CEO Blaine Monaghan can look back at a very interesting stock chart since he was appointed CEO of Pacific Ridge Exploration (PEX.V) at the beginning of 2021. Starting at $0.05, the share price reached a high of 58 cents before recently settling down in the 30-40 cent range. This rapid appreciation enabled the company to raise in excess of C$7M to fund its aggressive 2022 exploration plans.

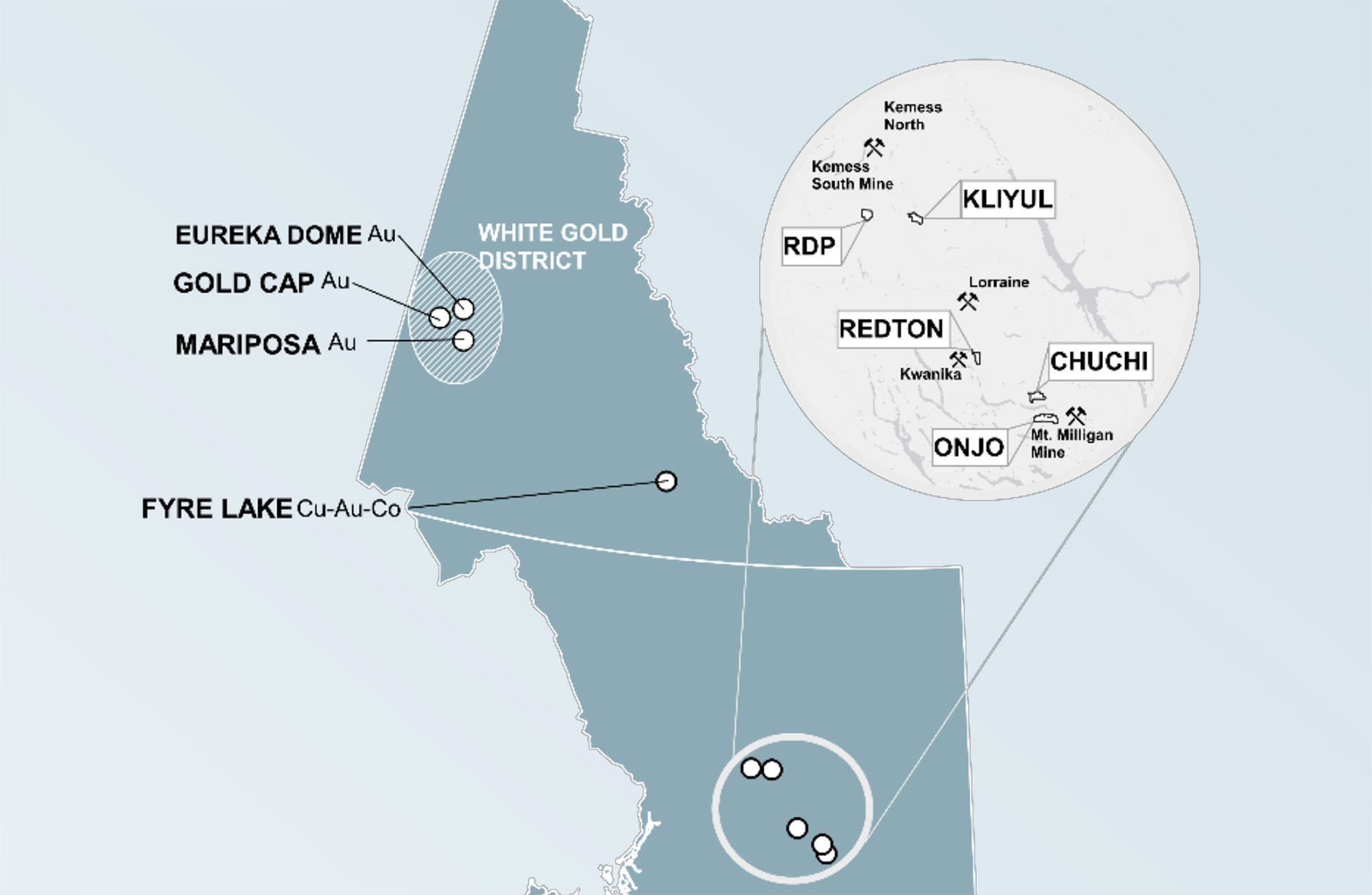

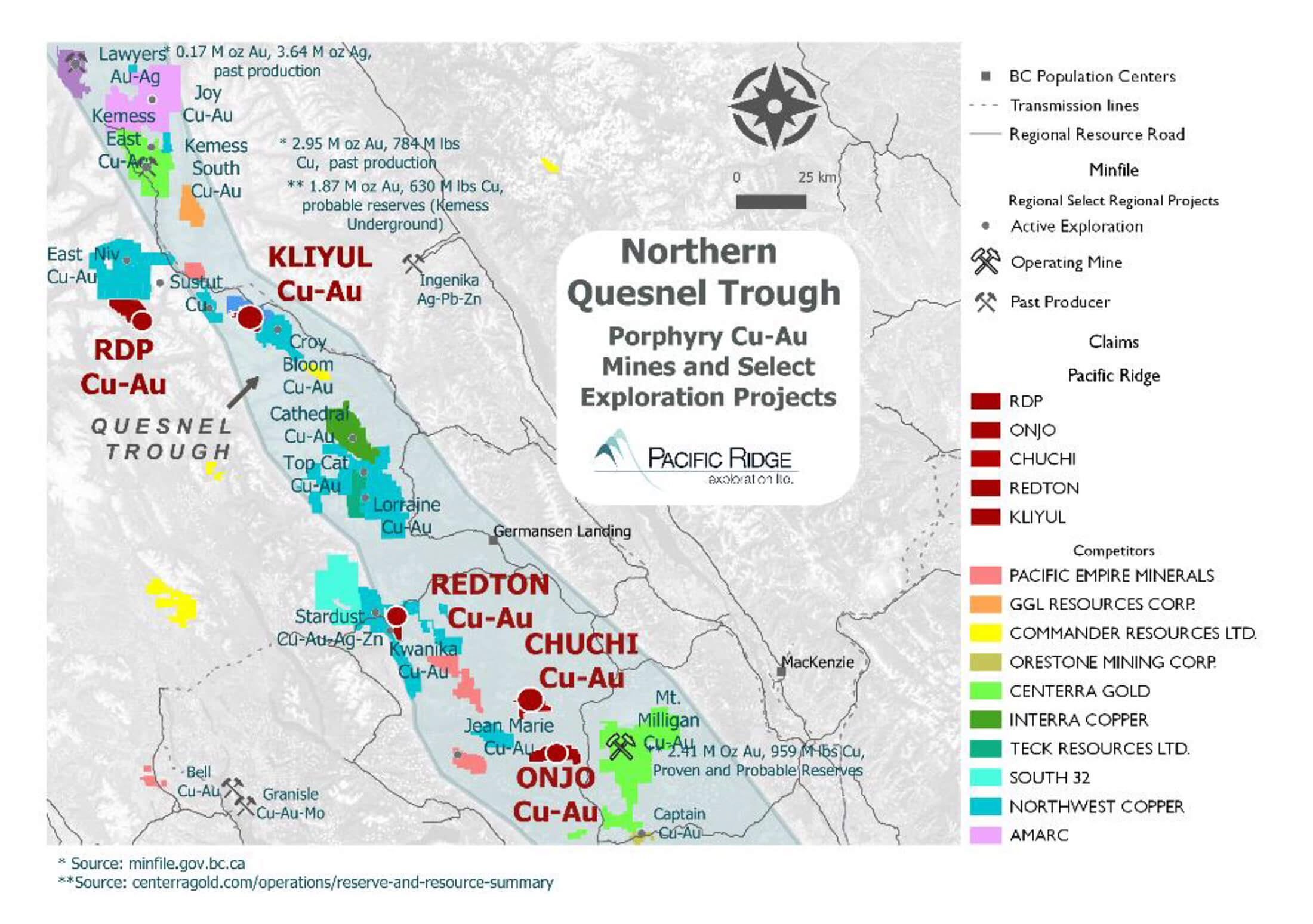

While most investors are likely interested in Pacific Ridge Exploration for its flagship Kliyul copper-gold project, CEO Monaghan is on a mission to pick up “forgotten” copper-gold exploration assets in the vicinity of Kliyul. This makes sense as the company’s goal is “to become British Columbia’s leading copper-gold exploration company”.

