The copper price (and the copper market in general) has been on fire. Although the copper price was hit hard during the COVID pandemic, it gained momentum towards the end of the summer and when the positive vaccine news has hit the wires, the copper price just continued to move up and hasn’t looked back since.

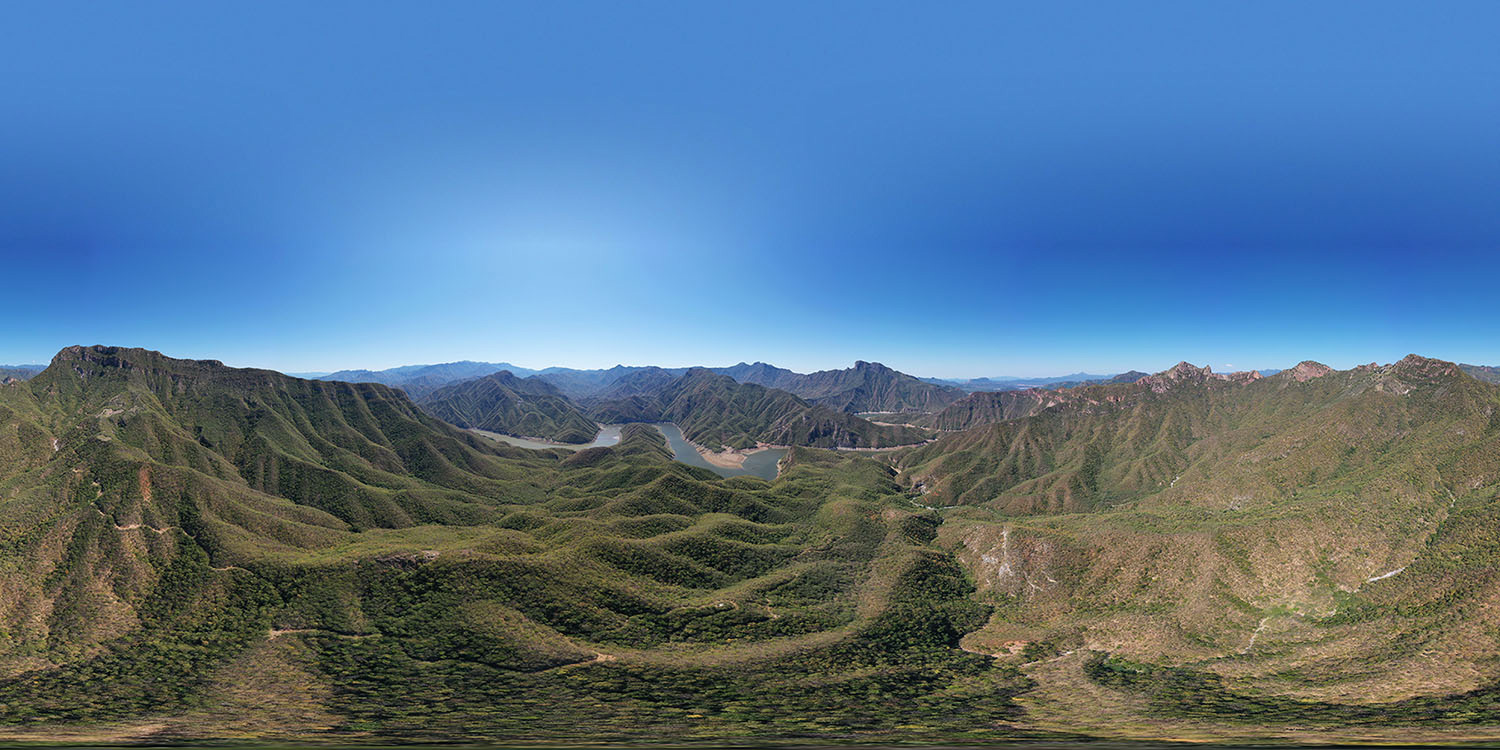

This had a very positive impact on Oroco Resource Corp (OCO.V) which is working towards a maiden NI43-101 compliant resource on its Santo Tomas copper porphyry project in Mexico. We caught up with Adam Smith, VP Business Development of the company. We didn’t just discuss Oroco and Santo Tomas: as Smith has an excellent knowledge of all things copper, we were happy to pick his brain on what’s going on on the markets these days.

A chat with Adam Smith

Adam, over the past few years you have built up quite the expertise on copper and the copper market and whenever we discuss the copper markets with you, you always have some valuable inputs and ideas. Does the current copper price surprise you?

We’ve tried to understand the market and have assembled a body of proprietary research to help us with that, and do our best to speak with people at the centre of the industry. That research and those connections have given us confidence in the views that have become an underlining premise in Oroco’s business plan, that large, well situated copper deposits not already developed are extremely scarce assets and any that match that description will be the subject of acquisitive interest.

