Perhaps the best asset acquired by Minera Alamos (MAI.V) in the acquisition of Corex Gold in 2018 was adding president Doug Ramshaw to the team. Ramshaw appears to be omnipresent and does what a president has to do: explain the story to as many ears willing to listen as possible.

It’s been a while since we reviewed Minera Alamos, and Ramshaw is the sole culprit. Not to blow smoke up his hindquarters, but exactly because he is so approachable and omnipresent, there rarely is an opportunity for us to discuss something that hasn’t already been said or discussed before and there was nothing useful for us to add.

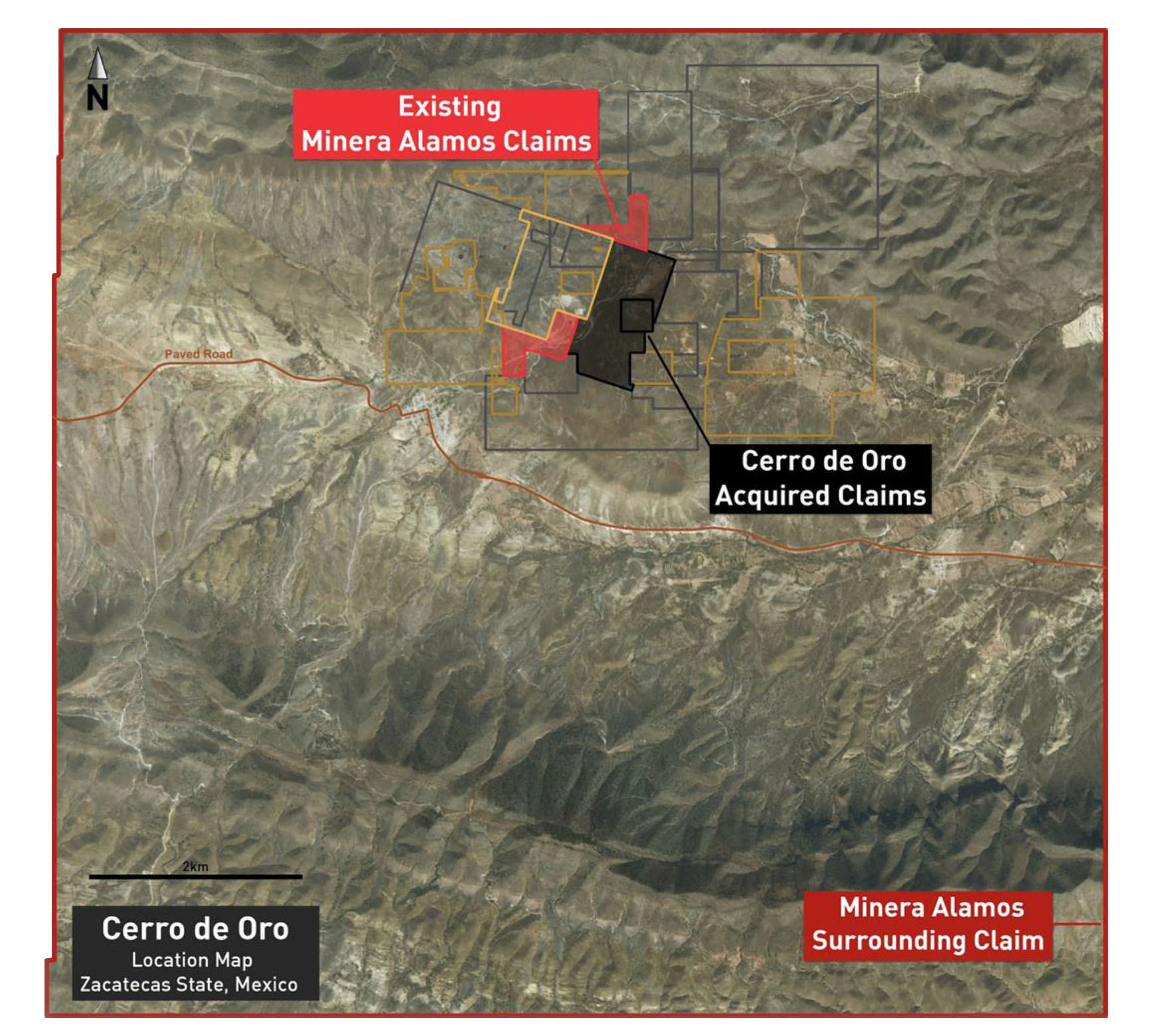

The company filed the technical report on Cerro de Oro last week and this report contains the NI43-compliant resource estimate at Cerro de Oro, the new near-production gold project in Mexico’s Zacatecas state. The headline result of 630,000 ounces of gold was already pre-announced in a November press release, but as usual, the entire technical report contains valuable information and we have used certain elements to try to calculate the economics of Cerro de Oro.

Please note, all our calculations are just our opinion and are in no way the official guidance or expectation of Minera Alamos as a company. While we believe our assumptions to be reasonable, just interpret them for what they are: a back of the envelope calculation.

