Very few people realized Mariana Resources Ltd. (MARL.L, MARL.V) also owned a bunch of interesting exploration assets in Santa Cruz Province, Argentina when Sandstorm Gold (SAND, SSL.TO) made a move to acquire the company. The attention of the market was solely going to the minority stake in the ultra-high grade Hot Maden Copper-Gold project in Turkey, and the Argentinean properties were pretty much valued at zero in that transaction. That’s surprising, considering Mariana was valued at in excess of 100M GBP based on these Argentinean properties alone, before the Turkish assets were acquired in 2014.

Sandstorm’s core business is acquiring royalties and streaming deals on existing properties, and it leaves the exploration phase and development phase of properties to others. That’s why Sandstorm had no plans to explore the Argentinean properties themselves, and the gold streamer was looking for a way to monetize these properties with two things in mind. First of all, it wanted to make sure the exploration properties would end up with a group technically and financially capable of aggressively advancing these gold-silver assets, and secondly, Sandstorm wanted to secure not only a royalty, but a retained interest and continued exposure to success on the assets.

That’s why the deal is a win-win situation for both New Dimension Resources (NDR.V) and Sandstorm: thanks to the low purchase price (payable over a 14-year period), NDR will be able to direct its cash resources to the projects, whilst Sandstorm is comfortable ending up with a 2% NSR and a high equity position in New Dimension Resources. The best of both worlds.

