Oroco’s (OCO.V) share price has been all over the place in the past 24 months. Whereas the company was only able to close just one tranche of a C$0.30 financing in March 2020 when the COVID pandemic started to accelerate, its share price reached an all-time high of C$3.6 in May last year and at that point, the company was likely overvalued as its 73.2% stake (which can be increased to 85.5%) in the core concessions of the Santo Tomas project was valued at almost C$700M.

While Santo Tomas remains an exciting exploration project, we shouldn’t forget the company wasn’t even drilling at that point and the market was getting ahead of itself in a way that even prevented the company from tapping the equity markets to fill its treasury. It’s not easy to market a financing when your property – which hadn’t been drilled in decades – is valued at almost a billion Canadian Dollars.

Since reaching that all-time high the share price has been sliding to a more appropriate level for what still is an early-stage exploration project without a NI43-101 compliant resource estimate. As the copper price remained above $4 per pound and as supply concerns remain an issue, there has been renewed interest in copper projects and Oroco was able to fill its treasury with an equity raise totaling in excess of C$18M at C$1.70 per share.

As COVID restrictions around the world have been lifted (or are in the process of being lifted), we flew to Mexico in March of this year to kick the tires of Santo Tomas and Oroco’s local team.

Accessibility and the importance of working with local people

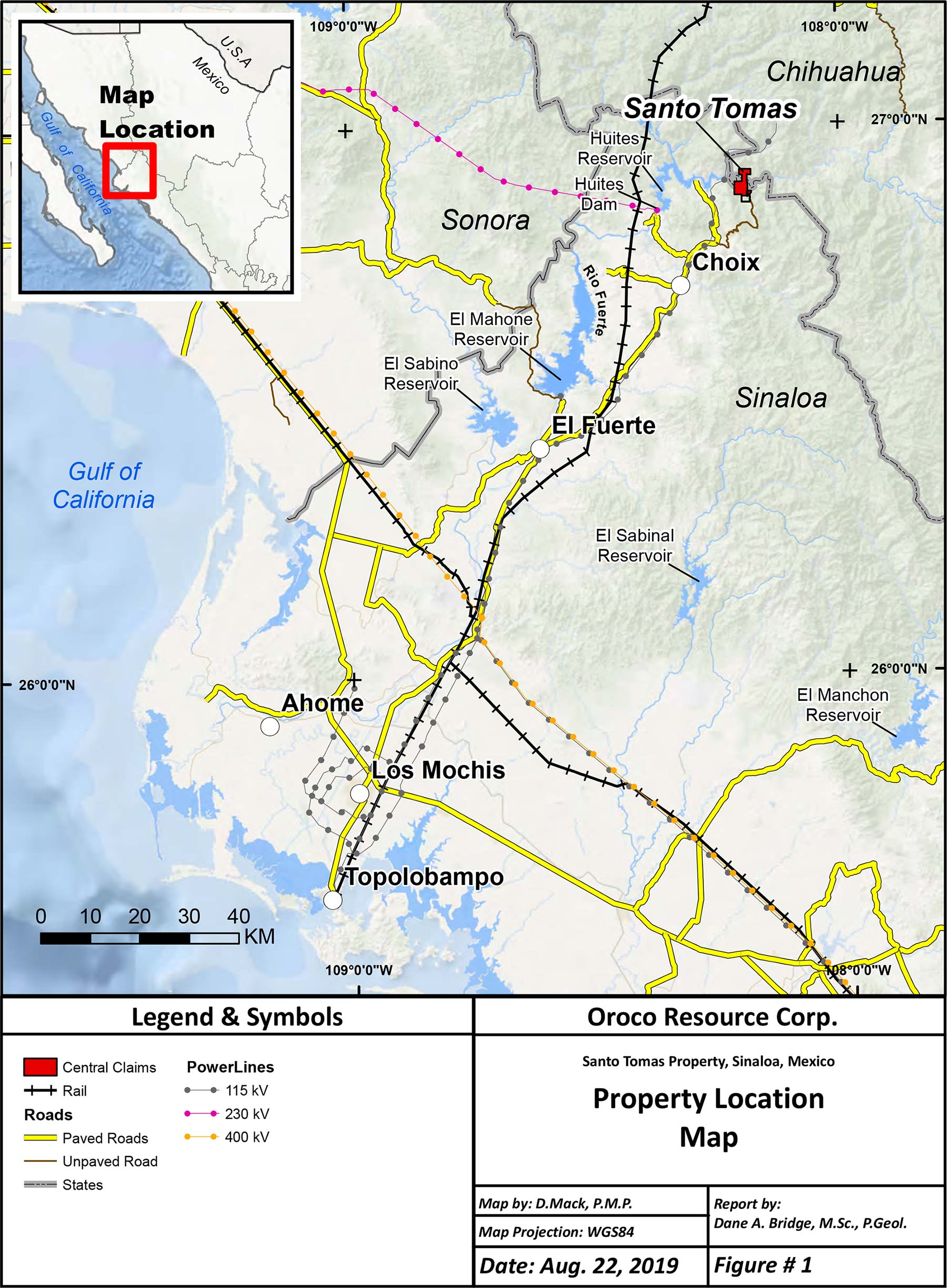

From Mexico City, we flew to the ‘international’ airport of Los Mochis, about two hours away. The term ‘international’ is an exaggeration as there are zero scheduled international flights and specific charters flights would be the only incoming and outgoing international flights. Los Mochis should be seen as a local airport, serving domestic needs and is doing a fine job in just doing that. With on average two flights to Mexico City per day, it is a convenient way to get as close to Choix as possible. Just a short drive to the southeast of Los Mochis is Topolobampo, which has a deepwater port that is currently being expanded. Additionally, a new LNG plant is currently being developed. This plant will have a liquefaction capacity of 4 million tonnes per year and French energy giant TotalEnergies has already signed a binding offtake agreement for about a third of the capacity. So this entire region around Los Mochis is bustling with activity these days.

From Los Mochis, it’s a two-hour drive on paved roads (which makes it easy to transport the copper concentrate to the port of Topolobampo) to get to Choix where the company’s local office and core shack are located.