The current prices DO surprise me, but they shouldn’t. It’s one thing to formulate ideas and forecasts and quite another to see them come to life, and copper is moving in much the way that our research suggested it would, albeit at a quicker pace than we may have forecast.

Many of the same forces that drove copper prices higher a decade ago are again in play. Added to that are a great many very supportive long-term supply and demand related vectors that weren’t a factor a decade ago, and which may be driving capital inflows into the copper market, affecting current prices.

Is the current strong copper price mainly caused by a pent-up demand that has been maintained under control during the pandemic but where the cork has now popped out of the bottle now?

Yes, as well as some surprising levels of copper purchases from China related to the creation of a stockpile, and large capital flows into copper which relate to financial market interest; speculative bets, if you will.

How sustainable do you think the current copper price is? While there obviously is a supply/demand imbalance, we’ll have to wonder how sustainable this is on a 1-3 year time frame (so let’s ignore the very long-term fundamentals for a second here)?

I may have a less bullish view in the near term than some we’ve been hearing. Several large new mines will be coming on stream. Kamoa, Oyu Tolgoi Phase 2, QB2, Grasberg Underground, and others, will add significant mine supply. Large additions to supply, last seen leading up to 2016, coincided with falling prices.

While I do not expect to see the exact same dynamic – there are positive demand side vectors currently that didn’t exist a decade ago, and the additions to supply, as big as they are, are significantly smaller than those leading up to 2016 and may still not be able to keep pace with growing demand – I do think there is a chance the near-term picture may be more moderate than some of the more bullish forecasts. I’ll be happy to be wrong on this one, but a little caution is never a bad thing. And if prices do moderate, or at least not take off for the stratosphere just yet, it’ll be just a head fake, as the demand picture will continue to grow, and past the middle of this decade, a decline from aging mines will really kick in and the pipeline of new projects becomes very sparse. Although prices may be supportive of new supply, the paucity of available projects will be a limiting factor and depletion at existing mines will continue to erode supply.

While we see parallels with for instance the increase of the iron ore price, it’s likely easier to expand iron ore mines rather than copper mines. So how do you see the supply/demand imbalance evolve in the mid-term and longer term?

