Over the past few years, Oroco Resource Corp. (OCO.V) spent tens of millions of dollars on exploring its flagship Santo Tomas copper project and we think it’s pretty fair to say this year is a pivotal year for the company. The updated resource estimate was released in May and the maiden Preliminary Economic Assessment should be released before the end of this quarter.

That PEA will incorporate a standard scenario with a traditional ‘mining and milling’ approach, and will likely consist of two phases. As a reminder, the total resource now contains 487 million tonnes of rock in the indicated resource category with an additional 600 million tonnes in the inferred resource category for a total of 3.5 billion pounds of copper in the indicated and almost 4.2 billion pounds of copper in the inferred resource with an additional 464 million pounds and 526 million pounds in copper-equivalents using the molybdenum, gold and silver.

Now that a maiden resource has been established, it’s up to the engineers and consultants to build a coherent mine plan and run the numbers from an economic point of view.

The recently published resource estimate will be the basis for a PEA

Oroco released its maiden resource on the Santo Tomas copper project in May. Interestingly, almost half of the consolidated tonnage is already part of the indicated resource category, which contains 487 million tonnes at an average grade of 0.36% copper-equivalent (and the equivalent calculation already takes the lower recovery rates for the other metals into consideration) for a total of 3.9 billion pounds of copper-equivalent (including 3.4 billion pounds of copper). The inferred resource category contains an additional 600 million tonnes at a similar average grade of 0.36% CuEq for a total of 4.7 billion pounds of copper equivalent (of which 4.2 billion pounds are copper).

Considering this is just the very first resource estimate on the Santo Tomas project (a 1996 resource was calculated, but this was prior to the current mineral resource standard, NI-43-101)), the results are very encouraging. The grade is perhaps a bit lighter than we had expected but fortunately the mineralized area is very consistent (so there shouldn’t be a whole lot of grade variation) while we are waiting for the technical report to be filed to see how easy it would be to access higher grade zones as early in the mine life as possible. Based on the metal prices used by the company, there are 6.7 pounds of net recoverable copper-equivalent per tonne of rock and at $3.80 copper the net recoverable rock value will just exceed US$25 per tonne (before taking payabilities of the concentrate –into consideration).

With an anticipated mining cost of $2.25/t, a strip ratio of 1:1 (and perhaps a bit lower, let’s wait for the Preliminary Economic Assessment for more details), a processing cost of $5/t (which is higher than what peers have been using in their economic studies) and G&A and selling costs of $2/t combined (all aforementioned costs are sourced from the most recent technical report and were used to run the numbers on the pit shell), the margin would be around $13.5/t using $3.80 copper as base case scenario. Using a copper price of $4/lb would increase the margin by almost 10% which confirms Santo Tomas will provide excellent leverage on the copper price going forward.

Brokerage firm Cantor Fitzgerald recently released a research report on Santo Tomas, and its analyst ended up with an after-tax NPV8% of US$1.74B using an initial capex of $1.5B and a Phase 2 expansion which doubles the average daily throughput from 60,000 tonnes per day to 120,000 tonnes per day in the fifth year of operations. The total LOM capex is estimated at US$2.4B (indicating the sustaining capex including the Phase 2 expansion would be around US$900M).

Keep in mind those aren’t our numbers nor Oroco’s or its guidance; it’s what the people at Cantor Fitzgerald independently came up with.

