The initial graphite hype from almost a decade ago has died which means only the companies with projects that have a serious chance of effectively being developed are left standing. NextSource Materials’ (NEXT.TO) Molo graphite project in Madagascar is one of those graphite projects that make economic sense and an updated feasibility study has unveiled economics that are even more impressive than previously completed studies indicated.

The recent private placement was meant to plug the hole in the working capital position and now it’s up to NextSource to secure the US$21M in capex funding and initiate the construction activities at Molo. NextSource has already secured its Mining and full Environmental Permit and the remaining smaller permits for Molo will naturally come during the construction process.

A recap of the Molo graphite project

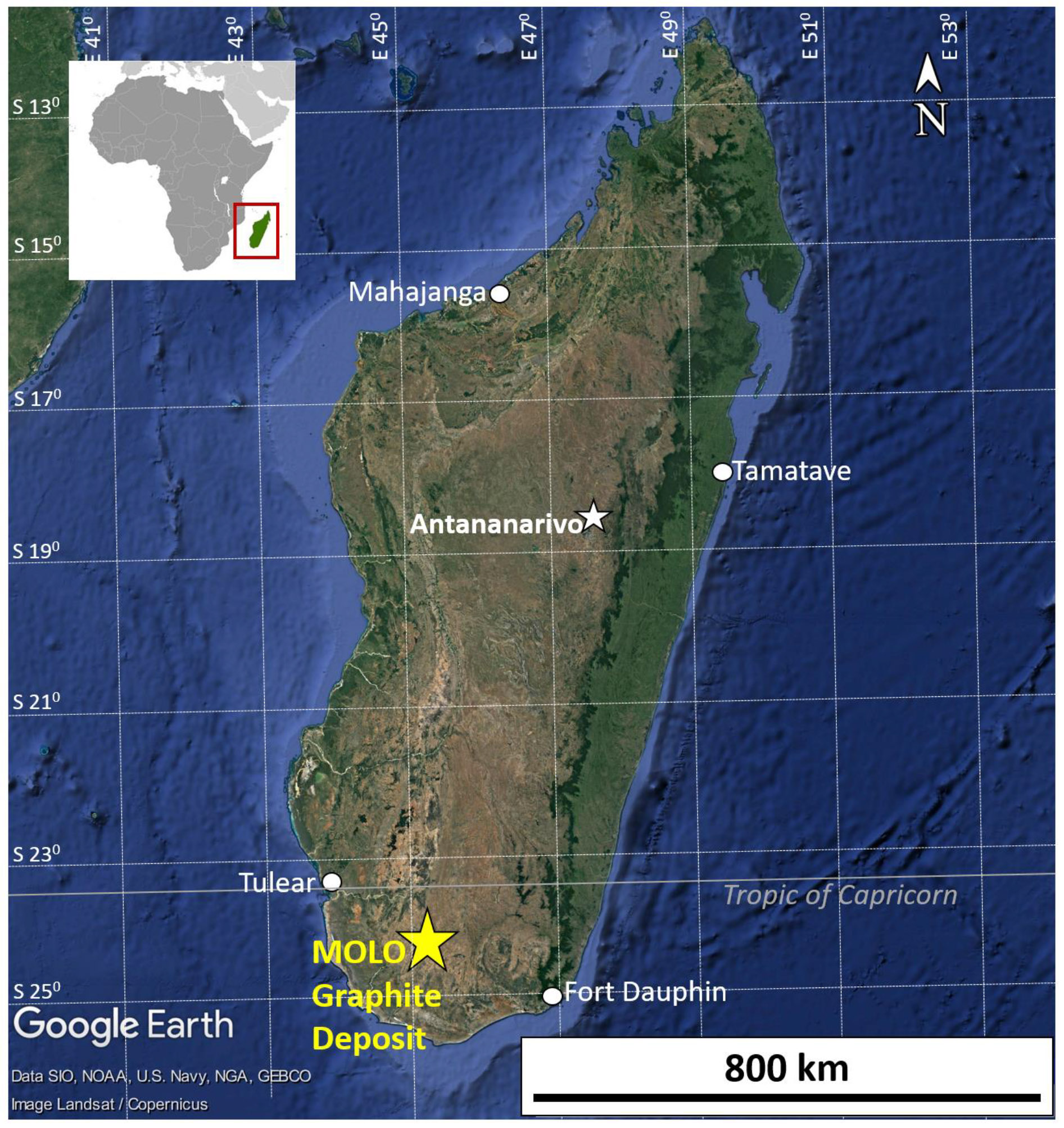

The Molo graphite project is located approximately 150-160 kilometers towards the southeast of Toliara, a port city and the administrative capital of the country (with Antananarivo obviously being the ‘official’ capital of the country). Molo is almost right in the middle between Toliara and Fort Dauphin, which also is a port city with modern facilities to load and unload vessels. This will also be the port that NextSource will use to export its graphite product. The port at Fort Dauphin was built with the assistance of the World Bank 5 years ago for Rio Tinto as part of its mineral sands operation (which produces ilmenite) and can easily handle more capacity.