The office is located in a quiet part of the city of 10,000 and is shared with the local partner, Minera Tempisque. This local company is headed by Ubaldo Trevizo who should be seen more as a pater familias of the employees as well as the community. Trevizo seemed to know everyone in town and having a local presence is one way for Oroco Resource Corp to get the project through all the permitting hurdles going forward. As that local presence is a key element for Oroco, they don’t just rely on a local partner, but president Ian Graham also relocated to Choix. Moving to Choix has no tangible value, but the intangible value could be important as the local community sees this isn’t a bunch of Canadian gringos coming in to ‘steal’ their natural riches. On top of that, the local family has a vested interest in seeing this project succeed, as Minera Tempisque owns a 22.5% stake in the non-core peripheral claims as well as a smaller interest in the core concessions of the Santo Tomas project.

While we were in Choix, the principals of Oroco supplied a second local school with IT equipment. This is a donation made by the principals of Oroco (no OCO funds were used) and it is their intent to supply all primary schools with new IT equipment. Corporate Social Responsibility isn’t a hollow term with the people of Oroco.

The core shack is located just a few kilometers out of town and the best way to describe the team there is as a ‘well-oiled machine’. Everyone seems to know what is expected of them, and consulting geologist Michael Smith who was retained to streamline all processes in the core shack. Efficiency will be key there as the company will ramp up the drill program throughout the year and the core boxes will come in at an increasingly fast pace, so it’s better to work out the kinks right away rather than facing bottleneck-related issues further down the road.

From the core shack, a 30-35 kilometer long gravel road leads straight to the North Zone of the Santo Tomas project. As the terrain is rough and the road is bumpy, it takes about 1.5 hours to reach the base camp on the North Zone.

That base camp likely was the biggest surprise. Most exploration companies have a base camp that could best be compared with ‘glorified huts’ and tents. Not so for Oroco Resource Corp which built a new and well-equipped base camp that was officially opened when we were there. While the company currently has just two drill rigs working on the North Zone, the camp is clearly built on the anticipation of aggressively expanding the drill program as it is large enough and offers plenty of facilities to house several drill crews. Additionally, the camp would be very useful when Santo Tomas gets further advanced and, hopefully, developed further down the road.

It’s that type of forward-looking thinking that makes Oroco rather special. One can wonder if it is really necessary to throw money at those things, but in the long run, things like a comfortable base camp will prove their value, even if it only creates the perception Oroco is taking things seriously. And it goes without saying using a local contractor for the construction and locally sourced employees to run the camp will create a lot of goodwill in the communities.

