Last month, Oroco Resource Corp (OCO.V) released the initial findings of the Preliminary Economic Assessment on its flagship Santo Tomas copper project in Mexico’s Sinaloa state. Although we prefer to wait for the entire technical report to be completed and filed, we wanted to share our preliminary findings. We broke them down into positive and negative takeaways, but with the caveat you should consider the PEA for what it is: a ‘preliminary’ study with a lot more work to be completed before reaching a definitive feasibility study. As CEO Lock mentions in his statement; the PEA is ‘a significant start to the process of evaluating Santo Tomas’. A start, with many more updates to follow as the company continues to advance the project.

The preliminary outcome of the PEA

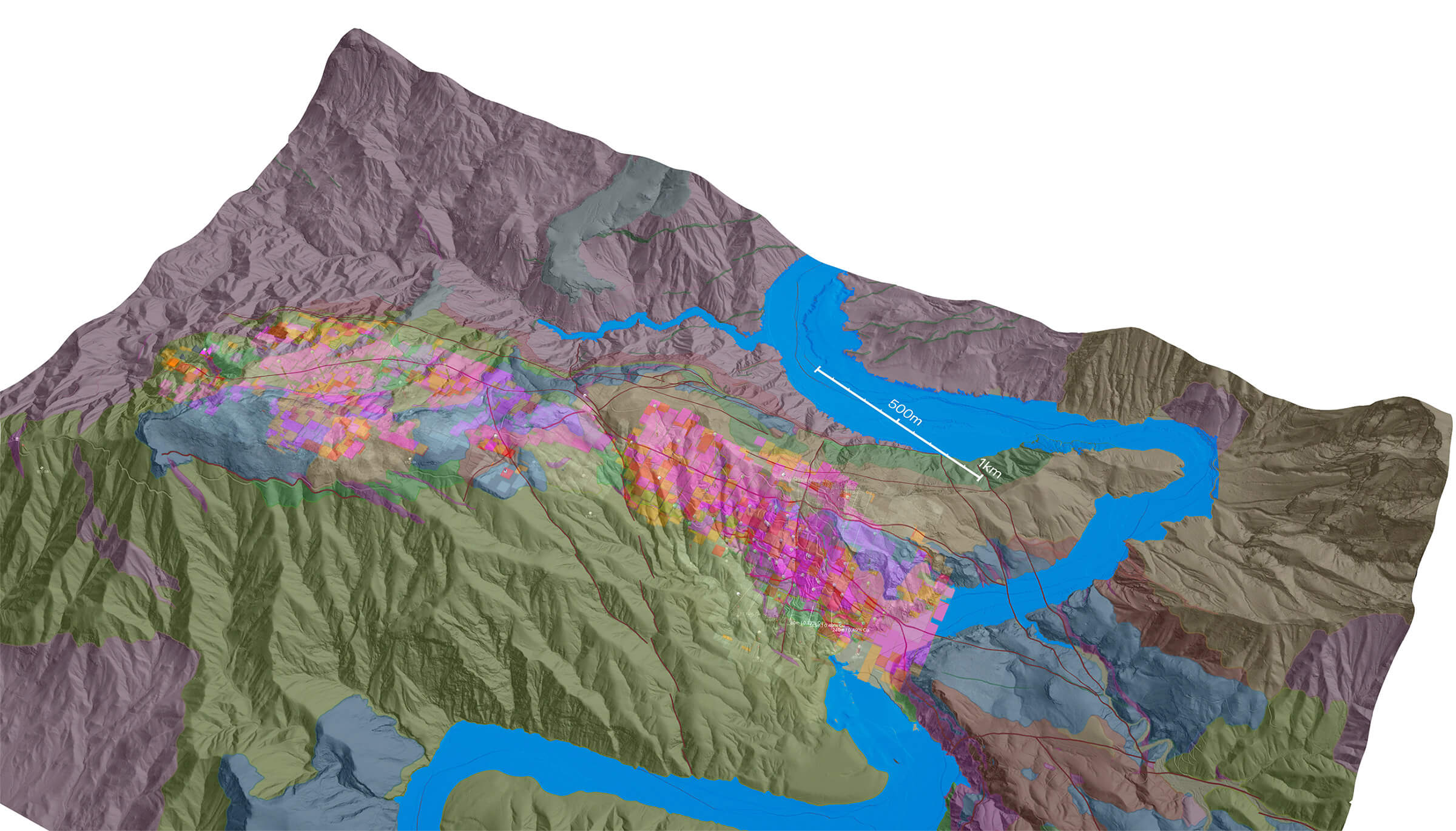

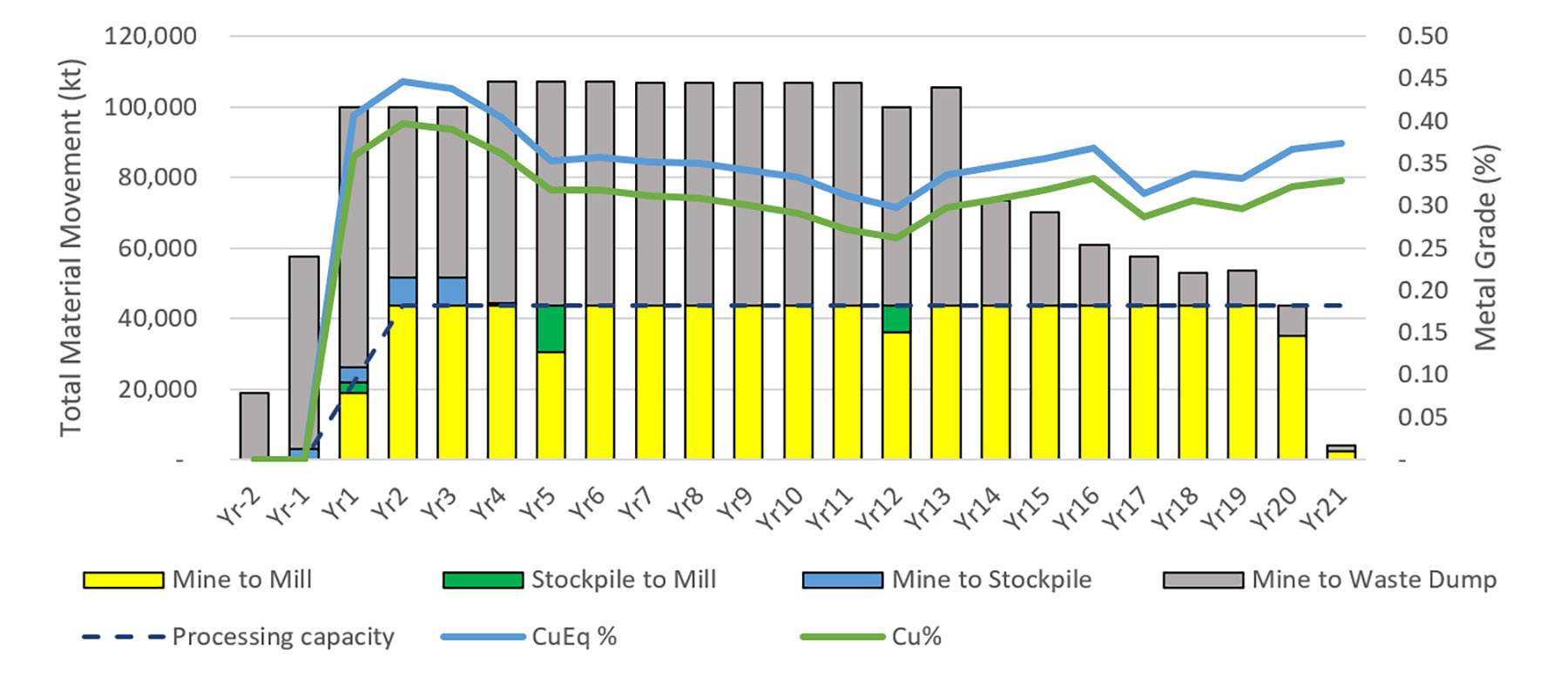

The Santo Tomas PEA has outlined a large scale open pit mining operation kicking off at 60,000 tonnes per day, immediately followed by an expansion to double the throughput to 120,000 tonnes per day. That’s not a surprise as due to the relatively low grade nature of the deposit, the economic case of Santo Tomas completely depends on economies of scale. That likely also is the reason why the expansion happens almost immediately, in the second year of the operations.

