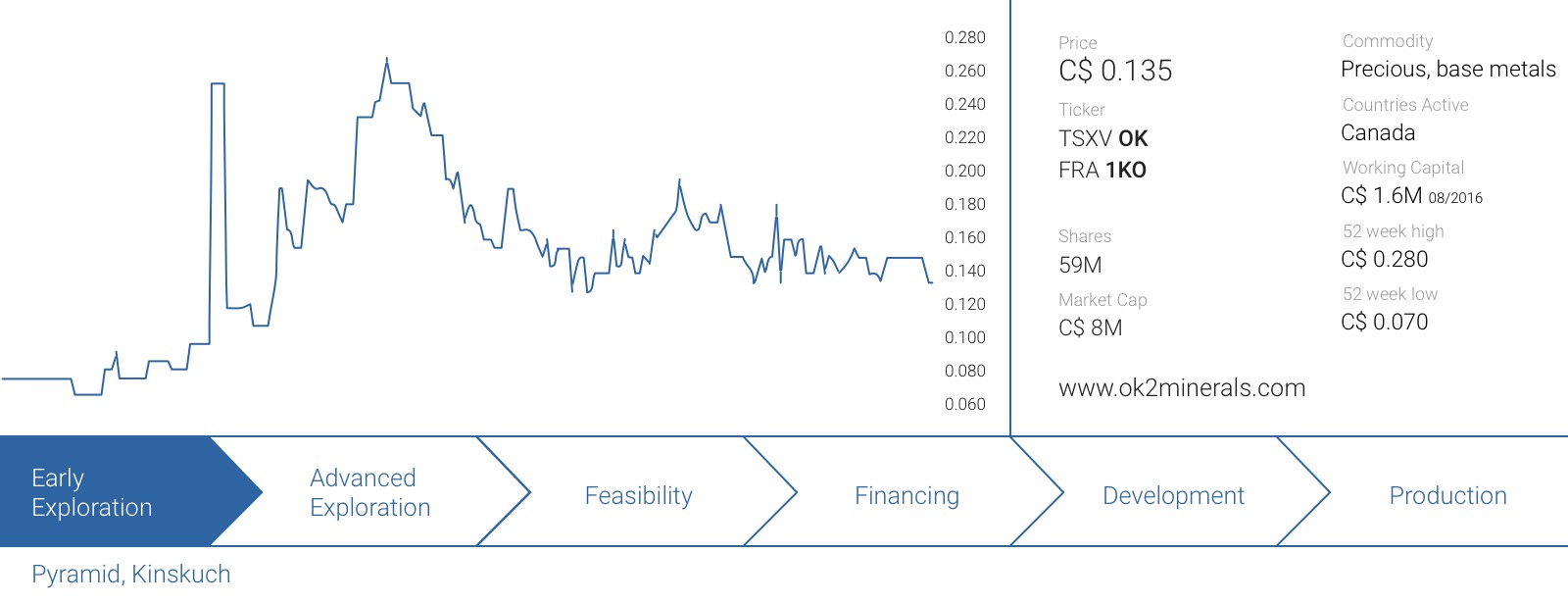

After changing its name from Gold Jubilee Capital to OK2 Minerals (OK.V) and inheriting the symbol previously belonging to success story Orko Silver, CEO Mike Devji has started to make the market aware of his newest company which is exploring for copper and gold in the mineral-rich province of British Columbia, Canada. After attending the conference in Zürich, Devji completed a little tour in Europe, and we attended one of the company’s presentations in the aftermath of both conferences.

The Pyramid project actually is an entire district

After taking some time off after the completion of the sale process of Orko Silver to Coeur Mining (CDE, CDM.TO), Mike Devji started to look around for ‘the next big thing’, and when he was introduced to the Pyramid project in British Columbia, the unique features of the property were appealing enough to vend the project into Gold Jubilee.

