Minaurum to complete a 2-3,000 meter drill program in 2017 which should allow the company to learn so much more about the mineralized structures. This small drill program should be sufficient to confirm the Dr. Franklins and Dr. Lowell’s theory, and could be the start of defining an economic deposit.

The Santa Marta project is very likely the only reason why Lowell Copper still has an important stake in Minaurum Gold, and David Lowell will be one of the people who’ll be looking forward to a first drill program at Santa Marta.

In the field

At La Quintera, we expect Minaurum to initiate a drill program (the first systemic drill program ever on the property) after completing the current mapping and sampling program. It’s our understanding drill targets are pretty much lighting up like a Christmas tree, and the hardest task for the company’s geologists will be to prioritize the different A-level targets.

It’s amazing to have traced a vein system over a total length of in excess of 7 kilometers, but there are two drill and exploration targets we would like to see prioritized.

First of all, the recently discovered bulk tonnage target could be very interesting as it could provide a path to fast-track La Quintera to production, and provide cash flow to Minaurum which could be used to fund its exploration activities. And, keep in mind, we were focusing on Pan American Silver being interested in the Adelita project to ‘fill the mill’, but even though La Quintera is a bit further away, it could also be very viable to process the ore from Quintera at the Alamo Dorado plant.

As the property is drill-ready, La Quintera will very likely be drilled before the summer. The company will be waiting for the sampling program to be completed before finalizing a drill program, but we would expect a relatively sizeable exploration program of up to 5,000 meters this year. We would expect the bulk tonnage target to be subject of drilling as it should be pretty easy to define a mineralized envelope (according to our interpretation of the maps and our chats with the company it looks like the bulk tonnage has a surface area of 2.7 hectares). Assuming an average depth of 100 meters (based on the nearby pits), we are anticipating a volume of 1.4 million cubic meters, and a tonnage of 3.5-4 million tonnes, depending on the density.

Considering the dump operations in the 50’s and 60’s were processing rock at an average grade of in excess of 10 ounces of silver per tonne of rock, we wouldn’t be surprised to see an exploration target of 30-40 million ounces of silver, and a bunch of by-products.

Besides this bulk tonnage target, we would also expect the company to drill new targets between the historical mines along with a few diamond holes under the historic mines on the property. According to the historic information, the veins were NOT mined out, but just abandoned, probably in the early 1900’s due to the Mexican Revolution. The miners were mining veins with an average grade of in excess of 2,000 g/t silver as well as a high single-digit percentage copper. Punching a few holes under the historical mine works will tell us a lot about the potential at depth, whilst Minaurum could also drill a few holes right next to these veins as one of the theories at La Quintera considers the potential for parallel veins (that might have remained undetected for the old miners) to be very realistic.

Minaurum still has C$2M in cash and will receive a $1M tax refund

We expect to see the company still having access to in excess of C$2M in cash at the end of this month. Additionally, the company expects to be refunded over US$1M in taxes from the Mexican government. This would be a bonus, as the company’s balance sheet hasn’t taken any tax repayment into consideration and has completely written-off the amount owing.

The almost 40 million warrants expiring this summer are in strong hands, whilst the 53 million warrants expiring in December 2018 are in the hands of just a few investors with a long-term mindset and who have supported the company during its ‘hibernation-phase’. These investors don’t seem to have any intention to ‘clip’ their warrants and will very likely just exercise their warrants when they expire.

Operating in Mexico – it’s all about the team

More than anywhere else, having an experienced and capable team is one of the most important assets of an exploration company. That’s certainly true in Mexico as the local communities play a very important role in the permitting processes of any given project. Sometimes it takes a bit longer than expected (cfr. Santa Marta), but in the end, Minaurum’s in-country team will be able to both secure the necessary permits and approvals to advance the projects in the existing pipeline, but will also be able to source new promising projects.

