Oroco Resource Corp (OCO.V) has released the assay results from hole 13 and 14 drilled on the Santo Tomas North Zone, the area where the historical grade shell has been designed. The average grade in both holes matches the expectations and the grades that could generally be expected based on the historical grade shell.

Drilling has now resumed and Oroco is now aggressively working towards a maiden resource estimate and a PEA which should both be completed in the next two to three quarters. That will provide a first look under the hood and establish a starting point to further advance the project.

Brasiles has been disappointing so far – but it was just the potential icing on the cake

Oroco has been drilling the Brasiles zone of the Santo Tomas project, located on the northern bank of the Fuerte River. Six holes have been completed as part of this first drill program, and Oroco has released the assay results from five of these holes.

The first two holes came up empty. That was perhaps a bit surprising as those holes were actually designed to drill-test an area where historical data suggested three historical holes were drilled. As the collars were not detected ànd as the holes came up empty, the logical conclusion here is that the historical data may contain some sloppy work (fortunately the main copper-bearing porphyry body at Santo Tomas is well documented and Oroco’s drill results have confirmed the historical data so the ‘sloppy’ work seems to be isolated to the Brasiles zone).

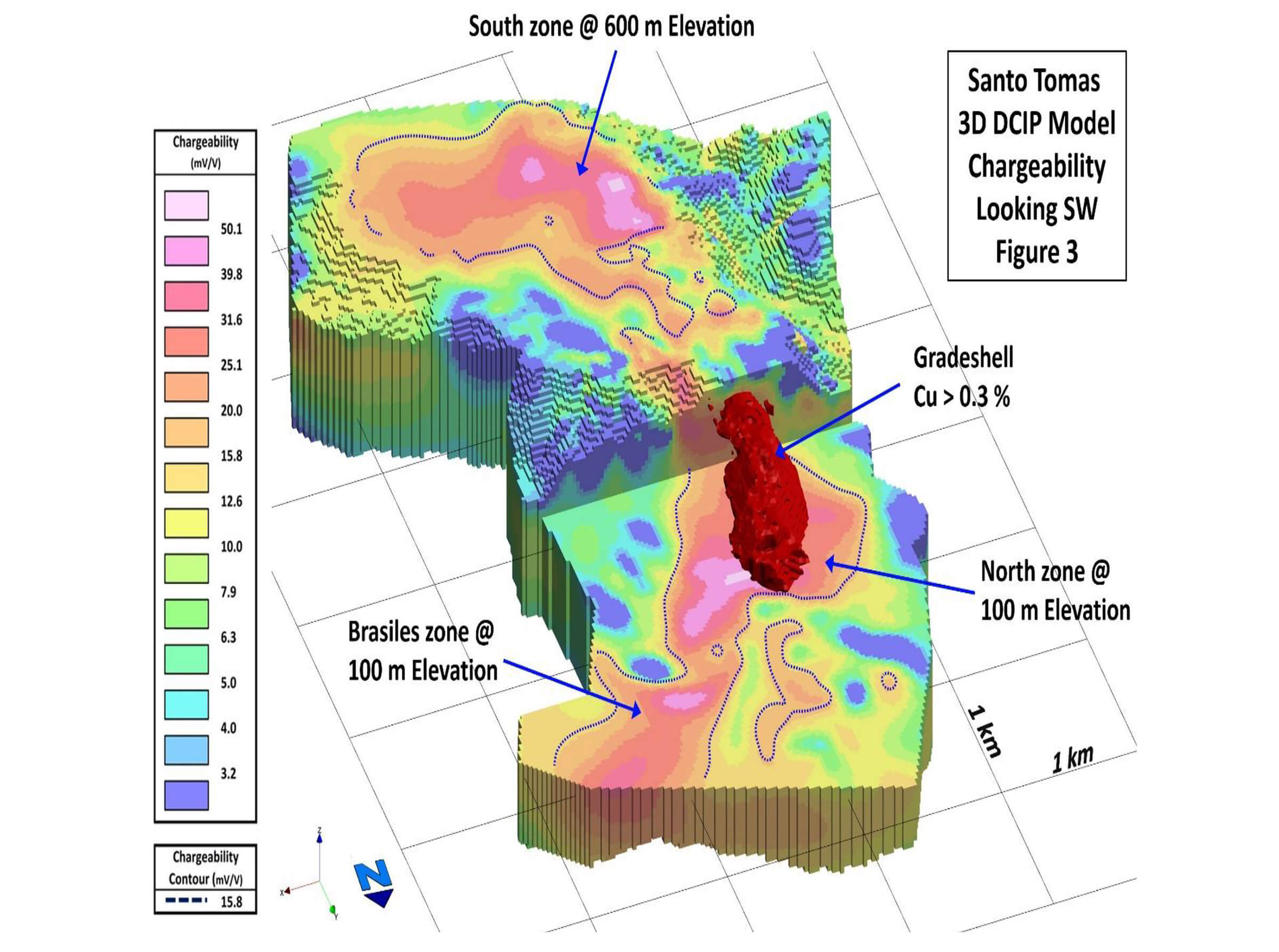

The other three holes Oroco has reported assay results on did contain copper. Hole 3 was okay with 166 meters of 0.42% copper-equivalent while hole 5 sported a thick interval of almost 214 meters containing 0.33% copper-equivalent. In both holes, the mineralization started pretty deep down-hole so it remains to be seen how the pieces of the puzzle may fall into place. The encountered mineralization also confirms the Santo Tomas zone continues on the other side of the River. That’s encouraging as this confirms the results of the 3D IP survey completed in 2021 which indicated the low resistivity runs for about 3.5 kilometers north of the North Zone.

Hole 4 at Brasiles contained three distinct areas of mineralization albeit relatively narrow with 24 meters of 0.39% CuEq, 14 meters of 0.19% CuEq and 16 meters containing 0.16% CuEq. Truth be told, we were very disappointed with the assay results from hole 4. When we visited the Santo Tomas project in March, hole 4 had just been completed and the geologists seemed to be pretty excited about it. Seeing now how the hole is without any doubt the worst of the three holes assay results were reported on, we are wondering how this discrepancy could be explained. But it once again shows that only lab results should be relied upon, no matter how good the core looks like and no matter what an XRF handgun tells you.

Are the Brasiles results disappointing? Yes. We had hoped for Oroco to find a higher grade zone as that would catapult the entire project into another league as it would have allowed Oroco to work out a ‘blend’ of ore varying with the copper price.

Despite the initial disappointment, it is encouraging to see the copper mineralization indeed seems to continue across the river. And although we had hoped to see higher grades, the 166 meters of 0.42% CuEq actually is a testament to the consistency of the mineralized zone, which has now been traced for over 2,000 meters across the river.

The recent drill results at the North Zone confirm the consistency of the mineralization

Oroco still had a drill rig working on the North Zone at Santo Tomas and we can expect a continuous news flow here as holes are shipped to the lab for analysis. Last month, Oroco released the assay results of hole 13 and hole 14 drilled at the North Zone.

