It hasn’t been easy for companies with base metal projects, and Oroco Resource Corp. (OCO.V) is one of the companies that has been hit hard by the lower copper price. The company successfully closed a first tranche of a C$1.5M financing, raising about half of the eyed amount but closing the second tranche of the financing may be more difficult given the current discounted price on the market.

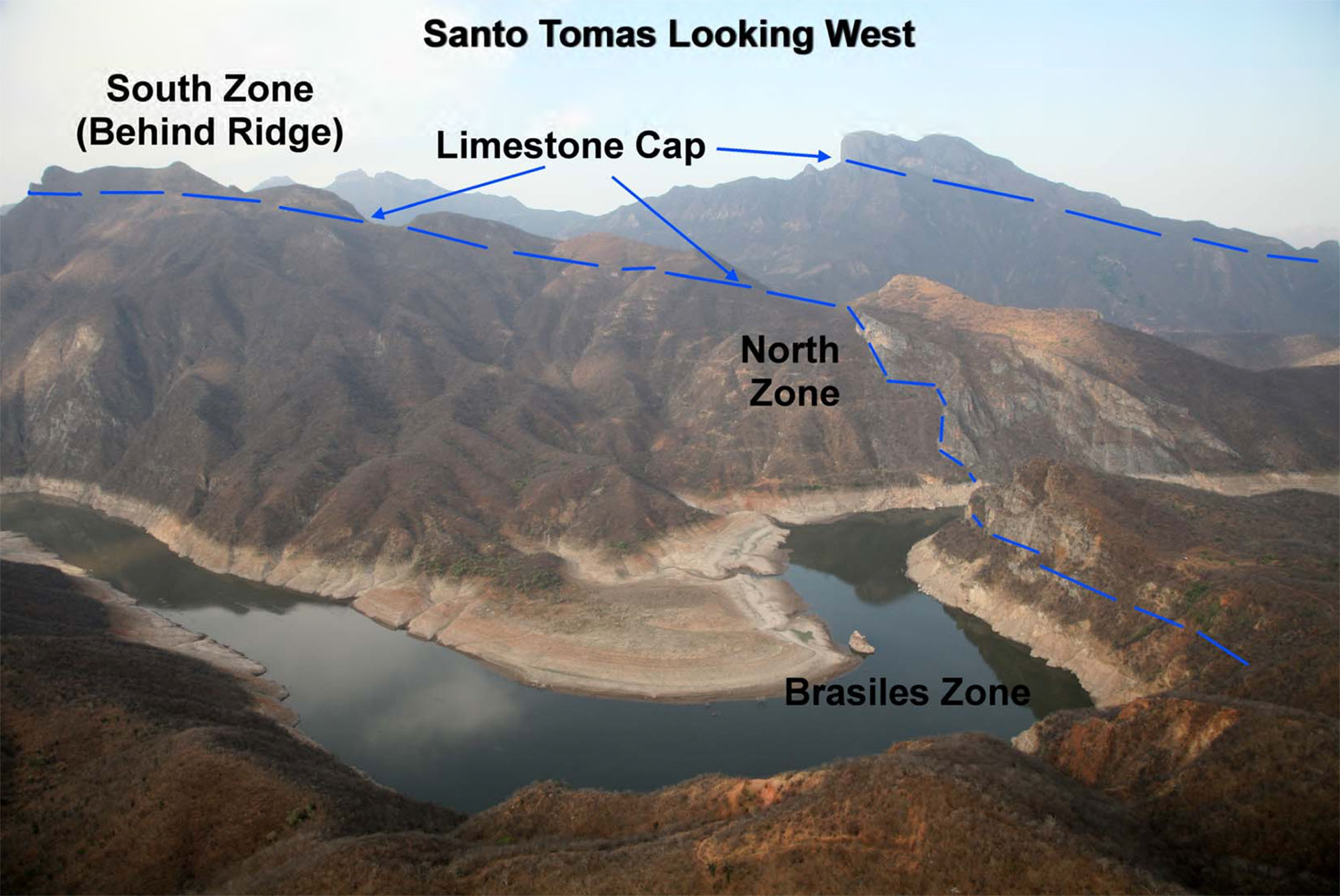

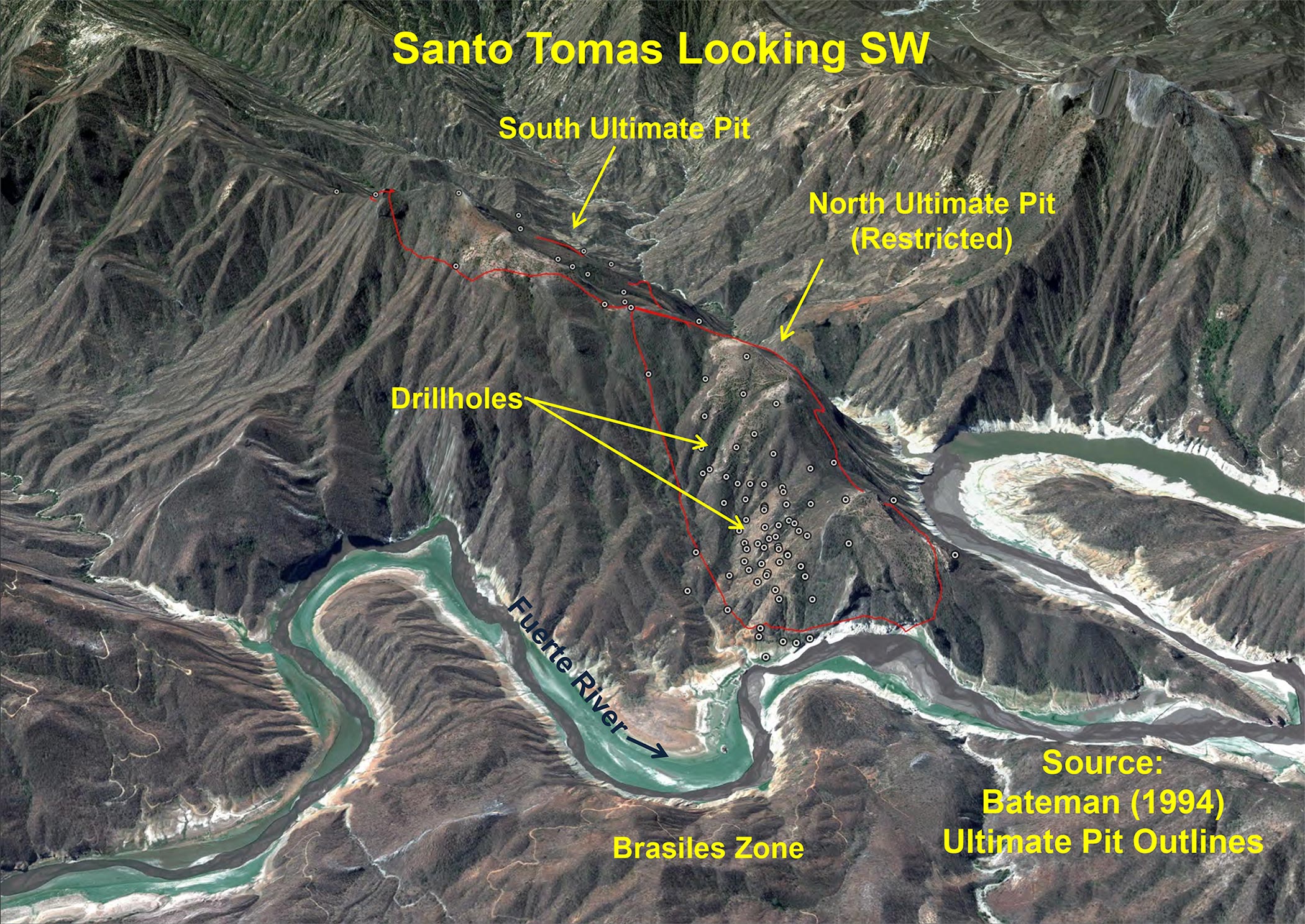

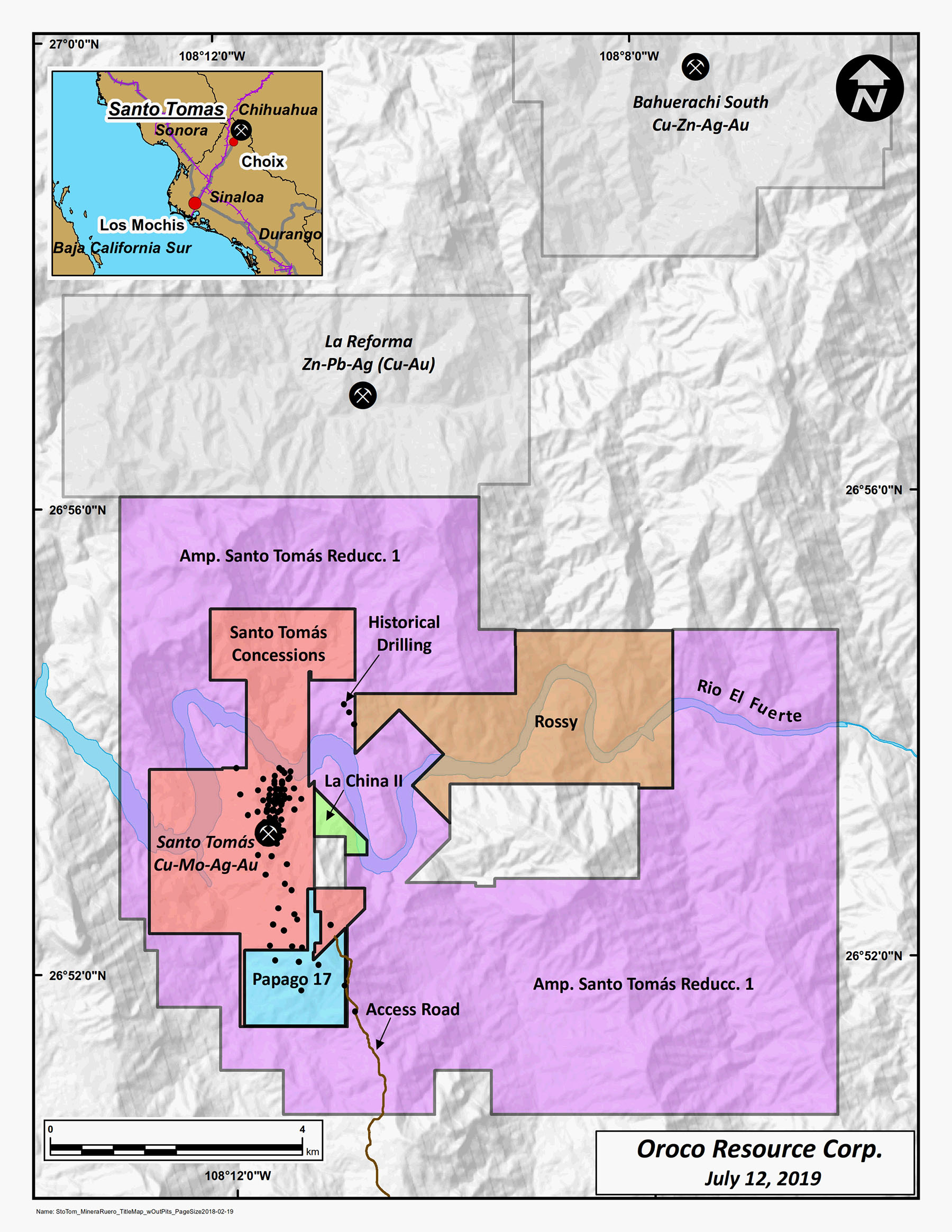

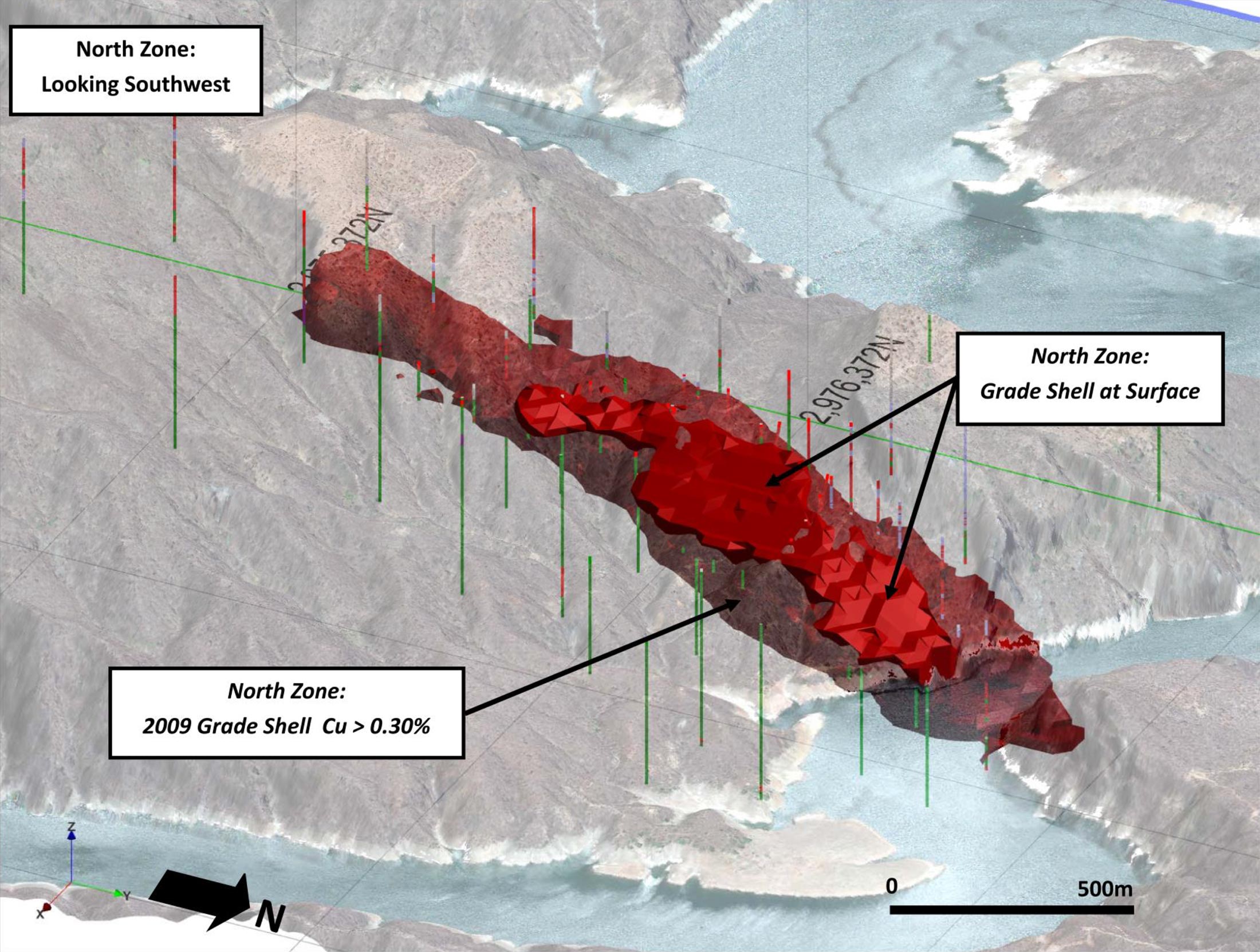

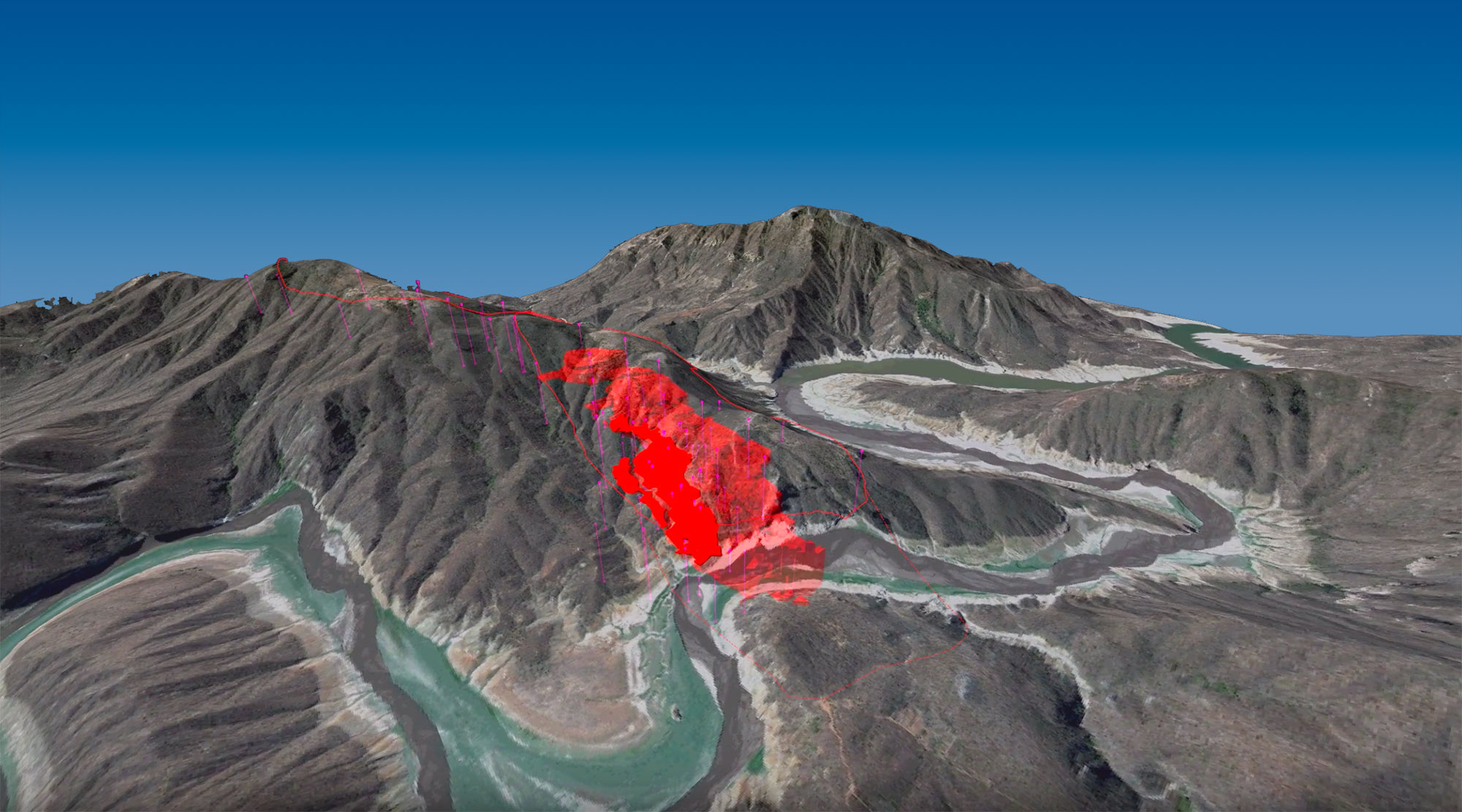