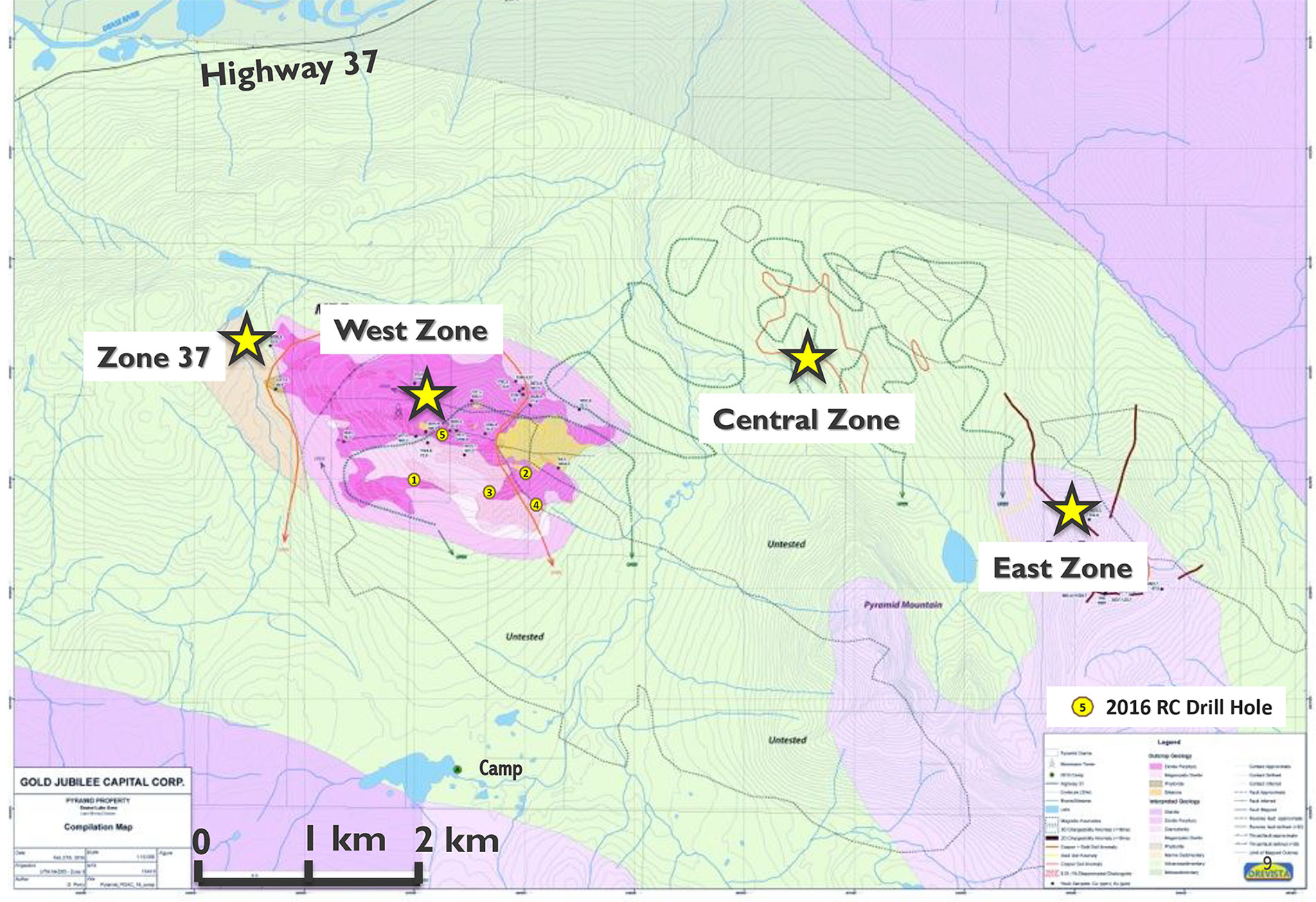

We consistently called it a ‘property’ and a ‘project’, but truth be told, the preliminary signs are indicating we might soon refer to Pyramid as an entirely new district. Even though the property enjoys easy access as Highway 37 is running right through the land package, no (serious) exploration activities have ever been conducted.