Pacific Ridge recently announced that it had entered into an agreement with Centerra Gold (CG.TO) to acquire up to a 75% interest in the Chuchi copper-gold project. With the acquisition of Chuchi, the company now owns or controls five copper-gold projects in British Columbia and provides us with a good reason to catch up with CEO Monaghan to learn more Pacific Ridge’s plans for the year.

A Q&A with Blaine Monaghan, CEO

The new Chuchi project

You recently announced an agreement whereby you could earn up to 75% in the Chuchi copper-gold project, currently owned by Centerra Gold. Could you tell us what attracted you to the project?

There are a number of reasons why we were attracted to Chuchi. Our goal is to become B.C.’s leading copper-gold exploration company. We are off to great start with our flagship Kliyul and our joint venture with Antofagasta for RDP. The acquisition of Chuchi puts us one step closer to achieving that goal. From an exploration standpoint, Chuchi hosts a large, well-mineralized gold-rich porphyry copper system, where many of the historical drill holes bottomed in mineralization. We believe that the core of the porphyry system has yet to be identified. Lastly, I expect there to be synergies with Onjo, which we acquired early in the year and is located close by.

What can you tell us about the main BP zone as that appears to be the most advanced section of the project with almost 50 holes completed on the project (while knowing another two dozen holes have been drilled but where the data could not be recuperated)?

The main BP Zone is defined by 4 km x 3 km halo of outer propylitic alteration surrounding a central 1.5 km x 1.5 km area of copper-gold mineralization, which is open to depth and potentially to the east across the north-south trending Valley Fault. Grades within the mineralized portion of the BP Zone range from 0.21% to 0.4% Cu and from 0.21 g/t to 0.44 g/t Au.

Are you planning any exploration activities on Chuchi during the upcoming summer period?

Pacific Ridge is planning an airborne ZTEM resistivity survey and a surface exploration program consisting of mapping, sampling, and core re-logging this summer with the objective of defining drill targets for the 2023 field season.

What is your budget for the summer exploration program?

We have budgeted C$5.3M for the 6,000 m program at Kliyul and C$0.7M for exploration at Chuchi, Onjo, and Redton. In addition, Antofagasta is funding a 1,500 m drill program at RDP.

We see it is in relative close proximity to the Onjo project which you acquired in February 2022. While your flagship Kliyul project is located almost 200 kilometers northwest of Chuchi, it is starting to look like you are building a second ‘cluster’ of projects as Redton, Chuchi and Onjo appear to be relatively close together. Is this a coincidence or do you (still) see more opportunities in that area?

Not a coincidence. We acquired RDP last year because of its proximity to Kliyul (it is located 40 km to the west), and the historic results. You will see the logistical synergies play out this year as the drill program at RDP will be supported from the Kliyul camp. I can see the same scenario further to south at Chuchi, Onjo, and Redton. With respect to further acquisitions in the area, we have a full plate now but will act if the right opportunity presents itself.

Do you see it as a deterrent you will only obtain 75% of the project when the earn-in agreement is completed? Usually, the junior company is the one farming out a property to a major in deals structured like this (just like you did with Antofagasta at RDP).

I don’t. Ideally you would like the opportunity to acquire an asset 100% but sometimes you have to accept that the other party would like to retain some exposure in case you have success. I view this as a positive if the minority owner is mid-tier or senior producer, like Centerra.

As this is project number five in your Quesnel Trough area, aren’t you spreading yourselves too thin, or is there enough ‘human capital’ in the company to cover all bases?

That is something I do worry about. At present, I believe that our “human capital” is sufficient. However, this is something that would need to be addressed if we have continued success at Kliyul and if Antofagasta has success at RDP – although Antofagasta is funding the drill program at RDP, we are the operator.