The property consists of more than 900 square kilometers and is serendipitously located in an ideal, open-pit, mining setting – a flat, sparsely populated, dry savannah-like land area situated far from the rainforest and mostly devoid of flora and fauna. NextSource has been working and exploring in Madagascar for nine years now, having invested over US$40 million to date and these efforts have allowed the company to delineate not one, but two massive resources compliant with the Canadian NI 43-101 standards – One massive graphite resource and an equally impressive vanadium resource, in terms of both size and quality. The Vanadium resource was actually discovered first and is a totally separate deposit from the graphite as both are located approximately 10 kilometers apart from each other. It was in 2012 that the company decided to focus exclusively on developing the graphite, which was then starting to develop a lot of market attention as a mineral that had a bright future as a material used in batteries.

As Madagascar is a former French colony, it shouldn’t be a surprise the BRGM (‘Bureau de Recherches Géologiques et Minières’) was the most active exploration company in the previous century, with very little exploration work having been completed since the late sixties and as far as NextSource knows, no historical trenches have been dug at Molo. NextSource was the very first company to systematically explore this region for graphite using trenching and geophysical surveys.

Following an extensive drill program that identified several viable graphite zones, NextSource chose the ‘Molo’ zone since it was the widest of the bunch and rapidly advanced the project to reach a measured reserve status over the subsequent three-year period. In all, NextSource has identified over 300 continuous line-kilometres of flake graphite, all immediately at surface on its property. It is safe to say that the company has sewn up an almost inexhaustible amount of graphite within its property boundaries, with only a fraction of that being included in the current total of 100 million tonnes in the measured and indicated resource categories (at 6.25-6.3% C) with an additional 41 million tonnes in the inferred category. The total reserve basis is approximately 22.4 million tonnes of ore at an average grade of 7.02% C. Both the resource and reserve statements remained unchanged in the 2019 Feasibility Study Update.