Cerro de Oro: the technical report has now been filed

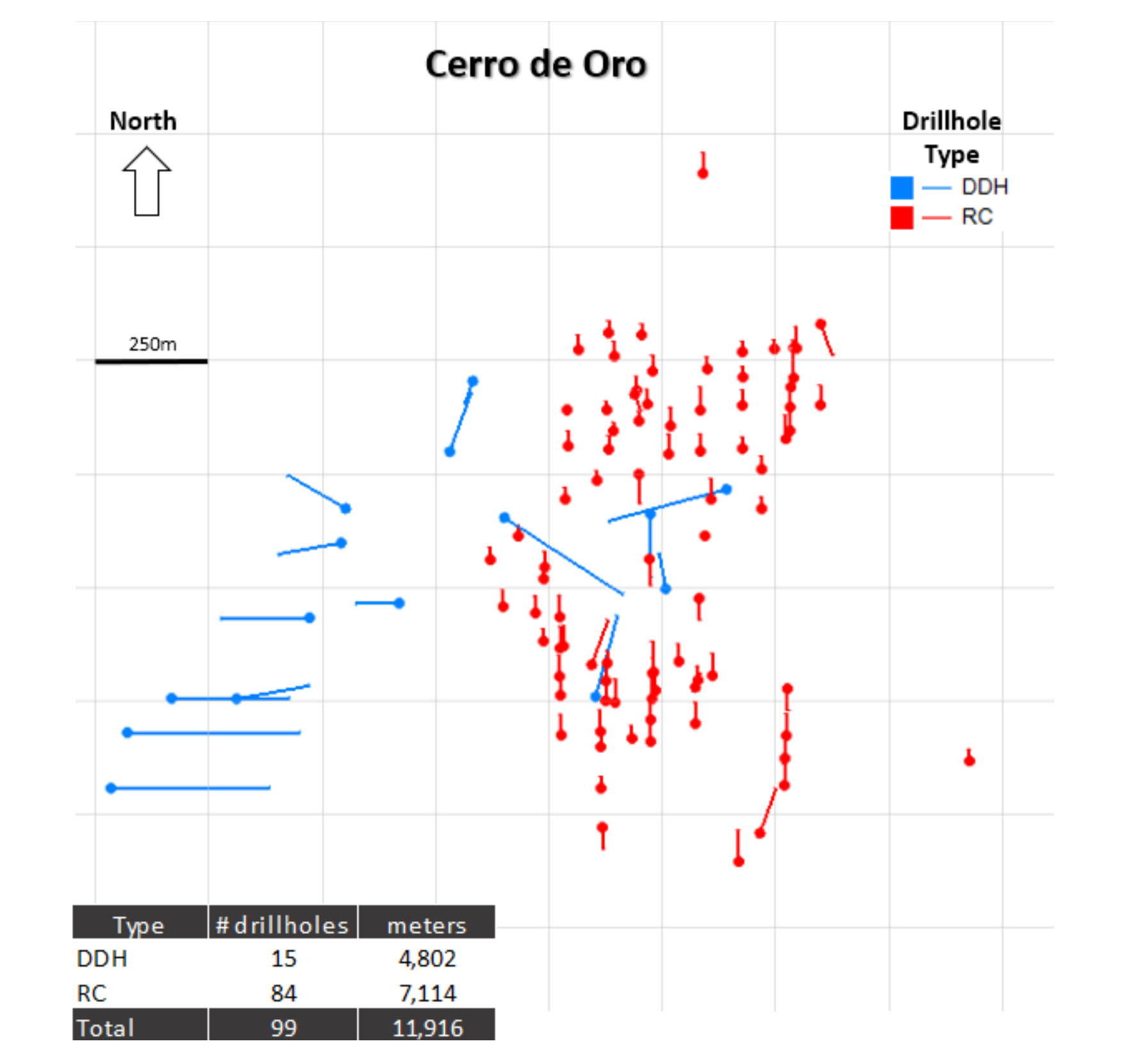

Just over three months after completing the Cerro de Oro acquisition in August, Minera Alamos completed a substantial raise (C$15M at C$0.63 in a no-warrant bought deal) and completed a maiden resource estimate using the rather extensive database of drill results from previous operators.