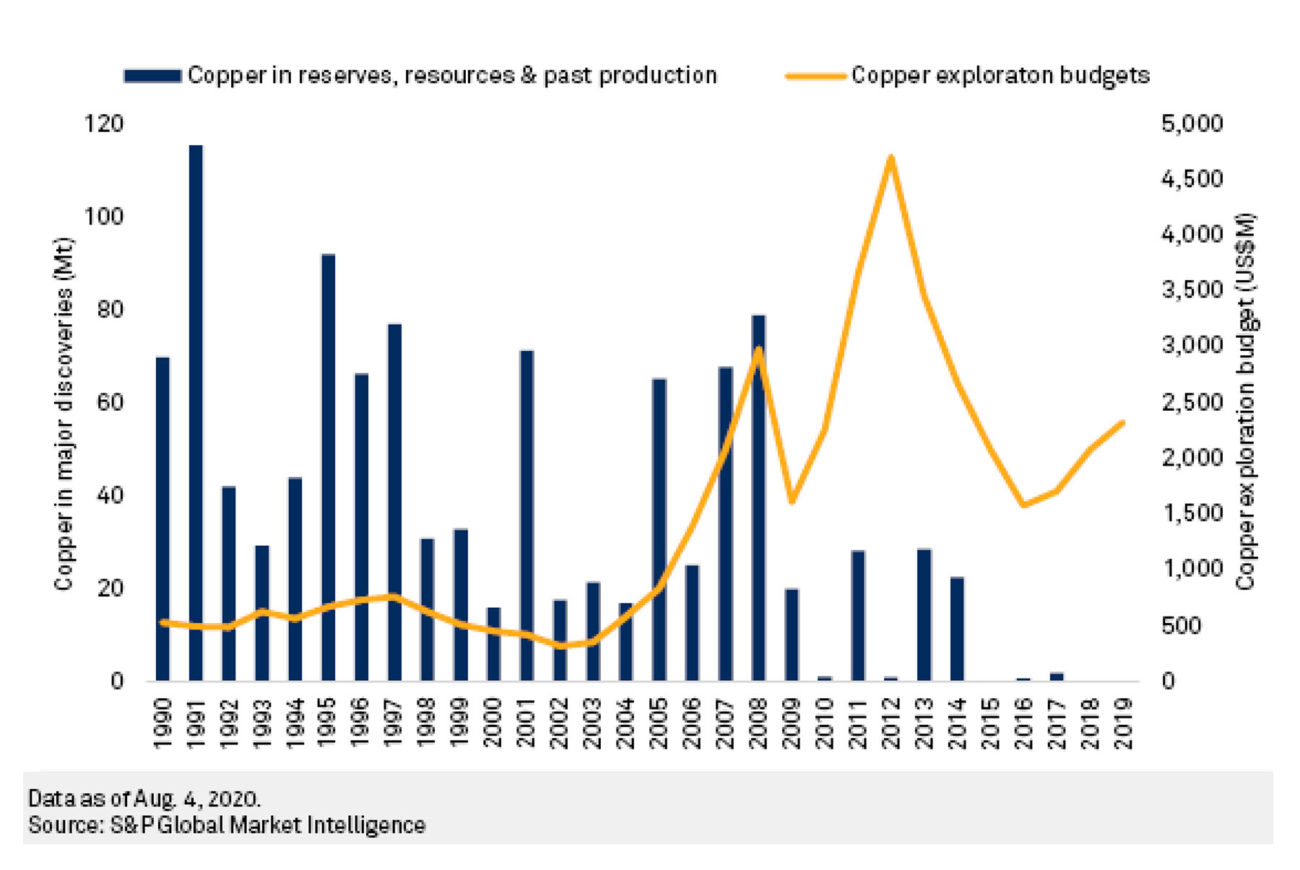

There are just so many positive vectors at work leading to tight supply conditions. The dramatic decline of new discoveries, the capital discipline of majors leading to muted commitment to new production, the decline of head grades worldwide, the introduction of legislation and empowerment in many jurisdictions anti-mining interests, and technical challenges to new supply, to name some of the major vectors.

Another major factor is the maxing out of brownfield expansions. While a great many younger iron ore projects have flexibility to expand production, aging copper mines have less. This lessening of flexibility can be seen trends related to their reserve base. Most of the increase in copper reserves and resources in the past decade have come from the use of lower cut-off grades at existing resources rather than meaningful new discoveries, of which there have been vanishingly few. And, a great many of these large, aging deposits have been mining above the average resource grade, suggesting future grades must focus on remaining lower grade portions of their ore bodies. We posted on the Oroco website a great study by Goehring & Rozencwajg which details this phenomenon.

Another data point: currently forecast new production during the next decade represents just 36% of the new mined copper supply of the past decade. Under two million tonnes of new production from 17 projects is forecast during the coming decade versus almost five million tonnes from 60 projects in the prior decade. This will almost certainly rise as new projects reach the point they can be planned, but limiting this is the paucity of available projects.

A steady three decade of decline in major discoveries, from hundreds during the 1990s to just a single one in the past five years (Rio’s Winu in Australia) will soon start to bite.

To meet the demands of the “electrification of everything” larger amounts of copper will have to come from new, but lower quality/higher cost deposits or portions of deposits currently in production, with the result being a need for higher prices, many forecasting tremendously higher prices.

From that point in the coming decade after the several big new mines come online, things will get very interesting. And if the demand starts with the kind of a bang that industry and governments are increasingly encouraging, funding and forecasting, the fireworks could start much earlier.

A few years ago, the copper price was under siege due to the ‘shadow banks’ in China using copper as collateral. It’s been awfully quiet on that front ever since. Do you have any insight on the stockpiles and perhaps the shadow inventories in China?

I don’t have any particular insight into this but suspect as the finance industry in China has matured, the activity of shadow banks would be curtailed and we’d expect use of copper stocks by them to be reduced or eliminated. I’d also think that our understanding of these matters may have been less than perfect and there may have been unreliable anecdotal information circulating.

Chile is considering hiking its royalty on copper production, the presidential elections in Peru may turn out to be negative for mining companies in the country as well. Ecuador still has some nice copper deposits and projects but the country is still met with some distrust in the mining community. How do you see the geopolitical risks evolve? Do you see the mining sector as low-hanging fruit for governments in desperate need of cash to fill the holes in their budgets?

Well managed, extractive industries generate tremendous benefits for host economies, but there’s a balance that must be struck between attracting/retaining on the one hand, and maximizing taxes, royalties and the like. Global capital allocation and investment decisions favour stability and a balanced approach to taxation. When countries get it wrong, they lose investment with capital goes to other jurisdictions, and as a consequence they lose the very thing they had sought, tax and royalty revenue.

But because mineral endowments aren’t at all spread evenly between countries miners can’t freely “shop” between countries and their tax and royalty regimes. Nevertheless, countries can certainly tax and regulate their way out of contention as an acceptable investment destination, but knowledge of that won’t discourage some from trying.