Hitting the ground running with these drill-ready properties

Las Calandrias

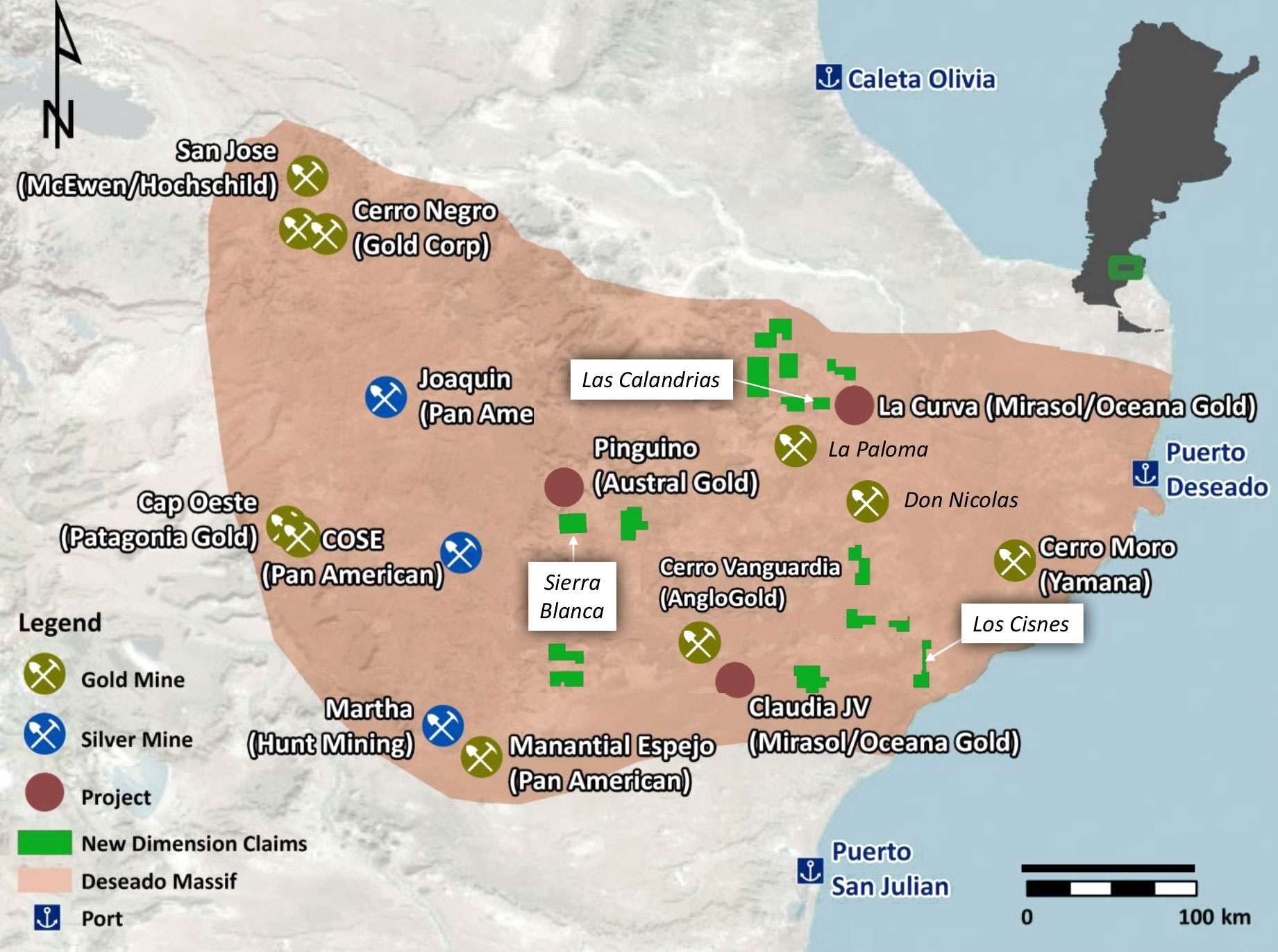

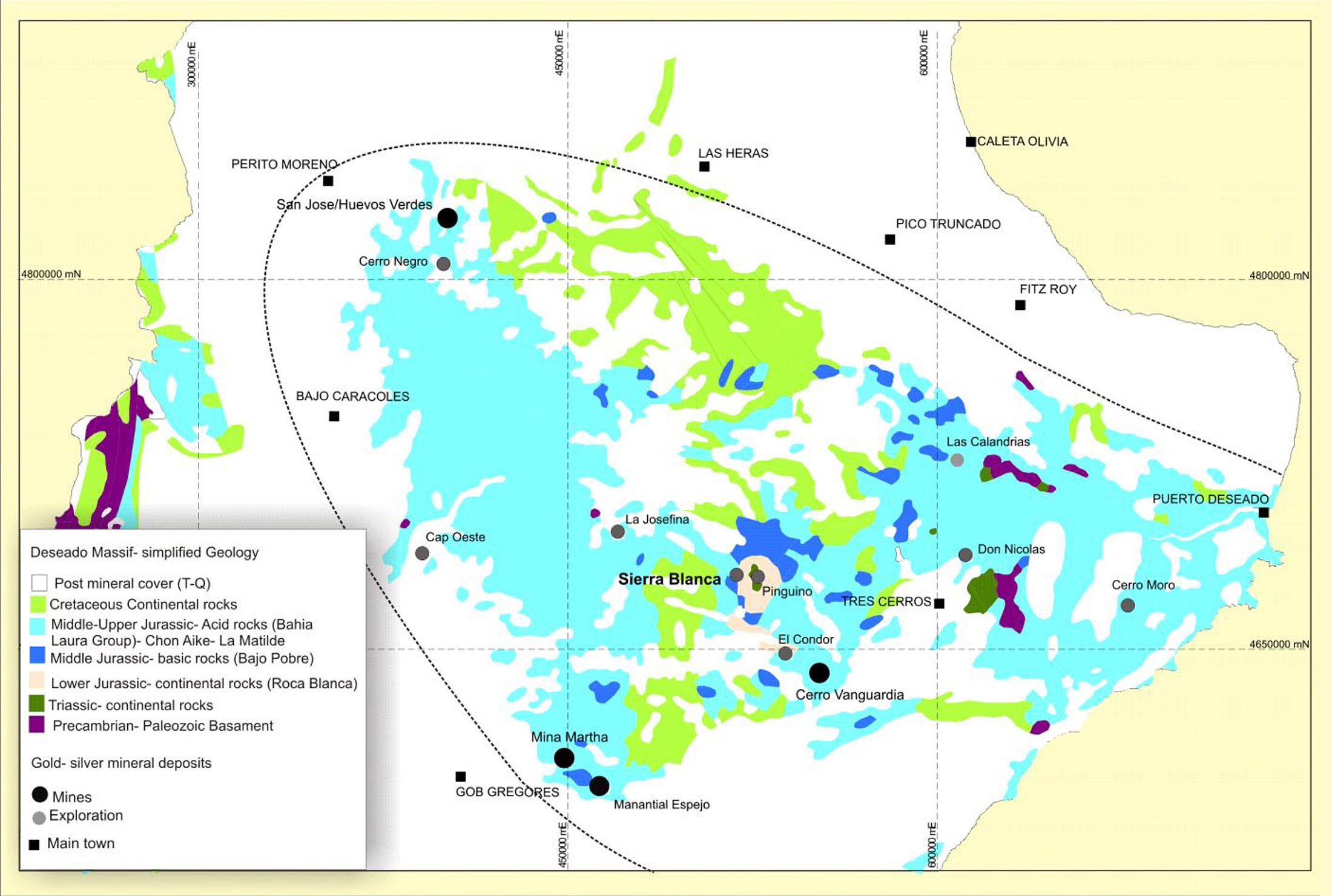

The Las Calandrias project is New Dimension’s flagship project and is located approximately 200 kilometers south of Comodoro Rivadavia in Argentina’s Santa Cruz province. NDR’s projects are located in a mining friendly region called the ‘Deseado Massif’, a 60,000 square kilometer area that already hosts several operating gold-silver mines and development stage projects. Existing precious metals operations in the Deseado Massif include AngloGold Ashanti’s (AU) Cerro Vanguardia mine, Goldcorp’s (GG, G.TO) Cerro Negro mine, Pan American Silver’s (PAAS, PAA.TO) Manantial Espejo mine, and Hochschild/McEwen Mining’s (MUX, MUX.TO) San Jose mine. In terms of recent developments, Yamana Gold (AUY) achieved full commercial production at its Cerro Moro mine in Q2, 2018, whilst the Don Nicolas mine (which borders the Las Calandrias Project to the south) was commissioned in December 2017.

The history of the property reads like a thriller as Mariana Resources actually made a completely new discovery. There had been no historical work at Las Calandrias, and Mariana went in blind after checking satellite images. The project is literally located in the middle of nowhere, and the nearest settlement is approximately 75 kilometers away.

However, the project does enjoy the access to excellent infrastructure: There’s a paved highway and airstrip just 15 kilometers away, whilst a power grid and gas pipeline can be found within walking distance (10 kilometers). This means the project could easily be linked to the existing facilities, which should help to keep the operating expenses low.

The unconventional exploration method based on satellite maps appeared to be very effective as the company almost immediately discovered several parallel quartz veins and breccia’s with just a few hundred meters in between both zones. The Calandria Vein Zone hosts high grade gold veins, whilst the southern end of the property (Calandria Sur) seems to be a more brecciated gold-silver project.