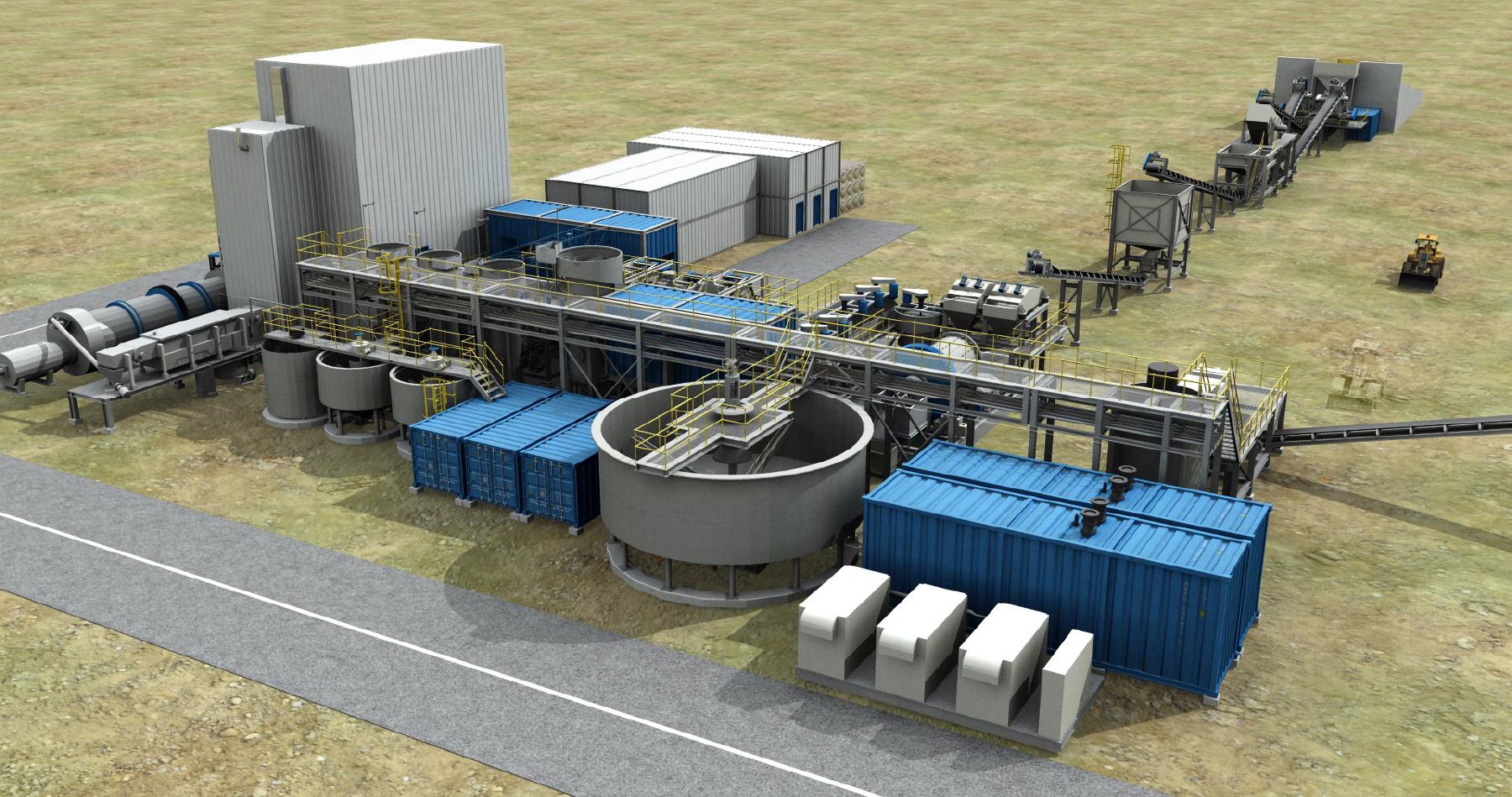

When it comes to the metallurgy of the Molo project, it is completely de-risked. Back in 2013, NextSource conducted the largest pilot plant to date of any graphite project globally at Canada’s renowned SGS Minerals Lakefield, who has completed pilot plants for over 14 graphite projects. But none of the other pilot plants even compared to the scale of NextSource’s. The company extracted 200 tonnes of ore (consisting of two 100 tonne samples collected from a lower grade area and a high-grade area, to make sure the metallurgical test work would be performed on a representative sample), which was then processed through the pilot plant, producing over 13 tonnes of high-quality flake graphite concentrate. It was this concentrate material that NEXT sent to prospective strategic offtakers in significant quantities, which enabled the Company to secure offtake agreements for initial (Phase 1) of production.

All these elements were subsequently used in the feasibility study and the recent update of that feasibility study indicating the project remains very robust.

The updated 2019 feasibility study shows a substantial improvement of the economics

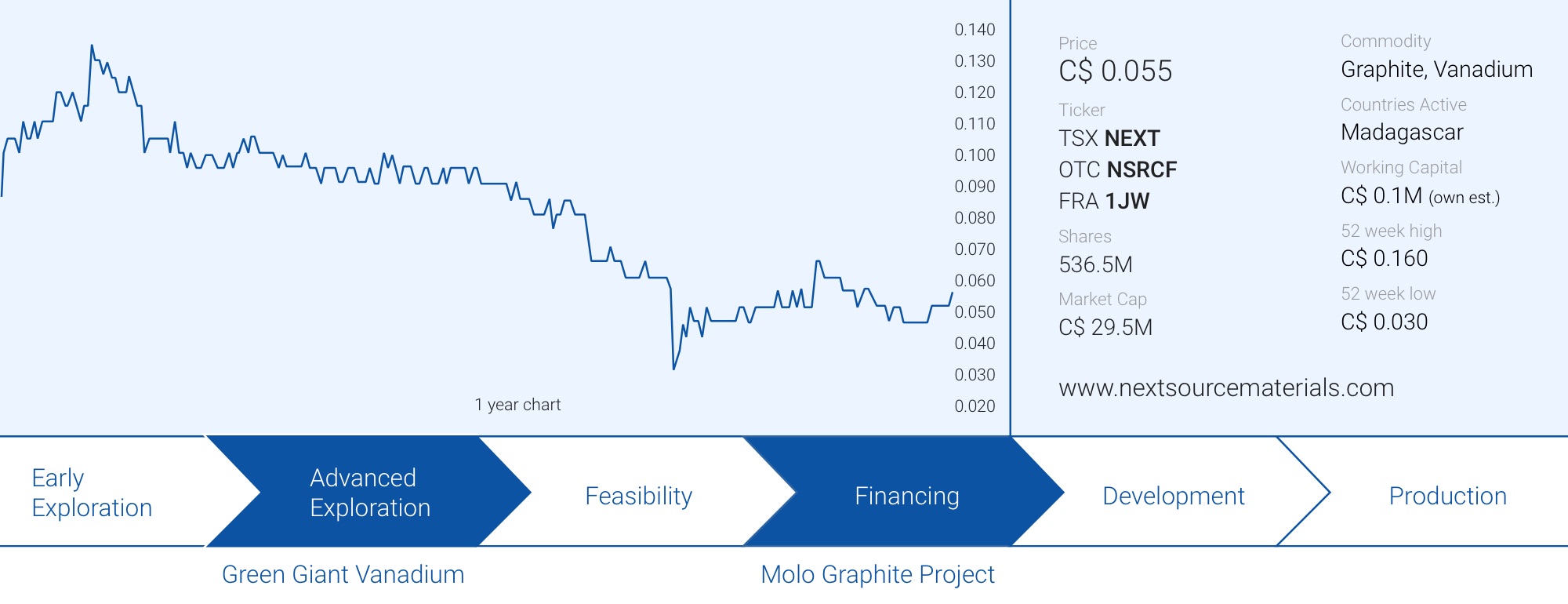

The original (2017) feasibility study on the Molo graphite project was focusing on Phase 1 output of 17,000 tonnes of the registered trademarked Superflake® product, where after a modular expansion towards 51,000 tonnes per year could be achieved by adding two additional modules each with a capacity of 17,000 additional tonnes of finished product per year. Phase 1 resulted in an after-tax IRR of 21.6% and NPV of US$25.5M. Hardly exciting, but NextSource’s management succeeded in showing the Molo project could be built at a very low initial capex (less than US$20M) with acceptable economics (an after-tax IRR exceeding 20%) while maintaining production costs in the lowest quartile.