Hole 13 was very interesting as it encountered copper mineralization on both sides and outside of that historical grade shell, as the image below shows. That’s positive as it expands the mineralized envelope but the 126 meter interval below the historical grade shell is a question mark at this point. Whether or not that zone could be viable at that depth fully (and solely) depends on the strip ratio to get down to that depth.

While the grade of 0.29% CuEq would be above the cutoff grade, keep in mind this means there’s only 6.4 pounds of copper-equivalent in every tonne. Applying an average recovery rate of 90% and a copper price of US$4/pound represents a recoverable value of US$23/t. So if the strip ratio is 4:1 and assuming a mining cost of US$2/t (HudBay used $1.08/t at Rosemont and Los Andes Copper used $1.85/t at Vizcachitas but we are already including the impact of inflation), the mining cost would come in at US$10/t while adding in the processing cost and G&A costs will make margins razor-thin. So the strip ratio will be very important for the deeper intervals. There’s only one potential mitigating factor: the copper price. At $6/pound, the 0.29% CuEq interval would likely be viable. At $3/pound it’s a waste of time for Oroco (or whoever mines this deposit). It’s a numbers game and whether or not a specific zone makes it into a mine plan will be subject to a lot of factors.

For some reason, the market reacted disappointed and the share price moved south when these results were released. We aren’t quite sure why as these assay results confirm the consistency of the mineralization at the North Zone. Are the grades spectacular? No. But they are in line with expectations as it’s hardly new information the North Zone will be a large low-grade earth moving exercise where economies of scale will determine the economic viability of the project.

Keeping that in mind, hole 13 was interesting as the ‘upper layer’ of 128 meters containing 0.27% copper or 0.32% copper-equivalent grade was encountered outside of the historical grade shell and close to surface. As the rock in that interval would have been scooped out anyway, this is a pure gain for Oroco as this basically means waste rock has now been converted into a thick interval of rock that could potentially be processed rather than discarded. So we would say hole 13 was successful as the higher interval will for sure be mined while the mineralized interval at the bottom of the hole could be a ‘maybe’ in function of the strip ratio and the copper price.

The next steps: resource and PEA

The moment of the truth is almost upon us as Oroco plans to gather all the data from the drill program to calculate a maiden NI43-101 compliant resource estimate on Santo Tomas’ North Zone. At this moment, the North Zone has been traced over a length of 1,200 meters and assuming an average width and depth of 400 meters and 300 meters respectively we would end up with approximately 400 million tonnes of rock as a theoretical concept at this stage (the current strike length is approximately 1,100 meters but we expect the ongoing drill program to further extend the size of the deposit). As a reminder, the historical resource estimate on the North Zone contained 609 million tonnes in the measured and indicated resource categories at an average grade of 0.34% copper. In an ideal world, Oroco could try to confirm that tonnage although everything will ultimately be a variable of the used copper price as that will determine the strip ratio and NSR value the cutoff grade will be based on. Additionally, as drill results will continue to come in, the size of the deposit could be updated and upgraded while we also don’t anticipate Oroco to have fully defined the grade shell by the end of this year. This means the upcoming resource should be treated as a starting point, a stepping stone rather than a ‘definitive’ concept.