We sat down with Ian Graham, Oroco’s new President to discuss his history, Oroco as a company and the Santo Tomas copper porphyry project in Mexico, where historical data has outlined a 1B+ tonne exploration target. Oroco’s main focus will be on bringing a large historical resource estimate into compliance with the NI43-101 rules.

About Ian

Ian, you have recently been appointed Oroco’s President after having been the company’s VP Exploration for about 8 months. Could you provide some sort of background on your career and accomplishments?

Sure, I am a geologist by training; out of university I spent 5 years with Anglo American in South Africa, initially at Anglo Research Labs followed by field-based diamond exploration. On coming to Canada in late ’94 I joined Rio Tinto’s Canadian exploration subsidiary on the Diavik Diamond Project as the project & subsequently resource manager. I remained with Rio until 2009, managing exploration and filling project roles at the Resolution Copper deep porphyry Cu project, Eagle Nickel now owned and operated by Lundin Mining (LUN.TO) and Bunder Diamonds in India.

Post Rio I’ve had junior corporate and technical roles in potash (Milestone, Western Potash, now in production as well), rare earths (as a director of Commerce Resources (CCE.V), VMS base metals (Wabasi discovery, DHR.V) and strategic copper-gold assets in Peru with Fidelity Minerals (FMN.V).

What made you decide to take on the President role at Oroco?

Oh, foremost the people. A solid team is in place: Craig (Dalziel, CEO), David (Rose, in-house counsel) and Adam (Smith, Corp Dev) have been unwavering in their commitment to solving the title on behalf of the rightful owners; and we’re supported by a board of committed people and a remarkable base of supportive shareholders.

On the ground in Mexico, Don Ubaldo and his small team have done an amazing job of building Oroco’s relationship with the local communities on a lean budget, and Paul McGuigan has curated the data, added to the knowledge base and leads our planning and preparations. Of course, the Santo Tomás project provides an incredible cornerstone on which we expect significant value will be built, but for me it’s the people who have brought the opportunity through. It is a privilege to have been invited onto the team.

About Santo Tomás

Oroco won the legal rights to the Santo Tomás project after a multi-year legal battle and the title transfer was completed in January and Altamura, through its local subsidiary, now owns the legal rights to the Santo Tomás project. As such, Oroco now calls the shots with regards to the exploration programs at Santo Tomás, correct?