The mine plan is based on a total of 848 million tonnes of material of which 388 million tonnes are in the indicated resource category while the remaining 460 million tonnes are sourced from the inferred resource category. Milling those tonnes during a 20-year mine life should result in a total payable copper production of 4.75 billion pounds while there will be significant by-products as well with 82.6 million pounds of molybdenum, 26.3 million ounces of silver and just over 330,000 ounces of gold. Having a decent amount of silver and gold could potentially pave the way for a gold and silver stream as part of a construction funding package (but we are of course getting ahead of ourselves now as we are likely still half a decade away from a definitive feasibility study).

Using a copper price of $3.85 per pound, the pre-tax NPV8% comes in at US$2.33B while the after-tax NPV8% is $1.24B.

That after-tax NPV and IRR are a bit lighter than what we would have liked to see but there appears to be some room for improvement (which we will discuss in the next section of this update).

Our takeaways: positive and negative

The negatives

1. Taxes

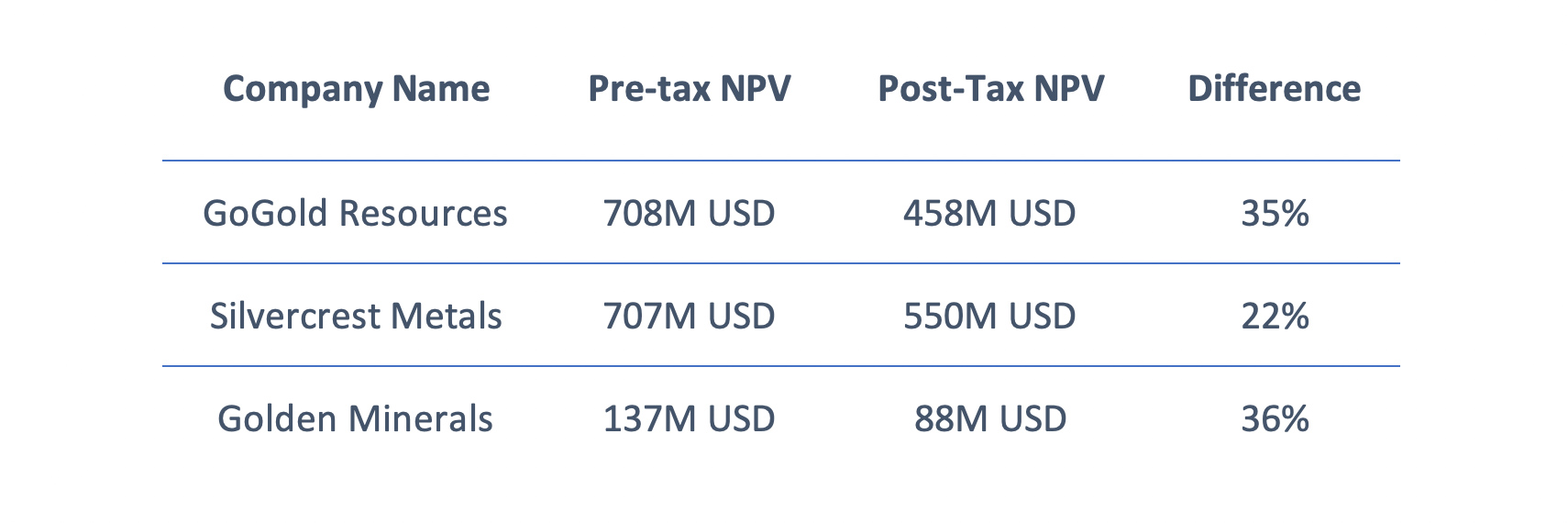

Let’s start with the negatives and get our comments out of the way here. We were quite surprised to see the big difference between the pre-tax NPV and after-tax NPV. Oroco’s pre-tax NPV came in at US$2.3B which was pretty good but the after-tax NPV8% is just US$1.2B. Surprisingly, this means the after-tax NPV is about 47% lower than the pre-tax NPV and that is quite a big difference. We compared this to other recently completed economic studies for Mexican mining projects and we have summarized the difference between the pre-tax and after-tax NPVs below.

As you can see, Oroco’s 47% difference definitely is an outlier and as far as we are concerned, it is likely the major reason why we think this PEA is ‘okay’ but cannot call it ‘good’. While we acknowledge the other Mexico-focused companies above are precious metals companies and thus not entirely comparable, we feel there is an additional tax optimization possible. Even if the average tax rate decreases from 47% to just 40%, the after-tax NPV would increase by 15% or US$160M.

Oroco management has indeed indicated the current PEA is just the ‘rough’ version and no tax optimization has taken place yet so we hope that a pre-feasibility study will incorporate the potential tax optimizations.

2. Timing of the expansion capex