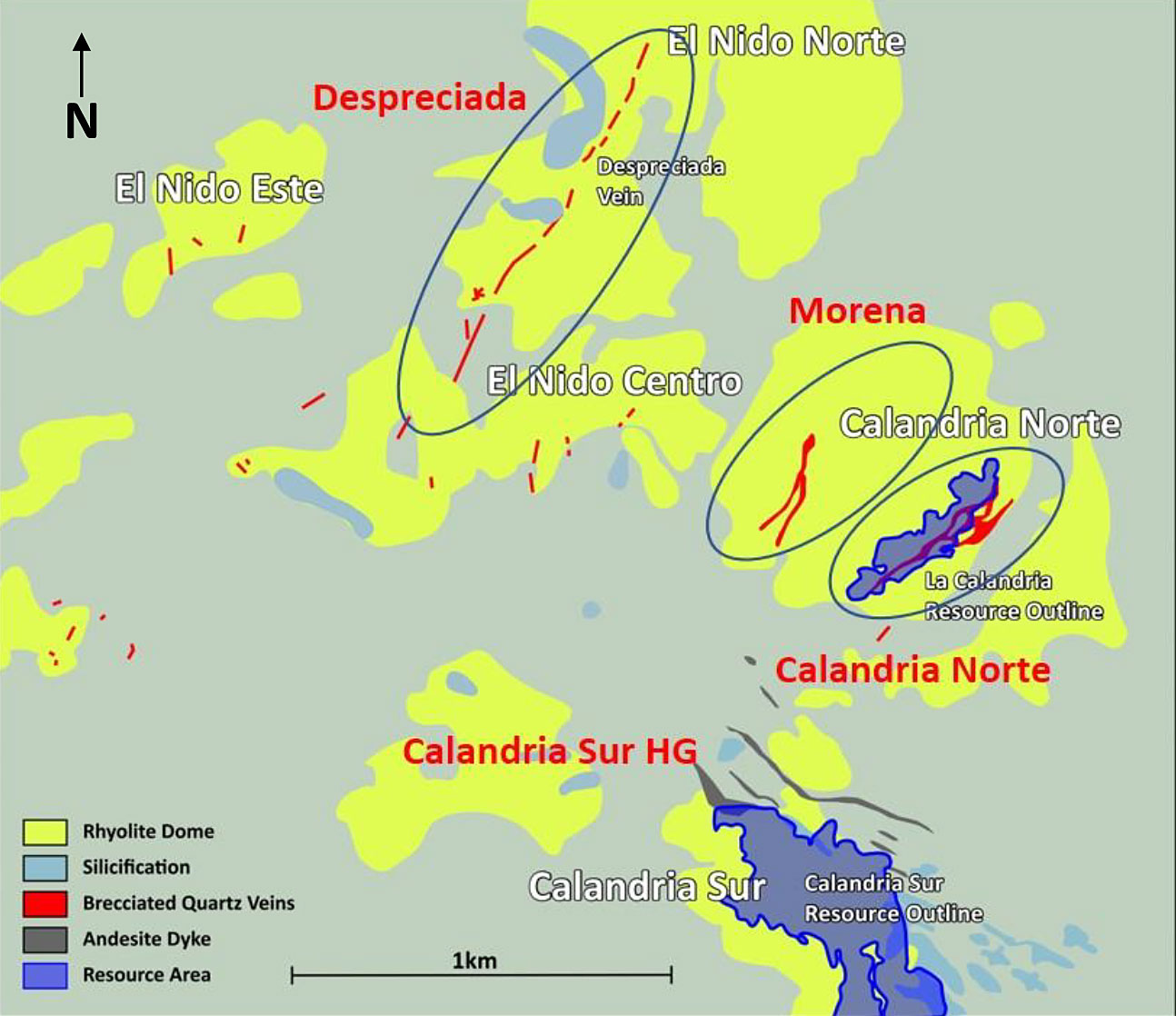

The North zone is the most interesting zone right now, and that’s where New Dimension will focus its attention on. This rhyolite dome complex is located approximately 600 meters north of Calandria Sur (see later), and four different vein systems have been detected on this part of the property: Calandria Norte, Refugio (Tongoril), Despreciada/Nido, and La Morena.

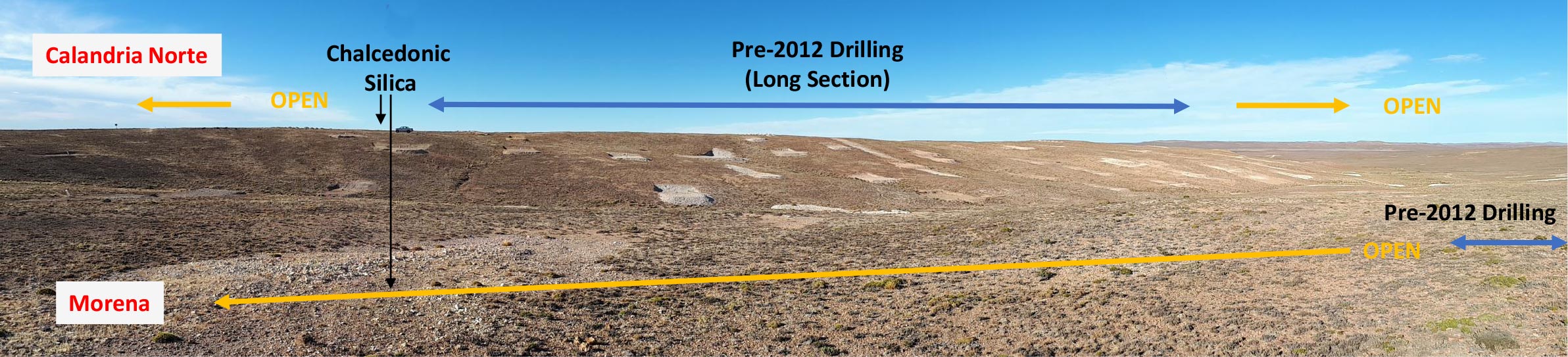

The company was already able to gather quite a bit of information on the Calandria Norte vein, and was able to trace it on surface (!) over a strike length of 400 meters. The average width on surface was 0.4-0.8 meters with average grades of 2.3-20 g/t gold and 8-55 g/t silver. However, surface expressions of the Calandria Norte vein are dominated by low temperature chalcedonic silica, which indicates that the best grades in such an epithermal system will be deeper down. Indeed, drilling in 2011 confirmed intervals such as 4m @ 75.9 g/t Au + 70 g/t Ag in hole CND45. A study in 2009 released a model with this vein covering an area of 500 by 80 meters (including stockwork), and reaching a 200 meters down dip. This represents approximately 20 million tonnes. It’s obviously still early days, but Mariana’s previous work following up on those preliminary indications allows New Dimension Resources to maximize the efficiency of the current drill program.