Yes. Craig and David have used the long period of the legal struggle to ensure that Oroco calls the shots and can deliver 100% of the project to a future acquirer.

You are currently trying to raise C$1.5M at C$0.30, and a first tranche for approximately half that amount has already closed despite the worsening circumstances on the copper market. Do you anticipate to close a second tranche in the next few weeks, or will you need the copper market and copper price to cooperate before doing so?

It’s a little early to call right now, but we’re hearing from the widespread network of well-informed supporters looking to ensure we’re capitalised and who have expressed their desire to participate and to help. Oroco has always been careful when financing – which has paid off and is evidenced by its general performance and market following, I am sure we will remain careful in the current environment.

Assuming you raise C$750K/C$1.5M, can you elaborate on the use of proceeds in both scenarios?

We have raised the C$750K, so we are stable for some time on the community and corporate fronts, and we’re financed to complete the 3D-DCIP as soon as people are cleared to travel into Mexico. When we raise the additional funds we will be poised to mobilize for drilling.

In the first six months of the current financial year (up to November 30th), you have spent approximately C$0.5M on exploration. Can you elaborate on what the money has been spent on?

We announced the court decision regarding title in May last year, and then proceeded with field mapping and structural /fieldwork for the NI43-101 which we filed in last September. We also acquired original historic data, worked on roads and access, paid some maintenance fees and at end-November paid the first $90K deposit on the 3D-DCIP.

Could you perhaps elaborate on the difference between the Santo Tomás core claims, and the non-core claims?

The core concessions comprise seven concessions totalling 1,172.9 ha, and which cover most of the historical drilling and known mineralization, and which were the subject of the legal title action. These are the concessions in which Oroco can earn up to an 81% interest in through expenditures of up to CAD$30 million.

Oroco has agreements with third parties by which it controls a direct 77.5% interest in three additional concessions that are adjacent to the Santo Tomás core concessions and an 80% interest in a fourth concession, totalling approximately 7,808 ha. We typically refer to these as the ‘peripheral’ concessions. A small part of the established historical resource lies in peripheral concessions, as do areas with potential for resource expansion or additional discovery.

Do you feel like not having a NI43-101 compliant resource estimate at Santo Tomás is hindering you in your abilities to spread the word about Santo Tomás/Oroco? How much money would you need to complete a compliant resource estimate which establishes at least the higher-grade core zone?

Not having a current compliant resource likely does restrict some of the parties we are introducing the project to from participating today, but I don’t think it restricts our ability to inform or spread the word. I suspect that our market valuation over the recent few quarters properly reflects the ‘exploration’ nature of the project – but consequently I view our opportunity to confirm past work as offering a compelling risk/reward opportunity.

