Flashback to just 11 months ago when the markets were crumbling during the PDAC Conference in Toronto, the hotspot of the (junior) mining scene, one would have been laughed out of the room if he/she would have made the claim copper would be trading at in excess of $3.5 per pound within a year.

Fast forward to the end of Q4 and the copper price has exceeded all expectations. Copper companies saw their share prices increase by triple digit percentages and Oroco Resource Corp (OCO.V) isn’t an exception. After reaching a low of C$0.20 during the pandemic, is share price hit C$2 in December and touched a high of C$2.12 before settling in around the current price of C$1.80. A true ten-bagger. Perhaps a bit surprising as the current market capitalization is approximately C$350M making the company one of the few pre-resource stage issuers with a substantial market cap. But with in excess of C$20M in cash in the bank, a very promising result from the 3D IP Survey and the anticipation of a substantial multiple-rig drill program in 2021 have fueled the share price to all-time highs and uncharted territory.

The recent update on the 3D IP Survey indicates a very large continuous chargeability anomaly

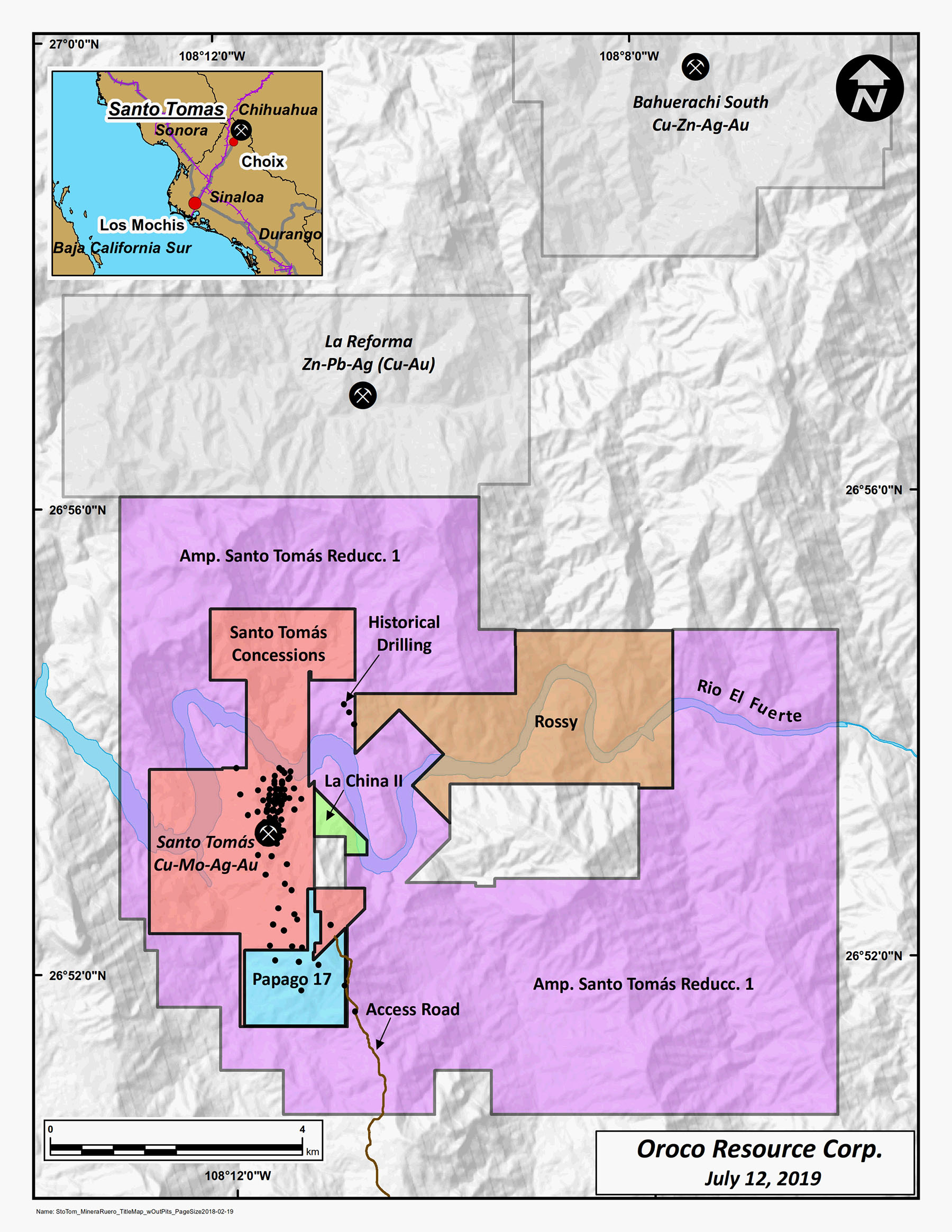

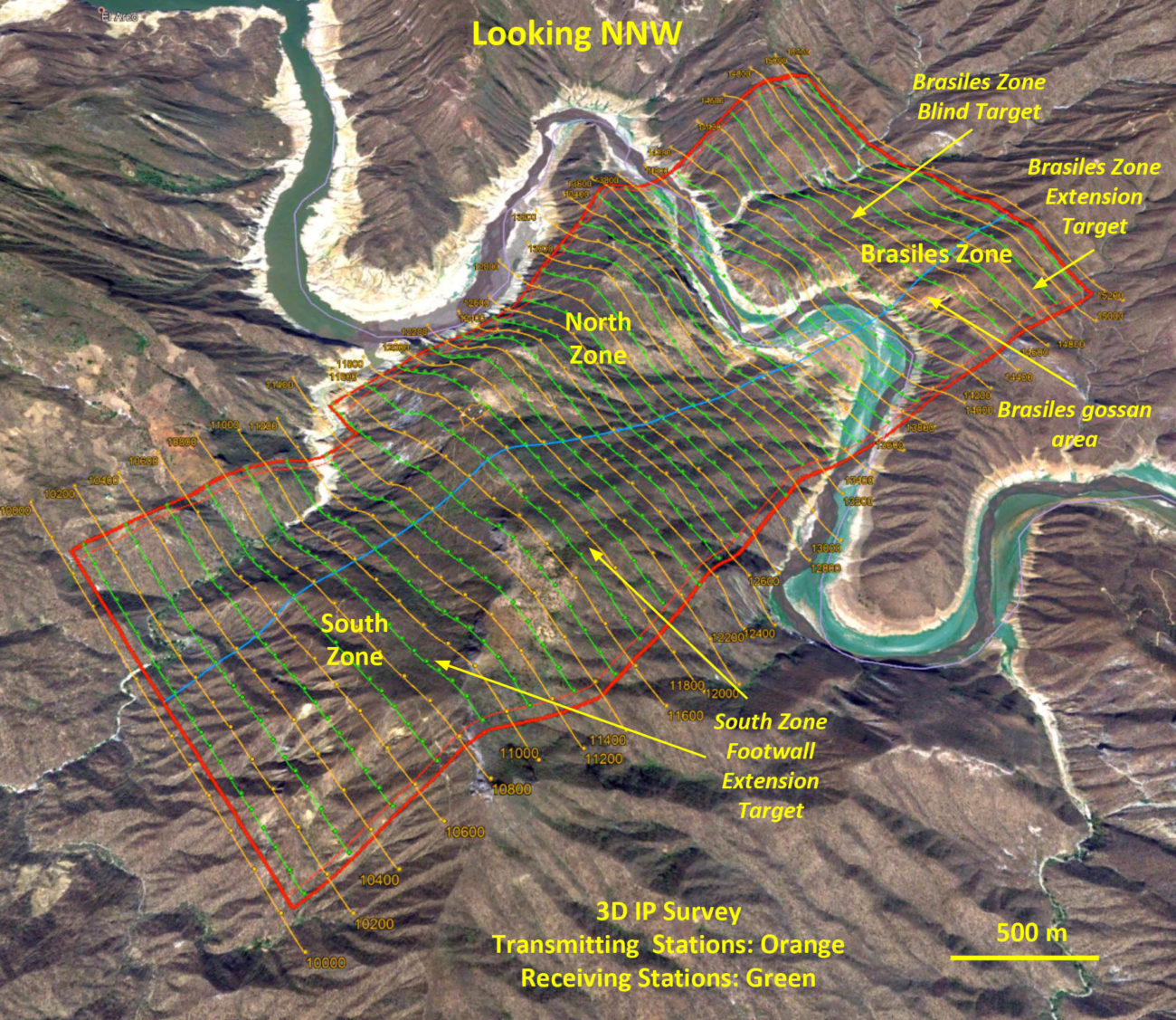

At the end of January, Oroco provided the market with an update on its ongoing 3D IP Survey. That extensive survey started a few months ago and the company is planning on covering the entire project area as the IP Survey helps to get a better understanding of the size of the chargeability anomalies.