At Oroco we’re committed to helping develop Santo Tomas in a fashion that contributes to sustainable growth and development, protects communities and reduces carbon emissions. We’re also comfortable in Mexico and confident that as a mining jurisdiction it will continue to balance the tax and royalty bite in a way that has made it very successful in attracting FDI in the sector. The current Federal government is reviewing mining legislation. We’re watching that process carefully, and are confident that any changes will be limited to the refinement of certain taxes and royalties and will not materially effect the attractiveness of Mexico as an investment destination.

Putting you on the spot: at what price level do you expect copper to be trading on December 31st of this year?

My bias is to prefer a copper price that does not discourage investment rather than a copper price that’s rocketing into space. Furthermore, I’m conscious that prices have been on a pretty good tear recently and may need to cool off. I’ll suggest a price per pound of $4.40 at year end. However, if the post-2009 financial crisis period is a guide, prices higher than current spot prices may be seen. Under that scenario and based on little more the “feel” of the current market I’ll say upside to $5.25 may be seen.

Either way, I’m pretty certain that any copper price in that range would produce exciting results when plugged in to your Santo Tomas economic model.

The company

Congratulations on being a ten-bagger in about a year. Just 15 months ago you had to cancel the second tranche of a placement priced at C$0.30 as markets were panicking, and now you’re trading at in excess of C$3. Did you expect this at all?

From the depths of market’s response to COVID last April to today it’s been quite the ride in the copper sector. But it was clear in the months leading up to January of 2020 that copper markets were starting to respond to more favourable supply/demand circumstances and the increased focus on copper’s role in renewable energy and energy use in general. COVID interrupted that but ultimately lead to circumstances that have been supportive of the higher copper prices we see today and the forecasts of even higher future copper prices.