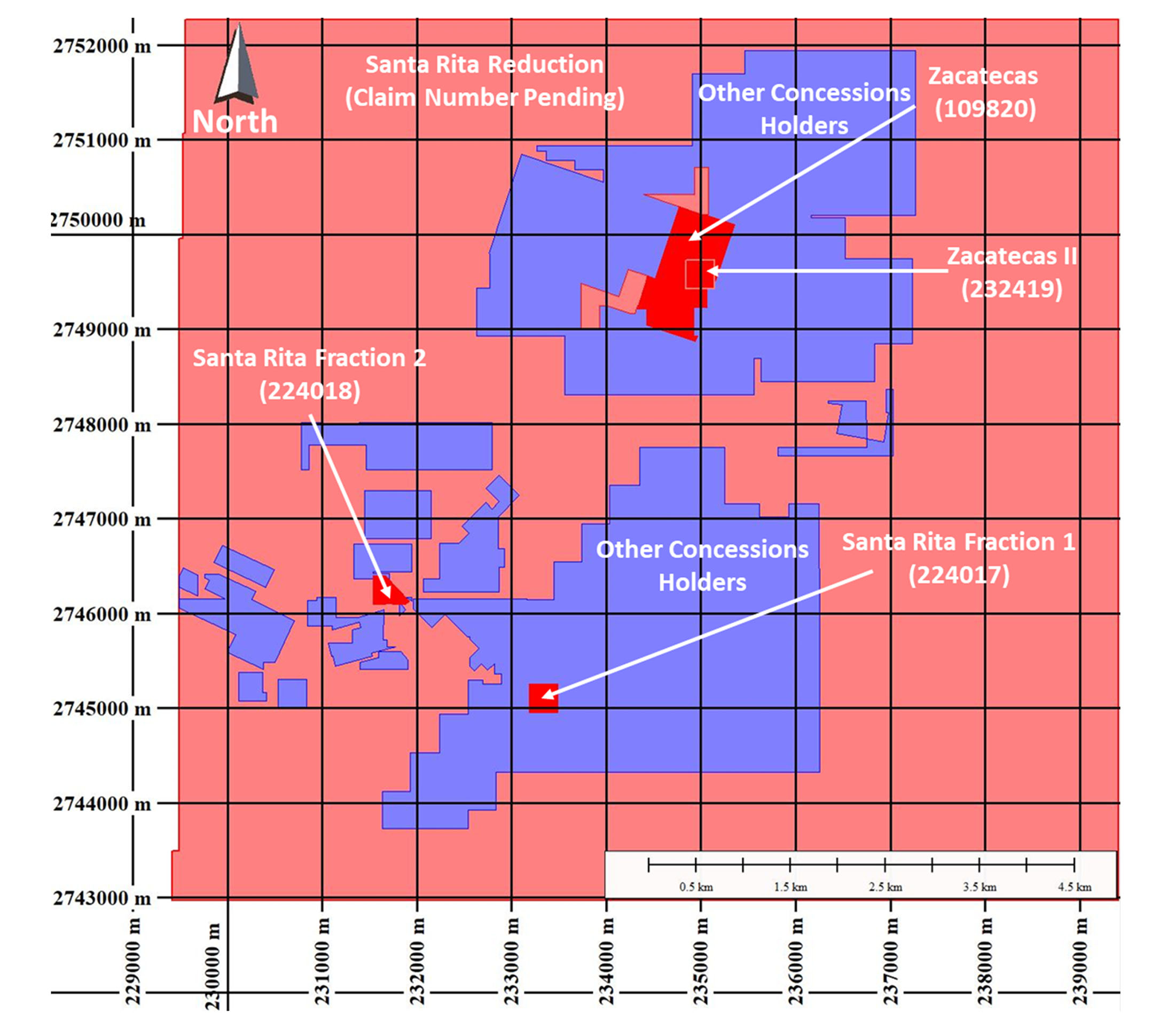

As the project is located in Zacatecas, a well-known mining province with a population and governing body that understands mining, we expect the permitting process to go smoothly and given the low capital intensity compared to for instance Fortuna, we expect Cerro de Oro to be sequenced in between Santana and Fortuna. The cash flow from Santana (expected in 2021) and the existing cash resources could and should be sufficient to self-fund the Cerro de Oro development capex (or at least cover a very substantial portion of the capex with existing cash rather than using debt).

The technical report has now been filed on SEDAR and rather than just rehashing the outcome of the resource calculation, we wanted to go one step further and discuss what the resource means and how the project should be valued.