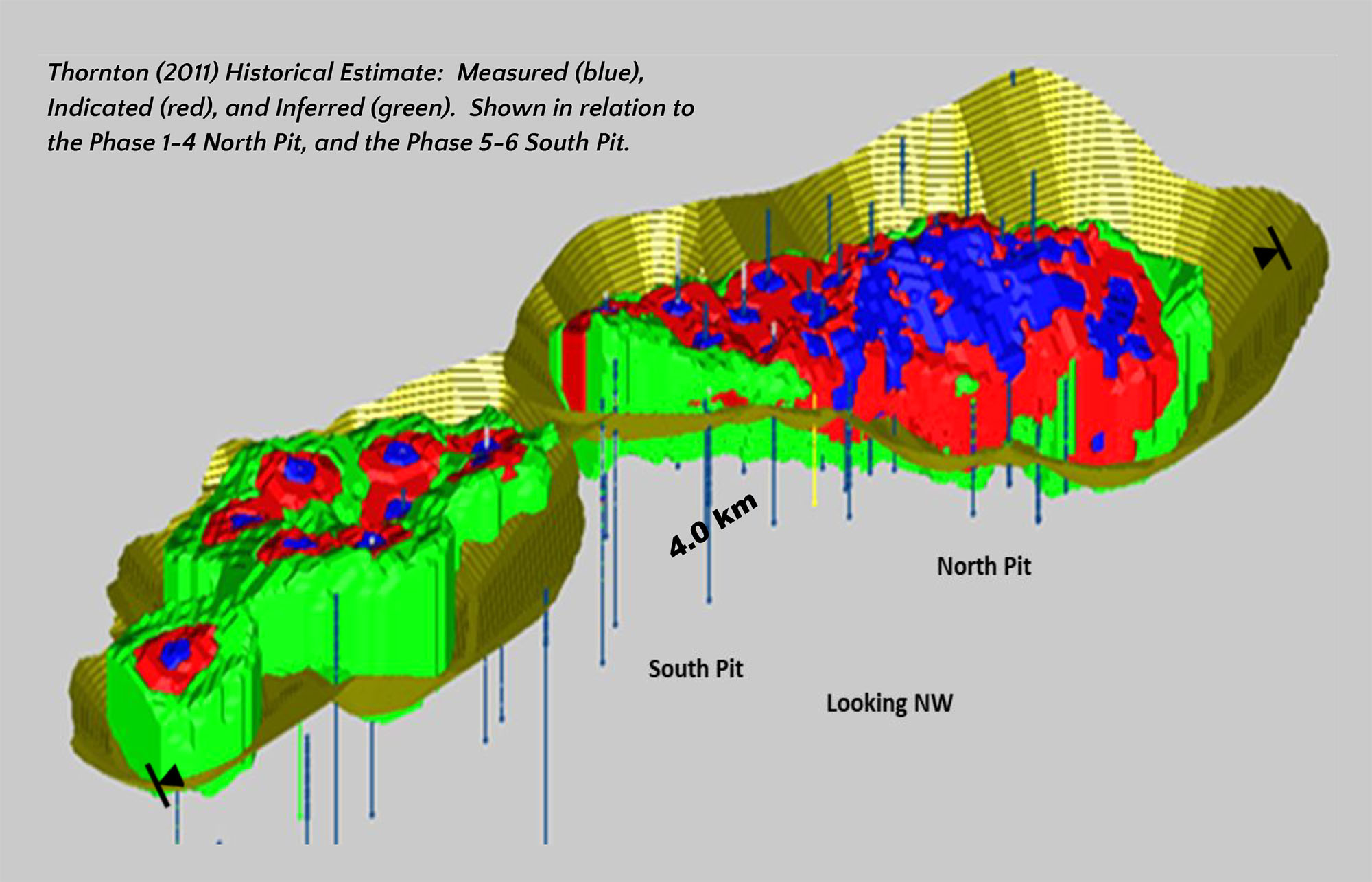

The initial results in November were encouraging but at that point, the company had only completed the interpretation of the South Zone. A nice warming up exercise, but what we mainly were interested in was seeing the results of the North Zone and the Brasiles Zone as there is some low hanging fruit ripe for picking given the amount of data available for the North Zone.

