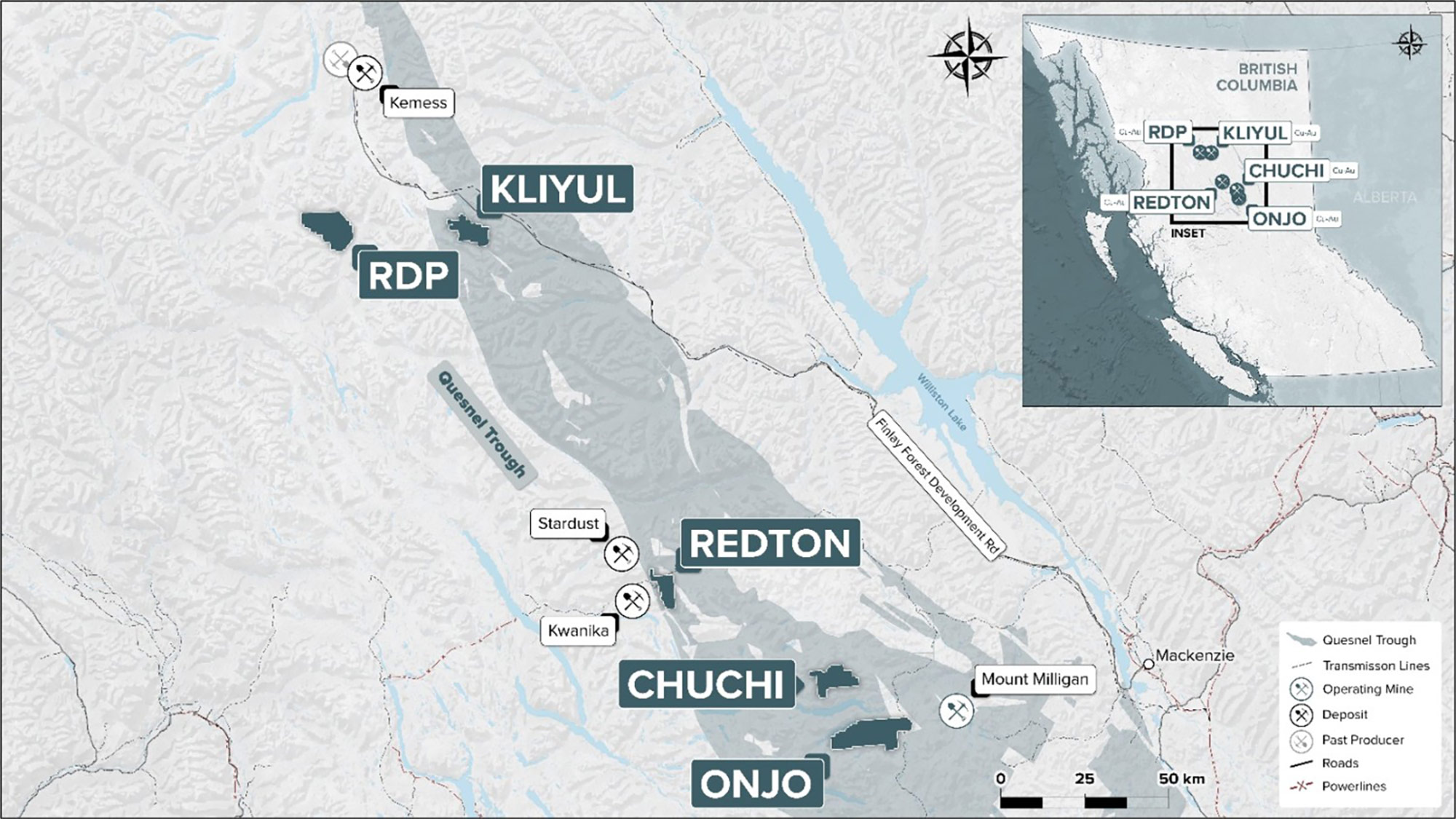

Pacific Ridge Exploration (PEX.V) has released the assay results from the first four holes it completed at its flagship Kliyul copper-gold project this exploration season. Pacific Ridge is in the middle of a planned 9,000 meter diamond drill program at Kliyul where it is pushing the project forward to reach critical mass or at least to warrant additional exploration expenditures.

Of the four recently released holes, one is good, while three others are ‘okay’. And ‘okay’ doesn’t mean bad; it means we expect the mineralization in those holes to be viable but as the capital expenditures to build a new mine are ballooning, every additional tonne of higher-grade material would be very welcome.