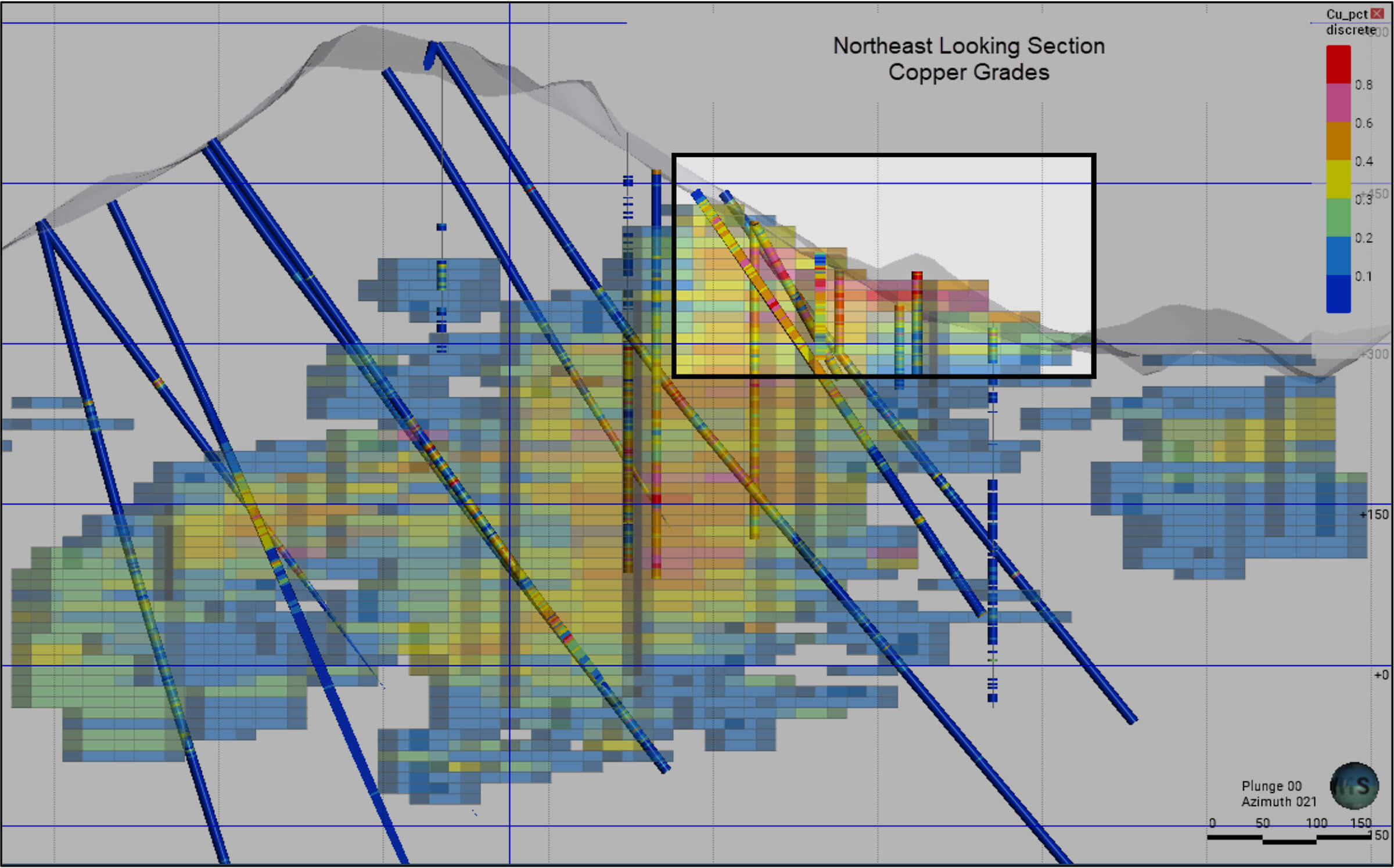

We feel the initial capex may be slightly higher than the US$1.5B Cantor came up with, but the impact on the economics should be negligible. The Cantor analysis uses an average grade of 0.35% CuEq throughout the mine life (which is lower than the current average resource grade), but the image below, sourced from the most recent technical report, indicates the potential for a higher grade starter pit (highlighted in the box below).

As you can see above, the block model is projecting some higher grade zones close to surface at the north zone. Don’t expect any spectacular grades but being able to process rock with an average grade of 0.40-0.45% CuEq could have a material impact on the economics as the company would recover 10-20% more copper in the first few years of the mine life. And as those cash flows would be front loaded it would help to 1) boost the initial incoming cash flow and reduce the external financing needs for the potential Phase 2 of the mining scenario and 2) add value to the NPV and boost the IRR because cash flows early on in the mine life are obviously discounted by a lower factor.

Is this a guarantee? No. And the proof of the pudding will be in the eating and the upcoming PEA will provide more clarity on this. Should our hunch – and that’s all it is, just a hunch and not the company’s official guidance – be correct, Oroco could easily produce 50-120 million additional pounds of copper in the first few years of the mine life compared to the scenario used by Cantor Fitzgerald which applied a 0.35% copper head grade throughout the mine life.

In any case, we are only weeks away from seeing the results of the Preliminary Economic Assessment on Santo Tomas and we will provide an updated review once the numbers are out.

There’s only one parting thought here. A PEA, and especially this PEA, is usually just the first stepping stone to advance a project towards development. The margin of error is pretty high in PEA studies and most mining companies take advantage of that to make a project look better than it actually is by using assumptions that are too optimistic.