Drilling is confirming the known grade shell so far – but Brasiles may be the wild card

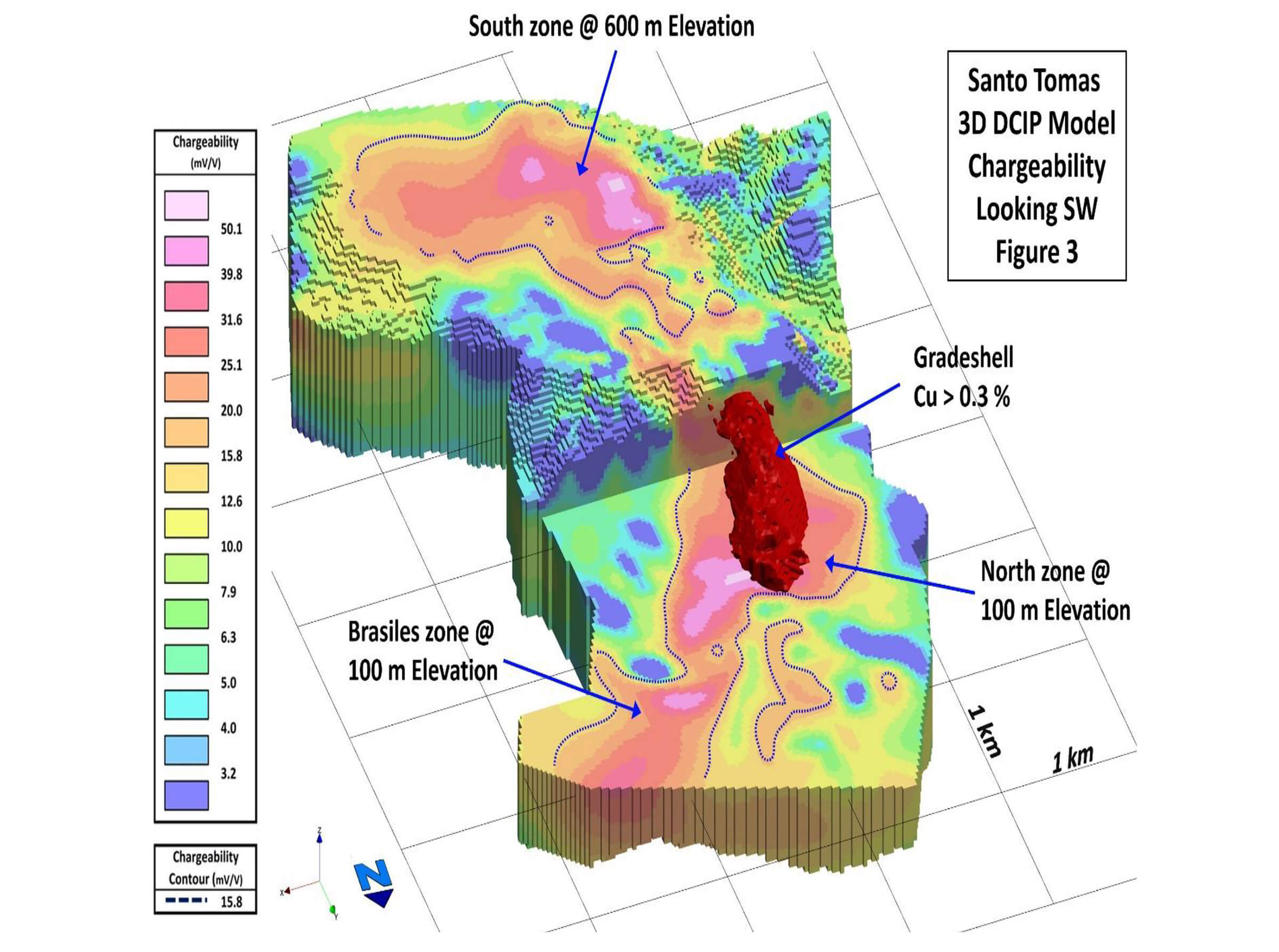

Keep in mind the Santo Tomas land package is located in two states. The North and South Zones are in the Sinaloa State while the Brasiles zone at the other side of the river is located in the state of Chihuahua.