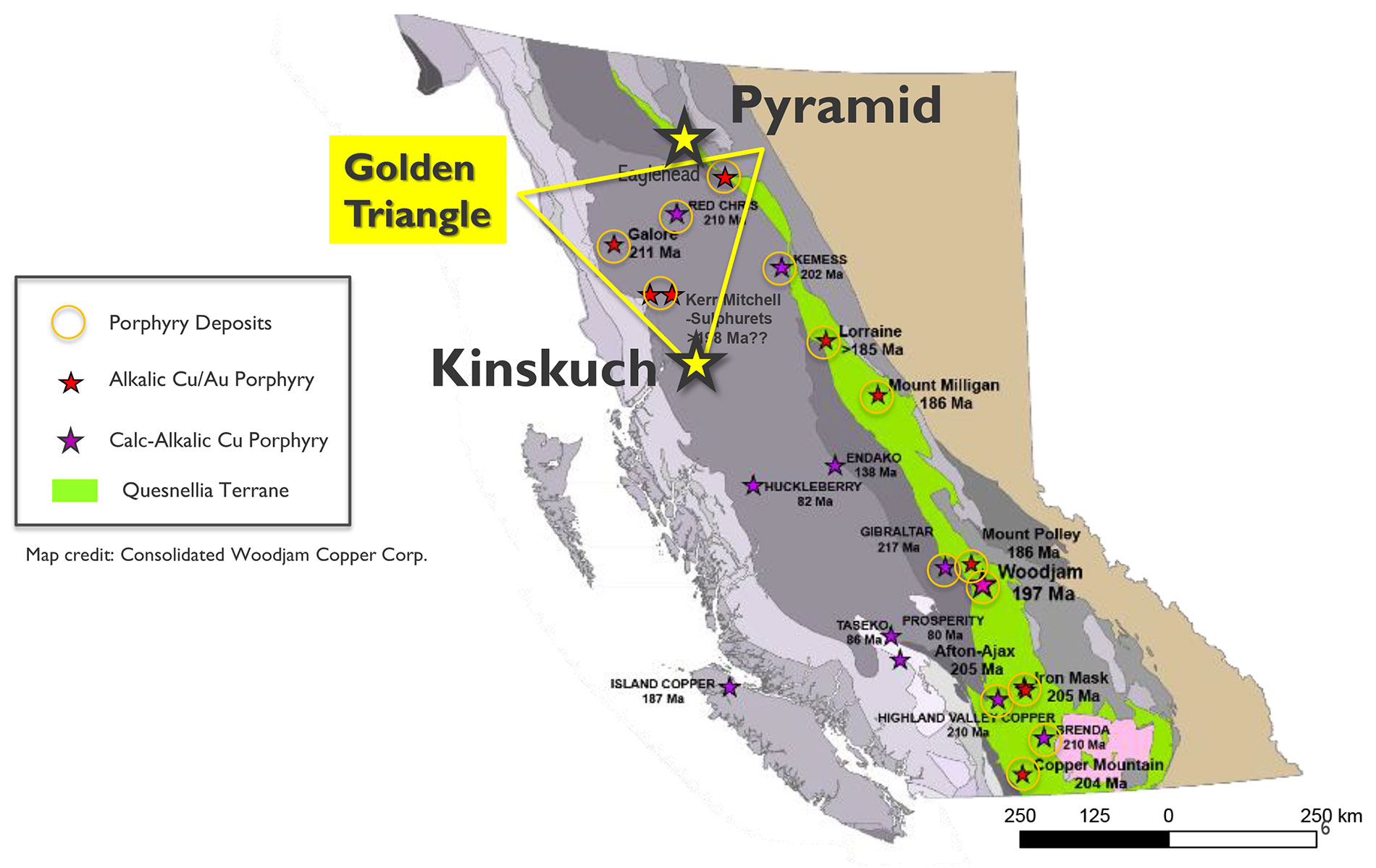

That’s surprising, because in the past few years wherein OK2 Minerals tried to get a better understanding of the mineralized structures at Pyramid, the potential became very clear and seemed to match all the expectations based on similar copper-gold porphyry systems in the Quesnel Terrane, a well-known mineralized trend extending from British Columbia all the way up to the southern part of the Yukon Territory.

It’s really important to realize the importance of the Quesnel Terrane as this is prime ‘hunting ground’ where several large copper-gold porphyries have been discovered with Centerra Gold’s (CG.TO) Mt Milligan project and Copper Mountain Mining’s (CUM.TO) project as most important examples. And based on the existing geological and geochemical characteristics of the property, OK2 Minerals decided to acquire a 100% interest in the property by map staking the previously unexplored area of favourable geology.