The other projects

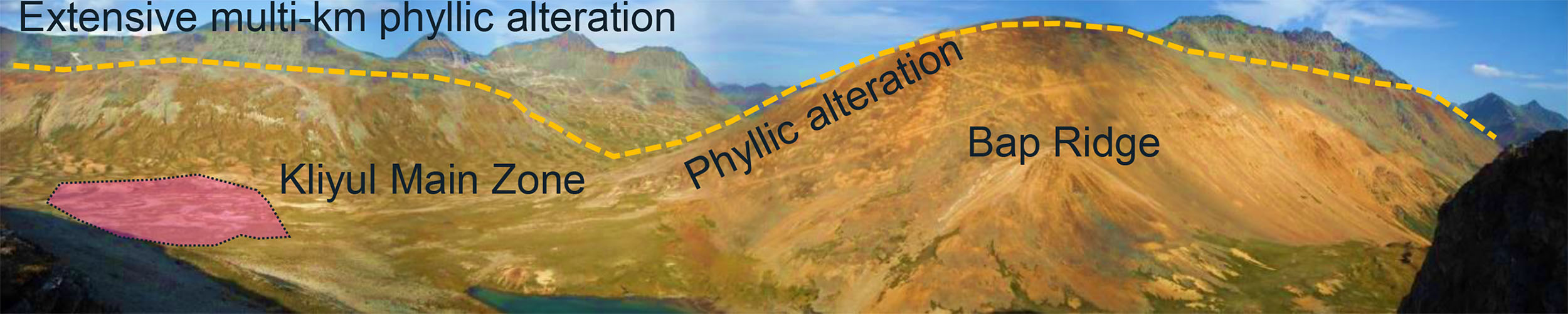

After your 2021 drill program at the flagship Kliyul project was cut short due to the weather, you must be excited to get back into the field and get some more work done there?

Absolutely! We are getting an earlier start this year and the program will be much bigger. We will mobilize next month and I hope that the two drill rigs will be turning by early July. We aim to complete 6,000 m at Kliyul this year versus 1,500 m last year. It will be the largest ever drill campaign at Kliyul!