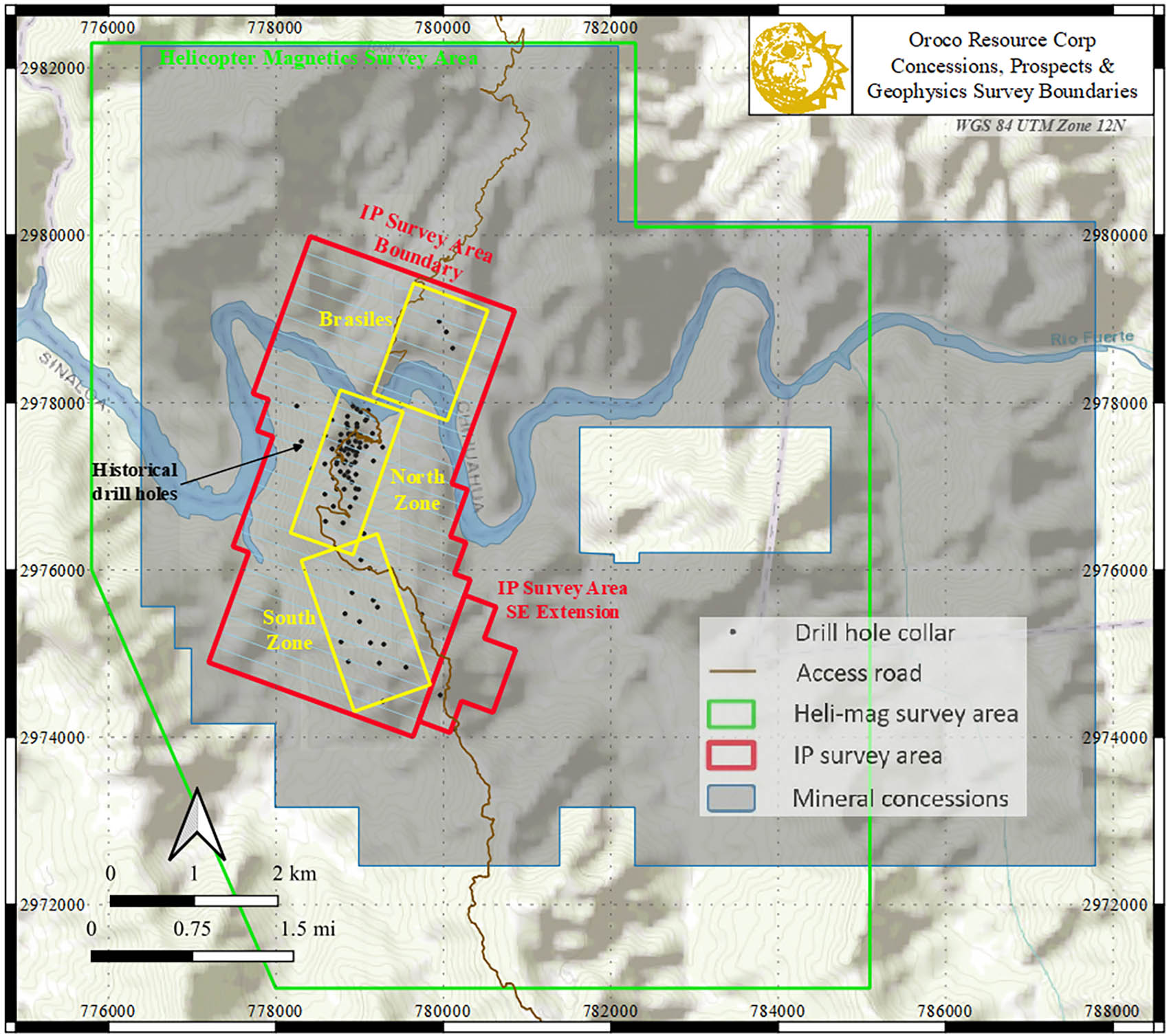

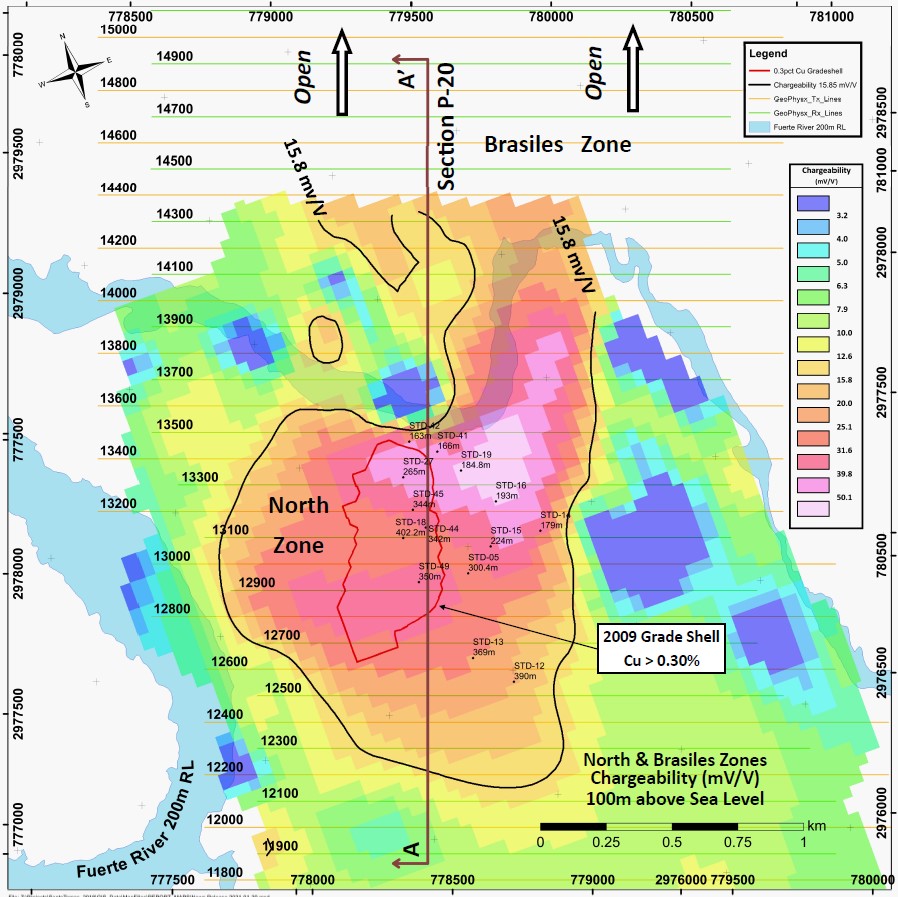

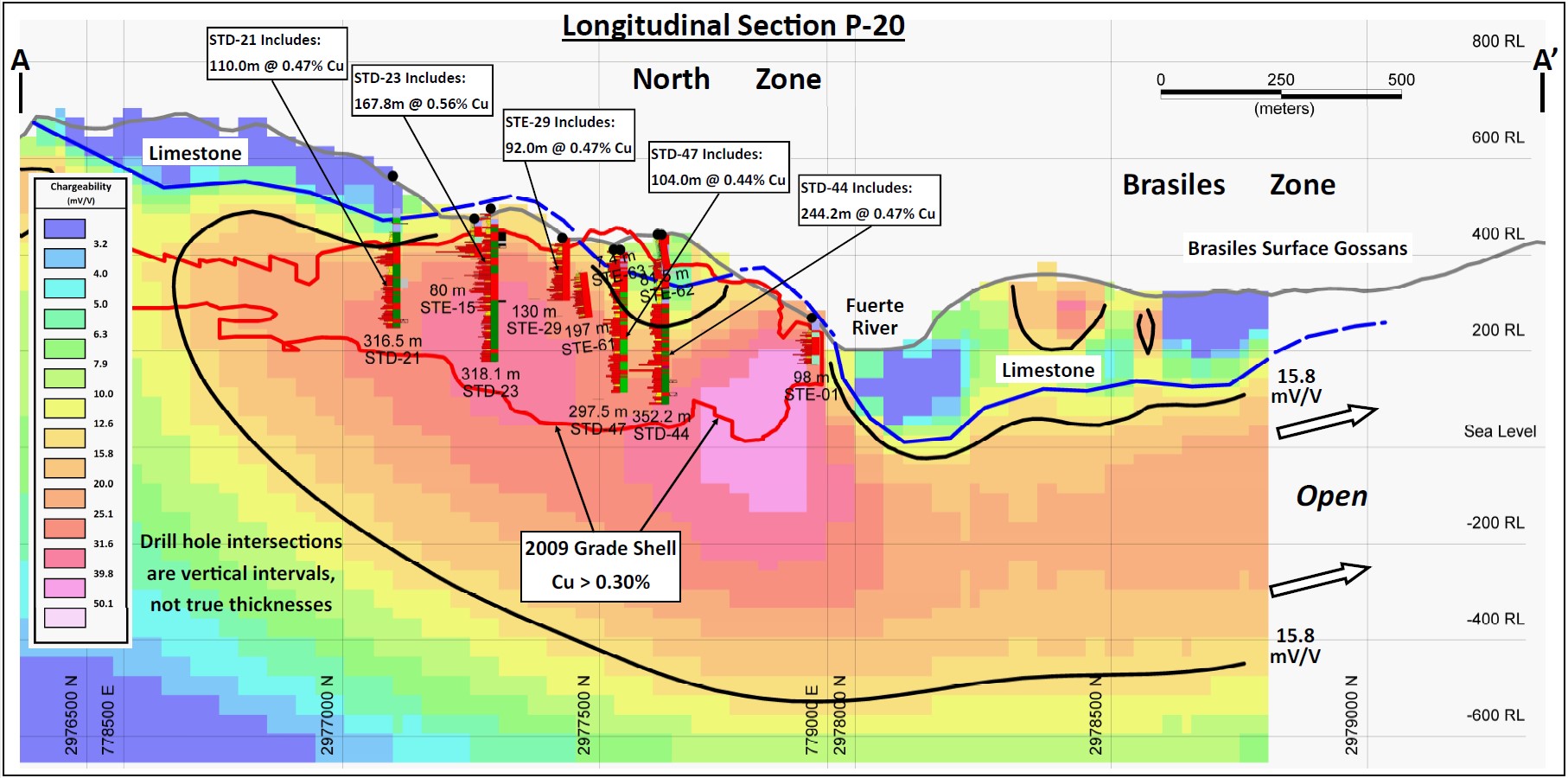

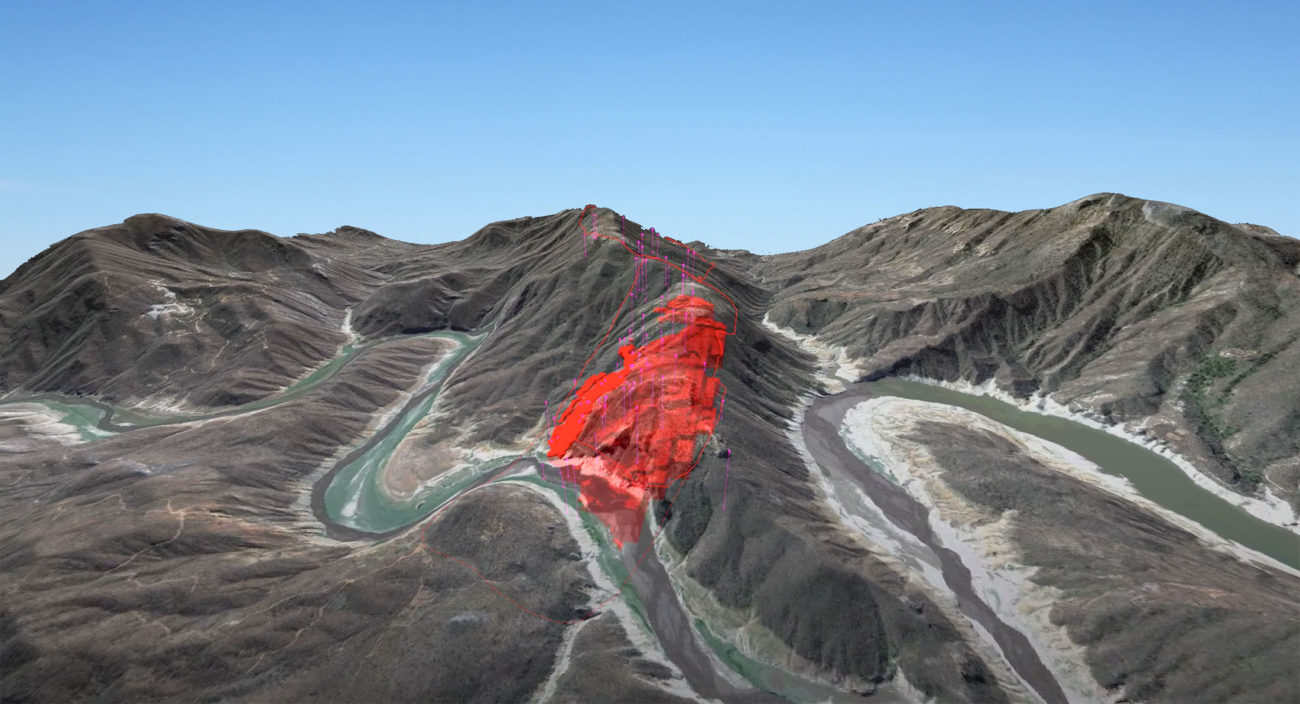

With these prices in mind, and the postive results of Oroco’s 3D IP survey – that has certainly provided evidence in support of the historical exploration drilling, resource estimates and PFS at Santo Tomas – we are seeing a reduction of the discount applied to the historical resource and a further rerating as a consequence of rising copper prices. While this is what we’d expected to see at Santo Tomas, and in line with our copper prices forecasts, , it’s one thing to formulate a plan and forecast how things may play out, but another to see it take place. That these forecasts have been quite accurate in predicting the copper market, both in terms of the metal pricing and the supply/demand dynamic, has had the effect of increasing our confidence in our forecasts of further copper market strength, even if the exact timing and price estimates remain elusive.

For the past six months or so you have been working on a 3D IP Survey. For the laymen among us, could you elaborate on what a 3D IP Survey is, and what you hope to achieve with it?

“Induced Polarisation” or “IP” is an electrical geophysical technique used for mapping certain electrical characteristics of rocks and sediments – including the electrical effects of any water they may contain – in shallow sub-surface environments. Along with conductivity and resistivity measurement, IP is an active ‘galvanic’ technique that requires direct contact between the ground and electrodes (metal stakes or sometime flat metal plates) that make a physical electrical connection with points on the ground above the volume to be surveyed.