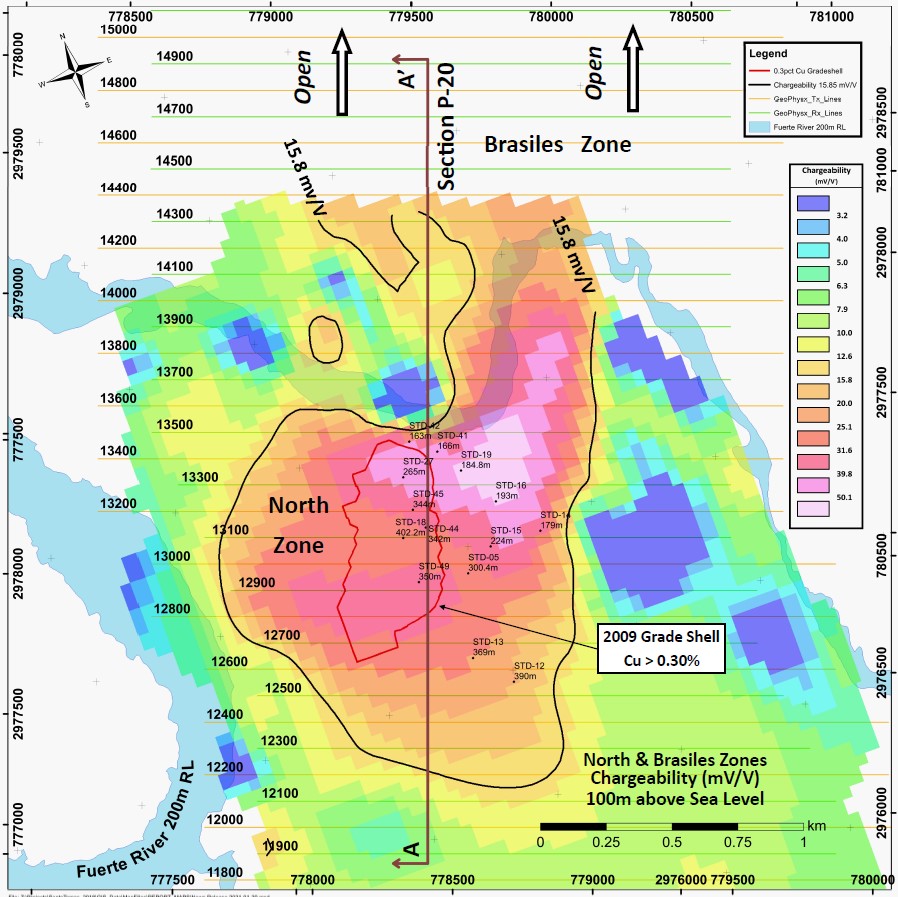

The results of the IP Survey on the North zone are exceeding expectations on all fronts: the continuity and consistency of the anomaly is striking. Additionally, the anomaly seems to be running further than expected in the northeastern direction while the chargeability anomaly has been chased to a vertical depth of approximately 600 meters. And the 600 meter cutoff is mainly because the IP Survey can’t provide reliable data from anything deeper, so for all we know, the chargeability anomaly may even extend further at depth but that doesn’t really matter at this point as there’s plenty of stuff to like closer to surface.