Approximately one kilometer from the La Calandria Vein zone is the Nido Este target, where more veins (also trending in a northeast direction) have been discovered. This zone was the subject of two drill holes but no silver or gold was detected. But as those holes were ‘wildcat’ holes, we wouldn’t write off Nido Este just yet, and we think New Dimension Resources will spend some time there to figure out where it should drill next.

As icing on the cake: a small outfit (Minera Don Nicolas) has recently completed the construction of a small 1,000 tonnes per day CIL plant and EW circuit, just 40 kilometers from the Las Calandrias North zone. This means that A) the permitting process to build and operate a plant is straightforward in this part of Argentina, but also B) New Dimension Resources could perhaps use the Don Nicolas mill in a scenario wherein Calandrias Norte would be fast-tracked to production.

Throughout the years, Mariana continued to explore the entire property and has now been able to expand the mineralization at Calandria Sur to an area of 750 by 350 meters extending to a depth of (at least) 120 meters. It’s important to note the total size of the mineralized structure is very likely even larger, but New Dimension is constrained by the (southern) border of its own exploration license with the Don Nicolas license. The mineralization remains open in both directions (northwest-southeast) indicating the potential to extend the strike length of Calandria Sur to 1,000 meters.

Looking at the current size of the mineralized envelope, our calculations show a total tonnage of 90 million tonnes. Of course, not every single tonne will contain economic mineralization, but it’s clear this target might provide some low-hanging fruit for New Dimension and should allow it to quickly expand the current resource estimate as Las Calandrias Sur.