A back of the envelope calculation: base case and optimistic

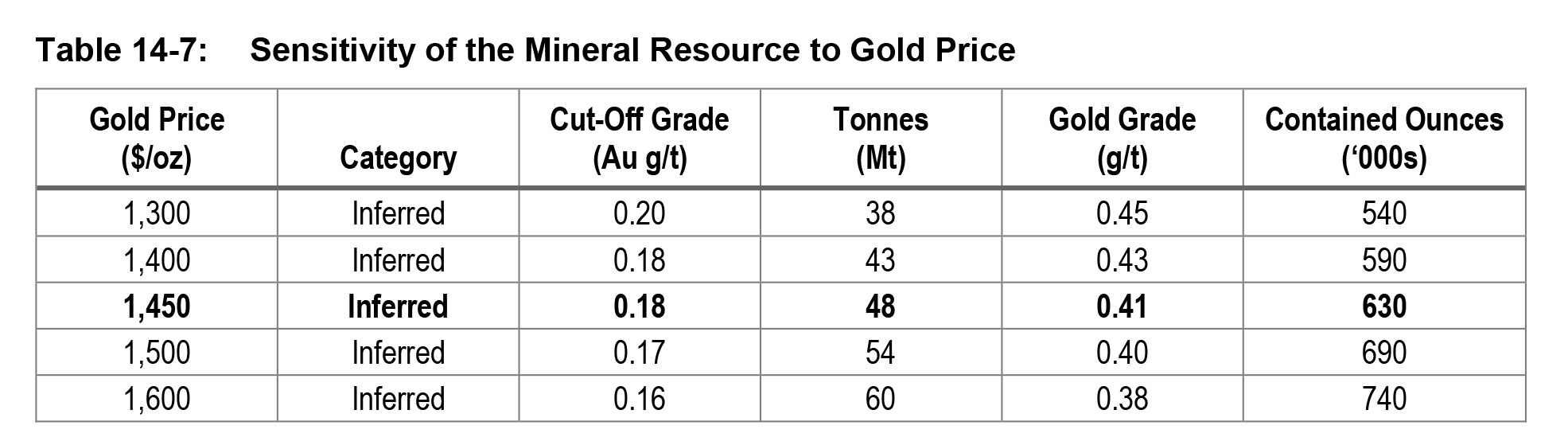

The sensitivity analysis of the resource using a different gold price is also interesting. The 630,000 ounce headline result is based on a resource using $1450 gold as base case scenario, increasing to 740,000 ounces using a gold price of $1600/oz. That’s the highest gold price used in the technical report, and using $1800 gold would likely push the total resource to 70-75 million tonnes at 0.35 g/t gold for in excess of 800,000 ounces.

In our base case scenario we will be using the $1450 gold price, and in our upside case we will be using the $1600 gold scenario. Granted, that’s just $150 higher while the gold price is about $400 higher but you could just consider the additional upside potential to be the icing on the cake.