We were also a bit surprised to see the company will kick off its Phase 2 expansion in year 2, whereas we had expected the expansion to occur in year 4 or 5. By putting the expansion this early in the mine life, you are basically ‘killing’ the NPV as there will hardly be any free cash flow going towards the NPV calculation in the first five years of the mine life. And as you know, those are the years where the cash flows are discounted by the lowest factor. $100M in free cash flow in year 6 (an arbitrary number to explain the impact of discounting) will only contribute $60-63M to the after-tax NPV8 calculation while this would contribute almost $80M if the cash flows would occur in year 3.

So, the timing of the expansion to 120,000 tpd is ‘special’ and it would be interesting to see the impact of the NPV if the expansion to 120,000 tpd would be delayed until later in the mine life. Because not only does the early expansion mess with the NPV calculation, it also raises ‘financeability’ questions. Lenders won’t only have to trust a company to successfully build Phase I but will have to trust the company that actually builds it to successfully kick off Phase 2 before it has even shown it is meeting the requirements and plans in Phase 1. This further strengthens our thought that this project, if it will be built, will have to be built by a senior producer than is able to self-generate the required cash flow for both capex phases. This is for sure not a project a junior like Oroco can bring into production.

3. The Mexican Peso

Surprisingly, the Mexcian Peso has gained a lot of strength in the past few months. The company used an exchange rate of 19.76 Pesos per US Dollar but the current spot rate is 18 Pesos per Dollar. This means a US Dollar does not go as far as anticipated in the economic study. While the majority of Oroco’s cost (both capex and opex wise) is expressed in USD, the strong Mexican Peso is a headwind. But of course, a lot can change between now and the definitive feasibility study.

The positives

1. The initial capex

We were pleasantly surprised when we saw the initial capex was just $1.34B as that is about 20-25% less than what we were expecting. Even if you would exclude the impact of leasing, the initial capex is estimated at $1.49B and that is slightly lower than we had anticipated. However, considering the US$667M expansion capex already occurs in Y2, you could wonder if that expansion capex shouldn’t really be seen as initial capex considering it occurs so early in the mine life.