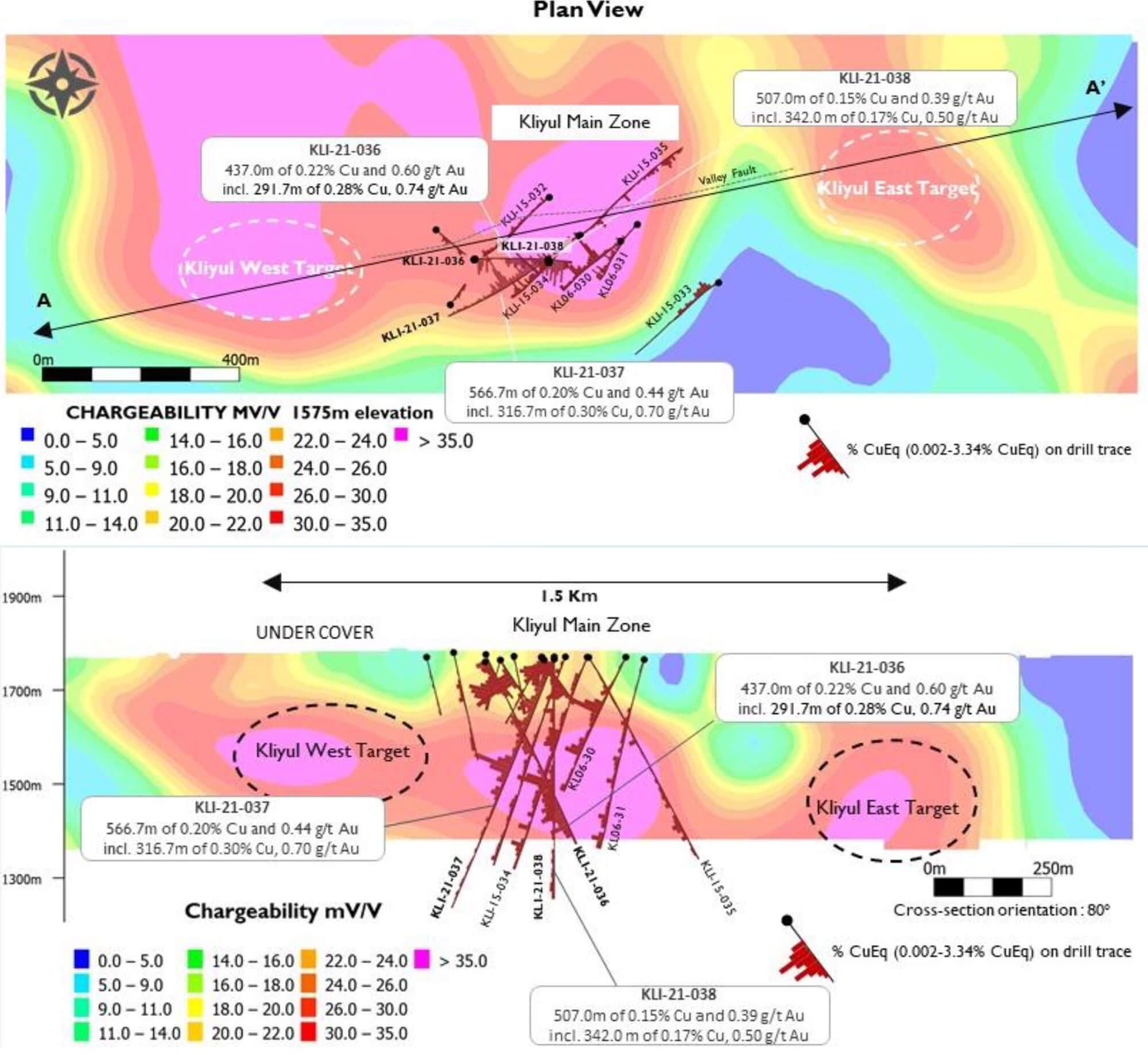

The three holes completed last year were drilled in relatively close proximity to historical holes and known mineralization. Will this year’s drill program focus on trying to expand the mineralized envelope and ‘drilling for tonnes’?

Exactly. I believe that the grade works. Now we have to demonstrate that Kliyul has the size potential. Drilling will be focused on the Kliyul Main Zone, where most of the historical drilling was focused, and two adjacent targets, Kliyul East and Kliyul West, which have never been drill tested before. The total strike length of these targets is over 1.5km.