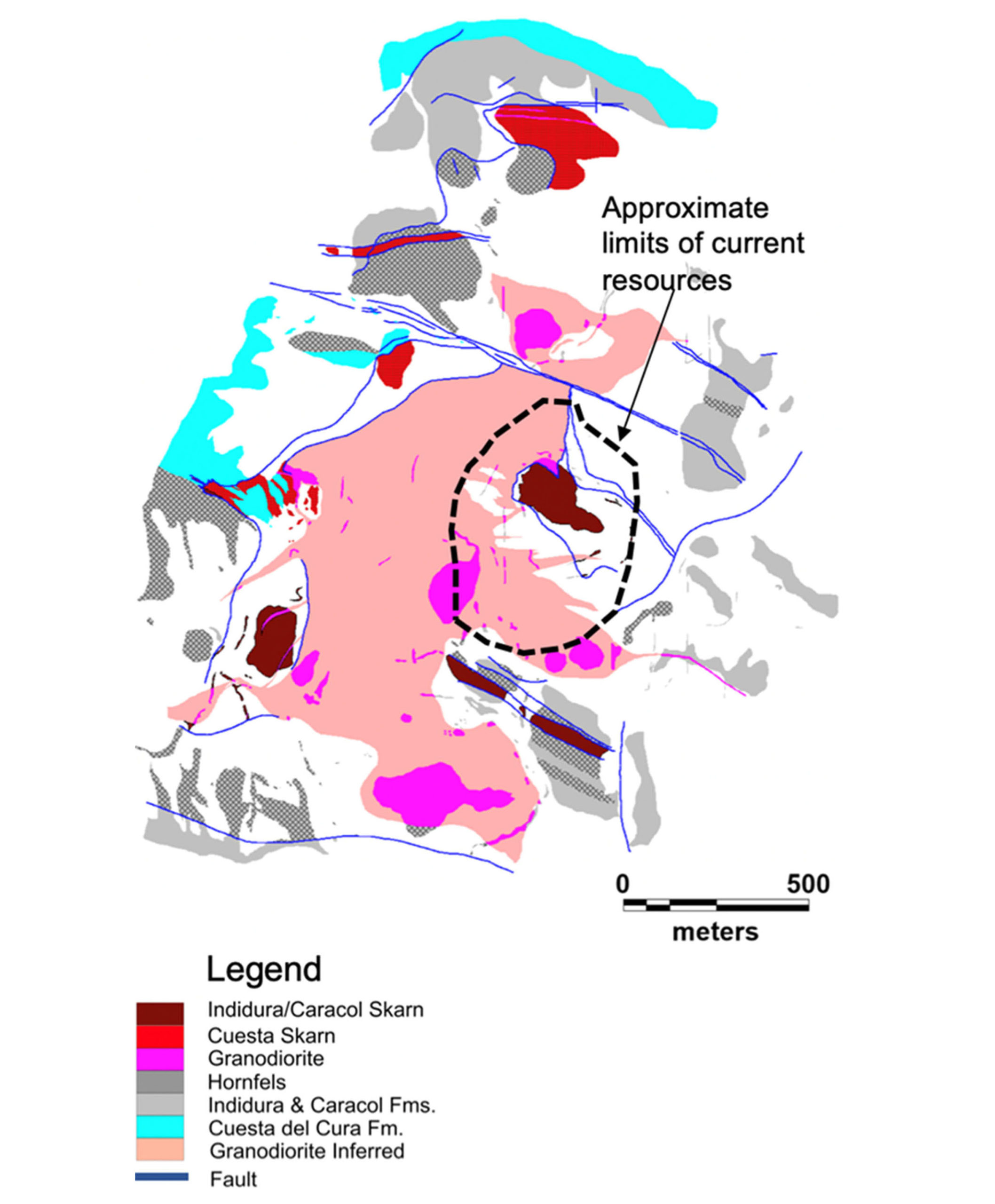

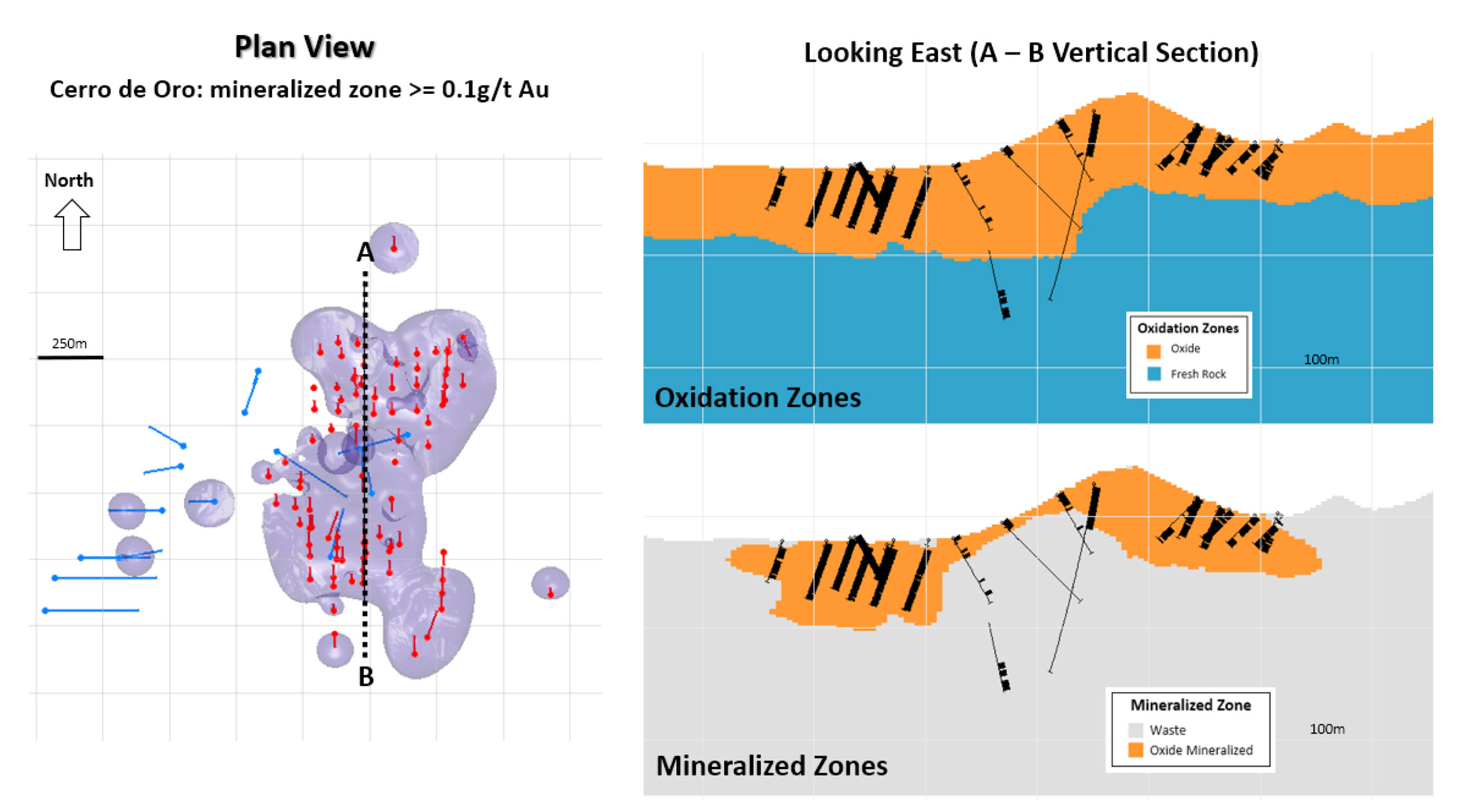

Unlike other mining projects, we don’t expect the strip ratio to vary wildly based on using a different cutoff grade. As you can see in the image below, the mineralization is very consistent and expanding the pit to include more lower-grade rock should not have a material impact on the strip ratio.