2. The leverage on the copper price

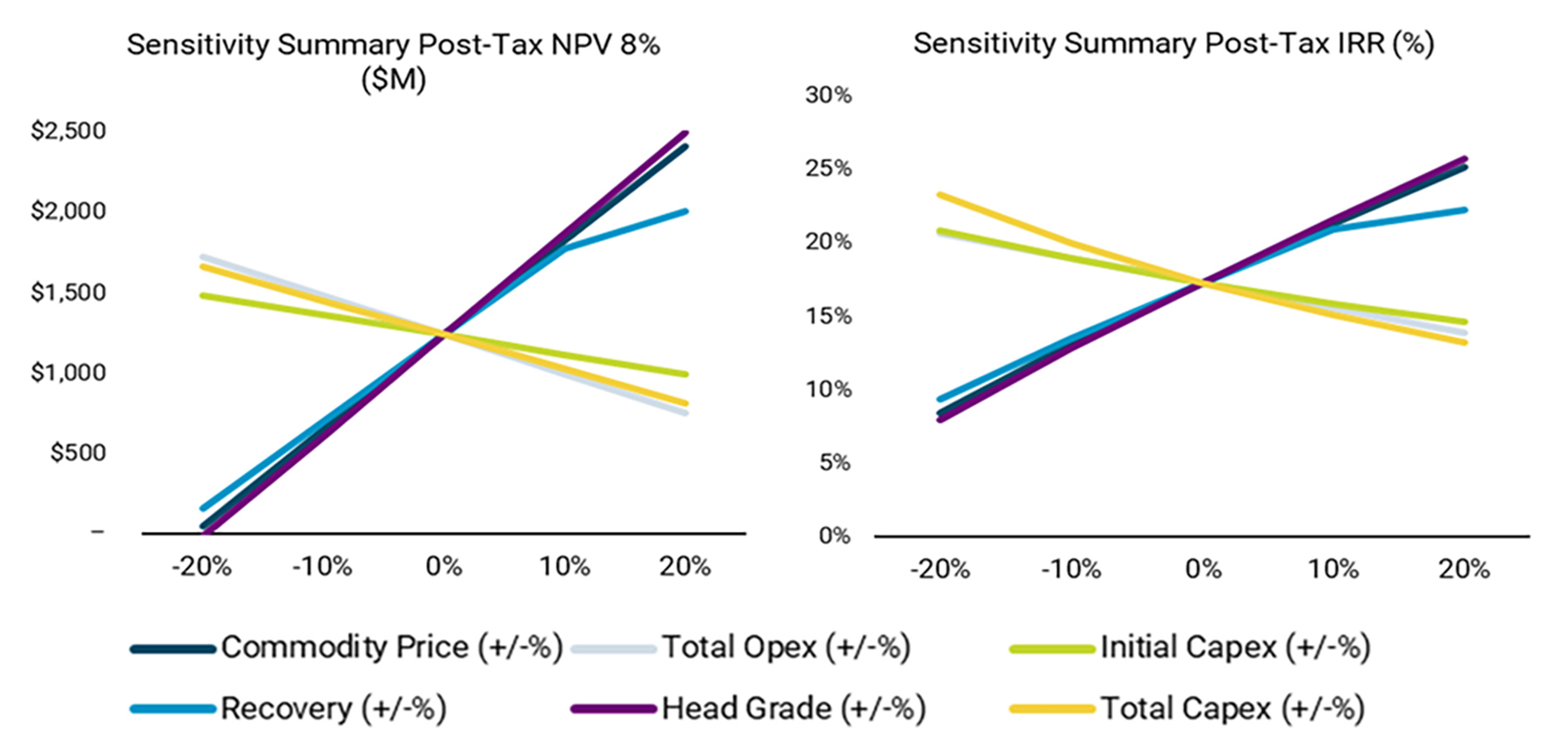

While the post-tax IRR is just 17.3%, the pre-tax IRR is a decent 23%. However, keep in mind this is based on a copper price of $3.85 per pound, and that is a premium of about 5% versus the current copper price. Based on the sensitivity analysis shown below, a 5% lower commodity price (note: this means the gold and silver prices in this scenario are 5% lower as well, at respectively $1615 and $21.50 per ounce), the after-tax NPV8% would drop to approximately US$1B. Still decent, but it confirms the project is very dependent on the commodity prices. And the pendulum of course swings both ways: a 10% higher commodity price deck would increase the after-tax NPV8% to close to US$2B. So, as far as leverage on the copper price goes, Oroco is still a valid candidate (but this point is valid for every copper company out there and not an Oroco-specific argument, of course).