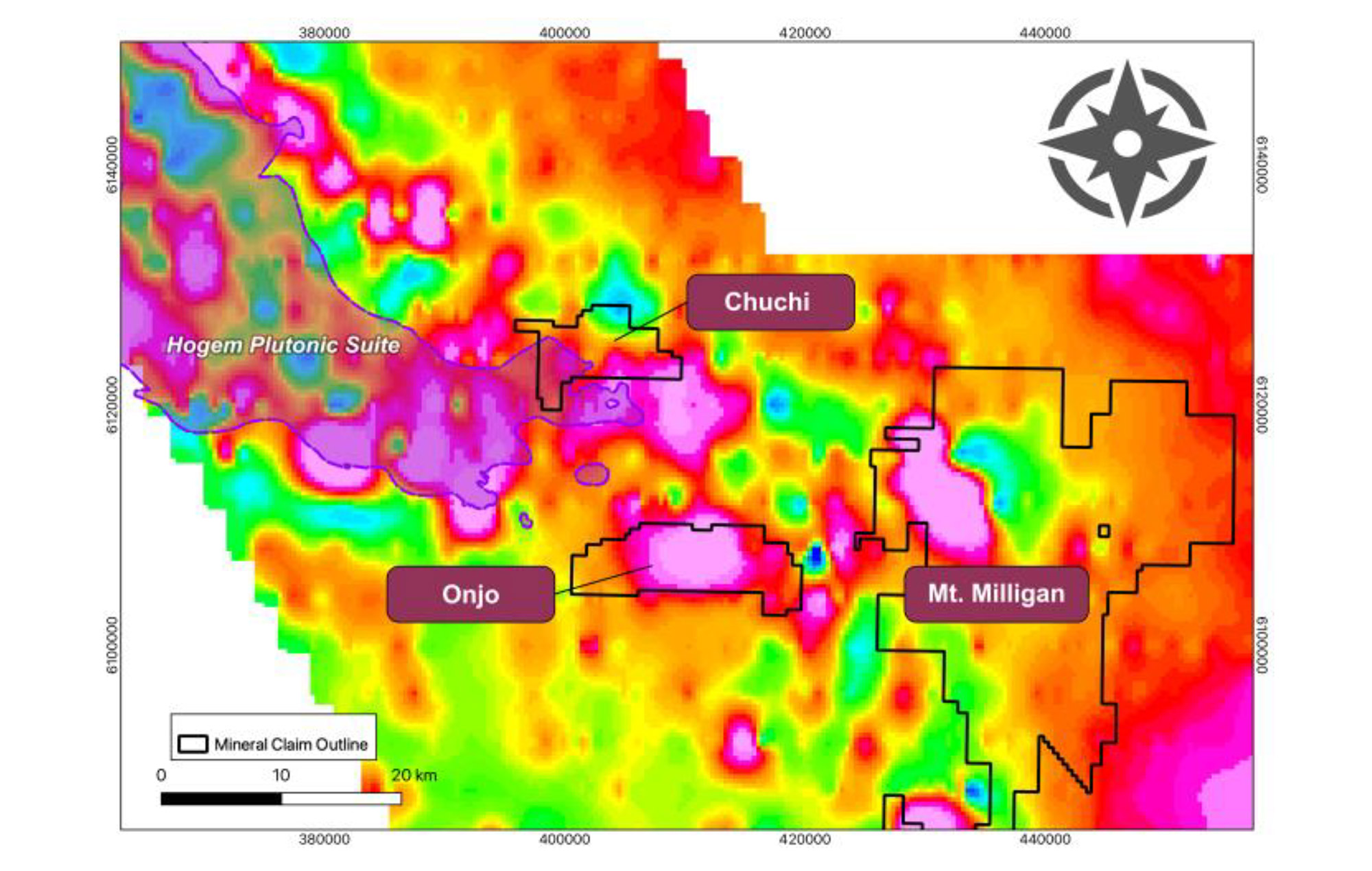

The Chuchi project is the second project you are adding to your portfolio this year as you acquired full ownership of the Onjo project in February. The location of Onjo appears to be particularly interesting as it is located within walking distance from the big Mt Milligan copper-gold mine, owned and operated by Centerra Gold. When you acquired the project, you called it a ‘double compelling opportunity’. Could you elaborate on that statement? What makes Onjo so exciting?

Sure. The style of mineralization, the accessibility, and the proximity to one of B.C.’s largest copper-gold mines make Onjo a compelling exploration project. However, when you combine the above with a new exploration hypothesis, that past operators encountered the upper levels of an alkalic porphyry system, Onjo’s exploration potential is even more compelling.

What are the exploration plans for the RDP project for this year? As per the earn-in agreement, Antofagasta will have to spend C$1M in the first year of the option period, so we should be seeing some action, no?

Yes, Antofagasta is funding a 1,500 m diamond drill program at RDP. We are the operators and the Kliyul camp will support this drill program as it is only a 15-minute helicopter ride from RDP to Kliyul.

Your recent raise

You originally announced a best efforts brokered placement to raise C$6.4M in March but you were successful in further expanding the size of the offering and when all the dust settled, you raised a total of C$7.4M consisting of C$6.3M in charity flow-through units issued at C$0.328 and C$1.15M in hard-dollar units at C$0.23 per unit. In hindsight, you timed your raise very well as it now appears to be unfeasible to raise that amount at those terms in the current volatile markets. What kind of runway do you have with those funds?

It means that our exploration programs at Kliyul, Chuchi, Onjo and Redton are fully funded. It’s also important to point out that we have warrants that are now in the money and when exercised would bring in an additional C$1.6M. Lastly, I’m expecting a final C$850K payment from BMC Minerals for Fyre Lake sometime this year. Overall, we are in great shape and are very excited to get back to Kliyul this summer to demonstrate its size potential.

Conclusion

Pacific Ridge Exploration is positioning itself as an up-and-coming copper-gold exploration company in British Columbia. CEO Monaghan has been busy growing the project portfolio which now consists of five projects, one of which has been optioned to Antofagasta, one of the world’s largest copper producers.

Pacific Ridge timed its recent capital raise very well as it likely would not be able to get it done in the current market and the C$7M raised in that financing means that this year’s exploration plans are fully funded. Kliyul will receive most of the attention and this year’s drill program will be focused on expanding mineralization at the Kliyul Main Zone laterally and to depth. The company believes that grades at Kliyul would work in this type in this environment. Now it needs to prove that the Kliyul Main has the size potential. With drilling to start in little over a month, we’ll find out soon.

Disclosure: The author has a long position in Pacific Ridge Exploration. Pacific Ridge Exploration is a sponsor of the website. Please read our disclaimer.