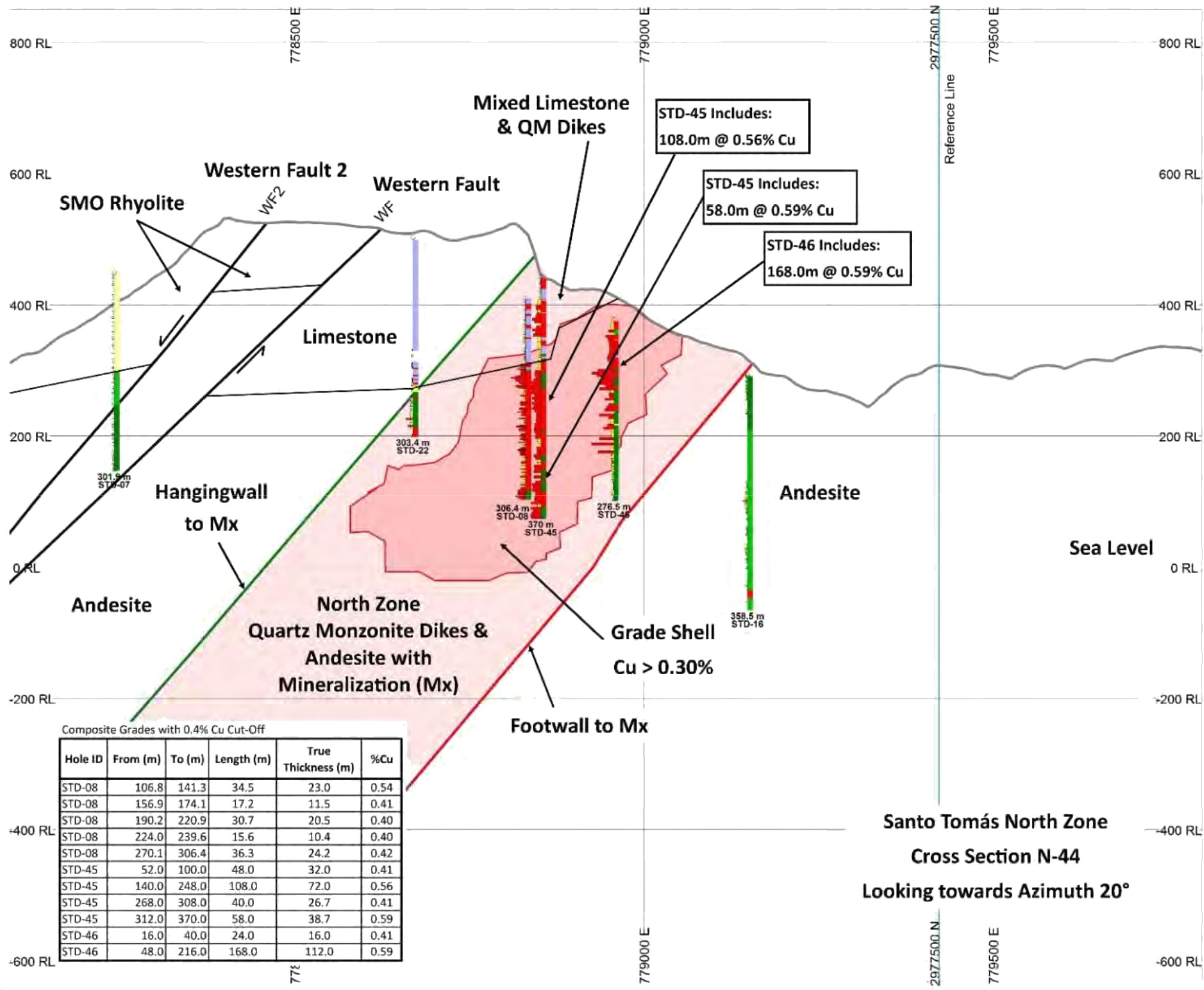

To confirm in essence the nature of mineralization at the ‘North Zone’ core as defined by the historical work will cost some US$1.5M in direct drilling costs – as outlined in principle in the NI43-101 published last year. Presently we anticipate doing some further drilling prior to a resource re-statement – as outlined in the technical report, we envisage spending up to a further US$4.5M. Our QPs will help us define the proper point at which to issue a new and compliant resource, dependent upon the new drilling sufficiently corroborating the historic work and allowing both new and historic data to be applied to the estimation.

Despite the recent volatility on the copper markets, we have heard rumors larger players are looking at some copper assets (all over the world). Have you seen any inbound interest of potential tire-kickers?

Yes, indeed, we also understand that copper is a specific focus of many of the world’s mining giants, and a number of mid-sized producers with growth ambitions and agendas. I sincerely hope and trust that most of the parties represent more than tire kickers!

Adam Smith, responsible for corporate development at Oroco, has done an excellent job in providing shareholders and potential shareholders access to copper-related research. What’s your opinion on the copper market (in general), and the type of projects that could be good enough to cross the finish line?

I couldn’t agree more – Adam’s focus on the copper space and his willingness to learn and share his insights has helped Oroco position and communicate Santo Tomás’ potential widely. Personally, I expect that the range of copper projects types that may contend for commercial development is likely to increase some, essentially out of necessity. But there is little doubt that the at or near surface, readily developed copper porphyry deposits are likely to cross your ‘finish line’ at the front of the pack. And as RFC Ambrian has recently published in an updated copper report, that pack is now pretty thin!

As for the future of copper, well I think that since the bronze age it has been, and will continue to be for the foreseeable future, a perennial essential element for human flourishing. As long as mankind needs grid power or electric motors we will need copper – and in this COVID pandemic we might remind ourselves of copper’s anti-microbial effects. I am not aware of any projections that see us needing less than all the copper we’ve ever mined as a species over the next 40 or so years. So I would say the market for copper is strong, and that Santo Tomas will be a future producer.