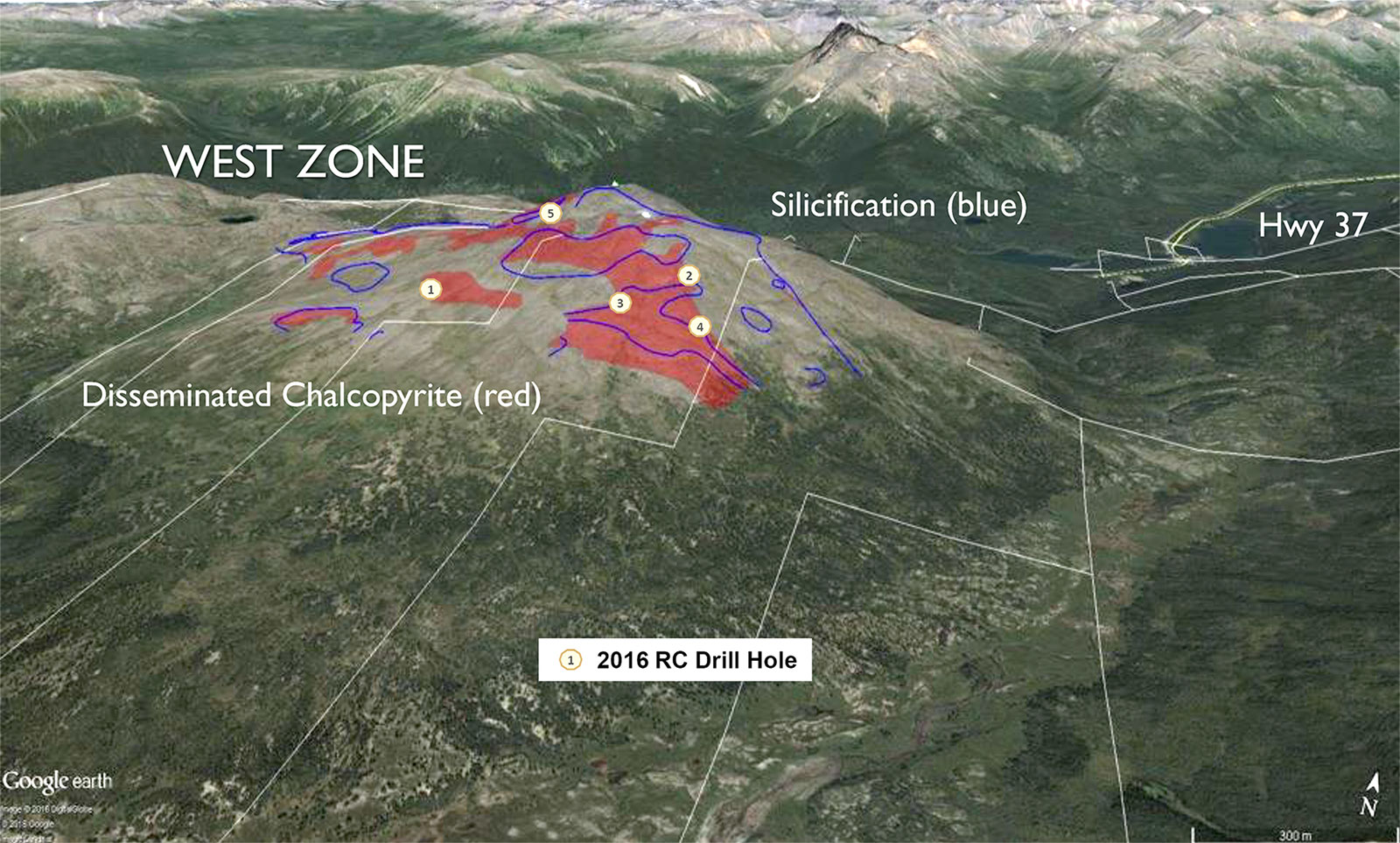

As you’d expect from a small exploration outfit, the company decided to pursue a proof of concept based on basic exploration programs. Until earlier this year, OK2 Minerals focused on mapping and sampling programs to make sure its technical team knew the property inside out before committing to a drill program. Earlier this year, the first phase of its 2016 exploration program was a huge success and even before the final assay results were received from the lab, the company decided to expand its land package at Pyramid. Whereas the property had a size of ‘just’ 73 square kilometers in 2013, the total size is now just over 185 square kilometers after successfully staking an additional 50 square kilometers to the northwest and south.