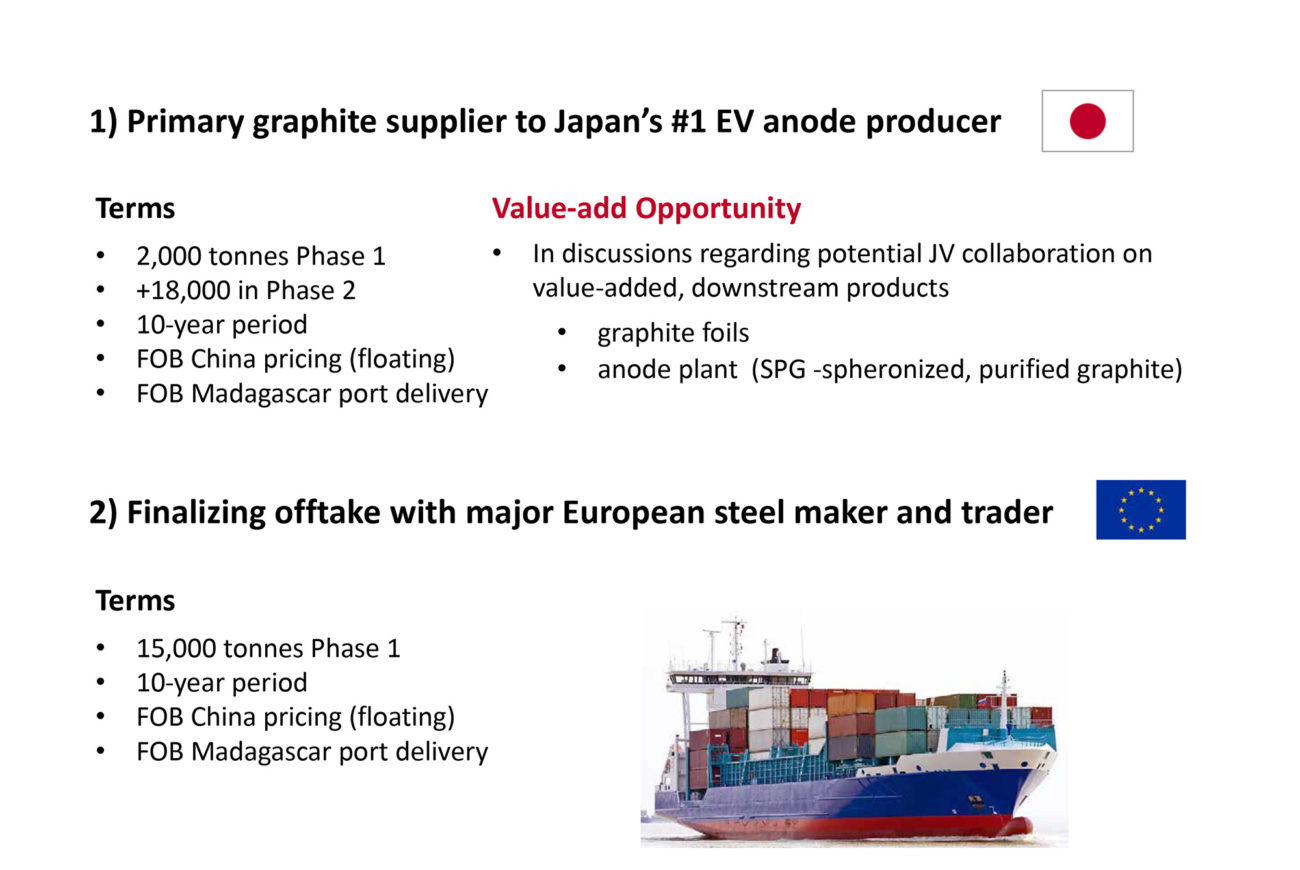

With the 2017 feasibility study, NextSource went to the other side of the spectrum: from designing a large high-capex project to a smaller, financeable modular approach. But this created new problems. Luxury problems this time, as NextSource’s Superflake product caught the attention of several large market parties and entered into a binding offtake agreement for an initial 20,000 tonnes per year graphite supply deal with a ‘prominent Japanese graphite trading company’. That’s indeed more than the initial 17,000 tonnes eyed by NextSource, and as this was followed by a letter of intent with a major European steel producer for an additional 15,000 tonnes per year. Both supply agreements would be for an initial period of 10 years and NextSource’s new feasibility study was actually designed to cater to the demand of those two parties.