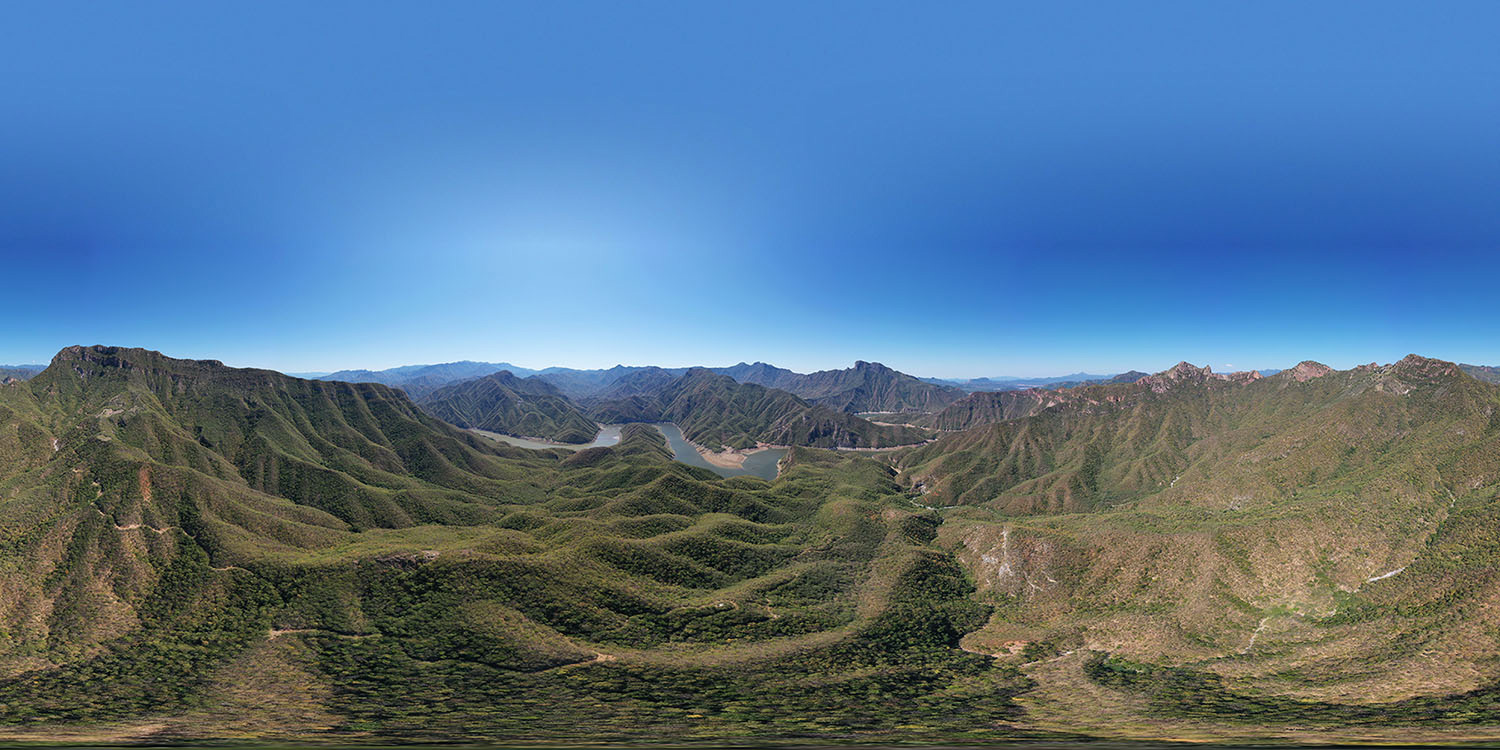

3. No need to divert the river

A few years ago, when Oroco kicked off its exploration programs at Santo Tomas, the initial interpretation of a potential economic scenario included the diversion of the El Fuerte river. Although doable, that wouldn’t be the easiest thing to permit and in the current PEA there is no river diversion scenario. The plan now includes leaving some mineralized material behind on the northern side of the northern pit acting as a buffer between the actual pit and the river. Yes, that means the company leaves about 100 million tonnes behind but that is a more optimal solution than trying to divert the river. This potentially also leaves upside for whoever may end up with this project, especially if the Brasiles Zone could be connected with the Santo Tomas North zone (the gap between both zones hasn’t been drilled yet).