Galvanic surveys use electrodes to inject current (“current electrodes”), and a number of electrodes are arrayed away from the site of injection to measure for voltage return (“potential electrodes”). Knowing the injected current at the injection site(s) and the measured voltage at the potential electrodes during injection, the resistance/conductivity of the ground may be calculated. By continuing to measure the voltage at the potential electrodes after the injection current is turned off, a measure of how volumes of the ground affect the rate at which the voltage at the potential electrodes drops off over time can be recorded. This delay in the discharge is referred to as the chargeability of a material.

Chargeability and resistivity can assist in the interpretation of possible materials in the subsurface. These electrical methods are not limited to surface land measurements, they can also be applied in bodies of water, to investigate sediments and the underlying geology, and also within boreholes, allowing for improved resolution at depth.

To use the data for interpretation, the measured point values of resistivity and chargeability are recalculated to apparent resistivity and chargeability which aggregate a result from the current flows beneath the electrodes rather than just from a discrete point or layer. These values are not ideally suited to making an interpretation and thus a further processing step, called inversion, is required.

In this process, software is used to find a model of chargeability or resistivity distribution that would produce the same result as the data recorded in the field. The resistivity values within the returned model will form the basis for an interpretation.

However, the model is non-unique and the chargeability and resistivity range of the various geological components will commonly overlap, and so a certain level of ambiguity has to be assumed. Distinct geological formations may have formed in contrasting geological settings but can have the same resistivity or chargeability, so some prior knowledge of the geological setting from geological maps and drill holes must always contribute to a geological interpretation of a geophysical survey.

As further exploratory work is done by other geophysics or direct observation from mapping, trenching, drilling or underground development, constraints can be added into the inversion models over time to improve the model and the derived geological interpretations. So, if exploration for economic mineral sulphide accumulation is a target for an IP survey, for example, the possibility that the target mineralisation and any non-economic sulphide mineral accumulations or clay-rich deposits would be indistinguishable from each other in the inversion model is high.

The application of electrical surveys can occur as simple soundings, profiles along a linear array of current and potential electrodes, or a wide distribution of electrodes may be migrated across a larger area.