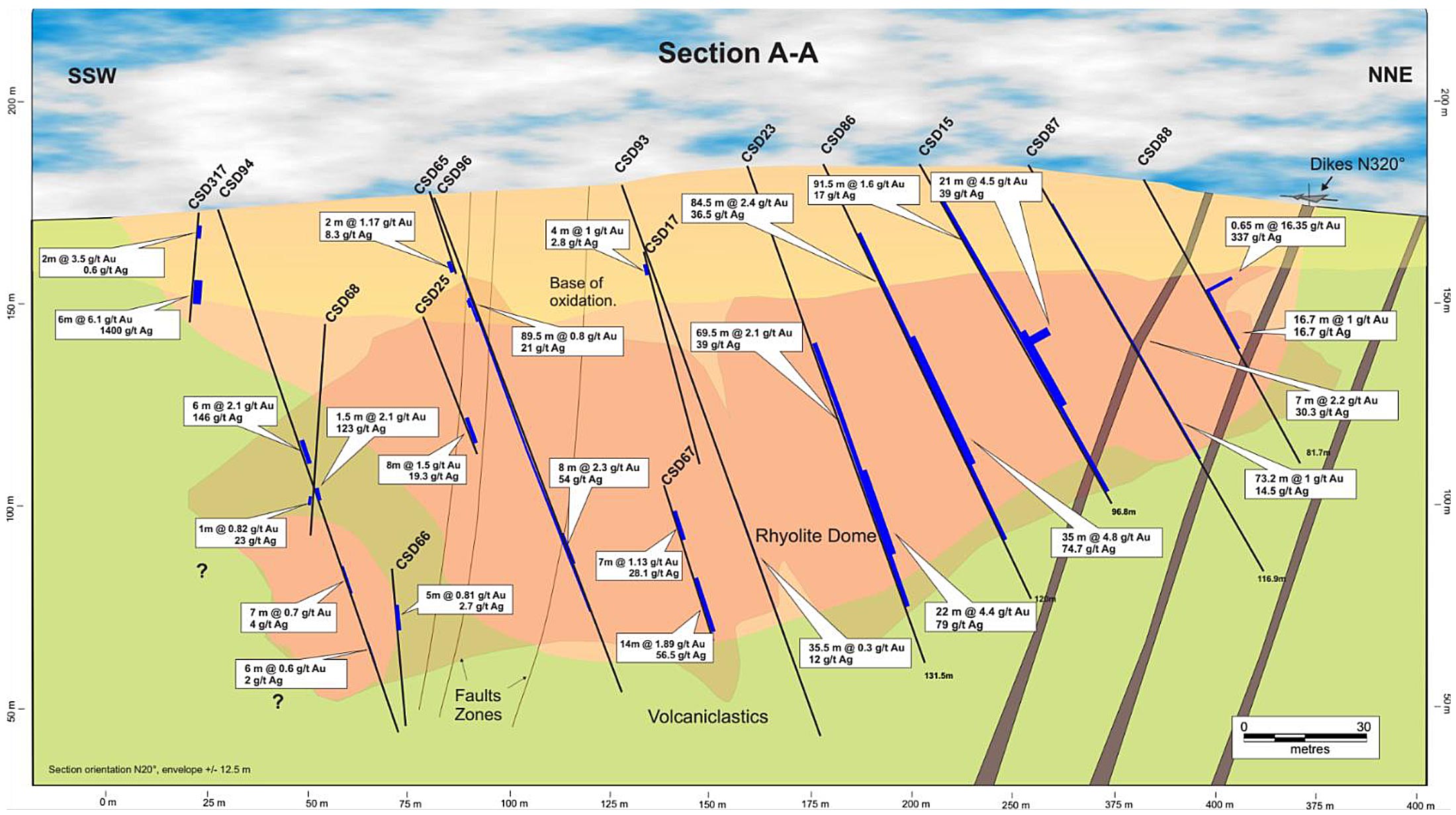

We are also intrigued by the Calandria Sur dome. This was originally deemed to be a low priority target by Mariana Resources, but one of the southernmost cross sections revealed some really interesting assay results in the rhyolite dome (which starts just 20-30 meters from surface). With 90 meters of 0.8 g/t gold and 21 g/t silver as well as similar long intercepts of almost 70 meters containing 2.1 g/t gold ad 39 g/t silver and 92 meters of 1.6 g/t gold and 17 g/t silver, it shouldn’t be too hard to build tonnes here as well.

Great news, but this doesn’t appear to be the company’s priority due to complicated metallurgy at Calandria Sur (see later). This means New Dimension’s primary focus at Las Calandrias will be on the epithermal vein system at the North zone.

Los Cisnes

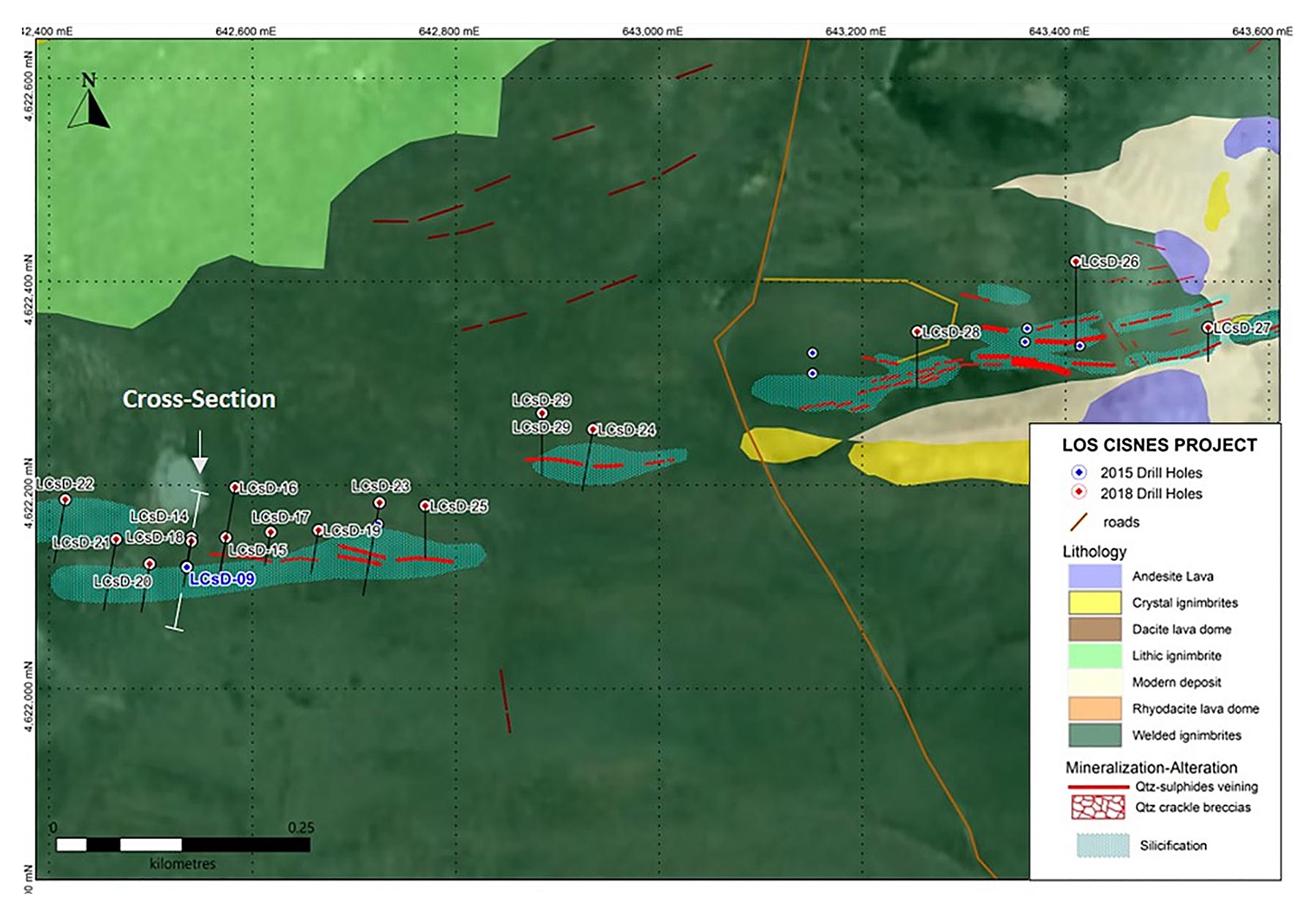

The second interesting project in New Dimension’s portfolio is the Los Cisnes project which is also located in Santa Cruz, approximately 75km SW of Yamana’s Cerro Moro gold-silver mine. New Dimension started its 2018 drill program at Los Cisnes, primarily as a result of logistical considerations associated with the approaching Patagonian winter, before subsequently returning the focus to Las Calandrias.

The Los Cisnes project is a vein and breccia system where historical exploration work has unveiled the existence of high grade veins at the El Brio target, whilst the El Solar target seems to be hosting a rhyolite dome complex, which indicates a large but lower grade mineralized system.