The Japanese buyer would require 2,000 tonnes per year during the first phase of the Molo production plan followed by an additional 18,000 tonnes per year in Year 3 of operation when Molo Phase 2 will be up and running while the European buyer was interested in securing the 15,000 tonnes per year in the first phase (note the agreement with the European trader is not definitive nor binding yet, and we hope to see NextSource converting the letter of intent into a binding agreement soon).

That’s why the new feasibility study is focusing on the initial 17,000 tonnes per year followed by a phase 2 expansion which would immediately boost the output by an additional 28,000 tonnes per year to a combined 45,000 tonnes. With hard commitments for 20,000 tonnes per year and a LOI to be converted into a fixed commitment for the additional 15,000 tonnes, almost 80% of the total output of 45,000 tonnes per year would be spoken for under long-term offtake agreements and NextSource could sell the remaining 10,000 tonnes per year under an additional offtake agreement or on the spot market.

The initial 17,000 tonnes per annum phase will now cost US$21M (due to inflation) and the feasibility study envisages the expansion to 45,000 tonnes per year in the third year of the mine life (the production will be kept steady at 17,000 tpa for the first two years). Phase 2 expansion will be quite cheap: just US$39M.

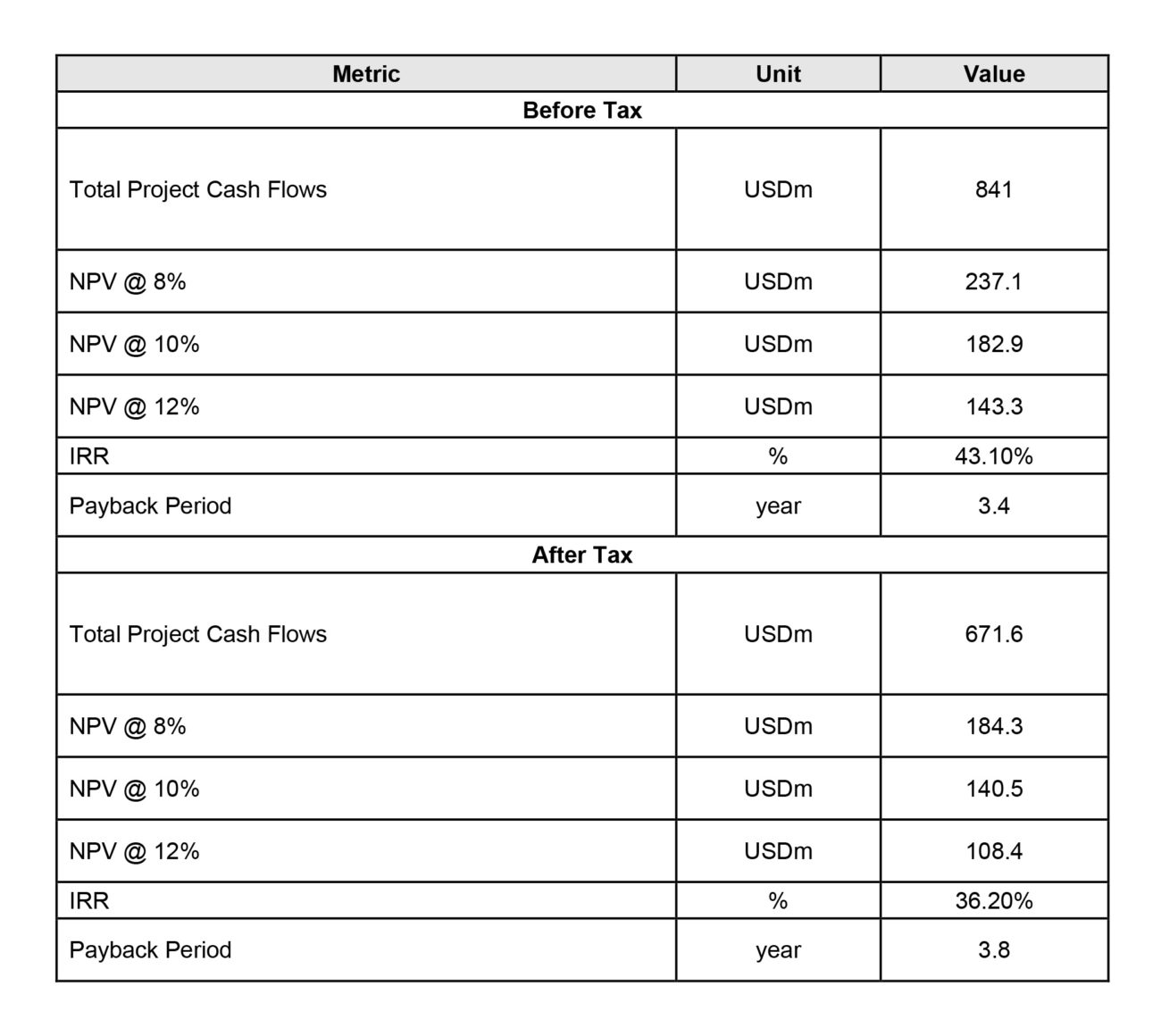

The combination of both phases will result in an after-tax NPV8% of US$184M and an after tax internal rate of return of 36% with an initial payback period of just below 4 years. The payback period is a little bit longer than you’d expect to see for a 36% IRR project but that’s obviously because the cash flows will be limited in the first two years due to the lower production rate and the additional capital investment of US$39M in Phase 2.