Reviewing the first four holes

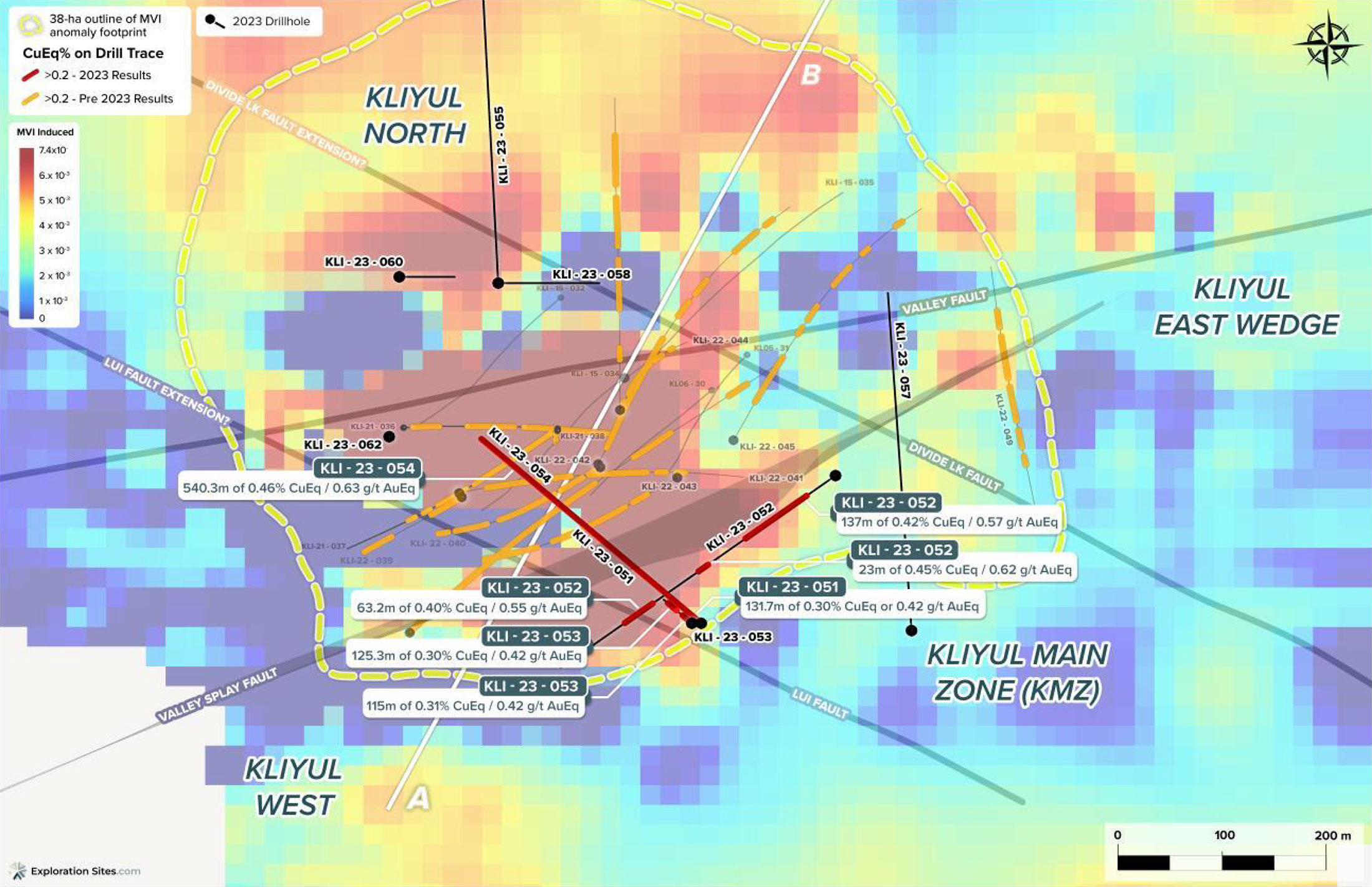

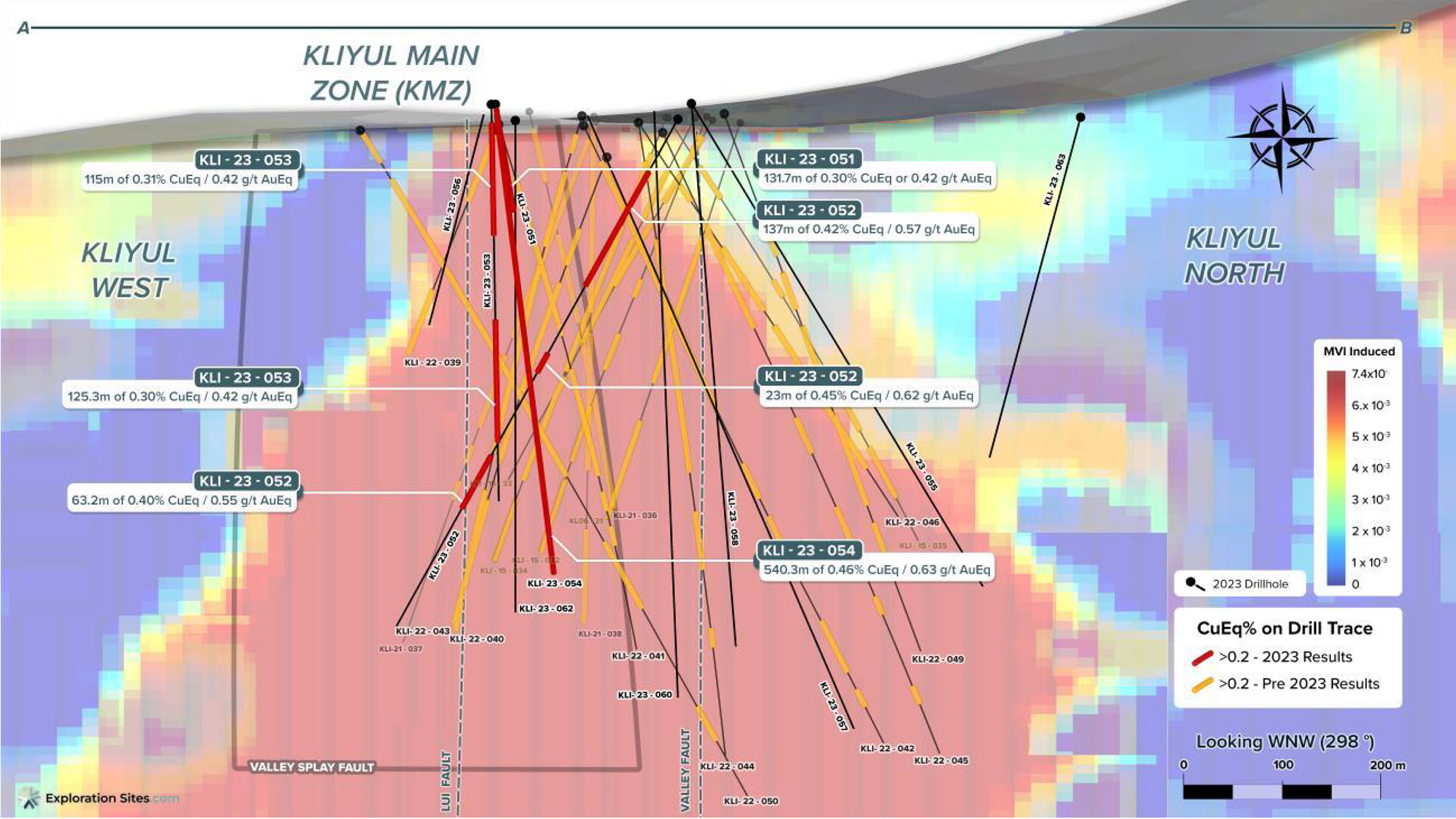

A summary of the holes can be found below, but it is clear why hole KLI-23-054 was mentioned first, as it is most definitely the best hole of the four. Hole KLI-23-054 returned in excess of 300 meters containing 0.62% copper-equivalent (consisting of 0.23% copper, 0.51 g/t gold and 1.22 g/t silver). This hole has the characteristics of an ore grade intercept, a decent grade over a decent length.

The other holes were mineralized as well, but the grades and lengths do not compare to hole KLI-23-054. Hole 52 intersected 137 meters of 0.42% copper-equivalent, which is okay, while holes 51 and 53 encountered mineralization with a similar grade (in the mid-0.40% range) but over shorter lengths, 36 meters and 31.5 meters, respectively. Keep in mind porphyry targets are by their very nature low grade, which means economies of scale will be extremely important to determine the viability of the project. In other words, it’s better to have 300 meters at 0.40% rather than 30 or 50 meters at 0.60% material.