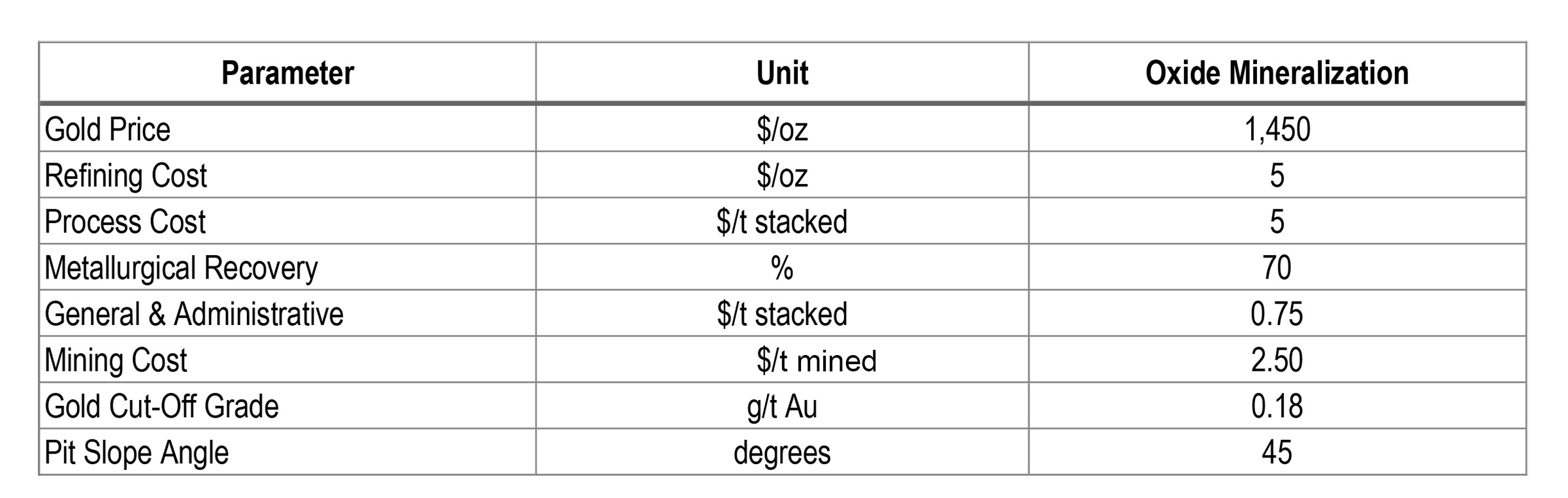

The technical report also contains the inputs used to determine the cutoff grade, and we will use the same numbers to simulate an economic scenario. We noticed one issue in the table below; the mining cost should obviously be expressed on a per tonne basis, and not per ounce of gold.

We will use an initial capex of US$15M and an annual sustaining capex of $3M. The anticipated throughput will be 20,000 tonnes per day and we will use a straight line depreciation.

Scenario 1: $1455 gold

In this scenario we will be using the resource based on a $1455 gold price (important: there are no royalties on the project. We just increased the $1450 base case scenario with the anticipated refining cost to make our calculations a bit easier) and a strip ratio of 0.6:1. Minera Alamos is mentioning a strip ratio of 0.25:1 in its corporate presentation, but we will be a bit more conservative and use 0.6:1. This results in a production cost of $9.75 per tonne of rock.

Moving over to the anticipated revenue per tonne of processed rock. We know the average grade is 0.41 g/t. Minera Alamos is using a recovery rate of 70%, but we know the previous owner of the project also completed bottle roll tests and reached a recovery rate of 75%. We feel 70% may be a bit conservative here and will be using 73% ourselves. This means that for every tonne with an average grade of 0.41 g/t gold placed on the leach pad, 0.30 g/t gold can be recovered. At $1450 gold, the net recoverable revenue per tonne would be $13.95/t.

The mine life in this scenario is 6.5 years, so the annual depreciation expense will be $2.3M. I will assume the $3M in sustaining capex will be immediately expensed and not capitalized. We will use a 40% average tax rate.

Using those numbers, the pre-tax and pre-sustaining capex margin per tonne is $4.20/t. The depreciation expenses are $0.32/t and sustaining capex represents $0.41/t. This means the taxable margin per tonne will be $3.47 and applying the 40% tax rate means a net after-tax margin of $2.08/t. We now have to add the depreciation expense back to this number (as the depreciation represents a sunk cost (= the capex) which needs to be applied to figure out the taxable income.