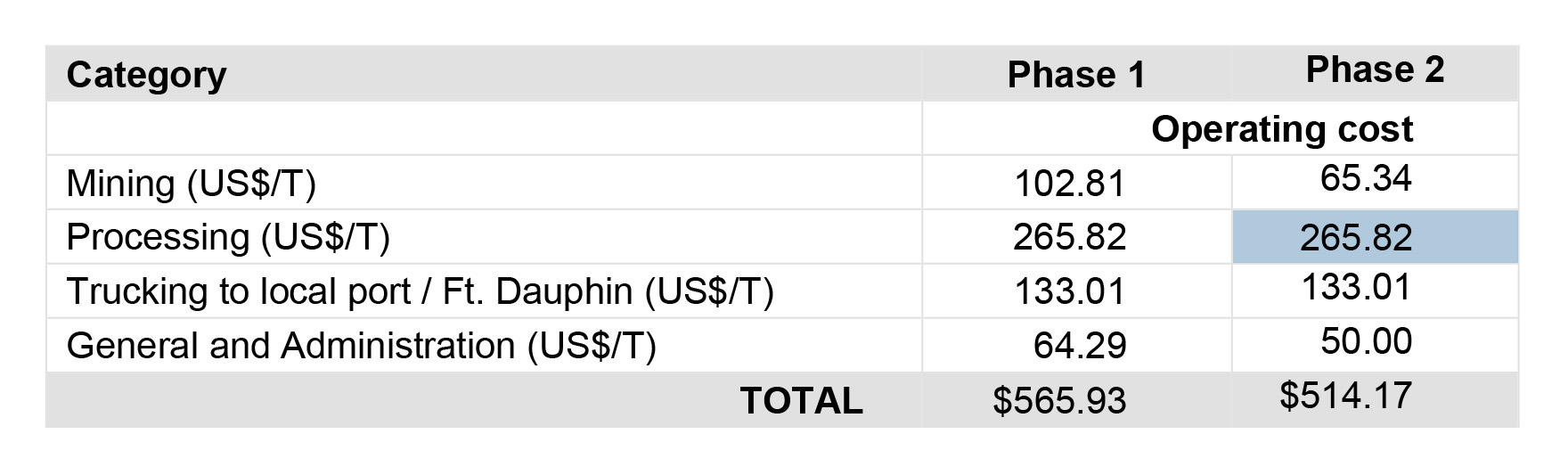

We also see some possibilities to further increase the Net Present Value of the project. When reviewing the technical report we noticed that although the mining and G&A cost per tonne was dropping rather dramatically in the second phase of the mine life due to the economies of scale, the processing cost per tonne remained unchanged.

Interesting, as we would assume there would be economies of scale that could be unlocked in the processing phase as well (for instance, whether you produce 17,000 tpa or 45,000 tpa you would still need just one plant manager whose salary could then be spread out over almost three times the tonnage). We discussed this with NextSource management which confirmed that although the mining and G&A expenses per tonne were optimized for the second phase, the processing cost was indeed NOT optimized as this would have taken at least two additional months and NextSource wanted to have the feasibility study out as soon as possible.

This means the operating cost of $514/t during the second phase of the mine life appears to be conservative as NextSource should be able to reduce the processing cost per tonne. Even if the cost savings would be minimal (6%), the operating cost would drop to less than $500/t, and considering the 28 years at a production of 45,000 tonnes per year would produce 1.26 million tonnes of Superflake a cost-saving of $15/t would increase the pre-tax cash flow by at least US$18M.

On an after-tax basis, the project will generate a total cash flow of US$672M and even if you would apply a 12% discount rate, the after-tax NPV would still come in at in excess of US$100M.