New Dimension’s 2018 drill program focused on the high grade El Brio zone where the company wanted to follow up on a scout drill hole completed by Mariana Resources, that returned 2.9 meters of 755 g/t silver. A stunning interval, and New Dimension is trying to get a better understanding of the mineralized system and completed two step-back holes and two step-out holes. The two step-out holes were also very successful in confirming the high-grade silver zone as the drill bit encountered 2 meters of 381 g/t silver (starting at a depth of just 39 meters) as well as almost 2 meters of 182 g/t gold from a depth of 60 meters. It’s important to note both step-out holes were drilled on opposite sides of the discovery hole.

The step-back holes were perhaps even more impressive, and confirmed the mineralization appears to be continuing (and remain open) at depth. Hole 14 encountered 4.4 meters at 566 g/t silver from a depth of 100 meters, whilst hole 18 found 4.4 meters containing 123 g/t silver. Needless to say there seems to be a lot of silver lying around. Not all zones appear to be economic at this point, but that’s not what this drill program was about. It’s still very early days at Los Cisnes, and New Dimension’s technical team is still figuring out the characteristics of this high-grade silver zone, and so far, so good.

Three other projects

We chose to focus in this report on the two projects that have been drilled this year, but New Dimension’s portfolio also contains the Sierra Blanca silver-gold project in Argentina, the Savant Lake gold(-copper) project in Ontario, and a joint venture with Yamana Gold on the Domain gold project in Manitoba (29.56% NDR, 70.44% Yamana). Recall that Yamana are also operating in Santa Cruz, Argentina, making this more than a good relationship to have.

We chose to focus in this report on the two projects that have been drilled this year, but New Dimension’s portfolio also contains the Sierra Blanca silver-gold project in Argentina, the Savant Lake gold(-copper) project in Ontario, and a joint venture with Yamana Gold on the Domain gold project in Manitoba (29.56% NDR, 70.44% Yamana). Recall that Yamana are also operating in Santa Cruz, Argentina, making this more than a good relationship to have.

Sierra Blanca is another high grade gold-silver project that was originally part of the Mariana portfolio. The company has been able to track a vein for a total length of 1.1 kilometers, but the cumulative strike length of all veins encountered on the property is in excess of 20 kilometers.

The project isn’t as advanced as Los Cisnes or Las Calandrias, but the trenching results look extremely promising. And that’s even an understatement for 9.4 meters at almost 25 kilograms of silver per tonne of rock. On top of that, a scout drill program encountered 3 meters at 9.5 g/t gold and almost 1 oz/t silver, and a longer interval of 30 meters at a lower grade of 2.2 g/t gold and in excess of 3 oz/t silver. Needless to say the Sierra Blanca property is also very interesting, and we hope New Dimension will be able to advance this project in the next few years.

In Canada, New Dimension Resources is in the process of acquiring full ownership of the Savant Lake gold(-copper) project. The company is required to issue 120,000 shares of New Dimension and to pay C$60,000 in cash to the vendors. And whilst we do acknowledge the Savant Lake project could be very prospective for gold and base metal (VMS-type) exploration, we think (and hope) the main focus of New Dimension will be on the Argentinean portfolio. That being said, the company plans to do some work at Savant Lake later this year, so we are looking forward to see NDR’s plans for the Canadian project. At Domain, Yamana is the Project Operator and, whilst results from the 2017 winter drill program were highly encouraging, little work is expected to be undertaken here during 2018.

The current resource estimate at Las Calandrias and the historical metallurgical test work

Considering Calandria Sur and Norte are different types of deposits and will have to be processed in a different way (see later), it’s a bit confusing to see the company report a ‘global’ resource estimate which combines both the Sur and Norte resources.

Fortunately, the technical report provides a good breakdown of the Norte and Sur resources. As expected from an epithermal vein system at Calandria Norte, the majority of the resource is hosted in the fresh sulphide rock which hosts approximately 61,000 ounces of the total 75,000 oz resource estimate.

At Calandrias Sur, it will be important to make the distinction between oxide-, transition- and primary zones as the latter will be a bit more difficult to process. Calandrias Sur contains 332,000 ounces of gold, of which 228,000 ounces are hosted in the fresh rock. This means a total of 104,000 ounces were categorized as oxide or transition material and could be processed in a heap leach scenario.

The Company has indicated that an updated Mineral Resource Estimate for the Las Calandrias project will be completed around mid-September. It will include assay results from both historical and 2018 drilling.

Mariana Resources also completed some very preliminary test work on the metallurgical side of the project. The Calandria Sur zone was subject to some testing, and it looks like both the oxide zones and transition zones could be processed using the cheap heap leach technique. The average recovery rate of the gold was 91.9% for the oxide zones and almost 69% for the transition zone.

That’s a good result as it could allow New Dimension to ‘kick start’ the development of Las Calandrias. Although the project definitely hasn’t reached critical mass just yet. The total amount of gold in the oxide and transition zones is just 50,000 ounces (at Sur and Norte combined), which definitely doesn’t warrant the development just yet. It’s encouraging to see that if a resource of 125-200,000 ounces could be outlined, NDR could give the heap leach process a go. That would provide the cash flow to fund the construction of a conventional CIL circuit, or to truck the rock to an existing CIL plant with excess capacity.

And yes, Mariana Resources had also conducted metallurgical test work on the Calandaria Sur zones that host the sulphide resource. According to the company, there appear to be two options to recover gold in the primary zone (which is hosted in pyrite). A first option would be a flotation circuit followed by pressure oxidation and cyanidation, which resulted in an average recovery rate of 83% for the gold and 75% for the silver.