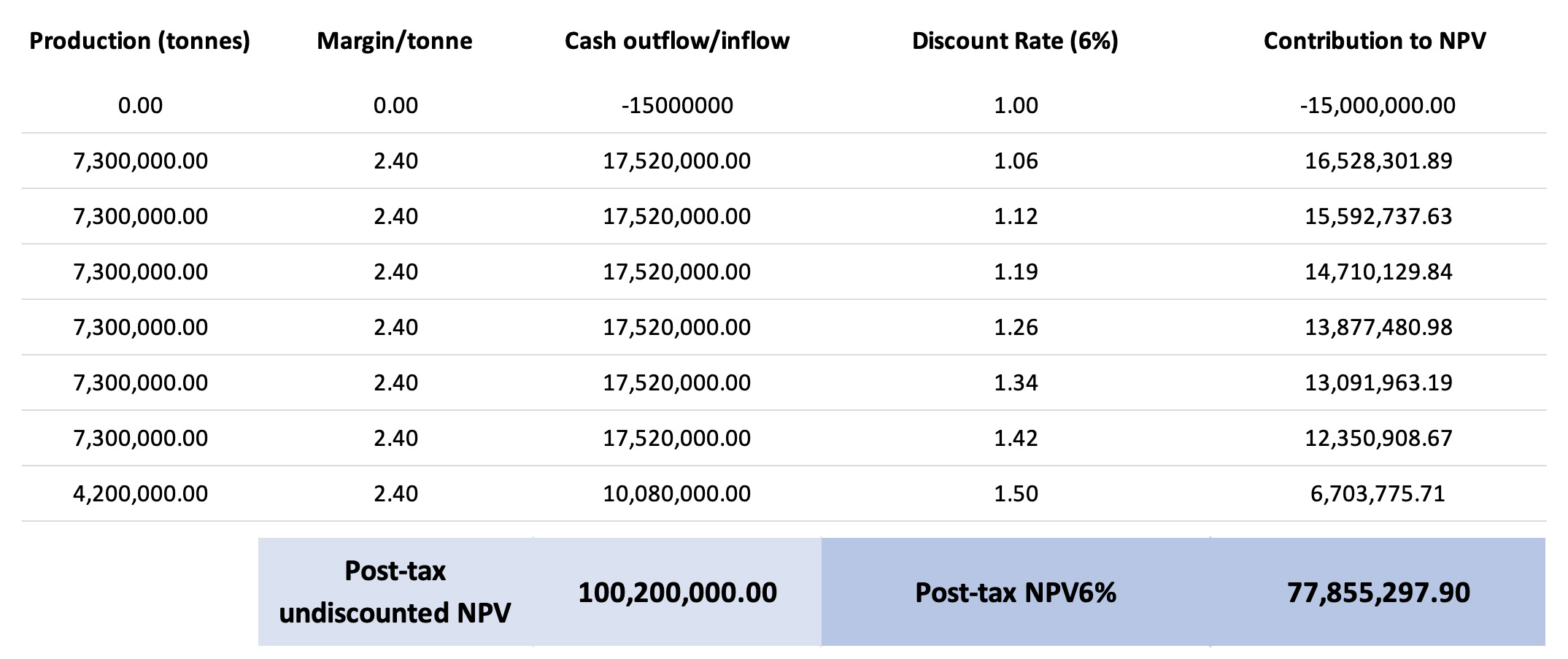

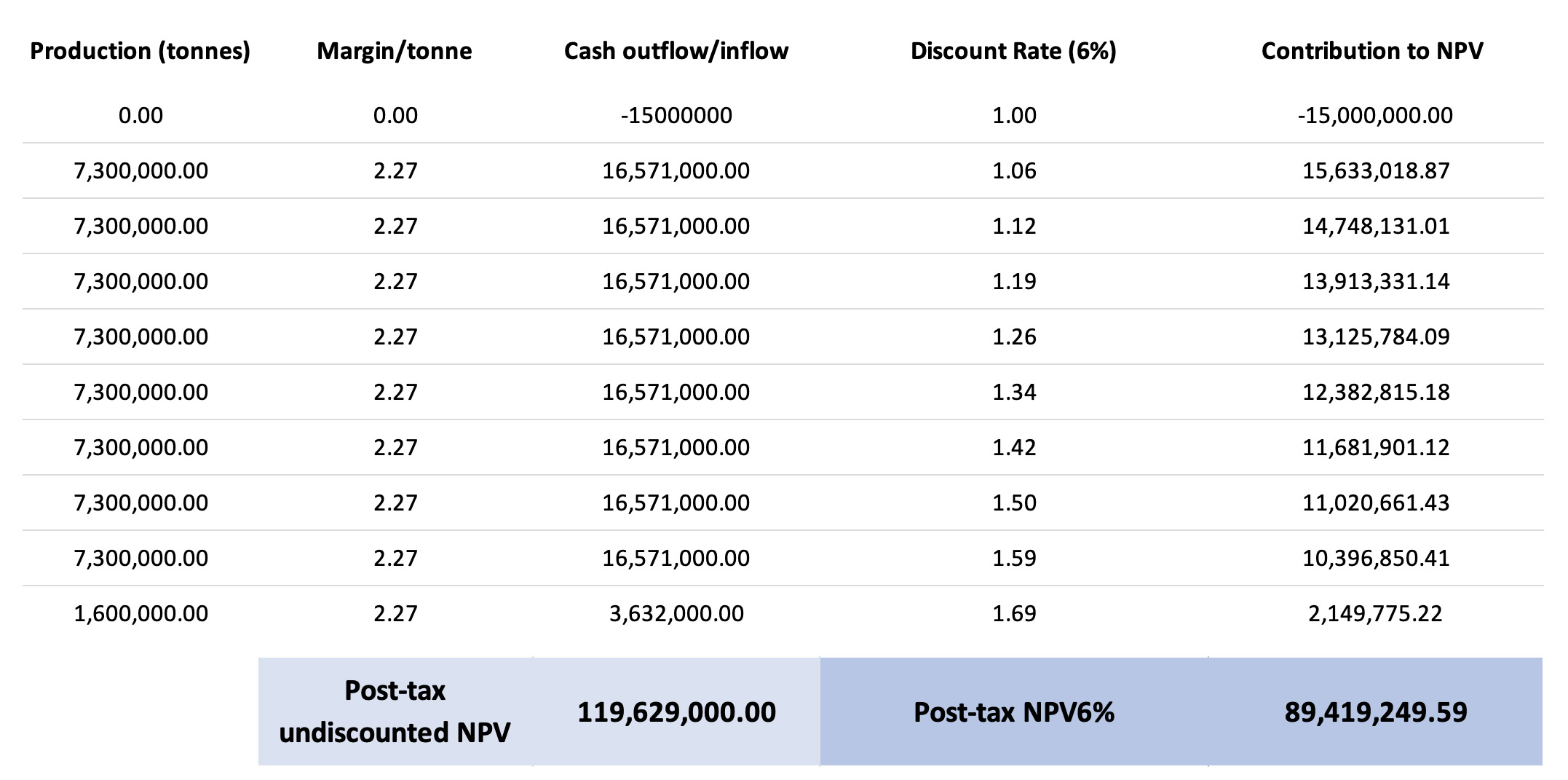

So at $1450 gold and using the assumptions mentioned above, the net after-tax margin per tonne is approximately $2.40/t, and this results in the following back of the envelope NPV calculation using a 6% discount rate – lower than the 7.5% used by Minera Alamos for Fortuna, but higher than the 5% usually used for gold projects.