Being able to pick up the La Quintera project right before other senior players could make a move is a strong testimony to the quality of the people on the ground. Dr. Peter Megaw and David Jones are pivotal parts of the team as Megaw discovered MAG Silver’s (MAG) Juanicipio project and his insights will be very valuable at the La Quintera project. David Jones has decades of experience in the Guerrero Gold Belt which is very important to deal with the local communities.

Vuelcos del Destino

Team Bio’s

Darrell Rader

Mr. Rader is responsible for the company’s corporate development, marketing and financing. Having raised over $100 million for mineral exploration and development over his 15 year career, Mr. Rader has significant contacts with institutional investors and bankers. Mr. Rader is currently a director and the founder of Defiance Silver Corp., a near-term Mexican Silver Producer. He previously served as the Manager of Corporate Development for Energold Drilling Corp and IMPACT Silver Corp. Over his eight year tenure, Energold grew from three drill rigs to over eighty in its fleet and IMPACT was transformed from a grass roots silver explorer into a profitable silver miner.

Dr. Peter Megaw

Mr. Megaw, C.P.G., has a Ph.D. in geology from the University of Arizona and more than 35 years of relevant experience focused on silver and gold exploration in Mexico. Dr. Megaw has been instrumental in a number of mineral discoveries in Mexico including Excellon Resources’ Platosa Mine (the highest-grade operating silver mine in Mexico) and MAG Silver’s Juanicipio Deposit (over 800M ounces silver in deposit and immediate surrounding area). Dr. Megaw was awarded the Society for Mining, Metallurgy and Exploration 2012 Robert M. Dreyer Award for excellence in Applied Economic Geology and the Carnegie Mineralogical Award in 2009. This year, he will also be receiving the 2017 Thayer Lindsley Award for Major Discoveries.

David Jones

Mr. Jones is the owner and President of Minera Zalamera S.A. de C.V. (Mexico) and Paradex, Inc. (U.S.). He has 30 years of exploration and management experience, for the past 15 years working in property management/acquisition and as a specialist in skarn and porphyry systems throughout Mexico. Clients have included Teck Corp, BHP-Billiton, Penoles, Luismin, and Grupo Mexico. He is the discoverer of the Los Filos and Independencia gold deposits of the Guerrero Gold Belt and is considered the foremost expert on these gold systems and is actively working on the advancement of other such projects

Michael Williams

Mr. Williams is currently the President and CEO of Vendetta Mining Corp and past chairman of Underworld Resources which was aquired by Kinross Gold Corp. Mr. Williams has significant contacts with both retail and institutional investors and has an extensive investment banking network.

Conclusion

Minaurum Gold has several horses in the stable, but we are very enthusiast about the La Quintera and Santa Marta projects. La Quintera is pretty much drill-ready (with a first drill program expected to start very soon) and with an existing mining license in place, La Quintera could be in production within the next 24 months whereby a small plant could process the ore from the dumps and the bulk tonnage exploration target. Due to the large size of the La Quintera project, Minaurum could be in a position to unlock a lot of value for its shareholders and it’s really unique to be the first company to explore an entire silver district which has been dormant for the past century.

We know La Quintera produced at least 140 million ounces of silver from high-grade ore, with limited mining and recovery expertise. We are convinced there’s much more in the ground there, and we are confident the 2017 drill program will prove us right. If the historic grades and the grades of the dumps are any indication, Quintera should be very profitable, even at $15 silver!

Santa Marta is another high-grade project, and once the drill permits will be secured, Minaurum will hit the ground running to prove up a high-grade VMS deposit.

Minaurum Gold has six horses in its stable, but with Santa Marta and La Quintera it has two thoroughbreds that could easily win the race in 2017. The year will be filled with catalysts and the current share price of C$0.10 could be seen as an excellent opportunity given the risk/reward profile.

Disclosure: Minaurum Gold is a sponsoring company. We have a long position. Please read the disclaimer

Pingback: Minaurum Gold Advancing Alamos Silver | Forex Profit Pros

Pingback: Minaurum gold advancing Alamos Silver – test