When the assay results returned from the lab, the expectations were confirmed as the outcrop samples contained several decent-grade results (‘decent’ in terms of ‘value’, but as all samples were taken at surface, it’s actually really exciting to see grab samples returning 0.9% Copper and 1.1 g/t gold or 0.68% copper and 0.71 g/t gold), but an outcrop sample from Zone 37 deservedly grabbed the headlines with a gold value of just short of 83 g/t (and yes, that’s not a typo)! This sampling program was immediately followed by a short Reverse Circulation drill program focusing on the West Zone (see later).

Kinskuch Lake – a new acquisition, but also a potential company maker

In the second half of the third quarter, OK2 Minerals announced the acquisition of the Kinskuch Lake copper-gold project which is also located in the Golden Triangle. As it’s more towards the south of the province, exploring the tenements is possible on a year-round basis (as opposed to Pyramid, where more infrastructure will be needed to allow the company to explore during the winter season as well).

Part of the property was actually drilled by Teck Resources in an attempt to discover another large copper-gold porphyry system in British Columbia, and even though the historical exploration remained limited to just 13 drill holes, we really learned a lot from these drill results.

First of all, the holes were actually pretty shallow, as the average depth was just 165 meters which is literally barely scratching the surface (as these porphyry systems tend to go much deeper), and it’s absolutely not surprising to see the discovery hole returning 21 meters of 0.86% copper and 0.64 g/t gold (which by itself is an outstanding result compared to its BC peers) ending in mineralization grading 50 meters of 0.33% copper and 0.21 g/t Au.

What’s important is that no other drilling occurred after the discovery hole, as Teck Resources basically had to shut down its exploration division during the turmoil on the commodity markets. The project was dropped and forgotten, and it’s remarkable to see a small company like OK2 Minerals being able to pick up the Kinskuch Lake claims (thanks to its excellent relationship with the vendors) as we would have expected Hecla Mining (whose claims surround the Kinskuch Lake project) to have snapped up the land package.

Is there ‘something’ there at Kinskuch Lake? Yes, absolutely. After the discovery hole, there’s no doubt there actually is a copper-gold porphyry system on the Kinskuch Lake claims, but the total size and grade obviously remains unknown for now.

The exploration plans for next year: very straightforward

Even though both porphyry systems are huge and will eventually require quite a bit of cash to drill out, OK2 Minerals seems to have a rather cautious approach. Instead of going out and raising millions of dollars to punch a few holes at Pyramid and Kinskuch Lake, CEO Devji is wary about any potential dilution and strongly believes in a methodological approach which might be a bit slower, but will be more efficient in the longer run.

For 2017, the preliminary budget is estimating to spend a total of C$2-3M at Pyramid and approximately half a million dollar at Kinskuch Lake. This indeed isn’t a lot of money, but this drill program will allow the company to get a much better understanding of what exactly it’s sitting on.

At Pyramid, it will be really interesting to see the results of the current RC drill program at the West Zone. OK2 Minerals has started a 5-10 hole RC drill program with five holes focusing on the West Zone (see the previous image), and we would expect to see the first drill results in the first half of December, depending on the turnaround time at the lab. These holes will test any potential mineralization or structures at a depth of up to 200 meters, and this short drill program is predominantly focusing on defining structures and drill targets for a first diamond drill program next year.

Kinskuch will also receive some attention next year, and any future drill program will be based on this year’s success during a mapping and sampling program as well as a winter compilation of all previous exploration data.

Since the last work program on the property, much new information and geological knowledge has been gained from the advanced exploration being completed at the nearby KSM deposit owned by Seabridge Gold (SA.TO, SA) and the Pretium’s (PVG, PVG.TO) -Brucejack deposit. The exploration team will benefit from that knowledge when completing the compilation work this winter.