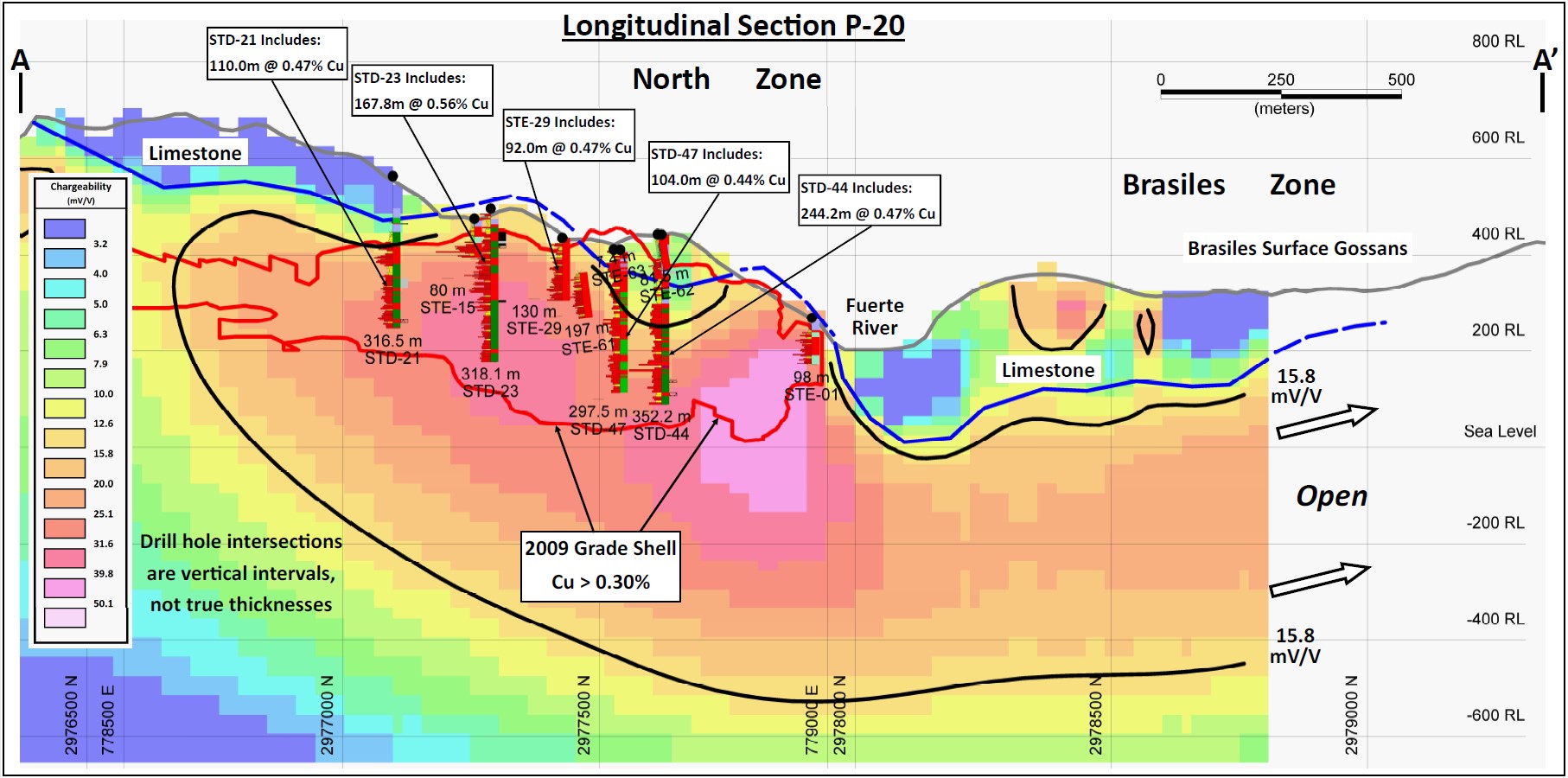

The image above shows a long section of a part of the IP Survey, and you can clearly see the correlation between the 2009 grade shell (the non-compliant open pit) and the chargeability highs. Keep in mind there is NO 1:1 correlation between chargeability highs and copper mineralization. The chargeability high simply means there’s a thick layer of sulphides present and the anomaly could be explained by pyrite and chalcopyrite as well so it doesn’t necessarily have to mean all the orange zones in the image above will have copper grades above a cutoff grade. A logical follow-up to test the chargeability high would be to test for conductivity, but really only the drill bit will be able to provide a hard confirmation whether or not the anomaly confirms the copper-bearing system extends much deeper and much further to the north-northeast than the current pit shell. While we can obviously expect the copper mineralization that has been encountered in the pit shell to be more widespread than just in the pit shell, it’s still too early to extrapolate the dimensions of the anomaly to an exploration target.

Will the north zone grow? Undoubtedly. Even if the anomaly does not fully consist of a copper-bearing anomaly with grades above reasonable cutoff grades, it’s hard to imagine none of those tonnes will contain copper mineralization. The second image provides us with more insight on the footprint of the anomaly.

As you can see, the chargeability high seems to be intensifying towards the northeast of the pit shell and we think this would be a very logical drill target for Oroco Resource Corp. to follow up on. Again, the anomaly only shows there are sulphides present and this does not necessarily mean the copper grades will tag along, but common sense tells you the copper mineralization likely won’t stop at the pit outlines (in red).

Is it reasonable to expect to find more copper directly adjacent to the pit outline? Absolutely. Is it reasonable to expect the entire anomaly to contain above cutoff copper grades? Probably not as there will be mineralization below cutoff grade (meaning the copper values would be too low to be economic) and portions of the anomaly will have been caused by the footprint of the pyrite and chalcopyrite. But we would love to be wrong and see the North Zone evolve into a multi-billion tonne super pit concept, that’s for sure!