On an after-tax basis, the NPV6% comes in at almost US$78M, which is just over C$100M. Again, this is based on A) $1450 gold and B) just the currently known oxide resource: it excludes all exploration potential and excludes the potential to leach the underlying sulphides.

Scenario 2: $1605 gold

In the second scenario, we are using a slightly higher gold price of $1605/oz which results in an effectively received price of $1600/oz after taking the refining cost into consideration.

In this scenario we will use a slightly higher strip ratio of 0.85:1 as the lower cutoff grade may indicate a little bit more waste may have to be excavated. This results in a production cost of $10.25/t.

The average grade drops to 0.38 g/t which means that after applying a 73% recovery rate, 0.2775 g/t gold will be recoverable, for a recoverable value of $14.27/t. You’ll notice the net margin per tonne ($4.02) is slightly lower than in the first scenario (due to our assumption the strip ratio will be slightly higher). However, at $1600 gold (and higher, this scenario would still be preferred as the extended mine life means an additional 12 million tonnes will be processed which reduces the impact of the slightly lower margins.

The sustaining capex remains the same but as the mine life increases to 8.2 years, the depreciation expense decreases to $1.83M per year or $0.25/t as the same sunk cost can be spread out over 60 million tonnes instead of 48 million tonnes.

This means the pre-tax margin in this scenario comes in at $4.02 – $0.25 – $0.41 = $3.36. Applying the 40% tax rate results in a net margin of $2.02/t and after adding back the depreciation expense, the net after-tax cash margin per tonne is approximately $2.27/t. Approximately 13 cents per tonne lower than in the $1450 gold scenario which feels counter-intuitive but that’s pretty normal given the lower average gold grade and the longer mine life. And as you can see below, the higher amount of tonnes makes up for the slightly lower margin.

Indeed, despite the lower margin per tonne, the after-tax NPV6% increases by approximately US$12M to US$89.4M which is around C$115M. So while the lower grade results in a lower margin, this trade-off study shows the extended mine life more than makes up for that.

Again, we would like to emphasize this is just a back of the envelope calculation and should only be used for educational purposes. It’s based on elements we deem to be reasonable and feasible but for instance completely ignores the exploration potential (extending the mine life by another 2 years would add an additional C$25M in after-tax NPV to the calculation) and ignores the leach potential of the sulphide mineralization located under the oxide layer. Additionally, we used a straight line depreciation but perhaps Minera will be able to pursue an accelerated depreciation which would reduce the tax bill in the first few years which would boost the net cash flows in that time frame.

There should be more upside than downside, let’s be clear about that.

Minera is fully cashed up and will be cash flow positive by the end of next year

Minera needs cash to continue the development of Santana and to fund the permitting and construction of Cerro de Oro. As the company raised C$15M in the third quarter, it’s now in an excellent shape on the financial front and the existing cash position is sufficient to complete the Santana construction and will go a long way to assist in the construction of Cerro de Oro (and cash flow from Santana should complete the budget).

As of the end of September, Minera Alamos had just over C$23M in cash and almost C$4M in marketable securities (the shares in Prime Mining) which could be liquidated as well. On top of that, subsequent to the end of the quarter, Minera received a C$3.5M finders fee related to a third party owner project and used these proceeds to repay C$2.4M in debt and accrued interest, resulting in a C$1.1M net cash increase. So on a pro-forma basis, Minera has access to approximately C$28M in cash and securities (excluding the expenses incurred at Santana since September 30th).

Conclusion

2021 will be the year of the truth for Minera Alamos. The company has been marketing itself as the specialist in low-capex mines in Mexico and the successful development of the Santana project could result in a substantial rerating for the company as investors are currently still discounting the development-stage assets (Cerro de Oro and La Fortuna) while the exploration upside at all three projects appears to be valued at zero right now.

Even more important than a market rerating will be seeing a positive free cash flow. And cash flow means flexibility. Flexibility to develop Cerro de Oro without having to rely on financing windows in the market, and the flexibility to avoid expensive financing structures. Getting the ball rolling at Santana and starting to write a chapter of cash flow positive gold production without having any net debt on the balance sheet (unlike so many other starting producers) should allow the company to keep all its options open and perhaps aggressively start working towards bringing Cerro de Oro into production. But not just Cerro de Oro. A successful development of Santana could get the ball rolling on the entire development pipeline and catapult Minera Alamos to the status of a 100,000+ ounce gold producer by the end of 2023.

Disclosure: The author has a long position in Minera Alamos. Minera Alamos is not a sponsor of the website. Please read our disclaimer.