The management team made the end game pretty clear

Good projects can be ruined by bad management, so it’s always important to have a look at who’s in the driver seat as well. During the presentation, Devji correctly emphasized the importance of being surrounded with a good team, and the short bio’s here below confirm that all main guys on the team have deserved their reputation elsewhere.

Devji and Cavey used to work together at Orko Silver, Blair Schultz is a very nice addition to the team but perhaps the most noticeable ‘transfer’ is James Currie who left a (high-paying) job as COO at Pretium Resources (PVG) to join the ranks of OK2 Minerals. Let’s also not forget directors Tag Gill and Cyrus Driver who were respectively controller and director of Orko Silver.

The end game is also pretty similar to the previous deals where the management has been involved in. We think OK2 Minerals has no intention to develop a copper-gold mine (or two) on its own, so once a decent resource estimate showcasing the potential of the property has been completed, the best way to create shareholder value will very likely be the outright sale of a property, or the company as a whole.

Mike Devji – Chairman, CEO and Director

An experienced financier of public companies, Mr. Devji led a group of investors who financed a 40% interest in the South Kemess Gold-Copper Deposit in British Columbia, Canada. That interest was subsequently sold for over $400 million. Mr. Devji was Vice President of Orko Silver and was responsible for raising more than $50 million to explore the La Preciosa silver deposit in Durango, Mexico. Orko Silver was sold to Coeur Mining in 2013 for $380 million.

James A. Currie, P.Eng. – President, COO and Director

Mr. Currie was most recently the Chief Operating Officer of Pretivm Resources leading the development of the company’s Brucejack high-grade gold asset in British Columbia. Previously, he led the construction and development of New Gold Inc.’s New Afton gold mine in B.C., which went into production ahead of schedule in 2012. Over the course of his 37-year career in the mining industry he has held roles in senior management, engineering and operations, on a number of projects that have progressed through feasibility to successful operation on schedule and budget. Mr. Currie holds a Bachelor of Applied Science degree with honours in mining engineering from Queen’s University and is a registered professional engineer. He is the 2014 co-winner of AME BC’s prestigious EA Scholtz Award for Excellence in Mine Development for his work on New Afton.

George Cavey, P.Geo. – Vice-President Exploration and Director

Vice-President Exploration and Director – Over 35 years in exploration and consulting as the president of OreQuest Consultants. Past President of the Canadian Council of Professional Geoscientists. The 2004 recipient of the APEGBC C.J. Westerman Award. Also the recipient of the 2010 Canadian Professional Geoscientist Award, Canada’s highest honor for a Professional Geoscientist. Consultant to the BCSC and the TSX Venture Exchange. Former Vice President Exploration for Orko Silver who discovered the 264 million ounce La Preciosa silver deposit.

Blair Schultz, B.Math, Acc. Dir. – Director

Mr. Schultz has extensive knowledge in the capital markets having served as Vice President of K2 Investment Management for 13 years. In 2012, Blair was challenged with the role of Chairman for Klondex Mines, where they successfully transformed an insolvent exploration project into one of TSX’s most successful companies. He had a temporary executive role, and is still a director of Klondex as it has evolved from a $40 M company into a $1 B producer today. He is member of the Board for Eastmain Resources. Early in 2016, Mr Schultz was a director and Chair of the Special Committee of VMS Ventures which he negotiated a successful sale to Royal Nickel.

Conclusion

We usually don’t care at all about greenfields exploration companies but when an experienced and proven management team takes the reigns of an exploration company with the right assets, we are listening. And that’s exactly why OK2 Minerals is standing out from the crowd as this company is combining the right team with some very interesting assets.

Rome wasn’t built in a day and it will take several years to advance the projects and build the company but this definitely isn’t unusual, as the Orko story, for instance, took approximately 10 years to unfold. And the management team doesn’t make it a secret it wants to do the exact same thing here. Mike Devji and his team have no intention to build a billion-dollar mine, but will advance the assets until a bigger player comes along with a wad of cash.

Keeping this in mind, the new company’s name ‘OK2 Minerals’ is very well chosen.

The author has a long position in OK2 Minerals.OK2 Minerals is a sponsor of the website. Please read the disclaimer