Let’s pull up the results of hole KLI-23-052, which returned 137 meters of 0.22% copper, 0.26 g/t gold and 1.41 g/t silver to further explain this. It will be challenging to have any payable silver in the concentrate, so let’s err on the side of caution and ignore silver for the time being. No metallurgical test work has taken place at Kliyul but the recovery rates from nearby Mount Milligan (operated by Centerra Gold (CG.TO, CGAU)) are 79% for copper and 64% for the gold as per the 2022 technical report. Northwest Copper (NWST.V), which published a PEA earlier this year, reported a 84% and 60% recovery rate for copper and gold, respectively. The average of both is 82% for copper and a 62% for gold.

This would result in a recoverable rock value of $24.7 per tonne using $3.75 copper ($8,250/t) and $1900 gold. At a strip ratio of 1:1 the operating margin would be around $13.5/t (we are using the operating costs as published by Centerra Gold, which we will explain below). At 2.5:1 (again, we don’t know the strip ratio yet, so this is just a theoretical calculation) this would drop to around $10/t.

Mount Milligan is expected to operate at a mining cost of $2.13 per tonne and a processing cost of $4.99/t, while G&A is budgeted at just over $2/t. These costs are quite realistic and in line with other similar large open pit copper mines. This also indicates the strip ratio will be important. If the strip ratio is 1:1, the total production cost per tonne would be (2*$2.13) + $4.99 + $2.15 = $11.4/t. And for every 0.5 increase in the strip ratio, the cost per tonne will increase by just over $1. Needless to say this is a very rudimentary back-of-the-envelope calculation.

From an operating perspective, based solely on using Mount Milligan and Kwanika as comparisons, we are not projecting that the recovery rates at Kliyul will be better or worse. Keep in mind Pacific Ridge is a pre-resource stage exploration company without any own metallurgical studies. But applying the regional recovery rates to rock with 0.42% CuEq indicates that grade should be sufficient for a profitable operation. While there is very little doubt that the calculation of net revenue per tonne minus opex will be positive, building a 40-50,000 tpd mine will likely cost about $1.2-1.5B on a standalone basis and that initial investment will have to be paid back out of cash flows. Would 0.40% CuEq mineralization exceed the traditional cutoff grades and end up in a mine plan? Very likely, yes. Is that type of rock the real ‘money maker’? No, that’s why the higher-grade zones like the 0.62% CuEq encountered in hole 54 are so important and why economies of scale will play a very important role here.

Let’s run the numbers again to figure out the recoverable rock value:

Notice that the operating margin doubles in this scenario (and again, this is just a theoretical thinking exercise)? So even a small uptick in the copper-equivalent grade could have major economic implications and will likely determine Kliyul’s fate. Roughly speaking, for every 0.05% CuEq grade increase, the operating margin increases by 25% compared to rock with a grade of 0.42% CuEq. That’s why expanding the mineralized zone is so important. The higher the total tonnage in a potential resource, the lower the capex intensity is (capex versus tonnage in a mine plan). The four holes just released have not expanded the north-south strike length by about 100 meters. According to the company’s press release, the mineralized body at the Kliyul Main Zone now measures 600 by 450 meters on surface, and up to a depth of 600 meters below surface.

Simple math indicates that’s 162 million cubic meters and applying a specific gravity of 2.85 (the specific gravity used calculating GT Gold’s Saddle North deposit) would result in close to half a billion tonnes. Note: this is NOT a resource calculation nor a target or guidance provided by the company. It is a simple calculation of the size of the Kliyul Main Zone mineralized body right now. It should not be viewed as a resource or a reserve as not every tonne will be mineralized or fit within a pit shell. It just represents the current Kliyul Main Zone mineralized body.

Bottom line, size matters and lower grade material can work if there’s enough of it.