Mexico’s Sinaloa province still leaves a bitter aftertaste in the mouths of a lot of people. What’s your take on the security situation down there?

Look, community wellbeing and the management of risks to people and property really are our highest priority. Oroco’s founding partners and board insist we, indeed that I, focus on our social and security initiatives. And we have seen that third parties planning visits have the same requirement and insist on rigorous personnel security. We have hired a firm staffed by people with global experience; critically, their company is Mexico-centric and operates from an in-country operations center to help us plan our activities and monitor the region so as to manage risks for zero incidents. Within our axis of operations, which straddles the Chihuahua border and features neighbouring, foreign-owned projects and mines, we are vigilant and our embedded sources show the situation is understood and manageable.

And having previously developed a project that was put into production in Mexico has helped Oroco develop strong in-country networks, each of which has been tapped to inform and advise us. In Choix, our base of operations, the team is fundamentally integrated into the social networks and local economy: they keep us well informed on the currents and specifics of local issues. So, we are very focused on risk management – but recall that Mexico and Sinaloa are strong mining jurisdictions.

About Oroco

Oroco is still earning in on the Santo Tomás project and since the completion of the acquisition of Altamura Copper, it now owns a direct 56.7% stake in Santo Tomás. This will get boosted to 64.7% after spending C$3M and 72.9% after spending C$10M. Could you elaborate how much has already been spent on the project and how close you are to the C$3M spending requirement?

At last tally we effectively have earned the equivalent of 61.4% on the core concessions. So once we get drilling we will cross the 64.7% mark pretty quickly.

And just to be clear, there is no time limit on completing your earn-in to 81%, correct?

That is correct. But make no mistake, we won’t let that security slow our progress. It is our intention to move the project forward with a sense of urgency.

In your Management Discussion & Analysis filing on SEDAR, you just describe the two other JV partners as ‘Other’ and ‘Third Parties’. Could you perhaps elaborate on who those two other parties are, how your relationship is with them?

The success of the last decade of legal work was greatly aided by Altamura and Oroco’s ability to bring parties together to achieve a common and mutually beneficial goal. One of those parties is Santo Tomás’ original owner, on whose behalf Altamura Copper worked to reclaim rightful ownership following a title dispute with roots going back almost twenty years. The others are parties whose inclusion as partners provides essential strategic, technical and community relations advantages, and most of these parties have ongoing roles aligned with Oroco’s success.

Most Oroco principals already have a large stake in Oroco as they were private shareholders of Altamura (which was recently acquired by Oroco in a 39.8M share deal) and insider filings show both David Rose and Craig Dalziel acquired 8.3M shares as part of the acquisition of Altamura Copper. Can we expect to see insider participation in the second tranche of the financing as a sign of confidence in the underlying value of the Santo Tomás project?

I did participate in the first tranche of the thirty cent unit financing and invested about C$25,000 in Oroco as part of the C$0.30 placement, and in addition to those shares and warrants and the 600,000 options I also have options over certain existing shares from the founder’s positions. Suffice it to say I am well incentivised to ensure we take Santo Tomás forward for the benefit of all shareholders.

As for the principals they are always investing in Oroco, whether directly or by having provided past personal funds to cover community exigencies that arose at the project. I think that the extraordinary shareholder loyalty I have observed since joining Oroco is an indication of their faith in a principled management. Their participation is sometimes low profile – tucked away at the end of the last financing release you will find that a couple of million options were cancelled. These were seven cent options issued to the principals. For the record I was content that those options remained, but the principals thought that the seven cent exercise price was too dilutive to the company. So make no mistake, these guys are all in on Oroco.

Any parting thoughts?

Thanks for the interview. I would just say that I believe that Santo Tomás is one of the most compelling copper exploration projects being advanced today, and I am pleased you are willing to help us tell the story to your readers.

Conclusion

It’s not easy to be a copper exploration company these days, but the Santo Tomas project in Mexico’s Sinaloa state appears to be shaping up to become one of the larger open pittable copper resources on the North American continent. Having closed the first tranche of a C$0.30 financing raising C$750,000 is a good step to boost the company’s working capital position, thereby reducing the financial risk, but a higher copper price will make the life of Oroco’s management so much easier as a new drill program to convert the historical resource into a NI43-101 compliant resource will help Ian Graham and his team to spread the word.

Disclosure: The author has a long position in Oroco Resource Corp. Oroco is a sponsor of the website.