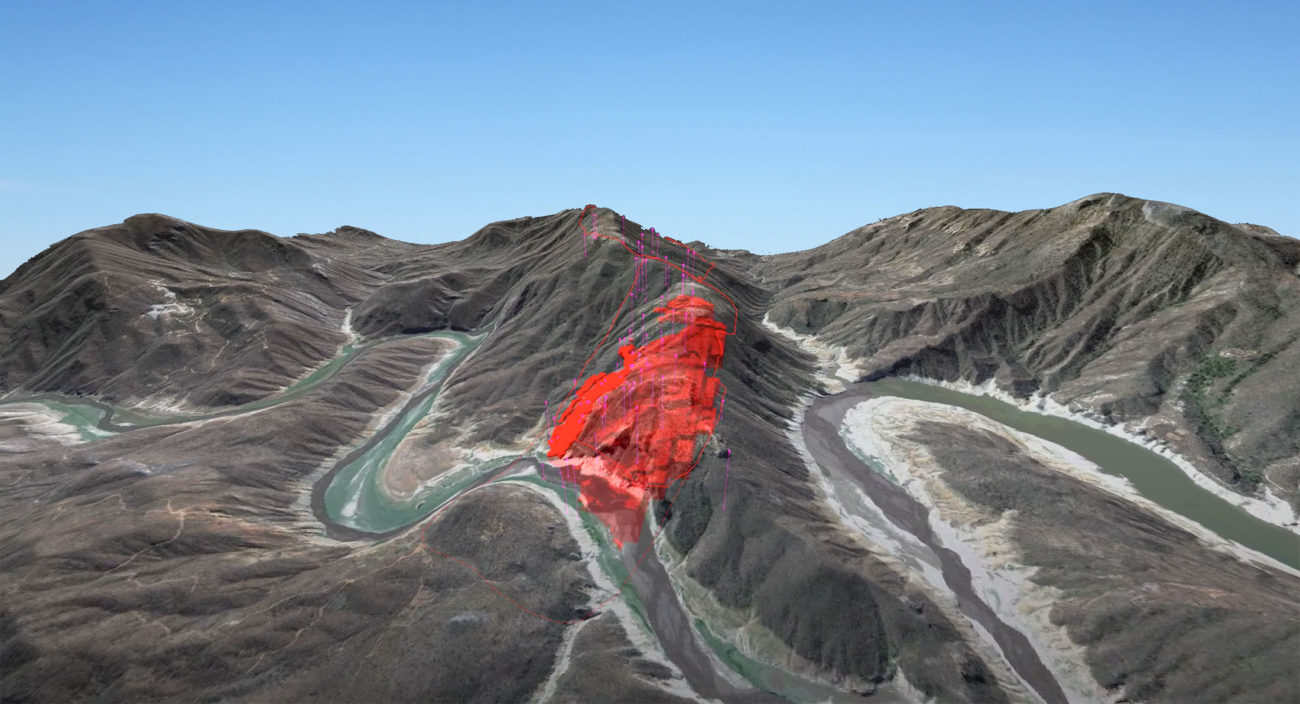

The 3D IP Survey is now in its final phase and we hope to see the interpretation of the final batch before the end of the quarter. It will be very interesting to see the chargeability results of the Brasiles zone where three holes were drilled in the nineties. The data from these holes is not available although John Thornton who has been working on the project for years in the past few decades has some specific recollections of hitting 1% copper(-equivalent) intervals. Good to know, but we’ll have to wait for the drill bit to perhaps twin the original holes.

For now, Brasiles is just icing on the cake but should the 3D IP Survey confirm a high chargeability anomaly, we would expect Oroco to plan twinning the historical holes as soon as possible. The currently available results of the IP survey seem to confirm the mineralization continues across the river on the Brasiles zone so it would be reasonable to expect the company to encounter more copper mineralization, but it’s too soon too talk about size and grade right now. Let’s wrap up the IP Survey and punch a few holes into the Brasiles target before getting carried away. For now, the main value of the Santo Tomas project is still related to the North Zone which will be aggressively drill-tested.