One of the main ‘issues’ is the fragmented ownership of the Santo Tomas project, but you seem to be working towards a more homogenous structure. At the end of April, you announced Oroco entered into an agreement with Ruben Rodriguez who relinquishes its right to a 27.8% ownership of Xochipala Gold in a deal that will see Oroco make a US$1.5M payment to Rodriguez for 13.9% of the shares and register the residual shares to the tune of 13.9% (of Xochipala) in his name thereby converting a right to an effective ownership. Could you elaborate on how this deal came together?

With the announcement of the acquisition of half the Rodriguez interest we have indeed started the process of streamlining ownership. The Rodriguez family held a stake that could be reduced to 9% but lacked liquidity. With an unclear timing and liquidity path we offered a small but still significant payment and that offered them some certainty, and a remaining 4.5% stake allows them participation in future upside.

While we take pains to describe the ownership structure in detail, it can be stated in simple terms as a current beneficial ownership of 72.3% ownership of the core concessions which will rise to 85.5% with the expenditure of a total of CAD $30 million. The core concessions have two minority owners, the Rodriguez interest and another, that can be reduced to 10% ownership, with Rodriguez’s now reduced to 4.5%. Further streamlining opportunities will be sought.

Oroco has an ownership of 77.5% of the peripheral concessions. An earn-in to an increased ownership in the peripheral concession is also anticipated with a 90% interest targeted.

Talking about the earn-in requirements, how much of the required C$30M have you already spent so far?

Despite accomplishing a great deal at Santo Tomas, 3D IP, MAG and LIDAR surveys, the completion of a road network, core handling and storage facilities and crew accommodations, for instance, to date we’ve spent less than 10% of the CAD $30 million total. Once drilling commences the figure will rise rapidly and with a strong treasury and a great many in the money warrants we’re well funded to achieve that earn-in rapidly.

It looks more advantageous than making the US$16M payment for the full ownership of Xochipala, but is there also a firm plan to try to further increase your position in Xochipala? As that appears to be the easiest way to further increase your ownership in Sant Tomas beyond the 85.5% you can now earn.

Agree, we think capital is best spent “in the ground.” Any increase beyond the 85.5% interest in the core properties we could earn would be as a result of future negotiations with the minority partners. I’m confident opportunities will present themselves.

Under the original agreement, Rodriguez was entitled to a 0.5% NSR as well. Has this right been removed as well under the current agreement?

That NSR remains with the Rodriguez family.

You’re now fully cashed up with a working capital of about C$22M as of the end of February and about 16 million warrants that are all in the money, you’re in an excellent financial shape. May we assume this will have a positive impact on your plans to drill Santo Tomas and you’re planning an aggressive multi-rig drill program?

Yes and Yes.

There are approximately CAD $17 million of in-the-money warrants and plenty of liquidity should the holders seek to use the markets to raise cash to exercise.

The 3D IP survey has certainly expanded our horizons at Santo Tomas and multiple rigs are being considered for the +5 km of strike length, considerable width and in many cases, IP indicated depth potential of circa 1 km and potentially greater.

How much time and how many meters do you think you will need to get to a sizeable NI43-101 compliant resource? You obviously have access at a humongous amount of data, including a historical resource, and that will likely be a big help to advance Santo Tomas as efficiently as possible?

The historical drill data base has been tremendously helpful. Seeing strong correlation between the IP results and historical drill results has added to the usefulness of that geophysical tool. And the drill data has allowed us to prioritize drill targets for maximum early benefit. For instance, the ability to quickly confirm, expand and calculate a resource in the area of the 0.30% cut-off gradeshell could provide a confident economic case for a mine start up at Santo Tomas.

The ultimate drill plan will be guided by success in the early stages, but from what we know based on past drilling and the IP survey results, it looks like 80-100 km of core will be a great start, but we could see greater numbers. A compliant resource can be calculated in stages, with the first estimate done with a smaller number of holes concentrated in a specific area. I’ll guess that you’ll see the calculation of a resource done at Santo Tomas in stages, with the first once possible with after the initial +/- 12-20 holes.

Conclusion

The copper price is on fire and this has boosted Oroco’s share price to C$3.50 for a market capitalization of just over C$640M. Not bad at all as Oroco will only end up owning 85.5%-90% (core properties-peripheral poperties) of Santo Tomas based on the current earn-in structure (which we expect to evolve as Oroco may try to further streamline the ownership structure).

With plenty of cash in the bank, Oroco will likely design a very aggressive drill program for Santo Tomas which should help the company to convert its historical resource to the modern NI43-101 compliant standards in no time.

Disclosure: The author has a long position but has sold shares over the past few months to take profits off the table. Oroco is a sponsor of the website. Please read our terms & conditions.