4. Sulphide leaching

The press release mentioned eleven potential ‘project enhancement opportunities’ but we would argue this is a non-exhaustive list as for instance the tax optimization possibility isn’t mentioned. We are also quite interested in the very first bullet point of the list below, as it mentions the potential to leach sulphide rock. That’s not a new technique and several senior producers like Freeport McMoRan (FCX) have already tested and approved the most recent technique. In fact, Freeport’s corporate presentation already highlights the potential of sulphide leaching (see slide 23 here). We will obviously have to wait for the company to release data on its sulphide leaching test work to see if it makes sense at Santo Tomas but we should know soon as the company has confirmed it will publish the results of the first test phase in the current quarter. Sulphide leaching could also pave the way to add tonnage with an average grade just below the cutoff grade to the mine plan, so we are definitely looking forward to seeing the sulphide leach test results

- Project Enhancement Opportunities

- The application of sulfide leaching on lower grade chalcopyrite resources currently assigned to waste. Preliminary studies have commenced, and results are expected in Q4 2023. CAPEX/OPEX costs for an SX/EW facility are developed but are not considered in this PEA.

- Fully evaluate oxide copper resources that are currently carried as waste in combination with sulfide leaching using available data from surface sampling and drilling.

- Optimize mine plan around larger loading and haulage equipment.

- Optimize mobile mining fleet considering mixed fuel and or electrified options.

- Infill resource drilling in the area between North and South zones: additional resource in that area would improve optimized pit development and reduce mining costs.

- Additional comminution studies and variability testing to better constrain recoveries across the full range of expected mill feed grades based on rock and alteration types.

- Consider relocation of the primary crushing facility closer to the pit(s) via in-pit crushing stations and conveyance via tunnels from both North and South pits to the mill feed stockpile.

- Investigate coarse particle flotation to reduce comminution costs and improve factors of safety on TSF design.

- Drill hydrogeological test wells at the north end of the North Pit to better define pit inflow and pit dewatering costs.

- Drill selected geotechnical holes to optimize pit slope angles and reduce mining of waste.

- Optimize heavy equipment leasing terms.

Conclusion

It was never Oroco’s intention to try to build Santo Tomas by itself but the PEA has now made it abundantly clear this is a project for the ‘big boys’. That also is the reason why the company attracted Richard Lock as its CEO and it is the reason why pretty much everything that happens at Santo Tomas is already geared towards meeting the standards of the more senior producers.

This PEA should be seen exactly for what it is: a preliminary economic assessment. It offers a first look under the hood without any pretense. As mentioned earlier in this update, we would love to see more work on tax optimization as we think this could add value to the after-tax NPV8% and could hopefully boost the after-tax IRR towards that 20% threshold.

We look forward to seeing the definitive technical report and Oroco’s plan to raise sufficient funds to move the project towards a pre-feasibility study. We hope this PEA will make the heads of some larger companies turn and in an ideal world, the PFS activities (which we estimate at C$25M as the company will need an infill drill program to convert inferred resources into the measured and indicated category) could be funded by the proceeds of the strategic entrance of a company in Oroco’s capital. Unfortunately the company will likely have to raise money sooner than that as the most recently filed financial statements indicate a working capital deficit of just over C$1M.

In any case, having ‘hard numbers’ to talk about may make it easier for Oroco to discuss the merits of the Santo Tomas project. The company is currently trading at 0.07 times the after-tax NPV8% based on an 85.5% ownership and its current share count (which will obviously increase). Of course, the share count will increase further, so don’t read too much into this multiple yet, but it definitely does provide more meaningful data points, allowing for a direct comparison with its peers.

Disclosure: The author has a long position in Oroco Resource Corp. Oroco is a sponsor of the website. Please read our terms & conditions.