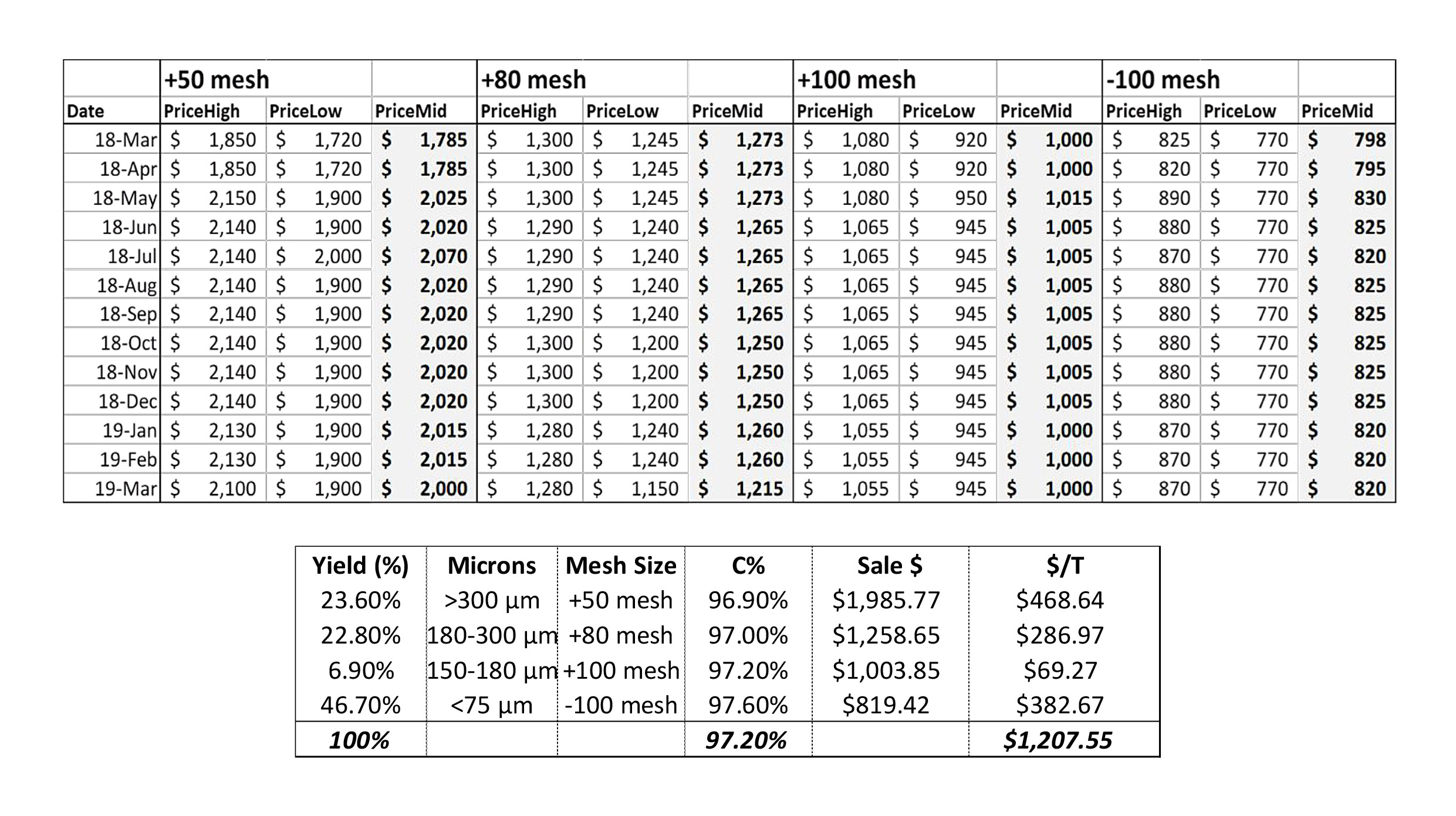

These numbers are based on an average basket price of $1209 per tonne of Superflake product and this price consists of a weighted average price of the four main products the Molo graphite project will produce.