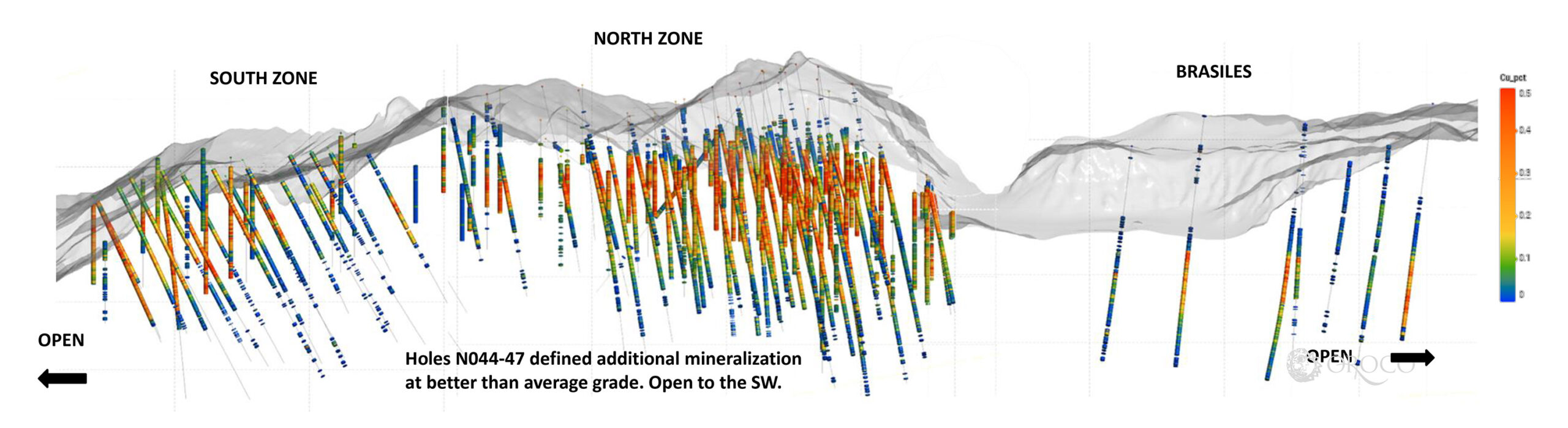

Projects rarely get any better as they advance to pre-feasibility and feasibility studies, but Oroco may potentially have an ace up its sleeve. The main focus is on the potential to reduce waste, and that could come from additional drilling where waste blocks in the model could be converted into mineable rock depending on the outcome of the PEA which will give the company a better idea of the grade needed to mine the rock at a profit. It’s apparent on the VRIFY 3D model that Santo Tomas remains open in a number of directions.