A second option would be to produce just a pyrite concentrate. The recovery rates for this option were estimated at 82% for the gold and 83% for the silver. Considering this option should be cheaper, we would expect New Dimension to work on producing a pyrite concentrate for shipment to a specialized smelter. Only a few smelters in the world would accept this concentrate. We think the Tshumeb smelter in Namibia, owned and operated by Dundee Precious Metals (DPM.TO) could be a logical choice considering Las Calandrias is located just two hours by truck from a port, and Namibia is conveniently located on the other side of the ocean.

At the Calandria Norte vein, the average recovery rates for the gold (using the LeachWell test results) remain stable (ranging from 85% for the primary zone to 94% for the oxide zone), and a classic CIL circuit seems to be the most convenient option.

New Dimension obviously needs to spend more time and resources on met work, but it’s encouraging to see it won’t have to start from scratch. And the main priority right now should obviously be expanding the gold and silver resources to reach the critical mass.

The deal terms

As Sandstorm Gold, the property vendor, really wanted to make this deal work to ensure the properties would end up in the hands of a very capable management and technical team, we have the impression the streamer has been very generous at the negotiation table. There are no upfront payments, no balloon payments, and no minimum work commitments.

The only requirement is for New Dimension to pay Sandstorm C$400,000 (in cash or stock, at New Dimension’s election) per year until 2032, which means the total consideration for the properties will be capped at C$5.6M (unless the projects reach commercial production before that date, as that’s one of the milestones that could halt the annual payments). But if you’d apply a 5% discount rate to the ‘value’ of the money (C$400,000 in 2032 will be worth less than C$400,000 today), the total acquisition cost is just C$4M. Additionally, Sandstorm Resources will end up with a 2% NSR on the properties, which is ultimately what Sandstorm is really interested in.

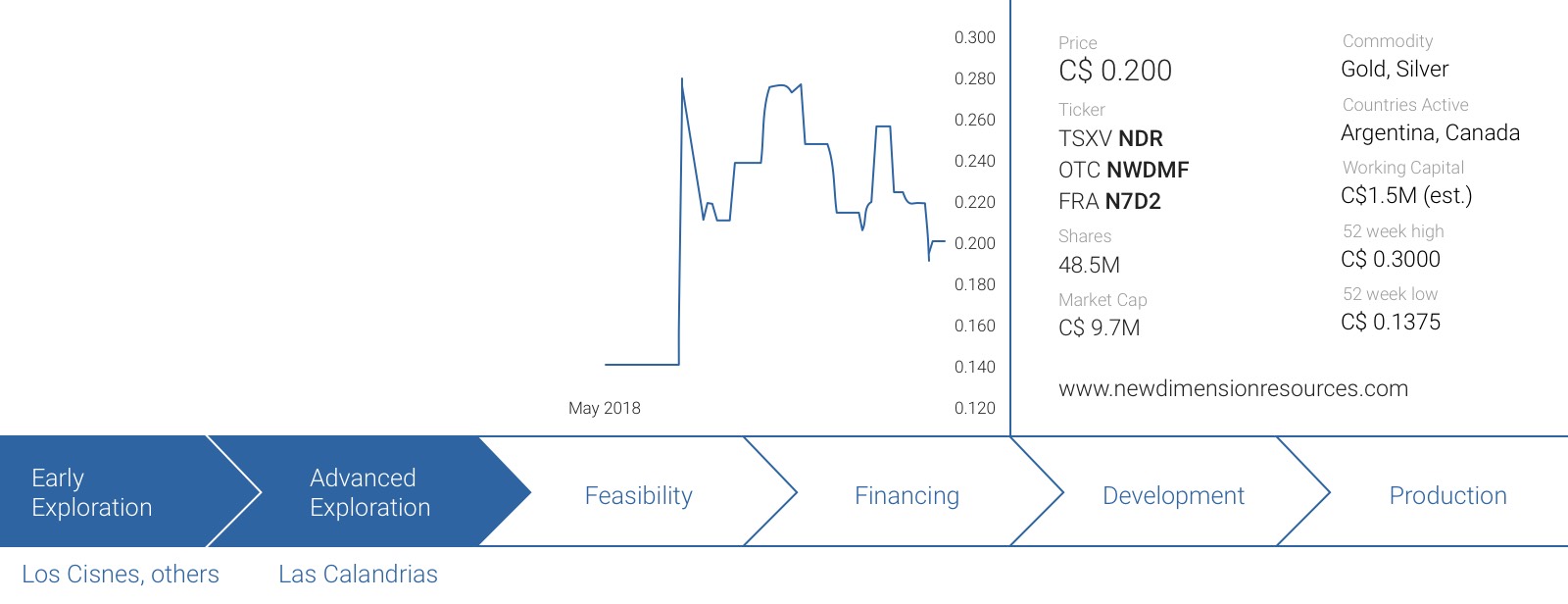

New Dimension’s current financial situation and share data

After completing a C$3.8M raise in the first half of this year, New Dimension Resources currently has approximately 48.5M shares outstanding. The vast majority of these shares (almost 40M) remain in lock-up until September 15th and there might be some pressure on New Dimension’s share price once these shares become free trading next month.

However, we expect the company to release the assay results from the Las Calandrias drill program weeks before these shares start trading, so the market might be able to naturally ‘absorb’ the stock that will become available. Also, the Company currently expects to release an updated Mineral Resource Estimate for Las Calandrias around mid-September. It’s important to note there are virtually no warrants outstanding, so the risk of ‘warrant clippers’ remains relatively low. Those who bought the C$0.11 paper and sell, will no longer retain any upside potential from a discovery.