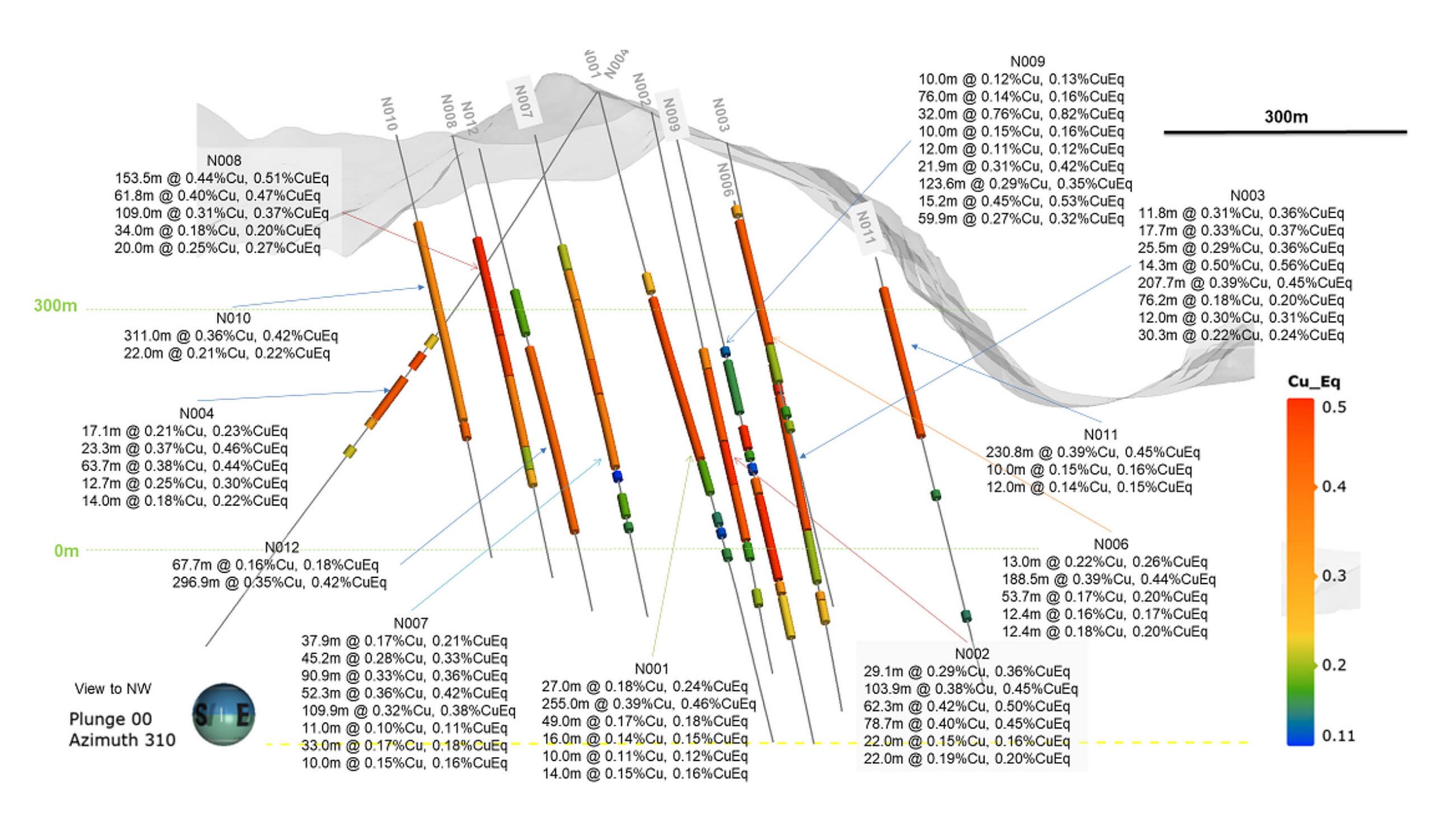

Drilling started in the third quarter of last year, and the main purpose of the drill program on the North Zone and South Zone in this first phase of the program is to confirm the findings of the historical drill programs. So far, so good, as in last week’s update, Oroco confirmed it targeted the mineralization at the anticipated depths with the expected average widths.

At the North Zone, the company has now drilled off a strike length of approximately 900 meters and no negative surprises were encountered. The mineralized intervals are thick and the average grade is in line with what would be expected.

One may be disappointed by the average grade of ‘just’ 0.42-0.45% copper-equivalent, but investors need to be aware the North Zone was never expected to be a high-grade zone. Oroco is chasing tonnage as the North Zone development would per definition be a massive earth-moving exercise where ‘economies of scale’ and ‘efficiency’ will be the key words as this grade is in line with other large-scale copper projects around the world.

If we would for instance single out hole 10, we see the drill bit intersected 311 meters 0.42% copper-equivalent consisting of 0.36% copper, 0.011% molybdenum and 0.029 g/t gold. Let’s forget about the gold for now as the gross rock value is just around $1.5/tonne which means the gold component in that hole will likely contain just over $1/t in payable revenue.

The 0.011% molybdenum is pretty interesting as the molybdenum price has been increasing over the past two years. Using a molybdenum price of $19/pound, the molybdenum credit is approximately $5/t (before taking recoveries and payabilities into consideration). Copper is and remains the main commodity here with approximately 8 pounds of copper per tonne of rock. Applying a copper price of $4/pound results in a rock value of $32/t (again, before taking recoveries and payabilities into account, as Oroco needs to do more work on theses). So over 80% of the revenue will be generated from the copper component. Also keep in mind these numbers don’t include any of the silver. Oroco does not report silver values and doesn’t take them into consideration when calculation the copper-equivalent grade but there should be some payable silver in the rock. It’s tough to ‘guesstimate’ how much so we are just using the copper-equivalent calculation based on the copper, molybdenum and gold for now.