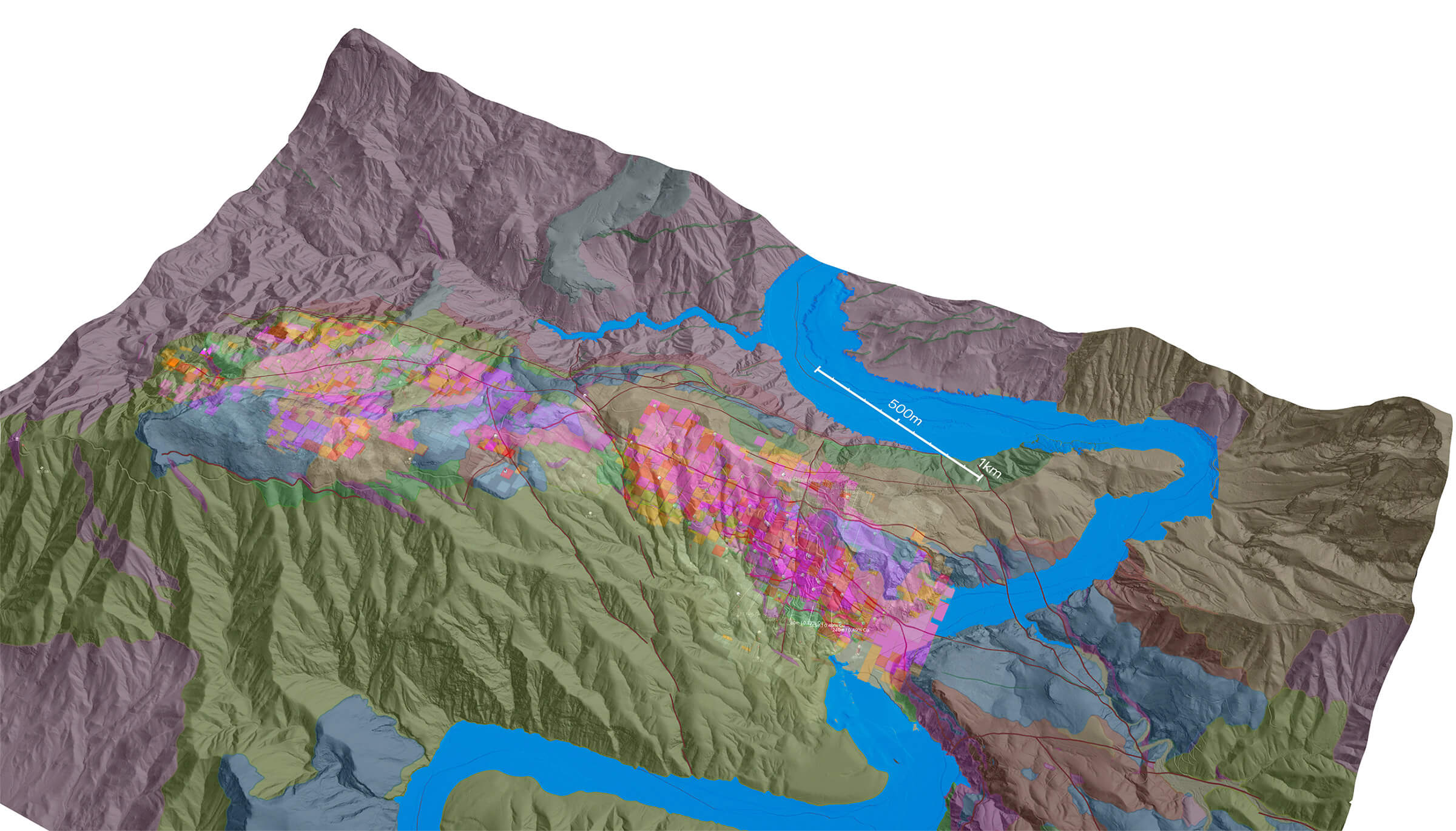

A company is allowed to include inferred resources in a mine plan designed for a PEA and based on a mining rate of 60,000 tonnes per day in the first five years followed by an expansion to 120,000 tonnes per day (which is similar to what the Cantor Fitzgerald mine plan looks like), and the total mine life should exceed 20 years. We don’t expect all 1.1 billion tonnes to be included in the mine plan as rather than moving the El Fuerte river, the company will likely excavate a pit leaving the side of the river untouched. That likely means about 100-150 million mineralized tonnes at the northernmost end of the North Zone won’t be mined. And then of course not every tonne of mineralized material ends up in the mine plan for efficiency reasons. We would already be happy to see 800 million tonnes ending up in the mine plan, but let’s wait for the PEA before drawing conclusions.

The company just topped up its treasury

Last week, Oroco announced it has raised C$1.75M in a financing priced at C$0.65 per unit. Each unit consisted of one common share and one full warrant allowing the warrant holder to acquire an additional share of the company for C$0.90 during a 24-month period. A total of 2.7 million units were issued which means that if/when the warrants come in the money and are being exercised, the company will receive close to C$2.5M in additional cash inflow.

This wasn’t a large financing and appears to be aimed at ensuring the market doesn’t start to speculate against Oroco if the treasury is running on fumes. The company will likely report its financial results by the end of September (it needs to report its full-year results for the financial year which ended in May, and full-year results take more time than interim results). According to the most recently available balance sheet (February 2023), the company had about C$3.1M in working capital and raised an additional C$4.5M (at C$0.75) subsequent to the end of that quarter. As the company was still burning cash on the Santo Tomas project during the first semester, most of that cash has likely been used on drilling and consulting services (for the resource calculation and the PEA, which will be published this quarter). It’s tough to guesstimate the current cash or working capital position, but the current raise should be more than sufficient to cover the next few months as the company’s consultants are working to get the PEA out as soon as possible.

It is however very encouraging to see the management team stepped up the plate. Chairman Dalziel acquired 130,308 units while CEO Lock purchased just over 40,000 units in the placement. Their participation represented in excess of 6% of the total dollar amount raised. Richard Lock didn’t own any shares before and although the 40,000 units represent just C$26,000, that amount does equal in excess of a monthly salary (pre-tax and likely represents about two months of take-home pay). Also, keep in mind Lock’s employment agreement includes a bonus representing 0.1% of the sales value of either the company or the Santo Tomas project with a minimum of US$300,000 and a maximum of US$600,000. So if Santo Tomas would be sold for – and this is a purely arbitrary number – US$400M, Lock would take home US$400,000 in a completion bonus on top of the normal change of control payments. So while he doesn’t own much stock, he is incentivized to make a transaction happen.

Conclusion

Oroco Resource Corp. has diligently ticked all boxes and the recently completed resource calculation will be the basis for the Preliminary Economic Assessment which is slated for completion in September. The outcome of the PEA will be important for the company as it should provide a backstop for the valuation. And while this does not mean the market will care, it should hopefully attract some (corporate) interest in the project. Oroco will need about C$20-30M to advance the project towards pre-feasibility study (infill drilling will be needed to upgrade the current resources) and in an ideal world, a strategic/corporate investor would step up the plate to acquire an equity or project interest.

Unfortunately, this isn’t an ideal world and it’s still tough out there for exploration-stage companies. But hopefully a positive PEA will draw more attention to Oroco and Santo Tomas and establish Santo Tomas as a big, viable project and a potentially large copper producer.

Disclosure: The author has a long position in Oroco Resource Corp. Oroco is a sponsor of the website. Please read our terms & conditions.