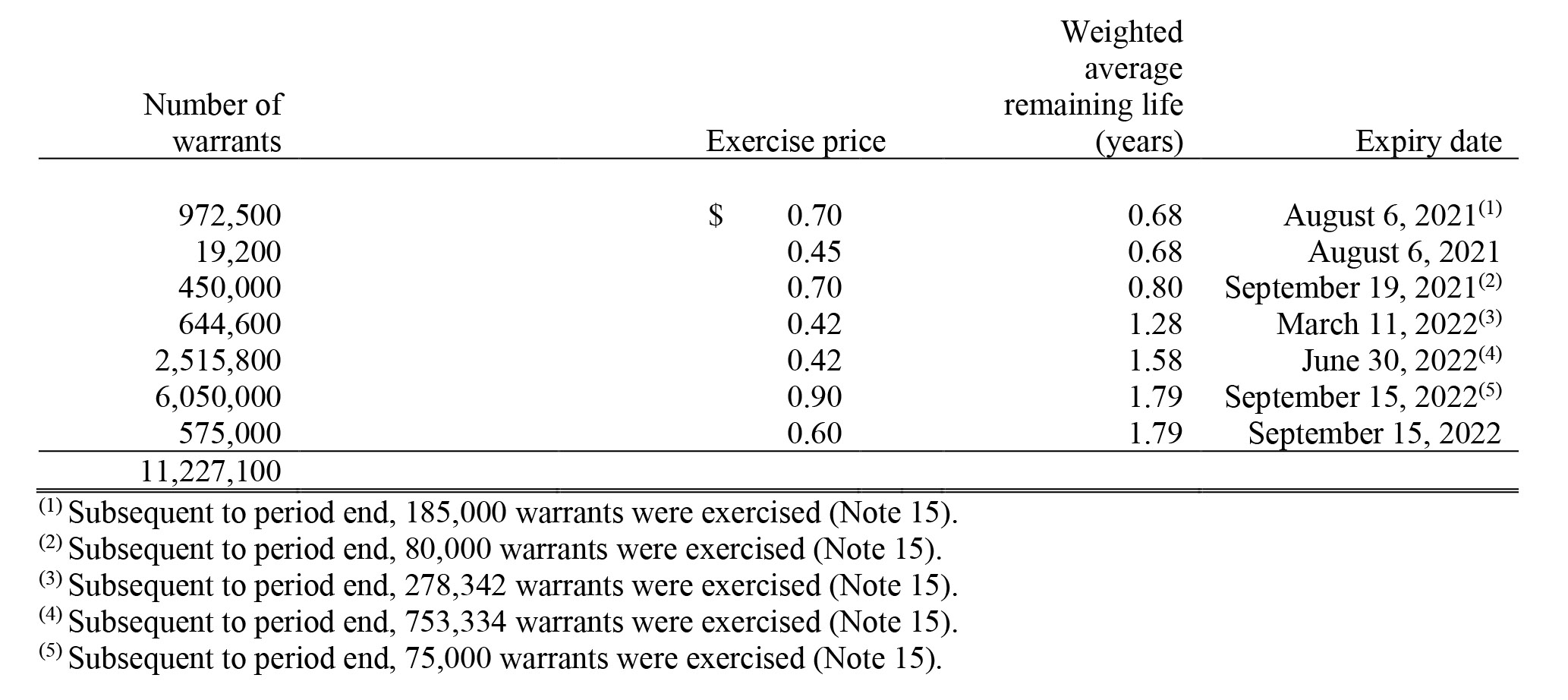

The recent capital raise pushes the cash position to in excess of C$20M

Not only can you recognize a good management during a severe downturn, even when a rising tide lifts all boats a management team can distinguish itself from others. What we particularly like about Oroco’s strategy is that it’s not afraid to raise money. And it’s not afraid to raise it in substantial blocks.

In December, the company closed a C$15.5M financing priced at C$1.20 with each unit consisting of one common share as well as ½ warrant with an exercise price of C$1.60 per warrant. 6.45 million warrants were issued as part of this placement and should these warrants – which are currently in the money- be exercised, Oroco would see an additional C$10M hit its treasury.