And perhaps one additional remark. The copper-equivalent grade calculation is based on a moly price of $12, which is 275% higher than the copper price so every 0.01% moly represents 0.0375% copper-equivalent in the equivalent calculation.

However, if we would use the current spot prices for copper and molybdenum, that ratio would increase from 3.75 to in excess of 4 (4.2 to be exact) which means that based on the spot prices, the copper-equivalent grade offered by Oroco is relatively conservative. But of course, commodity prices can change fast so it’s perhaps a good idea to be rather conservative. While seeing the historical grade shell being confirmed in these first dozen holes is great, after visiting the property we are getting more excited about and interested in Brasiles, the area just across the El Fuerte river.

The Brasiles zone is literally located right across the river from the North Zone, and Brasiles is projected to be the extension of the North Zone across the Rio Fuerte. Although the North Zone is the ‘most advanced’, Brasiles could be the wild card here as it could add a lot of tonnage to a combined resource estimate. On top of that, if the interpretation of Brasiles as the extension of the North Zone is correct, it paves the way to complete additional exploration activities along strike, beyond the zone currently known as Brasiles.

This basically creates a win/no-lose situation. The ‘no lose’ option is clear: even if Brasiles comes up empty, Oroco has the North Zone to fall back on and will have to figure out if the North and South Zone are economically viable. This would be a worst-case scenario.

The first few holes at Brasiles have encountered chalcopyrite so while we obviously need to wait for the lab results to see the grade, the Brasiles zone is very clearly mineralized. So it’s not a question of ‘is there copper at Brasiles?’ but a question of grade and tonnage. And that could create the ‘win’ situation as the consolidated tonnage could be increased rather fast. And this is not just pulled out of thin air as the technical report on the Santo Tomas mentions the mineralization is projected to pass under the river from the North Zone int the Brasiles Zone. And hopefully, the 2022 drill program will provide more useful insight on this theory.

Finding chalcopyrite at Brasiles is a very important first indicator and we are now looking forward to seeing the actual assay results which we are expecting to see in May.

The recent capital raise underpins Orocos exploration plans

In the last week of March, Oroco closed a C$18.2M financing priced at C$1.70 per unit. Each unit consisted of one share as well as a full warrant with each warrant allowing the warrant holder to acquire an additional share of Oroco at an exercise price of C$2.40 per share, within 24 months from the closing date of the financing. Oroco raised a total of C$18.2M which should result in net proceeds of approximately C$17.5M after taking finder’s fees into account.

This immediately puts the company in a very enviable position as it is fully funded for its ongoing drill program which is currently being executed with three drill rigs (two rigs are drilling the North Zone while one additional drill rig is drilling the Brasiles zone). And as the assay results continue to come in, further validating the exploration theory, Oroco should be able to raise more money later this year as it continues to de-risk the project.

With a current cash position of in excess of C$25M, Oroco could very well be in its best shape ever as not only is it fully cashed up, it will be a news-heavy year with drill results coming in every few weeks.

As 2022 (and hopefully 2023 too!) will be a busy year, former CEO Craig Dalziel is taking a step back and Richard Lock has been appointed as the company’s new CEO. Lock is coming over from Polymet Mining (POM.TO, PLM) where he was senior vice president and project director of the NorthMet copper project in Minnesota. An interesting project but Polymet has been held back by permitting issues for the better part of the past decade.

Lock comes with an impressive resumé and it sounds like the Oroco team is expecting a lot from him so let’s hope he can lift the entire team and company to a higher level.

Conclusion

The drill program is the ultimate truth machine. No matter how good a historical resource estimate looks, it’s now up to the company to initially confirm said resource and then further increase the tonnage and contained copper. The very initial drill results from the holes completed at the historical grade shell have confirmed the historical report but Brasiles really is the wild card here.

This is the first time in almost 30 years the Santo Tomas project is being drilled, and Oroco is just scratching the proverbial surface. There’s much more to discover and uncover but these things take time. With in excess of C$20M and likely closer to C$25M in the bank, Oroco is in excellent shape to keep on drilling and the next few catalysts for this story will all be drill-related.

Disclosure: The author has a small long position in Oroco Resource Corp. Oroco is a sponsor of the website. We paid for our airfare and non-Sinaloa expenses in Mexico, the company covered all local expenses. Please read our terms & conditions.