And just to avoid any confusion: we would be fine with an initial resource of 400 million tonnes and very happy if the 600 million tonnes from the historical resource estimate could be confirmed (even if this would include tonnes from the South Zone). We should remain realistic as the first resource will be based on just around 30,000 meters of drilling and we would warn against overly optimistic expectations as ultimately not the company but independent third party consultants will have to sign off on the quality of a resource.

Oroco will continue to drill this year and in the third quarter we should see some metallurgical drilling taking place, which will be the basis for a metallurgical test program. That is an incredibly important step before even thinking about the viability of the project. After all, a pound of copper only has value if it can be mined at a profit.

Historical data indicated an average recovery rate of just under 91% for the copper which would be good. But as those studies were conducted almost three decades ago and metallurgy has continued to evolve, we hope to see a slightly higher recovery rate as that would be very beneficial to the project. Just to give you an idea of how important any improvement is: if the recovery rate would increase from 90.7% to 92% on a total mineable resource of 4 billion pounds of copper, the pre-tax undiscounted cash flow would increase by in excess of US$200M at a copper price of US$4/lb. Every increase in the recovery rate would be very welcome.

The safety issues

Oroco had to suspend its drill campaign in June to let the authorities do their work in the region. Without going into too much detail, it appeared a family feud was derailing and in order to nip things in the bud, the government decided to deploy the army in the region to make sure the situation did not escalate further. We were told there was no direct danger to the Oroco employees or the exploration site but it’s a testament to Oroco’s mindset it does not want to take any risks when it comes to its employees.

After a 3.5 week hiatus, the army considered its task to be completed and exited Choix. This allowed Oroco to get its crews back in the field and the drill program was continued.

Oroco is still fully cashed up

Oroco timed the market very well earlier this year when it decided to pull the trigger on a substantial C$18.2M financing priced at C$1.70 per unit (more than double the current share price).

Each unit consisted of one share as well as a full warrant with each warrant allowing the warrant holder to acquire an additional share of Oroco at an exercise price of C$2.40 per share, within 24 months from the closing date of the financing. Oroco raised a total of C$18.2M which should result in net proceeds of approximately C$17.5M after taking finder’s fees into account.

Considering Oroco still had a working capital position of approximately C$10M as of the end of February, we expect the year-end results (Oroco’s financial year ends in May) to show a very healthy cash balance despite aggressively exploring the Santo Tomas project in the past. A June-dated corporate presentation on the Oroco website mentions a cash position of C$24M and it seems to be very safe to assume the current working capital level still exceeds C$20M.

This puts the company in a good position to push forward with the Santo Tomas exploration plans and reach the resource and PEA stage without having to raise any more cash.

Conclusion

As a wise person told us ‘the pendulum of the market swings both ways. Oroco was too expensive just last year, but now the pendulum seems to have swung the other way’. And that’s a very accurate description. The company is making good progress on the North Zone at Santo Tomas but the share price is trading at the same level as in Q3 2020.

At the current copper price of $3.25-3.50, Santo Tomas likely isn’t going anywhere (unless a higher grade zone would indeed be discovered at Brasiles). But that’s the case for virtually every other large scale copper project in the world. And that’s the interesting conundrum the world is facing now: the demand for copper will at least remain stable and will likely increase but no one will want to commit to high capex bills in a $3.25 copper environment. And the copper price evolution in the past 24 months has shown us the copper price can evolve pretty fast. And at a copper price of US$4.25 per pound the in situ rock value would be much healthier at $28/t, increasing by almost $5/t for every 0.05% increase in the copper values.

Oroco has now started to drill the Northeastern portion of the North Zone where the highest grades of the historical grade shell were located. More drill rigs should be added soon as Oroco anticipates to have five or six drill rigs turning in September. That will speed up the drill program and keep the company on track to deliver a resource estimate and PEA in early 2023.

Oroco Resource Corp’s North Zone at Santo Tomas is delivering exactly what could be expected of it: the drill bit confirms the blanket of mineralization is very consistent and that’s exactly what one wants to see here as Santo Tomas has always been and will always be a project that will be built based on economies of scale.

Disclosure: The author has a small long position in Oroco Resource Corp. Oroco is a sponsor of the website. We paid for our airfare and non-Sinaloa expenses in Mexico, the company covered all local expenses. Please read our terms & conditions.