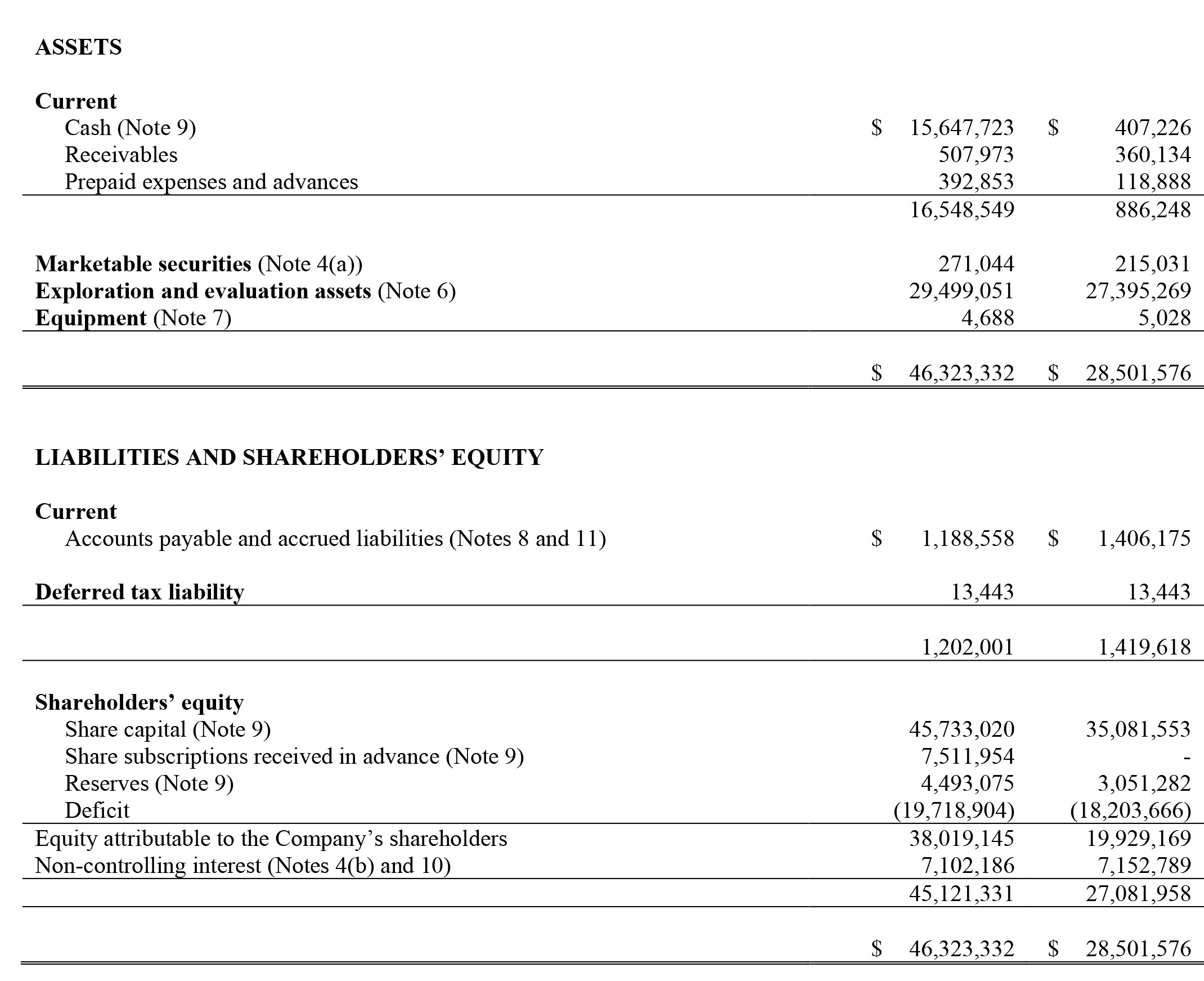

As of the end of November, Oroco had C$15.6M in cash, but this already included C$7.5M related to the December financing. Whereas the total working capital of Oroco was approximately C$15.3M as of the end of November, recent talks with the Oroco management indicates the company currently has approximately C$21-21.5M in working capital which means about C$2M has been spent since November. That seems very reasonable given this includes about 2.5 months of G&A and the majority of the expenses related to the 3D IP Survey. Additionally, Oroco has made a US$400,000 (originally deferred) payment related to the legal expenses to solve the Santo Tomas title issue.

As of the end of November, Oroco had 11.2M warrants outstanding and subsequent to end of the quarter, about 1.3M warrants were exercised. This means that we can reasonably expect the company to have around 16-16.5M warrants outstanding (the company website mentions 16.44M warrants as of January 21st) at various strike prices (including the warrants issued as part of the December placement).

Based on the overview above, we can expect the remaining 1.17M warrants at C$0.70 and 19,200 warrants at C$0.45 to be exercised before they expire this year. That would bring in approximately C$0.83M in cash. And of course, we will likely continue to see the 2022 warrants being exercised on a gradual basis as well. We are not worried about Oroco’s cash level and dare to say the current cash level, as well as the cash inflow we can reasonably expect from warrant exercises, will be sufficient for Oroco to complete its C$30M expenditure requirement to earn its 81% stake in the project.

Despite the healthy treasury and the abundance of warrants that are in the money, we believe the best thing Oroco can do is raising more money at the current valuation. Not only will the extra cash go a long way towards also completing a 2022 exploration budget, finding money at the current valuations would actually also validate the current valuation and keep the momentum going. To be clear, we are currently unaware of any money-raising efforts from Oroco but if Oroco sees an opportunity to raise an additional C$10-15M at decent terms before the copper frenzy wears off and before seeing some weakness during and after Chinese New Year, it should definitely do so. After all, sitting on C$35M in the bank is still better than sitting on C$20M. An exploration-stage company should never be too proud (or too arrogant) to raise more cash whenever a financing window is wide open: you never know when it’s shutting down again.

And remember, issuing additional shares is not dilution if the company does something useful with it. Seeing Oroco’s overhead expenses (C$0.4-0.5M per quarter), we know the management isn’t jetting around the world on a leased Gulfstream V. In fact, President Ian Graham is in the final stages of preparing a move to Mexico as he’d like to be able to supervise the exploration program from the driver’s seat.

Conclusion

Oroco has been rewarded by the market for consistently meeting the expectations and ticking all the boxes it promised it would. The company is in a luxury position with in excess of C$20M in cash and millions of warrants that are currently in the money and will help to keep the treasury topped up at a healthy level.

Oroco’s strong share price performance also means it is now one of the leaders of the pack in the copper exploration phase and it’s one of the few companies boasting a multi-hundred million market capitalization without a resource estimate. The current share price provides an exceptional opportunity for investors to consider monetizing a portion of their position to reduce the investment risk (as you can read in the disclosure, we have regularly been taking some profit off the table). Buying or selling stocks is everyone’s own decision as every single investor has his/her own risk tolerance.

For 2021, we expect the company to complete the 3D IP Survey and release the results before embarking on a substantial drill program. The size of the program is unknown at this point, but we expect Oroco to target a 40-60,000 meter drill program using 3-6 drill rigs (keep in mind this drill program may not be fully completed in the current calendar year), and this should go a long way to provide enough data points to release a NI43-101 compliant resource estimate at that point. Expect Oroco to hit the road with a very aggressive drill program which should result in a continuous news flow from the summer on.

Disclosure: The author has a long position but has sold shares over the past few months to take profits off the table. Oroco is a sponsor of the website. Please read our terms & conditions.