At the end of May, New Dimension had C$3.5M in cash, but we expect the current cash position to have decreased to C$1-1.5M after the recent drill program.

The management & board of directors

Eric Roth – President, CEO & Director. Former COO of Mariana Resources and former CEO of Extorre Gold Mines

Mr. Roth (PhD in Economic Geology, University of Western Australia, FAusIMM) is a non-executive director of Awale Resources Ltd. He has 25 years of experience in international minerals exploration and mining project evaluation, and was most recently Chief Operating Officer of Mariana Resources, which was acquired by Sandstorm Gold in July, 2017. Prior to this, he was Chief Executive Officer of Aegean Metals Group Inc., President and Chief Executive Officer and then Director of Extorre Gold Mines Ltd. until Extorre was acquired by Yamana Gold Inc. in June, 2012. Prior to Extorre, he was engaged as a consultant on South American gold projects for Exeter Resource Corp. and Kinross Gold Corp. From January, 2002, to March, 2008, he was also employed by AngloGold Ashanti Ltd., initially as the Lima-based Peruvian project and South American opportunities manager and subsequently as the Johannesburg-based global head of greenfields exploration. He is also a principal of consulting firm ER Global Consulting SA.

John Wenger – CFO

Mr. Wenger, is the Chief Financial Officer and VP Strategy for Contact Gold Corp., a Nevada-focused exploration company. Prior to that he was the CFO and Secretary at Pilot Gold Inc. where he was part of a management team that raised over $100 million, and successfully completed multiple property transaction deals and acquisitions. Mr. Wenger worked for Ernst & Young LLP Chartered Accountants from 2001 to 2011, where he acquired considerable experience in financial reporting for both Canadian and U.S. publicly listed companies, primarily in the mining industry. Mr. Wenger has been a Chartered Professional Accountant with the Chartered Professional Accountants of British Columbia since 2006.

Glen Parsons – Director. Former CEO of Mariana Resources

Mr. Parsons (CA and BComm in economics) is the Chief Executive Officer for Awale Resources Ltd., and a qualified chartered accountant. Mr. Parsons has over 20 years international experience in company building, corporate finance, treasury, operational and general management. His most recent role was as Chief Executive Officer of Mariana Resources, running a diversified global exploration and development company, which was acquired in July, 2017, by Sandstorm Gold. He is also non-executive chairman of AfriTin Mining Ltd., an African tin-focused exploration and development company. He has built new profitable businesses and divisions within both large and small organizations. He was also an executive director of RFC Corporate Finance Ltd., a specialist mineral resources investment bank and fund manager. His specific experience in the junior mining and exploration sector is extensive with appropriate LSE (London Stock Exchange)-AIM (Alternative Investment Market), Toronto Stock Exchange and TSX Venture Exchange knowledge and has been involved with a number of successful global equity and debt raisings for junior and developing mining companies on these exchanges. Thomas H. Burkhart – Director

Mr. Burkhart is Vice President of Exploration for Argonaut Gold Inc. Prior to his current role with Argonaut Gold, Mr. Burkhart was Vice President of New Dimension Resources Ltd. (1999-2010) and Vice President of Pegasus Gold Inc. (1984-1998) Mr. Burkhart graduated with a B.Sc. in Geology in 1979 from the University of Nevada. He has nearly 30 years experience in exploration and project management in Mexico, South and Central America, Canada, Alaska, Australia and the Western U.S.

Scott Heffernan – Director

Mr. Heffernan is Executive Vice President of Exploration for Trek Mining Inc. Prior to Trek Mining, he was VP Exploration of True Gold until it was acquired by Endeavour Mining in April 2016. Heffernan is a registered professional geologist with 20 years of hands-on exploration and management experience throughout the Americas and Africa. Prior to joining True Gold, he held the dual positions of VP Exploration for Wealth Minerals Ltd., and Exploration Manager (Argentina) of Cardero Resource Corporation. Previous to that he was with Equity Exploration Ltd., a Vancouver-based consulting and contracting firm specializing in turn-key geological project management. Mr. Heffernan received his B.Sc. (Geology) from the University of Alberta and completed his M.Sc. (Geological Sciences) with the Mineral Deposit Research Unit (MDRU) at the University of British Columbia.

Fred G. Hewett – Director

Mr. Hewett is a Professional Engineer with over 40 years of experience in the mining industry. He graduated in 1972 from the University of British Columbia with a Bachelor of Science degree in Geology and has worked his way through many aspects of the mining profession from Mine Geologist, Exploration Manager to Chief Engineer with several major Canadian mining companies. Mr. Hewett joined the Northair Group as Exploration Manager in 1981 and retired as President, CEO and Director of International Northair Mines Ltd in 2014. He is a fellow of the Geological Association of Canada, a life member of the Canadian Institute of Mining & Metallurgy and holds memberships in the Association of Professional Engineers of British Columbia, the Association for Mineral Exploration British Columbia and the Society of Exploration Geologists.

Conclusion

At the current share price of C$0.20, New Dimension Resources’ market capitalization of C$9.7M (which includes approximately C$1-1.5M in cash, following completion of their 2018 drill program) doesn’t appear to be doing the company any justice. Both Las Calandrias and Los Cisnes should be worth at least the current market capitalization on their own, and then you still get Sierra Blanca and Savant Lake thrown in for free.

The only reason why Mariana didn’t continue to work on these projects was the fact that nothing beats a 15 g/t gold and 2% copper project (Hot Maden) and it made sense for Mariana to dedicate its resources to the ‘money maker’. But for New Dimension Resources, the Argentinean portfolio will be the main focus, and the exploration properties are finally getting the attention they deserve.

Disclosure: New Dimension Resources is not a sponsor of the website. We have a long position. Please read the disclaimer