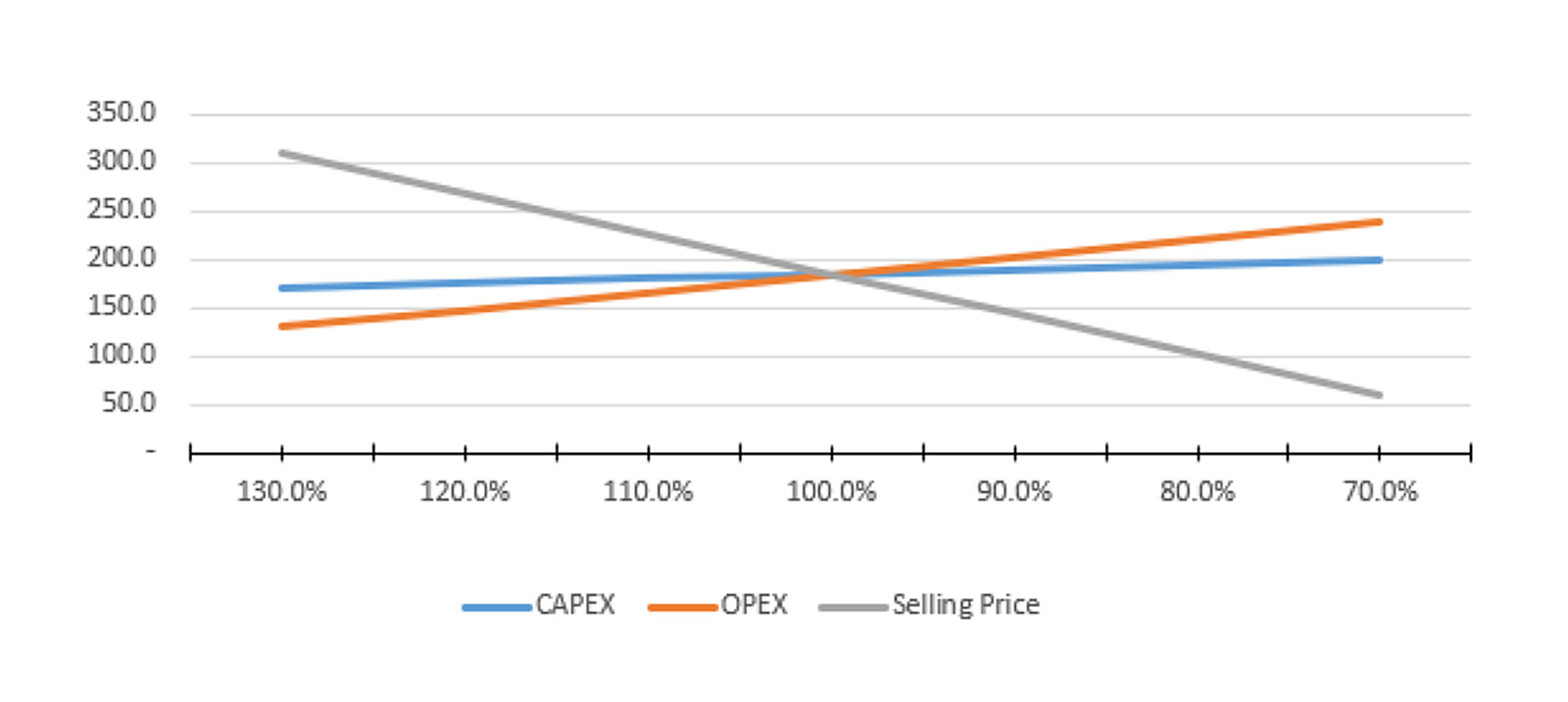

In the introduction of this report we mentioned only very few graphite projects will see the light of day as some of them are capital intensive and/or need a high graphite price to be or remain profitable. With an initial capex of US$21M (and US$60M for the combined Phase 1+2) the Molo graphite project is one of the more ‘financeable’ projects out there. Additionally, the sensitivity analysis shows the NPV will remain in the triple-digit zone even if the average price of the graphite basket drops by 10% (to US$1080/t) or even 20% (to US$960/t).

As you can see on the image above the after-tax NPV8% will come in at around US$100M should Nextsource only receive 80% of the anticipated sales price for its graphite, and just over US$50M in case the graphite price drops by 30% to US$840/t thanks to the low average production cost of around US$500/t when the project reaches its steady-state output at 45,000 tonnes per year.

NextSource just raised C$1.3M to strengthen the balance sheet

At the end of October, NextSource Materials issued almost 29.1M units at a price of C$0.045 per unit to raise C$1.31M in an attempt to repair the balance sheet where the working capital deficit had increased to in excess of C$1M as of the end of the third quarter in September.

Each unit consisted of one common share and half a warrant with each full warrant entitling the warrant owner to purchase an additional share of NextSource at C$0.09 within a 24-month time frame. Should these 14.5M warrants be exercised, NextSource will receive an additional C$1.3M in proceeds. The financing closed on October 25th and as the traditional 4 month hold period is applicable on this placement, the new shares will be freely tradeable from the end of February on.

The 29 million shares were placed with just a handful of investors and three members of the board participated for the maximum percentage allowed by the TSX.

Is Dundee done selling?

To be honest, a year ago we didn’t even consider a sub-5 cent placement would be a possibility as the graphite markets were quite robust and the economics of the Molo graphite project remained strong. Back in May and June, the stock was trading at 10 cents and an updated feasibility study was in the works and it appeared to be (relatively) smooth sailing for NextSource, but we were wrong.

As Dundee merged two funds, with each having a 10 percent stake in NextSource, Dundee had to sell off stock to get back below the maximum 10 percent threshold allowed in the fund. In the most recent alternative monthly report (filed in October, Dated September 30th), Dundee disclosed a position of 42 million shares, down from 89 million shares in 2018, and the 81.6 million shares as of the end of February. So of the total of 115 million shares that traded in that six month period, almost 40% of the volume was Dundee dumping stock on the market and this has put a tremendous amount of pressure on the share price, forcing the company to price the placement at just C$0.045.

Conclusion

The results of the updated feasibility study indicate stellar economics for the Molo graphite project and now it’s up to Nextsource to secure funding for the Phase I plans. According to its internal timeline, the company is giving itself the entire first semester to secure funding and expects to complete a financing arrangement by July which should allow the initial production to start in Q2 2021 while the eventual 45,000 tpa output should be reached by early 2023.

2020 will be the year of the truth on many levels for Nextsource as it will be critical to secure funding (at an acceptable cost of capital) while also locking in a definitive agreement with the European party interested in an offtake agreement. The current market capitalization of around C$26M versus the after-tax NPV8% of US$184M (C$243M) indicates a favorable risk/reward ratio, but it will be up to NextSource’s management to deliver on its promises this year and make the Molo project the world’s next profitable graphite mine.

Disclosure: The author holds a long position in NextSource Materials Inc. NextSource Materials Inc. is a sponsor of the website.