Conclusion

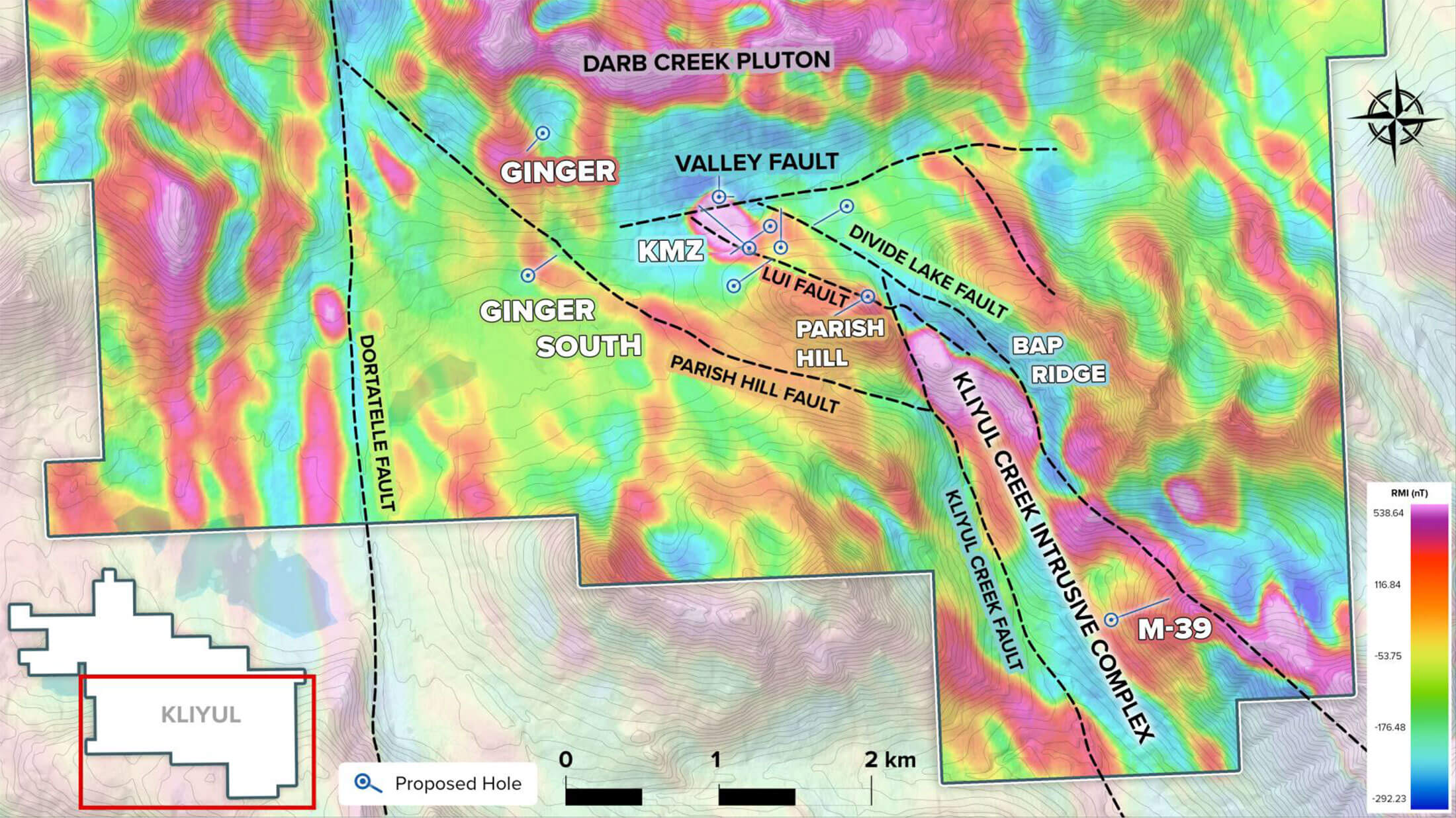

Although still early days at Kliyul, the company is diligently working towards expanding the size of the Kliyul Main Zone mineralized body. CEO Monaghan has stated on several occasions that their minimum target size for Kliyul is 250 million tonnes and that they wouldn’t pursue a 43-101 complaint resource if they didn’t believe that they had achieved that goal. Pacific Ridge is making great progress towards that goal, having tripled the size of Kliyul Main Zone mineralized body in last year’s drilling and have further expanded with the first four holes from this year’s drill program.

The Company is doing what it promised: expanding the Kliyul Main Zone mineralized body. However, until Pacific Ridge reaches its goal and publishes a resource, the potential economics of Kliyul are a moot point.

It’s also important to point out that the Company hasn’t even completed this year’s drill program yet (it has completed approximately 70% of the planned 9,000 meters by now) so there is plenty more news to come. While we think that 0.40-0.45% CuEq is a little bit light, higher grade zones, like hole 54, can dramatically improve the potential economics of Kliyul. If the next few holes contain higher-grade intervals, in excess of 0.50% CuEq, could be a whole different ball game, especially if the holes are drilled in new or underexplored areas. And that’s not unlikely. Some of the holes drilled in 2021 and 2002 were even better than KLI-23-054.

The main takeaway from the first four holes is that the Kliyul Main Zone mineralized body continues to grow. There are many more drill holes to report and if Pacific Ridge can continue to expand Kliyul Main Zone mineralized body, which CEO Monaghan is confident that they will, then they are one step closer to achieving their ultimate objective: delineating a deposit that will result in M&A.

Disclosure: The author has a long position in Pacific Ridge Exploration. Pacific Ridge Exploration is a sponsor of the website. Please read our disclaimer.